Futures Rebound On Hopes Of Resuming Ukraine Negotiations, Oil Soars To Decade High

Futures Rebound On Hopes Of Resuming Ukraine Negotiations, Oil Soars To Decade High

U.S. futures and European stocks rose on Wednesday after…

U.S. futures and European stocks rose on Wednesday after the Kremlin said Russia was ready to resume negotiations with Ukraine. Nasdaq 100 contracts were up 0.7% by 730 a.m. ET reversing earlier declines of as much as 0.8%. S&P 500 futures rose 0.5%, while Dow futures gained 0.7%. Oil soared with Brent trading above $111 as traders realized that Russian oil output will be substantially reduced despite sanction loopholes. The dollar rose and 10Y yields rose.

Among notable premarket movers, Salesforce.com shares climbed as much as 3.9% after the enterprise software company forecast first-quarter revenue above estimates, while Nordstrom Inc. surged 34% as its sales and guidance for 2022 both topped expectations. SoFi Technologies Inc. also gained 21% on better-than-expected quarterly results. Hewlett Packard Enterprise climbed after raising its profit forecast. Bank shares also rose, putting them on track to rebound from their worst day since June 2020. In corporate news, Mastercard said it got about 4% of its net revenues last year from business linked to Russia, while Ukraine-related business accounted for about 2%. Meanwhile, Morgan Stanley has raised $2 billion for its latest private equity fund North Haven Capital Partners VII.

Global equity markets have been whipsawed since last week after Russia’s invasion of Ukraine, which sent commodity prices to historic highs and raised worries of the economic hit from resulting sanctions. With investors now abandoning bets on a half-percentage point rate hike by the Federal Reserve in March, focus will be on Chair Jerome Powell’s testimony to lawmakers later today, in which he is expected to signal the U.S. central bank will go ahead with plans to hike rates this month, reassure lawmakers that the central bank will act to curb the highest inflation rates in decades.

"A Catch-22 for markets is set up," Mark Taylor, a trader at Mirabaud Securities, wrote in an email. “The Fed will not be looking to shock and awe while there are fears of nukes flying around. This all means short-term stagflation fears build, but when we can breath relief that the situation with Russia is coming to a conclusion, there will be another day of normalization and reality will bite with a vengeance.”

“The Fed is going to have to continue to tamp down inflation, which I think is invariably going to get worse before it gets better,” Kathryn Rooney Vera, head of global macro research at Bulltick LLC, said on Bloomberg Television. “We said stagflation is the biggest risk this year and that’s going to be the case.”

US President Biden said getting prices under control is his highest priority and that he will soon send Congress a request for more pandemic-related funding. Biden outlined details of his plan to fight inflation called Building a Better America in which he called for the lowering of costs not wages such as through building cars in the US and wants to lower drug prices. Furthermore, he announced a new "test to treat" program in which people that test positive for COVID-19 at a pharmacy can get free antiviral pills on the spot. Biden's administration weighs potential new probe aimed at US' edge in new technologies in a move to confront China, WSJ reports; sources say efforts could include a new investigation under Section 301. Additionally, sources add they are considering heightened scrutiny of US companies investments within China and tighter export controls on sensitive tech and greater cooperation with Asian/European allies.

Meanwhile, hostilities in Ukraine continue; Here is a snapshot of the latest developments courtesy of Newsquawk:

- Ukraine and Russia will hold a second round of discussion later today, via Tass citing a aide to the Ukraine presidential office

- Russia's Kremlin says the Russian delegation will be waiting later today and are ready to continue talks; not clear if Ukrainian officials will attend the talks. Will "not shoot ourselves in foot" with countersanctions. Are huge quantities of "nationalist units" in Ukraine that must be got rid of; need to punish them for crimes against own people.

- Ukraine Foreign Minister says Russia's demand are unchanged from what President Putin said at the start of the war.

- US President Biden announced that the US will join allies and ban Russian flights from using US airspace , while the DoJ is assembling a task force to go after the crimes of Russian oligarchs and the US is joining European allies to find and seize assets. Biden added that they are choking off Russia's access to technology that will sap its economic strength and weaken its military for years to come.

- US official said “he could imagine Putin detonating a nuclear weapon in the atmosphere over an unpopulated area as a warning to the West.”, according to Fox News' Bryan Llenas

- Russia’s Defense Ministry said on Wednesday that its forces had captured Kherson, a Ukrainian port, according to a report by Interfax. The government in Kyiv hasn’t confirmed the information, but said overnight that troops were moving toward the city.

- European Union ambassadors agreed to exclude seven Russian banks from the SWIFT financial-messaging system but spared the nation’s biggest lender Sberbank PJSC and a bank part-owned by Russian gas giant Gazprom PJSC

- Russia’s central bank banned coupon payments to foreign owners of ruble bonds known as OFZs

- The Ukrainian army also said that Russian airborne troops landed in Kharkiv, according to AFP.

- EU Council agreed on sanctions to exclude some Russian banks from the SWIFT system and voted to ban broadcasting of Sputnik and RT in the EU.

- Russian envoy to UN Gatilov said the time has come to remove nuclear weapons from western and eastern Europe, while they see no desire on part of the Ukrainian regime to try and find a legitimate and balanced solution to problems.

- Russian Foreign Minister Lavrov says Crimea is part of Russia and non-negotiable, via Al Jazeera; will not allow Ukraine to obtain nuclear weapons

- Turkish Foreign Minister expects Russia and Ukraine to reach ceasefire agreement in upcoming talks, according to Sputnik

- Trading platform MarketAxes will not provide trading for Russian sovereign bonds and corporates until further notice

- US nuclear power industry is lobbying the White House to allow continued uranium imports from Russia, according to Reuters sources.

- IAEA Nuclear watchdogs have convened an emergency meeting in Vienna. Follows Russia informing the IAEA that is has control of territory around Zaporizhzhia, the location of a nuclear plant.

In Europe, the Stoxx 600 erased early declines to trade 0.3% higher. Energy and mining stocks outperformed, while utilities were the biggest decliners. Ericsson led European telecom shares lower after the U.S. Department of Justice said it failed to make adequate disclosures about its operations in Iraq. Italian bonds led euro-area peers lower, paring Tuesday’s sharp gains, as money markets brought forward wagers on a quarter-point European Central Bank rate hike to year-end from 2023, after data showed consumer prices surged to an all-time in February.

Earlier in the session, Asian stocks were poised to snap a streak of three-straight gains as escalating Russia-Ukraine tensions and surging oil prices spurred a broad risk-off mood. The MSCI Asia Pacific Index fell as much as 1.3%, with financial and consumer-discretionary shares the biggest drags. Japanese equities were among the region’s worst performers, while Hong Kong shares retreated on a looming lockdown amid a Covid-testing blitz. Asian markets saw some reprieve earlier this week as talks between Russia and Ukraine slightly eased investors’ concerns. However, selling pressure returned Wednesday as a surge in commodity prices amid more sanctions fanned expectations for higher inflation. U.S. President Joe Biden vowed to confront Russia over its invasion of Ukraine in his first State of the Union address. The Asian stock benchmark has declined about 6% so far this year, compared to drops of about 10% in the European and U.S. counterparts. “We are entering a new phase where we have inflation, but central banks will be unable to tackle it as decisively as before since they need to take care of risk-off markets,” said Hiroshi Yokotani, managing director at State Street Global Advisors. “The next step for market players is to prepare for more risk-off trade.” Geopolitical tensions have led to some paring back of rate-hike bets, and a 50-basis-point increase by the Federal Reserve this month now appears almost off the table. Investors will be eyeing Fed Chairman Jerome Powell’s congressional speech for more clues.

Japanese equities fell, following U.S. peers lower, as a spike in oil prices drove concerns over inflation. Electronics and auto makers were the biggest drags on the Topix, which fell 2%, the most since Jan. 27. Tokyo Electron and Daikin were the largest contributors to a 1.7% loss in the Nikkei 225. “The Ukraine situation is worsening, spurring concern over a slowdown in the global economy,” said Mitsushige Akino, a senior executive officer at Ichiyoshi Asset Management. “There’s growing worry over stagflation with a jump in the prices of natural resources including crude.”

Indian stocks fell, tracking peers across Asia, as surging crude oil prices fanned inflationary risks. The S&P BSE Sensex slipped 1.4% to 55,468.90, in Mumbai, snapping two sessions of gains. The NSE Nifty 50 Index declined 1.1% to 16,605.95. India’s markets were closed for a holiday yesterday. HDFC Bank retreated 3.7% to its lowest level since April 2021 and was the biggest drag on both key indexes. Thirteen of the 19 sector sub-indexes compiled by BSE Ltd. dropped, led by a gauge of auto stocks. Sanctions imposed in response to Russia’s invasion of Ukraine have pushed the price of Brent oil, a major Indian import, to about $111 a barrel. Higher commodity prices have also clouded global monetary policy, with central banks’ battling price pressures while trying to keep growth on track. READ: India’s Economic Recovery Slows Amid Growing External Risks “The market is currently caught between many macro crosswinds – higher inflationary pressure exerted by sharp rises in commodities prices across the board, determination on the part of central banks to withdraw monetary accommodation and slowing growth impulses,” said S Hariharan, head of sales at Emkay Global Financial Services. Metal and energy companies were key gainers on Sensex, led by a 5.6% surge in Tata Steel Ltd. “The street is expecting oil prices to hit $120-125 a barrel sooner than later,” Prashanth Tapse, an analyst at Mehta Equities Ltd. wrote in a note. Long-term charts for the Nifty 50 are “painting a bearish picture,” with downside inter-month risk seen at 14,271 mark, according to the note.

In rates, treasuries retreated and yields rose 1-4bps, led by the front end, following yesterday's double VaR shock which saw front- and back-end yields crater. 10-year yields were near lows of the day, as S&P 500 futures follow European stocks higher: Treasury yields were heaper by ~7bp across front-end of the curve, flattening 2s10s by more than 3bp; 10-year yields back to around 1.75%, cheaper by 3bp vs Tuesday’s close; U.K. 10-year lags by ~5bp following Tuesday’s strong outperformance.

Italian bonds led euro-area peers lower, paring Tuesday’s sharp gains, as money markets brought forward wagers on a quarter-point European Central Bank rate hike to year-end from 2023, after data showed consumer prices surged to an all-time in February. Gilts and Bunds also pare some of Tuesday’s sharp gains, as money markets wager on a faster pace of ECB and BOE policy tightening amid a focus on surging inflation. Sovereign bonds surged in Japan, Australia and New Zealand on Wednesday, extending a global rally as Russia’s invasion of Ukraine spurred a flight to the safety of government debt; Aussie bonds trimmed gains after 4Q GDP data.

In FX, the Bloomberg Dollar Spot Index rose and the greenback traded mixed against its Group-of-10 peers. Australian and New Zealand dollars were the top performers as oil led commodity complex higher, though the Norwegian krone slumped along with Sweden’s krona, with the latter trading more than 1% lower against the greenback. The euro fell to a day low of $1.1059 in the European session, its weakest level since May 2020. The pound slid versus the dollar, touching the lowest level since December. The ruble fell for a third day in onshore trading after Russia said it would press forward with its invasion into Ukraine

In commodities, oil soared to decade highs with Brent hitting $111 and WTI trading around $110, amid reports that multiple buyers were boycotting Russian oil purchases.

Spot gold falls roughly $12 to trade at around $1,933/oz. Spot silver loses 1.4%, trades at $25. Most base metals trade in the green; LME zinc outperforming peers. Bitcoin is modestly firmer and at the top-end of the week's relatively substantial range.

Looking at the day ahead now, and data releases include the Euro Area’s flash CPI reading for February (which came in at a new record high of 5.8%, vs Exp. 5.4%), along with German unemployment for February, and the ADP’s report of private payrolls for February from the US. From central banks, the main highlight will be Fed Chair Powell’s testimony before the House Financial Services Committee, but we’ll also hear from the Fed’s Evans and Bullard, the ECB’s Vice Preisdent de Guindos and Chief Economist Lane, and the BoE’s Deputy Governor Cunliffe and Tenreyro. On top of that, the Bank of Canada will be making its latest monetary policy decision, and the Fed will release their Beige Book.

Market Snapshot

- S&P 500 futures up 0.4% to 4,319.50

- STOXX Europe 600 up 0.38% to 444.04

- MXAP down 1.3% to 180.98

- MXAPJ down 0.8% to 593.83

- Nikkei down 1.7% to 26,393.03

- Topix down 2.0% to 1,859.94

- Hang Seng Index down 1.8% to 22,343.92

- Shanghai Composite down 0.1% to 3,484.19

- Sensex down 1.5% to 55,388.36

- Australia S&P/ASX 200 up 0.3% to 7,116.66

- Kospi up 0.2% to 2,703.52

- German 10Y yield little changed at -0.04%

- Euro down 0.4% to $1.1079

- Brent Futures up 5.3% to $110.55/bbl

- Gold spot down 0.6% to $1,934.33

- U.S. Dollar Index up 0.30% to 97.70

Top Overnight News from Bloomberg

- The bond market is dialing back expectations for how quickly and steeply the Federal Reserve will raise interest rates as Russia’s war in Ukraine threatens to exert a drag on global economic growth

- Russia’s Defense Ministry said on Wednesday that its forces had captured Kherson, a Ukrainian port, according to a report by Interfax. The government in Kyiv hasn’t confirmed the information, but said overnight that troops were moving toward the city

- SNB Vice President Fritz Zurbruegg said inflation will “peak later this year and decelerate over the next year,” according to an interview published Wednesday in in L’Agefi

- China’s top government officials have issued orders to prioritize energy and commodities supply security, sparked by concerns over disruptions stemming from the Ukraine-Russia war

- The People’s Bank of China will add to its policy toolbox and further improve a framework that includes monetary policy and macroprudent policy in 2022, the country’s central bank said in a statement after a meeting on the matter

- Russia will pay a coupon due on ruble bonds on Wednesday, according to an official familiar with the matter, but it’s not clear how foreigners will be able to access the cash after the central bank banned transfers to foreign investors

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly negative following the weak handover from Wall St where all major indices declined and bonds surged as the ongoing geopolitical turmoil surrounding Ukraine spurred a flight to safety and firm rally in oil prices. ASX 200 gained with the index led higher by the energy sector after Brent crude reclaimed the USD 110/bbl level. Nikkei 225 was pressured as exporters suffered the ill-effects of recent outperformance in the domestic currency and with automakers subdued after several reported a decline in US auto sales for last month. Hang Seng and Shanghai Comp. were subdued following a substantial liquidity drain by the PBoC but with losses cushioned by strength in China’s oil majors and with Baidu shares rallying after it beat on earnings.

Top Asian News

- Singapore Aims to Clear Foreign Labor Crunch in ‘Few Months’

- Hong Kong Reports 55,353 Covid Cases, 117 Deaths Wednesday

- Gold Near 13-Month High as Invasion of Ukraine Spurs ETF Inflows

- Asian Stocks Snap Three-Day Rally on Renewed Ukraine Tensions

Losses in Europe trimmed and bourses are now predominantly positive following Kremlin commentary around today's potential negotiations, Euro Stoxx 50 +0.8%. Sectors have become less defensive as the session progressed, with Tech, Insurance and Banking names now firmer after being among the laggards around the open. US futures are firmer, ES +0.7%, posting broad-based gains and similarly benefitting from the Kremlin commentary; though, Focus turns to Fed Chair Powell's testimony.

Top European News

- Russia’s First Victim of Sanctions is Sberbank’s Europe Business

- Europe’s Biggest Logistics Firms Halt Deliveries Into Russia

- Gold Near 13-Month High as Invasion of Ukraine Spurs ETF Inflows

- Just Eat Takeaway Gains After ‘In Line’ Results

In FX, dollar outperforms as UST yields rebound and the curve steepens, DXY above 97.800 at one stage. Loonie resistant amidst another spike in oil ahead of BoC that is unanimously expected to lift rates by 25 bp and could provide QT guidance; USD/CAD closer to 1.2700 than 1.2750. Aussie and Kiwi underpinned after strong data and as commodity prices continue to climb - comfortably above 0.7250 and 0.6750 respectively. Euro still lagging fundamentally and technically with EUR/USD down to 1.1060 before paring some losses and EUR/CHF sub-1.0200. Yen retreats as bonds correct lower and momentum fades through 115 vs the Buck. Rouble still reeling as Russian assault rumbles on and Kremlin rails against nationalist factions in Ukraine.

In commodities, WTI and Brent are experiencing another session of substantial gains, posting upside in excess of USD 5.00/bbl with Brent May and WTI April peaking at USD 113.02/bbl and USD 111.50/oz respectively. US Energy Inventory Data (bbls): Crude -6.1mln (exp. +2.7mln), Gasoline -2.5mln (exp. -1.4mln), Distillate +0. 4mln (exp. -1.7mln), Cushing -1.0mln. US Department of Energy announced an emergency sale of 30mln bbls of crude oil from SPR and said the release is aimed at addressing market and supply disruptions related to the Russian invasion of Ukraine. US Senate GOP offered a bill to ban US purchase of Russian oil. US Transportation Secretary Buttigieg said everything is on the table when it comes to banning Russian oil imports to the US and that active discussions on that are being led by allies overseas, while he suggested there could be more heard about this in the coming days, according to Fox Business' Lawrence. China is reportedly moving to secure commodity supplies rocked by the Ukrainian conflict, according to Bloomberg; government officials have issued orders to prioritise energy and commodities supply security; pushing state-owned buyers to fill any potential supply gaps for barley, corn, iron ore and oil/gas. Italian oil giant Eni (ENI IM) is to pull out of Russia-Turkey gas pipeline, according to AFP. Yamal-Europe pipeline has resumed eastbound gas flows to Poland from Germany, via Reuters citing Gascade data. Spot gold/silver are softer as havens lost their allure amid the Kremlin's commentary around a Russia-Ukraine meeting; albeit, spot gold remains in proximity to the USD 1930/oz mark. OPEC+ is set to stick to its existing policy of gradual oil output increases at today's meeting despite the Ukraine crisis, according to multiple Reuters' sources. OPEC+ JMMC expected to be a short meeting, indicates OPEC+ will stick to existing plan for +400k BPD oil output increase in April, according to a Gulf source cited by Reuters.

US Event Calendar

- 7am: Feb. MBA Mortgage Applications, prior -13.1%

- 8:15am: Feb. ADP Employment Change, est. 375,000, prior -301,000

- 2pm: U.S. Federal Reserve Releases Beige Book

Central Banks

- 9am: Fed’s Evans Discusses Economy and Monetary Policy

- 9:30am: Fed’s Bullard Discusses the Economic Outlook

- 10am: Fed Chair Powell Testifies Before House Panel

- 2pm: U.S. Federal Reserve Releases Beige Book

- 4:30pm: New York Fed’s Logan Discusses Fed Asset Purchases

DB's Jim Reid concludes the overnight wrap

We'll have a full review of President Biden's State of the Union address and a further surge in oil overnight later but the main story for markets at the moment has been a remarkable day and a half for the rates market. This was especially prevalent yesterday in Europe. 10yr bunds (-21.0bps) fell back into negative territory (-0.072% at the close) after seeing their largest daily fall since the Euro Crisis over a decade ago. This was echoed right across the continent with yields on 10yr gilts (-28.1bps) seeing their largest decline since the day after the Brexit referendum in 2016, whilst OATs (-24.2bps), and BTPs (-30.5bps) saw similarly unprecedented moves lower. It’s certainly not a typical risk-off with Italy being the best performer which indicates that much of it is more to do with a dramatic repricing of the ECB’s potential hawkishness, which has likely been exacerbated by positioning dynamics given the increasing expectation of hawkish central bank action.

Indeed, overnight index swaps are pricing in just 5.6bps worth of hikes from the ECB by the December meeting, down from a peak above 50bps less than a month earlier, which would have been enough to take the deposit rate out of negative territory. That view was then given added support by Olli Rehn of Finland’s central bank, who said that “given the new situation, we need to take a moment of reflection as regards the speed and way of a gradual normalization of monetary policy”. The next ECB meeting is only a week tomorrow now, so we shouldn’t have long to wait to find out how the conflict is affecting their thinking. On our Russia/Ukraine call, Mark Wall suggested he believed the ECB re-pricing doesn’t reflect the overall concern the committee have on inflation so it's fair to say we have two huge conflicting forces here. For this week though the geopolitics are steamrolling over the inflation hawks for which I will put my hand up and say I am one.

This shift in central bank pricing was evident in the United States as well, where Fed funds futures not only moved to fully price out a 50bps hike at the next meeting, (only 96% probability of a 25bp hike now), but also priced out another -12.0bps worth of hikes from 2022 as a whole, having already taken out -21.5bps worth the previous day. This heightened uncertainty means that all eyes will be on Fed Chair Powell today, who’s testifying before the House Financial Services Committee, and his appearances today and tomorrow will be some of the last Fedspeak we get before the FOMC enters their pre-meeting blackout period this Saturday. In terms of the reaction from Treasuries, they had a more subdued move relative to their European counterparts, although yields on 10yr Treasuries were still down -9.8bps on the day to 1.73%, again entirely driven by lower real yields. There is not much change overnight. As I mentioned yesterday, real yields collapsing has probably helped cushion the blow for risk assets of the recent very negative events. US 10yr real yields are now -54.8bps lower from their post US CPI levels (Feb 10th), and -37.3bps over the last two days. At -0.97% they are below their levels from immediately before the December FOMC minutes released in early January that signalled the FOMC was more actively considering QT than the market was expecting, which kicked off the Fed’s hawkish turn that was the dominant market story for the first six to seven weeks of the year. How quickly things change. One other rates dynamic we were covering a lot before the geopolitical escalation was the flattening of the yield curve. The 2s10s curve has only flattened around -7bps since Biden’s speech noting an invasion was imminent back on February 11, so the rally has been a relatively parallel shock lower for the entire curve.

Another notable feature about yesterday’s moves was that even as investors moved to price out aggressive central bank hikes this year given the geopolitical risks, commodity prices actually took another leg higher to fresh multi-year highs. So central banks are going to have a real challenge on their hands as they seek to prevent supply-driven inflation becoming entrenched whilst also protecting growth. In terms of those commodity moves, Brent Crude oil prices were up by a massive +7.15% to $104.97/bbl, their highest closing level since 2014, whilst WTI also rose +8.03% to $103.41/bbl. They are up another 4-5% this morning so big moves in Asia. There were also big milestones amongst agricultural commodities yesterday, which again will be very bad news on the inflation front. On that, wheat futures (+5.35%) surpassed their previous high back in 2012 to move up to levels not seen since 2008, soybeans (+3.25%) hit a post-2012 high, and corn prices (+5.07%) hit their highest level since May 2021. Both Ukraine and Russia are large producers of wheat, together accounting for around 30% of the world’s wheat exports, so this is one of the channels where the direct economic impact is acute.

It was another bad day for equities against that backdrop, although to be fair both the major US and European indices are still notably above their lows from last week even with yesterday’s falls. By the close of trade, the S&P 500 (-1.55%) and the STOXX 600 (-2.37%) had both lost further ground, with cyclical sectors leading the declines on both sides of the Atlantic. The Vix advanced to 34.0pts, its highest level since January 2021. S&P futures are back up around +0.5% this morning. In Russia, the main indices remained closed yesterday, but depositary receipts traded in London pointed to further losses again, with those on Sberbank down by another -80.10%, on top of its -74.00% decline on Monday, whilst Gazprom fell by -71.32%, on top of its own -52.51% decline the previous day.

Last night President Biden gave the annual State of the Union address. He led the remarks with a show of support for Ukraine, championing the unity of western allies, and warning that Putin’s Russia would emerge from the conflict weaker. As he has argued before, Russia will not be made any weaker by way of American troops, which would only be in Europe to defend NATO territory. In terms of new developments, the President announced that American airspace would be restricted to all Russian flights.

He went on to signal fighting inflation as his top priority. The policies he’s prescribing, which all won’t make it to law (and were no longer framed as a single ‘build back better’ bill), focused on expanding the supply side of the economy to lower costs and discouraging anti-competitive dynamics. He also reiterated that the US would release strategic petroleum reserves to help cap energy costs. In terms of specific plans, Biden pitched for additional infrastructure investment to make US manufacturing and supply chains more productive, which he also framed as a way to compete economically versus China. He connected green investments as a way to cut energy costs as well, advocating investments in home energy efficiency and electric cars. On the labour market, he called for measures to lower the cost of child care to bring more parents into the work force to expand participation. The President also pitched tax reforms to offset the inflationary fiscal impulse of additional spending. Specifically, he advocated for corporate taxes, a global minimum tax, and closing tax loopholes on wealthier Americans. Finally, he signalled anti-competition policy would play a role in capping prices. So a full plate for the President’s party ahead of the mid-term elections.

On Covid, the President admitted a new variant could well come at some point, and asked for funding to remain prepared for it. Otherwise, he intimated the country should be ready to open up and stay open.

Yesterday's further commodities rally and the completely repricing of the ECB curve heightens the emphasis on today’s flash CPI reading for February, which is out at 10am London time. In advance of that however, we did get the German and Italian inflation readings for February, which both came in above expectations on the EU-harmonised measure. The German figure rose to +5.5% on a year-on-year basis (vs. +5.4% expected), and Italy’s rose to +6.2% (vs. 5.5% expected). In a sign that investors are moving to price in higher inflation for the years ahead as well, inflation breakevens rose across multiple countries yesterday, with Germany and Italy’s 10yr breakeven hitting fresh highs for the decade, at 2.19% and 2.03% respectively.

On the war itself, fighting appeared to intensify further, with reports of more forces mounting near the border and Russia vowing to press forward until its goals were met. The next round of peace negotiations are set to begin today which will create a small amount of hope.

Elsewhere on the data side, the US ISM manufacturing reading for February rose to 58.6 (vs. 58.0 expected), with the new orders component at a 5-month high of 61.7 (vs. 56.3 expected). We also had the final Euro Area manufacturing PMI, which came in a bit beneath the flash reading at 58.2 (vs. flash 58.4).

Today, is the third day of DB’s Global ESG conference. If you missed Mike Bloomberg’s keynote on Monday, you can watch the replay here. Nike’s featured sustainability presentation from Tuesday can be replayed here. At the conference today, we will have presentations from Mastercard, Anheuser-Busch, Zoom Media, Ingersoll Rand and Ardagh Metal Pkg. In addition, there is an investor work shop focused on water scarcity and pollution at 12:00 GMT. You can register for the conference here.

DB’s Mining team is hosting an Expert Call on Thursday 3 March at 3pm (4pm CET, 10am EST) to discuss the impact of the Russia-Ukraine crisis on industrial metals, where Russia is major global exporter. The call will explore the potential influence of sanctions, the impact of renewed energy price appreciation, how China could react from a supply policy and demand stimulus perspective and the risk of demand destruction from rising prices. For further details and the registration link click here

To the day ahead now, and data releases include the Euro Area’s flash CPI reading for February, along with German unemployment for February, and the ADP’s report of private payrolls for February from the US. From central banks, the main highlight will be Fed Chair Powell’s testimony before the House Financial Services Committee, but we’ll also hear from the Fed’s Evans and Bullard, the ECB’s Vice Preisdent de Guindos and Chief Economist Lane, and the BoE’s Deputy Governor Cunliffe and Tenreyro. On top of that, the Bank of Canada will be making its latest monetary policy decision, and the Fed will release their Beige Book.

Government

Survey Shows Declining Concerns Among Americans About COVID-19

Survey Shows Declining Concerns Among Americans About COVID-19

A new survey reveals that only 20% of Americans view covid-19 as "a major threat"…

A new survey reveals that only 20% of Americans view covid-19 as "a major threat" to the health of the US population - a sharp decline from a high of 67% in July 2020.

What's more, the Pew Research Center survey conducted from Feb. 7 to Feb. 11 showed that just 10% of Americans are concerned that they will catch the disease and require hospitalization.

"This data represents a low ebb of public concern about the virus that reached its height in the summer and fall of 2020, when as many as two-thirds of Americans viewed COVID-19 as a major threat to public health," reads the report, which was published March 7.

According to the survey, half of the participants understand the significance of researchers and healthcare providers in understanding and treating long COVID - however 27% of participants consider this issue less important, while 22% of Americans are unaware of long COVID.

What's more, while Democrats were far more worried than Republicans in the past, that gap has narrowed significantly.

"In the pandemic’s first year, Democrats were routinely about 40 points more likely than Republicans to view the coronavirus as a major threat to the health of the U.S. population. This gap has waned as overall levels of concern have fallen," reads the report.

More via the Epoch Times;

The survey found that three in ten Democrats under 50 have received an updated COVID-19 vaccine, compared with 66 percent of Democrats ages 65 and older.

Moreover, 66 percent of Democrats ages 65 and older have received the updated COVID-19 vaccine, while only 24 percent of Republicans ages 65 and older have done so.

“This 42-point partisan gap is much wider now than at other points since the start of the outbreak. For instance, in August 2021, 93 percent of older Democrats and 78 percent of older Republicans said they had received all the shots needed to be fully vaccinated (a 15-point gap),” it noted.

COVID-19 No Longer an Emergency

The U.S. Centers for Disease Control and Prevention (CDC) recently issued its updated recommendations for the virus, which no longer require people to stay home for five days after testing positive for COVID-19.

The updated guidance recommends that people who contracted a respiratory virus stay home, and they can resume normal activities when their symptoms improve overall and their fever subsides for 24 hours without medication.

“We still must use the commonsense solutions we know work to protect ourselves and others from serious illness from respiratory viruses, this includes vaccination, treatment, and staying home when we get sick,” CDC director Dr. Mandy Cohen said in a statement.

The CDC said that while the virus remains a threat, it is now less likely to cause severe illness because of widespread immunity and improved tools to prevent and treat the disease.

“Importantly, states and countries that have already adjusted recommended isolation times have not seen increased hospitalizations or deaths related to COVID-19,” it stated.

The federal government suspended its free at-home COVID-19 test program on March 8, according to a website set up by the government, following a decrease in COVID-19-related hospitalizations.

According to the CDC, hospitalization rates for COVID-19 and influenza diseases remain “elevated” but are decreasing in some parts of the United States.

Government

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

Government

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While “Waiting” For Deporation, Asylum

The Great Replacement Loophole: Illegal Immigrants Score 5-Year Work Benefit While "Waiting" For Deporation, Asylum

Over the past several…

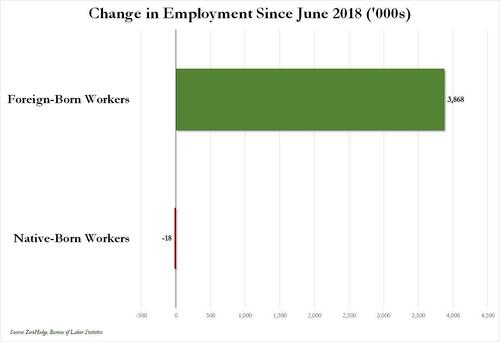

Over the past several months we've pointed out that there has been zero job creation for native-born workers since the summer of 2018...

... and that since Joe Biden was sworn into office, most of the post-pandemic job gains the administration continuously brags about have gone foreign-born (read immigrants, mostly illegal ones) workers.

And while the left might find this data almost as verboten as FBI crime statistics - as it directly supports the so-called "great replacement theory" we're not supposed to discuss - it also coincides with record numbers of illegal crossings into the United States under Biden.

In short, the Biden administration opened the floodgates, 10 million illegal immigrants poured into the country, and most of the post-pandemic "jobs recovery" went to foreign-born workers, of which illegal immigrants represent the largest chunk.

'But Tyler, illegal immigrants can't possibly work in the United States whilst awaiting their asylum hearings,' one might hear from the peanut gallery. On the contrary: ever since Biden reversed a key aspect of Trump's labor policies, all illegal immigrants - even those awaiting deportation proceedings - have been given carte blanche to work while awaiting said proceedings for up to five years...

... something which even Elon Musk was shocked to learn.

Wow, learn something new every day https://t.co/8MDtEEZGam

— Elon Musk (@elonmusk) March 10, 2024

Which leads us to another question: recall that the primary concern for the Biden admin for much of 2022 and 2023 was soaring prices, i.e., relentless inflation in general, and rising wages in particular, which in turn prompted even Goldman to admit two years ago that the diabolical wage-price spiral had been unleashed in the US (diabolical, because nothing absent a major economic shock, read recession or depression, can short-circuit it once it is in place).

Well, there is one other thing that can break the wage-price spiral loop: a flood of ultra-cheap illegal immigrant workers. But don't take our word for it: here is Fed Chair Jerome Powell himself during his February 60 Minutes interview:

PELLEY: Why was immigration important?

POWELL: Because, you know, immigrants come in, and they tend to work at a rate that is at or above that for non-immigrants. Immigrants who come to the country tend to be in the workforce at a slightly higher level than native Americans do. But that's largely because of the age difference. They tend to skew younger.

PELLEY: Why is immigration so important to the economy?

POWELL: Well, first of all, immigration policy is not the Fed's job. The immigration policy of the United States is really important and really much under discussion right now, and that's none of our business. We don't set immigration policy. We don't comment on it.

I will say, over time, though, the U.S. economy has benefited from immigration. And, frankly, just in the last, year a big part of the story of the labor market coming back into better balance is immigration returning to levels that were more typical of the pre-pandemic era.

PELLEY: The country needed the workers.

POWELL: It did. And so, that's what's been happening.

Translation: Immigrants work hard, and Americans are lazy. But much more importantly, since illegal immigrants will work for any pay, and since Biden's Department of Homeland Security, via its Citizenship and Immigration Services Agency, has made it so illegal immigrants can work in the US perfectly legally for up to 5 years (if not more), one can argue that the flood of illegals through the southern border has been the primary reason why inflation - or rather mostly wage inflation, that all too critical component of the wage-price spiral - has moderated in in the past year, when the US labor market suddenly found itself flooded with millions of perfectly eligible workers, who just also happen to be illegal immigrants and thus have zero wage bargaining options.

None of this is to suggest that the relentless flood of immigrants into the US is not also driven by voting and census concerns - something Elon Musk has been pounding the table on in recent weeks, and has gone so far to call it "the biggest corruption of American democracy in the 21st century", but in retrospect, one can also argue that the only modest success the Biden admin has had in the past year - namely bringing inflation down from a torrid 9% annual rate to "only" 3% - has also been due to the millions of illegals he's imported into the country.

We would be remiss if we didn't also note that this so often carries catastrophic short-term consequences for the social fabric of the country (the Laken Riley fiasco being only the latest example), not to mention the far more dire long-term consequences for the future of the US - chief among them the trillions of dollars in debt the US will need to incur to pay for all those new illegal immigrants Democrat voters and low-paid workers. This is on top of the labor revolution that will kick in once AI leads to mass layoffs among high-paying, white-collar jobs, after which all those newly laid off native-born workers hoping to trade down to lower paying (if available) jobs will discover that hardened criminals from Honduras or Guatemala have already taken them, all thanks to Joe Biden.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex