Uncategorized

How 6 venture capitalists are thinking about 2023 — and their advice to startups

Venture capitalists are in the business of bets, writing checks to the people and ideas they believe are going to impact the world. As part of an annual…

Venture capitalists are in the business of bets, writing checks to the people and ideas they believe are going to impact the world.

As part of an annual GeekWire tradition, we asked six investors to come up with predictions for 2023.

Of course, the startup world can be anything but predictable. Last year started with headlines about the blistering proliferation of unicorn startups and the mind-boggling amount of investment that flowed to startups in 2021. But by summer, startups were gearing up for a recession, and investment slowed throughout the latter half of this year.

Funding to startups in the Pacific Northwest was down more than 50% in the second half of 2022 compared to the same time period in 2021, according to data from GeekWire’s fundings list.

Still, there were many startups that landed large deals, and several firms raised more funds.

All of the venture capitalists we spoke with say they plan to deploy the same or more capital into startups in the new year, even amid ongoing concerns for startups heading into 2023.

We asked the investors to name the hottest and most overhyped tech trends; their thoughts on generative AI such as ChatGPT; the biggest tech story out of Seattle; their advice for startups; and non-tech predictions. Some of the answers include:

- Seattle emerging as the leader in energy innovation.

- Microsoft or Amazon taking a more aggressive stance toward work-from-home.

- Romanesco as the next vegetable to have a moment.

Read on for their full answers.

Sheila Gulati, managing director at Tola Capital

Does your firm plan to make more or fewer investments in 2023, and why? Definitely more. Tola Capital is expanding, and we are looking for new investments for our third fund. We are aggressively pursuing next generation founders leveraging the massive technology revolution underway in AI.

Best advice for startups in 2023: Listen to your customers. In times good and bad, your customers might not tell you what they need but they will often share their challenges. If you approach conversations with a genuine curiosity to understand how things are being done today, you’ll be best positioned to build new technological solutions that will solve real customer pains (and it’s also a proven path to growth).

Hottest tech of 2023: AI infrastructure. We started Tola Capital because we felt so compelled by the enterprise software opportunities driven by, at the time, new cloud platforms. We are even more excited about the changes that AI will bring in how the world works.

Most overhyped tech of 2023: Quantum computing, we still need some time to make that one real.

Biggest tech story out of Seattle in 2023: Seattle has two important plays that are synergistic with one another. The technology megacaps of Microsoft and Amazon calling Seattle home have created an incredible concentration of talent in the local ecosystem. We are seeing more and more of this talent learn from these companies, and then build their own startups to tackle new challenges in the market. The Seattle ecosystem mixes no-boundary ambition with refined execution experience, and we believe this city will deliver many of the best companies in the AI revolution.

Crypto in 2023 will… continue to struggle when it comes to overall market confidence. That said, many builders are still pursuing a Web3 vision built on decentralized technologies, and we believe there is continued value in startups who focus on the picks and shovels like Web3 developer tools and security.

Generative AI in 2023 will… create awe-inspiring consumer applications that will change our relationship with creators and artists. It will also cross into profoundly useful business applications that will drive our productivity to the next level.

In 2023, we need more… commitment to founders. We saw FOMO (fear of missing out) drive investor behavior over the past two years — including putting placeholder checks into companies and investing at unsustainable valuations. To navigate uncertain times, founders need partners who repeatedly show up — through ups and downs — and whose incentives are aligned with theirs.

In 2023, we need less… aggressive scaling prior to true product-market fit. Given the availability of capital during the past decade, investors and founders often confused weak confirmations of product value with true validation of product market fit. As a result, teams will need to be cautious about pouring fuel on the fire and care about efficiency and growth — but that’s a good thing for all of us.

Any other non-tech predictions?

- Pickleball, another Seattle-area invention, will hit the mainstream with the recent announcement of Major League Pickleball.

- Romanesco will be the next vegetable to have a moment. Kale, brussel sprouts, and cauliflower have each had a turn and Romanesco is the elevated cauliflower cousin.

Andy Liu, partner at Unlock Venture Partners

Does your firm plan to make more or fewer investments in 2023? Our firm plans on making more investments in 2023 primarily because we believe the best companies are created during a down-cycle as entrepreneurs have higher conviction, business models are more disciplined, and there is less competitive noise. We are believers that technology still represents the best lever of growth into the future even with this short-term down-cycle.

Best advice for startups in 2023: Focus on building strong positive unit economics above growth — optionality is your friend.

Hottest tech of 2023: At Unlock Venture Partners, we’re focused on finding world class tech entrepreneurs instead of finding the hottest tech of 2023. Personally, though, I’m very interested in the latest health tech, whether it’s related to exercise, sleep, mental health and diet, especially after emerging from the pandemic. It’s been fascinating to watch and learn.

Most overhyped tech of 2023: I’m not sure if this is overhyped, but I would be very cautious in 2023 focusing on consumer discretionary, specifically related to tech hardware products. The bar will be much higher in 2023 for a successful startup launch of a consumer hardware product.

Biggest tech story out of Seattle in 2023: Seattle emerging as the leader in energy innovation.

Crypto in 2023 will… Most tokens (99%) will go to near zero in market cap. The remaining survivors will emerge to be long-term winners and create real value for users.

Generative AI in 2023 will… transform several industries — creative, engineering, ed-tech and human capital. It will attract the majority of early stage VC dollars in 2023.

In 2023, we need more… entrepreneurs that embark on a long-term journey to build enduring companies that change people’s lives for the better.

In 2023, we need less… mental stress. The constant headlines on COVID-19, geopolitics, politics and social media are creating long-term issues for humanity. Here’s hoping for more inspiration from the entrepreneurial and tech community in 2023.

Any other non-tech predictions? The trifecta of Seahawks, Mariners and Kraken winning championships. One can wish, right?

James Newell, managing partner at Voyager Capital

Does your firm plan to make more or fewer investments in 2023? Voyager is likely to make more investments in 2023 than in 2022 because the venture markets will have fully digested the reset in the pricing of risk assets over the last year. Unsurprisingly, founders take a bit longer than investors to acknowledge any cooling of the VC market. This typically leads to a 6-to-9 month period where it is hard for parties to come to an agreement. So, the best companies decide to grow and wait and deal velocity slows down.

Best advice for startups in 2023: 2023 will not be different than any other year. Focus what you can control and ruthlessly prioritize what matters the most for the stage of your company. Hire fantastic people. Find product-market fit. Establish attractive unit economics. Develop a scalable go-to-market motion.

Hottest tech of 2023: It seems clear that Generative AI will be the hottest trend of 2023, though it could very well be the most overhyped technology by the end of the year.

Most overhyped tech of 2023: Twitter alternatives. I would love to see Mastodon or Post.news or anything else become viable as Elon continues his Howard Hughes character arc. But I think we’re all about to learn a lesson about vanity-driven network effects as a durable moat. I see more people talking about quitting than actually quitting and joining another network.

Biggest tech story out of Seattle in 2023: Either Microsoft or Amazon taking a more aggressive stance toward work-from-home. Many companies have internally come to the realization that work-from-home and remote policies can be a tremendous benefit for individual employees but a detriment to productivity levels at companies. As the hiring environment shifts in a difficult economic environment, one or both of our tech behemoths will enforce “in-office, four days per week.”

Crypto in 2023 will… continue to disappear from all the Twitter and LinkedIn profiles of late-cycle dollar chasers. Where did all my Cryptopunks and .ETH friends go? There are plenty of honest, brilliant and hard-working people out there trying to build real products and perhaps clearing out the scammers will be a positive. But Satoshi’s white-paper was published 14 years ago. At some point, it isn’t intellectually honest to say “it’s early” anymore.

Generative AI in 2023 will… find significant use cases and market traction. Some of what is out there is scary good and low-end content generation at scale is now viable. The real question is whether GeekWire will be using “ChatGPTaylorSoper” to write their features in 2023.

In 2023, we need more… angel investors in the Cascadia region. As challenging as it is to raise VC in our region, it is even more difficult to find angel check writers who have a risk appetite to back all the talented folks we have in this ecosystem. We have some great angels here but until we get critical mass, we will never fully unlock the talent in this region.

In 2023, we need less… COVID. Way less COVID.

Any other non-tech predictions? Julio leads the AL in home runs as the Mariners make the playoffs, followed by the Seahawks clinching a playoff berth in December of 2023. This will be the first time in Seattle’s history that both teams have made the playoffs in the same calendar year. And yes, that also implies that the Seahawks will miss the 2022 playoffs.

S. “Soma” Somasegar, managing director at Madrona Venture Group

Does your firm plan to make more or fewer investments in 2023? With the macroeconomic climate today, we’ve seen a slowdown in mid-stage and later-stage fundraising rounds this past year, and that may continue next year. But, having said that, the deal flow and the pace of deal-making at the early stages is still fairly high. We are all about finding great entrepreneurs and opportunities, and I think this kind of economic situation can often end up being fantastic vintage years for new companies and investments.

We are all jazzed and excited about the entrepreneurs we are seeing and the deals we are getting a chance to evaluate, and we did just raise our latest set of funds a couple of months ago. So, we don’t expect a slowdown in our investment pace overall — we fully expect our investment base to be the same or slightly better.

Best advice for startups in 2023: The world has moved from growth at all costs to efficient growth. If you think about the growth rate and the cash burn to get the growth rate, that’s a continuum. It is really important to find the right balance for you as a company, given your stage, your market opportunity and how much market is there for your product or service. So, my advice is to focus on efficient growth.

Hottest tech of 2023: The hottest category is generative AI, and the specific technology is GPT-4. The world is going gaga over GPT-3 and all the ways you can use it, but GPT-4 is going to be a significant step-function change, not just an incremental change. We predict GPT-4 will be multi-modal — it’s no longer going to be just text or just images or just video. I also think we’re going to see higher levels of performance at lower costs with this next iteration.

Most overhyped tech of 2023: On the one hand, the most over-hyped tech is going to be generative AI, and on the other hand, the most under-hyped tech is going to be generative AI. There is a cross-section of folks who are maybe going a little overboard with generative AI, but at the same time, people not using it are going to start getting very excited about it.

Biggest tech story out of Seattle in 2023: I think we are going to see some phenomenal collaboration between Microsoft and OpenAI that has the potential to fundamentally make Azure a fantastic AI platform.

Crypto in 2023 will… stabilize and continue its journey to figure out its role in society.

Generative AI in 2023 will… go mainstream. All kinds of companies and people will get exposed to generative AI in one way, shape, or form, and as I mentioned earlier, I think generative AI is going be multi-modal in 2023.

In 2023, we need more… breakthrough innovation at the intersection of life sciences and data and computer science. The kinds of things that are possible, whether it is therapeutics or drug discovery — I think the world needs that. I’m looking forward to seeing what the intersection of these two things can do.

In 2023, we need less… of what I call pure software-as-a-service offerings. In fact, I’ve been saying this for five years — I think any new application that is not intelligent really doesn’t have a role in this world. If somebody is excited about a software-as-a-service play without paying attention to data, machine learning/AI, or thinking about how to build an intelligence layer, we don’t need that.

Any other non-tech predictions? Major League Cricket coming to the U.S. might happen in 2023.

Julie Harrelson, managing director at Cascade Seed Fund

Does your firm plan to make more or fewer investments in 2023? Cascade’s strategy has been consistent, which is to lean into our process and pace investments over time, be deliberate and plan to fund 3-to-7 deals a year. Cascade is investing on a horizon that says it takes 5-to-8 years+ to build value and we have a fund currently deploying capital. In 2022, we made seven investments, and 11 follow-on investments.

Best advice for startups in 2023: Likely to be a tough one. If raising, be prepared for no’s, long lead times and lots of conversations. Lead with momentum metrics such as ability to generate revenue and how that grows. Non-revenue related metrics should be secondary. If you are pre-revenue, then data around usage, cohorts, pilots/trials will all inform the revenue potential question. Focus on business fundamentals such as team, cash flow, planned use of funds and product-market fit. We have heard from many founders that they are planning to raise in Q1 and Q2. That means lots of optionality for investors.

Hottest tech of 2023: Tools for measuring stress and sleep patterns for founders and CEOs?! But seriously, we are seeing many solutions for innovating business models and processes. Stuff that could seem quite boring from the outside but could completely revolutionize finance, logistics and other verticals.

Most overhyped tech of 2023: Generative AI — both its benefits and disadvantages. At its best, Generative AI can increase efficiency, quality and quantity of content. At its worst, it can increase complexity and create a plethora of issues. As we all have experienced, speed and capacity of innovative technology both increases the upside and the downside.

Biggest tech story out of Seattle in 2023: The story will unfold over the course of the year and it will show the same ability to weather the storm and come out better on the other side as Seattle tech always has. Potential layoffs and dynamic industry and world changes could lead to an increased number of tech startups that try to solve big issues. Massive executive changes at tech companies could happen. Plus, there could be at least one ginormous fail no one expected.

Crypto in 2023 will… still have too much hype and drama and this is not a current area of Cascade investment. Keep an eye on the protocols developers are using and the transaction volume on those protocols — that is interesting to us.

Generative AI in 2023 will… increase content. This means both opportunity and confusion. Innovation is defined as creative destruction and Generative AI is a disruptor. Where there is disruption, there are both opportunities and challenges.

In 2023, we need more… kindness and consideration as we all are challenged to grow and change.

In 2023, we need less… hubris.

Any other non-tech predictions? Mariners, Seahawks, Sounders, Storm and Kraken will all win their championships, and all shall be right with the world. And the U.S. women’s team will win the 2023 FIFA Women’s World Cup. I’m a fan.

T.A. McCann, managing director at PSL Ventures

Does your firm plan to make more or fewer investments in 2023? About the same. We see so many great technologies available to utilize, with very clear market needs, and with many of the large companies slowing hiring or doing layoffs, we think there will be even more people starting companies worthy of early-stage capital. In addition, the PSL Studio continues to evolve, refine and accelerate, creating even more companies for our PSL Ventures fund to invest in.

Best advice for startups in 2023: Be very specific about when you plan to raise money (spring or fall season). Know the metrics or milestones that you think you will achieve when you move into “active fundraising mode.” Spend more time talking to future investors, while in “passive fundraising mode.” Focus harder on the unit economics of your business (customer acquisition cost/customer lifetime value). Over-communicate your plans with your team (e.g., town halls) and your investors (e.g., monthly updates) to make sure everyone understands the plans and evolving strategy.

Hottest tech of 2023:

- GPT-3 and ChatGPT, for all the reasons everyone else is excited about them. I am particularly excited about the ability for consumers and end users to try these technologies out, to play with them, to get new ideas. Most tech like this is only available to developers or highly technical people. Specifically, I’m excited about the combination of summarization, content generation, and “informed iteration” enabled in things like ChatGPT. This combination of “gather all this data” (could be a dataset or a novel), pull out the “relevant things,” generate something new, and then let the end user provide more iteration using text or visual tools is incredibly interesting.

- Bioengineering. Everything from how we understand/visualize biology to the ability to design and manufacture new proteins, or even new lifeforms like this or this. The overlap of biology, software, and big data will continue to unlock many more possibilities to improve life and the planet.

Most overhyped tech of 2023: Meta’s attempts in the metaverse. They keep trying on so many levels and just seem to miss the mark on what people want, need, and will pay for.

Crypto in 2023 will… just maintain. The FTX debacle will hurt crypto overall in 2023, especially with general public sentiment (lots of “see, I told you so…”), but the underlying tech and approach will continue to get better during another “crypto winter.” There are lots of good companies, working on important foundational technologies. Many of these companies have raised lots of money and will continue to work on core projects around crypto, blockchains, smart contracts and NFTs. I would expect very few new coins or big public projects relative to years past, but Bitcoin and Ethereum are likely to remain somewhat stable as many users and use cases have been established.

Generative AI in 2023 will…

- Drive a tremendous amount of consumer experimentation. Interfaces like ChatGPT and Hugging Face are just the start. There will be more on everything, especially where creativity and technology overlap (design, architecture, film/video, music).

- Find some footing in actual business use cases. Examples like Jasper or Github Copilot will grow in popularity, and we are likely to see more business use cases in marketing, content creation and legal tech.

- Expand use cases in synthetic image generation — how do we use AIs to train other AIs when they need to recognize things? Self-driving cars, medical image analysis, physical world inspection/analysis…more synthetic data, better AI success on its goals, and the learning loops will accelerate. Loops upon loops.

In 2023, we need more…

- Climate tech investing — how are “traditional” VCs investing in direct or indirect climate tech companies and technologies.

- Better coordination between government and private sector investing. Things like the U.S. Infrastructure Bill (billions to be spent) or NSF funding could be much better aligned with venture capital to accelerate the startup pace. We can help entrepreneurs garner both forms of capital, but aligning timelines, metrics for success, the process of securing, and reporting could really help entrepreneurs be more productive and successful.

In 2023, we need less…

- Twitter BS from Elon. Be kind, measured and methodical in your management, please. You can provide a good or bad example of how to run a company.

- War in Ukraine and other places in the world.

- Division on how we help people live better and longer lives (#wearamask).

Uncategorized

One city held a mass passport-getting event

A New Orleans congressman organized a way for people to apply for their passports en masse.

While the number of Americans who do not have a passport has dropped steadily from more than 80% in 1990 to just over 50% now, a lack of knowledge around passport requirements still keeps a significant portion of the population away from international travel.

Over the four years that passed since the start of covid-19, passport offices have also been dealing with significant backlog due to the high numbers of people who were looking to get a passport post-pandemic.

Related: Here is why it is (still) taking forever to get a passport

To deal with these concurrent issues, the U.S. State Department recently held a mass passport-getting event in the city of New Orleans. Called the "Passport Acceptance Event," the gathering was held at a local auditorium and invited residents of Louisiana’s 2nd Congressional District to complete a passport application on-site with the help of staff and government workers.

'Come apply for your passport, no appointment is required'

"Hey #LA02," Rep. Troy A. Carter Sr. (D-LA), whose office co-hosted the event alongside the city of New Orleans, wrote to his followers on Instagram (META) . "My office is providing passport services at our #PassportAcceptance event. Come apply for your passport, no appointment is required."

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The event was held on March 14 from 10 a.m. to 1 p.m. While it was designed for those who are already eligible for U.S. citizenship rather than as a way to help non-citizens with immigration questions, it helped those completing the application for the first time fill out forms and make sure they have the photographs and identity documents they need. The passport offices in New Orleans where one would normally have to bring already-completed forms have also been dealing with lines and would require one to book spots weeks in advance.

These are the countries with the highest-ranking passports in 2024

According to Carter Sr.'s communications team, those who submitted their passport application at the event also received expedited processing of two to three weeks (according to the State Department's website, times for regular processing are currently six to eight weeks).

While Carter Sr.'s office has not released the numbers of people who applied for a passport on March 14, photos from the event show that many took advantage of the opportunity to apply for a passport in a group setting and get expedited processing.

Every couple of months, a new ranking agency puts together a list of the most and least powerful passports in the world based on factors such as visa-free travel and opportunities for cross-border business.

In January, global citizenship and financial advisory firm Arton Capital identified United Arab Emirates as having the most powerful passport in 2024. While the United States topped the list of one such ranking in 2014, worsening relations with a number of countries as well as stricter immigration rules even as other countries have taken strides to create opportunities for investors and digital nomads caused the American passport to slip in recent years.

A UAE passport grants holders visa-free or visa-on-arrival access to 180 of the world’s 198 countries (this calculation includes disputed territories such as Kosovo and Western Sahara) while Americans currently have the same access to 151 countries.

stocks pandemic covid-19 grantsUncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

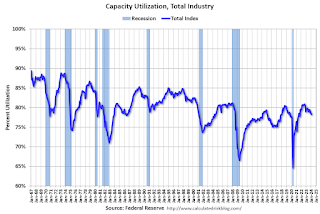

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex