Futures Slide Following Reports Of Ukraine Shelling

Futures Slide Following Reports Of Ukraine Shelling

It was a relatively quiet overnight session until just before 11pm ET on Wednesday, when…

It was a relatively quiet overnight session until just before 11pm ET on Wednesday, when Russia's RIA Novosti news agency reported that Russian-backed separatists claimed Ukrainian forces had violated cease-fire rules in four places with a message posted on the self-proclaimed Donetsk People's Republic (DNR)’s Telegram channel claiming that "the situation on the line of contact has sharply escalated. The enemy is making attempts to unleash active hostilities." This was followed promptly by the Ukrainian government returning the accusation and pointing the finger at separatists as being behind the shooting. Amid the he fired, she fired confusion, monitors from the Organization for Security and Cooperation in Europe (OSCE), which has been observing the situation in eastern Ukraine, recorded numerous shelling incidents along the line of contact in Donbas on Thursday morning, a diplomatic source told Reuters. The breathless reporting was enough to send US equity futures tumbling 30 points in just a few seconds...

... while Treasury yields also collapsed...

... and gold spiked higher

When the smoke had settled - so to speak - U.S. equity futures dropped 15 points or 0.34% to 4455, reversing much of the overnight loss, with Nasdaq and Dow futures down 0.52% and 0.28% respectively, while Europe’s Stoxx 600 Index was little changed and Asian shares edged up. Energy companies underperformed as crude oil fell. Havens such as the yen and gold pushed higher. Government bond yields retreated and the dollar was steady.

Separately in geopolitcs, Russia’s Foreign Ministry denied a claim by the U.S. and Britain that it’s added as many as 7,000 troops to what President Joe Biden has said are around 150,000 soldiers already near Ukraine’s borders. European Union leaders will discuss the tensions Thursday in Brussels, before Group of Seven foreign ministers meet in Munich on Saturday.

Westpac analyst Sean Callow said markets were "clearly on edge" and vulnerable since a lot of traders had assumed tension was easing. Some investors advised clients not to panic over the geopolitical crisis, however.

"Drawdowns driven by geopolitical stress events are typically short-lived for well-diversified portfolios," said Mark Haefele, chief investment officer at UBS Global Wealth Management. He added that their base case was a "relaxation of geopolitical tensions".

The latest gyrations show that “equities markets are still vulnerable to Ukraine-Russia related geopolitical risks,” said Lee Jaesun, an analyst at Hana Financial. Those concerns over Ukraine overshadowed the latest Fed minutes, in which officials concluded they would start raising rates soon and were on alert for persistent inflation that would justify faster tightening. There were few new details on balance-sheet runoff plans.

Investors are also fretting about the imminent rate hikes from the Fed, and expect at least 150 basis points of Fed tightening in 2022 -- up from 75 basis points just a few weeks ago -- to fight price pressures. The worry is whether the pivot away from pandemic-era stimulus will squeeze economic growth and inject more turbulence across assets.

“The market will continue to be quite volatile until certain questions are clarified -- for example, how these rate hikes are going to be laid out going forward,” Marcella Chow, JPMorgan Asset Management

Going back to the market, Nvidia dropped 3.7% in premarket trading after the chipmaker’s latest earnings and forecasts failed to impress everyone, even though beating estimates. By contrast, Cisco Systems Inc. jumped after better-than-expected results. Amazon.com has agreed to accept Visa Inc.’s cards across its global network, settling a feud that threatened to damage the financial giant’s business and disrupt e-commerce payments. Here are some of the other notable premarket movers today:

- DoorDash (DASH US) shares jump 24% in U.S. premarket trading after it reported that a record number of people ordered from the food-delivery app in 4Q.

- Upstart Holdings was upgraded by two notches at BofA, to buy from underperform, in a move that comes after the cloud-based artificial intelligence lending platform’s results. Shares are up 1% premarket.

- TripAdvisor (TRIP US) drop 9% in U.S. premarket trading after the company reported results that missed estimates. While 4Q came in below consensus due to omicron and investments in the Viator unit, commentary for 1Q and 2022 was positive, according to Truist Securities.

- Marin Software (MRIN US) shares soar 22% in U.S. premarket trading after the marketing software company announced an integration with TikTok.

- Albemarle (ALB US) shares dropped 7% in premarket after the lithium company’s gross profit missed Street estimates.

- Fastly (FSLY US) shares plunge 29% in U.S. premarket trading after the infrastructure software company forecast revenue for 2022 that missed the average analyst estimate. Piper Sandler and Morgan Stanley both cut their price targets on the stock.

- Hyatt Hotels Corp. (H US) fell 6.4% in postmarket trading Wednesday after a the company posted a wider loss per share for the fourth quarter than analysts had expected.

- Global-E Online Ltd. (GLBE US) climbs 16% premarket after the e-commerce company provided a year revenue forecast that topped estimates.

- Trupanion (TRUP US) fell 7.6% in extended trading after the pet medical insurance company reported a quarterly loss that widened from the year-earlier period.

- KAR Auction Services (KAR US) jumped 7.6% in postmarket trading, after the vehicle auction company’s fourth-quarter profit and revenue beat the average analyst estimate.

- QuantumScape (QS US) sank 5.6% in premarket trading, after the battery-technology company reported a wider-than- expected loss for the fourth quarter.

- Informatica (INFA US) declined 5.9% in extended trading on Wednesday, after the application software company gave an outlook for adjusted first- quarter operating profits are dowthat was weaker than expected.

In Europe, the Euro STOXX slipped 0.1% while Britain's FTSE 100 dropped 0.65%. Strong corporate earnings in Europe helped keep the losses in check. Nestle dropped after warning profitability may decline for a second year and Swedish cloud communications firm Sinch AB fell after reporting weak growth. Reckitt Benckiser Group Plc jumped after forecasting profit margin growth, while Kering SA gained as Gucci sales surged past pre-pandemic levels. Here are the most notable European market movers:

- Kering shares jump as much as 7.9%, the most intraday since November 2020, after the French luxury conglomerate reported 4Q sales at its Gucci brand that impressed analysts. Peers LVMH, Hermes and Burberry also rise.

- Reckitt rises as much as 5.6%, the most since Oct. 26, after it reported 4Q like-for-like sales that beat the average analyst estimate. The firm finished FY21 “strongly,” powered by its health division, according to Jefferies.

- Carrefour climbs as much as 5.3% after the French grocer reported 4Q sales and full-year results that Jefferies said show ongoing progress in French recovery and “impressive” free cash. The broker lifted its price target to EU22 from EU21.75.

- Schneider Electric gains as much as 2.7% in Paris after the company reported results and gave FY22 forecasts including organic revenue of +7% to +9%. Liberum highlights a 2% 4Q sales beat and expects both the margin beat and guidance for margin expansion to be taken favorably.

- RWE rises as much as 5.6% after the company raised its forecast.

- Arcadis surges as much as 9.2%, the most intraday since October 2020, after 4Q results that KBC Securities said beat consensus “on nearly all metrics.”

- Sinch slumps as much as 17%, the most since Nov. 2, after the Swedish cloud communications firm posted 4Q earnings which included a miss on adjusted Ebitda and a slowdown in organic revenue growth. Handelsbanken notes weak gross profit growth weighed on results.

- Standard Chartered falls as much as 5.1% after reporting full-year results that Shore Capital (buy) described as “disappointing.”

- Sodexo drops as much as 6.6% after the French caterer unexpectedly said it’s appointing chairwoman Sophie Bellon as its new CEO, disappointing investors.

Earlier in the session, Asian equities edged up as expectations for easing of pandemic restrictions in some countries fueled a rally in shares tied to economic reopening. The MSCI Asia Pacific Index was up 0.1% after falling as much as 0.5% on renewed geopolitical concerns. Japanese travel-related stocks jumped ahead of a conference by Prime Minister Fumio Kishida where he is expected to ease virus-related curbs. South Korea’s cosmetic makers advanced on hopes for looser mask rules, while Singapore’s aviation stocks gained on plans to cut travel and social restrictions. EARLIER: Asian Stocks Reverse Early Gains on Fresh Concerns Over Ukraine Reopening stocks were in focus in Hong Kong too after a report that the financial hub plans to mass test the entire city spurred optimism that authorities are laying the groundwork to gradually open the economy. “Investors are looking at the growth story in Asia as countries ease restrictions, especially for inbound travel,” said Margaret Yang, a strategist at DailyFX. “We don’t see much of a cloud ahead of us in this region with the market already pricing in Fed hawkishness to a large extent.” Equity benchmarks in New Zealand and Vietnam were among the biggest gainers in Asia on Thursday. Traders were also weighing the minutes of the latest Federal Reserve meeting, which showed officials concluded that they would start raising interest rates soon and were on alert for persistent inflation that would justify a faster pace of tightening. “How the market views Fed’s rate hike trajectory will be cleared up quite a bit in the next two to three months, after which we’d have exhausted the negative side of things,” said Tomo Kinoshita, a global market strategist at Invesco Asset Management in Tokyo. Then, “share prices will gradually be back on a recovery trend.”

Japanese equities fell for a third time in four days amid renewed concerns over Russia-Ukraine tensions. Electronics makers and service providers were the biggest drags on the Topix, which fell 0.8%. Recruit and Fast Retailing were the largest contributors to a 0.8% loss in the Nikkei 225. Losses accelerated in the afternoon after Russian state news agency RIA Novosti reported Russian-backed separatists had claimed Ukrainian forces violated cease-fire rules overnight in four places, without mention of casualties. Allegations of cease-fire violations from both sides are frequent. The Kremlin has repeatedly denied any plans to invade its neighbor. Positive earnings from Applied Materials have been a reason to buy up electronics-sector shares, “but apart from that, a lot of other sectors will fall on risks of potential conflict in Ukraine,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities.

Indian stocks fell for a second day, after fluctuating between gains and losses several times through the session, as traders weighed developments around Ukraine as well as prospects for U.S. Federal Reserve interest-rate hikes. The S&P BSE Sensex dropped 0.2% to 57,892.01 in Mumbai, while the NSE Nifty 50 Index slipped 0.1%. Of the 30 shares on the Sensex, 19 dropped and 11 gained. ICICI Bank Ltd. was the biggest drag on the index and fell 1.8%. Thirteen of 19 sectoral indexes compiled by BSE Ltd. declined, led by a group of lenders. Activity on the Ukraine-Russia border is a focus of investors’ attention, along with the latest U.S. Fed minutes that showed officials plan to start raising rates soon and are on alert for inflation. “Trading in current scenario is not recommended,” Rahul Sharma, analyst at Equity 99, wrote in a note. “Investors will get many opportunities to buy quality stocks at dips in coming days.” The earnings season for India’s top companies ended Thursday with 28 of the 50 Nifty companies either meeting or exceeding estimates. Nineteen have missed profit estimates, while three can’t be compared.

In rates, Treasuries hold some of the flight-to-quality gains amassed during Asia session after report Russian-backed separatists claimed that Ukrainian forces violated cease-fire rules. Yields lower on the day by 3bp-5bp across most of the curve. 10-year yield hovers around 2%, richer by ~3bp vs Wednesday’s close and outperforming bunds by 2.5bp; gilts trade broadly in line with Treasuries in the sector. Long-end lags on the curve, steepening 5s30s by ~2bp on the day. There is a $9b 30-year TIPS auction is ahead at 1pm ET. The new issue is poised to draw the first positive yield in sales of the tenor since February 2020, following record-low result of -0.292% in the most recent semiannual 30-year TIPS sale in August; current- issue yield is about 0.15%. Yields on Germany's 10-year government bond , the go-to safe-haven asset in the euro zone, were little changed at 0.267%.

In FX, the dollar was little changed; G-10 currency trading more broadly did not resemble traditional risk-off, with Kiwi and Aussie dollars plus pound outperforming. The yen jumped as Russian state news agency RIA Novosti reported Russian-backed separatists’ claims of Ukrainian forces violating cease-fire rules overnight in four places. Yen jumped as much as 0.5% while the Russian ruble fell around 1% to halt a three-day bounce, the worst performer among EMs.

In commodities, crude benchmarks were pressured as we await clarity on reported shelling in Donbas; currently, and WTI Brent remain around USD 1.00/bbl from the overnight trough. The current peaks of USD 93.31/bbl and USD 94.48/bbl in WTI and Brent were set overnight on the initial report via Sputnik of Ukraine firing shells on LPR localities. However, Ukraine has denied this saying Russian forces were responsible; EU leaders to meet later on the subject. Oil has been hurt by the prospect of a resumption in official Iranian exports if diplomatic talks lead to a nuclear accord, but it has also been whipsawed by supply worries stemming from the Russian troop buildup. European natural gas prices increased after two days of declines. China state planner asks some iron ore traders to help verify if there is hoarding or other irregularities; asks some iron ore traders to release high inventories to decent level; will set up market supervision.

Gold prices broke higher to hit an eight-month high of $1,892 an ounce , up 1.2% on the session and helped by nervousness across markets and a weaker dollar.

Bitcoin is under modest pressure, but remains within a USD 43-44k range thus far.

To the day ahead now, and data releases include US housing starts and building permits for January, along with the weekly initial jobless claims. From central banks, the ECB will be publishing their Economic Bulletin, and we’ll also hear from the ECB’s Lane, De cos, and the Fed’s Bullard and Mester. Finally, Walmart will be releasing earnings.

Market Highlights

- S&P 500 futures down 0.3% to 4,458.00

- STOXX Europe 600 down 0.1% to 467.30

- MXAP up 0.1% to 190.35

- MXAPJ up 0.4% to 627.45

- Nikkei down 0.8% to 27,232.87

- Topix down 0.8% to 1,931.24

- Hang Seng Index up 0.3% to 24,792.77

- Shanghai Composite little changed at 3,468.04

- Sensex little changed at 57,984.72

- Australia S&P/ASX 200 up 0.2% to 7,296.18

- Kospi up 0.5% to 2,744.09

- German 10Y yield little changed at 0.26%

- Euro down 0.1% to $1.1359

- Brent Futures down 1.0% to $93.82/bbl

- Brent Futures down 1.0% to $93.82/bbl

- Gold spot up 1.1% to $1,891.21

- U.S. Dollar Index up 0.15% to 95.85

Top Overnight News from Bloomberg

- Russia’s Foreign Ministry denied a claim by the U.S. and Britain that it’s added as many as 7,000 troops to what President Joe Biden has said are around 150,000 soldiers already near Ukraine’s borders

- European natural gas prices jumped after two days of declines as the U.S. rejected Russia’s claims that it was pulling back troops from the border with Ukraine

- With precipitous drops in some leading technology stocks and wild swings in the S&P 500, equities have provided plenty of drama this year. But for clues to the direction of the U.S. economy, listen to the $23 trillion U.S. Treasury market. Right now, that market is saying inflation and the potential for a slowdown in growth are both threats

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed as the region trimmed earlier gains on reports of tensions in Ukraine. ASX 200 was propped up by its Healthcare and Mining sectors whilst Telstra and Wesfarmers fell on earnings. Nikkei 225 saw upside capped by manufacturers after Japanese exports missed forecasts, with Nikkei citing slowing overseas demand for cars and global supply constraints. Hang Seng and were non-committal in early trade and the indices swung between gains andShanghai Comp. losses

Top Asian News

- Hong Kong Is Said to Plan Testing Entire Population for Covid

- Taiwan Sees Xi as Too Focused on Big Reshuffle to Attack Now

- Hong Kong Should Mull Delaying Election, Lawmaker Says

- Gold Fields Bet on Giant Mine Pays Off After Years of Losses

European bourses remain at the whim of geopolitical developments, performance waned after a firmer cash open (Euro Stoxx 50 Unch.) in-spite of a brief respite on generally constructive corporate updates. As such, are softer across the board (ES -0.5%), moving with the broader risk tone as we await clarity US futures on the shelling in Donbas. Given broader sentiment, sectors are a mixed bag as leads post-earnings from KeringLuxury/Personal Goods and Carrefour while are pressured on benchmark performance given geopols; a dynamic that explainsOil & Gas the -0.6% relative underperformance alongside FX dynamics.

Top European News

In commodities, crude benchmarks are pressured as we await clarity on reported shelling in Donbas; currently, and WTI Brent remain around USD 1.00/bbl from the overnight trough. The current peaks of USD 93.31/bbl and USD 94.48/bbl in WTI and Brent were set overnight on the initial report via Sputnik of Ukraine firing shells on LPR localities. However, Ukraine has denied this saying Russian forces were responsible; EU leaders to meet later on the subject. Russia's Italian ambassador says that Russian PM Putin has told Italian PM Draghi that they are ready to increase gas supplies to Italy, if required, via Reuters. Spot gold/silver are bid amid the tentative risk-sentiment. Action that spurred spot gold to just shy of USD 1900 /oz, though we are yet to mount a convincing test of the mark. China state planner asks some iron ore traders to help verify if there is hoarding or other irregularities; asks some iron ore traders to release high inventories to decent level; will set up market supervision.

In FX, the Kiwi evades risk-off headwinds amidst constructive Antipodean cross flows in the run up to next week’s RBNZ meeting, as some speculate on an above consensus 50 bp hike. Yen in favour as mortar fire in Eastern Ukraine rekindles fear of military conflict - USD/JPY tests psychological support near 115.00 where options begin and end at 114.90 in line with a key Fib. Rouble rattled by rising tensions and potential further sanctions. Dollar betwixt and between after less hawkish than anticipated FOMC minutes as DXY struggles to keep taps on the 96.00 level Lira was on edge ahead of the CBRT, but ultimately unfazed by unchanged Repo Rate, as Turkish President repeats pledge to lower rates and inflation.

Central banks:

- ECB's de Cos says the policy direction is clear but the ECB should not draw any premature conclusions when it comes to timeframes, with a highly uncertain situation such as tensions in Ukraine, ECB should not provide a further source of uncertainty. PEPP reinvestments should be used flexibly and proactively.

- ECB lifts its own provisions for financial risks to maximum, according to the annual report.

- CBRT Policy Announcement: Holds rates at 14.00% (exp. 14.00%); says comprehensive review on policy framework being conducted; will continue to use all tools decisively

- Turkish President says Turkey will break the shackles of interest rates with the goal to lower inflation to single digits.

In Fixed Income, bonds remain bid, but rangy after overnight surge on safe-haven grounds. Debt still in the grip of geopolitical dynamics as Russia and Ukraine exchange accusations over the shelling in Eastern Ukraine. OATs and absorb French and Spanish supply reasonably well

US Event Calendar

- 8:30am: Feb. Initial Jobless Claims, est. 218,000, prior 223,000; Continuing Claims, est. 1.61m, prior 1.62m

- 8:30am: Jan. Building Permits MoM, est. -7.2%, prior 9.1%, revised 9.8%; Building Permits, est. 1.75m, prior 1.87m, revised 1.89m

- 8:30am: Jan. Housing Starts MoM, est. -0.4%, prior 1.4%; Housing Starts, est. 1.7m, prior 1.7m

- 8:30am: Feb. Philadelphia Fed Business Outl, est. 20.0, prior 23.2

DB's Jim Reid concludes the overnight wrap

I'm looking for a dog psychologist this morning. Our dog Brontë has always taken socks and shorts etc. and buried them in the bushes outside. This is fairly annoying but this past week she has suddenly moved onto far more high value stuff. She's managed to sneak out of our back door, and bury, one of my wellington boots, a full girl’s school uniform and my wife's comfy slippers. All have been eventually found buried deep in mud after an extensive search through the bushes by my wife. As long as Brontë doesn't take my crutches then it’s a curiosity for now but any clues as to what's she trying to tell us gratefully received.

For most of the day the market was lightly buried under geopolitical risk. However the session was turned around towards the end as the FOMC minutes delivered no surprises which was a relief to many. The S&P 500 managed to creep into positive territory, finishing +0.09% higher, with cyclical stocks leading the way. The index was -0.75% immediately before the release of the minutes. Tech stocks slightly underperformed, with the NASDAQ ending -0.11%.

The minutes showed the Fed had discussed principles that would inform their decisions on QT, but didn’t discuss any of those decisions themselves. They emphasised what the market had already come to expect, that liftoff is all but guaranteed at the next meeting in March, but didn’t provide any insights as to whether liftoff will be +25bps or +50bps. To be fair this was before the 7.5% CPI print last week. Nevertheless markets liked the lack of incremental hawkishness and 2yr treasury yields declined a further -2bps following the minutes, bringing the day’s rally to -5.7bps, as it seemed some were perhaps expecting a more active debate around a potential +50bp hike. In turn, the chance of a +50bp hike priced in STIR markets was reduced marginally, ending the day around 49%.

10yr US Treasury yields ended the day -0.5bps at 2.04%, which led to the 2s10s steepening by +5.2ps to 51.3bps. As it happens, that’s the first time that the 2s10s curve has steepened for two days in a row since the first two trading sessions of the year, which just shows how the picture in 2022 so far has mostly been one of pretty relentless flattening.

The developments actually coincided with strong US data releases yesterday for January, backing up the better-than-expected picture we’d seen from the jobs report. First, retail sales expanded by +3.8% (v.s +2.0% expected) in their fastest monthly gain since last March, whilst the figure excluding autos was up +3.3% (vs. +1.0% expected). Then we also had the industrial production numbers, which grew by +1.4% (vs. +0.5% expected).

We also saw our now regular series of inflation beats come through. The UK CPI release for January came in at a post-1992 high of +5.5% (vs. +5.4% expected), with the number also being above the BoE’s own staff projection of +5.4% in their Monetary Policy Report two weeks ago. Core CPI was similarly a tenth above expectations at +4.4%, having hit a post-1992 high of its own too. Then later in the day we had the same data from Canada, with CPI up to +5.1% (vs. +4.8% expected), having surpassed 5% for the first time since 1991.

Those upside inflation surprises failed to stop sovereign bond yields moving lower in Europe, even as we also had comments from Latvian central bank Governor Kazaks that the ECB was “quite likely” to raise interest rates this year to deal with inflation. Indeed, the earlier risk-off tone actually saw investors dial down their bets on the amount of tightening expected this year by the ECB and the BoE, helping yields on 10yr bunds to fall -3.1bps to 0.27%, as those on 10yr OATs (-2.9bps) and gilts (-5.7bps) fell back too. The biggest declines across DM sovereign yields was in 2yr gilts which fell -12.6bps. Traders pared back bets the BoE would hike by +50bps at the March MPC from a 72% probability on Tuesday to a 54% chance by yesterday’s close, as inflation data, whilst beating, did not deliver the same kind of fireworks as US CPI. It seems there must have been some positioning squaring after the print.

To be fair the European fixed income rally was helped by earlier comments from the US and allies contradicting the assertion that Russia was pulling back troops, with NATO Secretary General Stoltenberg saying that it appeared as though Russia was continuing its military build-up, and they had not seen any de-escalation on the ground. He added that this appeared to be the “new normal” for Europe, downplaying hopes of any discrete conclusion to the crisis. Later in the session, those remarks were given further backing by US Secretary of State Blinken in an MSNBC interview, who said “We continue to see critical units more toward the border and not away from the border”.

That more negative rhetoric from officials was reflected in oil prices which traded near recent highs intraday, moving above $95/bbl at one point, before marking a very sharp turn lower in the afternoon, with Brent Crude (-3.32%) closing at $93.28/bbl. European natural gas prices fared better, paring back losses of -9.11% shortly after the open to only close -1.58% lower. The impact was also evident in safe haven assets, with precious metals including gold (+0.87%) and silver (+1.00%) erasing some of the previous day’s declines as well.

Earlier, European equities were relatively subdued, with the STOXX 600 eking out a +0.04% gain, even as a number of the continent’s major indices such as the DAX (-0.28%) and the CAC 40 (-0.21%) lost ground.

This morning Asian markets have put in a mixed performance following the release of those Fed minutes. Mainland Chinese stocks are trading higher with the Shanghai Composite (+0.35%) and CSI (+0.62%) both advancing, and the Kospi was also up +0.43%. However, the Hang Seng (-0.62%) has reversed its early morning gains, and the Nikkei (-0.85%) is trading lower after Japan’s exports grew less than expected due to slowing external demand coupled with global supply constraints. The data showed exports rose +9.6% y/y (vs. +17.1% expected), with the country also recording its biggest monthly trade deficit in eight years. Looking ahead, equity futures are pointing lower in the US and Europe, with those on the S&P 500 (-0.50%) and DAX (-0.67%) both down.

Oil prices also have also been under pressure overnight amidst the prospects of an Iranian nuclear deal being reached, with Brent crude down -1.09% to $93.78/bbl. Meanwhile, USTs extended their retreat with the 10-year yield easing -4.4bps to move back just beneath the 2% mark, at 1.995%.

To the day ahead now, and data releases include US housing starts and building permits for January, along with the weekly initial jobless claims. From central banks, the ECB will be publishing their Economic Bulletin, and we’ll also hear from the ECB’s Lane, De cos, and the Fed’s Bullard and Mester. Finally, Walmart will be releasing earnings.

Government

Looking Back At COVID’s Authoritarian Regimes

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked,…

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked, in March 2020, when President Trump and most US governors imposed heavy restrictions on people’s freedom. The purpose, said Trump and his COVID-19 advisers, was to “flatten the curve”: shut down people’s mobility for two weeks so that hospitals could catch up with the expected demand from COVID patients. In her book Silent Invasion, Dr. Deborah Birx, the coordinator of the White House Coronavirus Task Force, admitted that she was scrambling during those two weeks to come up with a reason to extend the lockdowns for much longer. As she put it, “I didn’t have the numbers in front of me yet to make the case for extending it longer, but I had two weeks to get them.” In short, she chose the goal and then tried to find the data to justify the goal. This, by the way, was from someone who, along with her task force colleague Dr. Anthony Fauci, kept talking about the importance of the scientific method. By the end of April 2020, the term “flatten the curve” had all but disappeared from public discussion.

Now that we are four years past that awful time, it makes sense to look back and see whether those heavy restrictions on the lives of people of all ages made sense. I’ll save you the suspense. They didn’t. The damage to the economy was huge. Remember that “the economy” is not a term used to describe a big machine; it’s a shorthand for the trillions of interactions among hundreds of millions of people. The lockdowns and the subsequent federal spending ballooned the budget deficit and consequent federal debt. The effect on children’s learning, not just in school but outside of school, was huge. These effects will be with us for a long time. It’s not as if there wasn’t another way to go. The people who came up with the idea of lockdowns did so on the basis of abstract models that had not been tested. They ignored a model of human behavior, which I’ll call Hayekian, that is tested every day.

These are the opening two paragraphs of my latest Defining Ideas article, “Looking Back at COVID’s Authoritarian Regimes,” Defining Ideas, March 14, 2024.

Another excerpt:

That wasn’t the only uncertainty. My daughter Karen lived in San Francisco and made her living teaching Pilates. San Francisco mayor London Breed shut down all the gyms, and so there went my daughter’s business. (The good news was that she quickly got online and shifted many of her clients to virtual Pilates. But that’s another story.) We tried to see her every six weeks or so, whether that meant our driving up to San Fran or her driving down to Monterey. But were we allowed to drive to see her? In that first month and a half, we simply didn’t know.

Read the whole thing, which is longer than usual.

(0 COMMENTS) budget deficit coronavirus covid-19 white house fauci trump canadaUncategorized

The hostility Black women face in higher education carries dire consequences

9 Black women who were working on or recently earned their PhDs told a researcher they felt isolated and shut out.

Isolated. Abused. Overworked.

These are the themes that emerged when I invited nine Black women to chronicle their professional experiences and relationships with colleagues as they earned their Ph.D.s at a public university in the Midwest. I featured their writings in the dissertation I wrote to get my Ph.D. in curriculum and instruction.

The women spoke of being silenced.

“It’s not just the beating me down that is hard,” one participant told me about constantly having her intelligence questioned. “It is the fact that it feels like I’m villainized and made out to be the problem for trying to advocate for myself.”

The women told me they did not feel like they belonged. They spoke of routinely being isolated by peers and potential mentors.

One participant told me she felt that peer community, faculty mentorship and cultural affinity spaces were lacking.

Because of the isolation, participants often felt that they were missing out on various opportunities, such as funding and opportunities to get their work published.

Participants also discussed the ways they felt they were duped into taking on more than their fair share of work.

“I realized I had been tricked into handling a two- to four-person job entirely by myself,” one participant said of her paid graduate position. “This happened just about a month before the pandemic occurred so it very quickly got swept under the rug.”

Why it matters

The hostility that Black women face in higher education can be hazardous to their health. The women in my study told me they were struggling with depression, had thought about suicide and felt physically ill when they had to go to campus.

Other studies have found similar outcomes. For instance, a 2020 study of 220 U.S. Black college women ages 18-48 found that even though being seen as a strong Black woman came with its benefits – such as being thought of as resilient, hardworking, independent and nurturing – it also came at a cost to their mental and physical health.

These kinds of experiences can take a toll on women’s bodies and can result in poor maternal health, cancer, shorter life expectancy and other symptoms that impair their ability to be well.

I believe my research takes on greater urgency in light of the recent death of Antoinette “Bonnie” Candia-Bailey, who was vice president of student affairs at Lincoln University. Before she died by suicide, she reportedly wrote that she felt she was suffering abuse and that the university wasn’t taking her mental health concerns seriously.

What other research is being done

Several anthologies examine the negative experiences that Black women experience in academia. They include education scholars Venus Evans-Winters and Bettina Love’s edited volume, “Black Feminism in Education,” which examines how Black women navigate what it means to be a scholar in a “white supremacist patriarchal society.” Gender and sexuality studies scholar Stephanie Evans analyzes the barriers that Black women faced in accessing higher education from 1850 to 1954. In “Black Women, Ivory Tower,” African American studies professor Jasmine Harris recounts her own traumatic experiences in the world of higher education.

What’s next

In addition to publishing the findings of my research study, I plan to continue exploring the depths of Black women’s experiences in academia, expanding my research to include undergraduate students, as well as faculty and staff.

I believe this research will strengthen this field of study and enable people who work in higher education to develop and implement more comprehensive solutions.

The Research Brief is a short take on interesting academic work.

Ebony Aya received funding from the Black Collective Foundation in 2022 to support the work of the Aya Collective.

depression pandemicUncategorized

US Economic Growth Still Expected To Slow In Q1 GDP Report

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised…

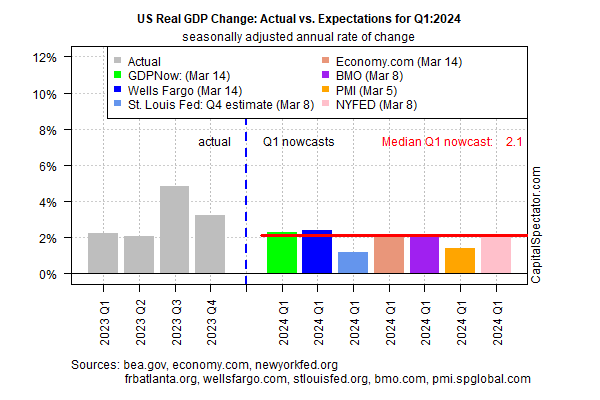

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised estimate is based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Output for the January-through-March period is currently projected to soften to a 2.1% increase (seasonally adjusted annual rate). The estimate reflects a substantially softer rise vs. Q4’s strong 3.2% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to government data.

Today’s revised Q1 estimate was essentially unchanged from the previous Q1 nowcast (published on Mar. 7). At this late date in the current quarter, the odds are relatively high that the current median estimate is a reasonable guesstimate for the actual GDP data that the Bureau of Economic Analysis will publish in late-April.

GDP rising at roughly a 2% pace marks another slowdown from recent quarters, but if the current nowcast is correct it suggests that recession risk remains low. The question is whether the slowdown persists into Q2 and beyond. Given the expected deceleration in growth on tap for Q1, the economy may be flirting with a tipping point for recession later in the year. It’s premature to make such a forecast with high confidence, but it’s a scenario that’s increasingly plausible, albeit speculatively so for now.

Yesterday’s release of retail sales numbers for February aligns with the possibility that even softer growth is coming. Although spending rebounded last month after January’s steep decline, the bounce was lowr than expected.

“The modest rebound in retail sales in February suggests that consumer spending growth slowed in early 2024,” says Michael Pearce, Oxford Economics deputy chief US economist.

Reviewing retail spending on a year-over-year basis provides a clearer view of the softer-growth profile. The pace edged up to 1.5% last month vs. the year-earlier level, but that’s close to the slowest increase in the post-pandemic recovery.

Despite emerging signs of slowing growth, relief for the economy in the form of interest-rate cuts may be further out in time than recently expected, due to the latest round of sticky inflation news this week.

“When the Fed is contemplating a series of rate cuts and is confronted by suddenly slower economic growth and suddenly brisker inflation, they will respond to the new news on the inflation side every time,” says Chris Low, chief economist at FHN Financial. “After all, this is not the first time in the past couple of years consumers have paused spending for a couple of months to catch their breath.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

recession pandemic economic growth fed recession gdp recovery consumer spending

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A