LeBron James’ Net Worth Sets Another Record (It’s a Big One)

Legendary business savvy has made LeBron James the first NBA player to reach a key milestone.

Legendary business savvy has made LeBron James the first NBA player to reach a key milestone.

LeBron James is, first and foremost, one of the greatest basketball players to ever step foot on the court. He might be the best, period, but that’s a heated discussion for some other time.

He’s also an actor, activist, former vice president of the National Basketball Players Association, investor, a Web 3 pioneer, an occasional rapper and an all-around multi-hyphenate of the first order.

He’s now officially a billionaire, with Forbes’s estimating that "James has officially become the first-ever billionaire NBA player.”

Being a professional basketball player is certainly a lucrative job.

Last year the median annual salary of a NBA player was $4,347,600.

But it takes a lot of hustle to reach James’ level of success.

So how did he get there? Let’s break it down.

His NBA Career

James is far and away the highest-paid player in NBA history.

As of November of last year, he has earned over $390 million since his professional career began in 2003.

His contract with the Los Angeles Lakers is set to expire at the end of the 2022-2023 season, which will net him an additional $44 million.

His base annual salary is estimated to be $42.5 million.

Forbes ranks James as the second-highest paid athlete in the world after soccer legend Lionel Messi.

Warner Bros. Pictures

His Comedic And Acting Career

Beyond his prowess on the court, James immediately gained attention for his thousand-watt smile and natural charisma.

As soon as he entered the NBA, winning the Rookie of the Year award with the Cleveland Cavaliers, it was clear he wasn’t just a basketball star.

He began easing himself into Hollywood in a way that’s become traditional for high-profile athletes and other non-actors for decades, by cameoing on “The Simpsons” (in 2005) and hosting “Saturday Night Live” (in 2007).

Along the way he cameoed in “Entourage” (it was the ‘00s, after all) and lent his voice to cartoons including “The Cleveland Show” and “SpongeBob SquarePants.”

On the subject of cartoons, in 2011 he executive produced and lent his voice to the animated web series “The LeBrons.”

It’s not exactly fondly remembered, as critics said it basically served as a way for LeBron to extend his brand.

It helped by shoehorning in appearances by the many brands he was endorsing at the time, including HP (HPQ) - Get HP Inc. Report, Intel (INTC) - Get Intel Corporation Report, Sprite (KO) - Get Coca-Cola Company Report, and Beats by Dr. Dre (APPL) .

These all served as warm-ups for his true breakthrough into Hollywood, playing himself in the 2015 comedy “Trainwreck.”

Written by and starring then-ascendent comedian Amy Schumer and directed by Judd Apatow, the film showed that LeBron had keen comic timing, and was willing to play with the expectations people might place on a professional actor.

His running joke is that he gets upset that Bill Hader’s character might watch the latest episode of “Downton Abbey.”

Critics raved about his performance.

"It seems safe to declare that he has given the greatest motion-picture acting performance by an active professional basketball player of all time,” the New Yorker said.

James kept the momentum going, executive producing the game show “The Wall” and appearing in and producing the HBO talk show “The Shop.”

It has since moved to YouTube.

He’s also produced, through his SpringHill Entertainment Company, a plethora of TV shows and documentary specials, ranging from “Cleveland Hustles” to “Shut Up and Dribble.”

But his biggest foray into the larger entertainment world came with his starring role in “Space Jam: A New Legacy,” a sequel to the Michael Jordan-starring animated characters and a basketball star movie from 1996.

The movie was delayed by the pandemic, and simultaneously released on HBO Max last summer, earning a not great $162.8 million box office against a $150 million budget.

The film was savaged by critics, who tore it apart for basically being a smorgasbord of plugs for various intellectual properties owned by Warner Bros, including not just Bugs Bunny and company but “Rick & Morty,” “Austin Powers,” and “Game of Thrones.”

LeBron was nominated for a Razzie for Worst Actor. His salary for the film, and many of his other projects, is unknown. But it presumably all adds up.

His Music Career

Like Shaquille O'Neal before him, James has been known to rock the mic. The Billboard charts are rarely bothered by his presence.

His Real Estate Holdings

It’s estimated that James owns “roughly $80 million worth of real estate.”

That includes a Brentwood mansion that he bought for $20.5 million in 2021 and a Beverly compound worth $36.75 million.

He also owns a seven-acre mansion in his native Akron, Ohio.

His Endorsements

This is his real money maker.

James has endorsed products ranging from AT&T (T) - Get AT&T Inc. Report, Nike (NKE) - Get NIKE, Inc. Class B Report, Beats Electronics, Coca-Cola, Kia Motors (KIMTF) , Nike (NKE) - Get NIKE, Inc. Class B Report, Walmart (WMT) - Get Walmart Inc. Report, Ruffles and Mountain Dew (PEP) - Get PepsiCo, Inc. Report, to name just a few.

He typically earns $50 million to $90 million per year from endorsements.

His first endorsement deal with Nike paid out $90 million in seven years.

In 2015, he signed a lifetime deal with the company for an estimated $32 million annually.

Kevin C. Cox/Getty Images

His Business Deals

James has been noted by his shrew business sense.

Forbes notes he has “has long structured deals to give him equity in brands he partners with, giving him a cut of the upside instead of a quick paycheck.”

He’s an investor in Lyft (LYFT) - Get Lyft, Inc. Class A Report, Blaze Pizza, Lobos 1707, Tonal, with his Blaze endorsement alone earning him $25 million.

He also co-founded the designer retail store UNKNWN in Miami, Florida.

He owned stock in Beats by Dre and according to ESPN, when Apple purchased the brand for $3 billion, he earned $30 million in cash and stocks from the sale.

All in all, Forbes estimates that he has racked up “$900 million in income from endorsements and other business ventures.

stocks pandemic real estate

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

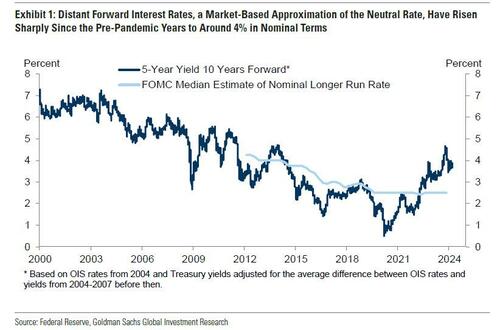

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

Spread & Containment

Household Net Interest Income Falls As Rates Spike

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

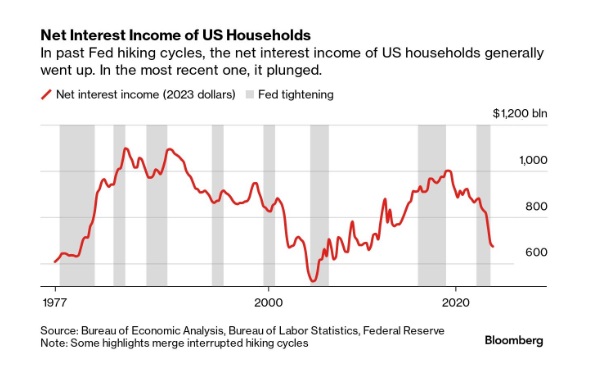

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex