Russia to regulate digital assets as currency, McDonald’s eyes the metaverse, YouTube to adopt NFTs and XRP pumps 30%: Hodler’s Digest, Feb. 6-12

Coming every Saturday, Hodlers Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption…

Coming every Saturday, Hodlers Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more a week on Cointelegraph in one link.

Top Stories This Week

Russian government and central bank agree to treat Bitcoin as currency

The Russian government and central bank made an agreement to regulate crypto as an analogue of currencies instead of digital financial assets.

The updated regulation is part of a draft law that is slated to launch on Feb. 18, and will see approved cryptocurrencies such as Bitcoin function in lawful exchanges through the banking system or licensed intermediaries.

As part of the incoming framework, crypto transactions worth more than 600,000 rubles ($8,000) would have to be declared; otherwise, such transactions could be considered a criminal act. Those who illegally accept cryptocurrencies as payment will incur fines.

Upcoming Apple iPhone feature to give merchants a way to accept crypto payments

This week, Apple unveiled a new Tap to Pay feature for its iPhones that will enable businesses and merchants to conduct contactless point-of-sale transactions with Apple Pay, credit cards, debit cards and digital wallets.

The move also enables customers who use crypto payment methods such as Coinbase Card and Crypto.com Visa Card to use their holdings to make payments via Tap to Pay. However, it will most likely involve the conversion of crypto to fiat in real time to do so.

Apple announced Stripe as the first platform to offer Tap to Pay on the iPhone and indicated that other payment platforms and apps will introduce the feature throughout 2022.

XRP gains 30% after Ripple gets permission to explain fair notice defense vs. SEC

The price of XRP surged 30% this week on the back of positive developments in the long-running court case between Ripple Labs and the United States Securities and Exchange Commission (SEC).

According to court documents from last week, Judge Analisa Torres permitted Ripple to respond to the SEC’s memorandum of law in support of the motion to strike Ripple’s fourth affirmative defense. The judge also ordered for the unsealing of three documents concerning the case, including two email threads belonging to Ripple CEO Brad Garlinghouse and co-founder Chris Larsen respectively, as well as Garlinghouse’s deposition notice.

Shortly after the news was published, the price of XRP rallied around 30% between Feb. 3 and Feb. 7. The gains have held up well over that period, with CoinMarketCap data showing a 32% gain in XRPs price over the past seven days at the time of writing.

YouTube sees incredible potential in NFT video sales despite backlash threat

YouTube is looking at integrating NFTs, blockchain and Web3 tech into its platform in a bid to roll out new features for its partnered creators. In a Thursday blog post, YouTube’s chief product officer Neal Mohan also stated the firm is aiming to ramp up its metaverse-based services.

Mohan outlined that YouTube creators are looking for new ways to make content and add revenue streams, and the Web3 tech could be the solution, stating:

Web3 also opens up new opportunities for creators. We believe new technologies like blockchain and NFTs can allow creators to build deeper relationships with their fans. Together, theyll be able to collaborate on new projects and make money in ways not previously possible.

McDonalds files trademarks for McMetaverse restaurants that deliver

In a move that seems entirely unnecessary, fast-food giant McDonalds was said to be eyeing the metaverse this week after reports surfaced that the firm had registered 10 virtual world-related trademarks.

Trademark attorney and founder of Gerben Perrott PLLC, Josh Gerben, stated via Twitter that the McDonalds trademark applications involved a virtual restaurant featuring actual and virtual goods and operating a virtual restaurant featuring home delivery.

Based on the application, McDonald’s seeks to provide downloadable multimedia files for artwork, audio and video files, and NFTs. At the same time, its also working on providing virtual concerts and events.

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $43,485 Ether (ETH) is at $3,103 and XRP is at $0.81. The total market cap is at $1.67 trillion, according to CoinMarketCap.

At the end of the week, Bitcoin (BTC) is at $43,485 Ether (ETH) is at $3,103 and XRP is at $0.81. The total market cap is at $1.67 trillion, according to CoinMarketCap.

The top three gainers of the week are Gala (GALA) at 63.46%, IoTeX (IOTX) at 39.76% and Shiba Inu (SHIB) at 39.27%.

The top three altcoin losers of the week are Maker (MKR) at -8%, Convex Finance (CVX) at -5.8% and Nexo (NEXO) at -3.42%.

For more info on crypto prices, make sure to read Cointelegraphs market analysis.

Most Memorable Quotations

After working in traditional finance for over a decade, I became disillusioned by the many limitations and injustices I witnessed. The industry is plagued by unreasonable fees and inefficient systems. In various ways, these all serve to favor the wealthy and suppress the underprivileged.

Jack Tao, founder and CEO of Phemex

“To be a world leader, Canada needs to make sure crypto-asset experts and investors are telling us what policy they need or what policy they dont need.”

Michelle Rempel Garner, member of parliament in the House of Commons of Canada

I think youre going to see every brand that you can think of make these [metaverse-related trademark] filings within the next 12 months. I dont think anyone wants to be the next Blockbuster and just completely ignore a new technology thats coming.

Josh Gerben, trademark attorney and founder of Gerben Perrott PLLC

As Web3 and blockchain technologies move forward and the crypto market comes of age, we know that media is an essential element to build widespread consumer understanding and education.

Changpeng Zhao, founder and CEO of Binance

Todays arrests, and the departments largest financial seizure ever, show that cryptocurrency is not a safe haven for criminals.”

Lisa Monaco, deputy attorney general for the U.S. Department of Justice

We see the future of the metaverse as being truly decentralized and existing almost completely on the blockchain, so the future of marriage in the metaverse will not need to have a record of their marriage in the real world.

Jordan Rose, founder and president of Rose Law Group

There are dozens of artists preparing lawsuits against OpenSea for selling infringing NFTs. These examples are a sneak preview of a wave of litigation heading towards the space. Its both good and bad in that it discourages creativity and growth in some ways, but its beneficial because it will ultimately help provide some guidelines in terms of clear legal parameters and guidelines for the space.

Jeff Gluck, CEO of CXIP Labs

The current [Bitcoin] supply dynamics can best be described as a powder keg. The question remains who lights the match.

FSInsight’s Digital Assets In A Post-Cycle World report

Prediction of the Week

A quarter of people will have spent time in the metaverse by 2026: Research

Tech research and consulting company Gartner published a report on Monday estimating that 25% of people will be spending at least one hour a day in the metaverse by 2026, for activities such as work, shopping, education, socializing and entertainment.

The ambitious estimate appears to be the brainchild of Gartner vice president Marty Resnick, who predicted in the report that around 30% of the worlds organizations will have metaverse-based products and services within the next four years:

Eventually, they will take place in a single environment the metaverse with multiple destinations across technologies and experiences.

FUD of the Week

DoJ seizes $3.6B in crypto and arrests two in connection with 2016 Bitfinex hack

The U.S. Department of Justice dropped a bombshell announcement on Tuesday, revealing that it had made arrests of two individuals and seized 119,756 Bitcoin ($5.1 billion at current prices) stolen from the Bitfinex exchange in 2016.

Ilya Lichtenstein and his wife Heather Morgan are alleged to have conspired to launder crypto connected to the infamous Bitfinex hack, with the DoJ stating that it had traced 25,000 siphoned BTC being transferred to financial accounts owned by the pair.

In a futile effort to maintain digital anonymity, the defendants laundered stolen funds through a labyrinth of cryptocurrency transactions, said Deputy Attorney General Lisa Monaco. Thanks to the meticulous work of law enforcement, the department once again showed how it can and will follow the money, no matter what form it takes.

Central Bank of Ireland nixes crypto funds: Too difficult ‘for a retail investor’

The Central Bank of Ireland stated this week that it may not approve crypto investment funds because they are supposedly too complicated for the lowly retail investor.

The comments were made via the February 2022 Securities Markets Risk Outlook Report in which the central bank warned that the crypto market provides a potential threat to investor protection. The central bank said:

The Central Bank is highly unlikely to approve a UCITS or a Retail Investor AIF proposing any exposure to crypto-assets, taking into account the specific risks attached to crypto-assets and the possibility that appropriate risk assessment could be difficult for a retail investor without a high degree of expertise.

BBC pulls doco as doubts emerge over trader who turned $50 into $8M

The British Broadcasting Corporation (BBC) pulled a documentary featuring a 20-year-old crypto trader who claimed to have turned $50 into $8 million last year. The story was set to explore how Hanad Hassan made his fortune and started to give back to the community following his newfound wealth.

The BBCs promo for the documentary stated that Hassan launched a crypto project called Orfano that donated all of its profits to charity, stating that as much as $200,000 had been allocated to a good cause last year. However, The Guardian essentially called out the BBC for conducting shoddy research, with the publication’s media editor, Jim Waterson, writing:

The Guardian asked the BBC if it was confident in [Hassan’s] claimed financial returns and questioned why the programs promotional material did not mention that Hassans cryptocurrency Orfano was abruptly shut down in October, with many unhappy investors claiming they were left out of pocket as a result.

The BBC swiftly said it had withdrawn the show but did not make any further comment on its editorial checks, Waterson continued.

Best Cointelegraph Features

Charity hack fixes your crypto CGT bill: Endaoment

Robbie Heegers Endaoment has facilitated the donation of over $30 million of cryptocurrency to 243 different charities. These donations come from altruistic cryptocurrency investors who are also partly motivated by reducing their tax burdens to Uncle Sam and keeping more of their profits.

The virus killer: How blockchain contributes to the fight against COVID-19

Blockchain-powered solutions have been on the front line of the battle against Covid-19, yet their potential has been underutilized.

Music in the Metaverse creates social and immersive experiences for users

Music is becoming a key feature in the metaverse, but will challenges hamper adoption?

The best of blockchain, every Tuesday

Subscribe for thoughtful explorations and leisurely reads from Magazine.

By subscribing you agree to our Terms of Service and Privacy Policy

cryptocurrency bitcoin blockchain crypto btc xrp link covid-19 currencies crypto

International

TikTok Ban Obscures Chinese Stock Gold Rush

No one wants to invest in China right now. The country’s stock market is teetering on the brink of collapse. And it is about to lose its biggest foothold…

No one wants to invest in China right now.

The country’s stock market is teetering on the brink of collapse.

And it is about to lose its biggest foothold in America — TikTok.

Yet, beneath its crumbling economy, military weather balloons and blatant propaganda tools lie some epic opportunities…

…if you have the stomach and the knowledge.

Because as Jim Woods wrote in his newsletter last month:

“China has been so battered for so long, that there is a lot of deep value here for the ‘blood in the ‘’red’’ streets’ investors.”

And boy was he right.

However, this battle-tested veteran didn’t recommend buying individual Chinese stocks.

He was more interested in the exchange-traded funds (ETFs) like the CHIQ.

And here’s why…

Predictable Manipulation

China’s heavy-handed approach creates gaping economic inefficiencies.

When markets falter, President Xi calls on his “national team” to prop up prices.

$17 billion flowed into index-tracking funds in January as the Hang Sang fell over 13% while the CSI dropped over 7%.

Jim Woods saw this coming from a mile away.

In late February, he highlighted the Chinese ETF CHIQ in late February, which has rallied rather nicely since then.

This ETF focuses on the Chinese consumer, a recent passion project for the central government.

You see, around 2018, when President Xi decided to smother his own economy, notable shifts were already taking place.

The once burgeoning retail market had slowed markedly. Developers left cities abandoned, including weird copies of Paris (Tianducheng) and England.

Source: Shutterstock

So, Xi and co. shifted the focus to the consumer… which went terribly.

For starters, a lot of the consumer wealth was tied up in real estate.

Then you had a growing population of unemployed younger adults who didn’t have any money to spend.

Once the pandemic hit, everything collapsed.

That’s why it took China far longer to recover even a sliver of its former economy.

While it’s not the growth engine of the early 2000s, the old girl still has some life left in it.

As Jim pointed out, China’s consumer spending rebounded nicely in Q4 2023.

Source: National Bureau of Statistics of China

Combined with looser central bank policy, it was only a matter of time before Chinese stocks caught a lift.

The resurgence may be largely tied to China’s desire to travel. After all, its people have been cooped up longer than any other country.

But make no mistake, this doesn’t make China a long-term investment.

Beyond what most people understand about China’s politics, there’s a little-known fact about how they treat foreign investors.

Money in. Nothing out.

When we buy a stock, we’re taking partial ownership in that company. This entitles us to a portion of the profits (or assets).

That doesn’t happen with Chinese companies.

American depository receipts (ADRs) aren’t actual shares of a company. It’s a note that the intermediary ties to shares of the company they own overseas.

So, we can only own Chinese companies indirectly.

But there’s another key feature you probably weren’t aware of.

Many of the Chinese companies we, as Americans invest in, don’t pay dividends. In fact, a much smaller percentage of Chinese companies pay any dividends.

Alibaba is a perfect example.

Despite generating billions of dollars in cash every year, it doesn’t pay dividends.

What do its managers do with the money?

Other than squirreling away $80 billion on its balance sheets, they do share buybacks.

Plenty of investors will tell you that’s even better than dividends.

But you have no legal ownership rights in China. So, what is that ADR in reality?

We’d argue nothing but paper profits at best, and air at worst.

That’s why it’s flat-out dangerous to own shares of individual Chinese companies long-term.

Any one of them can be nationalized at any moment.

Chinese ETFs reduce that risk through diversification, similar to junk bond funds.

Short of an all-out ban, like between the United States and Russia, the majority of the ETF holdings should remain intact.

Opportunistic Investing

If China is so unstable, and capable of changing at a moment’s notice, how can investors uncover pockets of value?

As Jim showed with his ETF selection, you can have some sector or thematic idea so long as you have the data to support it.

China, like any large institution, isn’t going to change its broad economic policies overnight.

As long as you study the general movements of the government, you can steer clear of the catastrophic zones and towards the diamond caves.

Because when things look THIS bad, you know the opportunities are even juicier.

But rather than try to run this maze solo, take this opportunity to check out Jim Woods’ latest report on China.

In it, he details the broad economic themes driving the Chinese government, and how to exploit them for gain.

Click here to explore Jim Woods’ report.

The post TikTok Ban Obscures Chinese Stock Gold Rush appeared first on Stock Investor.

stocks pandemic real estate etf consumer spending gold russia chinaInternational

The Great Escape… of UK Unemployment Reporting

https://bondvigilantes.com/wp-content/uploads/2024/03/1-the-great-escape-of-uk-unemployment-reporting-1024×576.pngThe Bank of England Monetary Policy Committee…

The Bank of England Monetary Policy Committee potentially has a problem: it requires data to make its labour market forecasts and assessments, but the unemployment statistics have become increasingly unreliable. This is because the Labour Force Survey participation rate (on which the unemployment figures are based) has fallen below 50% since 2018 and has been as low as 15% recently[1]. What is the solution to this difficult measurement problem? An answer can be found in the classic war film, The Great Escape.

In 1943, the Escape Committee of Stalag Luft III was tasked with digging a tunnel to freedom. Unfortunately, they had a problem. They needed to measure the distance between one of the prisoner’s huts and the forest beyond the prison perimeter, but they had no reliable tools to measure this critical variable. Fortunately they had two mathematicians within the group who came up with a method to gauge the distance to the forest so that the tunnel would be long enough to ensure escape without detection. The idea was to eyeball the distance using a 20 foot tree for scale (the tree was the one ‘accurate’ measurement around which they could work with). They got individual prisoners to gauge the distance from the hut to the tree and then averaged all of the estimates. The critical distance measure was therefore the average of a large sample size of guesstimates. Fortunately, it more or less worked. Happily, modern economists have an equivalent to rely on in the area of unemployment. Their version of the Stalag Luft III tree strategy is something called the Beveridge Curve.

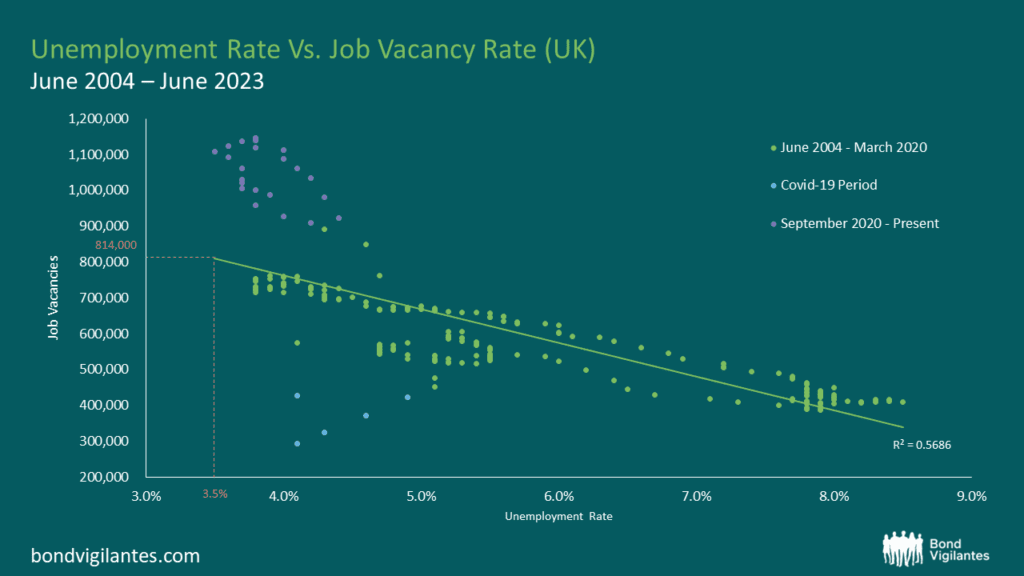

The Beveridge Curve is simply an observed relationship between an economy’s unemployment rate and its job vacancy rate at the same point in time. An excellent exposition can be found in the Bond Vigilantes archive[2]. When you plot the two variables against one another over a given period, the data points disclose a curve. This curve shows us that when unemployment increases, job vacancies decrease and vice versa. I have plotted the current curve below using the available data from the Office for National Statistics (ONS)[3]. The bottom left quadrant of the graph (the blue dots) relate to the Covid-19 era and the top left quadrant (the purple dots) represent the last 2 years’ worth of data. The green dots represent the remaining data from July 2004 to June 2023.

Source: Office for National Statistics, Dataset JP9Z & UNEM

Source: Office for National Statistics, Dataset JP9Z & UNEM

From these charts and new data from the ONS, we can observe that in the UK, the level of unemployment is increasing and that the job vacancy rate is decreasing. At face value, this suggests that current Bank of England monetary policy is working and that the inflation rate is slowing as the economy cools. One could argue that we are on track for a reasonably soft landing. Nothing new so far.

Things become more interesting when we consider the Beveridge Curve in conjunction with the most recent job vacancy data. We are told that there are now 814,000 job vacancies as of the 31st December 2023[4]. Ordinarily, we would use the curve and clearly be able to extrapolate from the Job Vacancy data what our Unemployment figure might be. However, we also know that the current unemployment data is unreliable, which makes this harder. Using our model inclusive of data oddities, we could extrapolate that with 814,000 job vacancies, we might expect an unemployment rate of around 3.5%. Yet, we know that our unemployment figures are unreliable so the question therefore is, how big an increase in unemployment are we likely to see given what we know about job vacancies?

In order to estimate the magnitude of the rise in unemployment, we need to look further afield. If we study the levels of economic inactivity in the UK, we can observe that they have remained stationary at 22%[5] for the last decade. We can also see that the population of the UK has risen over the same period by around 5.91%[6]. Further, we know that the Labour Force Survey (LFS) samples 40,000 households per quarter to obtain its data, but of late has had a response rate of only 15% (6,000 households). Therefore a critical question for policy makers is what is happening with the 85%, the non-responders?

Given the small sample size, it is entirely possible that the LFS suffered survey bias that is being erroneously weighted away. In other words, the LFS compensates for the paucity of response data by accessing other regional population statistics as a legitimate part of their methodology. The problems of non-responders are being addressed in upcoming LFS releases but for the time being, the data is not as clear as it ought to be. With such a small sample size, it seems possible – indeed probable – that unemployment levels are being underreported. This would explain why the current unemployment rate of 3.8%[7] is dramatically lower than the historic average of 6.7% (1971-2023). We see further evidence for this in the forecasts of the UK’s unemployment rate on Bloomberg which have been consistently above the actual levels for the last few published data points. So whilst the published headline figures might be looking reasonable, the underlying story looks like it could be hiding something more sinister.

Through it all, the Beveridge Curve remains a reasonable template. Job vacancies are definitely falling, so we should expect to see unemployment rising. Like the Stalag Luft III measurement solution, the Beveridge Curve offers a constructive way out of our present statistical dilemma. That being said, analogies can only be taken so far. Unfortunately for the inmates of Stalag Luft III, the calculation didn’t quite work and the tunnel came up short. No one actually made a Great Escape. What does this mean for UK unemployment data? Time may tell.

[1] The UK’s ‘official’ labour data is becoming a nonsense (harvard.edu)

[2] https://bondvigilantes.com/blog/2013/11/a-shifting-beveridge-curve-does-the-us-have-a-long-term-structural-unemployment-problem/

[3] Unemployment – Office for National Statistics (ons.gov.uk)

[4] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/timeseries/jp9z/unem

[5] https://www.ethnicity-facts-figures.service.gov.uk/work-pay-and-benefits/unemployment-and-economic-inactivity/economic-inactivity/latest/#:~:text=data%20shows%20that%3A-,22%25%20of%20working%20age%20people%20in%20England%2C%20Scotland%20and%20Wales,for%20a%20job)%20in%202022

[6] https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationestimates/bulletins/annualmidyearpopulationestimates/mid2021

[7] https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment

unemployment covid-19 monetary policy unemployment ukInternational

Germany Is Running Out Of Money And Debt Levels Are Exploding, Finance Minister Warns

Germany Is Running Out Of Money And Debt Levels Are Exploding, Finance Minister Warns

By John Cody of Remix News

German Finance Minister…

By John Cody of Remix News

German Finance Minister Christian Lindner is warning his own government that state finances are quickly growing out of hand, and the government needs to change course and implement austerity measures. However, the dispute over spending is only expected to escalate, with budget shortfalls causing open clashes among the three-way left-liberal coalition running the country.

With negotiations kicking off for the 2025 budget, much is at stake. However, the picture has been complicated after the country’s top court ruled that the government could not shift €60 billion in money earmarked for the coronavirus crisis to other areas of the budget, with the court noting that the move was unconstitutional.

Since then, the government has been in crisis mode, and sought to cut the budget in a number of areas, including against the country’s farmers. Those cuts already sparked mass protests, showcasing how delicate the situation remains for the government.

Lindner, whose party has taken a beating in the polls, is desperate to create some distance from his coalition partners and save his party from electoral disaster. The finance minster says the financial picture facing Germany is dire, and that the budget shortfall will only grow in the coming years if measures are not taken to rein in spending.

“In an unfavorable scenario, the increasing financing deficits lead to an increase in debt in relation to economic output to around 345 percent in the long term,” reads the Sustainability Report released by his office. “In a favorable scenario, the rate will rise to around 140 percent of gross domestic product by 2070.”

Under EU law, Germany has limited its debt levels to 60 percent of economic output, which requires dramatic savings. A huge factor is Germany’s rapidly aging population, with a debt explosion on the horizon as more and more citizens head into retirement while tax revenues shrink and the social welfare system grows — in part due to the country’s exploding immigrant population.

Lindner’s partners, the Greens and Social Democrats (SPD), are loath to cut spending further, as this will harm their electoral chances. In fact, Labor Minister Hubertus Heil is pushing for a new pension package that will add billions to the country’s debt, which remarkably, Lindner also supports.

Continue reading at rmx.news

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex