Government

Radical Gender Ideology Invades Small-Town Schools

Radical Gender Ideology Invades Small-Town Schools

Authored by Jackson Elliott via The Epoch Times,

When the school called his 14-year-old…

Authored by Jackson Elliott via The Epoch Times,

When the school called his 14-year-old son to the principal’s office for refusing to say a female student was a boy, Matthew Duncan decided he’d had enough.

At first, Duncan’s son thought his longtime classmate was joking when she told him to say she was a man. He refused.

“You can’t do that! You can’t call somebody by something that they’re not,” Duncan said school administrators in Grants Pass chastised the boy.

“Just so you know, if you do it again, you’re gonna get in trouble,” they warned his son, Duncan said.

After the school year ended, Duncan transferred his two children to a private school.

Grants Pass is a small, conservative town, but locals have found they can’t control what their children get taught in public school. Families have found directives from Oregon’s governor trample their own beliefs. Teachers who want a politically neutral curriculum say local schools have actively promoted LGBT ideology.

“There was never a push towards dominance and control like it is now,” said Duncan. “You can’t voice your opinion.”

In response, many families in Grants Pass have withdrawn their children from public school, enrolling them in private school or starting to homeschool, Grants Pass teachers, school administrators and parents told The Epoch Times.

But those solutions can be expensive and inconvenient, and private schools sometimes don’t have enough space to absorb the exodus of students.

Boys Aren’t Girls

In just a few years, LGBT ideology has swept into Oregon schools, said Betty, a former school employee who used her first name only to avoid backlash within the community. She retired early because she was tired of trying to help kids, while simultaneously fighting left-wing ideology, she told The Epoch Times.

Just a few years ago, there wasn’t any LGBT indoctrination in her school, Betty said. Then, education workers slowly and quietly filled schools with pro-LGBT material.

“I mean, we’re out in the country. It’s conservative. And it’s like [the truth is], ‘Beware! It’s not!'” she said.

One day, Betty discovered a poster in the library that stated left-wing talking points.

“We believe black lives matter, no human is illegal, love is love, women’s rights are human rights, science is real, water is life, injustice anywhere is a threat to justice everywhere,” it read.

It didn’t seem like education to provide just one perspective on controversial issues, she said. So she put up her own poster next to it.

“We believe all lives matter, legal immigration, marriage is one man & one woman, unborn female and male babies have rights, God’s creation supports science, water is life, return to law abiding Constitutional America,” Betty’s poster read.

Then she got called to the principal’s office.

“They said, ‘You know what? This is unacceptable. You need to clear everything with us,'” Betty recalled.

The school forced her to take her poster down, but allowed the left-wing poster to remain, she said.

In another incident, when Betty stopped a young elementary school boy from walking into the girls’ bathroom by mistake, administrators expressed their disapproval.

“Oh, did I get it for that!” she exclaimed. “They said, ‘Betty, don’t you understand? They can walk wherever they want.'”

Radical gender ideology broke into schools after younger teachers embraced it in their training in college.

“They bought the propaganda,” Betty lamented. “They were immersed in the propaganda at the college level, so they’re just spewing that out. My sense is that they don’t have the same morality that us oldsters do.”

Another conservative teacher, Deborah, left her job after facing pressure to resign, she said. Deborah chose not to use her real name because she was concerned about drawing criticism.

Before she left, a school-mandated lecture told all teachers to raise their hands if they had “white privilege,” she said. She was the only one not to signal affirmation.

“No one else, as far as I know—no one else spoke up,” she said.

In another incident, a student expressed panic after Donald Trump was elected president. The girl said she feared Trump would put her in a concentration camp because she was a lesbian, Deborah recalled.

Deborah assured her it wouldn’t happen, she said. The student filed a complaint, and the school’s administration talked with Deborah about the incident.

“It was so ridiculous,” she said. “It never went anywhere, and is not even documented in my employment file. But I was visited by the administration because of it.”

Then, after Deborah accidentally handed a graded test to the wrong student, the student filed a complaint against her. Documents she provided to The Epoch Times show that the school assigned her “focus goals” that included passing out papers to the correct students.

Deborah has 22 years of teaching experience. She said she believes the school used the complaint to make her job so frustrating that she would quit. She suspects the school wanted her out because of her political beliefs.

“I think that people knew that I probably wouldn’t call a girl a boy,” Deborah said.

After the complaint, the school subjected all her work to intense scrutiny, she said.

“I would have to email my every single detail [in a] plan, at 5 in the morning to the principal and the personnel director,” Deborah recalled. “And then they would have people coming in my class every day. Different administrators were picking apart everything. And I found that many of the things that they said were just flat-out lies.”

Tired of the pressure, Deborah retired in 2019.

Local Kids, State Standards

Some in the community believe schools have also swung left in towns like Grants Pass, because Oregon’s state government sets educational standards that promote radical gender ideology.

“The whole system is set up to reprogram the kids. I mean, that’s what they’re doing. They’re literally destroying these innocent little brains,” said Betty.

The Oregon State Board of Education (OSBE) sets educational policies and standards for the state. The governor selects the board’s members.

Democrats have controlled the governor’s office since 1986. Oregon’s current governor, Kate Brown, is the nation’s first openly bisexual politician.

Some have accused the Oregon Department of Education (ODE) of pushing left-wing ideology at the expense of educational excellence. Its website urges administrators to educate while focusing on race and ethnicity.

Oregon’s health education standards also say children should learn there are “many ways to express gender” in kindergarten. They should learn about sexual orientation in third grade, the standards state, and they should be taught how to prevent the spread of AIDS in third grade as well.

By third grade, the guidelines continue, students should “recognize differences and similarities of how individuals identify regarding gender or sexual orientation.”

From kindergarten, students should learn to “recognize the importance of treating others with respect including gender expression,” the standards read. Students of the same age should also “identify different kinds of family structures.”

Sometimes, Oregon state curriculum is pornographic, in the opinion of Heidi Napier, a Grants Pass local who works with the area’s Republican Party education committee.

Napier paid for a copy of the state’s curriculum and discovered it included photographs of diseased genitals and line drawings of people having sex.

When Napier showed the pictures to a police officer, he told her that it would be a crime if she distributed them to children.

It’s legal, however, to use the same materials in the classroom.

“These are from the CDC,” the officer told her. “And as long as they’re used by a schoolteacher, they’re not pornography. But if anybody else used them, they would be considered pornography.”

Napier wondered if she could even show them at a school board meeting without facing repercussions.

The outside of Grants Pass High School suggests the school promotes left-wing gender ideology. The school has a rainbow LGBT pride heart above its main entrance and LGBT pride stickers on the windows of its classrooms.

The Epoch Times requested an interview with the Grants Pass school district, but one had not been scheduled by press time.

Pushing Private School

In response to ideological teaching, many Grants Pass parents have removed their children from public schools.

Admissions for Grants Pass New Hope Christian School have skyrocketed in the last three years, according to school administrator Annie Burnham.

Since 2020, the school has gone from 190 students to 340, with about 30 students on a waiting list, she said. To meet the need, New Hope more than doubled its staff. This switch is part of a nationwide post-COVID-19 trend.

Read more here...

Government

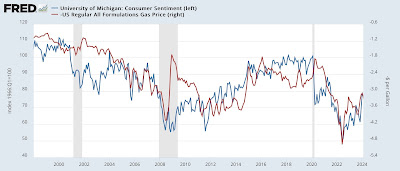

“Are you better off than you were four years ago?”

– by New Deal democratNo economic news today, so let me take a look at the supposed killer recent GOP meme that they claim is completely unanswerable:…

- by New Deal democrat

No economic news today, so let me take a look at the supposed killer recent GOP meme that they claim is completely unanswerable: “Are you better off today than you were four years ago?”

International

AI can help predict whether a patient will respond to specific tuberculosis treatments, paving way for personalized care

People have been battling tuberculosis for thousands of years, and drug-resistant strains are on the rise. Analyzing large datasets with AI can help humanity…

Tuberculosis is the world’s deadliest bacterial infection. It afflicted over 10 million people and took 1.3 million lives in 2022. These numbers are predicted to increase dramatically because of the spread of multidrug-resistant TB.

Why does one TB patient recover from the infection while another succumbs? And why does one drug work in one patient but not another, even if they have the same disease?

People have been battling TB for millennia. For example, researchers have found Egyptian mummies from 2400 BCE that show signs of TB. While TB infections occur worldwide, the countries with the highest number of multidrug-resistant TB cases are Ukraine, Moldova, Belarus and Russia.

Researchers predict that the ongoing war in Ukraine will result in an increase in multidrug-resistant TB cases because of health care disruptions. Additionally, the COVID-19 pandemic reduced access to TB diagnosis and treatment, reversing decades of progress worldwide.

Rapidly and holistically analyzing available medical data can help optimize treatments for each patient and reduce drug resistance. In our recently published research, my team and I describe a new AI tool we developed that uses worldwide patient data to guide more personalized and effective treatment of TB.

Predicting success or failure

My team and I wanted to identify what variables can predict how a patient responds to TB treatment. So we analyzed more than 200 types of clinical test results, medical imaging and drug prescriptions from over 5,000 TB patients in 10 countries. We examined demographic information such as age and gender, prior treatment history and whether patients had other conditions. Finally, we also analyzed data on various TB strains, such as what drugs the pathogen is resistant to and what genetic mutations the pathogen had.

Looking at enormous datasets like these can be overwhelming. Even most existing AI tools have had difficulty analyzing large datasets. Prior studies using AI have focused on a single data type – such as imaging or age alone – and had limited success predicting TB treatment outcomes.

We used an approach to AI that allowed us to analyze a large and diverse number of variables simultaneously and identify their relationship to TB outcomes. Our AI model was transparent, meaning we can see through its inner workings to identify the most meaningful clinical features. It was also multimodal, meaning it could interpret different types of data at the same time.

Once we trained our AI model on the dataset, we found that it could predict treatment prognosis with 83% accuracy on newer, unseen patient data and outperform existing AI models. In other words, we could feed a new patient’s information into the model and the AI would determine whether a specific type of treatment will either succeed or fail.

We observed that clinical features related to nutrition, particularly lower BMI, are associated with treatment failure. This supports the use of interventions to improve nourishment, as TB is typically more prevalent in undernourished populations.

We also found that certain drug combinations worked better in patients with certain types of drug-resistant infections but not others, leading to treatment failure. Combining drugs that are synergistic, meaning they enhance each other’s potency in the lab, could result in better outcomes. Given the complex environment in the body compared with conditions in the lab, it has so far been unclear whether synergistic relationships between drugs in the lab hold up in the clinic. Our results suggest that using AI to weed out antagonistic drugs, or drugs that inhibit or counteract each other, early in the drug discovery process can avoid treatment failures down the line.

Ending TB with the help of AI

Our findings may help researchers and clinicians meet the World Health Organization’s goal to end TB by 2035, by highlighting the relative importance of different types of clinical data. This can help prioritize public health efforts to mitigate TB.

While the performance of our AI tool is promising, it isn’t perfect in every case, and more training is needed before it can be used in the clinic. Demographic diversity can be high within a country and may even vary between hospitals. We are working to make this tool more generalizable across regions.

Our goal is to eventually tailor our AI model to identify drug regimens suitable for individuals with certain conditions. Instead of a one-size-fits-all treatment approach, we hope that studying multiple types of data can help physicians personalize treatments for each patient to provide the best outcomes.

Sriram Chandrasekaran receives funding from the US National Institutes of Health.

treatment genetic pandemic covid-19 spread russia ukraine world health organizationGovernment

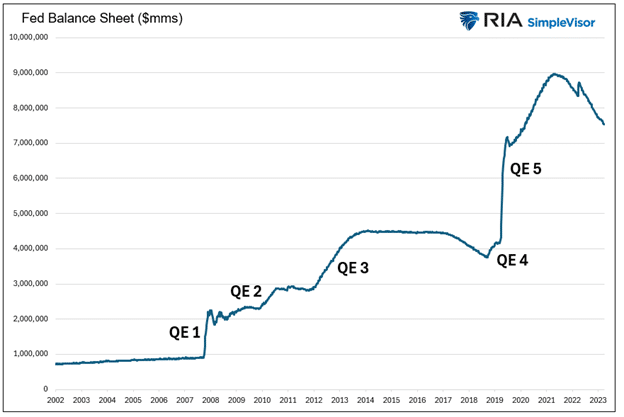

QE By A Different Name Is Still QE

The Fed added Quantitative Easing (QE) to its monetary policy toolbox in 2008. At the time, the financial system was imploding. Fed Chair Ben Bernanke…

The Fed added Quantitative Easing (QE) to its monetary policy toolbox in 2008. At the time, the financial system was imploding. Fed Chair Ben Bernanke bought $1.5 trillion U.S. Treasury and mortgage-backed securities to staunch a financial disaster. The drastic action was sold to the public as a one-time, emergency operation to stabilize the banking system and economy. Since the initial round of QE, there have been four additional rounds, culminating with the mind-boggling $5 trillion operation in 2020 and 2021.

QE is no longer a tool for handling a crisis. It has morphed into a policy to ensure the government can fund itself. However, as we are learning today, QE has its faults. For example, it’s not an appropriate policy in times of high inflation like we have.

That doesn’t mean the Fed can’t provide liquidity to help the Treasury fund the government’s deficits. They just need to be more creative. To that end, rumors are floating around that a new variation of QE will help bridge potential liquidity shortfalls.

The Sad Fiscal Situation

The Federal government now pays over $1 trillion in interest expenses annually. Before they spend a dime on the military, social welfare, or the tens of thousands of other expenditures, one-third of the government’s tax revenue pays for the interest on the $34 trillion in debt, representing deficits of years and decades past.

There are many ways to address deficits and overwhelming debt, such as spending cuts or higher taxes. While logical approaches, politicians favor more debt. Let’s face it: winning an election on the promise of spending cuts and tax increases is hard. It’s even harder to keep your seat in Congress if you try to enact such changes.

More recently, the Federal Reserve has been forced to help fund today’s deficits and those of years past. We can debate the merits of such irresponsible behavior all day, but for investors, it’s much more critical to assess how the Fed and Treasury might keep the debt scheme going when QE is not an option.

Borrowing For Deficits

Before spreading rumors about a new variation of QE, let’s review the problem. The graph below shows the widening gap between federal spending and tax receipts. Literally, the gap between the two lines amounts to the cumulative Federal deficit. Instead of plotting deficit data, we prefer outstanding total federal debt as it better represents the cumulative onus of deficits.

The graph below shows the Treasury debt has grown annually for the last 57 years by about 1.5% more than the interest expense. Such may not seem like a lot, but 57 years of compounding makes a big difference.

Declining interest rates for the last 40+ years are to thank for the differential. The green line shows the effective interest rate has steadily dropped until recently. Even with the current instance of higher interest rates, the effective interest rate is only 3.00%.

Fiscal Dominance

The Fed has been increasingly pressed to help the U.S. Treasury maintain the ability to fund its debt at reasonable interest rates. In addition to presiding over lower-than-normal interest rates for the last 30 years, QE helps the cause. By removing Treasury and mortgage-backed securities from the market, the market can more easily absorb new Treasury issuance.

Fiscal dominance, as we are experiencing, occurs when monetary policy helps the Treasury fund its debts. Per The CATO Institute:

Fiscal dominance occurs when central banks use their monetary powers to support the prices of government securities and to peg interest rates at low levels to reduce the costs of servicing sovereign debt.

2019 Revisited

In 2019, before the massive pandemic-related deficits, government spending ramped up over the prior few years due to higher spending and tax cuts. In September 2019, the repo markets strained under the pressure of the growing Treasury demands. The banks had plenty of securities but no cash to lend. For more information on the incident and the importance of liquidity in maintaining financial stability, please read our article, Liquidity Problems.

When a bank, broker, or investor can’t borrow money despite being willing to post U.S. Treasury collateral, that is a clear sign that the banking system lacks liquidity. That is exactly what happened in 2019.

The Fed came to the rescue, offering QE and lowering interest rates.

Shortly later, in March 2020, government spending blossomed with the pandemic, and the Fed was quick to help. As we shared earlier, the Fed, via QE, removed over $5 trillion of assets from the financial markets. That amount was on par with the surge of government debt.

The Fed is mandated to manage policy to achieve maximum employment and stable prices. Mandated or not, recent experiences demonstrate the Fed has become the de facto lender to the Treasury, albeit indirectly.

The Fed Is In Handcuffs

While Jerome Powell and the Fed might like to help the government meet their exorbitant funding needs with lower interest rates and QE, they are shackled. Higher inflation resulting from the pandemic and fiscal and monetary policies force them to reduce their balance sheet and keep rates abnormally high.

Unfortunately, as we wrote in Liquidity Problems, the issuance of Treasury debt rapidly drains excess liquidity from the system.

While the Fed hesitates to cut rates or do QE, they may have another trick up their sleeve.

Spreading Rumors

The following is based on rumors from numerous sources about what the Fed and banking regulators may do to alleviate funding pressures and liquidity shortfalls.

Banks have regulatory limits on the amount of leverage they can employ. The amount is set by the type and riskiness of assets they hold. For instance, U.S. Treasuries can be leveraged more than a loan to small businesses. A dollar of a bank deposit may allow a bank to buy $5 of a Treasury note but only lend $3 to a riskier borrower.

The regulatory structure currently recognizes eight Global Systematically Important Banks (GSIB). They are as follows: Bank of America, The Bank of New York, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, State Street, and Wells Fargo & Company.

Rumor has it that the regulators could eliminate leverage requirements for the GSIBs. Doing so would infinitely expand their capacity to own Treasury securities. That may sound like a perfect solution, but there are two problems: the banks must be able to fund the Treasury assets and avoid losing money on them.

BTFP To The Rescue Again

A year ago, the Fed created the Bank Term Funding Program (BTFP) to bail out banks with underwater securities. The program allowed banks to pledge underwater Treasury assets to the Fed. In exchange, the Fed would loan them money equal to the bond’s par value, even though the bonds were trading at discounts to par.

Remember, since 2008, banks no longer have to book gains or losses on assets unless they are impaired or sold.

In a new scheme, bank regulators could eliminate the need for GSIBs to hold capital against Treasury securities while the Fed reenacts some version of BTFP. Under such a regime, the banks could buy Treasury notes and fund them via the BTFP. If the borrowing rate is less than the bond yield, they make money and, therefore, should be very willing to participate, as there is potentially no downside.

The Fed still uses its balance sheet in this scheme, but it could sell it to the public as a non-inflationary action, as it did in March 2023 when the BTFP was introduced.

Summary

The federal government’s escalating debt and interest expenses underscore the challenges posed by prolonged deficit spending. The problem has forced the Fed to help the Treasury meet its burgeoning needs. The situation becomes more evident with each passing day.

The recently closed BTFP program and rumors about leverage requirements provide insight into how the Fed might accomplish this tall task while maintaining its hawkish anti-inflationary policy stance.

The post QE By A Different Name Is Still QE appeared first on RIA.

treasury securities bonds repo markets pandemic monetary policy qe fed federal reserve government debt congress interest rates-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex