Government

“Santa Rally Is Finally Here”: Futures Hit All Time High Day After Powell Goes Full Jean-Claude Trichet

"Santa Rally Is Finally Here": Futures Hit All Time High Day After Powell Goes Full Jean-Claude Trichet

One day before what everyone knew would be a hawkish pivot by the Fed, the mood was dour with tech names tumbling and futures hanging…

One day before what everyone knew would be a hawkish pivot by the Fed, the mood was dour with tech names tumbling and futures hanging one for dear life. One day after, Jerome Powell confirmed he would go full Jean-Claude Trichet as the Fed would not only turbo-taper into a sharply slowing economy, ending its QE program by March but then proceed with hiking rates as many as 3 times in 2022 (more than the 2 hike consensus), with the BOE shocking markets moments ago with a surprise rate hike and even the ECB trimming its turbo QE, and futures are.... at all time highs. That's right - eminis are higher by 140 points in 24 hours because the Fed was more hawkish than consensus expected. At 8:00 a.m. ET, Dow e-minis were up 215 points, or 0.61%, S&P 500 e-minis were up 27.25 points, or 0.57%, and Nasdaq 100 e-minis were up 100 points, or 0.61%.

Treasury yields jumped alongside European bonds after the BOE became the first major central bank to raise rates since the pandemic, while the dollar fell and the pound jumped. The Euro also hit session highs after the ECB seemed to turn ever so slightly more hawkish as its monthly QE is set to shrink in the coming year.

"The market likes facts it can digest. With the uncertainty now gone, it finds relief,” said Frederik Hildner, a portfolio manager at Salm-Salm & Partner. Gradual rising rates “provides more firepower for the next downturn, as it displays the ability normalize monetary policy.”

On Wednesday, Jerome Powell said the U.S. economy no longer needed increasing amounts of policy support as annual inflation has been running at more than double the central bank's target in recent months, while the economy nears full employment. Recent readings on surging producer and consumer prices as well as the fast-spreading Omicron variant of the coronavirus have fueled anxiety as the benchmark S&P 500 inches closer to a record high.

"Is the Santa Rally finally here? Markets certainly seem to have a spring in their step... the prospect of three interest rate hikes in 2022 would suggest the central bank has a clear plan to not let inflation get out of control," Russ Mould, investment director at AJ Bell wrote in a client note.

"Equally, it isn't being too aggressive to trip up the economy. This sense of balance is exactly what investors want, and an upbeat tone from the Fed certainly seems to have rubbed off on markets" Bell said, clearly goalseeking his narrative to the market's response as just 24 hours later he would be saying just the opposite when futures were tanking of hawkish Fed fears.

Big tech stocks and banks led gains in premarket trading. Shares in Tesla, Microsoft, Meta and Amazon.com rose between 0.7% and 2.4%, with the lift pushing Apple shares nearer to an historic market value of $3 trillion. Bank stocks including JPMorgan, Morgan Stanley, Bank of America, Wells Fargo and Citigroup all gained between 0.7% and 0.8%. Here are some of the biggest U.S. movers today:

- Apple (APPL) and other big U.S. tech stocks rise after the Federal Reserve said that it would speed up its taper, joining in with a broader relief rally across risk assets. Apple shares are up 0.6%, with the stock drawing nearer to an historic market capitalization of $3 trillion. Also Thursday, Goldman Sachs said lead times for Apple’s iPhone have declined in the latest week.

- Assertio (ASRT US) shares rise 4% after the company announced the $44 million acquisition of the Otrexup device from Antares Pharma.

- Blue Bird (BLBD US) dropped 6% after the school bus-maker provided a weaker-than-expected sales outlook. The company also offered $75m shares at $16/share in a private placement.

- Danimer Scientific (DNMR) falls 10% after announcing that it plans to offer $175 million of convertible senior notes.

- Delta Air Lines (DAL) is up 2% after saying it expects to report a profit for the fourth quarter, citing a strong demand for travel over the winter holiday period and a decline in jet fuel prices. Other airline stocks are also higher.

- DocuSign (DOCU) falls 2% as Morgan Stanley issued a downgrade, saying third-quarter results changed the firm’s view regarding the durability of growth through tough post-pandemic comparables.

- Freyr Battery (FREY) gains 14% after executing its inaugural offtake agreement for at least 31 GWh of low-carbon battery cells.

- IronNet (IRNT US) slumps 25% after the cybersecurity company’s results fell short of expectations, prompting a Street-low target from Jefferies.

- Lennar Corp. (LEN US) declined 6% after it reported a forecast for purchase contracts that was weaker than expected.

- Plug Power (PLUG) gains 5% after signing an agreement with Korean electric-vehicle manufacturer Edison Motors to develop an electric city bus powered by hydrogen fuel cells.

- Syndax Pharmaceuticals (SNDX) falls 8% after pricing 3.2 million shares at $17.50 each.

- Tesla (TSLA) is up 2%, rising with other electric vehicle stocks amid a broader gain in technology stocks and U.S. futures on hopes that the Federal Reserve’s policy tightening will fight high inflation without hampering economic growth.

- Wayfair (W) falls 2% after BofA downgraded the stock to underperform, citing weak near-term data and difficult comparisons through the first quarter of 2022 for the online furniture retailer.

European equities rally with Euro Stoxx 50 up as much as 2.1% before drifting off best levels. The U.K.’s exporter-heavy FTSE 100 Index pared some gains after the BOE decision, while European dipped modestly after the European Central Bank’s meeting. Miners, tech and autos are the best performers, utilities and media names lag.

Equities have whipsawed in recent weeks as investors attempted to price in the prospect of rate hikes, while assessing risks from the spread of the omicron variant. The market’s early response to the Fed signals some relief arising from policy clarity, and optimism that the rebound from pandemic lows can weather the pivot away from ultra-loose monetary settings.

“The market is breathing a sigh of relief that the FOMC meeting suggested that it is taking inflation risks in the United States more seriously,” Ann-Katrin Petersen, an investment strategist at Allianz Global Investors, said in an interview with Bloomberg TV. “The question really will be whether the Fed will dare to do even more in order to taper the inflation risk.”

Asian stocks rose, halting a four-day slide, as confidence in Federal Reserve policy allowed investors to take on riskier assets. The MSCI Asia Pacific Index climbed as much as 0.8%, buoyed by energy and technology shares. Japan was Asia’s top performer, aided by a weaker yen. Hong Kong and China stocks eked out gains amid ongoing concern over U.S. sanctions. Australian equities declined for a third day. Asia’s benchmark advanced for the first time this week on hopes the Fed will effectively combat surging prices without choking off economic growth. The U.S. central bank said it will double the pace of its asset tapering program to $30 billion a month and projected three interest-rate increases in 2022. In the run-up to the Fed’s decision, Asia’s equity gauge slumped almost 2% over the past four days, keeping it below the 50-day moving average. The short-term boost to stock market sentiment is from Fed Chair Jerome Powell’s comments about wage inflation not being the main issue for now, and expectations that there’ll be full employment next year, said Ilya Spivak, head of Greater Asia at DailyFX. However, there’s a “meaningful risk” that the Fed’s latest policy stance will trigger liquidation as Asia stock portfolios are de-risked, Spivak said.

Japan’s stocks rose for a second day after the yen weakened and U.S. stocks rallied amid speculation the Federal Reserve will combat surging prices without choking off economic growth. The Topix index climbed 1.5% to close at 2,013.08 in Tokyo, while the Nikkei 225 Stock Average advanced 2.1% to 29,066.32. Keyence Corp. contributed the most to the Topix’s gain, increasing 2.5%. Out of 2,181 shares in the index, 1,674 rose and 421 fell, while 86 were unchanged. “It wouldn’t be strange to see the discount on Japanese equities narrowing following the FOMC meeting results, with market interest centered around electronics, machinery, automakers and marine transportation stocks,” said Takashi Ito, an equity market strategist at Nomura Securities. Electronics firms and automakers helped lift the Topix as the yen headed for a four-day slump against the dollar, with the currency falling 0.1% to 114.19

Australia's S&P/ASX 200 index fell 0.4% to close at 7,295.70, extending its losing streak to a third day. CSL was the worst performer after the benchmark’s second-biggest company by weighting completed a placement to fund its Vifor acquisition. Mesoblast was the top performer after saying it plans to conduct an additional U.S. Phase 3 trial of rexlemestrocel-L in patients with chronic low back pain. Investors also digested November jobs data. Australian employment soared last month, smashing expectations and pushing the jobless rate lower as virus restrictions eased on the east coast. In New Zealand, the S&P/NZX 50 index fell 0.7% to 12,777.54

In rates, cash USTs bull steepened, bolstered by a large curve steepener that blocked in early London. Bunds are soft at the back end, peripherals slightly wider ahead of today’s ECB meeting. Gilts bear steepen slightly, white pack sonia futures are lower by 2-3.5 ticks.

In FX, the dollar slipped for a second day and oil rose; cable snapped to best levels of the week after the BOE unexpectedly hiked rates. The Bloomberg Dollar Spot Index fell for a second day as the greenback weakened against all its Group-of-10 peers apart from the yen; Tresury yields fell, led by the belly of the curve. Commodity currencies were the best G-10 performers, led by the krone, which reversed an earlier loss after Norway’s central bank raised its interest rate for the second time this year and flagged another increase in March as officials acted to cool the rebounding economy despite renewed coronavirus concerns. The Australian and New Zealand dollars reversed earlier losses amid upbeat stock markets; the Aussie earlier weakened as RBA Governor Lowe hinted at the prospect of no rate hikes next year. The yen fell as the Federal Reserve’s decision reaffirmed yield differentials ahead of the Bank of Japan’s outcome on Friday. Bonds rose after a solid auction. Elsewhere in FX, NOK outperforms in G-10 after Norges Bank rate action, other commodity currencies are similarly well bid.

In commodities, Crude futures hold a narrow range around best levels of the session. WTI is up 1.1% near $71.70, Brent near $74.70. Spot gold grinds higher, adding ~$9 near $1,786/oz. LME copper outperforms in a well-bid base metals complex

To the day ahead now, and the main highlights will be the aforementioned policy decisions from the ECB and the BoE. On the data side, we’ll also get the flash PMIs for December from around the world, the Euro Area trade balance for October, and in the US there’s November data on industrial production, housing starts and building permits, as well as the weekly initial jobless claims. Finally, EU leaders will be meeting for a summit in Brussels.

Market Snapshot

- S&P 500 futures up 0.5% to 4,734.25

- STOXX Europe 600 up 1.2% to 476.39

- MXAP up 0.8% to 193.11

- MXAPJ up 0.5% to 623.76

- Nikkei up 2.1% to 29,066.32

- Topix up 1.5% to 2,013.08

- Hang Seng Index up 0.2% to 23,475.50

- Shanghai Composite up 0.8% to 3,675.02

- Sensex up 0.1% to 57,851.57

- Australia S&P/ASX 200 down 0.4% to 7,295.66

- Kospi up 0.6% to 3,006.41

- Brent Futures up 1.0% to $74.59/bbl

- Gold spot up 0.5% to $1,786.03

- U.S. Dollar Index down 0.36% to 96.16

- German 10Y yield little changed at -0.36%

- Euro up 0.2% to $1.1316

Top Overnight News from Bloomberg

- The greenback is set for its biggest annual gain in six years and its rally appears to be far from over, market participants say. The prime mover: a hawkish Federal Reserve that’s drawn a roadmap of interest-rate increases over the next three years, while other central banks look much more reticent to withdraw stimulus

- The ECB is poised to unveil a gradual withdrawal from extraordinary pandemic stimulus in the face of soaring inflation whose path is further clouded by the omicron coronavirus variant

- The “phenomenal pace” at which the new Covid-19 omicron strain is spreading across the U.K. will trigger a surge in hospital admissions over the holiday period, according to Boris Johnson’s top medical adviser

- The Swiss National Bank kept both the deposit and the policy rate at -0.75%, as widely predicted by economists. With the global economic recovery on shaky footing due to the omicron variant, President Thomas Jordan and fellow policy makers also reiterated their pledge to supplement subzero rates with currency interventions as needed

- France will impose tougher rules on people traveling from the U.K., including a ban on non-essential trips and a requirement to self-isolate, as it tries to slow the spread of the omicron variant

- IHS Markit said its index tracking output across the U.K. economy fell to 53.2 this month from 57.6 in November, reflecting weaker-than-expected growth in service industries including hotels, restaurants and travel-related businesses. Business-to-business services stalled

- European power prices soared to records after Electricite de France SA said that two nuclear reactors will stop unexpectedly and two will have prolonged halts -- just as the continent heads for a cold snap with already depleted gas inventories

- Hungary’s central bank increased the effective base interest rate for the fifth time in as many weeks to tackle the fastest inflation since 2007 and shore up the battered forint

A more detailed look at global markets courtesy of Newsquawk

Asian equity markets traded mixed as the region digested the FOMC meeting. The ASX 200 (-0.4%) was negative with heavy losses in the healthcare sector and as COVID infections remained rampant. There were also notable comments from RBA Governor Lowe that the board discussed tapering bond purchases in February and ending it in May or could even end purchases in February if economic progress is better than expected, although it is also open to reviewing bond buying again in May if the data disappoints. The Nikkei 225 (+2.1%) outperformed and reclaimed the 29k level after the Lower House recently passed the record extra budget stimulus and with the latest trade data showing double-digit percentage surges in Imports and Exports, despite the latter slightly missing on expectations. The Hang Seng (+0.2%) and Shanghai Comp. (+0.8%) were varied with Hong Kong pressured by losses in the big tech names amid ongoing frictions between the world’s two largest economies and as US lawmakers proposed a bill to allow the US oversight of China audits, although the mainland was kept afloat amid further speculation of a potential LPR cut this month, as well as reports that China will boost financial support for small businesses and offer more longer-term loans to manufacturers. Finally, 10yr JGBs were indecisive despite the constructive mood in Tokyo and with price action stuck near the 152.00 focal point, while demand was also sidelined amid mixed results at the 20yr JGB auction and as the BoJ kickstarts its two-day meeting.

Top Asian News

- Indonesia Reports First Omicron Case in Jakarta Facility

- Asia Stocks Snap Four-Day Drop as Traders Take on Risk After Fed

- Shimao Group Shares Set for Best Day in Month

- Money Manager Vanishes With $313 Million From China Builder

Equities in Europe have taken their cue from the post-FOMC rally seen across Wall Street (Euro Stoxx 50 +1.6%; Stoxx 600 +1.1%) following somewhat mixed APAC trade. As a reminder, markets saw relief with one of the major risk events out of the way, and with Chair Powell refraining from throwing hawkish curveballs. That being said, the forecast does see three rate hikes next year, whilst the Fed Board next year will also be more hawkish – at least within the rotating voters - with George, Mester and Bullard poised to vote from 2022. Nonetheless, US equity future continues grinding higher with all contracts in the green and the RTY (+1.3%) outperforming vs the NQ (+0.7%), ES (+0.6%), and YM (+0.5%). Bourses in Europe also experience broad-based gains with no real outliers, although the upside momentum somewhat waned amid some softer-than-expected PMI metrics ahead of ECB. Sectors in Europe paint a clear pro-cyclical bias. Tech outperforms following a similar sectorial performance seen on Wall Street. Basic Resources and Oil & Gas follow a close second, with Autos and Travel & Leisure also among the biggest gainers. The downside sees Personal & Household Goods, Telecoms and Food & Beverages. Healthcare meanwhile fares better than its defensive peers as Novartis (+4%) is bolstered after commencing a new USD 15bln buyback, highlighting confidence in growth and pipeline. On the flip side, EDF (-12%) shares have slipped after it narrowed FY EBITDA forecasts and highlighted some faults with some nuclear reactors amid corrosion.

Top European News

- Britain’s Covid Resurgence Cuts Growth to Slowest Since Lockdown

- SNB Says Franc Is Highly Valued as Omicron Clouds Outlook

- Norway Delivers Rate Hike That Omicron Had Threatened to Derail

- Erdogan Approves Third Capital Boost for State Banks Since 2019

In FX, not much bang for the Buck fits the bill accurately as it is panning out in the FOMC aftermath even though market expectations were matched and arguably exceeded in terms of dot plots showing three hikes in 2022 vs two anticipated by most and only one previously, while the unwinding of asset purchases will occur in double quick time to end in March next year instead of June. However, there appears to be enough in the overall statement, SEP and Fed chair Powell’s post-meeting press conference to offset the initial knee-jerk spike in the Dollar and index that lifted the latter very close to its current y-t-d peak at 96.914 vs 96.938 from November 24. Indeed, the terminal rate was maintained at 2.5%, no decision has been taken about whether to take a break after tapering before tightening, and the recovery in labour market participation has been disappointing to the point that it will now take longer to return to higher levels. In response, or on further reflection, the DXY has recoiled to 96.141 and through the 21 DMA that comes in at 96.238 today.

- NZD/AUD/CAD/GBP/EUR/CHF - All on the rebound vs their US counterpart, with the Kiwi back on the 0.6800 handle and also encouraged by NZ GDP contracting less than feared in Q3, while the Aussie is hovering around 0.7200 in wake of a stellar jobs report only partly tempered by dovish remarks from RBA Governor Lowe who is still not in the 2022 hike camp and non-committal about ending QE next February or extending until May. Elsewhere, the Loonie has clawed back a chunk of its losses amidst recovering crude prices to regain 1.2800+ status ahead of Canadian wholesale trade that is buried between a raft of US data and survey releases, Sterling is flirting with 1.3300 in advance of the BoE that is likely to hold fire irrespective of significantly hotter than forecast UK inflation, the Euro is pivoting 1.1300 pre-ECB that is eyed for details of life after the PEPP and the Franc is somewhat mixed post-SNB that maintained rates and a highly valued assessment of the Chf with readiness to intervene as required. Note, Usd/Chf is meandering from 0.9256 to 0.9221 vs Eur/Chf more elevated within a 1.0455-30 band.

- JPY - The Yen is underperforming on the eve of the BoJ and looking technically weak to compound its yield and rate disadvantage after Usd/Jpy closed above a key chart level on Wednesday (at 114.03). As such, Fib resistance is now exposed at 114.38 vs the circa 114.25 high, so far, while decent option expiry interest may be influential one way or the other into the NY cut given around 1.3 bn at the 114.25 strike, 1.7 bn at 114.30 and 1.2 bn or so at 114.50.

In commodities, WTI and Brent front-month futures are taking advantage of the risk appetite coupled with the softer Buck. WTI Jan trades on either side of USD 71.50/bbl (vs low USD 71.39/bbl) while Brent Feb sees itself around USD 74.50/bbl (vs low USD 74.28/bbl). Complex-specific news has again been on the quiet end, with prices working off the macro impulses for the time being, and with volumes also light heading into Christmas trade. Elsewhere spot gold and silver ebb higher – in tandem with the Dollar, with the former eyeing a group of DMAs to the upside including the 100 (1,788/oz), 21 (1,789/oz) 200 (1,794/oz) and 50 (1,796/oz). Turning to base metals, LME copper has been catapulted higher amid the risk and weaker Dollar, with prices re-testing USD 9,500/t to the upside. Meanwhile, a Chinese government consultancy has said that China's steel consumption will dip 0.7% on an annual basis in 2022 amid policies for the real estate market and uncertainties linked to COVID-19 curb demand.

US event calendar

- 8:30am: Dec. Initial Jobless Claims, est. 200,000, prior 184,000; Continuing Claims, est. 1.94m, prior 1.99m

- 8:30am: Nov. Housing Starts MoM, est. 3.1%, prior -0.7%

- 8:30am: Nov. Housing Starts, est. 1.57m, prior 1.52m

- 8:30am: Nov. Building Permits MoM, est. 0.5%, prior 4.0%, revised 4.2%

- 8:30am: Nov. Building Permits, est. 1.66m, prior 1.65m, revised 1.65m

- 8:30am: Dec. Philadelphia Fed Business Outl, est. 29.6, prior 39.0

- 9:15am: Nov. Manufacturing (SIC) Production, est. 0.7%, prior 1.2%; Industrial Production MoM, est. 0.6%, prior 1.6%

- 9:45am: Dec. Markit US Manufacturing PMI, est. 58.5, prior 58.3

- 9:45am: Dec. Markit US Services PMI, est. 58.8, prior 58.0

DB's Jim Reid concludes the overnight wrap

Yesterday’s biggest story was obviously the Fed. In line with our US economists call (their full recap here), the FOMC doubled the pace of taper to $30bn a month, which would bring an end to QE in mid-March. The new dot plot showed three rate hikes in 2022, up from the Committee being split over one hike in September. Farther out, the median dot had 3 additional hikes in 2023 and 2 hikes in 2024, bringing fed funds just below their estimate of the longer-term rate. Notably, all 18 Committee members have liftoff occurring next year, and 10 have 3 hikes penciled in, suggesting consensus behind the recent hawkish turn was strong. Short-end market pricing increased in line and now has around 2.9 hikes priced for 2022. The first hike is fully priced for the June meeting, but notably, meetings as early as March are priced as live, more on that in a bit.

In the statement, the Committee admitted that inflation had exceeded target for some time (dropping ‘transitory’ completely), and that liftoff would be tied to the economy reaching full employment. By the sounds of the press conference, progress toward full employment has proceeded pretty rapidly. Chair Powell noted that while labour force participation progress has been disappointing, almost every other measure of labour market strength shows a very strong labour market, and could create upside risks to inflation should wage growth start to increase beyond productivity. It is within that context that he framed the decision to taper faster, it will leave the Fed in a position to react as needed, providing optionality. In that vein, he stressed a few times that the lag between the end of taper and liftoff need not be as long as it was in the last cycle, and that the Fed will raise rates after taper is done whenever needed, hence meetings as early as March being live.

Notably on Omicron, the Chair, like the rest of us, recognises we don’t know much about the variant yet, but seemed optimistic about the economy’s ability to withstand subsequent Covid shocks, regardless of Omicron’s specifics. While Covid shocks can tighten supply chains, discourage labour participation, and reduce demand, as more people get vaccinated those impacts should dwindle over time, so his argument went. Hammering the point home, he sounded confident that the economy can handle whatever Omicron brings without any additional QE, justifying the accelerated taper path despite Covid risks.

The hawkish turn had been well forecast through Fed speakers since the last meeting, not least of which the Chair himself during Congressional testimony, which served to dull the market impact. Treasury yields were slightly higher, (2yr Tsys +0.6bps and 10yr Tsys +1.5 bps) but were quite docile for an FOMC afternoon. The dollar initially strengthened on the statement release before reversing course and ending the day -0.24% lower. Stocks were the real outperformers, as the S&P 500 rallied through the FOMC events, gaining +1.63%, the best daily performance in two months, while the Nasdaq increased +2.15%. The Russell 2000 matched the S&P, gaining +1.65%. Obviously the market was anticipating the change in policy, but if doubling taper and adding three rate hikes in the next year isn’t enough to tighten financial conditions, what is? The Chair was asked about that in so many words in the press conference, where he responded by noting financial conditions could change on a dime. Indeed, they will have to tighten from historically easy levels if the Fed is to bring inflation back to target through policy.

The Fed may be out of the way now, but the central bank excitement continues today as both the ECB and the BoE announce their own policy decisions later on. We’ll start with the ECB, who like the Fed have faced much higher than expected inflation lately, with the November flash estimate coming in at +4.9%, which is the highest since the formation of the single currency. Whilst Omicron has cast a shadow of uncertainty, with Commission President von der Leyen saying yesterday that it was likely to become dominant in Europe by mid-January, our European economics team doesn’t think there has been anything concrete enough to alter the ECB from their course (like the Fed). In our European economists’ preview (link here) they write the ECB appears on track to initiate a transition to a monetary policy stance based more on policy rates and rates guidance and less on liquidity provision. The ECB is set to confirm that PEPP net purchases will end in March, but will cushion the blow by working flexibility into the post-PEPP asset purchase arrangement. They are also set to make the policy framework more flexible to better respond to inflation uncertainties.

One thing to keep an eye out for in particular will be the latest inflation projections, with a report from Bloomberg suggesting that they’ll show inflation beneath the 2% target in both 2023 and 2024. So if that’s true, that could offer a route to arguing against a tightening of monetary policy for the time being, since the ECB’s forward guidance has been that it won’t raise rates until it sees inflation at the target “durably for the rest of the projection horizon”.

Today’s other big decision comes from the BoE, where our UK economist is expecting that there’ll be a 15bps increase in Bank Rate, taking it up to 0.25% although they suggest it’s a very close call. See here for the rationale. Ahead of that decision later on, we received a very strong UK inflation print for November, with CPI rising to +5.1% (vs. +4.8% expected), up from +4.2% in October and the fastest pace in a decade. That’s running ahead of the BoE’s own staff forecasts in the November Monetary Policy Report, which had seen inflation at just +4.5% that month, so six-tenths beneath the realised figure. We’ll get their decision at 12:00 London time, 45 minutes ahead of the ECB’s.

In terms of the latest on the Omicron variant, there are continued signs of concern in South Africa, with cases coming in at a record 26,976 yesterday, whilst the number in hospital at 7,339 is up +73% compared to a week ago. Meanwhile the UK recorded their highest number of cases since the pandemic began, at 78,610. England’s Chief Medical Officer, Chris Whitty, said that a lot of Covid records would be broken in the coming weeks, and also that a majority of cases in London were now from the Omicron variant. Separately, the French government is set to hold a meeting tomorrow on Covid measures, and EU leaders will be discussing the pandemic at their summit today.

When it comes to Omicron’s economic impact, we could see some light shed on that today as the December flash PMIs are released from around the world. Overnight we’ve already had the numbers out of Australia and Japan where hints of a slowdown are apparent. Japan's Manufacturing PMI came out at 54.2 (54.5 previous) and the Composite at 51.8 (53.3 previous) while Australia’s Manufacturing and Composite came in at 57.4 and 54.9 respectively (59.2 and 55.7 previous).

Overnight in Asia stocks are trading mostly higher led by the Nikkei (+1.78%) followed by the Shanghai Composite (+0.28%), and KOSPI (+0.22%). However the CSI (-0.07%) and Hang Seng (-0.81%) are losing ground on concerns of US sanctions on Chinese tech companies. In Australia, the November employment report registered a strong beat by adding 366.1k jobs against 200k consensus. This is being reflected in a +12.75 bps surge in Australia's 3y bond. Elsewhere, in India wholesale inflation for November rose +14.2% year on year, levels last seen in 2000 against a consensus of +11.98% on the back of higher food and input prices. DM futures are indicating a positive start to markets today with S&P 500 (+0.19%) and DAX (+1.04%) contracts both higher as we type.

Ahead of the Fed, European markets had put in a fairly steady performance yesterday, with the STOXX 600 up +0.26%. That brought an end to a run of 5 successive declines, with technology stocks in particular seeing an outperformance. Sovereign bond markets were also subdued ahead of the ECB and BoE meetings later, with yields on 10yr bunds (+0.9bps), OATs (+0.5bps) and gilts (+1.2bps) only seeing modest moves higher.

In DC, despite optimistic sounding talks earlier in the week, the latest yesterday was President Biden and Senator Manchin remained far apart on the administration’s build back better bill, imperiling its chances of passing before Christmas. Elsewhere, reports suggested the President would have more nominations for the remaining Fed Board vacancies this week.

Looking at yesterday’s other data, US retail sales underwhelmed in November with growth of just +0.3% (vs. +0.8% expected), and measure excluding gas and motor vehicles was also up just +0.2% (vs. +0.8% expected). Also the NAHB’s housing market index for December moved up to a 10-month high of 84, in line with expectations.

To the day ahead now, and the main highlights will be the aforementioned policy decisions from the ECB and the BoE. On the data side, we’ll also get the flash PMIs for December from around the world, the Euro Area trade balance for October, and in the US there’s November data on industrial production, housing starts and building permits, as well as the weekly initial jobless claims. Finally, EU leaders will be meeting for a summit in Brussels.

Government

Survey Shows Declining Concerns Among Americans About COVID-19

Survey Shows Declining Concerns Among Americans About COVID-19

A new survey reveals that only 20% of Americans view covid-19 as "a major threat"…

A new survey reveals that only 20% of Americans view covid-19 as "a major threat" to the health of the US population - a sharp decline from a high of 67% in July 2020.

What's more, the Pew Research Center survey conducted from Feb. 7 to Feb. 11 showed that just 10% of Americans are concerned that they will catch the disease and require hospitalization.

"This data represents a low ebb of public concern about the virus that reached its height in the summer and fall of 2020, when as many as two-thirds of Americans viewed COVID-19 as a major threat to public health," reads the report, which was published March 7.

According to the survey, half of the participants understand the significance of researchers and healthcare providers in understanding and treating long COVID - however 27% of participants consider this issue less important, while 22% of Americans are unaware of long COVID.

What's more, while Democrats were far more worried than Republicans in the past, that gap has narrowed significantly.

"In the pandemic’s first year, Democrats were routinely about 40 points more likely than Republicans to view the coronavirus as a major threat to the health of the U.S. population. This gap has waned as overall levels of concern have fallen," reads the report.

More via the Epoch Times;

The survey found that three in ten Democrats under 50 have received an updated COVID-19 vaccine, compared with 66 percent of Democrats ages 65 and older.

Moreover, 66 percent of Democrats ages 65 and older have received the updated COVID-19 vaccine, while only 24 percent of Republicans ages 65 and older have done so.

“This 42-point partisan gap is much wider now than at other points since the start of the outbreak. For instance, in August 2021, 93 percent of older Democrats and 78 percent of older Republicans said they had received all the shots needed to be fully vaccinated (a 15-point gap),” it noted.

COVID-19 No Longer an Emergency

The U.S. Centers for Disease Control and Prevention (CDC) recently issued its updated recommendations for the virus, which no longer require people to stay home for five days after testing positive for COVID-19.

The updated guidance recommends that people who contracted a respiratory virus stay home, and they can resume normal activities when their symptoms improve overall and their fever subsides for 24 hours without medication.

“We still must use the commonsense solutions we know work to protect ourselves and others from serious illness from respiratory viruses, this includes vaccination, treatment, and staying home when we get sick,” CDC director Dr. Mandy Cohen said in a statement.

The CDC said that while the virus remains a threat, it is now less likely to cause severe illness because of widespread immunity and improved tools to prevent and treat the disease.

“Importantly, states and countries that have already adjusted recommended isolation times have not seen increased hospitalizations or deaths related to COVID-19,” it stated.

The federal government suspended its free at-home COVID-19 test program on March 8, according to a website set up by the government, following a decrease in COVID-19-related hospitalizations.

According to the CDC, hospitalization rates for COVID-19 and influenza diseases remain “elevated” but are decreasing in some parts of the United States.

Government

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

Government

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While “Waiting” For Deporation, Asylum

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While "Waiting" For Deporation, Asylum

Over the past several…

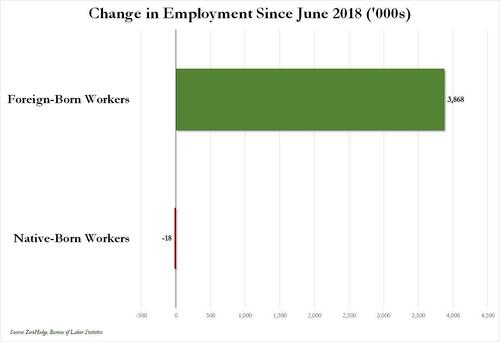

Over the past several months we've pointed out that there has been zero job creation for native-born workers since the summer of 2018...

... and that since Joe Biden was sworn into office, most of the post-pandemic job gains the administration continuously brags about have gone foreign-born (read immigrants, mostly illegal ones) workers.

And while the left might find this data almost as verboten as FBI crime statistics - as it directly supports the so-called "great replacement theory" we're not supposed to discuss - it also coincides with record numbers of illegal crossings into the United States under Biden.

In short, the Biden administration opened the floodgates, 10 million illegal immigrants poured into the country, and most of the post-pandemic "jobs recovery" went to foreign-born workers, of which illegal immigrants represent the largest chunk.

'But Tyler, illegal immigrants can't possibly work in the United States whilst awaiting their asylum hearings,' one might hear from the peanut gallery. On the contrary: ever since Biden reversed a key aspect of Trump's labor policies, all illegal immigrants - even those awaiting deportation proceedings - have been given carte blanche to work while awaiting said proceedings for up to five years...

... something which even Elon Musk was shocked to learn.

Wow, learn something new every day https://t.co/8MDtEEZGam

— Elon Musk (@elonmusk) March 10, 2024

Which leads us to another question: recall that the primary concern for the Biden admin for much of 2022 and 2023 was soaring prices, i.e., relentless inflation in general, and rising wages in particular, which in turn prompted even Goldman to admit two years ago that the diabolical wage-price spiral had been unleashed in the US (diabolical, because nothing absent a major economic shock, read recession or depression, can short-circuit it once it is in place).

Well, there is one other thing that can break the wage-price spiral loop: a flood of ultra-cheap illegal immigrant workers. But don't take our word for it: here is Fed Chair Jerome Powell himself during his February 60 Minutes interview:

PELLEY: Why was immigration important?

POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans do. But that's largely because of the age difference. They tend to skew younger.

PELLEY: Why is immigration so important to the economy?

POWELL: Well, first of all, immigration policy is not the Fed's job. The immigration policy of the United States is really important and really much under discussion right now, and that's none of our business. We don't set immigration policy. We don't comment on it.

I will say, over time, though, the U.S. economy has benefited from immigration. And, frankly, just in the last, year a big part of the story of the labor market coming back into better balance is immigration returning to levels that were more typical of the pre-pandemic era.

PELLEY: The country needed the workers.

POWELL: It did. And so, that's what's been happening.

Translation: Immigrants work hard, and Americans are lazy. But much more importantly, since illegal immigrants will work for any pay, and since Biden's Department of Homeland Security, via its Citizenship and Immigration Services Agency, has made it so illegal immigrants can work in the US perfectly legally for up to 5 years (if not more), one can argue that the flood of illegals through the southern border has been the primary reason why inflation - or rather mostly wage inflation, that all too critical component of the wage-price spiral - has moderated in in the past year, when the US labor market suddenly found itself flooded with millions of perfectly eligible workers, who just also happen to be illegal immigrants and thus have zero wage bargaining options.

None of this is to suggest that the relentless flood of immigrants into the US is not also driven by voting and census concerns - something Elon Musk has been pounding the table on in recent weeks, and has gone so far to call it "the biggest corruption of American democracy in the 21st century", but in retrospect, one can also argue that the only modest success the Biden admin has had in the past year - namely bringing inflation down from a torrid 9% annual rate to "only" 3% - has also been due to the millions of illegals he's imported into the country.

We would be remiss if we didn't also note that this so often carries catastrophic short-term consequences for the social fabric of the country (the Laken Riley fiasco being only the latest example), not to mention the far more dire long-term consequences for the future of the US - chief among them the trillions of dollars in debt the US will need to incur to pay for all those new illegal immigrants Democrat voters and low-paid workers. This is on top of the labor revolution that will kick in once AI leads to mass layoffs among high-paying, white-collar jobs, after which all those newly laid off native-born workers hoping to trade down to lower paying (if available) jobs will discover that hardened criminals from Honduras or Guatemala have already taken them, all thanks to Joe Biden.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex