Uncategorized

Jerry 2023 State of the American Driver Report Reveals Impact of Rising Car Expenses on Household Budgets

Jerry 2023 State of the American Driver Report Reveals Impact of Rising Car Expenses on Household Budgets

PR Newswire

PALO ALTO, Calif., Jan. 4, 2023

A Quarter of Americans Spend Over 15% of Take-Home Pay on Monthly Car Payments; Two-Thirds of Driv…

Jerry 2023 State of the American Driver Report Reveals Impact of Rising Car Expenses on Household Budgets

PR Newswire

PALO ALTO, Calif., Jan. 4, 2023

A Quarter of Americans Spend Over 15% of Take-Home Pay on Monthly Car Payments; Two-Thirds of Drivers Report Rising Auto Expenses Force Them to Cut Spending Elsewhere

PALO ALTO, Calif., Jan. 4, 2023 /PRNewswire/ -- Jerry, the superapp for car owners, today releases the findings from its 2023 State of the American Driver Report, its second-annual study that offers a comprehensive, data-driven look into the current state of the car ownership experience. It reveals the full extent of the financial burden American car owners face and breaks down their shifting pandemic-era purchasing patterns.

Jerry's 2023 State of the American Driver Report analyzes results from a national survey of more than 1,200 American drivers across all 50 states and four generations – Gen Z, Millennials, Gen X and Boomers. Two-thirds of respondents confirm that rising car costs forced them to cut spending in other categories, including groceries, restaurants, clothing, entertainment and vacations.

A whopping 24% of drivers expect to shop for a car in 2023, and a majority (61%) of those who plan to shop remain loyal to traditional dealerships versus online retailers. Nearly half (49%) of American drivers are interested in buying or leasing an electric vehicle as their next car, a 10% jump from last year motivated mainly by the record high gas prices they paid in 2022. Meanwhile, the slight majority cite concerns over inconvenience of charging and high vehicle prices as their primary reason to stick with gas-powered vehicles.

- Those who are buying aren't getting what they actually want – A third of drivers surveyed who bought a vehicle in 2022 said they ended up buying used instead of new because of limited supply. A quarter said they bought a make or model that wasn't their first choice.

- High prices and interest rates are weighing on 2023 shopping plans – About a quarter of drivers said they plan to shop for a new or used vehicle in 2023, similar to numbers seen a year earlier. About half of respondents said they don't plan to shop for a new vehicle at all, and others said lower prices and interest rates would change their mind.

- Unhealthy amounts of household income are going to car expenses – Nearly a quarter of American drivers spend more than 15% of their take-home pay on car payments. About two-thirds said the cost of owning a car forced them to cut spending in other areas in 2022. A quarter said they cut back on groceries, while nearly a third spent less on family vacations.

- Insurance costs are rising but policyholders aren't taking action – Rising car insurance premiums forced nearly a quarter of Americans to take out less coverage than they wanted in 2022. Yet 63% didn't shop around for better deals.

- High gas prices spark increased EV interest – After a year in which gas prices reached a record high, nearly half (49%) of American drivers said they are interested in getting an EV as their next vehicle, up from 39% in 2021. Saving money on gas remains the most commonly cited reason for their interest in EVs.

- Preference for Tesla may be waning – Tesla remains the top choice of EV among American drivers, but about two-thirds say another brand would now be their first choice. Ford, Chevrolet and Hyundai are the top picks after Tesla.

- Diehard ICE buyers remain – Still, a slight majority of Americans (51%) say they have no interest in buying or leasing an EV for their next vehicle, pointing to the inconvenience of charging and high vehicle prices as their top reasons.

- The roads are more dangerous – Nearly a third of Americans say driving has become more dangerous since COVID. In 2022, nearly one in five witnessed a driver get out of their car to confront someone in another vehicle. One in five men and nearly one in 10 women say they sometimes keep a loaded handgun within reach while driving.

"The disruption we're experiencing in the car market is likely to continue for at least another year or two," says Henry Hoenig, Jerry data journalist and study author. "Supply-chain problems that have hit vehicle production are not fully resolved and the supply of newer used vehicles likely won't return to normal until at least 2025. This means used-car prices will probably remain elevated, even if they fall somewhat from the recent highs. There's never been more need or demand for Americans to find savings on all their car expenses."

While nearly a quarter of Americans report spending more than 15% of their household's monthly after-tax income on their monthly car payment – before accounting for insurance, gas, repairs, or maintenance – ways to save do still exist. The Jerry app saves both time and money on car expenses. Customers who use Jerry to buy car insurance save, on average, more than $800 a year. Customers who refinance their car loan with Jerry, on average, reduce their monthly payment by $134.

"One of the easiest ways to find savings on some of your larger car expenses, like insurance, is to shop around. Our survey shows that more than half of Americans simply never do," Hoenig added. "Shopping for insurance isn't nearly as antiquated and complex as it once was. Those past, negative experiences are most likely what's been stopping them. We've rebuilt the customer experience from the ground up to do virtually all the work for customers, for free, and in minutes. The savings potential is out there and we hope that what we do makes an even more meaningful difference in many American's lives right now."

The report was released on Jan. 4 in conjunction with Jerry Chief Financial Officer Ed Chung's participation in the Acxiom "Innovations in Data About People" panel at 10 a.m. PT in Las Vegas Convention Center's West Hall, room W219, during CES 2023.

The Jerry app offers many additional money-saving car ownership services. To learn more, visit getjerry.com. To review the full report, click here.

Methodology: Jerry's 2023 State of the American Driver report is based on data from a nationally representative survey of 1,257 respondents conducted in November 2022 using a platform and audience from Pollfish. Results were filtered to include only respondents who own or lease a vehicle and drive regularly, and were blended for age, gender and state. More information about Pollfish and its audiences can be found on its website.

About Jerry: Jerry saves you time and money on your car expenses. Jerry first launched its AI- and machine-learning-based car insurance comparison service in 2019 and today serves more than 3 million customers as a licensed insurance broker and an authorized auto refinance provider. For more information, to save money on car insurance or reduce monthly auto loan payments by refinancing, visit getjerry.com or download the Jerry app in the App Store or Google Play.

View original content to download multimedia:https://www.prnewswire.com/news-releases/jerry-2023-state-of-the-american-driver-report-reveals-impact-of-rising-car-expenses-on-household-budgets-301712912.html

SOURCE Jerry

Uncategorized

One city held a mass passport-getting event

A New Orleans congressman organized a way for people to apply for their passports en masse.

While the number of Americans who do not have a passport has dropped steadily from more than 80% in 1990 to just over 50% now, a lack of knowledge around passport requirements still keeps a significant portion of the population away from international travel.

Over the four years that passed since the start of covid-19, passport offices have also been dealing with significant backlog due to the high numbers of people who were looking to get a passport post-pandemic.

Related: Here is why it is (still) taking forever to get a passport

To deal with these concurrent issues, the U.S. State Department recently held a mass passport-getting event in the city of New Orleans. Called the "Passport Acceptance Event," the gathering was held at a local auditorium and invited residents of Louisiana’s 2nd Congressional District to complete a passport application on-site with the help of staff and government workers.

'Come apply for your passport, no appointment is required'

"Hey #LA02," Rep. Troy A. Carter Sr. (D-LA), whose office co-hosted the event alongside the city of New Orleans, wrote to his followers on Instagram (META) . "My office is providing passport services at our #PassportAcceptance event. Come apply for your passport, no appointment is required."

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The event was held on March 14 from 10 a.m. to 1 p.m. While it was designed for those who are already eligible for U.S. citizenship rather than as a way to help non-citizens with immigration questions, it helped those completing the application for the first time fill out forms and make sure they have the photographs and identity documents they need. The passport offices in New Orleans where one would normally have to bring already-completed forms have also been dealing with lines and would require one to book spots weeks in advance.

These are the countries with the highest-ranking passports in 2024

According to Carter Sr.'s communications team, those who submitted their passport application at the event also received expedited processing of two to three weeks (according to the State Department's website, times for regular processing are currently six to eight weeks).

While Carter Sr.'s office has not released the numbers of people who applied for a passport on March 14, photos from the event show that many took advantage of the opportunity to apply for a passport in a group setting and get expedited processing.

Every couple of months, a new ranking agency puts together a list of the most and least powerful passports in the world based on factors such as visa-free travel and opportunities for cross-border business.

In January, global citizenship and financial advisory firm Arton Capital identified United Arab Emirates as having the most powerful passport in 2024. While the United States topped the list of one such ranking in 2014, worsening relations with a number of countries as well as stricter immigration rules even as other countries have taken strides to create opportunities for investors and digital nomads caused the American passport to slip in recent years.

A UAE passport grants holders visa-free or visa-on-arrival access to 180 of the world’s 198 countries (this calculation includes disputed territories such as Kosovo and Western Sahara) while Americans currently have the same access to 151 countries.

stocks pandemic covid-19 grantsUncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

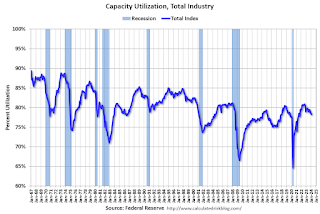

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex