Jittery Futures Coiled Tightly Ahead Of Today’s Jobs Report Main Event

Jittery Futures Coiled Tightly Ahead Of Today’s Jobs Report Main Event

S&P futures rebounded from an overnight drop and swung between…

S&P futures rebounded from an overnight drop and swung between gains and losses as investors looked forward to the week's main event, the September payrolls report, for clues on what the Fed will do next after a raft of hawkish Fed doused expectations on Thursday for a quick halt to rate hikes. Nasdaq 100 futs fell 0.3%, trimming deeper losses, amid a sharp premarket drop for semiconductor stocks prompted by a plunge in AMD which slumped after it preannounced much weaker-than-expected 3Q revenue and margins . Meanwhile, S&P500 futures on the S&P 500 Index traded little changed, although the benchmark was poised for the best weekly advance since June. Treasuries drifted lower, the dollar was flat, and cryptos were unchanged.

In premarket trading, Credit Suisse shares gained 7.9% after the lender offered to buy back debt securities for as much as CHF BN, in a show of financial strength after recent concerns about the bank’s solidity. Shares are up 14% this week, best weekly return since June 2020. They have recovered from a 12% intraday drop on Monday, when the stock slumped to a fresh low Shares are 49% down YTD. On the other end, chipmakers led the slide in early New York trading. Besides AMD’s 6% plunge, Nvidia Corp. and Intel Corp. fell more than 2% each amid concern that a slowing world economy will sharply dent semiconductor demand. Here are some other notable premarket movers

- Twitter shares fell as much as 1.9% to $48.45 in US premarket trading on Friday, trading almost 10% below Elon Musk’s offer price of $54.20 as the deal is said to be contingent on receiving $13 billion in debt financing, according to people familiar with the matter. They were flat by 6am in New York.

- Chip stocks were lower in US premarket trading after Samsung and AMD reported disappointing figures within hours of each other. The announcements signaled a deteriorating climate for global chip demand affecting the entire personal computers supply chain, including chipmakers, semiconductor equipment makers and PC manufacturers. AMD -6.4%, Nvidia -3.3%, Intel -2.8%.

- Pot stocks rallied in US premarket trading on Friday, set to extend Thursday’s gains after President Joe Biden pardoned thousands of Americans for possession of marijuana and ordered a review of its legal status, sparking hopes that decriminalization of the drug was drawing nearer and a more favorable regulatory environment for cannabis-related firms. Tilray Brands +9%, Canopy Growth +9%, Cronos Group +2.4%.

- DraftKings shares jump as much as 9.2% in US premarket trading on Friday, boosted by a report that the sports-betting firm is said to be nearing a sizable new partnership with Disney’s ESPN, signaling that interest in legalized sports betting in increasing. DraftKings trades at a price-to-sales multiple of 4.2 times, according to Bloomberg data, down from a peak of around 37 times reached in March 2021.

- Levi Strauss shares fell as much as 4.6% in US premarket trading on Friday after the jeans maker cut its adjusted earnings per share and net revenue growth outlook for the full year, stoking worries that it could be tough for retailers in the near-term as the company grapples with the impact of a stronger dollar, weakness in its European markets and supply-chain disruption.

- Payoneer Global jumps as much as 8.4% in premarket trading following news that the company will join the S&P SmallCap 600 index before trading opens on Oct. 12.

- Lyft shares fall 3.7% in US premarket trading after RBC downgraded the ride- sharing firm and slashed its PT, saying its bull case for the stock looks increasingly less likely.

- Aehr Test Systems jumped 9% in extended trading after the semiconductor manufacturing company reported net sales growth and improved adjusted earnings in the fiscal first quarter.

As previewed earlier, today's main event is the jobs report and as JPM noted, prior to Friday's NFP (and CPI next Wednesday), the market has been oscillating between the “hawkish Fed” and “Fed pivot” narrative. While the JOLTS Job Openings and the ISM Manufacturing employment index showed more evidence of a slowing labor market, the stronger than expected ADP/ISM Services once again proved the economy still remains strong and therefore weakens the hope of a near-term pivot from the Fed. In a nutshell, according to JPM's trading deks, with consensus expected tomorrow’s NFP to print +255k, Equity bulls would need a print ~100k to see the market alter its Fed expectations (full preview here).

The data will follow hawkish comments from Fed officials. Chicago Fed President Charles Evans said the benchmark rate will probably be at 4.5% to 4.75% by next spring, and Minneapolis Fed’s Neel Kashkari said the central bank is “quite a ways away” from pausing its campaign of rate increases.

“Barring an unexpectedly shocking number, I do not think today’s release will prompt the Fed to change tack,” said Stuart Cole, the head macro economist at Equiti Capital. “This has certainly been the message that various Fed officials have been promulgating.”

Meanwhile, according to Bloomberg, US Treasury yields are heading for a 10th week of increases, the longest streak since 1984, as the Fed stays resolute in its fight against inflation despite recent data suggesting a cooling of the economy. Investors are being swayed between hopes for an end to monetary tightening by March next year and concern over the possibility of a deep recession that such a pivot would underscore.

At the same time, investor focus is increasingly trained on signs of a weaker earnings-reporting season. Besides Thursday’s dour trading update from European oil major Shell, underwhelming figures from AMD and South Korean Samsung Electronics Co. are reinforcing concerns for the global economy.

“The issue of the Fed pivot remains the main factor restricting risk appetite,” Sebastien Barbe, the head of emerging-market research and strategy at Credit Agricole CIB, wrote in a note. “Cautiousness should remain in place ahead of the US jobs report. Given the repeated hawkish comments by Fed speakers, this may not be enough to sustainably support risk appetite.”

In Europe, the Stoxx 50 fell 0.2%. FTSE MIB outperforms, adding 0.2%; IBEX lags, dropping 0.5%. Tech, consumer products and retailers are the worst-performing sectors. Here are the biggest European equity movers:

- Renault shares climb as much as 4.8%. The automaker is raised to outperform from neutral and PT hiked to EU55 from EU35 at Oddo on its successful operational recovery and accelerating “product offensive.”

- Credit Suisse shares gain 8.4% after the lender offered to buy back debt securities for as much as CHF3bn, in a show of financial strength after recent concerns about the bank’s solidity.

- Telenor shares jump as much as 5.1%, the most since July 2020, after the telecom operator agreed to sell a 30% stake in its Norwegian fiber network to a consortium led by KKR and Oslo Pensjonsforsikring.

- Storytel gains as much as 11%, the most since August, after the Swedish publishing house released preliminary streaming revenue for the third quarter that was slightly above guidance, according to DNB

- European chip stocks are under pressure on Friday after industry bellwethers AMD and Samsung posted results that widely missed analysts’ expectations. ASML drops as much as 2.9%

- Adidas shares decline as much as 3.2% with UBS saying the uncertainty about its partnership with Kanye West’s Yeezy brand is a “negative development” for the sportswear group.

- Ocado shares decline as much as 3.1% after PT cut to a Street-low 420p from 595p at Morgan Stanley, which maintains an underweight rating on the grocery delivery group and says the case for its automated model has “got harder.”

- Building materials group Marshalls slumps 28% after it warned on a slowdown in demand for its landscaping products, prompting Peel Hunt to cut earnings estimates.

Asian stocks fell, on track to snap a three-day winning streak, as Federal Reserve officials reiterated their hawkish views and tech shares weighed. The MSCI Asia Pacific Index declined as much as 1.3%, with tech and consumer discretionary shares falling after five Fed officials on Thursday separately signaled inflation remained too high in the US. Some chip shares slid after Advanced Micro Devices’ preliminary third-quarter sales missed projections and Samsung reported disappointing preliminary quarterly results. Meanwhile, China’s electric-vehicle firms led declines on the Hong Kong market as concerns grew over weaker-than-expected orders. Vietnam’s stocks tumbled to the lowest in almost two years as a wave of forced selling hit the market amid concerns about rising interest rates. Liquidity remained relatively low with the onshore China market closed for the Golden Week holiday. The Asian gauge remains on track for its best week since July after weak US economic data earlier fueled hopes that the Fed may be less aggressive in tightening. Traders will scrutinize the US payroll data out later Friday for signs of economic slowdown and the impact on monetary policy. “Clearly the equity market is still playing chicken with the Fed around,” Joshua Crabb, head of Asia Pacific equities at Robeco, told Bloomberg Television. The interest-rate environment “is here to stay and that will continue to put pressure on some of the more highly valued sort of companies.”

Japanese stocks dropped as investors remained cautious over the outlook for Fed policy and awaited an upcoming monthly US payrolls report. The Topix fell 0.8% to 1,906.80 as of the market close in Tokyo, while the Nikkei 225 declined 0.7% to 27,116.11. Mitsubishi UFJ Financial Group contributed the most to the Topix’s decline, decreasing 2.2%. Out of 2,168 stocks in the index, 569 rose and 1,495 fell, while 104 were unchanged. “There is uncertainty whether US interest rate hikes could be 75bps or 100bps during the FOMC meeting in November,” said Naoki Fujiwara, chief fund manager at Shinkin Asset Management. “We are watching the unemployment rate and wage growth.”

Stocks in India ended flat on Friday but posted their first weekly advance in four, helped by a recovery in metal companies. The S&P BSE Sensex was little changed at 58,191.29 in Mumbai, while the NSE Nifty 50 Index dropped 0.1%. For the week, the gauges rose 1.3% each. Tata Consultancy Services was the most prominent decliner among the Sensex 30 companies, dropping 1.3%. The country’s biggest software exporter will kickoff quarterly earnings season Monday. Titan was among the best performers after reporting strong sales growth for three-months through September. Eleven of the 19 sector sub-indexes compiled by BSE Ltd. retreated, led by oil & gas companies, while consumer durables makers were the top performers. A measure of metal companies was the top gainer for the week, posting its best advance since July.

In FX, the Bloomberg Dollar Spot Index slipped 0.1% as the dollar fell against all Group of 10-peers apart from the kiwi. Demand for dollar topside exposure in the long-end remains strong ahead of the payrolls report.

- The euro rose above $0.98 and Bund yields climbed by up to 4bps as real yields continued to push higher alongside ECB tightening wagers.

- The cable led G-10 gains to trade above $1.12 after reversing early European session weakness. Yields on gilts rose by 3-6bps.

- The New Zealand dollar rose against the greenback as the nation’s bond yields closed up to 10bps higher.

- Australian dollar and Norwegian krone strengthened somewhat. Australian yields rose up to 7bps.

- The yen snapped a two-day decline as traders weigh the risk of an intervention by Japanese authorities to support the currency after it weakened past 145 per dollar. The currency is still set for an eighth straight week of declines

In rates, Treasuries were slightly cheaper across the curve after most yields reached weekly highs while maintaining narrow ranges ahead of September jobs report. Gilts and bunds weigh, underperforming Treasuries. US yields cheaper by up to 3bp across belly of the curve, cheapening 2s5s30s fly by 3.5bp on the day to around 12bp, up from as low as -13.7bp on Tuesday; 10-year yields around 3.85%, richer vs bunds and gilts by 6bp and 2bp. UK 10-year yield rises 2.5bps to 4.19%, while German 10-year climbs 4.5bps to 2.13%.

In commodities, US crude futures rose to approach $89 a barrel, on course for the biggest weekly surge since March. Spot gold is little changed at ~$1,713/oz. Bitcoin is contained within very narrow parameters, essentially pivoting the USD 20k mark as we head into the NFP release.

To the day ahead now, and the highlight will likely be the aforementioned US jobs report for September. Otherwise, data releases include German industrial production and Italian retail sales for August. From central banks, we’ll hear from the Fed’s Williams, Kashkari and Bostic, as well as BoE Deputy Governor Ramsden. Finally, EU leaders will be meeting in Prague.

Market Snapshot

- S&P 500 futures down 0.2% to 3,748.50

- STOXX Europe 600 down 0.2% to 395.56

- MXAP down 1.1% to 143.02

- MXAPJ down 1.3% to 463.87

- Nikkei down 0.7% to 27,116.11

- Topix down 0.8% to 1,906.80

- Hang Seng Index down 1.5% to 17,740.05

- Shanghai Composite down 0.6% to 3,024.39

- Sensex down 0.3% to 58,069.57

- Australia S&P/ASX 200 down 0.8% to 6,762.77

- Kospi down 0.2% to 2,232.84

- German 10Y yield little changed at 2.13%

- Euro up 0.2% to $0.9813

- Brent Futures up 0.1% to $94.53/bbl

- Gold spot up 0.0% to $1,712.81

- U.S. Dollar Index down 0.24% to 111.9

Top Overnight News from Bloomberg

- Investors poured the most money into cash since April 2020 on fears of a looming recession, but stocks could see further declines as they don’t fully reflect that risk, say Bank of America Corp. strategists

- Underlying inflation in the euro area is increasingly driven by higher demand, according to the European Central Bank, which has listed the trend among reasons to lift borrowing costs

- Inflation expectations among euro-zone consumers held steady in August, according to the European Central Bank, which has been raising interest rates in the face of record price gains

- The European Central Bank is ratcheting up pressure on some banks to keep 2022 bonuses in check amid fears about the darkening economic outlook, according to people with knowledge of the matter

- A report by the Recruitment & Employment Confederation showed UK companies are starting to impose hiring freezes because of pessimism about the outlook, and employees are deciding “stay put” rather than apply for other jobs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were lower as the region followed suit to the weak performance seen in global counterparts with risk appetite sapped amid the slew of hawkish Fed rhetoric and with participants awaiting the key US jobs data. ASX 200 was subdued by underperformance in the real estate sector and after the RBA Financial Stability Review noted financial stability risks have increased globally and that some households are already feeling the strain from higher rates which is likely to persist for some time. Nikkei 225 was pressured and briefly dipped below the 27,000 level after disappointing data in which Household Spending showed a surprise M/M contraction and with wage growth softer than previous. Hang Seng declined amid weakness in property and tech stocks with sentiment also not helped by reports that the US is to announce new measures that will effectively halt some exports of US equipment to Chinese firms making advanced NAND and DRAM memory chips.

Top Asian News

- BoK said it will maintain its stance of raising interest rates going forward to combat inflation which is expected to remain in the 5-6% range for a considerable period of time, according to Yonhap.

- RBA Financial Stability Review stated that financial stability risks have increased globally and markets are stressed by synchronised policy tightening, geopolitical tension, higher USD and rising energy prices. RBA also stated that stability risks would be magnified by further substantial tightening in global markets and some households are already feeling the strain from higher rates which is likely to persist for some time.

- Japanese top currency diplomat Kanda says has never felt a limit to ammunition for currency intervention, making various steps so as not to face a limit to ammunition when it comes to FX intervention, via Reuters.

- Malaysia Cuts Personal Income Tax by 2 Percentage Points

- Tycoon Faces Key Vote for Plan to Tap Vedanta Cash Reserves

- Gold Set for Largest Weekly Gain Since March as Jobs Data Loom

- Taiwan Exports Shrink for First Time Since 2020 on Global Slump

European bourses are modestly on the backfoot, though have trimmed this slightly as the session progresses, in limited newsflow pre-NFP. Nonetheless, are still on track to conclude the week with upside of just over 2% WTD for the Stoxx 600. Stateside, futures are similarly contained and lie either side of the unchanged mark with NQ -0.1% modestly lagging amid yield upside as officials pushback on an imminent pivot. ECB recently told some banks to exercise restraint on pay and dividends amid concerns about a potential wave of defaults, according to Bloomberg.

Top European News

- UK PM Truss is watering down former UK PM Johnson's plans to cut 91k civil service jobs, according to FT.

- Irish Foreign Minister Coveney says the new air of positivity has created a flicker of optimism, lots of issues yet to be resolved (re. Brexit/N. Ireland).

- Greece Should Take Turkey’s Warnings Seriously, Erdogan Says

- Credit Suisse Short Bets Soar Weeks Ahead of Strategy Review

- Brexit Grudges Recede as Truss Makes Inroads With EU Allies

- New Jupiter Boss to Shake Up Dozens of Funds and Cut CIO Role

- Swedish Housing Market Slump Deepens on Rate, Energy Worries

Geopolitics

- US President Biden said the nuclear 'Armageddon' threat is back for the first time since the Cuban Missile Crisis, according to AFP News Agency.

- Japanese government spokesperson Kihara said Japan is to impose additional sanctions against Russia and will freeze assets of more Russians after the annexation of parts of Ukraine, according to Reuters.

- US and South Korea are to conduct joint maritime drills involving the US aircraft carrier off the east coast on October 7th-8th, while the South Korean military said it will continue to strengthen its abilities to respond against North Korean provocation through joint drills, according to Yonhap.

- US forces conducted an airstrike in northern Syria on Thursday which killed Islamic State leader Abu-Hashum Al-Umawi and another IS official, according to Reuters.

- Turkish President Erdogan in a call with Russian President Putin discussed improving bilateral relations, according to the Turkish readout via Reuters.

FX

- Typically tense pre-NFP trade has seen the DXY briefly dip below 112.00, to a 111.94 low, before regathering itself and holding marginally above the figure.

- Action that comes to the benefit of peers across the board with GBP the primary beneficiary, Cable to a 1.1218 peak, but closely followed by other activity FX.

- EUR/USD is more contained given a hefty amount of OpEx around today's NY Cut, with participants also cognisant of worrying German data.

- After yesterday's relative outperformance, the CHF and NZD are the relative laggards and are currently unchanged on the session.

- CNB Minutes (Sep): Mora and Holub voted for a 75bp hike, other members regarded rates as commensurate with the current situation. Consensus that inflation was probably close to peaking.

- HKMA purchases HKD 1.57bln from the market as the HKD hits the weak end of its trading range.

Fixed Income

- Core benchmarks dipped to lows amid the morning's German data release, with Import Prices lifting again, though have gained some poise since in quiet trade.

- Currently, Bunds are towards the mid-point of a ~70tick range with similarly settled action in USTs and Gilts before US data & Fed speak.

- As such, yields are elevated but off highs of 3.85%, 2.16% & 4.22% for US, German and UK 10yrs respectively.

Commodities

- WTI and Brent are off highs but still holding onto gains of around USD 0.50/bbl and are at the top-end of the week’s USD 86.35/bbl – 95.00/bbl parameter in Brent Dec’22.

- For today, the main potential catalyst is the EU’s informal meeting of heads of state. A gathering which is focused on “Russia's war in Ukraine, energy and the economic situation.”

- US Secretary of State Blinken said the US will not do anything that infringes upon its interests and is reviewing a number of response options when asked about ties with Saudi Arabia and OPEC+ cuts, according to Reuters.

- US Republican Senator Grassley will seek to add the NOPEC bill to the defence policy bill, according to Reuters.

- OPEC Sec Gen says oil production capacity freed up by the latest production reductions could allow nations to intervene in the event of any crises in the oil market, according to Al Arabiya.

- Spot gold is little changed overall having derived some very brief upside from the DXY’s move below 112.00; however, the metal remains capped by the 50-DMA.

US Event Calendar

- 08:30: Sept. Change in Nonfarm Payrolls, est. 255,000, prior 315,000

- Change in Private Payrolls, est. 275,000, prior 308,000

- Change in Manufact. Payrolls, est. 20,000, prior 22,000

- Unemployment Rate, est. 3.7%, prior 3.7%

- Underemployment Rate, prior 7.0%

- Labor Force Participation Rate, est. 62.4%, prior 62.4%

- Average Hourly Earnings YoY, est. 5.0%, prior 5.2%; Average Hourly Earnings MoM, est. 0.3%, prior 0.3%

- Average Weekly Hours All Emplo, est. 34.5, prior 34.5

- 10:00: Aug. Wholesale Trade Sales MoM, est. 0.5%, prior -1.4%;

- Wholesale Inventories MoM, est. 1.3%, prior 1.3%

- 15:00: Aug. Consumer Credit, est. $25b, prior $23.8b

Fed speakers

- 10:00: Fed’s Williams Speaks in Moderated Q&A

- 11:00: Fed’s Kashkari Discusses Agriculture, Food and Inflation

- 12:00: Fed’s Bostic Discusses Inequality

DB's Jim Reid concludes the overnight wrap

In these stressful markets I’ve kept my personal anecdotes to a minimum but I have a few butterflies this morning as I have a big 36 hole golf matchplay final on Sunday. After 2 major knee operations in the last 12 months, 4 back injections in the last 18, a long period with a trapped nerve in my shoulder, a numb hand and countless rounds of physio, I’ve eventually played the best golf of my life this year and have got down to a 2.6 handicap. I have to give my opponent 16 shots over 36 holes though so it’s going to be hard. A couple of weeks later I’m also in a scratch final with no shots given. However the problem is my opponent is off +1. My current mid-life crisis obsession (after piano, cycling, etc. previously) is to get down to scratch. I suspect I’ll fail as I don’t hit it far enough. However I’m doing weights and speed training which is why I keep getting injured. My wife despairs at my obsessiveness most of the time but it keeps me going!!

We’re all going to be obsessing about payrolls today and then US CPI next week. Clearly the latter has more potential to shape trading over the next few weeks but the former is always a big event. In terms of what to expect from today's jobs report, our US economists are forecasting that nonfarm payrolls grew by +275k in September. That’s slightly above the +250k consensus print, but if realised that would still be the slowest pace of monthly job growth since April 2021. However versus long-term average that would still be a hefty print even if you adjust for population. Our economists think that’ll be enough to push the unemployment rate down a tenth to 3.6%, especially given the three-tenths rise in the participation rate in August. When it comes to the Fed, both futures and our US economists see a +75bps move as the likely outcome at the next meeting, and a strong report today would cement those expectations, not least given the recent chatter that the Fed might slow down their pace of hikes earlier than anticipated.

Today's print comes as the mood has soured again over the last 48 hours even if the prior 48 hours were spectacular enough to leave us notably stronger for the week still for risk even if bonds have given up their gains.

Yesterday saw a fresh selloff in stocks and bonds alongside further dollar strength after multiple Fed speakers pushed back on speculation that they’re about to ease up on hiking rates. That wasn’t helped by the news on the inflation side either, with oil prices reaching a one-month high, whilst commodities more broadly advanced for a 4th day running.

Going through some of these themes we’ll start with the Fed, since yesterday saw an array of speakers who reiterated hawkish talking points from the get-go. In particular, Minneapolis Fed President Kashkari said that “Until I see some evidence that underlying inflation has solidly peaked and is hopefully headed back down, I’m not ready to declare a pause. I think we’re quite a ways away from a pause.” So that adds to the previous day’s FOMC members who similarly pushed back on an imminent reversal. Later in the session, we heard from Presidents Evans and Mester, Governors Cook and Waller. They all held the line, pushing back on any pivot pricing. Notably, President Evans, another reformed dove, said rates would be near 4.5-4.75% by the spring of next year, with the market pricing terminal rates at the lower end of that range at 4.55% as of March.

Against that backdrop, investors continued to price out the chances of a Fed pivot next year, with Fed funds futures for December 2023 up +13.4bps on the day to 4.33%, their biggest one-day increase since the September FOMC itself. Now that’s still beneath the 4.6% that the FOMC had in their dot plot for end-2023 a couple of weeks back, and the 4.50% the market priced in 8 days ago, but the moves over the last couple of days do suggest they’re having some success in pushing back on the rate cut speculation. The impact of that worked its way through to Treasury yields, with the 10yr yield up +7.1bps to 3.82%, having been led by a +6.8bps rise in the real yield to 1.61%. That's still some room below the late September intraday peak of 4.02%, but quite a bounce from Tuesday’s intraday low of 3.56%. That range is all within seven days, such is the recent volatility in bond markets. This morning in Asia, yields on the 10yr are just a tad lower as we go to press.

It’s worth keeping an eye on long-end Gilts as they continue to unwind some of the once in a lifetime sized rally from 5% last week after the BoE stepped in. 30yr yields closed at 4.29% having been as low as 3.62% on Monday. Anecdotal evidence points to the LDI saga still impacting that end of the curve.

The hawkish Fed rhetoric impacted on equities as well, with the S&P 500 (-1.02%) and the STOXX 600 (-1.25%) each seeing a noticeable pullback. The NASDAQ proved more resilient falling only -0.68%. In addition, the VIX index of volatility picked up again following a run of 4 consecutive declines, moving up +1.97pts to finish above 30 again at 30.52.

One factor that won’t be welcomed by policymakers is the latest rise in commodity prices, with Brent crude (+1.12%) and WTI (+0.79%) oil prices rising for a 4th day running, which follows the decision by the OPEC+ group to cut their production levels the previous day. In response, US President Biden said that his reaction was “Disappointment. And we’re looking at what alternatives we may have”. In the meantime, there was a modest downtick in European natural gas futures (-3.91%) to €167 per megawatt-hour. Speaking of which, our research colleagues in Frankfurt published their latest gas supply monitor yesterday (link here), in which they update their scenarios for this winter to reflect the latest developments. They also preview what to expect from the informal meeting of EU leaders taking place in Prague today.

Staying on Europe, sovereign bonds lost ground across the continent in line with the US moves, with yields on 10yr bunds (+5.4bps), OATs (+4.4bps) and BTPs (+4.7bps) all moving higher. That follows a similar dose of scepticism from investors about whether the ECB might pivot alongside the Fed, and the deposit rate priced in by overnight index swaps for June 2023 moved up more than 15bps for the second straight day, increasing +15.5bps yesterday to 2.89%. Those moves also came as we got the accounts from the ECB’s September meeting when they hiked by 75bps, which indicated that “some members” had preferred to only hike by 50bps, although “all members joined a consensus to raise the three key ECB interest rates by 75 basis points”. There was also a view that policy rates were still “significantly below the neutral rate”, even with the latest rate hike”, and it said that chief economist Lane had “stressed that price pressures were extraordinarily high and likely to persist for an extended period.”

Back in the UK, there were fresh signs that the recent market turmoil was impacting the mortgage market, after Moneyfacts reported that the average 5yr fixed mortgage rate was now above 6%. That puts it at its highest level since February 2010, and follows the previous day’s news that the 2yr fixed rate had also passed the 6% milestone. Furthermore, there were some warnings on the energy front, with National Grid saying that there was one scenario (although not its base case) that could see 3-hour power cuts if there wasn’t enough gas supply. The more negative newsflow occurred as sterling continued to lose ground against the US Dollar again, with a further -1.45% fall that brings its declines over the last two sessions to -2.76%. And gilts struggled as well, and not just at the long-end as discussed earlier, with 10yr yields up +13.3bps on the day to 4.15%.

Asian equity markets are also declining this morning with the Hang Seng (-1.13%) leading losses, pulling back from a strong rebound earlier this week with the Nikkei (-0.59%) also trading in negative territory. Meanwhile, the Kospi (+0.06%) is swinging between gains and losses with the index heavyweight Samsung Electronics downbeat 3Q preliminary earnings forecast weighing on sentiment. Elsewhere, markets in China are closed for the National Day holiday.

Looking forward, stock futures in the US are fluctuating with contracts tied to the S&P 500 (+0.03%) and NASDAQ 100 (+0.04%) just above flat ahead of the big day.

Early morning data showed that Japan’s real wages (-1.7% y/y) fell in August for the fifth consecutive month, following a revised -1.8% fall in July. At the same time, household spending (+5.1% y/y) increased in August (v/s +6.7% expected) following a +3.4% gain in July as the economy continued to recover from COVID-19 restrictions albeit with rising prices probably preventing further gains.

Ahead of today’s US jobs report, the weekly initial jobless claims for the week ending October 1 came in at 219k (vs. 204k expected), although there was a -3k downward revision to the previous week, without any apparent impact from the recent hurricane, which our US econ team believes will show up in next week’s data. Elsewhere, German factory orders contracted by more than expected in August, falling -2.4% (vs. -0.7% expected), but there was a sharp upward revision to the previous month, as the data now showed a +1.9% expansion (vs. -1.1% previously).

To the day ahead now, and the highlight will likely be the aforementioned US jobs report for September. Otherwise, data releases include German industrial production and Italian retail sales for August. From central banks, we’ll hear from the Fed’s Williams, Kashkari and Bostic, as well as BoE Deputy Governor Ramsden. Finally, EU leaders will be meeting in Prague.

International

There will soon be one million seats on this popular Amtrak route

“More people are taking the train than ever before,” says Amtrak’s Executive Vice President.

While the size of the United States makes it hard for it to compete with the inter-city train access available in places like Japan and many European countries, Amtrak trains are a very popular transportation option in certain pockets of the country — so much so that the country’s national railway company is expanding its Northeast Corridor by more than one million seats.

Related: This is what it's like to take a 19-hour train from New York to Chicago

Running from Boston all the way south to Washington, D.C., the route is one of the most popular as it passes through the most densely populated part of the country and serves as a commuter train for those who need to go between East Coast cities such as New York and Philadelphia for business.

Veronika Bondarenko

Amtrak launches new routes, promises travelers ‘additional travel options’

Earlier this month, Amtrak announced that it was adding four additional Northeastern routes to its schedule — two more routes between New York’s Penn Station and Union Station in Washington, D.C. on the weekend, a new early-morning weekday route between New York and Philadelphia’s William H. Gray III 30th Street Station and a weekend route between Philadelphia and Boston’s South Station.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Amtrak, these additions will increase Northeast Corridor’s service by 20% on the weekdays and 10% on the weekends for a total of one million additional seats when counted by how many will ride the corridor over the year.

“More people are taking the train than ever before and we’re proud to offer our customers additional travel options when they ride with us on the Northeast Regional,” Amtrak Executive Vice President and Chief Commercial Officer Eliot Hamlisch said in a statement on the new routes. “The Northeast Regional gets you where you want to go comfortably, conveniently and sustainably as you breeze past traffic on I-95 for a more enjoyable travel experience.”

Here are some of the other Amtrak changes you can expect to see

Amtrak also said that, in the 2023 financial year, the Northeast Corridor had nearly 9.2 million riders — 8% more than it had pre-pandemic and a 29% increase from 2022. The higher demand, particularly during both off-peak hours and the time when many business travelers use to get to work, is pushing Amtrak to invest into this corridor in particular.

To reach more customers, Amtrak has also made several changes to both its routes and pricing system. In the fall of 2023, it introduced a type of new “Night Owl Fare” — if traveling during very late or very early hours, one can go between cities like New York and Philadelphia or Philadelphia and Washington. D.C. for $5 to $15.

As travel on the same routes during peak hours can reach as much as $300, this was a deliberate move to reach those who have the flexibility of time and might have otherwise preferred more affordable methods of transportation such as the bus. After seeing strong uptake, Amtrak added this type of fare to more Boston routes.

The largest distances, such as the ones between Boston and New York or New York and Washington, are available at the lowest rate for $20.

stocks pandemic japan europeanInternational

The next pandemic? It’s already here for Earth’s wildlife

Bird flu is decimating species already threatened by climate change and habitat loss.

I am a conservation biologist who studies emerging infectious diseases. When people ask me what I think the next pandemic will be I often say that we are in the midst of one – it’s just afflicting a great many species more than ours.

I am referring to the highly pathogenic strain of avian influenza H5N1 (HPAI H5N1), otherwise known as bird flu, which has killed millions of birds and unknown numbers of mammals, particularly during the past three years.

This is the strain that emerged in domestic geese in China in 1997 and quickly jumped to humans in south-east Asia with a mortality rate of around 40-50%. My research group encountered the virus when it killed a mammal, an endangered Owston’s palm civet, in a captive breeding programme in Cuc Phuong National Park Vietnam in 2005.

How these animals caught bird flu was never confirmed. Their diet is mainly earthworms, so they had not been infected by eating diseased poultry like many captive tigers in the region.

This discovery prompted us to collate all confirmed reports of fatal infection with bird flu to assess just how broad a threat to wildlife this virus might pose.

This is how a newly discovered virus in Chinese poultry came to threaten so much of the world’s biodiversity.

The first signs

Until December 2005, most confirmed infections had been found in a few zoos and rescue centres in Thailand and Cambodia. Our analysis in 2006 showed that nearly half (48%) of all the different groups of birds (known to taxonomists as “orders”) contained a species in which a fatal infection of bird flu had been reported. These 13 orders comprised 84% of all bird species.

We reasoned 20 years ago that the strains of H5N1 circulating were probably highly pathogenic to all bird orders. We also showed that the list of confirmed infected species included those that were globally threatened and that important habitats, such as Vietnam’s Mekong delta, lay close to reported poultry outbreaks.

Mammals known to be susceptible to bird flu during the early 2000s included primates, rodents, pigs and rabbits. Large carnivores such as Bengal tigers and clouded leopards were reported to have been killed, as well as domestic cats.

Our 2006 paper showed the ease with which this virus crossed species barriers and suggested it might one day produce a pandemic-scale threat to global biodiversity.

Unfortunately, our warnings were correct.

A roving sickness

Two decades on, bird flu is killing species from the high Arctic to mainland Antarctica.

In the past couple of years, bird flu has spread rapidly across Europe and infiltrated North and South America, killing millions of poultry and a variety of bird and mammal species. A recent paper found that 26 countries have reported at least 48 mammal species that have died from the virus since 2020, when the latest increase in reported infections started.

Not even the ocean is safe. Since 2020, 13 species of aquatic mammal have succumbed, including American sea lions, porpoises and dolphins, often dying in their thousands in South America. A wide range of scavenging and predatory mammals that live on land are now also confirmed to be susceptible, including mountain lions, lynx, brown, black and polar bears.

The UK alone has lost over 75% of its great skuas and seen a 25% decline in northern gannets. Recent declines in sandwich terns (35%) and common terns (42%) were also largely driven by the virus.

Scientists haven’t managed to completely sequence the virus in all affected species. Research and continuous surveillance could tell us how adaptable it ultimately becomes, and whether it can jump to even more species. We know it can already infect humans – one or more genetic mutations may make it more infectious.

At the crossroads

Between January 1 2003 and December 21 2023, 882 cases of human infection with the H5N1 virus were reported from 23 countries, of which 461 (52%) were fatal.

Of these fatal cases, more than half were in Vietnam, China, Cambodia and Laos. Poultry-to-human infections were first recorded in Cambodia in December 2003. Intermittent cases were reported until 2014, followed by a gap until 2023, yielding 41 deaths from 64 cases. The subtype of H5N1 virus responsible has been detected in poultry in Cambodia since 2014. In the early 2000s, the H5N1 virus circulating had a high human mortality rate, so it is worrying that we are now starting to see people dying after contact with poultry again.

It’s not just H5 subtypes of bird flu that concern humans. The H10N1 virus was originally isolated from wild birds in South Korea, but has also been reported in samples from China and Mongolia.

Recent research found that these particular virus subtypes may be able to jump to humans after they were found to be pathogenic in laboratory mice and ferrets. The first person who was confirmed to be infected with H10N5 died in China on January 27 2024, but this patient was also suffering from seasonal flu (H3N2). They had been exposed to live poultry which also tested positive for H10N5.

Species already threatened with extinction are among those which have died due to bird flu in the past three years. The first deaths from the virus in mainland Antarctica have just been confirmed in skuas, highlighting a looming threat to penguin colonies whose eggs and chicks skuas prey on. Humboldt penguins have already been killed by the virus in Chile.

How can we stem this tsunami of H5N1 and other avian influenzas? Completely overhaul poultry production on a global scale. Make farms self-sufficient in rearing eggs and chicks instead of exporting them internationally. The trend towards megafarms containing over a million birds must be stopped in its tracks.

To prevent the worst outcomes for this virus, we must revisit its primary source: the incubator of intensive poultry farms.

Diana Bell does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

genetic pandemic mortality spread deaths south korea south america europe uk chinaUncategorized

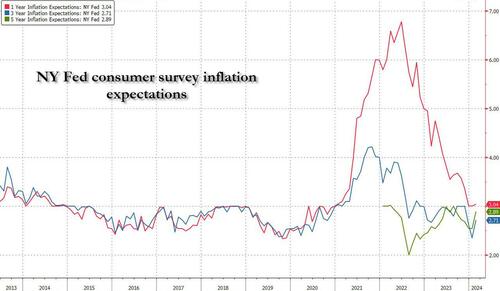

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

One month after the inflation outlook tracked…

One month after the inflation outlook tracked by the NY Fed Consumer Survey extended their late 2023 slide, with 3Y inflation expectations in January sliding to a record low 2.4% (from 2.6% in December), even as 1 and 5Y inflation forecasts remained flat, moments ago the NY Fed reported that in February there was a sharp rebound in longer-term inflation expectations, rising to 2.7% from 2.4% at the three-year ahead horizon, and jumping to 2.9% from 2.5% at the five-year ahead horizon, while the 1Y inflation outlook was flat for the 3rd month in a row, stuck at 3.0%.

The increases in both the three-year ahead and five-year ahead measures were most pronounced for respondents with at most high school degrees (in other words, the "really smart folks" are expecting deflation soon). The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at all horizons, while the median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined at the one- and three-year ahead horizons and remained unchanged at the five-year ahead horizon.

Going down the survey, we find that the median year-ahead expected price changes increased by 0.1 percentage point to 4.3% for gas; decreased by 1.8 percentage points to 6.8% for the cost of medical care (its lowest reading since September 2020); decreased by 0.1 percentage point to 5.8% for the cost of a college education; and surprisingly decreased by 0.3 percentage point for rent to 6.1% (its lowest reading since December 2020), and remained flat for food at 4.9%.

We find the rent expectations surprising because it is happening just asking rents are rising across the country.

At the same time as consumers erroneously saw sharply lower rents, median home price growth expectations remained unchanged for the fifth consecutive month at 3.0%.

Turning to the labor market, the survey found that the average perceived likelihood of voluntary and involuntary job separations increased, while the perceived likelihood of finding a job (in the event of a job loss) declined. "The mean probability of leaving one’s job voluntarily in the next 12 months also increased, by 1.8 percentage points to 19.5%."

Mean unemployment expectations - or the mean probability that the U.S. unemployment rate will be higher one year from now - decreased by 1.1 percentage points to 36.1%, the lowest reading since February 2022. Additionally, the median one-year-ahead expected earnings growth was unchanged at 2.8%, remaining slightly below its 12-month trailing average of 2.9%.

Turning to household finance, we find the following:

- The median expected growth in household income remained unchanged at 3.1%. The series has been moving within a narrow range of 2.9% to 3.3% since January 2023, and remains above the February 2020 pre-pandemic level of 2.7%.

- Median household spending growth expectations increased by 0.2 percentage point to 5.2%. The increase was driven by respondents with a high school degree or less.

- Median year-ahead expected growth in government debt increased to 9.3% from 8.9%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.6 percentage point to 26.1%, remaining below its 12-month trailing average of 30%.

- Perceptions about households’ current financial situations deteriorated somewhat with fewer respondents reporting being better off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off and a slightly larger share of respondents expecting to be worse off a year from now.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 1.4 percentage point to 38.9%.

- At the same time, perceptions and expectations about credit access turned less optimistic: "Perceptions of credit access compared to a year ago deteriorated with a larger share of respondents reporting tighter conditions and a smaller share reporting looser conditions compared to a year ago."

Also, a smaller percentage of consumers, 11.45% vs 12.14% in prior month, expect to not be able to make minimum debt payment over the next three months

Last, and perhaps most humorous, is the now traditional cognitive dissonance one observes with these polls, because at a time when long-term inflation expectations jumped, which clearly suggests that financial conditions will need to be tightened, the number of respondents expecting higher stock prices one year from today jumped to the highest since November 2021... which incidentally is just when the market topped out during the last cycle before suffering a painful bear market.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex