iPhone SE (2020) release date, specs, features and rumors

iPhone SE (2020) release date, specs, features and rumors

iPhone SE (2020) officially launched

April 17, 2020 UPDATE: After months of rumors and speculations, Apple has officially launched the budget-friendly model. The device has been named iPhone SE (2020) instead of iPhone 9. It has a starting price of $399. Apple has started accepting pre-orders for the new iPhone SE. Deliveries are set to start on April 24th in the US.

The second-generation iPhone SE features a 4.7-inch LCD screen with thick bezels at the top and bottom. The device gets Touch ID fingerprint sensor instead of the Face ID. It smaller size makes the iPhone SE easier to operate with one hand.

The phone is available in three different color options – White, Black, and PRODUCT(RED). It has the familiar aluminum and glass design. The iPhone SE comes with an IP67 rating for water-resistance, meaning it can remain submerged in up to one meter deep water for 30 minutes.

The iPhone SE (2020) has a single 12MP camera on the back with Portrait Mode, Portrait Lighting and Depth Control. It can record 4K videos at up to 60fps. For selfies, it gets a 7MP sensor with Portrait Mode, Portrait Lighting, and Depth Control.

One of the biggest highlights of the new phone is its processor. The iPhone SE gets the same A13 Bionic chipset that runs the iPhone 11 Pro. Apple hasn’t officially revealed the RAM and battery size. But third-party sources have confirmed that it packs 3GB RAM and a 1,820mAh battery. The device is available in three different storage options of 64GB, 128GB, and 256GB.

PREVIOUS

Apple’s highly anticipated low-cost iPhone 9/iPhone SE 2 is just a few weeks away, according to a bunch of leaks and rumors. But the coronavirus outbreak could force Apple to change its plans. The device will reportedly be aimed at people who prefer a budget-friendly phone with a smaller screen. Here’s the lowdown on the iPhone 9 release date, price, specs, and rumors.

What will it be called?

Well, we don’t know for sure. Both the iPhone 9 and iPhone SE 2 names have been doing rounds in the rumor mill. Apple launched the iPhone SE in 2016 as a budget-friendly, small-screen option for people who didn’t want its larger and more expensive phones. The new device will have a similar target audience. So, it could be called iPhone SE 2.

However, various leaks have indicated that the smartphone would look similar to the iPhone 8, which has started showing its age. A device with iPhone 8-like appearance and upgraded internals could be called iPhone 9. At this point, iPhone 9 seems far more likely than iPhone SE 2.

According to reports coming out of Korea, wireless carrier Korea Telecom has been advertising the device as iPhone 9. The carrier was also advertising Samsung’s Galaxy S20 before its launch. It’s unlikely that the Korean telecom operator was given false information.

iPhone 9 release date

Apple could launch the iPhone 9 as soon as the first week of April. According to MacRumors, the iPhone 9 cases have reached Best Buy stores in the US. A Best Buy employee shared an image of the case, which has the Urban Armor Gear branding. There is no mention of the phone’s name on the case box. It simply says, “New iPhone 4.7″, 2020.”

Best Buy has asked its employees not to showcase the new iPhone 9 cases to customers until April 5th. It indicates that the device could debut on or around April 5. Given the coronavirus outbreak, Apple will likely launch the iPhone 9 the same way it recently launched the iPad Pro and MacBook Air with Magic Keyboard.

Recently, reliable Twitter tipster Evan Blass claimed that Apple would launch the low-cost iPhone 9 in March this year. DigiTimes reported on February 13 that Taiwan-based compound semiconductor makers were preparing to start production of components for the low-cost iPhone model. Apple had launched the iPhone SE in March of 2016.

There are speculations that the coronavirus outbreak in China could disrupt the supply chain and force Apple to delay the iPhone 9 launch.

Reputed Apple analyst Ming-Chi Kuo of TF International Securities (via MacRumors) has told clients that the iPhone production won’t ramp up significantly until the second quarter of 2020. Kuo has warned that the coronavirus outbreak could cause delay in the launch of new Apple products.

The Cupertino company has also lowered its revenue guidance for the March quarter. The coronavirus outbreak has disrupted Apple’s supply chain in Asia. Nikkei Asian Review has learned from supply chain sources that the iPhone 9 production was supposed to start in February. But it has been pushed back to sometime in March.

Even if Apple ends up delaying the iPhone 9 launch, we can still expect the device to hit the store shelves in the first half of this year. The iPhone 9 is widely anticipated by people who want an affordable and small-screen iPhone with the latest processor. Apple hasn’t yet sent out invites for the iPhone 9 launch event.

Design and display

There have been contradictory reports about the iPhone 9’s screen size. Some reports suggest it would feature a 4.7-inch screen. Others claim it would get a 4.9-inch display. And Japanese blog Mac Otakara has reported that it would sport an even larger 5.4-inch screen.

As per the renders shared by Twitter tipster OnLeaks, the phone would get a 4.7-inch IPS LCD Retina display. Its form factor will be similar to iPhone 8 with thick bezels at the top and bottom of the screen. It would also have a physical home button with Touch ID support. The phone will also get rid of the 3D Touch functionality to cut costs. It gets only a single camera on the back.

It will be difficult for Apple to pack a 5.4-inch display in an iPhone 8 chassis, unless Apple ditches the home button and Touch ID in favor of Face ID. But Face ID will significantly increase the costs, which won’t go with Apple’s low-cost theme for the phone.

The iPhone 9 will also reportedly have a stainless steel frame. Its back panel is expected to have frosted glass rather than the glossy glass of the iPhone 11. According to OnLeaks, the handset will be available in silver, red, and space grey color options.

The features and specs

Despite its low cost, the iPhone 9 is going to be insanely powerful. Twitter tipster OnLeaks has learned from supply chain sources that the iPhone 9 would run the A13 chipset with 3GB RAM. The iPhone 11 series runs the same A13 processor. It is expected to pack 64GB of base storage.

Not much is known about its battery performance. Apple could keep its battery capacity same as iPhone 8, but improve battery life through software optimization. Thanks to the glass rear panel, the device could also support wireless charging.

It is said to have only a single camera on the back. But Apple will likely use the new sensors from iPhone 11 series. It could support new features like 100% Focus Pixels, QuickVideo, Portrait Mode, Night Mode, Smart HDR, and 4K video recording. On the front, it will likely retain the 7MP camera from the iPhone 8.

iPhone 9 price

Back in 2016, Apple released the iPhone SE with a starting price of $399. The iPhone 9 could debut at a similar price point. Reputed Apple analyst Ming-Chi Kuo of TF International Securities has also talked about the upcoming low-cost iPhone being priced at around $399. Fast Company has also learned from its sources that the iPhone 9 would sett at $399.

Even if Apple chooses to increase the price a little, the iPhone 9 is unlikely to cost more than $450. Currently, the iPhone 8 starts at $449. The $399 price point will make the iPhone 9 an attractive choice, especially in emerging markets like China and India where most people can’t afford the iPhone 11.

Chinese vendors such as Xiaomi and OnePlus have carved out a market for themselves by offering high-end features at low prices. And they have been eating into Apple’s sales in China, India, and other countries. With the iPhone 9 release date just around the corner, we’ll soon find out if the new iPhone is something Chinese vendors should worry about.

The post iPhone SE (2020) release date, specs, features and rumors appeared first on ValueWalk.

Uncategorized

Profits over patients: For-profit nursing home chains are draining resources from care while shifting huge sums to owners’ pockets

Owners of midsize nursing home chains harm the elderly and drain huge sums of money from facilities using opaque accounting practices while government…

The care at Landmark of Louisville Rehabilitation and Nursing was abysmal when state inspectors filed their survey report of the Kentucky facility on July 3, 2021.

Residents wandered the halls in a facility that can house up to 250 people, yelling at each other and stealing blankets. One resident beat a roommate with a stick, causing bruising and skin tears. Another was found in bed with a broken finger and a bloody forehead gash. That person was allowed to roam and enter the beds of other residents. In another case, there was sexual touching in the dayroom between residents, according to the report.

Meals were served from filthy meal carts on plastic foam trays, and residents struggled to cut their food with dull plastic cutlery. Broken tiles lined showers, and a mysterious black gunk marred the floors. The director of housekeeping reported that the dining room was unsanitary. Overall, there was a critical lack of training, staff and supervision.

The inspectors tagged Landmark as deficient in 29 areas, including six that put residents in immediate jeopardy of serious harm and three where actual harm was found. The issues were so severe that the government slapped Landmark with a fine of over US$319,000 − more than 29 times the average for a nursing home in 2021 − and suspended payments to the home from federal Medicaid and Medicare funds.

But problems persisted. Five months later, inspectors levied six additional deficiencies of immediate jeopardy − the highest level.

Landmark is just one of the 58 facilities run by parent company Infinity Healthcare Management across five states. The government issued penalties to the company almost 4½ times the national average, according to bimonthly data that the Centers for Medicare & Medicaid Services first started to make available in late 2022. All told, Infinity paid nearly $10 million in fines since 2021, the highest among nursing home chains with fewer than 100 facilities.

Infinity Healthcare Management and its executives did not respond to multiple requests for comment.

Race to the bottom

Such sanctions are nothing new for Infinity or other for-profit nursing home chains that have dominated an industry long known for cutting corners in pursuit of profits for private owners. But this race to the bottom to extract profits is accelerating, despite demands by government officials, health care experts and advocacy groups to protect the nation’s most vulnerable citizens.

To uncover the reasons why, The Conversation delved into the nursing home industry, where for-profit facilities make up more than 72% of the nation’s nearly 14,900 facilities. The probe, which paired an academic expert with an investigative reporter, used the most recent government data on ownership, facility information and penalties, combined with CMS data on affiliated entities for nursing homes.

The investigation revealed an industry that places a premium on cost cutting and big profits, with low staffing and poor quality, often to the detriment of patient well-being. Operating under weak and poorly enforced regulations with financially insignificant penalties, the for-profit sector fosters an environment where corners are frequently cut, compromising the quality of care and endangering patient health.

Meanwhile, owners make the facilities look less profitable by siphoning money from the homes through byzantine networks of interconnected corporations. Federal regulators have neglected the problem as each year likely billions of dollars are funneled out of nursing homes through related parties and into owners’ pockets.

More trouble at midsize

Analyzing newly released government data, our investigation found that these problems are most pronounced in nursing homes like Infinity − midsize chains that operate between 11 and 100 facilities. This subsection of the industry has higher average fines per home, lower overall quality ratings, and are more likely to be tagged with resident abuse compared with both the larger and smaller networks. Indeed, while such chains account for about 39% of all facilities, they operate 11 of the 15 most-fined facilities.

With few impediments, private investors who own the midsize chains have swooped in to purchase underperforming homes, expanding their holdings even as larger chains divest and close facilities.

“They are really bad, but the names − we don’t know these names,” said Toby Edelman, senior policy attorney with the Center for Medicare Advocacy, a nonprofit law organization.

In response to The Conversation’s findings on nursing homes and request for an interview, a CMS spokesperson emailed a statement that said the CMS is “unwavering in its commitment to improve safety and quality of care for the more than 1.2 million residents receiving care in Medicare- and Medicaid-certified nursing homes.”

“We support transparency and accountability,” the American Health Care Association/National Center for Assisted Living, a trade organization representing the nursing home industry, wrote in response to The Conversation‘s request for comment. “But neither ownership nor line items on a budget sheet prove whether a nursing home is committed to its residents.”

Ripe for abuse

It often takes years to improve a poor nursing home − or run one into the ground. The analysis of midsize chains shows that most owners have been associated with their current facilities for less than eight years, making it difficult to separate operators who have taken long-term investments in resident care from those who are looking to quickly extract money and resources before closing them down or moving on. These chains control roughly 41% of nursing home beds in the U.S., according to CMS’s provider data, making the lack of transparency especially ripe for abuse.

A churn of nursing home purchases even during the pandemic shows that investors view the sector as highly profitable, especially when staffing costs are kept low and fines for poor care can easily be covered by the money extracted from residents, their families and taxpayers.

A March 2024 study from Lehigh University and the University of California, Los Angeles also shows that costs were inflated when nursing home owners switched to contractors they controlled directly or indirectly. Overall, spending on real estate increased 20.4% and spending on management increased 24.6% when the businesses were affiliated, the research showed.

“This is the model of their care: They come in, they understaff and they make their money,” said Sam Brooks, director of public policy at the Consumer Voice, a national resident advocacy organization. “Then they multiply it over a series of different facilities.”

This is a condensed version of an article from The Conversation’s investigative unit. To find out more about the rise of for-profit nursing homes, financial trickery and what could make the nation’s most vulnerable citizens safer, read the complete version.

Campbell is an adjunct assistant professor at Columbia University and a contributing writer at the Garrison Project, an independent news organization that focuses on mass incarceration and criminal justice.

Harrington is an advisory board member of the nonprofit Veteran's Health Policy Institute and a board member of the nonprofit Center for Health Information and Policy. Harrington served as an expert witness on nursing home litigation cases by residents against facilities owned or operated by Brius and Shlomo Rechnitz in the past and in 2022. She also served as an expert witness in a case against The Citadel Salisbury in North Carolina in 2021.

real estate pandemicInternational

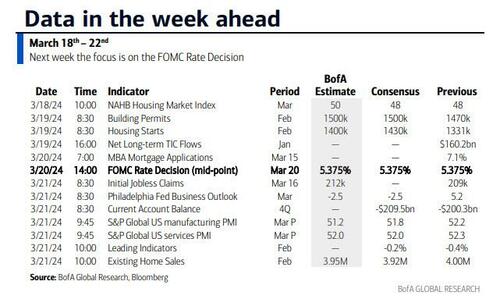

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

Spread & Containment

Supreme Court To Hear Arguments In Biden Admin’s Censorship Of Social Media Posts

Supreme Court To Hear Arguments In Biden Admin’s Censorship Of Social Media Posts

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

The…

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

The U.S. Supreme Court will soon hear oral arguments in a case that concerns what two lower courts found to be a “coordinated campaign” by top Biden administration officials to suppress disfavored views on key public issues such as COVID-19 vaccine side effects and pandemic lockdowns.

The Supreme Court has scheduled a hearing on March 18 in Murthy v. Missouri, which started when the attorneys general of two states, Missouri and Louisiana, filed suit alleging that social media companies such as Facebook were blocking access to their platforms or suppressing posts on controversial subjects.

The initial lawsuit, later modified by an appeals court, accused Biden administration officials of engaging in what amounts to government-led censorship-by-proxy by pressuring social media companies to take down posts or suspend accounts.

Some of the topics that were targeted for downgrade and other censorious actions were voter fraud in the 2020 presidential election, the COVID-19 lab leak theory, vaccine side effects, the social harm of pandemic lockdowns, and the Hunter Biden laptop story.

The plaintiffs argued that high-level federal government officials were the ones pulling the strings of social media censorship by coercing, threatening, and pressuring social media companies to suppress Americans’ free speech.

‘Unrelenting Pressure’

In a landmark ruling, Judge Terry Doughty of the U.S. District Court for the Western District of Louisiana granted a temporary injunction blocking various Biden administration officials and government agencies such as the Department of Justice and FBI from collaborating with big tech firms to censor posts on social media.

Later, the Court of Appeals for the Fifth Circuit agreed with the district court’s ruling, saying it was “correct in its assessment—‘unrelenting pressure’ from certain government officials likely ‘had the intended result of suppressing millions of protected free speech postings by American citizens.’”

The judges wrote, “We see no error or abuse of discretion in that finding.”

The ruling was appealed to the Supreme Court, and on Oct. 20, 2023, the high court agreed to hear the case while also issuing a stay that indefinitely blocked the lower court order restricting the Biden administration’s efforts to censor disfavored social media posts.

Supreme Court Justices Samuel Alito, Neil Gorsuch, and Clarence Thomas would have denied the Biden administration’s application for a stay.

“At this time in the history of our country, what the Court has done, I fear, will be seen by some as giving the Government a green light to use heavy-handed tactics to skew the presentation of views on the medium that increasingly dominates the dissemination of news,” Justice Alito wrote in a dissenting opinion.

“That is most unfortunate.”

The Supreme Court has other social media cases on its docket, including a challenge to Republican-passed laws in Florida and Texas that prohibit large social media companies from removing posts because of the views they express.

Oral arguments were heard on Feb. 26 in the Florida and Texas cases, with debate focusing on the validity of laws that deem social media companies “common carriers,” a status that could allow states to impose utility-style regulations on them and forbid them from discriminating against users based on their political viewpoints.

The tech companies have argued that the laws violate their First Amendment rights.

The Supreme Court is expected to issue a decision in the Florida and Texas cases by June 2024.

‘Far Beyond’ Constitutional

Some of the controversy in Murthy v. Missouri centers on whether the district court’s injunction blocking Biden administration officials and federal agencies from colluding with social media companies to censor posts was overly broad.

In particular, arguments have been raised that the injunction would prevent innocent or borderline government “jawboning,” such as talking to newspapers about the dangers of sharing information that might aid terrorists.

But that argument doesn’t fly, according to Philip Hamburger, CEO of the New Civil Liberties Alliance, which represents most of the individual plaintiffs in Murthy v. Missouri.

In a series of recent statements on the subject, Mr. Hamburger explained why he believes that the Biden administration’s censorship was “far beyond anything that could be constitutional” and that concern about “innocent or borderline” cases is unfounded.

For one, he said that the censorship that is highlighted in Murthy v. Missouri relates to the suppression of speech that was not criminal or unlawful in any way.

Mr. Hamburger also argued that “the government went after lawful speech not in an isolated instance, but repeatedly and systematically as a matter of policy,” which led to the suppression of entire narratives rather than specific instances of expression.

“The government set itself up as the nation’s arbiter of truth—as if it were competent to judge what is misinformation and what is true information,” he wrote.

“In retrospect, it turns out to have suppressed much that was true and promoted much that was false.”

The suppression of reports on the Hunter Biden laptop just before the 2020 presidential election on the premise that it was Russian disinformation, for instance, was later shown to be unfounded.

Some polls show that if voters had been aware of the report, they would have voted differently.

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex