Global Real Estate Professional Services Procurement Report with Top Spending Regions and Market Price Trends | SpendEdge

– Over 200 Forbes 2000 companies rely on our actionable insights

Global Real Estate Professional Services Procurement Report with Top Spending Regions and Market Price Trends | SpendEdge

- Over 200 Forbes 2000 companies rely on our actionable insights

- More than 100 CPOs and 500 category managers use our insights daily

- SpendEdge has the fastest growth rate in number of reports and client base

PR Newswire

NEW YORK, March 8, 2022

NEW YORK, March 8, 2022 /PRNewswire/ -- The Real Estate Professional Services market size is expected to grow by USD 1,326.82 Billion by 2026, at a Compound Annual Growth Rate (CAGR) of 5.16% during the forecast period. To know more about this market.

Request For a Free Sample Report

Real Estate Professional Services Market Analysis

Analysis of the cost and volume drivers and supply market forecasts in various regions are offered in this Real Estate Professional Services research report. This market intelligence report also analyzes the top supply markets, market opportunities, challenges and the critical cost drivers that can aid buyers and suppliers devise a cost-effective category management strategy.

To get instant access to over 1000 market-ready procurement intelligence reports without any additional costs or commitment.

The report provides insights on the following information:

- Regional spend dynamism and factors impacting costs

- The total cost of ownership and cost-saving opportunities

- Supply chain margins and pricing models

- Competitiveness index for suppliers

- Market favorability index for suppliers

- Supplier and buyer KPIs

Get detailed insights on the COVID-19 pandemic crisis and recovery analysis of Real Estate Professional Services Market

Detect blind spots in your revenue decisions by analyzing interconnected unknowns around the "Real Estate Professional Services Market."

Report Metrics | Details |

Base year considered | 2021 |

Forecast period | 2022 - 2026 |

Forecast units | USD Billion |

Geographies covered | North America, South America, Europe, Middle East and Africa, and APAC |

Leading Real Estate Professional Services suppliers | CBRE Group, Jones Lang LaSalle, and Cushman & Wakefield |

Top Pricing Models | Fixed fee pricing model, and Project-based pricing model |

Best Selling Procurement Research Report:

- Wireline Logging Services - Forecast and Analysis: The Real Estate Professional Services will grow at a CAGR of 5.50% during 2021-2025. Prices will increase by 3%-5% during the forecast period and suppliers will have moderate bargaining power in this market.

- Asset Recovery Services Category Sourcing and Procurement Report: This report evaluates suppliers based on cost and pricing, past engagements, productivity, and geographical presence.

- Data Feed Management- Sourcing and Procurement Intelligence Report: The report provides a complete drill-down on global data feed management services spend outlook at a global as well as regional level. Current spend scenario, growth outlook, incremental spend, and other key information is available individually for North America, South America, Europe, Middle East and Africa, and APAC.

This procurement report answers help buyers identify and shortlist the most suitable suppliers for their Real Estate Professional Services Market requirements following questions:

- Am I engaging with the right suppliers?

- Which KPIs should I use to evaluate my incumbent suppliers?

- Which supplier selection criteria are relevant for?

- What are the workplace computing devices category essentials in terms of SLAs and RFx?

Table of Content

- Executive Summary

- Market Insights

- Category Pricing Insights

- Cost-saving Opportunities

- Best Practices

- Category Ecosystem

- Category Management Strategy

- Category Management Enablers

- Suppliers Selection

- Suppliers under Coverage

- US Market Insights

- Category scope

Appendix

About SpendEdge:

SpendEdge shares your passion for driving sourcing and procurement excellence. We are the preferred procurement market intelligence partner for 120+ Fortune 500 firms and other leading companies across numerous industries. Our strength lies in delivering robust, real-time procurement market intelligence reports and solutions.

Contact

SpendEdge

Anirban Choudhury

Marketing Manager

Ph No: +1 (872) 206-9340

https://www.spendedge.com/contact-us

View original content to download multimedia:https://www.prnewswire.com/news-releases/global-real-estate-professional-services-procurement-report-with-top-spending-regions-and-market-price-trends--spendedge-301496007.html

SOURCE SpendEdge

Uncategorized

Analyst revamps MicroStrategy stock price target after Bitcoin buy

Here’s what could happen to MicroStrategy shares next.

How does Michael Saylor feel about bitcoin? We'll let him tell you in his own words.

"Bitcoin is a swarm of cyberhornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy," the executive chairman and co-founder of MicroStrategy (MSTR) once said.

Too subtle? Still not sure how the former CEO of the software intelligence company feels about the world's largest cryptocurrency?

Maybe this will help.

"Bitcoin is a bank in cyberspace, run by incorruptible software, offering a global, affordable, simple and secure savings account to billions of people that don't have the option or desire to run their own hedge fund," Saylor said.

Okay, so the guy really likes bitcoin. And on March 19, the first day of spring, MicroStrategy took a bigger bite out of bitcoin when the company said it had bought 9,245 bitcoins for $623 million between March 11 and March 18.

MicroStrategy said it a completed a $603.75 million convertible debt offering — its second in a week — to raise money to buy bitcoin.

The company now holds about $13.5 billion of bitcoin, which adds up to more than 1% of the 21 million bitcoin that will ever exist, according to CoinDesk.

Committed to developing bitcoin network

MicroStrategy said in a regulatory filing that it had paid roughly $7.53 billion for its bitcoin stash, an average of $35,160 per coin.

The company's stock fell on Tuesday, while bitcoin posted its biggest single-day loss since November 2022. MicroStrategy was off slightly to $1,416 at last check on Wednesday and bitcoin was up 2.3% to $63.607.

Related: Analyst unveils Nvidia stock price 'line in the sand'

Phong Le, MicroStrategy’s president and CEO, told analysts during the company’s Feb. 6 fourth-quarter-earnings call that "we remain highly committed to our bitcoin strategy with a long-term focus.."

"We consider MicroStrategy to be the world's first bitcoin development company," he said. "We are a publicly traded operating company committed to the continued development of the bitcoin network through activities in the financial markets, advocacy, and technology innovation."

MicroStrategy earned $4.96 a share in the quarter, beating the FactSet consensus of a loss of 64 cents, and light years beyond the year-ago loss of $21.93 a share.

Revenue totaled $124.5 million, compared with FactSet's call for $133 million and the year-earlier tally of $132.6 million.

During the call, Saylor told analysts that "2024 is the year of birth of bitcoin as an institutional-grade asset class."

MicroStrategy, he said, completed the first 15 years of the bitcoin life cycle, back when it was largely unregulated and misunderstood.

"The next 15 years, I would expect, will be a regulated, institutional, high-growth period of bitcoin, very, very different in many ways from the last 15 years," Saylor said.

Crypto's dark days

"Bitcoin itself is performing well for a number of reasons, but one reason is because it represents the digital transformation of capital," he added.

Of course, life with bitcoin wasn't always sunshine and roses.

More Wall Street Analysts:

- Analyst unveils Nvidia stock price 'line in the sand'

- Analyst revamps homebuilder stock price target before Fed rate call

- Analysts revamp Nvidia price targets as Blackwell tightens AI market grip

We take you back now to those less-than-thrilling days yesteryear, when covid-19 was on the rampage and the price of bitcoin fell 30% from March 8 to March 12 2020.

By the end of 2021, bitcoin had fallen nearly 30%. And 2023 saw the cryptocurrency sector wracked with bankruptcy and scandal, with the likes of FTX CEO Sam Bankman-Fried being convicted of fraud, conspiracy, and money laundering.

SBF, as he has been known, is scheduled to be sentenced in Manhattan federal court on March 28. He faces a long stretch.

But bitcoin rose about 160% in 2023 and hit a record $73,750 on March 14.

Saylor recently said that his high hopes for bitcoin this year stemmed largely from the U.S. Securities and Exchange Commission approving spot bitcoin ETFs and the upcoming bitcoin halving, where when bitcoin's mining reward is split in half.

MicroStrategy is the first bitcoin development company, Saylor told analysts, but perhaps not for long.

"We've published our playbook, and we're showing other companies how to do it," he said.

TD Cowen analyst Lance Vitanza cited MicroStrategy's latest bitcoin acquisition when he adjusted his price target for the company's shares on March 20.

The analyst cut the investment firm's price target on MicroStrategy to $1,450 from $1,560 and affirmed an outperform rating on the shares.

He says the shares remain an attractive vehicle for investors looking to gain bitcoin exposure.

Related: Veteran fund manager picks favorite stocks for 2024

stocks covid-19 cryptocurrency bitcoin cryptoSpread & Containment

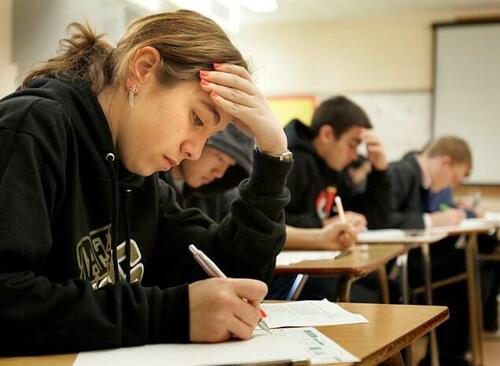

$500 Per Hour Tutors Are Back In Vogue Now That Colleges Have Decided SATs Are, In Fact, A Necessity

$500 Per Hour Tutors Are Back In Vogue Now That Colleges Have Decided SATs Are, In Fact, A Necessity

It was just about a month ago we noted…

It was just about a month ago we noted that SATs were once again being reconsidered by colleges who had reduced or eliminated their requirement due to (pick one: diversity, racism, climate change, equity, gender affirmation).

As a result of the comeback, Bloomberg noted this week that tutors, sometimes costing $500 per hour, are all of a sudden back in vogue.

Bloomberg wrote that demand for SAT tutoring and prep centers is surging as several top colleges reintroduce mandatory SATs, and students adapt to the SAT's new digital format.

Kaplan reported a significant enrollment increase, attributed to digital testing and the reinstatement of testing requirements by institutions and three Ivy League schools—Yale, Dartmouth, and Brown—have reinstated mandatory SATs, alongside MIT and the University of Texas at Austin. This shift has left many students scrambling for preparation before early application deadlines.

Companies like The Princeton Review have also seen a spike in interest for prep services.

Parents Bloomberg profiled are once again investing in tutoring services for their children to improve their chances of success. The debate over standardized testing's fairness persists however, with critics arguing it favors wealthier students who can afford extensive prep. But those winning the argument still claims that standardized tests provide valuable benchmarks for admissions, potentially aiding in diversifying the applicant pool.

We noted last month in a piece from American Greatness, that according to Axios, multiple colleges used the Chinese Coronavirus pandemic as an excuse to weaken the importance of SAT and ACT test scores in most student applications. But in recent weeks, several schools have reversed course; Yale is considering repealing its prior policy of making SAT/ACT requirements optional, with Dartmouth already reinstating the requirements earlier this month. MIT reversed a similar policy back in 2022.

Other schools that have eliminated SAT/ACT requirements include Harvard and Columbia. Harvard, along with Cornell and Princeton, have extended their policy of making the scores optional, while Columbia’s policy remains permanent.

One of the motivating factors behind the reversal is ongoing research showing a clear correlation between students’ standardized test scores, and their subsequent academic performance and graduation rates in college. Some schools had previously opposed the test requirements for reasons of “diversity,” baselessly accusing the tests of being “racist” and against minority students.

International

Disney remote jobs: the most magical WFH careers on earth?

Disney employs hundreds of thousands of employees at its theme parks and elsewhere, but the entertainment giant also offers opportunities for remote w…

The Walt Disney Co. (DIS) is a major entertainment and media company that operates amusement parks, produces movies and television shows, airs news and sports programs, and sells Mickey Mouse and Star Wars merchandise at its retail stores across the U.S.

While most of the jobs at the multinational entertainment conglomerate require working with people — such as at its theme parks, film-production facilities, cruise ships, or corporate offices — there are also opportunities for remote work at Disney. And while remote typically means working from home, with Disney, it could also mean working in a non-corporate office and being able to move from one location to another and conduct business outside normal working hours.

Related: Target remote jobs: What type of work and how much does it pay?

What remote jobs are available at Disney?

Many companies, including Disney, have called employees to return to the office for work in the wake of the COVID-19 pandemic, and the bulk of the company’s positions are forward-facing, meaning they involve meeting with clients and customers on a regular basis.

Still, there are some jobs at the “most magical company on earth” that are listed as remote and don’t require frequent in-person interaction with people, including opportunities in data entry and sales.

On Disney’s career website, there are limited positions available where the work is completely remote. One listing, for example, is for a “graphics interface coordinator covering sporting events.” This role involves working on nights, weekends, and holidays — times when corporate offices tend to be closed — and it may make sense for the company to hire people who can work from home or to travel and work in a location separate from the game venue.

Some of the senior roles that are shown on the website involve managers who can oversee remote teams, whether that be in sales or data. Sometimes, a supervisor overseeing staff who work outside corporate offices may be responsible for hiring freelancers who work remotely.

On the employment website Indeed, there are limited positions listed. A job listing for a manager in enterprise underwriting for a federal credit union indicates weekend duty, working outside of an 8 a.m. to 5 p.m. schedule, and being able to work in different locations. The listed annual salary range of $84,960 to $132,000, though, is well above the national annual average of around $50,000.

Internationally, Disney offers remote work in India, largely in the field of software development for its India-based streaming platform, Disney+ Hotstar.

The company also offers some hybrid schemes, which involve a mixture of in-office and remote work. For a mid-level animator position based in San Francisco, the role would involve being in the office and working from home occasionally.

How much do remote jobs at Disney pay?

Pay for remote jobs at Disney varies significantly based on location. A salary for a freelance artist in New York City, for example, may be higher than for the same job in Orlando, Florida.

Disney lists actual salary ranges in some of its job postings. For example, the yearly pay for a California-based compensation manager who works with clients is $129,000 to $165,000.

In an online search for “remote jobs at Disney,” results range from $30 to $39 an hour, for data entry, or $28.50 to $38 an hour for social media customer support.

How can I apply for remote jobs at Disney?

You can look for remote jobs on Disney's career site, and type “remote” in the search field. Listings may also appear on career-data websites, including Indeed and Glassdoor.

How many employees does Disney have?

In 2023, Disney employed about 225,000 people globally, of which around 77% were full-time, 16% part-time, and 7% seasonal. The majority of the workers, around 167,000, were in the U.S.

Disney says that a significant number of its employees, including many of those who work at its theme parks, along with most writers, directors, actors, and production personnel, belong to unions. It’s not immediately known how many remote workers at the company, if any, are union members.

india pandemic covid-19-

Spread & Containment1 week ago

Spread & Containment1 week agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex