Spread & Containment

Get Used To Living Under “Subsidiarity” After The Great Reset

Get Used To Living Under "Subsidiarity" After The Great Reset

Authored by Mark Jeftovic via bombthrower.com,

#Davos2021 started yesterday.

We’ve all been hearing a lot The Great Reset lately, new slogans abound such as Build Back Better,…

Authored by Mark Jeftovic via bombthrower.com,

#Davos2021 started yesterday.

We’ve all been hearing a lot The Great Reset lately, new slogans abound such as Build Back Better, the New Normal, and what seems to be a “new” model called “Stakeholder Capitalism” is being espoused (although it is not new, I wrote about the pendulum swinging from stakeholder supremacy to shareholder supremacy back in the days of Milton Friedman in the inaugural post for this site).

Recently I decided it would be helpful challenge my own reflexive inclination to suspect that we were all being collectively screwed by our institutions, yet again. I wondered if these momentous shifts were simply one of those tectonic phase shifts that occur throughout history and that I shouldn’t leap to the conclusion that it’s some disingenuous and ultimately malevolent pseudo-reality being imposed from above.

It is fitting that as #Davos2021 begins, I outline my arc in which I tried to suspend disbelief around The Great Reset narrative, forcing myself to pose the question:

What if The Great Reset was getting a bad rap?

Maybe it’s true that the world has changed irrevocably, and that change hasn’t been driven or captured by a razor thin scab of elites at the top of the socio-economic pyramid who are setting the agenda. The idea of a reset may be well founded, after all when I first started writing about wealth inequality and crony capitalism over a decade ago, I called it “Rebooting Capitalism”.

So I started going through Klaus Schwab’s books: The Fourth Industrial Revolution (2016), COVID-19: The Great Reset (2020) and most recently, Stakeholder Capitalism. (2021). It started out as s a curious blend of nodding one’s head in agreement, underlining numerous passages, musing that maybe this is just descriptive, not prescriptive. By that I mean, maybe Schwab is simply trying to make sense of the shifts occurring, and not really offering frameworks around what should happen next, but just trying to parse what is happening and possible trajectories of the future.

This former case is similar to Warren Mosler’s description of Modern Monetary Theory (MMT). It describes how Mosler and other MMT-ers think the system actually works and why the outcomes will not be as conventional economics generally fears. In Stephenie Kelton’s more recent book The Deficit Myth, she builds on this theme that MMT is more descriptive with some prescriptive policy recommendations. But my overall sense of it is that these books about MMT were more about trying to articulate a new way of looking at the existing system and not trying to drive a completely overriding agenda (even if that’s what would happen if policy makers seize on MMT as a rationalization for destroying their currencies).

I mention MMT here specifically because we touch on it again when I contrast it to Charles Hugh Smith’s concept of Community Labour Integrated Money Economy (CLIME), a little later.

With Schwab, he spends a lot of time in a descriptive mode, talking about the what is happening in the world, although we do see some of his assumptions creeping in and for awhile, I am cautiously optimistic that if everything Schwab outlines as a policy response to global issues like global poverty, and of course now, the pandemic, maybe it’s just the way of the world and this is the direction things are going without there necessarily being a SPECTRE-like entity in the WEF driving a self-serving agenda.

When Schwab talks about how a grand ideal of a standard issue One World Government model, what he calls the Neoliberal Utopia simply will not work, I breathe a sigh of relief,

“Consider a global government [that] regulates multinational companies in global markets, and people gather in a global democracy and global unions. It is an unrealistic an undesirable goal, as it increases the distance between individuals and the immediate social ecosystems they are a part of. It also decreases their feeling of commitment to the people and the environment closest to them…Though the 20th century neoliberalists once may have seen such a global model as a Utopian ideal, it would inevitably end in the political disenfranchisement of local communities. When the center of power is too far removed from people’s everyday realities, neither political governance nor economic decision-making would have popular support.”

- Stakeholder Capitalism p.181

But then, the more I read, the more I couldn’t shake the sense that when a guy like Schwab means by the word “commitment, what he really means is “obedience”. Schwab understands that people aren’t really going to accept decisions from on high, especially if on high is a centralized world government.

What we really need is “Subsidiarity”

Schwab goes on to introduce with a flourish one of the core pillars of Stakeholder Capitalism: Subsidiarity (the other is “Value creation and sharing”):

A primary principle for the implementation of Stakeholder Capitalism is therefore that of subsidiarity. It is not an untested or purely theoretical principal. Applied most famously in the governance of the European Union..it asserts that decisions should be taken at the most granular level possible, closest to where they will have the most noticeable effects. It determines, in other words, that local stakeholders should be able to decide for themselves, except when it is not feasible or effective for them to do so.

Subsidiarity is supposed to mean “whatever can be done at lower levels of government should not be done at higher levels”, but my guess is the devil would be in the details. Like in that last sentence of the quote, when it is not feasible or effective for the “stakeholders” in Stakeholder Capitalism to decide certain matters for themselves, those will have to be decided for them.

What would those sorts of issues be?

Well for starters, there’s climate change. That’s one of the things that’s already been decided…

“It makes sense to coordinate this challenge first at the global level.” but then the second level is at the national level, where countries can take different approaches, a limit on auto travel would have significant effect in the United States, where cars are the primary mode of transportation. Taking a different approach, such as limiting air travel, would affect certain groups of people more than others. Subsidiarity supports a national or local level of decision making for countries to determine which path will work best for them to effectively address the global goal”.

As Schwab blithely bandies about various limitations and curtailments on everybody else’s range of motion and economic choices, there is never any treatment of climate change as anything but a global crisis that justifies the complete re-ordering of everybody’s lives.

And yet, the same level of drastic re-ordering of everybody else’s lives is proffered in Schwab’s other book, COVID-19: The Great Reset, even though by his own admission in that same book, COVID-19 is a not civilization ending plague:

“Even in the worst-case horrendous scenario, COVID-19 will kill far fewer people than the Great Plagues, including the Black Deaths, or World War II did”

- COVID-19: The Great Reset p. 17

Albeit one that provides an excellent opportunity to reorder everybody else’s lives,

changes that would have seemed inconceivable before the pandemic struck, such as new forms of monetary policy like helicopter money (already a given), the reconsideration/recalibration of some of our social priorities and augmented search for the common good as a policy objective, the notion of fairness acquiring political potency, radical welfare and taxation measures, and drastic geopolitical realignments.

The broader point is this: the possibilities for change and the resulting new order are now unlimited and only bound by our imagination, for better or for worse. Societies could be poised to become either more egalitarian or more authoritarian, or geared towards more solidarity or more individualism, favouring the interests of the few or the many…

You get the point: we (as in the WEF) should take advantage of this unprecedented opportunity to reimagine your world.

If COVID-19 is a comparatively lightweight pandemic to be opportunistically seized upon to drastically reorder everybody’s lives, one cant help but wonder if the climate “crisis” isn’t yet another global softball. Perhaps in the cold light of day, it could turn out that climate change is either out of our hands (if it is driven largely or even partially by solar cycles) or that climate alarmism is in itself more toxic and destructive than the direct effects of climate change itself, as Michael Shellenberger asserts in “Apocalypse Never”,

Apocalypse Never explores how and why so many of us came to see important but manageable environmental problems as the end of the world, and why the people who are the most apocalyptic about environmental problems tend to oppose the best and most obvious solutions to solving them.

Shellenberger, Michael. Apocalypse Never (p. xi). Harper. Kindle Edition.

Shouldn’t there be some sort of process or governance structure in there to protect the world’s citizens from being overly regulated by somebody else’s idea of what is important? Should there be some counterbalance to these unilateral assessments of when drastic measures are required, especially when those measures would supersede our own agency in ordering our lives?

But there isn’t, not in Schwab’s Stakeholder Capitalism after the The Great Reset.

What we get instead is “subsidiarity”:

Another example around climate change, conspicuous in its lack of coverage in Schwab’s books is the idea of nuclear energy.

If the entire world is headed toward an eventual transition off of fossil fuels (if for no other reason than Peak Oil) then shouldn’t the safest, cleanest, efficient energy source be featured prominently? The next generation pebble bed reactors and micro-reactors are safe to the point of being effectively riskless when compared to other forms of energy generation and the number fatalities those other forms cause when accidents do occur:

The worst energy accident of all time was the 1975 collapse of the Banqiao hydroelectric dam in China. It collapsed and killed between 170,000 and 230,000 people. It’s not that nuclear energy never kills. It’s that its death toll is vanishingly small. Here are some annual death totals: walking (270,000), driving (1.35 million), working (2.3 million), air pollution (4.2 million). By contrast, nuclear’s known total death toll is just over one hundred.

Leading Shellenberger, an environmental activist of 30 years to assert that,

Nuclear is the safest way to make reliable electricity. In fact, nuclear has saved more than two million lives to date by preventing the deadly air pollution that shortens the lives of seven million people per year….

Nuclear’s worst accidents show that the technology has always been safe for the same inherent reason that it has always had such a small environmental impact: the high energy density of its fuel.

- Shellenberger, Michael. Apocalypse Never (p. 151). Harper. Kindle Edition.

And then there’s also Thorium, which can’t meltdown and the radiation half-life is measured in weeks, not years. There is no mention of any of this in any of Schwab’s books.

Under subsidiarity, local governments across the world will be tasked with addressing problems Kraus Schwab and the Davos crew (the wealthiest 0.01% of humanity that own somewhere north of $36 trillion of the global assets) deem to be problems, and reorder the world according to how the WEF thinks things should be prioritized.

What are the priorities?

We get some insight by looking at the list of “Deep Shifts” Schwab predicts in his earlier book: The Fourth Industrial Revolution, where he posits what the big changes are that are coming at us in terms of tipping points, positive outcomes, negative outcomes and “unknown / cuts both ways”.

Shift #1: Implantable Technologies (p. 121)

“Digital tatoos not only look cool but can perform useful tasks, like unlocking a car, entering mobile phone codes with a finger point or tracking body processes”

(or implementing immunity passports).

Shift #10: Smart Cities (p.144)

Shift #11: Big Data for Decisions (p. 145)

Shift #22: Designer Beings

Tipping point in for this one will be when “The first human whose genome was directly and deliberately edited is born” (which I will point out, has already happened with the CRISPR babies in China).

Shift #23: Neurotechnologies (p. 170)

Tipping point: “The first human with fully artificial memory implanted in the brain”.

Together, they coalesce to usher in an impetus toward transhumanism ordered by Big Data and AI that will probably, in lieu of any honest debate or public consultation around these shifts, result in a type of social credit system.

And that’s what is missing from Schwab’s books. There is nothing in the framework where local communities can identify and define what they see as problems for themselves and work toward solving them. There is no mechanism for asserting their own priorities of types of things the communities themselves may value above the WEF’s “Deep Shifts”, such as full or meaningful employment, privacy, or self-sovereign health care.

Directionality matters

In other words, what is missing from Stakeholder Capitalism is that, despite paying lip service to inclusion and community, there are no actual mechanisms for priorities coming from the bottom up.

What I’ve been realizing is that you can take two systems that have outwardly similar mechanics, like MMT and Charles Hugh Smith’s CLIME. Both systems describe an economy from which money is created ex nihilo to fulfill or generate economic activity. But from those two frameworks one can envision two very different outcomes: hyper-inflation and a two-tier society on one, and a robust community of involved economic actual stakeholders getting stuff done in the other. Why?

Because one is a top-down framework where the incentives are set by policy makers removed from the economy they attempt to fine tune, while the other is a bottom-up ecosystem where actual economic activity is a direct result of market signalling and community needs.

Conclusion

After reading through the Schwab material having initially forced myself to suspend judgement, I now am now firmer in my initial suspicions that The Great Reset, Stakeholder Capitalism and Build Back Better slogans that come out of these annual Davos circle jerks are blissfully oblivious to what they themselves actually are.

They believe that the role they are ostensibly to serve is as the “enlightened stewards” of society, taking the liberty of reimagining everybody else’s lives.

In reality, they are the living embodiment of uber-woke super wealthy elites , so tacitly sure that their belief systems are the product of their own personal enormous material success that they can’t really be beliefs but self-evident truths. After all, if they were wrong, they wouldn’t be super rich, right?

What is being proposed however, what The Great Reset and Stakeholder Capitalism is, isn’t just benignly wrong-headed or egregiously presumptive: it is chilling.

It doesn’t specifically call for social credit, or an AI-driven authoritarianism, yet that is what its tenets and incentives will produce. It aspires toward transhumanism, and so far all indications are that governments, and global elites seem to be buying into it and singing the “Build Back Better” mantra of Stakeholder Capitalism in concert.

What it will lead to is The Great Bifurcation, the 3rd Scenario I posited in The Jackpot Chronicles. Much has come into focus now since I wrote that just this past summer.

If The Great Reset comes about, and I think it’s already here, it will lead to that two tier society where the world’s underclass are governed algorithmically via smartphones, digital, programmable scrip (UBI) and well ordered dopamine hits. Meanwhile the far smaller populace that actually owns all the assets globally live in a parallel universe where they retain agency, freedom of movement, diet, and thought.

On my mailing list I talk about what we can do as individuals to try and get clear of The Great Reset. Because even if we loathe this with every fibre of our being, find it oppressive and tyrannical, anti-human, anti-spirit and soulless, we won’t be able to do anything about it from the wrong side of the impermeable membrane that will very soon cordon off the haves from the haves-nots.

We have to defend our liberties, our civil rights and our assets in the New Normal. In a worst case scenario it’ll require forming an underground network a la Isaac Assimov’s Foundation. The Foundation’s stated purpose was to survive the onset of a Galactic Dark Age and preserve the accumulated culture and wisdom of a civilization that had irrevocably embarked on a path that would trigger its own demise.

Now more than ever it is important we all try to improve things from the grass roots level as the Stakeholder Capitalism rubric may be the last gasp of a system about the come off the rails completely or after a prolonged period of disruption and tyranny.

Charles Hugh Smith and I are working on a base framework for CLIME that will empower communities to create their own local exchange currency and take control over their own community economies.

- Join my mailing list to be notified about that and get other advice on surviving The Great Reset.

- Start setting up on alternative communications channels like Telegram, Signal and Keybase (we’re setting up a Bombthrower Telegram here)

- Support third-party political parties like the Greens if your left-of-center or the Libertarians or PPC if you’re on the right; withdraw your financial support and votes from incumbent political parties everywhere, at all levels (more on this in another post).

Hold your ground where possible, but prepare for a type of Samizdat communications culture for awhile. We may have to keep in touch with each other from the underground. The mainstream media will be no help and Big Tech is part of the problem.

Government

Harvard Medical School Professor Was Fired Over Not Getting COVID Vaccine

Harvard Medical School Professor Was Fired Over Not Getting COVID Vaccine

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

A Harvard Medical School professor who refused to get a COVID-19 vaccine has been terminated, according to documents reviewed by The Epoch Times.

Martin Kulldorff, an epidemiologist, was fired by Mass General Brigham in November 2021 over noncompliance with the hospital’s COVID-19 vaccine mandate after his requests for exemptions from the mandate were denied, according to one document. Mr. Kulldorff was also placed on leave by Harvard Medical School (HMS) because his appointment as professor of medicine there “depends upon” holding a position at the hospital, another document stated.

Mr. Kulldorff asked HMS in late 2023 how he could return to his position and was told he was being fired.

“You would need to hold an eligible appointment with a Harvard-affiliated institution for your HMS academic appointment to continue,” Dr. Grace Huang, dean for faculty affairs, told the epidemiologist and biostatistician.

She said the lack of an appointment, combined with college rules that cap leaves of absence at two years, meant he was being terminated.

Mr. Kulldorff disclosed the firing for the first time this month.

“While I can’t comment on the specifics due to employment confidentiality protections that preclude us from doing so, I can confirm that his employment agreement was terminated November 10, 2021,” a spokesperson for Brigham and Women’s Hospital told The Epoch Times via email.

Mass General Brigham granted just 234 exemption requests out of 2,402 received, according to court filings in an ongoing case that alleges discrimination.

The hospital said previously, “We received a number of exemption requests, and each request was carefully considered by a knowledgeable team of reviewers.”

“A lot of other people received exemptions, but I did not,” Mr. Kulldorff told The Epoch Times.

Mr. Kulldorff was originally hired by HMS but switched departments in 2015 to work at the Department of Medicine at Brigham and Women’s Hospital, which is part of Mass General Brigham and affiliated with HMS.

“Harvard Medical School has affiliation agreements with several Boston hospitals which it neither owns nor operationally controls,” an HMS spokesperson told The Epoch Times in an email. “Hospital-based faculty, such as Mr. Kulldorff, are employed by one of the affiliates, not by HMS, and require an active hospital appointment to maintain an academic appointment at Harvard Medical School.”

HMS confirmed that some faculty, who are tenured or on the tenure track, do not require hospital appointments.

Natural Immunity

Before the COVID-19 vaccines became available, Mr. Kulldorff contracted COVID-19. He was hospitalized but eventually recovered.

That gave him a form of protection known as natural immunity. According to a number of studies, including papers from the U.S. Centers for Disease Control and Prevention, natural immunity is better than the protection bestowed by vaccines.

Other studies have found that people with natural immunity face a higher risk of problems after vaccination.

Mr. Kulldorff expressed his concerns about receiving a vaccine in his request for a medical exemption, pointing out a lack of data for vaccinating people who suffer from the same issue he does.

“I already had superior infection-acquired immunity; and it was risky to vaccinate me without proper efficacy and safety studies on patients with my type of immune deficiency,” Mr. Kulldorff wrote in an essay.

In his request for a religious exemption, he highlighted an Israel study that was among the first to compare protection after infection to protection after vaccination. Researchers found that the vaccinated had less protection than the naturally immune.

“Having had COVID disease, I have stronger longer lasting immunity than those vaccinated (Gazit et al). Lacking scientific rationale, vaccine mandates are religious dogma, and I request a religious exemption from COVID vaccination,” he wrote.

Both requests were denied.

Mr. Kulldorff is still unvaccinated.

“I had COVID. I had it badly. So I have infection-acquired immunity. So I don’t need the vaccine,” he told The Epoch Times.

Dissenting Voice

Mr. Kulldorff has been a prominent dissenting voice during the COVID-19 pandemic, countering messaging from the government and many doctors that the COVID-19 vaccines were needed, regardless of prior infection.

He spoke out in an op-ed in April 2021, for instance, against requiring people to provide proof of vaccination to attend shows, go to school, and visit restaurants.

“The idea that everybody needs to be vaccinated is as scientifically baseless as the idea that nobody does. Covid vaccines are essential for older, high-risk people and their caretakers and advisable for many others. But those who’ve been infected are already immune,” he wrote at the time.

Mr. Kulldorff later co-authored the Great Barrington Declaration, which called for focused protection of people at high risk while removing restrictions for younger, healthy people.

Harsh restrictions such as school closures “will cause irreparable damage” if not lifted, the declaration stated.

The declaration drew criticism from Dr. Anthony Fauci, head of the National Institute of Allergy and Infectious Diseases, and Dr. Rochelle Walensky, who became the head of the CDC, among others.

In a competing document, Dr. Walensky and others said that “relying upon immunity from natural infections for COVID-19 is flawed” and that “uncontrolled transmission in younger people risks significant morbidity(3) and mortality across the whole population.”

“Those who are pushing these vaccine mandates and vaccine passports—vaccine fanatics, I would call them—to me they have done much more damage during this one year than the anti-vaxxers have done in two decades,” Mr. Kulldorff later said in an EpochTV interview. “I would even say that these vaccine fanatics, they are the biggest anti-vaxxers that we have right now. They’re doing so much more damage to vaccine confidence than anybody else.”

Surveys indicate that people have less trust now in the CDC and other health institutions than before the pandemic, and data from the CDC and elsewhere show that fewer people are receiving the new COVID-19 vaccines and other shots.

Support

The disclosure that Mr. Kulldorff was fired drew criticism of Harvard and support for Mr. Kulldorff.

The termination “is a massive and incomprehensible injustice,” Dr. Aaron Kheriaty, an ethics expert who was fired from the University of California–Irvine School of Medicine for not getting a COVID-19 vaccine because he had natural immunity, said on X.

“The academy is full of people who declined vaccines—mostly with dubious exemptions—and yet Harvard fires the one professor who happens to speak out against government policies.” Dr. Vinay Prasad, an epidemiologist at the University of California–San Francisco, wrote in a blog post. “It looks like Harvard has weaponized its policies and selectively enforces them.”

A petition to reinstate Mr. Kulldorff has garnered more than 1,800 signatures.

Some other doctors said the decision to let Mr. Kulldorff go was correct.

“Actions have consequence,” Dr. Alastair McAlpine, a Canadian doctor, wrote on X. He said Mr. Kulldorff had “publicly undermine[d] public health.”

International

“Extreme Events”: US Cancer Deaths Spiked In 2021 And 2022 In “Large Excess Over Trend”

"Extreme Events": US Cancer Deaths Spiked In 2021 And 2022 In "Large Excess Over Trend"

Cancer deaths in the United States spiked in 2021…

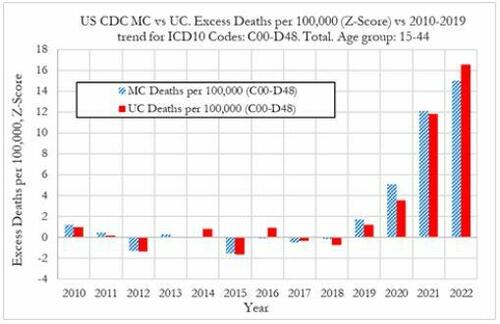

Cancer deaths in the United States spiked in 2021 and 2022 among 15-44 year-olds "in large excess over trend," marking jumps of 5.6% and 7.9% respectively vs. a rise of 1.7% in 2020, according to a new preprint study from deep-dive research firm, Phinance Technologies.

Extreme Events

The report, which relies on data from the CDC, paints a troubling picture.

"We show a rise in excess mortality from neoplasms reported as underlying cause of death, which started in 2020 (1.7%) and accelerated substantially in 2021 (5.6%) and 2022 (7.9%). The increase in excess mortality in both 2021 (Z-score of 11.8) and 2022 (Z-score of 16.5) are highly statistically significant (extreme events)," according to the authors.

That said, co-author, David Wiseman, PhD (who has 86 publications to his name), leaves the cause an open question - suggesting it could either be a "novel phenomenon," Covid-19, or the Covid-19 vaccine.

Cancer deaths in US in 2021 & 2022 in large excess over trend for 15-44 year-olds as extreme events. A novel phenomenon? C19? lockdowns? C19 vaccines? Honored to participate in this work. #CDC where are you? @DowdEdwardhttps://t.co/iUV5oQiWCW pic.twitter.com/uytzaIvvor

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 12, 2024

"The results indicate that from 2021 a novel phenomenon leading to increased neoplasm deaths appears to be present in individuals aged 15 to 44 in the US," reads the report.

The authors suggest that the cause may be the result of "an unexpected rise in the incidence of rapidly growing fatal cancers," and/or "a reduction in survival in existing cancer cases."

They also address the possibility that "access to utilization of cancer screening and treatment" may be a factor - the notion that pandemic-era lockdowns resulted in fewer visits to the doctor. Also noted is that "Cancers tend to be slowly-developing diseases with remarkably stable death rates and only small variations over time," which makes "any temporal association between a possible explanatory factor (such as COVID-19, the novel COVID-19 vaccines, or other factor(s)) difficult to establish."

That said, a ZeroHedge review of the CDC data reveals that it does not provide information on duration of illness prior to death - so while it's not mentioned in the preprint, it can't rule out so-called 'turbo cancers' - reportedly rapidly developing cancers, the existence of which has been largely anecdotal (and widely refuted by the usual suspects).

While the Phinance report is extremely careful not to draw conclusions, researcher "Ethical Skeptic" kicked the barn door open in a Thursday post on X - showing a strong correlation between "cancer incidence & mortality" coinciding with the rollout of the Covid mRNA vaccine.

The argument is over.

— Ethical Skeptic ☀ (@EthicalSkeptic) March 14, 2024

The Covid mRNA Vaxx has cause a sizeable 2021 inflection, and now novel-trend elevation in terms of both cancer incidence & mortality.

Now you know who the liars were all along.

????Incidence = 14.8% excess

????UCoD Mortality = 5.3% excess (lags Incidence) pic.twitter.com/uwN9GMrHl1

Phinance principal Ed Dowd commented on the post, noting that "Cancer is suddenly an accelerating growth industry!"

????Indeed it is…Cancer is suddenly an accelerating growth industry! @EthicalSkeptic provides a chart below showing US Cancer treatment in constant dollars with a current growth rate of 14.8% (6.3% New CAGR) versus long term trend of 1.78% CAGR or $33.8 billion in excess cancer… https://t.co/RIn4R2YZZ7

— Edward Dowd (@DowdEdward) March 14, 2024

Continued:

As a former portfolio manager of of a $14 billion Large Cap Growth Equity portfolio I can definitively say Cancer treatments and the Disabilities have become growth industries that both have inflection points coincidental to the mRNA vaccine rollouts in 2021.

— Edward Dowd (@DowdEdward) March 14, 2024

Chart 1 from… pic.twitter.com/TCt4X1plnM

Bottom line - hard data is showing alarming trends, which the CDC and other agencies have a requirement to explore and answer truthfully - and people are asking #WhereIsTheCDC.

We aren't holding our breath.

Experts are sounding the alarm on a spike in cancer diagnosis worldwide. It is still a mystery. @DowdEdward from Phinance Technologies has also been sounding the alarm for months.

— dr.ir. Carla Peeters (@CarlaPeeters3) March 15, 2024

We are facing a dramatic degradation of the human immune system https://t.co/CPnwP3Oj9G

Wiseman, meanwhile, points out that Pfizer and several other companies are making "significant investments in cancer drugs, post COVID."

Pfizer among several companies making significant investments in cancer drugs, post COVID. @DowdEdward @Kevin_McKernan @JesslovesMJK @niki_kyrylenko https://t.co/nefEZYLW1o https://t.co/r505Sbbcq4

— David Wiseman PhD, MRPharmS (@AdhesionsOrg) March 15, 2024

Phinance

We've featured several of Phinance's self-funded deep dives into pandemic data that nobody else is doing. If you'd like to support them, click here.

List of our projects following disturbing tends in deaths, disabilities and absences.

— Edward Dowd (@DowdEdward) March 16, 2024

Link to projects at bottom.

✅ V-Damage Project

✅ Excess Mortality Project

✅ US Disabilities Project

✅ US BLS Absence rates Project

✅ US Cause of Death Project

✅ UK Cause of Death…

Government

“I Can’t Even Save”: Americans Are Getting Absolutely Crushed Under Enormous Debt Load

"I Can’t Even Save": Americans Are Getting Absolutely Crushed Under Enormous Debt Load

While Joe Biden insists that Americans are doing great…

While Joe Biden insists that Americans are doing great - suggesting in his State of the Union Address last week that "our economy is the envy of the world," Americans are being absolutely crushed by inflation (which the Biden admin blames on 'shrinkflation' and 'corporate greed'), and of course - crippling debt.

The signs are obvious. Last week we noted that banks' charge-offs are accelerating, and are now above pre-pandemic levels.

...and leading this increase are credit card loans - with delinquencies that haven't been this high since Q3 2011.

On top of that, while credit cards and nonfarm, nonresidential commercial real estate loans drove the quarterly increase in the noncurrent rate, residential mortgages drove the quarterly increase in the share of loans 30-89 days past due.

And while Biden and crew can spin all they want, an average of polls from RealClear Politics shows that just 40% of people approve of Biden's handling of the economy.

Crushed

On Friday, Bloomberg dug deeper into the effects of Biden's "envious" economy on Americans - specifically, how massive debt loads (credit cards and auto loans especially) are absolutely crushing people.

Two years after the Federal Reserve began hiking interest rates to tame prices, delinquency rates on credit cards and auto loans are the highest in more than a decade. For the first time on record, interest payments on those and other non-mortgage debts are as big a financial burden for US households as mortgage interest payments.

According to the report, this presents a difficult reality for millions of consumers who drive the US economy - "The era of high borrowing costs — however necessary to slow price increases — has a sting of its own that many families may feel for years to come, especially the ones that haven’t locked in cheap home loans."

The Fed, meanwhile, doesn't appear poised to cut rates until later this year.

According to a February paper from IMF and Harvard, the recent high cost of borrowing - something which isn't reflected in inflation figures, is at the heart of lackluster consumer sentiment despite inflation having moderated and a job market which has recovered (thanks to job gains almost entirely enjoyed by immigrants).

In short, the debt burden has made life under President Biden a constant struggle throughout America.

"I’m making the most money I've ever made, and I’m still living paycheck to paycheck," 40-year-old Denver resident Nikki Cimino told Bloomberg. Cimino is carrying a monthly mortgage of $1,650, and has $4,000 in credit card debt following a 2020 divorce.

"There's this wild disconnect between what people are experiencing and what economists are experiencing."

CBS: Do you attribute the inflation crisis to the pandemic or Biden?

— RNC Research (@RNCResearch) March 15, 2024

WISCONSIN VOTER: "It's been YEARS now since the pandemic — I'm not buying that anymore. At first I did; I'm not buying that anymore because yogurt is STILL going up in price!" pic.twitter.com/apahb65scB

What's more, according to Wells Fargo, families have taken on debt at a comparatively fast rate - no doubt to sustain the same lifestyle as low rates and pandemic-era stimmies provided. In fact, it only took four years for households to set a record new debt level after paying down borrowings in 2021 when interest rates were near zero.

Meanwhile, that increased debt load is exacerbated by credit card interest rates that have climbed to a record 22%, according to the Fed.

[P]art of the reason some Americans were able to take on a substantial load of non-mortgage debt is because they’d locked in home loans at ultra-low rates, leaving room on their balance sheets for other types of borrowing. The effective rate of interest on US mortgage debt was just 3.8% at the end of last year.

Yet the loans and interest payments can be a significant strain that shapes families’ spending choices. -Bloomberg

And of course, the highest-interest debt (credit cards) is hurting lower-income households the most, as tends to be the case.

The lowest earners also understandably had the biggest increase in credit card delinquencies.

"Many consumers are levered to the hilt — maxed out on debt and barely keeping their heads above water," Allan Schweitzer, a portfolio manager at credit-focused investment firm Beach Point Capital Management told Bloomberg. "They can dog paddle, if you will, but any uptick in unemployment or worsening of the economy could drive a pretty significant spike in defaults."

"We had more money when Trump was president," said Denise Nierzwicki, 69. She and her 72-year-old husband Paul have around $20,000 in debt spread across multiple cards - all of which have interest rates above 20%.

Photographer: Jon Cherry/Bloomberg

During the pandemic, Denise lost her job and a business deal for a bar they owned in their hometown of Lexington, Kentucky. While they applied for Social Security to ease the pain, Denise is now working 50 hours a week at a restaurant. Despite this, they're barely scraping enough money together to service their debt.

The couple blames Biden for what they see as a gloomy economy and plans to vote for the Republican candidate in November. Denise routinely voted for Democrats up until about 2010, when she grew dissatisfied with Barack Obama’s economic stances, she said. Now, she supports Donald Trump because he lowered taxes and because of his policies on immigration. -Bloomberg

Meanwhile there's student loans - which are not able to be discharged in bankruptcy.

"I can't even save, I don't have a savings account," said 29-year-old in Columbus, Ohio resident Brittany Walling - who has around $80,000 in federal student loans, $20,000 in private debt from her undergraduate and graduate degrees, and $6,000 in credit card debt she accumulated over a six-month stretch in 2022 while she was unemployed.

"I just know that a lot of people are struggling, and things need to change," she told the outlet.

The only silver lining of note, according to Bloomberg, is that broad wage gains resulting in large paychecks has made it easier for people to throw money at credit card bills.

Yet, according to Wells Fargo economist Shannon Grein, "As rates rose in 2023, we avoided a slowdown due to spending that was very much tied to easy access to credit ... Now, credit has become harder to come by and more expensive."

According to Grein, the change has posed "a significant headwind to consumption."

Then there's the election

"Maybe the Fed is done hiking, but as long as rates stay on hold, you still have a passive tightening effect flowing down to the consumer and being exerted on the economy," she continued. "Those household dynamics are going to be a factor in the election this year."

Meanwhile, swing-state voters in a February Bloomberg/Morning Consult poll said they trust Trump more than Biden on interest rates and personal debt.

Reverberations

These 'headwinds' have M3 Partners' Moshin Meghji concerned.

"Any tightening there immediately hits the top line of companies," he said, noting that for heavily indebted companies that took on debt during years of easy borrowing, "there's no easy fix."

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Spread & Containment4 days ago

Spread & Containment4 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex