Uncategorized

Private equity market 2023-2027; A descriptive analysis of the five forces model, market dynamics, and segmentation – Technavio

Private equity market 2023-2027; A descriptive analysis of the five forces model, market dynamics, and segmentation – Technavio

PR Newswire

NEW YORK, Jan. 18, 2023

NEW YORK, Jan. 18, 2023 /PRNewswire/ — According to Technavio, the global private e…

Private equity market 2023-2027; A descriptive analysis of the five forces model, market dynamics, and segmentation - Technavio

PR Newswire

NEW YORK, Jan. 18, 2023

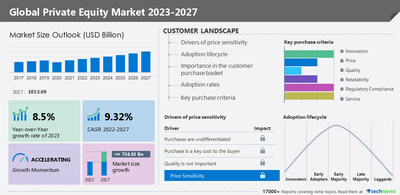

NEW YORK, Jan. 18, 2023 /PRNewswire/ -- According to Technavio, the global private equity market size is estimated to grow by USD 734.93 billion from 2022 to 2027. The market is estimated to grow at a CAGR of 9.32% during the forecast period. North America held the largest share of the global market in 2022, and the market in the region is estimated to witness an incremental growth of 38%. For more Insights on market size, Request a sample report

Private equity market - Five Forces

The global cloud data warehouse market is fragmented, and the five forces analysis covers–

- Bargaining Power of Buyers

- The threat of New Entrants

- Threat of Rivalry

- Bargaining Power of Suppliers

- Threat of Substitutes

- Interpretation of porter's five models helps to strategize the business, for entire details – buy the report!

Private equity market – Customer Landscape

The report includes the market's adoption lifecycle, from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Private equity market - Segmentation Assessment

Technavio has segmented the market based on end-user (privately held companies and start-up companies), application (leveraged buyouts, venture capital, equity investment, and entrepreneurship), and geography (North America, Europe, APAC, Middle East and Africa, and South America).

- The market share growth by the privately held companies segment will be significant during the forecast period. Private equities allow new buyers to shift from fixed deposits to fixed-income securities to get an understanding of the stock exchange. Bond buyers will have the option to get enough exposure to the stock exchange with fixed-income private equity. Also, private equities provide a fixed, regular return on a fixed time period, similar to fixed deposits of a bank. Such factors are driving the growth of the segment.

By geography, the global private equity market is segmented into North America, Europe, APAC, Middle East and Africa, and South America. The report provides actionable insights and estimates the contribution of all regions to the growth of the global private equity market.

- North America will account for 38% of the market's growth during the forecast period. Factors such as increased trading activities and the large presence of the equity market in the US are driving the growth of the regional market.

Private equity market – Market Dynamics

Key factor driving market growth

- The market is driven by the increase in private equity deals across the globe.

- There has been a significant rise in the number of strategic alliances over the years.

- For instance, Blackstone recently partnered with Thomson Reuters to carve out its financial and risk business into a USD 20 billion strategic venture.

- Similarly, in 2019 the formation of Perspecta combined DXC Technologies US public sector business with Vencore and KeyPoint Solutions, and General Dynamics acquisition of CSRA. It is the year's largest single transaction, valued at USD 9.7 billion.

- Such an increase in private equity deals across the world is driving the growth of the market in focus.

Leading trends influencing the market

- The rising number of high-net-worth individuals (HNWIs) globally is one of the major trends in the market.

- The number of HNWIs is increasing across the world. They have larger levels of investment and wealth portfolios.

- HNWIs are offered special services such as investment in reputable private equity and hedge funds and the opportunity to be a part of pre-IPO placements and pre-ICO sales of any venture.

- Some of the major financial services offered to HNWIs by wealth management companies include asset protection, financial planning, and investment monitoring, among others.

- Wealth management companies work closely with HNWI clients to get a better understanding of their financial goals and offer comprehensive portfolio advisory investment services.

- Thus, with the rising number of HNWIs across the world, the size of the global private equity market will expand during the forecast period.

Major challenges hindering the market growth

- Transaction risks are identified as major challenges in the market.

- Transaction risks occur when companies perform financial transactions between countries.

- During international transactions, the risk is that the currency rate can change before the transaction is completed.

- For example, during the transaction, if the currency has appreciated against the dollar, the person may gain profit. On the other hand, if the currency depreciates against the dollar, it will lead to loss.

- Such risks are expected to hinder the growth of the market.

What are the key data covered in this private equity market report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the private equity market between 2023 and 2027

- Precise estimation of the size of the private equity market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the private equity market industry across North America, Europe, APAC, Middle East and Africa, and South America

- A thorough analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of private equity market vendors

Gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

Related Reports:

- The home equity lending market is estimated to grow at a CAGR of 3.81% between 2022 and 2027. The size of the market is forecast to increase by USD 35,535.04 million. The massive increase in home prices is notably driving the market growth, although factors such as the fear of losing property may impede the market growth.

- The mutual funds market is estimated to grow at a CAGR of 9.76% between 2022 and 2027. The size of the market is forecast to increase by USD 71.62 trillion. The market liquidity is notably driving the market growth, although factors such as transaction risks may impede the market growth.

Private Equity Market Scope | |

Report Coverage | Details |

Page number | 154 |

Base year | 2022 |

Historic period | 2017-2021 |

Forecast period | 2023-2027 |

Growth momentum & CAGR | Accelerate at a CAGR of 9.32% |

Market growth 2023-2027 | USD 734.93 billion |

Market structure | Fragmented |

YoY growth 2022-2023 (%) | 8.5 |

Regional analysis | North America, Europe, APAC, Middle East and Africa, and South America |

Performing market contribution | North America at 38% |

Key countries | US, Canada, China, Germany, and UK |

Competitive landscape | Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

Key companies profiled | Advent International Corp., Allens, Apollo Asset Management Inc., Bain and Co. Inc., Bank of America Corp., BDO Australia, Blackstone Inc., AHAM Asset Management Berhad, Ernst and Young Global Ltd., HSBC Holdings Plc, JPMorgan Chase and Co., Morgan Stanley, MorganFranklin Consulting, Navy Federal Credit Union, Onex Corp., The Carlyle Group Inc., The Goldman Sachs Group Inc., The PNC Financial Services Group Inc., and U.S. Bancorp |

Market dynamics | Parent market analysis, market growth inducers and obstacles, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and market condition analysis for the forecast period |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by End-user

- Exhibit 06: Executive Summary – Chart on Market Segmentation by Application

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global - Market size and forecast 2022-2027 ($ billion)

- Exhibit 15: Data Table on Global - Market size and forecast 2022-2027 ($ billion)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global private equity market 2017 - 2021

- Exhibit 18: Historic Market Size – Data Table on Global private equity market 2017 - 2021 ($ billion)

- 4.2 End-user Segment Analysis 2017 - 2021

- Exhibit 19: Historic Market Size – End-user Segment 2017 - 2021 ($ billion)

- 4.3 Applicaton Segment Analysis 2017 - 2021

- Exhibit 20: Historic Market Size – Applicaton Segment 2017 - 2021 ($ billion)

- 4.4 Geography Segment Analysis 2017 - 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 - 2021 ($ billion)

- 4.5 Country Segment Analysis 2017 - 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 - 2021 ($ billion)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis - Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition - Five forces 2022 and 2027

6 Market Segmentation by End-user

- 6.1 Market segments

- Exhibit 30: Chart on End-user - Market share 2022-2027 (%)

- Exhibit 31: Data Table on End-user - Market share 2022-2027 (%)

- 6.2 Comparison by End-user

- Exhibit 32: Chart on Comparison by End-user

- Exhibit 33: Data Table on Comparison by End-user

- 6.3 Privately held companies - Market size and forecast 2022-2027

- Exhibit 34: Chart on Privately held companies - Market size and forecast 2022-2027 ($ billion)

- Exhibit 35: Data Table on Privately held companies - Market size and forecast 2022-2027 ($ billion)

- Exhibit 36: Chart on Privately held companies - Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Privately held companies - Year-over-year growth 2022-2027 (%)

- 6.4 Start-up companies - Market size and forecast 2022-2027

- Exhibit 38: Chart on Start-up companies - Market size and forecast 2022-2027 ($ billion)

- Exhibit 39: Data Table on Start-up companies - Market size and forecast 2022-2027 ($ billion)

- Exhibit 40: Chart on Start-up companies - Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Start-up companies - Year-over-year growth 2022-2027 (%)

- 6.5 Market opportunity by End-user

- Exhibit 42: Market opportunity by End-user ($ billion)

7 Market Segmentation by Application

- 7.1 Market segments

- Exhibit 43: Chart on Application - Market share 2022-2027 (%)

- Exhibit 44: Data Table on Application - Market share 2022-2027 (%)

- 7.2 Comparison by Application

- Exhibit 45: Chart on Comparison by Application

- Exhibit 46: Data Table on Comparison by Application

- 7.3 Leveraged buyouts - Market size and forecast 2022-2027

- Exhibit 47: Chart on Leveraged buyouts - Market size and forecast 2022-2027 ($ billion)

- Exhibit 48: Data Table on Leveraged buyouts - Market size and forecast 2022-2027 ($ billion)

- Exhibit 49: Chart on Leveraged buyouts - Year-over-year growth 2022-2027 (%)

- Exhibit 50: Data Table on Leveraged buyouts - Year-over-year growth 2022-2027 (%)

- 7.4 Venture capital - Market size and forecast 2022-2027

- Exhibit 51: Chart on Venture capital - Market size and forecast 2022-2027 ($ billion)

- Exhibit 52: Data Table on Venture capital - Market size and forecast 2022-2027 ($ billion)

- Exhibit 53: Chart on Venture capital - Year-over-year growth 2022-2027 (%)

- Exhibit 54: Data Table on Venture capital - Year-over-year growth 2022-2027 (%)

- 7.5 Equity investment - Market size and forecast 2022-2027

- Exhibit 55: Chart on Equity investment - Market size and forecast 2022-2027 ($ billion)

- Exhibit 56: Data Table on Equity investment - Market size and forecast 2022-2027 ($ billion)

- Exhibit 57: Chart on Equity investment - Year-over-year growth 2022-2027 (%)

- Exhibit 58: Data Table on Equity investment - Year-over-year growth 2022-2027 (%)

- 7.6 Enterpreneurship - Market size and forecast 2022-2027

- Exhibit 59: Chart on Enterpreneurship - Market size and forecast 2022-2027 ($ billion)

- Exhibit 60: Data Table on Enterpreneurship - Market size and forecast 2022-2027 ($ billion)

- Exhibit 61: Chart on Enterpreneurship - Year-over-year growth 2022-2027 (%)

- Exhibit 62: Data Table on Enterpreneurship - Year-over-year growth 2022-2027 (%)

- 7.7 Market opportunity by Application

- Exhibit 63: Market opportunity by Application ($ billion)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 64: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 65: Chart on Market share by geography 2022-2027 (%)

- Exhibit 66: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 67: Chart on Geographic comparison

- Exhibit 68: Data Table on Geographic comparison

- 9.3 North America - Market size and forecast 2022-2027

- Exhibit 69: Chart on North America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 70: Data Table on North America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 71: Chart on North America - Year-over-year growth 2022-2027 (%)

- Exhibit 72: Data Table on North America - Year-over-year growth 2022-2027 (%)

- 9.4 Europe - Market size and forecast 2022-2027

- Exhibit 73: Chart on Europe - Market size and forecast 2022-2027 ($ billion)

- Exhibit 74: Data Table on Europe - Market size and forecast 2022-2027 ($ billion)

- Exhibit 75: Chart on Europe - Year-over-year growth 2022-2027 (%)

- Exhibit 76: Data Table on Europe - Year-over-year growth 2022-2027 (%)

- 9.5 APAC - Market size and forecast 2022-2027

- Exhibit 77: Chart on APAC - Market size and forecast 2022-2027 ($ billion)

- Exhibit 78: Data Table on APAC - Market size and forecast 2022-2027 ($ billion)

- Exhibit 79: Chart on APAC - Year-over-year growth 2022-2027 (%)

- Exhibit 80: Data Table on APAC - Year-over-year growth 2022-2027 (%)

- 9.6 Middle East and Africa - Market size and forecast 2022-2027

- Exhibit 81: Chart on Middle East and Africa - Market size and forecast 2022-2027 ($ billion)

- Exhibit 82: Data Table on Middle East and Africa - Market size and forecast 2022-2027 ($ billion)

- Exhibit 83: Chart on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- Exhibit 84: Data Table on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- 9.7 South America - Market size and forecast 2022-2027

- Exhibit 85: Chart on South America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 86: Data Table on South America - Market size and forecast 2022-2027 ($ billion)

- Exhibit 87: Chart on South America - Year-over-year growth 2022-2027 (%)

- Exhibit 88: Data Table on South America - Year-over-year growth 2022-2027 (%)

- 9.8 US - Market size and forecast 2022-2027

- Exhibit 89: Chart on US - Market size and forecast 2022-2027 ($ billion)

- Exhibit 90: Data Table on US - Market size and forecast 2022-2027 ($ billion)

- Exhibit 91: Chart on US - Year-over-year growth 2022-2027 (%)

- Exhibit 92: Data Table on US - Year-over-year growth 2022-2027 (%)

- 9.9 China - Market size and forecast 2022-2027

- Exhibit 93: Chart on China - Market size and forecast 2022-2027 ($ billion)

- Exhibit 94: Data Table on China - Market size and forecast 2022-2027 ($ billion)

- Exhibit 95: Chart on China - Year-over-year growth 2022-2027 (%)

- Exhibit 96: Data Table on China - Year-over-year growth 2022-2027 (%)

- 9.10 Germany - Market size and forecast 2022-2027

- Exhibit 97: Chart on Germany - Market size and forecast 2022-2027 ($ billion)

- Exhibit 98: Data Table on Germany - Market size and forecast 2022-2027 ($ billion)

- Exhibit 99: Chart on Germany - Year-over-year growth 2022-2027 (%)

- Exhibit 100: Data Table on Germany - Year-over-year growth 2022-2027 (%)

- 9.11 Canada - Market size and forecast 2022-2027

- Exhibit 101: Chart on Canada - Market size and forecast 2022-2027 ($ billion)

- Exhibit 102: Data Table on Canada - Market size and forecast 2022-2027 ($ billion)

- Exhibit 103: Chart on Canada - Year-over-year growth 2022-2027 (%)

- Exhibit 104: Data Table on Canada - Year-over-year growth 2022-2027 (%)

- 9.12 UK - Market size and forecast 2022-2027

- Exhibit 105: Chart on UK - Market size and forecast 2022-2027 ($ billion)

- Exhibit 106: Data Table on UK - Market size and forecast 2022-2027 ($ billion)

- Exhibit 107: Chart on UK - Year-over-year growth 2022-2027 (%)

- Exhibit 108: Data Table on UK - Year-over-year growth 2022-2027 (%)

- 9.13 Market opportunity by geography

- Exhibit 109: Market opportunity by geography ($ billion)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 110: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 111: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 112: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 113: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 114: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 115: Matrix on vendor position and classification

- 12.3 Advent International Corp.

- Exhibit 116: Advent International Corp. - Overview

- Exhibit 117: Advent International Corp. - Product / Service

- Exhibit 118: Advent International Corp. - Key offerings

- 12.4 Apollo Asset Management Inc.

- Exhibit 119: Apollo Asset Management Inc. - Overview

- Exhibit 120: Apollo Asset Management Inc. - Business segments

- Exhibit 121: Apollo Asset Management Inc. - Key offerings

- Exhibit 122: Apollo Asset Management Inc. - Segment focus

- 12.5 Bain and Co. Inc.

- Exhibit 123: Bain and Co. Inc. - Overview

- Exhibit 124: Bain and Co. Inc. - Product / Service

- Exhibit 125: Bain and Co. Inc. - Key offerings

- 12.6 Bank of America Corp.

- Exhibit 126: Bank of America Corp. - Overview

- Exhibit 127: Bank of America Corp. - Business segments

- Exhibit 128: Bank of America Corp. - Key news

- Exhibit 129: Bank of America Corp. - Key offerings

- Exhibit 130: Bank of America Corp. - Segment focus

- 12.7 Blackstone Inc.

- Exhibit 131: Blackstone Inc. - Overview

- Exhibit 132: Blackstone Inc. - Business segments

- Exhibit 133: Blackstone Inc. - Key news

- Exhibit 134: Blackstone Inc. - Key offerings

- Exhibit 135: Blackstone Inc. - Segment focus

- 12.8 AHAM Asset Management Berhad

- Exhibit 136: AHAM Asset Management Berhad - Overview

- Exhibit 137: AHAM Asset Management Berhad - Product / Service

- Exhibit 138: AHAM Asset Management Berhad - Key offerings

- 12.9 Ernst and Young Global Ltd.

- Exhibit 139: Ernst and Young Global Ltd. - Overview

- Exhibit 140: Ernst and Young Global Ltd. - Product / Service

- Exhibit 141: Ernst and Young Global Ltd. - Key offerings

- 12.10 JPMorgan Chase and Co.

- Exhibit 142: JPMorgan Chase and Co. - Overview

- Exhibit 143: JPMorgan Chase and Co. - Business segments

- Exhibit 144: JPMorgan Chase and Co. - Key offerings

- Exhibit 145: JPMorgan Chase and Co. - Segment focus

- 12.11 MorganFranklin Consulting

- Exhibit 146: MorganFranklin Consulting - Overview

- Exhibit 147: MorganFranklin Consulting - Product / Service

- Exhibit 148: MorganFranklin Consulting - Key offerings

- 12.12 Navy Federal Credit Union

- Exhibit 149: Navy Federal Credit Union - Overview

- Exhibit 150: Navy Federal Credit Union - Product / Service

- Exhibit 151: Navy Federal Credit Union - Key offerings

- 12.13 Onex Corp.

- Exhibit 152: Onex Corp. - Overview

- Exhibit 153: Onex Corp. - Business segments

- Exhibit 154: Onex Corp. - Key news

- Exhibit 155: Onex Corp. - Key offerings

- Exhibit 156: Onex Corp. - Segment focus

- 12.14 The Carlyle Group Inc.

- Exhibit 157: The Carlyle Group Inc. - Overview

- Exhibit 158: The Carlyle Group Inc. - Business segments

- Exhibit 159: The Carlyle Group Inc. - Key news

- Exhibit 160: The Carlyle Group Inc. - Key offerings

- Exhibit 161: The Carlyle Group Inc. - Segment focus

- 12.15 The Goldman Sachs Group Inc.

- Exhibit 162: The Goldman Sachs Group Inc. - Overview

- Exhibit 163: The Goldman Sachs Group Inc. - Business segments

- Exhibit 164: The Goldman Sachs Group Inc. - Key news

- Exhibit 165: The Goldman Sachs Group Inc. - Key offerings

- Exhibit 166: The Goldman Sachs Group Inc. - Segment focus

- 12.16 The PNC Financial Services Group Inc.

- Exhibit 167: The PNC Financial Services Group Inc. - Overview

- Exhibit 168: The PNC Financial Services Group Inc. - Business segments

- Exhibit 169: The PNC Financial Services Group Inc. - Key offerings

- Exhibit 170: The PNC Financial Services Group Inc. - Segment focus

- 12.17 U.S. Bancorp

- Exhibit 171: U.S. Bancorp - Overview

- Exhibit 172: U.S. Bancorp - Business segments

- Exhibit 173: U.S. Bancorp - Key offerings

- Exhibit 174: U.S. Bancorp - Segment focus

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 175: Inclusions checklist

- Exhibit 176: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 177: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 178: Research methodology

- Exhibit 179: Validation techniques employed for market sizing

- Exhibit 180: Information sources

- 13.5 List of abbreviations

- Exhibit 181: List of abbreviations

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/private-equity-market-2023-2027-a-descriptive-analysis-of-the-five-forces-model-market-dynamics-and-segmentation---technavio-301723179.html

SOURCE Technavio

Uncategorized

One city held a mass passport-getting event

A New Orleans congressman organized a way for people to apply for their passports en masse.

While the number of Americans who do not have a passport has dropped steadily from more than 80% in 1990 to just over 50% now, a lack of knowledge around passport requirements still keeps a significant portion of the population away from international travel.

Over the four years that passed since the start of covid-19, passport offices have also been dealing with significant backlog due to the high numbers of people who were looking to get a passport post-pandemic.

Related: Here is why it is (still) taking forever to get a passport

To deal with these concurrent issues, the U.S. State Department recently held a mass passport-getting event in the city of New Orleans. Called the "Passport Acceptance Event," the gathering was held at a local auditorium and invited residents of Louisiana’s 2nd Congressional District to complete a passport application on-site with the help of staff and government workers.

'Come apply for your passport, no appointment is required'

"Hey #LA02," Rep. Troy A. Carter Sr. (D-LA), whose office co-hosted the event alongside the city of New Orleans, wrote to his followers on Instagram (META) . "My office is providing passport services at our #PassportAcceptance event. Come apply for your passport, no appointment is required."

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The event was held on March 14 from 10 a.m. to 1 p.m. While it was designed for those who are already eligible for U.S. citizenship rather than as a way to help non-citizens with immigration questions, it helped those completing the application for the first time fill out forms and make sure they have the photographs and identity documents they need. The passport offices in New Orleans where one would normally have to bring already-completed forms have also been dealing with lines and would require one to book spots weeks in advance.

These are the countries with the highest-ranking passports in 2024

According to Carter Sr.'s communications team, those who submitted their passport application at the event also received expedited processing of two to three weeks (according to the State Department's website, times for regular processing are currently six to eight weeks).

While Carter Sr.'s office has not released the numbers of people who applied for a passport on March 14, photos from the event show that many took advantage of the opportunity to apply for a passport in a group setting and get expedited processing.

Every couple of months, a new ranking agency puts together a list of the most and least powerful passports in the world based on factors such as visa-free travel and opportunities for cross-border business.

In January, global citizenship and financial advisory firm Arton Capital identified United Arab Emirates as having the most powerful passport in 2024. While the United States topped the list of one such ranking in 2014, worsening relations with a number of countries as well as stricter immigration rules even as other countries have taken strides to create opportunities for investors and digital nomads caused the American passport to slip in recent years.

A UAE passport grants holders visa-free or visa-on-arrival access to 180 of the world’s 198 countries (this calculation includes disputed territories such as Kosovo and Western Sahara) while Americans currently have the same access to 151 countries.

stocks pandemic covid-19 grantsUncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment3 days ago

Spread & Containment3 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex