Futures Rebound From Overnight Tesla Weakness As Key CPI Print Looms

Futures Rebound From Overnight Tesla Weakness As Key CPI Print Looms

US futures rebounded from a modest overnight selloff as big industrial firms were supported by Friday’s passage of a $1 trillion infrastructure bill, while Tesla fell on…

US futures rebounded from a modest overnight selloff as big industrial firms were supported by Friday's passage of a $1 trillion infrastructure bill, while Tesla fell on Elon Musk's plan to sell about a tenth of his stake after an impromptu Twitter poll suggested he "should" do what he likely already planned to do anyway. Oil, Bitcoin and treasury yields all rose while the dollar fell. At 745 a.m. ET, Dow e-minis were up 64 points, or 0.2%, S&P 500 e-minis were up 1.50 points, or 0.03%, and Nasdaq 100 e-minis were down 1.25 points, or 0.01%.

US stocks climbed to daily record highs almost every day last week, and the S&P 500 posted its fifth consecutive weekly rally supported by an upbeat earnings season, strong October jobs data and a positive update on Pfizer Inc's (PFE.N) experimental pill against COVID-19. Investors last week also shrugged off the Federal Reserve's decision to start reducing its monthly bond purchases put in place to support the economy during the COVID-19 pandemic. Meanwhile, with nearly 90% of the companies in the S&P 500 index having reported quarterly results, earnings are expected to have climbed 41.5% in the third quarter from a year earlier, according to Refinitiv.

Caterpillar, Boeing and 3M rose between 0.5% and 3% in premarket trading after the Congress passed a long-delayed infratructure bill, hailed by President Joe Biden as a "once in a generation" investment. Steel and aluminum producers also gained, with Nucor Corp up 2.6% and United States Steel Corp adding 4.9%.

"The news that Joe Biden is on the cusp of signing off a $1 trillion infrastructure package does provide a boost for industrial names that have largely enjoyed a strong third quarter in any case," Joshua Mahony, senior market analyst at IG, said in a client note.

Despite the continued euphoria, which according to Goldman could push the S&P well above 5,000 by year end, "the old ghost of inflation is re-emerging in everyone’s minds as many consider the next CPI figures to be crucial, especially in the U.S. where investors remain clueless about the pace of the Fed’s upcoming asset purchases,” said Pierre Veyret, a technical analyst at ActivTrades.

The big news over the weekend is when Elon Musk tweeted on Saturday that "much has been made lately regarding unrealized gains being used to avoid taxes" and proposed selling 10% of his Tesla stock ($21bln) if his Twitter followers supported the sale. Musk noted that he was prepared to accept either outcome. 57.9% voted "Yes" and 42.1% voted "No", with over 3.5mln votes. The stock was down 6% premarket (although it was rising fast) despite Jefferies raising its price target on Tesla to $1,400 from $950, a new Street-high. The stock holds a 2.5% weighting in the SPX and 6.4% weighting in the NDX.

"The majority voted for him to sell, which effectively signals that he is going to dump stock on the market," said Russ Mould, investment director at AJ Bell. "Investors may look at the situation and try and sell before he does, potentially then buying back at a lower price if they still liked the stock." Here are some of the biggest U.S. movers today:

- Electric vehicle charging stocks jumped in U.S. premarket trading after the House on Friday passed the biggest U.S. infrastructure package in decades. EV charging company Volta (VLTA US) jumps 15% premarket; EVgo (EVGO US) +12%, ChargePoint (CHPT US) +7.1%, Blink (BLNK US) +6.9%

- Cryptocurrency-exposed stocks jump in U.S. premarket trading with Bitcoin and Ether rising and the global crypto market now worth $3 trillion. Bit Digital (BTBT US) +12%, Riot Blockchain (RIOT US) +11%, Marathon Digital (MARA US) +11%, MicroStrategy (MSTR US) +7.8%, Coinbase (COIN US)+5.3%

- U.S.-listed Chinese education stocks including New Oriental Education (EDU US) and Tal Education (TAL US) rally in premarket trading after Dow Jones reported that Beijing plans to issue more than a dozen licenses that would allow companies to offer after-school tutoring, citing people familiar with the matter.

- Nvidia (NVDA US) extends gains from last week, rising 2.3% in U.S. premarket trading

- Marin Software (MRIN US) rose 12% in extended hours Friday after closing 17% higher during regular trading on Friday

Europe’s Stoxx 600 Index was also balanced hovering near a record, with energy companies up and retailers down. Energy stocks were Europe’s biggest gainers on Monday with oil rising as traders weigh the odds of a release of crude from the U.S. Strategic Petroleum Reserve. The Stoxx Europe 600 Energy index rose up 1.8%; TotalEnergies, Shell, BP and Equinor all trading higher. Wind-turbine companies Siemens Gamesa and Vestas the top gainers after the former’s FY results, which analysts said provide some relief after the guidance cut from Vestas last week. Here are some of the biggest European movers today:

- Darktrace shares rise as much as 12%, the most intraday since Sept. 17, with Berenberg (buy) reiterating its buy rating on the cybersecurity company following a recent site visit.

- Siemens Gamesa climbs as much as 9.9%, the most intraday since March 2020, with Citi (neutral) saying the wind-turbine maker’s results were a mixed bag but may soothe some concerns for investors.

- Richemont gains as much as 5.2% to a record after a report that activist investor Dan Loeb’s Third Point LLC built a stake in the Swiss luxury-goods company, spurring speculation of a shakeup that could boost its lagging stock price.

- Coloplast rises as much as 6.3%, the most intraday since February, after the Danish medical equipment maker agreed to acquire Atos Medical in a transaction valued at EU2.16 billion including debt. Handelsbanken says the deal is strategic and the valuation seems reasonable.

- Henkel drops as much as 6.6%, the most intraday since March 2020. The group’s new margin guidance implies clear pressure on its 2H trading, Citi (neutral) says in a note.

- PostNL falls as much as 6.7% after the mail delivery firm posted weaker-than-expected results for 3Q with normalized Ebit missing the average estimate and parcel volumes disappointing analysts.

- Bouygues declines as much as 5.2% after the French conglomerate agrees to buy Engie’s Equans for EU7.1b, prompting Bryan Garnier to downgrade the stock due to what the broker says was a high price tag and integration risk.

- H&M drops as much as 4.9%, among the biggest decliners in Europe’s Stoxx 600 Index on Monday, after being downgraded to sell from neutral at Goldman Sachs, which says the retailer’s margins will take a hit from inflation related to the cost of goods sold.

- Sonova slides as much as 7.3%, before paring drop to 3%, as hundreds of patients need to be reoperated due to a late recall of implants, NZZ am Sonntag reported on Sunday, based on its own investigation.

Asian markets were mixed as investors sold off healthcare stocks along with Covid-19 vaccine makers in the region while buying cyclical shares. The MSCI Asia Pacific Index erased a decline of as much as 0.4% as of 5:35 p.m. in Singapore, with consumer discretionary stocks also among the biggest drags. Vaccine maker CanSino Biologics tumbled the most on the regional gauge, sliding 17%, after Pfizer announced its pill reduced Covid-19 hospitalizations and deaths substantially. South Korean and Japanese health stocks also fell, while Hong Kong’s Hang Seng Index was the worst-performing benchmark in Asia on Monday. Indian stocks rose. Pfizer’s announcement has boosted hopes of accelerated reopenings in the region, helping travel and other cyclical shares. The passage of a $550 billion infrastructure bill in the U.S. also provided some relief, as traders assess the outlook for economic growth, inflation and interest rate hikes globally, particularly after the U.S. labor market got back on track in October. “Consistently improving nonfarm payroll data will presage a sooner than expected rate increase, something that Asian stocks are perhaps vulnerable to,” said Justin Tang, head of Asian research at United First Partners. Investors were also focused on China as the Communist Party meets this week for the first time in more than a year. Chinese heavyweight stocks have been underperformers amid Beijing’s regulatory clampdown, and any positive developments could boost the Asian stock gauge

Japanese equities fell, erasing an early gain, as investors eyed the latest corporate earnings reports along with progress toward economic reopenings. The Topix closed 0.3%, reversing a 0.4% gain, with electronics makers the biggest drag. Fast Retailing was the biggest contributor to a 0.4% loss in the Nikkei 225. Stocks rose in early trading following Japan’s announcement Friday of a broad easing of Covid-era border control measures that will relax restrictions for business and student travelers. U.S. shares gained Friday after solid jobs data and encouraging results from Pfizer’s Covid-19 pill study. Travel-related equities climbed across Asia on Monday while healthcare names dropped. “On the other hand, stocks that benefited from Covid-19 are correcting and there is concern that the overall lift to the market from the pandemic may peak out,” said said Ikuo Mitsui, a fund manager at Aizawa Securities. Disappointment with results from companies such as Honda and Kubota were also dragging on the market, Mitsui said

Indian stocks rose, driven by a rally in oil and gas producers, after the government lowered retail fuel taxes, while consumer durables companies were buoyed by festive buying. The S&P BSE Sensex gained 0.8% to 60,545.61 in Mumbai on Monday, extending its 0.5% advance during the special late Thursday evening trading session to mark Diwali, the festival of lights. The market was shut on Friday. The NSE Nifty 50 Index rose 0.9%, its strongest increase since Nov. 1, driven by mortgage lender HDFC and software major Infosys. The 50-stock index declined as much as 0.5% during the session before recovering in afternoon trade. All but two of the 19 sector sub-indexes compiled by BSE Ltd. were higher, led by a gauge of oil and gas companies. IndusInd Bank was a prominent decliner on both equity benchmarks after allegations that its micro-lending unit provided new loans to customers to keep their existing debt from souring. The lender denied the reports, but the shares fell 11%, the most since April 2020. Investors are also keeping an eye on the IPO of One97 Communications, the parent of fintech company Paytm, which is proposing to raise as much as 183 billion rupees ($2.5 billion) in India’s biggest share sale. The issue was 17% subscribed as of 4 p.m. in Mumbai on the first day of sales. Housing Development Finance Corp. contributed the most to the Sensex’s gain, increasing 2.7%. Out of 30 shares in the Sensex index, 21 rose and 9 fell.

Australian stocks dipped as a slump in healthcare countered gains in miners. The S&P/ASX 200 index fell less than 0.1% to close at 7,452.20, after swinging between gains and losses as miners climbed while health and tech stocks fell. Flight Centre and Webjet rallied, following other Asia travel-related stocks higher after Pfizer announced its pill reduced Covid-19 hospitalizations and deaths substantially. PolyNovo plunged after the burns treatment company said Friday that its managing director Paul Brennan is stepping down. In New Zealand, the S&P/NZX 50 index fell 0.3% to 13,041.30.

In FX, the Bloomberg Dollar Spot Index was little changed as the greenback traded mixed versus its Group-of-10 peers. Commodity-currencies gained while Sweden’s krona and the Swiss franc were the worst performers; the euro was steady and European government bond yields rose as yield curves steepened. The pound was little changed on a quiet data day, with focus on BOE Governor Andrew Bailey speaking later; year-to-date cable low of 1.3412 remained in view.

In rates,Treasuries were lower across the curve, led by gilts during European morning and as U.S. equity futures advance. Curve slightly flatter ahead of 3-year note auction at 1pm ET, while busy Fed speaker slate includes Powell at 10:30am. Treasury yields were cheaper by nearly 4bp in 7-year sector, which underperforms on the curve; long-end outperforms, flattening 5s30s, 10s30s spreads by 0.8bp and 0.6bp; 10-year around 1.485%, slightly outperforming U.K. 10-year on the day. The U.S. auction cycle - accelerated as Thursday is a U.S. bank holiday - begins with $56b 3-year, followed by 10- and 30-year new issues Tuesday and Wednesday; sales are first since Treasury Department reduced auction sizes.

In commodities, oil climbed, WTI up 1.4% to over $82/bbl, and Brent climbs 1.2% to the $83-handle. Base metals in the green, barring LME copper, which is down about 0.2%, while tin and aluminum lead gainers. Bitcoin climbs about 5%, trades between $65k-$66k range. Spot gold little changed.

Six Federal Reserve officials are set to give speeches on Monday, with most of the investor attention likely to be on Vice Chair Richard Clarida. Key inflation readings are also due through the week.

Market Snapshot

- S&P 500 futures little changed at 4,693.25

- STOXX Europe 600 little changed at 483.27

- MXAP little changed at 198.59

- MXAPJ up 0.2% to 646.80

- Nikkei down 0.4% to 29,507.05

- Topix down 0.3% to 2,035.22

- Hang Seng Index down 0.4% to 24,763.77

- Shanghai Composite up 0.2% to 3,498.63

- Sensex up 0.7% to 60,515.57

- Australia S&P/ASX 200 little changed at 7,452.21

- Kospi down 0.3% to 2,960.20

- Brent Futures up 1.3% to $83.78/bbl

- Gold spot down 0.2% to $1,814.83

- U.S. Dollar Index little changed at 94.24

- German 10Y yield little changed at -0.27%

- Euro little changed at $1.1569

Top Overnight News from Bloomberg

- ECB Chief Economist Philip Lane called the current period of inflation “very unusual and temporary,” adding that there are no signs that it is a “chronic” situation in an interview with Spanish newspaper El Pais

- Investor concerns over China Evergrande Group’s debt are shifting to the country’s stronger property companies as a selloff across the industry’s dollar bonds hits higher-quality borrowers

- Hedge funds look to have got their timing very wrong, piling into bullish short-term Treasuries bets ahead of some of the steepest yield spikes in years

- China posted a record monthly trade surplus in October as exports surged despite global supply-chain disruptions

- Shares tied to reopening trades from casinos to airlines surged in Asia on Monday after Pfizer Inc. said that its Covid-19 pill could reduce hospitalizations and deaths in high-risk patients by 89%

A more detailed look at global markets courtesy of Newsquawk

Asian equity markets began the week subdued and failed to take impetus from last Friday’s fresh record highs on Wall St and the forecast-topping NFP jobs data, as participants in the region digested somewhat mixed Chinese trade figures and US equity futures were also constrained with underperformance in NQ futures on a potential share sale by Tesla’s CEO Musk who took to a Twitter poll to decide whether to sell 10% of his stake in the EV manufacturer, equating to around USD 21bln. In that poll, 57.9% voted "Yes" and 42.1% voted "No", with over 3.5mln votes. The ASX 200 (-0.1%) was subdued with underperformance in tech, telecoms and the consumer-related sectors, but with downside in the index limited by M&A-related headlines including Sydney Airport entering a buyout deal valued at AUD 23.6bln. The Nikkei 225 (-0.4%) was initially positive after Japan reported no deaths from COVID-19 for the first time in 15 months and with its borders to reopen to business travellers and foreign students from today, although the index shortly gave up its opening gains amid residual effects from recent JPY inflows. The Hang Seng (-0.4%) and Shanghai Comp. (+0.2%) were mixed with price action tentative following the latest Chinese trade data over the weekend which showed a larger-than-expected trade surplus and strong exports, but USD-denominated imports missed estimates. Default concerns also lingered after a Hangzhou property developer missed a payment on a loan guaranteed by Fantasia Group and with an Evergrande unit missing offshore bond payments that were due on Saturday, while the recent Chinese sanctions on Taiwanese officials were also seen as a headwind for markets but was offset by the PBoC’s net liquidity injection. Finally, 10yr JGBs faded some of Friday’s advances as T-notes pulled back from the recent bull flattening with resistance just shy of the 132.00 level, while demand for JGBs was further hampered by the lack of BoJ purchases in the market although downside was also stemmed by the cautious tone in stocks.

Top Asian News

- Evergrande Unit’s Bondholders Yet to Receive Coupon Payments

- Japan New Capitalism Panel Pushes Innovation, SPACs, Fairer Pay

- Tesla Shipments in China Drop as Exports From Shanghai Jump

- Singapore, Malaysia to Launch Vaccinated Travel Lane Nov. 29

Equities in Europe kicked the week off in an uninspiring fashion and with a mild downside bias (Euro Stoxx 50 -0.2%; Stoxx 600 -0.1%) after a similar sentiment seeped from overnight APAC trade. US equity futures were originally mostly lower, but have since drifted into positive territory with the exception of the NQ – with Tesla (-6% pre-market) weighing on the tech-laden future after CEO Musk’s Twitter poll showed support towards a 10% stake sale by the CEO, whilst October China-made vehicle sales were also lower M/M. Tesla holds a 2.5% weighting in the SPX and 6.4% weighting in the NDX. Back to Europe, there isn’t much to report in terms of individual index action. Sectors are also mixed with no overarching theme. Oil & Gas stands as the current winner following overnight gains in the oil complex, whilst Autos sit at the bottom of the bunch with Volkswagen (-1.3%) also pressured amid a broker downgrade. Further for auto names - Chinese battery names are reportedly writing to EV producers, regarding battery supply, looking to renegotiate contracts and move away from fixed-price structures; amid strained lithium supplies set to increase the costs of such cells. In terms of M&A newsflow, Abrdn (+2.5%) confirmed it is in discussions around a potential acquisition of Interactive Investor. BHP (+0.1%) divested its interest in Mitsui Coal for up to USD 1.35bln. Engie (+0.9%) confirmed that they have entered exclusive negotiations to sell Equans to Bouygues (-4.2%), for EUR 7.1bln. Finally Third Point has reportedly acquired a stake in Richemont (+3.4%). Looking at analyst commentary, JPM upgraded the UK to overweight on the premise that the FTSE 100 had been lagging global peers for a while and as “UK equity trading with respect to certain macro variables appears to be evolving.”

Top European News

- The Hut Rises After Founder Hints at Taking Company Private

- Credit Suisse Says Asia Lending Back on Track After Scandals

- Mercedes Cars Get Fingerprint Payment Function in Visa Deal

- Day-to-Day Gas Deliveries to Europe Up to Gazprom: Kremlin

In FX, most majors are largely going through the motions on a relatively low-key Monday in terms of scheduled data and events, while the Greenback is meandering within its pre and post-US payrolls extremes of 94.184-634 from 92.194 to 92.380. However, the Kiwi is taking advantage of the Buck retreat and another reversal in the Aud/Nzd cross through 1.0400 amidst positive news on the NZ covid front as restrictions in Auckland are set to be relaxed from midweek. Hence, Nzd/Usd is hovering nearer the top of a 0.7154-04 band ahead of electronic card retail sales data tonight, while the Aussie is straddling 0.7400 vs its US counterpart in advance of NAB business sentiment and conditions tomorrow. Elsewhere, Sterling is still succumbing to a degree of BoE repositioning and Article 16 risk, as Cable looks for half round number support circa 1.3450, but is capped into 1.3500 and Eur/Gbp pivots 0.8575 where hefty option expiry interest resides (1.1 bn). However, the Franc is lagging alongside the Swedish Crown in G10 circles even though Switzerland’s nsa jobless rate dipped in October and latest weekly sight deposit data revealed a decline in domestic bank balances, with Usd/Chf eyeing 0.9150 and Eur/Chf closer to 1.0580 than 1.0550.

- EUR/CAD/JPY/NOK - The Euro is contained within a 1.1551-76 range awaiting more ECB speakers following an unexpected improvement in the Eurozone Sentix Index that was largely taken in stride, the Loonie is rotating around 1.2450 with some traction from a rebound in WTI crude prices rather than commentary from BoC Governor Macklem who believes inflation is transitory, but not short-lived, and the Yen is also anchored, either side of 113.50 with little independent impetus from the latest BoJ SOMP in advance of Japanese bank lending, trade and current account data. Meanwhile, the Norwegian Krona is tethered to 9.8800 vs the Euro and not really reacting to outgoing PM Solberg’s revised 2022 Budget proposal that is tighter than anticipated as pandemic support measures are unwound.

- EM/PM - Somewhat mixed Chinese trade data as the surplus hit a new record on blowout exports, but Usd-denominated imports missed consensus, while Evergrande and another property developer failed to make more bond interest payments, yet the Cnh and Cny are both holding above 6.4000 vs the Usd as PBoC sources contend that the prospects of easing are diminishing - see 9.58GMT post on the Headline Feed for more. Meanwhile, hawkish vibes from the BCB may give the Brl a boost as the Bank says it may lift the SELIC rate by a bigger margin if warranted next month, while the Czk could get a fillip from a dip in the Czech unemployment rate and Pln from updated NBP inflation and growth forecasts. Conversely, Gold has lost some lustre as bond yields back up and curves steepen, though retains a firm grip of the Usd 1800/oz handle.

In commodities, WTI and Brent front month futures gained at the open of futures before consolidating heading into the European open. Prices thereafter resumed the upward march with WTI Dec back around USD 82.50/bbl (vs 81.05 low) and Brent Jan around USD 84/bbl (vs low 82.50/bbl). News flow of the complex has thus far been light in European hours, although the weekend saw Saudi Aramco upping the December OSPs for all regions – sometimes seen as a proxy for demand. On the Iranian nuclear front, the Iranian Foreign Minister reiterated Iran's stance on the JCPOA and again called on the US to lift all sanctions at once – ahead of the resumption of nuclear talks on Nov 29th. The UAE energy minister also hit the wires this morning but provided little in the way of fresh commentary. Elsewhere, spot gold and silver are flat with the former within the overnight range around USD 1,815/oz whilst spot silver meanders north of USD 24/oz. Base metals are also uninteresting – LME copper trades on either side of USD 9,500/t awaiting more catalysts.

US Event Calendar

- Nothing major scheduled

Central Banks

- 9am: Fed’s Clarida Discusses Prospects for Monetary Policy

- 10:30am: Powell to Make Opening Remarks at Fed Diversity Conference

- 12pm: Fed’s Bowman Discusses the U.S. Housing Market

- 12pm: Fed’s Harker Speaks to Economic Club of New York

- 1:50pm: Fed’s Evans Speaks on Economy and Monetary Policy

DB's Jim Reid concludes the overnight wrap

This is going to be a strange week for me. My 6-year old daughter Maisie went into hospital yesterday, 75 miles from our home, for a week long stay with her mum for company. She’s having a hip operation for a rare condition she has (perthes). My poor wife is sleeping on a camp bed in the ward next to her bed for the week and can't leave the hospital due to covid restrictions. Meanwhile I’m in charge of the twins at home and can't visit for the same covid reasons. Thankfully work has allowed me to WFH and take the twins to school. To be honest I’ve no idea what I’m doing (I usually do bedtime) and as soon as I’ve pressed send this morning I’m off to read a parenting manual for the week from my wife that makes War and Peace look like a short story. We’re hopeful Maisie will make a near full recovery but it will be a minimum of a tough 12-18 months where she’s allowed only limited weight bearing while her hip bone hopefully regrows. So pink crutches and a pink wheelchair. So all food parcels to me welcome until next weekend.

Moving on to this week now. If you’d have told anyone at the start of the year that annual US CPI would be 5.9% in the penultimate print of the year (as consensus expects on Wednesday) after already spending five months already above 5% then I don’t think you’d have got many predicting that there would be utter calm and buoyancy in the market. Quite the opposite I’d imagine. At the start of the year the forecast for the full year was 2%. More on this below but elsewhere it is a quieter week ahead after all the fun and games of central banks and payrolls Friday last week. The peak of earnings season is well behind us now, especially in the US with ‘only’ 13 and 76 companies reporting in the S&P 500 and Stoxx 600 respectively. Perhaps the report of most interest to us on the inflationary side of the debate is the US JOLTS job opening figures on Thursday. As we mentioned in our CoTD on Friday (link here), according to DB Francis Yared, the quit rate in this report has been acting as if the labour market is already through full employment. So for the Fed and the market to be right on inflation, this needs to come down as covid employment supply shocks ease. This month will be too early for this and will likely still show a very tight labour market for the September survey period. Where NAiRU is is anyones guess at the moment but it feels higher than where it was pre-covid.

Other data will also provide further clues on inflation pressures this week, in particular the PPI reading tomorrow, as well as the inflation expectations in the University of Michigan’s index on Friday. Finally, China will be releasing their own CPI and PPI inflation figures on Wednesday too.

Previewing US CPI in more detail now, last month we had yet another upside surprise, which marked the 5th time in the last 7 months that the month-on-month figure has been above the median estimate on Bloomberg. Furthermore, we saw a number of fresh drivers behind inflation, with food inflation (+0.93%) seeing its biggest monthly increase since April 2020, whilst owners’ equivalent rent (+0.43%) saw its strongest increase since June 2006. These housing gauges are something that Fed officials have signposted as having the potential to provide more durable upward pressure on inflation. See page 19 in my 1970s Chart Book (link here) for a model that suggests this part of inflation that accounts for around 40% of core CPI will be comfortably above 4% yoy next year. The used car component may also pick up again given the 2-3 month lag between actual price rises and it appearing in the CPI, although this spike may wait another month as the lag is not precise. In terms of Wednesday’s print in month on month terms, our US economists are at +0.47% (consensus +0.6%), which would be the strongest monthly reading since July. They think core will print at +0.37% mom (consensus +0.4%).

There’ll be less central bank action this week but a potential area to keep an eye on will be any developments on Fed appointments, with Chair Powell’s current four-year term coming to an end in early February. President Biden said last Tuesday that he would announce his nominees “fairly quickly”. The wires (including Bloomberg) reported that both Fed Chair Powell and Governor Brainard met Biden separately at the White House on Thursday. Brainard could be slated for a VP or bank supervision role so tough to read too much into it. Separately, Axios have also reported that the White House is asking Democratic senators to meet with Powell before Thanksgiving. Bear in mind that whoever is nominated would need to be confirmed by the Senate. We don’t have a formal date yet on when this might be announced, but at this point 4, 8 and 12 years’ ago, the decision of who would be nominated for Fed Chair had already been made public.

On the US political front, the House passed the $550 billion bi-partisan infrastructure bill late on Friday night, with 13 yes votes from House Republicans and 6 no votes from progressive Democrats. Outlays are slated for the next ten years, and the Congressional Budget Office estimated the bill will add $256 billion to the Federal budget deficit over that time. A vote for the Biden administration’s social and climate spending bill is now slated for after next week’s Congressional break. Biden’s party also had a poor showing in elections last week, losing the Virginia governorship, and seeing the race in New Jersey come down to the wire. Biden carried both states comfortably only a year ago, so much has been made about what this means for Democratic chances to retain their razor thin majority in Congress in next year’s midterm elections.

On the earnings front, the highlights include PayPal today, before we hear from Bayer and Porsche tomorrow. Then on Wednesday we’ll get releases from Disney, Allianz, Adidas, Credit Agricole and EDF. Thursday sees Siemens, Merck and ArcelorMittal report, before AstraZeneca and Deutsche Telekom release on Friday. The rest of the day by day calendar is at the end as usual. Remember Thursday is a US holiday.

Over the weekend the most fascinating story has been Elon Musk conducting a Twitter poll as to whether he should sell 10% of his stake in Tesla. Of the 3.52 million who replied, 57.9% agreed he should. He had vowed to follow the results of this poll. This is of course linked to the ongoing US debate about the richest citizens’ tax payments. He would pay a considerable amount on any sale. Such a sale would only add 1-2% of the free float of Tesla but Nasdaq futures are -0.41% this morning relative to the -0.20% on S&P futures.

Asian stocks are steady to lower with the Shanghai Composite (+0.09%), Nikkei (-0.07%), CSI (-0.13%) flattish with the Hang Seng (-0.39%) and KOSPI (-1.00%) more in the red. Infrastructure firms exposed to the US have moved higher after the US House passed the $550 bn infrastructure bill (see below). 10yr US yields are back up +1.5bps after a major rally on Friday. Elsewhere in Japan Covid restrictions further eased with a 3 day quarantine now for short term travelers; this comes after the country has successfully inoculated 70% of its population.

Recapping last week now and central banks clearly dominated with the RBA kicking things off by opting not to defend their yield curve target, followed by the Fed launching their taper, and the BoE keeping policy on hold. The BoE was the least anticipated decision, and drove a global rally in sovereign yields. All told, 10y yields declined in Australia (-27.5bps, -2.0bps Friday), US (-10.1bps, -7.5bps Friday), UK (-18.9bps, -9.9bps Friday), Germany (-17.4bps, -5.6bps Friday), France (-20.7bps, -5.3bps Friday), and Italy (-29.3bps, -5.7bps Friday). A common thread across all the central bank communications was the pushback against the recent repricing towards earlier policy rate hikes, whether the pushback was tacit (in the case of the Fed) or explicit (the BoE didn’t hike despite widespread expectations). The ECB didn’t have any monetary policy decisions to weigh, but President Lagarde forcefully pushed back on the prospects of an increase to the policy rate in 2022 in a prepared speech and follow up interview. STIR markets responded, moving back anticipated rate hikes from where they stood a week before. In the US from July 22 to September 22, in the Euro area from July 22 to December 22, and the UK from December 21 into February 22 (although December is priced as a “live” meeting much as this week’s MPC was beforehand).

Global equity markets were boosted by the additional accommodation from rates, with the S&P 500, Nasdaq, DJIA, STOXX 600, DAX, and CAC 40 all finishing the week at all-time highs. The S&P 500 gained +2.00% over the week (+0.37% Friday), led by discretionary and tech sectors, while financials lagged on the drop in yields. The Nasdaq and DJIA gained +3.05% (+0.20% Friday) and +1.42% (+0.56% Friday) on the week, respectively. In Europe, the SXXP, DAX, and CAC increased +1.67% (+0.05% Friday), +2.33% (+0.15% Friday), and +3.08% (0.76%), respectively.

Back to the S&P, this was the last big week of 3Q earnings season. 446 companies have now reported, with 373 beating earnings estimates (83.6%).

Pfizer joined Merck in announcing an antiviral Covid pill, which should boost the world’s effort to fight the disease, especially as vaccine hesitancy becomes more binding on global inoculation than vaccine production. Relatedly, the CDC recommended that 5-to-11 year-olds can receive the Pfizer vaccine. Pfizer also posted very strong earnings last week.

COP 26 kicked off with plenary gathering of world leaders. India made the first day headlines by setting zero carbon targets, while there were also developments on methane reduction and a deal on deforestation. Negotiations continue this week.

Staying on energy, Brent and WTI declined -1.94% (+2.73% Friday) and -2.75% (+3.12% Friday) throughout the week, respectively. OPEC+ met and opted not to increase production to alleviate the recent run up in energy prices, which temporarily saw futures higher. It was quickly countered by the US administration officials intimating that the strategic petroleum reserves could be released to do the job instead.

Jobs numbers in the US Friday surprised to the upside, as nonfarm payrolls increased by 531k, while the unemployment rate ticked down to 4.6%. The participation rate was unchanged from the prior month at 61.6%, meaning that new jobs drove the decrease in unemployment. As we garnered from the FOMC at their meeting last Wednesday, the evolution of the labour market as the economy emerges from the delta variant will be crucial in determining the next steps of US monetary policy, since inflation readings and forecasts look to already be above target. Despite the strong jobs data, as mentioned earlier, yields fell pretty substantially on Friday, with the 10yr Treasury down -7.5bps and 10yr real yields -5.7bps lower. It’s not clear whether this was due to positioning dynamics (remember that VAR shocks have been prominent drivers of sovereign rates recently) or this says something more fundamental about how investors are interpreting the Fed’s reaction function with regard to employment data as they look towards rate hikes.

Government

Looking Back At COVID’s Authoritarian Regimes

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked,…

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked, in March 2020, when President Trump and most US governors imposed heavy restrictions on people’s freedom. The purpose, said Trump and his COVID-19 advisers, was to “flatten the curve”: shut down people’s mobility for two weeks so that hospitals could catch up with the expected demand from COVID patients. In her book Silent Invasion, Dr. Deborah Birx, the coordinator of the White House Coronavirus Task Force, admitted that she was scrambling during those two weeks to come up with a reason to extend the lockdowns for much longer. As she put it, “I didn’t have the numbers in front of me yet to make the case for extending it longer, but I had two weeks to get them.” In short, she chose the goal and then tried to find the data to justify the goal. This, by the way, was from someone who, along with her task force colleague Dr. Anthony Fauci, kept talking about the importance of the scientific method. By the end of April 2020, the term “flatten the curve” had all but disappeared from public discussion.

Now that we are four years past that awful time, it makes sense to look back and see whether those heavy restrictions on the lives of people of all ages made sense. I’ll save you the suspense. They didn’t. The damage to the economy was huge. Remember that “the economy” is not a term used to describe a big machine; it’s a shorthand for the trillions of interactions among hundreds of millions of people. The lockdowns and the subsequent federal spending ballooned the budget deficit and consequent federal debt. The effect on children’s learning, not just in school but outside of school, was huge. These effects will be with us for a long time. It’s not as if there wasn’t another way to go. The people who came up with the idea of lockdowns did so on the basis of abstract models that had not been tested. They ignored a model of human behavior, which I’ll call Hayekian, that is tested every day.

These are the opening two paragraphs of my latest Defining Ideas article, “Looking Back at COVID’s Authoritarian Regimes,” Defining Ideas, March 14, 2024.

Another excerpt:

That wasn’t the only uncertainty. My daughter Karen lived in San Francisco and made her living teaching Pilates. San Francisco mayor London Breed shut down all the gyms, and so there went my daughter’s business. (The good news was that she quickly got online and shifted many of her clients to virtual Pilates. But that’s another story.) We tried to see her every six weeks or so, whether that meant our driving up to San Fran or her driving down to Monterey. But were we allowed to drive to see her? In that first month and a half, we simply didn’t know.

Read the whole thing, which is longer than usual.

(0 COMMENTS) budget deficit coronavirus covid-19 white house fauci trump canadaUncategorized

The hostility Black women face in higher education carries dire consequences

9 Black women who were working on or recently earned their PhDs told a researcher they felt isolated and shut out.

Isolated. Abused. Overworked.

These are the themes that emerged when I invited nine Black women to chronicle their professional experiences and relationships with colleagues as they earned their Ph.D.s at a public university in the Midwest. I featured their writings in the dissertation I wrote to get my Ph.D. in curriculum and instruction.

The women spoke of being silenced.

“It’s not just the beating me down that is hard,” one participant told me about constantly having her intelligence questioned. “It is the fact that it feels like I’m villainized and made out to be the problem for trying to advocate for myself.”

The women told me they did not feel like they belonged. They spoke of routinely being isolated by peers and potential mentors.

One participant told me she felt that peer community, faculty mentorship and cultural affinity spaces were lacking.

Because of the isolation, participants often felt that they were missing out on various opportunities, such as funding and opportunities to get their work published.

Participants also discussed the ways they felt they were duped into taking on more than their fair share of work.

“I realized I had been tricked into handling a two- to four-person job entirely by myself,” one participant said of her paid graduate position. “This happened just about a month before the pandemic occurred so it very quickly got swept under the rug.”

Why it matters

The hostility that Black women face in higher education can be hazardous to their health. The women in my study told me they were struggling with depression, had thought about suicide and felt physically ill when they had to go to campus.

Other studies have found similar outcomes. For instance, a 2020 study of 220 U.S. Black college women ages 18-48 found that even though being seen as a strong Black woman came with its benefits – such as being thought of as resilient, hardworking, independent and nurturing – it also came at a cost to their mental and physical health.

These kinds of experiences can take a toll on women’s bodies and can result in poor maternal health, cancer, shorter life expectancy and other symptoms that impair their ability to be well.

I believe my research takes on greater urgency in light of the recent death of Antoinette “Bonnie” Candia-Bailey, who was vice president of student affairs at Lincoln University. Before she died by suicide, she reportedly wrote that she felt she was suffering abuse and that the university wasn’t taking her mental health concerns seriously.

What other research is being done

Several anthologies examine the negative experiences that Black women experience in academia. They include education scholars Venus Evans-Winters and Bettina Love’s edited volume, “Black Feminism in Education,” which examines how Black women navigate what it means to be a scholar in a “white supremacist patriarchal society.” Gender and sexuality studies scholar Stephanie Evans analyzes the barriers that Black women faced in accessing higher education from 1850 to 1954. In “Black Women, Ivory Tower,” African American studies professor Jasmine Harris recounts her own traumatic experiences in the world of higher education.

What’s next

In addition to publishing the findings of my research study, I plan to continue exploring the depths of Black women’s experiences in academia, expanding my research to include undergraduate students, as well as faculty and staff.

I believe this research will strengthen this field of study and enable people who work in higher education to develop and implement more comprehensive solutions.

The Research Brief is a short take on interesting academic work.

Ebony Aya received funding from the Black Collective Foundation in 2022 to support the work of the Aya Collective.

depression pandemicUncategorized

US Economic Growth Still Expected To Slow In Q1 GDP Report

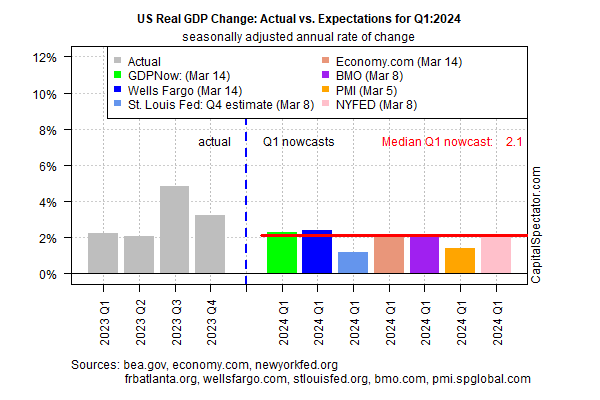

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised…

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised estimate is based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Output for the January-through-March period is currently projected to soften to a 2.1% increase (seasonally adjusted annual rate). The estimate reflects a substantially softer rise vs. Q4’s strong 3.2% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to government data.

Today’s revised Q1 estimate was essentially unchanged from the previous Q1 nowcast (published on Mar. 7). At this late date in the current quarter, the odds are relatively high that the current median estimate is a reasonable guesstimate for the actual GDP data that the Bureau of Economic Analysis will publish in late-April.

GDP rising at roughly a 2% pace marks another slowdown from recent quarters, but if the current nowcast is correct it suggests that recession risk remains low. The question is whether the slowdown persists into Q2 and beyond. Given the expected deceleration in growth on tap for Q1, the economy may be flirting with a tipping point for recession later in the year. It’s premature to make such a forecast with high confidence, but it’s a scenario that’s increasingly plausible, albeit speculatively so for now.

Yesterday’s release of retail sales numbers for February aligns with the possibility that even softer growth is coming. Although spending rebounded last month after January’s steep decline, the bounce was lowr than expected.

“The modest rebound in retail sales in February suggests that consumer spending growth slowed in early 2024,” says Michael Pearce, Oxford Economics deputy chief US economist.

Reviewing retail spending on a year-over-year basis provides a clearer view of the softer-growth profile. The pace edged up to 1.5% last month vs. the year-earlier level, but that’s close to the slowest increase in the post-pandemic recovery.

Despite emerging signs of slowing growth, relief for the economy in the form of interest-rate cuts may be further out in time than recently expected, due to the latest round of sticky inflation news this week.

“When the Fed is contemplating a series of rate cuts and is confronted by suddenly slower economic growth and suddenly brisker inflation, they will respond to the new news on the inflation side every time,” says Chris Low, chief economist at FHN Financial. “After all, this is not the first time in the past couple of years consumers have paused spending for a couple of months to catch their breath.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

recession pandemic economic growth fed recession gdp recovery consumer spending

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A