Futures Start New Month Flat As Fed’s QT2 Begins

Futures Start New Month Flat As Fed’s QT2 Begins

Stocks traded off session highs as weaker-than-average volumes mark the beginning of summer,…

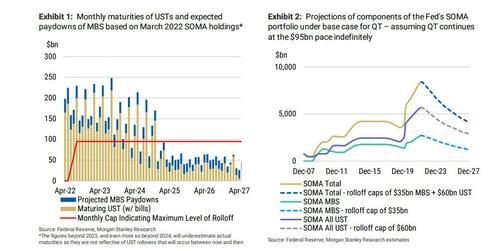

Stocks traded off session highs as weaker-than-average volumes mark the beginning of summer, and as traders awaited the jobs report later this week and eyed the official start of the Fed's second Quantitative Tightening program (which will end as "gloriously" as the first one) which will drain the Fed's balance sheet by $95BN per month.

Contracts on the S&P 500 were 0.2% higher by 730 a.m. in New York, after the underlying index finished May up exactly 0.1%; Nasdaq 100 futures were up 0.1%. European bourses and Asian stocks were modestly in the red to stgart the new quarter. The latest drop in Treasuries pushed 10-year yields closer to 2.9% as traders raised bets on Federal Reserve interest-rate hikes. The dollar advanced against major peers, and bitcoin traded around $31,500. Oil rose as investors assessed the future of OPEC+ unity, just as ministers from the group prepare to meet on Thursday to discuss its supply policy for July. Crude advanced about 10% in May, stoking more inflation worries.

Concerns that the Fed's rate hikes may induce a recession are keeping investors guessing about the outlook for the economy as rising food and energy costs squeeze consumers, and volatility has picked up.

“US markets, and by default, global markets, will still indulge in schizophrenic swings in market sentiment as the FOMO dip-buyers become increasingly frantic in their attempts to pick a cyclical low in equity markets,” said Jeffrey Halley, a senior market analyst at Oanda Asia Pacific Pte.

On Tuesday, Joe Biden used a rare meeting with Federal Reserve Chair Jerome Powell to declare that he’s respecting the central bank’s independence and to throw Powell under the bus for any continued high inflation. The meeting came ahead of US payroll numbersFriday.

“There are heightened concerns around inflation and where central banks are likely to go trying to combat inflation,” Kristina Hooper, Invesco Advisers chief global markets strategist, said on Bloomberg Radio. “This has gone from just an inflation scare to a growth scare. Uncertainty has grown.”

In premarket trading, Salesforce shares jumped 8.3% after the software company raised its full-year forecast for adjusted earnings. HP will be in focus after the company reported better-than-expected sales and profit driven by steady demand for computer systems. Other notable premarket movers:

- Digital Turbine (APPS US) fell 4.1% in New York premarket trading on Wednesday after the mobile services platform’s fourth-quarter results and first-quarter forecast. Roth Capital Partners analyst Darren Aftahi says the company provided soft guidance, but noted that its commentary around SingleTap licensing should be supportive.

- View (VIEW US) shares surge as much as 30% in US premarket trading, after the glass manufacturing firm reported its full-year results late Tuesday, with the company saying it expects to file its delinquent 10-K and 10-Q on or before June 30.

- ChargePoint (CHPT US) analysts noted that the EV charging network firm’s margins came under pressure due to rising costs and supply-chain disruption, leading some brokers to trim their targets on the stock. ChargePoint shares dropped 2.7% in US postmarket trading on Tuesday after posting a 1Q lossthat was wider than expected.

- Victoria’s Secret (VSCO US) analysts were positive on the lingerie company’s results, with Wells Fargo saying that its turnaround is on track despite a tough macroeconomic environment, while VitalKnowledge said that the update was a “big victory” amid the retail gloom. The shares gained 7.3% post-market Tuesday.

- HP (HPQ US) shares edged up in extended trading on Tuesday, after the company reported better-than- expected sales and profit driven by steady demand for computer systems. Analysts lauded the company’s execution as it navigates a challenging supply and macroeconomic environment.

- Ambarella (AMBA US) shares fell 5.6% in extended trading on Tuesday after the semiconductor device company issued a tepid second-quarter revenue forecast as lockdowns in China weigh on its near-term outlook. Analysts said that there is weakness in the near-term, but the long-term thesis remains intact.

Late on Tuersday, Fed's Bostic said there could be a significant reduction in inflation this year and that his suggestion for a pause in September should not be interpreted as a "Fed put" or belief that the Fed would rescue markets, according to an interview in MarketWatch. Elsewhere, Treasury Secretary Yellen said US President Biden's top concern is inflation and shares the Fed's priority of slowing inflation, while she added she was wrong about the path inflation would take and doesn't expect the same pace of job gains going forward, according to Reuters.

Citigroup Inc. strategists said that after a difficult first five months of 2022, the pain may not be over yet for global equity markets. The prospect of downward revisions to earnings estimates is the latest headwind to face stock investors, already rattled by runaway inflation and the potential impact of central-bank tightening aimed at controlling it, the strategists led by Jamie Fahy wrote in a note.

In Europe, the Stoxx 600 Index erased earlier gains to trade 0.2% lower a day after euro-zone figures showed a record jump in consumer prices and on investor concerns that record inflation will pressure the European Central Bank to act more aggressively, increasing the risk of an economic slump. The DAX outperformed, adding 0.3%. Miners, utilities and real estate are the worst-performing sectors. Autos are the day’s best performing sector and one of few rising subgroups amid declining markets; the Stoxx 600 Automobiles & Parts Index rises 2.1% as of 1:10pm CET, rebounding after a session of declines on Tuesday and on course for a fifth day of gains in six. Carmakers such as Stellantis, Renault and Volkswagen lead the advances. Stellantis +3.4%, VW +3.4%, Renault +3.4%, Porsche Automobil Holding SE +3.2%, BMW +2.8%, Volvo Car +2.5%, Mercedes-Benz Group +2.5%. Here are the biggest European movers:

- Dr. Martens shares surge as much as 30%, the most since January 2021, after the UK bootmaker reported pretax profit for the full year that beat the average analyst estimate.

- Lanxess shares rise as much as 2.5%, adding to an 11% gain on Tuesday. The chemicals group is raised to buy from hold at Stifel. Berenberg also hikes its PT on the stock.

- Societe Generale shares up as much as 2.6% after UBS upgrades the investment bank to buy from neutral, noting the company’s valuation is “too cheap to ignore.”

- Capricorn Energy shares rise after company reached an agreement on the terms of a recommended all-share combination with Africa-focused oil and gas developer Tullow Oil.

- Stadler Rail shares jump as much as 4.3%, most since March, after it signed a contract to deliver up to 510 FLIRT trains to the Swiss Federal Railways, according to a statement.

- OVS gains as much as 7.1% to highest since end of March after Banca Akros upgrades its rating to buy, saying in note that May appears to have been a strong month for the Italian fashion retailer.

- Saint-Gobain shares fluctuate after the building material company agreed to buy Canadian siding producer Kaycan for $928m to strengthen its position in the North American building-products market.

- Zalando shares fall as much as 5.1% after being downgraded to equal- weight from overweight at Barclays, which cites near-term challenges for the online fashion retailer.

Earlier in the session, Asian stocks edged lower after fluctuating in a narrow range, as traders assessed China’s easing virus restrictions and the persistent risk of global inflation. The MSCI Asia Pacific Index was down less than 0.1%, with declines in technology and utilities shares offsetting gains in consumer discretionary stocks. Japan’s Topix Index rose more than 1% as the yen weakened, while indexes in Malaysia and the Philippines fell the most. China’s shares were slightly lower after a private gauge showed factory activity in May contracted from the previous month as both production and new orders fell. Meanwhile, Shanghai’s Covid-19 cases continued to decline as most parts of the city reopened after two months under one of the world’s most restrictive pandemic lockdowns.

Asian equities completed their first monthly advance this year in May amid optimism China’s easing lockdowns will improve the region’s growth outlook, even as soaring oil prices and global inflation fuel concerns of tighter monetary policies. Near-term concerns over inflation, economic growth and China’s Zero Covid policy are likely to persist, but investors can expect a “stabilization in 3Q as valuations reset and positive catalysts emerge,” Chetan Seth, Asia Pacific equity strategist at Nomura, wrote in a note. Markets in South Korea and Indonesia were closed for holidays.

In FX, the Bloomberg Dollar Spot Index rose 0.1% as the greenback strengthened against all its Group-of-10 peers apart from the Australian dollar. The yen was the worst performer and fell to a two-week low. The euro neared the $1.07 handle before paring losses. Bunds were little changed with focus on ECB rate hike pricing and possible comments by policy makers including President Christine Lagarde before the ‘quiet’ period kicks ahead of next Thursday’s policy decision. The Aussie inched up and Australian bonds fell as data showed the economy grew faster than expected in the fourth quarter. Rising Treasury yields also weighed on Aussie debt.

In rates, Treasury yields inched up with the curve slightly bear-flattenning, before the Federal Reserve starts its quantitative-tightening program today. The Fed will start shrinking its balance sheet at a pace of $47.5 billion a month before stepping that up to $95 billion in September. Treasuries were slightly cheaper across the curve, with yields off session highs in early US session. Yields are up 2bp-3bp across the curve, led higher by 5-year sector; the 10-year yield is at 2.87% underperforms bunds and gilts. Economists expect a second straight half-point rate increase from the Bank of Canada at 10am ET; swaps market prices in 52bp and 184bp by year-end. IG dollar issuance slate empty so far; six entities priced a total of $12.6b Tuesday, and two stood down. Bunds and Italian bonds are little changed, with the 10-year yields on both trading off session high after ECB’s Holzmann said new inflation record backs need for a 50bps hike. Money markets are pricing a cumulative 119bps of tightening in December.

In commodities, WTI trades within Tuesday’s range, adding 1.6% to above $116. Most base metals are in the red; LME nickel falls 2.4%, underperforming peers. Spot gold falls roughly $8 to trade around $1,829/oz.

Looking the day ahead now, data releases include the global manufacturing PMIs for May and the US ISM manufacturing reading for May. Otherwise, there’s German retail sales for April, the Euro Area unemployment rate for April, US construction spending for April, the JOLTS job openings for April and, May ISM manufacturing and the latest Fed Beige Book. From central banks, the Bank of Canada will be making its latest policy decision and the Fed will be releasing their Beige Book. Otherwise, speakers include ECB President Lagarde and the ECB’s Knot, Villeroy, Panetta and Lane, the Fed’s Williams and Bullard, and PBoC Governor Yi Gang.

Market Snapshot

- S&P 500 futures little changed at 4,133.50

- STOXX Europe 600 down 0.3% to 442.18

- MXAP down 0.1% to 169.26

- MXAPJ down 0.5% to 556.42

- Nikkei up 0.7% to 27,457.89

- Topix up 1.4% to 1,938.64

- Hang Seng Index down 0.6% to 21,294.94

- Shanghai Composite down 0.1% to 3,182.16

- Sensex down 0.4% to 55,336.61

- Australia S&P/ASX 200 up 0.3% to 7,233.98

- Kospi up 0.6% to 2,685.90

- German 10Y yield little changed at 1.14%

- Euro little changed at $1.0727

- Brent Futures up 1.4% to $117.23/bbl

- Gold spot down 0.2% to $1,834.26

- U.S. Dollar Index up 0.16% to 101.92

Top Overnight News from Bloomberg

- The latest all-time high for euro-zone inflation strengthens the case for the European Central Bank to lift interest rates by a half-point in July, according to Governing Council member Robert Holzmann

- Croatia is about to find out whether it’s in good enough shape to become the euro zone’s 20th member. Progress made by country will be assessed in reports due Wednesday from the ECB and the European Union’s executive arm

- Sweden’s main stock exchange venue, Nasdaq Stockholm, is looking into a new service that will provide clearing for inflation-linked swaps in Swedish kronor

- China’s financial capital reported its fewest Covid-19 cases in almost three months as residents celebrated a significant easing of curbs on movement, while some companies took a more cautious approach, maintaining some restrictions in factories

- China’s factory activity in May contracted from the previous month as both production and new orders fell, although the slowdown wasn’t as fast as in April, a private gauge showed Wednesday

- Treasury Secretary Janet Yellen gave her most direct admission yet that she made an incorrect call last year in predicting that elevated inflation wouldn’t pose a continuing problem

- President Joe Biden said he’ll give Ukraine advanced rocket systems and other US weaponry to better hit targets in its war with Russia, ramping up military support as the conflict drags into its fourth month

- New Zealand’s central bank is seeking feedback on whether its monetary policy remit is “still fit for purpose,” Deputy Governor Christian Hawkesby said. “It’s not about should it still be about price stability and maximum sustainable employment,” he said. “It’s more about have we got the right inflation targets, are we measuring it the right way, what horizon are we trying to achieve it over, what other things should we have regard to.”

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks traded mixed as risk sentiment only mildly improved from the lacklustre performance stateside as the region digested another slew of data releases including the continued contraction in Chinese Caixin Manufacturing PMI. ASX 200 was kept afloat by strength in industrials, telecoms and the top-weighted financials sector, while better-than-expected Q1 GDP data provides some mild encouragement. Nikkei 225 was underpinned by further currency depreciation and with BoJ Deputy Governor Wakatabe reiterating the BoJ's dovish tone. Hang Seng and Shanghai Comp were indecisive after Chinese Caixin Manufacturing PMI remained in contraction territory and amid mixed COVID-related developments with Shanghai reopening from the lockdown whilst Beijing's Fengtai district tightened curbs and required all residents to work remotely.

Top Asian News

- Beijing reports two COVID cases during 15hrs to 3pm local time on June 1st

- Hong Kong Retail Sales Unexpectedly Rebound as Covid Curbs Ease

- Sri Lanka’s President Won’t Be Stepping Down Soon, Minister Says

- Europe, Asian Factories Under Pressure on China, War in Ukraine

- Philippine IPO’s Stellar Gain May Wane With Inflation: ECM Watch

European bourses are mixed, Euro Stoxx 50 +0.1%, and have struggled to find a clear direction after mixed APAC trade with a busy docket ahead. Stateside, futures are posting similar performance and looking to a busy data and Central Bank afternoon session, ES +0.2%.

Top European News

- UK government is drawing up plans that will task the BoE with stepping in and handling the implosion of a stablecoin in preparation for future crises in the crypto markets, according to The Times.

- EU Commission President von der Leyen will, on Wednesday, approve Poland’s national recovery plan; however, Politico reports that commissioners, including Timmermans and Vestager, will raise objections to this as Poland has not taken the necessary steps for Commission approval.

- UK House Prices Defy Slowdown Fears With 10th Consecutive Gain

- ECB Half-Point Hike Seen as Deutsche Bank Breaks With Consensus

- Wood to Sell Built-Environment Unit to WSP for $1.9 Billion

- BT’s Sport TV Deal With Warner Bros. Discovery Gets UK Probe

FX

- Yen extends losses through more technical support levels, 129.0O and 129.50 as BoJ reiterates dovish stance and maintains that it is undesirable for monetary policy to target FX rates.

- Dollar drifts otherwise after month end squeeze as attention turns to busy midweek agenda and run in to NFP on Friday, DXY retracts into tighter 102.060-101.760 range.

- Aussie outperforms on the back of firmer than forecast Q1 GDP data, but hampered by decent option expiry interest sub-0.7200 vs Greenback.

- Euro unable to glean much impetus from hawkish ECB Holzmann as option expiries sit between 1.0740-75.

- Loonie pivots 1.2650 pre-BoC awaiting confirmation of the 50bp hike expected or something more hawkish.

- Marked slowdown in Hungarian manufacturing PMI piles more pressure on Forint following half point NBH rate rise vs 60bp consensus, EUR/HUF inching closer to 400.00, at circa 398.50.

Commodities

- WTI and Brent are recovering from yesterday's WSJ source report induced downside, with participants awaiting clarity/details at Thursday's OPEC+ gathering.

- Currently, the benchmarks are holding around/above USD 117/bbl, vs respective lows of USD 114.58/bbl and USD 115.40/bbl respectively.

- Russian Foreign Minister Lavrov met with his Saudi counterpart on Tuesday in which they both praised the level of cooperation in OPEC+, while they noted stabilising effect that tight Russia-Saudi coordination has on the global hydrocarbon market, according to Reuters.

- UAE is considering a plan to increase its oil capacity by an additional 1mln bpd to a total 6mln bpd by 2030, according to Energy Intel.

- JMMC on Thursday now scheduled for 13:00BST (prev. 12:00BST), OPEC+ at 13:30BST, via Argus' Itayim.

- Police clashed with communities blocking MMG's Las Bambas copper mine in Peru.

- China's State Planner says renewable energy consumption is to reach circa. 1bln/T of standard-coal-equivalent by 2025, equal to 20% of total consumption; aims to secure around 33% of electricity from renewable sources by 2025.

- Spot gold is modestly softer amid ongoing USD upside and continuing to draft from a cluster of DMAs above USD 1840/oz, with base metals broadly lower as well.

Central Banks

- ECB's Holzmann says the record Eurozone inflation print backs the need for a 50bps hike, decisive action is required in order to avoid harsher steps later. A clear rate signal could support EUR.

- BoJ Deputy Governor Wakatabe said the BoJ must maintain powerful monetary easing and sustain an environment where wages can rise, while he added that the BoJ shouldn't rule out additional easing steps if risks to the economy materialise. Wakatabe also noted that most goods prices aren't increasing with recent inflation driven mostly by energy and some food price increases, as well as noted that consumer inflation has not yet achieved the BoJ's price goal in a sustained and stable manner, according to Reuters. Adds, it is undesirable to target FX in guiding monetary policy; desirable for FX to reflect fundamentals.

US Event Calendar

- 07:00: May MBA Mortgage Applications, prior -1.2%

- 09:45: May S&P Global US Manufacturing PM, est. 57.5, prior 57.5

- 10:00: April JOLTs Job Openings, est. 11.3m, prior 11.5m

- 10:00: April Construction Spending MoM, est. 0.5%, prior 0.1%

- 10:00: May ISM Manufacturing, est. 54.5, prior 55.4

- 14:00: U.S. Federal Reserve Releases Beige Book

Central Banks

- 11:30: Fed’s Williams Makes Opening Remarks

- 13:00: Fed’s Bullard Discusses the Economic and Policy Outlook

- 14:00: U.S. Federal Reserve Releases Beige Book

DB's Jim Reid concludes the overnight wrap

We'll be off here in the UK tomorrow and Friday as we'll be celebrating the Queen being on the throne for an astonishing 70 years. I find the best way to celebrate is via the medium of golf! To put things in perspective, when I get to 100 years old I'll be celebrating exactly 70 years at DB. In our absence Tim will still be publishing the EMR for the next couple of days.

Believe it or not it's now June! It only seems like yesterday it was Xmas. Perhaps 70 years isn't so long after all. Since it’s the start of the month, our usual performance review for the month just gone will be out shortly. A number of financial assets began to stabilise in May, helped by a combination of factors such as easing Covid restrictions in China and the potential that the Fed wouldn’t hike as aggressively as some had feared. That said, it’s still been an awful performance on a YTD basis, with the S&P 500 having seen its biggest YTD loss after 5 months since 1970, whilst most of the assets in our main sample are still beneath their levels at the start of the year.

But after some respite over the last couple of weeks, the last 24 hours have seen equities and bonds sell off in tandem once again as inflation fears cranked up another notch. The main catalyst was the much stronger-than-expected flash CPI reading for the Euro Area, which at +8.1% was the fastest annual pace since the single currency’s formation.

In terms of that Euro Area CPI reading, the main headline number of +8.1% was some way above the +7.8% reading expected, whilst core CPI also rose to a record +3.8% (vs. +3.6% expected). Unsurprisingly, this has only intensified the debate on how rapidly the ECB will hike rates, and Slovakian Central Bank Governor Kazimir became the latest member of the Governing Council to say that he was “open to talk about 50 basis points”, even if his baseline was still for a 25bps move in July. The investor reaction was evident too, and overnight index swaps moved to price in 119bps worth of ECB hikes by the December meeting, which is the highest to date. It also implies that the ECB would do more than simply four 25bp moves from July, which would only sum to 100bps. The European economics team published a blog taking a deep dive into underlying inflation across the continent (link here). There are lots of different cuts of the data in the piece, but the headline is a number of underlying metrics are scoring record highs, and that a lot of the pressure is being produced domestically and not just from external shocks. In particular, Germany registers above the rest of the continent with record high underlying inflation readings. All of this underscores the call for tighter ECB policy.

Speaking of which, as previewed at the top, DB’s European economists released their ECB preview ahead of next week’s meeting yesterday, and they are now expecting the ECB to implement at least one +50bp rate hike by September, the first shop to take such a stance according to the latest Bloomberg survey. They note a +50bp hike is more likely in September but there’s a risk it comes in July. There is actually a precedent for 50bps from the ECB, although you have to go all the way back to June 2000 to find the last time they moved so quickly at a single meeting, and a +50bp hike is consistent with the reaction function President Lagarde outlined in her recent blog. Our economists also believe the ECB will be underestimating inflation with their forecast updates at next week’s meeting, necessitating a bigger rate increase early in their hiking cycle. Additionally, they expect the ECB to get rates 50bps above neutral by the middle of next year for a modestly restrictive policy stance to fight inflation. For next week’s meeting, they believe the GC will signal the end of net APP (asset purchases), clearing the way for a July liftoff. They also expect the ECB staff to raise 2024 inflation forecast to 2% and confirm the expiration of TLTRO discounts.

Elsewhere on the inflation front, it appeared that Brent crude futures were set for a 9th consecutive daily gain and their second highest close in over a decade. However a post-European close Wall Street Journal article reported that OPEC was considering exempting Russia from its oil production deal in light of sanctions, which would pave the way for other members to pump a lot more oil. This drove an intraday reversal in Brent and WTI which closed down -1.14% and -0.35%, respectively having been up +2.97% and +4.27% at their peaks for the day.

Growing fears that inflation will prove even stickier than previously hoped led to a major selloff among sovereign bonds on both sides of the Atlantic yesterday. In Europe, yields on 10yr bunds (+6.7bps), OATs (+7.5bps) and BTPs (+12.1bps) all moved higher thanks to a rise in both real rates and inflation breakevens. Meanwhile in the US, yields on 10yr Treasuries were up +10.6bps to 2.84% as markets caught up following the Memorial Day holiday and then added a bit more for good measure. We're another +1.5bps higher this morning. As it happens, today also marks the start of the Fed’s quantitative tightening process, which starts at a pace of $30bn per month for Treasuries, and $17.5bn for MBS, although those numbers will both double after 3 months. For those wanting more details, Tim on my team released a playbook for the process a couple of weeks back (link here).

That prospect of stickier inflation and thus more aggressive rate hikes from central banks meant that equities took a knock yesterday as well. The S&P 500 was down -0.63% following its strongest weekly performance since November 2020, and small-cap stocks suffered in particular as the Russell 2000 shed -1.26%. It was a different story for the megacap tech stocks however, with the FANG+ index advancing another +0.69%, having gained more than +12% since its recent closing low last week. Over in Europe, the main indices also lost ground following their Monday gains, with the STOXX 600 (-0.72%), the DAX (-1.29%) and the CAC 40 (-1.43%) all falling back on the day. Equity futures are indicating a more positive start with contracts on the S&P 500 (+0.39%), NASDAQ 100 (+0.30%) and DAX (+0.64%) all higher.

Asian equity markets are mixed this morning. The Hang Seng is down -0.67% in early trade, tracking declines in US equity markets along with a pullback in Chinese listed tech stocks. Additionally, in mainland China, the Shanghai Composite (-0.10%) and CSI (-0.13%) are also lagging. Elsewhere, the Nikkei (+0.71%) is leading gains as the Japanese yen weakened -0.32% to 129.08 against the US dollar. Markets in South Korea are closed today for a holiday. Meanwhile, in Australia, the S&P/ASX 200 (+0.12%) is edging higher after Q1 GDP advanced +0.8% from the final three months of last year (v/s +0.7% expected), taking the annual pace to +3.3% and outpacing the pre-pandemic average of around +2%.

Other data showed that South Korea’s exports accelerated, growing +21.3% y/y in May (v/s +18.4% expected), against April’s upwardly revised +12.9% increase as shipments to Europe and US improved offsetting disruptions with China's trade. Separately, China’s Caixin manufacturing PMI improved to 48.1 from 46.0 in April.

Back to yesterday on the data front, the Conference Board’s consumer confidence indicator for May surprise to the upside at 106.4 (vs. 103.6 expected), although it was still a decline on the previous month. Otherwise in the US, the FHFA house price index for March came in at just +1.5% month-on-month (vs. +2.0% expected), but the S&P CoreLogic Case-Shiller 20-city index surprised on the upside with a +21.2% year-on-year gain (vs. +20.0% expected). Then the MNI Chicago PMI also surprised to the upside with a 60.3 reading (vs. 55.0 expected). Finally, the number of UK mortgage approvals in April fell to their lowest in nearly 2 years at 66.0k (vs. 70.5k expected).

To the day ahead now, and data releases include the global manufacturing PMIs for May and the US ISM manufacturing reading for May. Otherwise, there’s German retail sales for April, the Euro Area unemployment rate for April, US construction spending for April and the JOLTS job openings for April. From central banks, the Bank of Canada will be making its latest policy decision and the Fed will be releasing their Beige Book. Otherwise, speakers include ECB President Lagarde and the ECB’s Knot, Villeroy, Panetta and Lane, the Fed’s Williams and Bullard, and PBoC Governor Yi Gang.

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A