International

How the pandemic deepened an existing wellbeing crisis in headteaching – new research

A new study reveals the extent of the COVID pandemic’s effect on headteachers, including high workloads, stress and exhaustion.

The COVID pandemic exacerbated problems that had been simmering in the education profession across the UK. Already facing significant challenges with resources and workload, headteachers are now navigating the longer-term disruptions caused by COVID, with lasting ramifications for the profession, as well as schools and students.

Our new study found low wellbeing, depressive symptoms, high work-related stress and physical and mental exhaustion were common among headteachers during the height of the pandemic.

Even before the start of the pandemic in early 2020, teachers and headteachers had raised concerns about workload, wellbeing, recruitment and retention within the profession. In the preceding years, experts discussed the potential crisis in educational leadership as a result of the ever-changing demands on headteachers.

COVID has been described as the most significant disruption in the history of formal education by Unesco. Its data shows that more than 1.6 billion pupils and 100 million teachers globally were affected.

Headteachers had to design, implement and manage new roles and responsibilities on a scale never before seen. These decisions affected their lives, as well as the lives of their colleagues, students, families and communities.

Researchers initially responded by studying the effects on children and teachers, including in early-years settings, as well as across other education sectors such as higher education. But examining how school headteachers dealt with the effects of COVID in terms of wellbeing and work-related stress was neglected.

To address this research gap, we surveyed more than 320 headteachers in Wales and Northern Ireland. Our work was part of a wider international study conducted in 17 countries. Our aim was to investigate how COVID had affected headteachers and to explore whether men and women experienced the situation differently.

What we found

Our results in Wales and Northern Ireland were stark. Most headteachers reported higher workloads than before the pandemic, working at least 50 hours per week. This was coupled with high levels of work-related stress.

Stress and heavy workloads have been some of the major factors driving headteachers out of the profession in recent years and this worsened during in the first two years of the pandemic.

In fact, 63% of headteachers in our study told us they often sacrificed sufficient sleep, and 75% often gave up leisure activities in favour of work. These are examples of self-endangering behaviour – coping mechanisms that are necessary to fulfil working demands but are not conducive to health and wellbeing. Female leaders in our study were more likely to report these in response to high workloads.

Some 65% of headteachers reported low levels of wellbeing, which was lower than reported by the adult population in the UK. And 35% in our study reported depressive symptoms. These issues extend beyond headteachers themselves, as research suggests a link between teacher wellbeing and the health, wellbeing and attainment of pupils.

Increased workload and self-endangering behaviour can lead to burnout, a psychological syndrome caused by chronic job stress. Exhaustion is a core symptom of burnout, and almost 90% of heads in our study had high or very high levels of exhaustion.

Again, this was higher in women, who were also more likely to experience physical symptoms such as headaches or muscle pain. Wider research points to societal gender expectations as a contributing factor, highlighting the pressure of juggling work with domestic responsibilities such as childcare and looking after elderly family members.

Despite the many work-related challenges experienced by headteachers in our study, meaningfulness – the extent to which their work situation is perceived as worthy of commitment and involvement – was reported as high. Headteachers still valued their role and contribution, suggesting a strong sense of social responsibility.

This level of social responsibility must be matched by support and investment from policymakers, especially in a “new normal” for education.

Prioritising wellbeing

The assumption that society would simply bounce back after the pandemic has been short-lived. Most recently, headteachers in Wales and Northern Ireland have resorted to industrial action, citing high workload, below inflation pay awards and chronic school underfunding. This continued pressure is mirrored across the rest of the UK.

Our study’s findings add to the growing body of evidence on the pressures faced by headteachers, which have been amplified by the pandemic and the continuing challenges in education. This includes a decade of budget cuts, declining Pisa results (which ranks participating countries according to students’ performance in maths, reading and science) and persisting educational inequality.

Beyond the immediate pressures of managing schools during the first two years of COVID, headteachers also shoulder the responsibility of implementing systemic changes. Major educational reforms are either underway or have recently been completed in all four UK nations.

The wellbeing and working conditions of headteachers is fundamental if we want to create the conditions for children and young people to have the best start to their lives and thrive in society. We must learn the lessons from the pandemic and put support in place to improve the working conditions of headteachers and senior school leaders more generally. After all, the fate of current and future generations is in their hands.

Emily Marchant received funding from the ESRC during this study.

Orkan Okan receives funding from the German Federal Ministry of Health, from the Bavarian State Ministry of Health and Nursing, from the European Commission, from Erasmus+, from Niederösterreische Forschungsförderung, from Barmer Health Insurance, from AOK Health Insurance, and has received funding from the German Federal Ministry of Education and Research. Orkan Okan is member of the European Public Health Association (EUPHA), the International Health Literacy Association (IHLA), the International Union for Health Promotion and Education (IUHPE), the German Health Literacy Network, and the German Public Health Association.

Tom Crick receives funding from the Nuffield Foundation, Health and Care Research Wales, and the Welsh Government (but all unrelated to this study). He is affiliated with the UK Government through his role as Chief Scientific Adviser at the Department for Culture, Media and Sport.

link pandemic european ukInternational

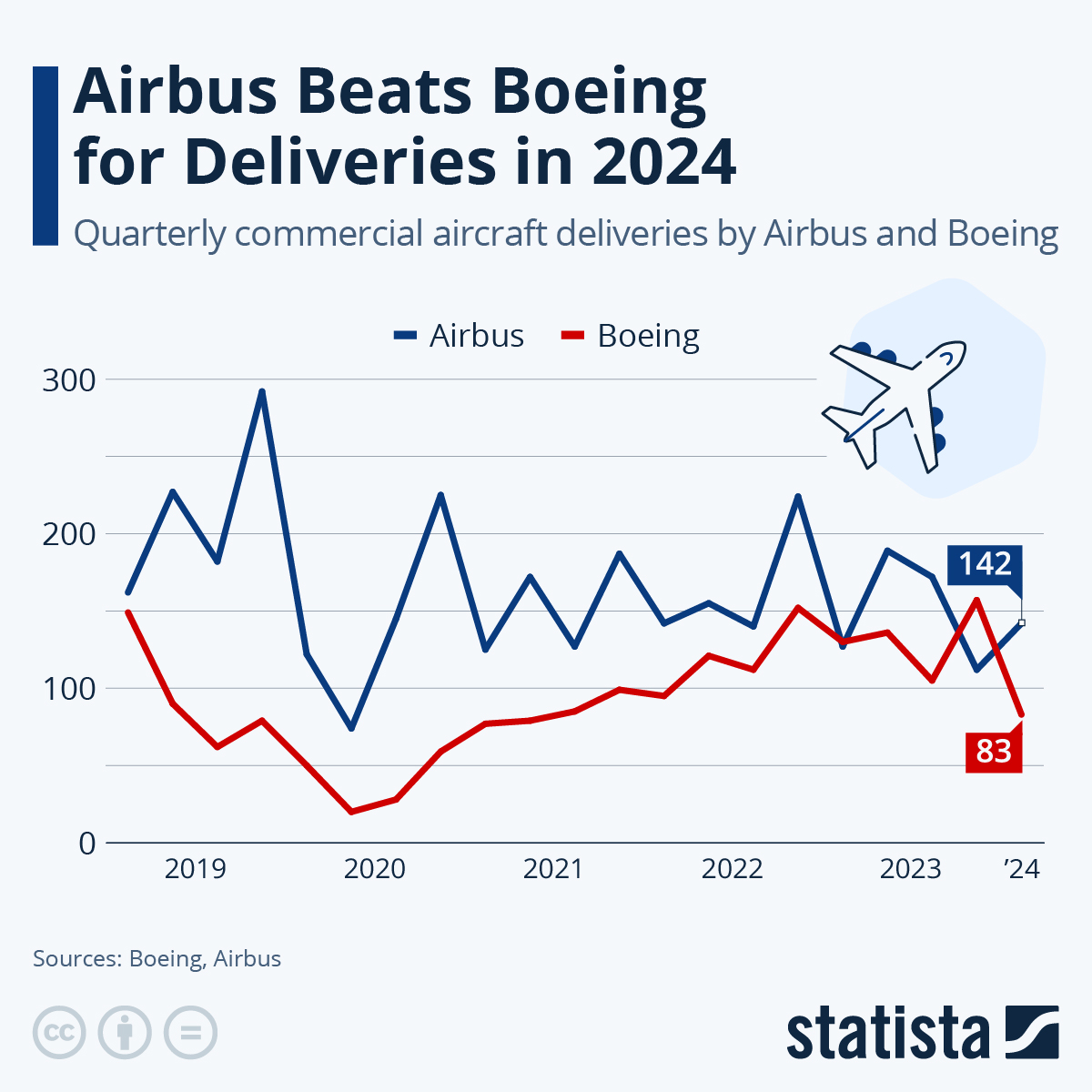

Airbus Beats Boeing For Deliveries In 2024

Airbus Beats Boeing For Deliveries In 2024

Boeing’s deliveries of commercial aircraft have faltered in the first three months of the year,…

Boeing’s deliveries of commercial aircraft have faltered in the first three months of the year, according to the company’s reports, published this week.

The U.S. aircraft manufacturer delivered just 83 planes in Q3, down from 130 in the same three-month period of last year.

In the meantime, its sole major competitor, Europe’s Airbus, saw an uptick in Q1, having delivered 142 of their planes, marking an increase from their Q1 2023 figure of 127.

Boeing has been mired in a series of safety issues since the start of the year, following a mid-air panel blowout on an Alaska Airlines 737 MAX 9 jet in January. This has led to a slowdown in production for the U.S. company, which is now limited to producing 38 of the 737 planes per month until it is clear that quality and safety procedures are being properly adhered to, as per the advisory of the U.S. Federal Aviation Administration (FAA). Boeing has slowed production even below this limit, with the company’s Chief Financial Officer Brian West stating that once the company has it “right” it will ramp up production, expecting to see figures improve in the latter half of the year.

Prior to 2019, Boeing had been in the lead for deliveries out of the two companies, but this changed following the two deadly 737 MAX 8 crashes of 2018 and 2019, and the ensuing temporary production halt of the model. While the same family, these were different planes than those involved in the more recent incidents and they were caused by different issues.

As Statista's Anna Fleck shows in the following chart, both companies saw dips in deliveries in 2020 with the Covid pandemic.

You will find more infographics at Statista

Boeing and Airbus are the world’s two major competitors when it comes to commercial plane manufacturing. While other manufacturers exist, they produce far lower numbers of aircraft than either of these two giants.

In a report by CNN, writer Allison Morrow explains that since pilots are trained in either Boeing or Airbus operating systems, it is difficult for airlines to switch planes.

With few companies having the capacity to produce large jets, both Airbus and Boeing continue to have a long backlog of orders (8,598 at the end of 2023 for Airbus; 5,591 at the end of March for Boeing).

Government

“This Memory-Holing Bull$hit Makes Me Go Ballistic” – CJ Hopkins’ Greatest Satiricial Ragefest Yet

"This Memory-Holing Bull$hit Makes Me Go Ballistic" – CJ Hopkins’ Greatest Satiricial Ragefest Yet

Authored by CJ Hopkins via Substack,

Thank…

Authored by CJ Hopkins via Substack,

Thank God for the German Hate Police!

Or heil … or whatever the appropriate salutation is for these unsung heroes. They just saved us all from “hate” again!

Yes, that’s right, once again, democracy-loving people here in New Normal Berlin and all across the New Normal world were right on the brink of being exposed to “hate,” and would have been exposed to “hate,” had the Hate Police not sprang into action.

You probably have no idea what I’m talking about.

OK, what happened was, some pro-Palestinian activists organized a “Palestine Congress,” and attempted to discuss the situation in Gaza, and call for solidarity with the Palestinians, and so on, right here in the middle of Berlin, the epicenter of European democracy, as if they thought they had a right to do that. The German authorities were clearly intent on disabusing them of that notion.

Early Friday morning, hundreds of black-clad Hate Police descended on the congress location. Reinforcements were called in from throughout the nation. Metal barricades were erected on the sidewalks. Hate Police stood guard at the entrance. The German media warned the public that a potential “Hate-Speech” attack was now imminent. Berliners were advised to shelter in place, switch off their phones and any other audio-receptive communication devices, and wad up little pieces of toilet paper and ram them deep into their ear canals to prevent any possible exposure to the “hate.”

Sure enough, minutes into the congress, the anticipated “Hate-Speech” attack was launched! A Palestinian activist — Salman Abu Sitta — who had written an article that allegedly “expressed understanding of Hamas,” and thus had already been placed on the official German “No-Speak” list, started speaking to the congress on Zoom or whatever. Or … it isn’t quite clear whether he actually started speaking. According to a Hate Police spokesperson, they raided the congress because “there [was] a risk of a speaker being put on the screen who in the past made anti-Semitic and violence-glorifying remarks.”

Anyway, the Hate Police stormed the venue, pulled the plug, dispersed the crowd, and banned the rest of the “Palestine Congress,” which was scheduled to continue on Saturday and Sunday. Then they arrested a Jewish guy who was wearing a Palestinian-flag-kippah, presumably out of an abundance of caution.

But the “Hate-Speech” attack wasn’t over yet. It was one of those multi-pronged “Hate-Speech” attacks, or at least it involved one other prong. Earlier that morning, or perhaps while the Hate Police were still neutralizing the threat at the venue, Dr. Ghassan Abu Sitta, a prominent British surgeon, who had volunteered in Gaza and was due to speak at the congress, was intercepted by the Berlin Airport Hate Police, refused entry into Germany, and forced to return to the UK. The Airport Hate Police informed the doctor that he was being denied entry in order to ensure “the safety of the people at the conference and public order,” Abu Sitta told the Associated Press.

Kai Wegner, Berlin’s mayor, presumably feeling a bit nostalgic for the fanatical days of 2020 to 2023 when one could persecute “the Unvaccinated” with total impunity, took to X to celebrate the Hate Police’s thwarting of this “Hate event.”

The pro-Palestinian activist community also took to X and expressed their displeasure. Yanis “Vaccinate Humanity” Varoufakis, who was one of the organizers and was scheduled to speak, was particularly incensed over the new German “fascism,” which apparently he has just now noticed, despite the fact that it has been goose-stepping around in a medical-looking mask for the last four years.

Yanis was not alone in his outrage. An increasing number of mainstream German journalists, authors, academics, and other members of the professional “progressive” classes are stunned that the new totalitarian society that they fanatically ushered into being during the so-called “Covid Pandemic” era — or stood by in silence and watched it happen — is now unleashing its fascistic force against them.

Which, OK, I get it. I mean, if I had just spent the last four years behaving like a Nazi, you know, persecuting “the Unvaccinated,” demonizing everyone who refused to wear the insignia of my fascistic ideology on their face, and parroting official propaganda like an enormous Goebbelsian keyboard instrument, or had just stood by in silence while other people did that, I would probably want to act like that never happened, and pretend that Germany was suddenly going “fascist” over the Israeli/Palestinian conflict, and just memory-hole the whole “Covid” thing.

I would probably be highly motivated to do that — if that was how I had behaved for the past four years — so that I didn’t appear to be a fucking hypocrite who will start clicking heels and following orders the moment the authorities declare another fake emergency and jack up the Fear.

Sorry … I’ve been trying to be less vituperative, but this memory-holing bullshit makes me go ballistic.

If there is one demographic that I do not need to hear sanctimonious exhortations to speak out against the global crackdown on dissent from, it is recently ex-Covidian-Cult leftists.

In any event, thank God for those Hate Police! If it weren’t for them … well, just imagine the horror, if the activists at that Palestine Congress had been allowed to express their opinions about Israel. They might have said the word “genocide,” or made reference to a “river” and a “sea.”

Who knows what that kind of unbridled “hate” could lead to?

Perhaps the end of democracy. Maybe even World War III.

International

Weekly Market Pulse: Are Higher Interest Rates Good For The Economy?

Interest rates surged last week on the back of a hotter than expected inflation report that wasn’t actually that bad (see below). Not that my – or your…

Interest rates surged last week on the back of a hotter than expected inflation report that wasn’t actually that bad (see below). Not that my – or your – opinion about these things matters all that much to the market. In the short run all that matters is what the majority believes is the truth. What they believed last week was that inflation isn’t falling fast enough and the Fed will not be cutting rates anytime soon. That was enough to send the bond market into a tizzy which impacted, well, everything. Stocks were down with small and midcaps taking it worse than large caps. Real estate was down but wasn’t the worst performing sector as financials, materials and healthcare all fared worse. Commodities and crude oil were down even with the Middle East bracing for more conflict between Iran and Israel. Gold did manage to post a small gain but that isn’t a positive even though we own it (see more on gold and the dollar below).

The rise in rates last week pushed the 10 year to its highest level since the peak at 5% in October of last year. The 10 year yield rose 19 basis points on Wednesday when the CPI report was released but by the end of the week was “only” up 11 basis points. The short term trend is obviously up and depending on how you define it, so is the intermediate term. Rates have been rising with only temporary interruptions since August of 2020 but the rise accelerated in March of 2022 when the Fed started to hike rates. Since March 8th, 2022 the 10 year Treasury rate is up 264 basis points. But why? Inflation? I think that’s what a lot of people would say or they might say the rate rise is tied to expectations about Fed policy, i.e. fear of the Fed raising rates more. But that is essentially saying the same thing, isn’t it? Why else would the Fed raise rates except if inflation doesn’t fall?

There’s a big problem with that interpretation though, mainly that inflation expectations haven’t been rising and even last week’s rise can’t really be blamed on inflation fears. How do we know? Because since the Fed started to hike rates in the spring of 2022, real rates have actually risen more than nominal rates. When nominal rates first started to rise in August of 2020, inflation expectations were around 1.5% for the 10 year breakeven rate. Inflation expectations rose along with nominal rates until the Fed started to hike, with the 10 year breakeven inflation rate hitting 3.02% on April 21, 2022, right after the Fed’s first hike in March. But since then, the nominal 10 year yield has risen 160 basis points while the 10 year TIPS yield has risen by 224. Since the Fed started raising rates, long term inflation expectations have fallen by 64 basis points. Last week’s CPI release didn’t change that. After the report the 10 year TIPS yield rose 15 basis points. By the end of the week TIPS yields were up 10 basis points, 1 basis point different from the nominal bond; despite a “hot” inflation report, inflation expectations didn’t change. Which means the rise in rates last week was almost all about real growth expectations, not inflation.

What that implies is intriguing to say the least. The implication of the CPI report is that the Fed’s rate cuts will be delayed, that rates will stay “higher for longer”. Why would that cause a rise in real growth expectations? One reason might be this:

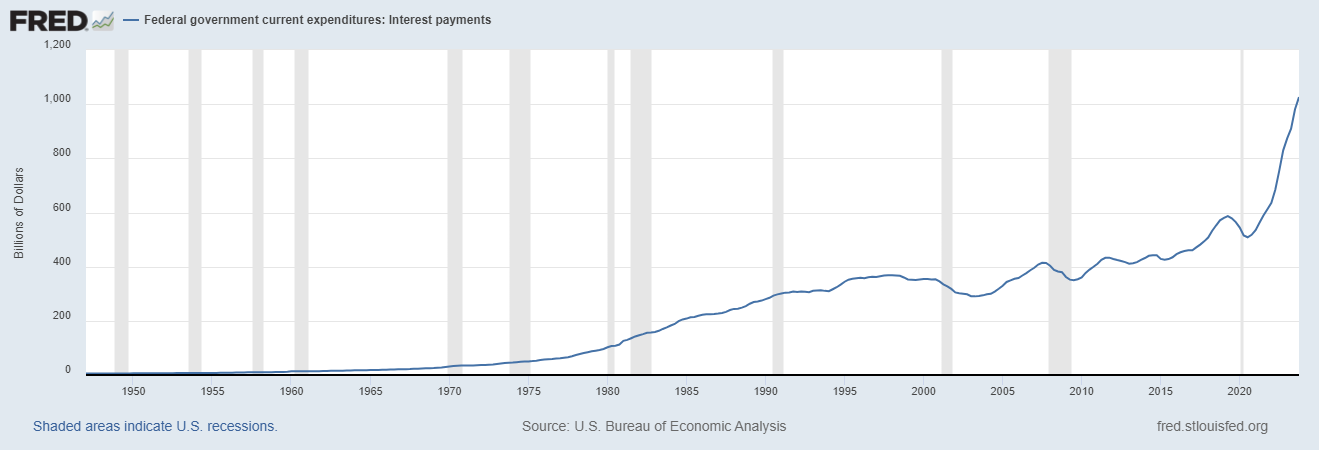

That’s Federal Government current expenditures on interest payments. There’s been a lot of pixels spent explaining why that’s bad from the perspective of the government but almost none spent on looking at it from another perspective. The government paying out more interest may have a deleterious effect on the federal budget but it is a boon to whoever is on the receiving end. Interest expense is up a cool half trillion dollars since the onset of COVID which is a lot of cheddar for somebody. Yes, some of it is going to foreign governments, including China, but holdings by foreigners actually peaked in 2021 and have been falling pretty steadily since. The Federal Reserve also isn’t getting any of this rise in interest payments since they are actually reducing their ownership of Treasuries (QT). So, where are the new Treasuries and all that interest going?

Holdings of Treasury Securities by households and nonprofits has risen from $435 billion in Q4 2021, right before the Fed started hiking rates, to $2.3 trillion in Q4 2023. If we dig into the Personal Income report we find that annualized personal interest income is up $288 billion since the end of 2021 so a lot of this interest paid out by the federal government is going straight to the bottom line of personal income. Lower interest rates would obviously be good for borrowers. The market seems more interested in the impact of higher rates on lenders.

The market appears to believe that a cut in interest rates would reduce real growth, rather than raise it as most everyone assumes. The market could be wrong about the impact of this post-COVID interest income windfall but that is the obvious conclusion. Since the Fed started hiking rates interest income has risen more than interest payments but the difference doesn’t seem like a lot at roughly $37 billion. But how that new income is distributed could make a big difference. And the personal income rise doesn’t take into account the income to corporations which are sitting on near records amounts of cash. Maybe there’s a reason the stocks of large companies with lots of cash are among the most resilient in the market. Federal government interest payments to persons and business are up an annualized $366.5 billion since the end of 2021:

If higher interest rates are now positive for real economic growth – and maybe there’s a limit to that where if rates get too high, the debt burden hurts the economy more than the income helps – that is just one more way the post-COVID economy is different than the one we had before the pandemic.

There are a lot of things happening in markets today that don’t conform with the norms of the last 40 years. Gold prices, for instance, are rising to a new record at the same time real interest rates and the dollar are rising which is the opposite of what we usually expect. Why? Good question and I don’t know for sure but I think the impact of those increased interest payments may be part of the answer. See below for more on gold but first a little more depth on the inflation picture.

Inflation

The Consumer Price Index (CPI) data for March, released on Wednesday last week, was higher than expected but the difference was actually pretty minor. The month to month change in the previous month’s release (February data) was reported as 0.4% which was the fourth straight month of acceleration in the month to month change. The market was hoping to see a lower sequential change with expectations for the headline and core CPI readings for March of 0.3%. The actual release showed a change of 0.4% and bonds reacted very negatively with the 2 year Treasury rate rising 23 basis points and the 10 year 19 basis points. Expectations for Fed rate cuts were pushed from June to September, at the earliest. Those are large moves in rates for one day and the impact on other assets was severe. Stocks were down of course, but the real losers were anything interest rate sensitive. REITs fell 4% on the day, high dividend stocks were down over 2%, financials were down nearly 2% that day and nearly 4% for the week. The S&P 500 fell less than 1% the day of the release and, as I write this on Friday, is down just 1.3% for the week. Small and mid cap stocks were down a little more but the real story is that stocks in general took the inflation reading in stride.

If we look at the actual data rather than relying on headlines, we get a less dire picture of the month to month change in the inflation rate. The February change in the CPI from January was actually +0.44206% which was rounded down to +0.4% for the press release. The change from February to March – the data released last week – showed a change of +0.37807%, which was rounded up to +0.4% for the press release. If the market was hoping the March reading would fall 0.1% from February (0.4% vs 0.3%), then the result was almost as expected. Instead of falling 0.1% the actual change was 0.06399%. If the actual result had been 0.02808% lower, it would have been rounded down to 0.3%. Would everyone have been happy with that result? I have no idea but my guess is yes which means bond yields had a huge move based on basically nothing.

The real message here is that investors shouldn’t be making long term decisions based on one economic data release. Does anyone really believe that the monthly inflation rate falling 0.06% instead of 0.1% really makes any difference? Does anyone really believe that the Bureau of Labor Statistics can measure the change in the inflation rate on a monthly basis to four decimal places? Have you interacted with a government agency recently? The inflation rate, assuming the BLS numbers are anywhere close to accurate, is gradually falling since the monthly peak in June of 2022. No, it isn’t falling in a straight line to the 2% target and if it was I’d be suspicious of the data. The real world just doesn’t work that way. And the first quarter of the year seems an especially silly time to be drawing any long term conclusions about inflation. How many companies make salary and pricing decisions at the beginning of the year? All of them?

The Fed updated its Summary of Economic Projections at last month’s FOMC meeting so their expectations are available to anyone who takes the time to read them (see here). Anyone who believes the CPI report last week changed their view of the economy should follow that link. First of all you won’t find any reference to the Consumer Price Index because that isn’t the measure the Fed uses for inflation. They use the Personal Consumption Expenditure measure of inflation which is currently a lot lower than the CPI. The year over year change in the PCE deflator was 2.5% in February vs 3.2% for the February CPI (the March yoy change was 3.5% and no you shouldn’t panic about that either). The Fed’s own projections don’t see much improvement in that measure for 2024 with a median expectation of 2.4% by the end of the year. The median expectation of the members contributing to the SEP is for PCE inflation to hit the 2% target in 2026. Yes, 2026.

Markets don’t move on reality; markets move on perception. Traders today don’t have any time to parse the data before acting. In most cases, the trading is driven by algorithms that are trained to react to headlines, which is why you get days like last Wednesday. It takes investors with a longer term focus to bring markets back to reality – when they can. Ultimately a lot of what happens day to day in markets is nothing more than noise because it is based on data that is flawed or misinterpreted. But the moves generated by noise are real nonetheless and can cause investors to overreact, to make errors and push markets to further extremes. It works in both directions but we only think of it as an error when it is to the downside. Bond yields probably fell too much after peaking in October last year based on false expectations about future Fed policy. That in turn pushed up interest sensitive sectors like REITs and stocks too much based on the reality of the inflation situation. Will the market now move too far in the opposite direction? Probably because that’s the way markets work these days.

Gold

Gold has been setting new highs, trading above $2400 at one point on Friday before succumbing to some profit taking. The odd thing about the rise is that gold prices are usually inversely correlated to the dollar (dollar down, gold up) and the dollar has been rising of late. Gold is also inversely correlated with real interest rates (real rates down, gold up and vice versa) and real rates have been rising right along with gold prices. Another thing in the post-COVID era that seems completely out of sync with how we came to expect things over the last 40 years. Why is this happening? One convenient explanation has been worries about war in the Middle East (and other places I suppose) since both the dollar and gold are considered safe havens. That’s certainly possible and coincides with a rise in oil that has also been blamed on Middle East tensions. But there are other reasons to expect gold to rise and ultimately for the dollar to fall. Gold may just be telegraphing a future move in the dollar.

The value of the dollar is influenced by changes in the US Current Account which is, in turn, driven primarily by the trade and budget balances. As the trade and budget deficits get worse, the current account deficit also worsens. A worsening current account deficit essentially means there is more money going out of the country than coming in and that has historically put pressure on the currency of the deficit nation. Both the trade and budget deficits are, once again, starting to grow. In the case of trade it is due to rising goods consumption and leaner inventories, the same reason we’re starting to see factory activity pick up. In the case of the budget deficit, it is the increased interest payments, among other things. The improvement seen in 2022 and 2023 appears to be over.

The current account data for the first quarter will likely confirm its deterioration as well. In the meantime, the dollar looks a lot like Wile E. Coyote running off the cliff:

For the dollar and gold to get back in sync, either the dollar or gold will have to fall. It could be both or either but given the current account situation, I would think the dollar would be the bigger mover.

The solid black line is the dollar index inverted.

If that is what happens, if the dollar plays catch up to gold, the implications for portfolios are significant. Commodities and gold have their best returns, by far, when the dollar is falling while international stocks tend to outperform domestic US stocks. Emerging markets perform particularly well. Real estate also performs well but it is more sensitive to interest rates.

Maybe this is just Middle East jitters and everything will return to normal soon. Or maybe the conflict between Israel and Iran really does escalate. Or maybe our deficit chickens finally come home to roost.

Joe Calhoun

Environment

10 year yields broke out of the channel they had been in for the last 18 months to the upside. The 10 year rate is in a short to intermediate term uptrend and I think we have to be prepared for the rate to test the 5% level set last October. Next week’s economic releases will be scrutinized for any economic weakness with data on retail sales, two Fed regional manufacturing surveys, industrial production and housing. We also get an update on the Leading Economic Indicators.

I think the real question about rates is whether this is just a cyclical rise or if the secular trend has changed. If it is the latter – and I’m definitely leaning that way – it will necessitate a change in our strategic allocation. That isn’t something we do lightly so we need to be sure but it may become necessary.

The dollar is also in a very short term uptrend since the beginning of the year but did not break out of the range it has been in since late 2022. The short term target is obviously the 107 peak last year. As I explained above, I think there are good reasons to expect the dollar to trade lower in coming years because of our budget and trade deficits. But the world is not always that logical and the dollar, despite all our government debt, is still a safe haven. And there are lots of reasons to want one of those right now. For now the short term trend is up and that’s all we really know.

Markets

Year to date, the gainers are down to Large Cap and commodities. Small cap (S&P 600), intermediate Treasuries and REITs are all down for the year. More amazingly, the same applies to three year returns, with only large cap stocks and commodities higher. I don’t have the numbers available right now but I’d guess that is a pretty rare occurrence. I’ll report back later in the week.

Sectors

Every sector was lower last week with financials the hardest hit. YTD still sees energy in the lead with Communication Services close behind. REITs and consumer cyclicals are down on the year.

Market/Economic Indicators

Rates were higher across the board but credit spreads remain well behaved.

Last week’s economic data that wasn’t about inflation:

- NFIB Small Business Optimism Index which needs to be retitled to the Small Business Pessimism index. Hit the lowest level since 2012 which sounds really bad but if you don’t remember the recession of 2012 or 2013 or 2014 or 2015 or 2016 or 2017 or 2018 or 2019 that’s because there wasn’t one. I’m not sure what this index is good for but it isn’t worth a darn as an economic indicator.

- Redbook Index – This measure of same store sales rose to 5.4% last week. It hit its nadir in the summer of last year when it turned negative for a few weeks but it has been rising steadily since then.

- Initial jobless claims fell to 211k. Jobs market remains strong

- Export and Import prices up 0.3% and 0.4% respectively. YOY change is -1.4% and +0.4%. Not exactly hot and one more reason why you really shouldn’t pay much attention to the CPI

- University of Michigan Consumer Sentiment fell a bit in the April preliminary reading to 77.9 from 79.4 in March. This has basically flatlined this year and is still up from last year’s readings in the 60s and low 70s. This one is only slightly more useful than the NFIB survey.

recession consumer sentiment pandemic economic growth treasury securities bonds sp 500 emerging markets stocks fomc fed federal reserve government debt budget deficit link real estate recession interest rates commodities gold oil iran china

-

International3 weeks ago

International3 weeks agoParexel CEO to retire; CAR-T maker AffyImmune promotes business leader to chief executive

-

Spread & Containment1 month ago

Spread & Containment1 month agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Government1 week ago

Government1 week agoClimate-Con & The Media-Censorship Complex – Part 1

-

International17 hours ago

International17 hours agoWHO Official Admits Vaccine Passports May Have Been A Scam

-

Spread & Containment6 days ago

Spread & Containment6 days agoFDA Finally Takes Down Ivermectin Posts After Settlement

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoVaccinated People Show Long COVID-Like Symptoms With Detectable Spike Proteins: Preprint Study

-

Uncategorized1 week ago

Uncategorized1 week agoCan language models read the genome? This one decoded mRNA to make better vaccines.

-

Uncategorized1 week ago

Uncategorized1 week agoWhat’s So Great About The Great Reset, Great Taking, Great Replacement, Great Deflation, & Next Great Depression?