Uncategorized

RE/MAX® Survey Finds Homeownership Remains a Top Priority, Despite Shifting Market Conditions

RE/MAX® Survey Finds Homeownership Remains a Top Priority, Despite Shifting Market Conditions

PR Newswire

DENVER, Dec. 12, 2022

Many consumers are also seeking guidance from real estate professionals

DENVER, Dec. 12, 2022 /PRNewswire/ — Today RE/M…

RE/MAX® Survey Finds Homeownership Remains a Top Priority, Despite Shifting Market Conditions

PR Newswire

DENVER, Dec. 12, 2022

Many consumers are also seeking guidance from real estate professionals

DENVER, Dec. 12, 2022 /PRNewswire/ -- Today RE/MAX, LLC released new survey findings highlighting consumer sentiment and intentions for homebuying and selling amid the changing housing climate of the last year. The findings reveal that homeownership remains a top priority for consumers, and many have adjusted their previous plans in order to take advantage of ideal conditions or in anticipation of a shifting market.

"We've seen historic competition in housing over the last two years. As the market begins to rebalance, homebuyers and sellers remain focused on the goal of homeownership despite the ongoing fluctuations," shares Nick Bailey, President and CEO of RE/MAX, LLC. "The findings of this survey underscore Americans' desire to own a home and highlights the important role real estate agents play in guiding them through the often-complex buying and selling process."

Key survey findings include:

Americans were not dissuaded by the real estate headlines and rising interest rates. Buyers remained intent on purchasing a home despite the process becoming more challenging – many were willing to spend more and/or expedite their timelines if it helped them score a new home.

- Sixty-eight percent of respondents plan to buy a house or condo in the next few years.

- Fifty-three percent have expedited their homebuying plans as a result of current market conditions.

- Almost half of respondents would be willing to spend over the asking price for a property:

- If they've had one or more rejected offers previously – 49%

- That meets 75% or more of their wish list – 45%

A shortage of inventory, historically low rates, and strong demand helped drive a sellers' market during the pandemic. As rates continue to rise and prices decline, sellers who may have previously been hesitant to sell have quickly changed their minds. Additionally, long-term impacts of the pandemic, like continued remote work, mean there are more opportunities for homeowners to choose where they want to live, without being limited by their job's location.

- Fifty-three percent of respondents who planned to sell their house in the next few years, reported that market conditions motivated them to sell their property sooner than they initially planned.

- The top three requirements for respondents moving to a new location include:

- Moving closer to family – 46%

- To a location with better weather – 44%

- Closer to their or their partner's job – 40%

As competition remains strong and rates rise, guidance from real estate professionals is even more critical.

- Fifty-nine percent plan to use a real estate agent when they buy or sell a house

- Forty-seven percent of respondents will visit a real estate website or directory for trusted information and recommendations for Realtors®.

The latest RE/MAX National Housing Report for October 2022 revealed a vastly different housing market from one year ago, with 30.7% fewer closings, 36.8% more homes for sale, and the average home taking nearly a week longer to sell, at 35 days on market. As a result, the Median Sales Price was pushed down 0.3% to $399,000 from September's $400,000 – the third straight month of decline. Across the report's 53 metro markets, all 10 months of 2022 thus far have posted lower home sales compared to 2021. October was the sixth consecutive month with more for-sale signs than the same month last year.

Bailey adds, "Housing is still a strong investment for Americans, and we expect to see sustained demand next year. However, it will be more important than ever for buyers and sellers to work with an expert to help them navigate the ever-changing market conditions."

To find a RE/MAX agent in your area, please visit www.remax.com

Methodology: Data is based on a survey conducted in partnership with SWNS Media Group and fielded between September 21, 2022 and October 10, 2022 among 2,000 men and women, between the ages 18-77+.

As one of the leading global real estate franchisors, RE/MAX, LLC is a subsidiary of RE/MAX Holdings (NYSE: RMAX) with nearly 140,000 agents in more than 110 countries and territories. Nobody in the world sells more real estate than RE/MAX, as measured by residential transaction sides. RE/MAX was founded in 1973 by Dave and Gail Liniger, with an innovative, entrepreneurial culture affording its agents and franchisees the flexibility to operate their businesses with great independence. RE/MAX agents have lived, worked and served in their local communities for decades, raising millions of dollars every year for Children's Miracle Network Hospitals® and other charities. To learn more about RE/MAX, to search home listings or find an agent in your community, please visit www.remax.com. For the latest news about RE/MAX, please visit news.remax.com.

Appendix:

- 84% of Gen Z, 79% of Millennials and 61% of respondents 77 or older plan to buy a house or condo in the next few years.

- More men (81%) than women (59%) plan to buy a house/condo in the next few years.

- More than half of women (51%) plan to rent.

- More than half of homebuyers in the Southwest (58%) reported that market conditions delayed their plans to buy a house.

- Homebuyers in the Northwest (64%) were the most likely to expedite their purchase process.

- Compared to other generations, Millennials are the most likely to spend over asking price for a property:

- That meets 75% of more of their wish list (54%)

- If they've had one or more rejected offers previously (57%)

- To help them stand out in a bidding war (48%)

- Most respondents (72%) are willing to spend $30,000 or less over the asking price.

- On average, men are willing to spend more over the asking price than women.

- Nearly half of buyers in the Midwest and Northeast are willing to offer over the asking price for a home to help them stand out in a bidding war.

- Homebuyers in the Midwest (75%) and Southwest (75%) are most likely to spend $20,000 or more over asking price.

- Nearly 1 in 3 respondents reported their primary reason for selling their current house is to take advantage of current market conditions (30%) – including 60% of respondents 77+ – or to upsize (33%)

- Most Gen Z respondents (56%) plan to move out of their current state of residence after they sell their current house/condo.

- Nearly half of homebuyers in the Southwest plan to purchase a home in a new state.

- A majority of Millennial (66%) and Gen X (58%) respondents plan to use a real estate agent when they buy or sell a house/condo; whereas most Gen Z (68%), Baby Boomer (63%), and respondents 77+ (63%) do not plan to or are not sure if they will use a real estate agent.

- A majority of home sellers (65%) plan to update their home prior to selling.

- Younger generations are more likely to upgrade their home prior to selling compared to Baby Boomers and those 77+.

- Compared to other regions, home sellers in the Midwest are not as likely to update their home prior to selling.

- The top upgrades sellers plan to make are to the bathroom (49%) and kitchen (48%).

View original content to download multimedia:https://www.prnewswire.com/news-releases/remax-survey-finds-homeownership-remains-a-top-priority-despite-shifting-market-conditions-301699948.html

SOURCE RE/MAX, LLC

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemicUncategorized

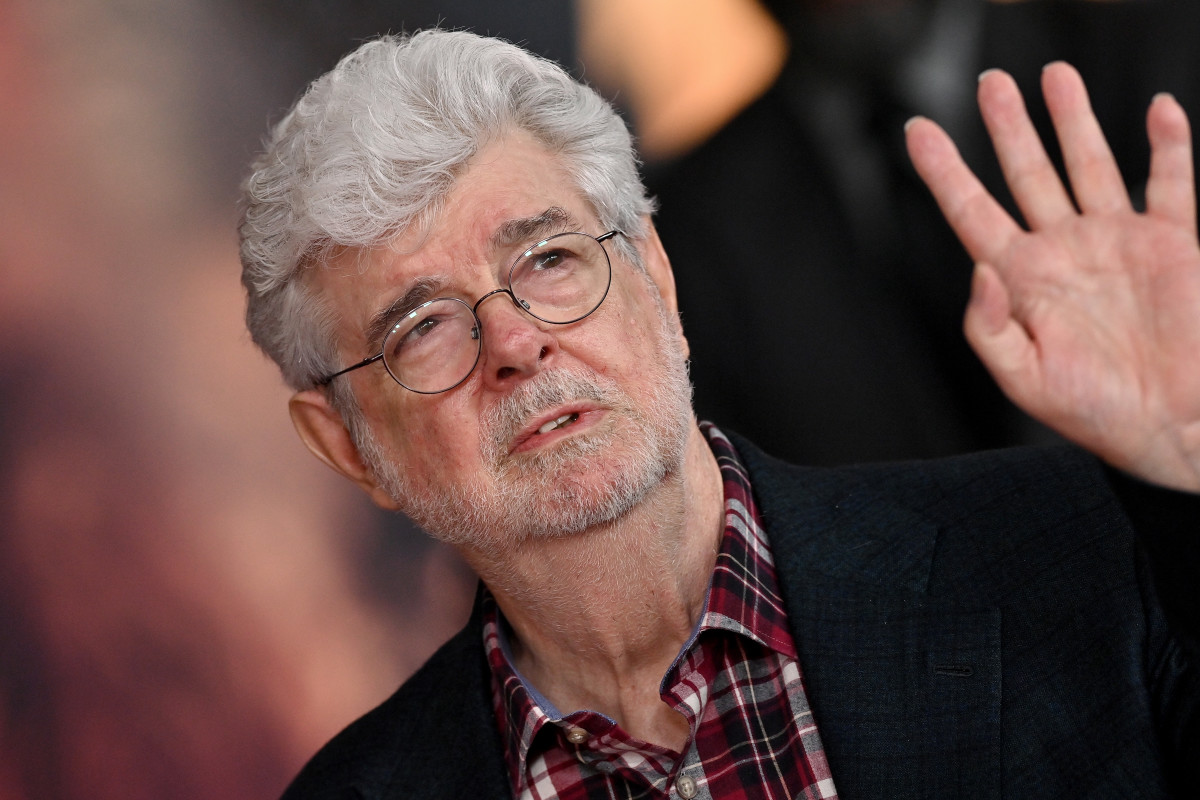

Star Wars icon gives his support to Disney, Bob Iger

Disney shareholders have a huge decision to make on April 3.

Disney's (DIS) been facing some headwinds up top, but its leadership just got backing from one of the company's more prominent investors.

Star Wars creator George Lucas put out of statement in support of the company's current leadership team, led by CEO Bob Iger, ahead of the April 3 shareholders meeting which will see investors vote on the company's 12-member board.

"Creating magic is not for amateurs," Lucas said in a statement. "When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same."

Related: Disney stands against Nelson Peltz as leadership succession plan heats up

Lucasfilm was acquired by Disney for $4 billion in 2012 — notably under the first term of Iger. He received over 37 million in shares of Disney during the acquisition.

Lucas' statement seems to be an attempt to push investors away from the criticism coming from The Trian Partners investment group, led by Nelson Peltz. The group, owns about $3 million in shares of the media giant, is pushing two candidates for positions on the board, which are Peltz and former Disney CFO Jay Rasulo.

Peltz and Co. have called out a pair of Disney directors — Michael Froman and Maria Elena Lagomasino — for their lack of experience in the media space.

Related: Women's basketball is gaining ground, but is March Madness ready to rival the men's game?

Blackwells Capital is also pushing three of its candidates to take seats during the early April shareholder meeting, though Reuters has reported that the firm has been supportive of the company's current direction.

Disney has struggled in recent years amid the changes in media and the effects of the pandemic — which triggered the return of Iger at the helm in late 2022. After going through mass layoffs in the spring of 2023 and focusing on key growth brands, the company has seen a steady recovery with its stock up over 25% year-to-date and around 40% for the last six months.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic recoveryUncategorized

Another airline is making lounge fees more expensive

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex