Government

Futures Rebound Despite Turkey Slaughter

Futures Rebound Despite Turkey Slaughter

Global markets, bond yields slid and the Turkish lira plunged towards a record low against on Monday after President Tayyip Erdogan shocked investors by replacing the country’s hawkish central bank…

Global markets, bond yields slid and the Turkish lira plunged towards a record low against on Monday after President Tayyip Erdogan shocked investors by replacing the country's hawkish central bank governor with a critic of high interest rates, Turkey's 4th new central bank head in 2 years.

However the global weakness took place against a backdrop of a pending short squeeze in the US, and despite the Turkey slaughter, the weakness was faded as the Emini S&P and Nasdaq 100 futures climbed alongside European technology shares on Monday as a drop in Treasury yields boosted pricier parts of the stock market. At 07:00 am ET, Dow E-minis were down 15 points, or 0.05%, S&P 500 E-minis were up 7.5 points, or 0.2% and Nasdaq 100 E-minis were up 104.5 points, or 0.8%.

Kansas City Southern jumped about 17% after Canadian Pacific Railway Ltd agreed to acquire the railroad operator in a $25 billion cash-and-stock deal to create the first railway spanning the United States, Mexico and Canada. Intel, Microsoft Corp and Apple led gains among Dow components in trading before the bell. Big U.S. bank slipped about 1% as yields dropped .

European equities faded an opening gap lower, with the Eurostoxx, DAX and FTSE 100 returning to little changed on the session having seen opening losses of between 0.6%-0.8%. Italy’s FTSE MIB rises 0.2% with local banks up 0.4%. The Stoxx 600 Index fell 0.1% to 423.11 with 344 members down, 249 up and 7 unchanged, reversing earlier losses. Autos and tech are the best performing sectors; the Stoxx Europe 600 Travel & Leisure Index remained 1% lower but the sector halved its initial slump, with airline and travel stocks falling after restrictions to curb the pandemic were extended in some European countries, while a U.K. government adviser said foreign holidays this summer are "unlikely."

Stocks that have benefited from lockdowns, including online retailers and food-delivery firms, climb on the possibility of extended restrictions in Germany and amid worries over vaccine supplies. Chancellor Merkel proposed keeping Germany’s lockdown in place for another four weeks, while vaccine tensions ramp up between the European Union and U.K. Shares in online grocer Ocado +1.6%, meal-kit maker HelloFresh +2.1%. Online retailers also rise: Zalando +1.5%, Asos +0.7%, Boohoo +0.5%, THG +0.9%

Here are some of Europe's other biggest movers today:

- Volkswagen common shares rise as much as 12% after Deutsche Bank raised its price target for the share class, citing electric- vehicle plans that sparked last week’s 22% rally. Porsche SE, the holding company in control of 53.3% of common stock, rises as much as 7% after Deutsche Bank increased its PT.

- Kingfisher shares rise as much as 6.6%. Morgan Stanley said the U.K. retailer’s FY22 consensus profit estimates will probably be increased ~10% after it reported FY results that beat expectations and provided guidance for the year ahead.

- Richemont shares climb as much as 4.2% amid speculation that Kering may seek to buy the Swiss luxury powerhouse after a report that it rejected an informal takeover offer earlier this year.

- Infineon shares gain as much as 3.8% after Credit Suisse upgrades the chipmaker to outperform from underperform thanks to the firm’s exposure to electric vehicles.

- BBVA shares decline as much as 7.7% as lenders with exposure to Turkey fall after the lira plunged following the ouster of the country’s central bank head over the weekend.

- TeamViewer shares fall as much as 5%, extending Friday’s slump, as analysts trim price targets following a margin guidance update due to its sponsorship deal with Manchester United.

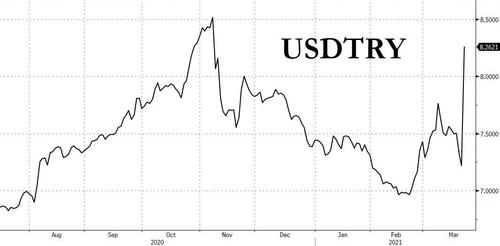

Turkish markets crashed after the dismissal of the nation’s central bank chief. The iShares MSCI Turkey ETF sank about 19% as Erdogan’s decision sparked fears of a reversal of recent rate hikes and capital controls. Circuit breakers were triggered in the BIST 100 Index early although the lira halved opening losses.

“The authorities will be left with two choices, either it pledges to use interest rates to stabilise markets, or it imposes capital controls,” said Per Hammarlund, senior EM strategist at SEB Research. “Given the increasingly authoritarian approach that President Erdogan has taken, capital controls are looking like the most likely choice.”

Euro zone banks exposed to the country such as Spain’s BBVA, Italy’s UniCredit, France’s BNP Paribas, and Dutch bank ING fell between 1.6% and 5.2%.

Earlier in the session, Asian stocks fell as losses in Japan offset gains in China, as investors eyed rising U.S. Treasury yields and semiconductor supply problems. Consumer discretionary and industrial shares weighed most heavily on the MSCI Asia Pacific Index, which slipped 0.2%. Japan’s Nikkei fell 1.5% as retail investors faced potential losses on large long positions in the high-yielding lira. New Zealand and Japan led declines among key national stock gauges. Chinese stocks outperformed, with the SHCOMP rising 1.1%, after People’s Bank of China Governor Yi Gang said the central bank still has room to pump liquidity into the economy. Shares of Asian shipping line operators jumped after dry-bulk rates rose to the highest level since Sept. 2019 on global recovery in iron-ore demand and economic activities. Baltic Dry Index surged 16.4% last week for its third straight weekly gain. In South Korea, Pan Ocean rose as much as 13%, HMM 9.4%, Korea Line 7.5%

The bond market remains in focus again, with the 10-year U.S. Treasury yield falling back to 1.68% from the highest levels in about 14 months following soothing comments from Federal Reserve officials. Treasuries advanced, outperforming bunds and gilts in a bull-flattening move lacking a clear driver. TSY yields are lower by up to 4bp-5bp across intermediates and long- end of the curve, flattening 2s10s by more than 3bp, 5s30s by ~1bp; 10-year yields around 1.675%, richer by 4.6bp on the day and outperforming bunds, gilts by ~3bp each. Most of the move occurred during Asia hours, leaving futures steady near highs of the day into early U.S. session. Back-end outperformance is consistent with quarter-end buying and pension fund demand. Peripheral spreads widened to Germany with Portugal and Spain underperforming.

IG credit issuance slate includes Naver $500m 5Y; desks are calling for as much as $40b+, and moments ago Oracle announced a 6 part deal adding even more rate locks. Treasury auctions resume Tuesday with $60b 2-year note sale, followed by $61b 5-year on Wednesday and the infamous $62BN 7-year auction whose rout started the recent market turmoil on Thursday.

A slate of auctions this week and moves by the Fed to let a key bank capital exemption lapse could stoke further volatility, while Powell comments 3 times this week. Last week’s Treasury selloff served as a stark reminder that investors remain concerned that a stronger economic recovery could lead to inflation. Despite reassuring comments from policymakers, some suspect price pressures could force the Federal Reserve to tighten monetary policy sooner than current guidance suggests.

“Clearly, the market is skeptical that the Fed will be able to keep interest rates at current levels for the next three years,” Diana Mousina, senior economist in the multi-asset group at AMP Capital Investors Ltd., said in a note. “We think that nominal bond yields can still shoot higher in the short-term towards 2% and above on inflation concerns. Markets are likely to worry that this move is permanent, rather than temporary.”

In FX, the tumble in the lira saw the yen firm modestly, with notable gains on the euro and Australian dollar. That in turn dragged the euro down slightly on the dollar to $1.1890. After an initial slip, the dollar soon steadied at 108.80 yen, while the dollar index was down slightly at 91.942. The Bloomberg dollar index gave back Asia’s modest gains. The big highlight of course was Turkey’s lira which weakened as much as 17% after Erdogan fired the central bank chief, while haven currencies like the Japanese yen and Swiss franc led gains in the group-of-10 currency basket. AUD, NOK and GBP lagged in G-10 although ranges are narrow. JPY and CHF outperform with EUR/CHF revisiting last Thursday’s lows.

Also supporting the yen were concerns Japanese retail investors that have built long lira positions, a popular trade for the yield-hungry sector, might be squeezed out and trigger another round of lira selling. Still, analysts at Citi doubted that the episode would lead to widespread pressure on emerging markets, noting the last time the lira slid in 2020, there was little spillover. “In terms of impact on other parts of the high-yielding EM, we believe that will be quite limited,” Citi said in a note. There was scant sign of safe-haven demand for gold, which eased 0.7% to $1,731 an ounce.

Crude futures push into the green but trade a narrow range. WTI regains a $61-handle, Brent near $64.70. Spot gold drops ~$15, before finding support near $1,730/oz. Most base metals trade well; LME zinc, lead and nickel gain over 1%.

Looking at the day and week ahead, durable goods orders and personal income and spending top a raft of economic data, while more than 20 FOMC speaking engagements including three appearances by Chair Jerome Powell, providing plenty of opportunity for more volatility in markets.

Market Snapshot

- S&P 500 futures down 0.1% to 3,894.25

- SXXP Index down 0.2% to 422.70

- MXAP down 0.2% to 208.03

- MXAPJ up 0.2% to 689.62

- Nikkei down 2.1% to 29,174.15

- Topix down 1.1% to 1,990.18

- Hang Seng Index down 0.4% to 28,885.34

- Shanghai Composite up 1.1% to 3,443.44

- Sensex down 0.6% to 49,576.54

- Australia S&P/ASX 200 up 0.7% to 6,752.46

- Kospi down 0.1% to 3,035.46

- German 10Y yield down 2 bps to -0.32%

- Euro little changed at $1.1904

- Brent futures down 0.6% to $64.14/bbl

- Gold spot down 0.8% to $1,730.46

- U.S. Dollar Index little changed at 91.96

Top Overnight News from Bloomberg

- Turkey’s stocks, bonds and the lira tumbled as the shock dismissal of the country’s central bank chief triggered concern the country is headed for a fresh bout of currency turbulence.

- AstraZeneca Plc’s coronavirus vaccine fared better than expected in a U.S. clinical trial, providing reassurance about its safety and efficacy

- The European Union’s path to joint fiscal stimulus is looking less assured than its monetary guardians would like, casting further clouds over an outlook already stunted by the bloc’s botched vaccination drive.

A look at global markets courtesy of Newsquawk

Asian equity markets began the week mixed as the region took its cue from the indecisive performance last Friday stateside following bitter US-China talks in Alaska and despite an overnight easing of yields. ASX 200 (+0.7%) was kept afloat with M&A news in focus after Blackstone made an offer to acquire Crown Resorts at a 20% premium which lifted shares in the latter by a similar extent although gains in Australia were capped amid heavy rain and floods in New South Wales which resulted in evacuation orders and pressured insurers. Nikkei 225 (-2.1%) suffered intraday losses of as much as 2% in the aftermath of the BoJ policy tweaks, ban on foreign spectators at the Tokyo Olympics and with auto stocks spooked due to a recent fire at the Renesas chip plant in Naka which the Co. stated could have a very large impact on its supply to automakers, while a firmer JPY also provided headwinds for Japanese markets. Hang Seng (-0.4%) and Shanghai Comp. (+1.1%) were mixed after the Alaska summit failed to reset relations between the world’s two largest economies and with Hong Kong tentative as it braces for IPO activity with Baidu to debut tomorrow, although the mainland was positive amid updates from the PBoC which kept the 1yr and 5yr Loan Prime Rates unchanged for an 11th consecutive month as expected, while there were also recent comments from PBoC Governor Yi that China has ample monetary policy tools and relatively large room for monetary policy adjustments. Finally, 10yr JGBs were higher as they tracked the rebound in USTs and decline in yields, with prices also supported by underperformance in Japanese stocks and the BoJ's presence in the market for over JPY 1.2tln of JGBs heavily concentrated in 1yr-10yr maturities.

Top Asian News

- CapitaLand to Split Main Businesses in Revamp After Rare Loss

- Korea Travel App Eyes Dual IPO Listing at $4 Billion-Plus Value

- China Confronted by Show of Western Unity at Canadian’s Trial

- Myanmar Junta Expects Asian Nations to Keep Investing After Coup

European equities initially opened the first session of the week mixed across the board (Euro Stoxx 50 -0.1%), but briefly experienced some negative bias in early trade. The mixed lead followed Asia’s similar handover whilst US equity futures similarly vary with the tech-laden NQ (+0.8%) outperforming as yields wane off last week's highs. Back to Europe, sectors opened firmly in the red with Travel & Leisure (-1.2%) the laggard due to the rising COVID infection rates across Europe. Paris has entered a new 4-week lockdown and Germany is reportedly set to extend its lockdown for a 5th month meaning the economic outlook and holiday prosperity has dwindled resulting in the travel & leisure sector being severely impacted this morning. Add to that, the UK's Defence Secretary refrained from ruling out an extension to the ban on foreign holidays in order to control the spread of coronavirus. Meanwhile, Banks (-0.3%) have also seen downside amid a lower yield environment and follow-through from banks with historical exposure to Turkey, such as BBVA (-6.1%) and ING (-1.7%), who have been considerably affected by the surprise sacking of the CBRT governor by the Turkish President. On the upside, Autos (+1.6%) is the notable outperformer which may be in turn due to Porsche (+5.5%) and Volkswagen’s (+5.4%) firmer openings. Elsewhere on the individual movers front, Infineon (+3.3%) trades higher after the Co. announced it expects to reach pre-shut down levels in June 2021 and sees no negative impact on FY revenues amid strong global demand after the Texan deep freeze. AstraZeneca (+1.4%) has shrugged off negative headlines after the positive US COVID vaccine trial findings where it met its endpoint and illustrated a 79% efficacy at preventing symptomatic cases and 100% efficacy vs severe or critical disease and hospitalisation. Residing to the downside is the aforementioned travel names, Ryanair (-3.8%) and Lufthansa (-3.3%) are the distinct underperformers and are feeling the full force of the potentially dampened recovery outlook this summer. Lastly, heading into month-end and following last week moves in equities and bonds, the Goldman Sachs pension model estimates USD 58bln of equities to sell for month & quarter end (vs prev. view USD 65bln). Additionally, despite the revised forecast it would still rank as the 4th largest estimate in absolute USD value over the past three years.

Top European News

- EU’s Plodding Stirs ECB Concerns as U.S. Delivers Stimulus

- Suez Shares Rise After Call for Higher Bid Rejected by Veolia

- Deliveroo Kicks Off $2.5 Billion IPO, U.K.’s Largest in 2021

- Merkel Seeks Four-Week Lockdown Extension in German Setback

In FX, having extended its post-200 bp rate hike recovery rally to around 7.1867 vs the Dollar, the Lira has been struggling to keep its head above 8.0000 and depreciated to lows circa 8.1745 at one stage following the latest removal of a CBRT Governor under the Presidency of Erdogan who is renowned for his unorthodox beliefs that tightening monetary policy merely heightens price pressures rather than helping to combat above target inflation. As such, Agbal becomes the 2nd Central Bank head to be sacked and after just 5 months in the role in wake of last Thursday’s front-loaded 1 week repo rate increase to 19% from 17% vs 18% almost universally forecast.

- DXY - Usd/Try aside, currency markets are relatively sedate and orderly as evidenced by the index hugging a tight line either side of 92.000 amidst relative calm in bond land after recent antics and last Thursday’s particularly aggressive bear-steepening that propelled benchmark yields to and through psychological levels. Indeed, the DXY is meandering between 92.155-91.872 and most of the Greenback’s G10 rivals are rangebound awaiting a catalyst to break one way or the other that could come from data, events and/or speakers today, but may be more likely later in the week given up to date and forward looking surveys like the preliminary Markit PMIs and Ifo.

- JPY/CHF - The Yen and Franc could conceivably be firmer on safe-haven grounds given the aforementioned angst in Turkey that has rekindled investor angst due to credibility concerns, as the former has another look at offers and supply ahead of 108.50, while the latter is back above 0.9300 and 1.1050 against the Buck and Euro respectively in the ongoing absence of any visible intervention via weekly Swiss bank sight deposits. However, the SNB looms and the Bank has reiterated that there is more room on the balance sheet for monetary policy purposes even though currency interventions in 2020 totalled Chf 100 bn vs only Chf 13.2 bn the year before.

- CAD/GBP/NZD/EUR - All pivoting their US counterpart in narrow confines, with the Loonie eyeing oil prices to see if WTI and Brent form a base and Sterling monitoring the vaccine situation following reports that the EU might block exports of AZN and ingredients to the UK. Elsewhere, the Kiwi appears to be benefiting from relative underperformance in the Aussie via the Aud/Nzd cross rather than anything NZ specific in advance of trade data and PMIs on Tuesday respectively, while the Euro awaits ECB QE updates and speakers for some independent impetus. Usd/Cad is currently straddling 1.2500, Cable 1.3850, Nzd/Usd 0.7150 as Aud/Nzd retreats through 1.0800 and Eur/Usd is rotating around 1.1900.

- AUD - As noted above, the Aussie is lagging and not really helped by a weaker PBoC midpoint fix for the CNY overnight, but Aud/Usd has bounced from sub-7700 lows alongside Usd/CNH easing back towards 6.5000.

In commodities, WTI and Brent front month futures trade choppy within relatively tight ranges following last week’s notable decline in prices, as traders weigh the demand impact from the renewed lockdown measures in the Eurozone with the fiscal stimulus effects in the run up to next week’s key OPEC+ meeting. In terms of the latest on the demand side, Germany is reportedly set to extend its lockdown for a 5th month as infection rates remain above levels that would overstretch hospitals, according to a draft proposal, whilst reports also state that the EU is said to expected to block the AstraZeneca vaccine and ingredient exports to the UK which could impact 20% of supply. Energy agencies and analysts have previously voiced concern over the fragility of the OECD demand outlook given the risks of intermittent lockdowns. Furthermore, the UK Defence Secretary over the weekend refused to rule out an extension to the ban on foreign travel, which again could hinder the recovery prospects for jet fuel demand. On the flip side, it remains to be seen how OPEC+ could react to these developments, having carefully manoeuvred away from a market disappointment at the prior meeting. On that noting, relatively stale data but nonetheless, OPEC+ February compliance reached a record 113% (OPEC 124% and Non-OPEC 94%) due to Saudi's unilateral cut, according to sources cited by Argus. Saudi Aramco also reported earnings over the weekend which highlighted the impact of last year’s oil rout, albeit again this is backward looking and cannot provide much in the way of an outlook in this every-changing environment. Futures have gained some traction in recent trade - WTI trades on either side of USD 61.50/bbl (USD 60.35-61.85/bbl intraday range) while its Brent counterpart sees itself just above USD 64.50/bbl (USD 63.45-64.85/bbl intraday range), with risk events ahead including a slew of central bank speakers and a potentially interesting ECB PEPP release. Elsewhere, spot gold and silver are softer as yields pull back. Spot gold in the grander scheme remains within tight ranges and still influenced by the recent USD 1720-1730/oz support zone. In terms of base metals, LME copper trades on either side of USD 9,000/t and modestly softer amid the risk tone across Europe. Overnight, attention was on iron ore futures as the Dalian contract slumped over 6% and coking coal also slipping some 7% amid reports of a pollution notice doing the rounds in China’s steel industry regarding its steel-making city Tangshan, which could threaten 30-50% of output. Goldman Sachs expects iron ore prices to contract 15-20% in H1 2022, with the 3-month, 6-month and 12-month forecasts at USD 135/t, USD 115/t and USD 100/t.

US Event Calendar

- 8:30am: Feb. Chicago Fed Nat Activity Index, est. 0.71, prior 0.66

- 10am: Feb. Existing Home Sales MoM, est. -2.9%, prior 0.6%

- 10am: Feb. Home Resales with Condos, est. 6.5m, prior 6.69m

DB's Jim Reid concludes the overnight wrap

While we fire up our abacus after its weekend slumber we’ll keep the monthly survey open for another couple of hours this morning. Amongst other questions, click here to rate the Fed and the ECB over the 12 month pandemic, whether the Fed will hike more or less than the market predicts, give your opinion as to whether you perceive the AZ vaccine to be as safe as Pfizer’s and also whether you are more or less healthy after a year of the pandemic. All help greatly appreciated. Results out tomorrow.

It’s been an interesting weekend with the highlight being Turkish central bank governor Naci Agbal surprisingly being replaced by Presidential decree. The Lira opened up last night as much as -17% down. As we type it is -10.32%. Agbal only lasted 4 months but this tenor was associated with an +18% rally in the Lira as rising interest rates, and with it inflation fighting policies, had attracted in investors. This all follows a 200bps hike on Thursday, double the consensus expectations. Maybe this is the most high profile victim of higher US yields seen so far.

The new central bank governor, Sahap Kavcioglu, said last night that the CBT will use monetary-policy tools effectively to deliver permanent price stability while adding that the bank’s rate-setting meetings will take place according to schedule. This likely eliminates the risk that markets might see a change in interest rates this week. The next rate setting meeting of the CBT is on April 15 given the present schedule. For a quick reaction to what has happened see our strategists’ piece last night here.

Asian markets have started the week on a weaker footing with the Nikkei (-1.82%), Hang Seng (-0.23%) and Kospi (0.17%) all trading lower. Chinese markets are an exception though with the CSI (+0.76%) and Shanghai Comp (+0.94%) both posting strong gains. Futures on the S&P 500 are currently at +0.02% after fluctuating between gains and losses but those on the Nasdaq are up +0.50% while European futures are pointing to a weaker open. Expect lots of chatter about where Turkey exposures are in the continent. Yields on 10y USTs are down -4.5bps bps to 1.678% with 10y real yields being down -3.4bps and 10y breakevens down -1.5bps. Japan (-2.5bps), Australia (-4.7bps) and New Zealand’s (-7.1bps) 10y bond yields are also trading lower.

In terms of markets it’s all about yields at the moment as last week saw the 7th successive weekly rise in US Treasuries yields - the longest streak since Jan/Feb 2018. Markets continue to be torn as to how much we should be worried about it. With the S&P closing the week only a fraction off Wednesday’s fresh all time highs then it’s clear that we’re coping for now. However there’s no doubt this is becoming complicated. When former US Treasury Secretary Summers says, as he did over the weekend, that the US faces the worst macroeconomic policy in 40 years one has to listen whether you agree or not.

A slight surprise on Friday was the announce of the reinstatement of the supplementary leverage ratio (SLR) for bank holdings of bank reserves and Treasuries after an emergency rule runs out at the end of this month. Yields spiked a few basis points higher on the news but there has been talk that the fear of this has been part of the reason yields have been on a relentless march upwards recently. There has been a fear of bank balance sheet deleveraging on this which has led to selling of the long end and has helped drive bills into negative territory. Deep down it’s another “too much cash in the system“ problem. People more expert on this than me suggest that after a period of consultation a fix will be found. Nevertheless, with all this in mind this week’s auctions will be a good litmus test of how comfortable markets are with bond market risk at the moment. Purely for bonds we have $60 billion 2-year tomorrow, $61 billion 5-year (Wednesday) and $62 billion 7-year notes (Thursday) to at least monitor. The bad 7-year auction at a similar time last month was a bit of a warning sign for demand at the then prevailing levels so this might be one to watch.

Elsewhere with the major central bank meetings now out of the way, market attention over the week ahead will likely turn back to the pace of the economic recovery, with a focus on the release of the flash PMIs for March (Wednesday), as well as the potential for increased pandemic restrictions as the global case count has begun to rise again. Other events in focus will include Fed Chair Powell and US Treasury Secretary Yellen testifying before congressional committees (Tuesday and Wednesday), Powell speaking at a BIS event today, as well as an EU leaders’ summit at the end of the week, where the pandemic and the vaccination programme will top the agenda.

In more specific detail on the PMIs, in recent months there’s been a divergence in the indicators, with Europe lagging behind the US, and the services sector lagging manufacturing. Indeed, the Euro Area composite PMI has been beneath the 50- mark for 4 successive months, whereas the US composite PMI rose to 59.5 in February, its highest level since August 2014. With restrictions beginning to tighten in Europe again whilst the stimulus checks arrive in the US, it’ll be interesting to see if this divergence widens further over the coming weeks and months. Also watch out for the Ifo business climate indicator from Germany (Friday).

From central banks, the main highlight will be Fed Chair Powell’s appearance tomorrow and Wednesday before the House Financial Services Committee and the Senate Banking Committee on the CARES Act. He’ll be doing this alongside Treasury Secretary Janet Yellen. Markets will be paying close attention to see if Powell has any further commentary on the Fed’s reaction function, particularly since their dot plot last week showed a majority of the FOMC keeping rates on holding through the end of 2023, even as they projected above-target inflation. Also of interest will be if Powell has any comments on the recent rise in yields, with those on 10yr US Treasuries rising to their highest levels since January 2020 in the week just gone.

Towards the end of the week, EU leaders will be gathering in Brussels for their latest summit, in which Covid-19 is expected to feature heavily on the agenda. The EU have been criticised for the slow pace of their vaccination programme, which has lagged behind the UK and the US, and a number of countries temporarily suspended the AstraZeneca vaccine following reports of blood clots last week. Commission President von der Leyen even refused to rule out using Article 122, which would in theory allow the EU to take control of the production and distribution of vaccines, potentially placing export controls on vaccines that had been destined elsewhere such as the UK. Separately on the pandemic, German Chancellor Merkel will be speaking with state leaders today as they decide their next steps to deal with rising caseloads. The country’s lockdown restrictions currently expire on March 28. Stricter restrictions are predicted with Bloomberg last night suggesting another 4-week extension to April 18th being likely. Across the other side of Atlantic, Massachusetts said that it will be easing restrictions further today with indoor and outdoor stadiums, including Fenway Park, allowed to reopen at 12% capacity, and the numbers allowed at public and private gatherings will also increase.

Recapping last week now and risk markets hit a bit of a snag as bond yields, particularly in the US, continued to surge higher. The S&P 500 lost -0.77% over the course of the week (-0.06% Friday), though it did reach a record high on Wednesday just after last week’s FOMC meeting. Small caps fell further as the Russell 2000 lost -2.77%, but is still up over +15.8% YTD compared to the S&P’s +4.2% gain. Tech stocks more or less moved in-line with the S&P as the NASDAQ composite fell -0.79% over the course of the week, though large cap tech stocks actually recovered versus their cyclical peers, with NYFANG index down just -0.51%, while bank stocks on both sides of the Atlantic saw their winning runs ease slightly. US Banks fell back -0.92% and their European counterparts lost -0.53%, though both are up +23.9% and +20.0% respectively YTD. The STOXX 600 outperformed US stocks overall, but the index was largely unchanged on the week (+0.06%). Oil prices saw a strong pullback, which weighed on energy stocks. There was no direct catalyst, but Brent (-6.78%) and WTI (-6.39%) crude both fell.

US 10yr yields rose 4 out of 5 days last week to finish +9.6bps higher (+1.3bps Friday) at 1.721% - its highest closing level since mid-January of last year. It was the seventh weekly rise in yields, which remains the longest streak since Jan/Feb 2018. The move at the long end saw the 2y10y yield curve steepen another +9.4bps to 156.8bps its steepest level since July 2015. Much of the move came following Wednesday’s FOMC meeting as the market repriced real rate and inflation expectations. Meanwhile core rates in Europe rose in a more moderated fashion. UK gilts rose +1.6bps to 0.84% as 10y bund yields increased +1.2bps to -0.29%.

International

Illegal Immigrants Leave US Hospitals With Billions In Unpaid Bills

Illegal Immigrants Leave US Hospitals With Billions In Unpaid Bills

By Autumn Spredemann of The Epoch Times

Tens of thousands of illegal…

By Autumn Spredemann of The Epoch Times

Tens of thousands of illegal immigrants are flooding into U.S. hospitals for treatment and leaving billions in uncompensated health care costs in their wake.

The House Committee on Homeland Security recently released a report illustrating that from the estimated $451 billion in annual costs stemming from the U.S. border crisis, a significant portion is going to health care for illegal immigrants.

With the majority of the illegal immigrant population lacking any kind of medical insurance, hospitals and government welfare programs such as Medicaid are feeling the weight of these unanticipated costs.

Apprehensions of illegal immigrants at the U.S. border have jumped 48 percent since the record in fiscal year 2021 and nearly tripled since fiscal year 2019, according to Customs and Border Protection data.

Last year broke a new record high for illegal border crossings, surpassing more than 3.2 million apprehensions.

And with that sea of humanity comes the need for health care and, in most cases, the inability to pay for it.

In January, CEO of Denver Health Donna Lynne told reporters that 8,000 illegal immigrants made roughly 20,000 visits to the city’s health system in 2023.

The total bill for uncompensated care costs last year to the system totaled $140 million, said Dane Roper, public information officer for Denver Health. More than $10 million of it was attributed to “care for new immigrants,” he told The Epoch Times.

Though the amount of debt assigned to illegal immigrants is a fraction of the total, uncompensated care costs in the Denver Health system have risen dramatically over the past few years.

The total uncompensated costs in 2020 came to $60 million, Mr. Roper said. In 2022, the number doubled, hitting $120 million.

He also said their city hospitals are treating issues such as “respiratory illnesses, GI [gastro-intenstinal] illnesses, dental disease, and some common chronic illnesses such as asthma and diabetes.”

“The perspective we’ve been trying to emphasize all along is that providing healthcare services for an influx of new immigrants who are unable to pay for their care is adding additional strain to an already significant uncompensated care burden,” Mr. Roper said.

He added this is why a local, state, and federal response to the needs of the new illegal immigrant population is “so important.”

Colorado is far from the only state struggling with a trail of unpaid hospital bills.

Dr. Robert Trenschel, CEO of the Yuma Regional Medical Center situated on the Arizona–Mexico border, said on average, illegal immigrants cost up to three times more in human resources to resolve their cases and provide a safe discharge.

“Some [illegal] migrants come with minor ailments, but many of them come in with significant disease,” Dr. Trenschel said during a congressional hearing last year.

“We’ve had migrant patients on dialysis, cardiac catheterization, and in need of heart surgery. Many are very sick.”

He said many illegal immigrants who enter the country and need medical assistance end up staying in the ICU ward for 60 days or more.

A large portion of the patients are pregnant women who’ve had little to no prenatal treatment. This has resulted in an increase in babies being born that require neonatal care for 30 days or longer.

Dr. Trenschel told The Epoch Times last year that illegal immigrants were overrunning healthcare services in his town, leaving the hospital with $26 million in unpaid medical bills in just 12 months.

ER Duty to Care

The Emergency Medical Treatment and Labor Act of 1986 requires that public hospitals participating in Medicare “must medically screen all persons seeking emergency care … regardless of payment method or insurance status.”

The numbers are difficult to gauge as the policy position of the Centers for Medicare & Medicaid Services (CMS) is that it “will not require hospital staff to ask patients directly about their citizenship or immigration status.”

In southern California, again close to the border with Mexico, some hospitals are struggling with an influx of illegal immigrants.

American patients are enduring longer wait times for doctor appointments due to a nursing shortage in the state, two health care professionals told The Epoch Times in January.

A health care worker at a hospital in Southern California, who asked not to be named for fear of losing her job, told The Epoch Times that “the entire health care system is just being bombarded” by a steady stream of illegal immigrants.

“Our healthcare system is so overwhelmed, and then add on top of that tuberculosis, COVID-19, and other diseases from all over the world,” she said.

A newly-enacted law in California provides free healthcare for all illegal immigrants residing in the state. The law could cost taxpayers between $3 billion and $6 billion per year, according to recent estimates by state and federal lawmakers.

In New York, where the illegal immigration crisis has manifested most notably beyond the southern border, city and state officials have long been accommodating of illegal immigrants’ healthcare costs.

Since June 2014, when then-mayor Bill de Blasio set up The Task Force on Immigrant Health Care Access, New York City has worked to expand avenues for illegal immigrants to get free health care.

“New York City has a moral duty to ensure that all its residents have meaningful access to needed health care, regardless of their immigration status or ability to pay,” Mr. de Blasio stated in a 2015 report.

The report notes that in 2013, nearly 64 percent of illegal immigrants were uninsured. Since then, tens of thousands of illegal immigrants have settled in the city.

“The uninsured rate for undocumented immigrants is more than three times that of other noncitizens in New York City (20 percent) and more than six times greater than the uninsured rate for the rest of the city (10 percent),” the report states.

The report states that because healthcare providers don’t ask patients about documentation status, the task force lacks “data specific to undocumented patients.”

Some health care providers say a big part of the issue is that without a clear path to insurance or payment for non-emergency services, illegal immigrants are going to the hospital due to a lack of options.

“It’s insane, and it has been for years at this point,” Dana, a Texas emergency room nurse who asked to have her full name omitted, told The Epoch Times.

Working for a major hospital system in the greater Houston area, Dana has seen “a zillion” migrants pass through under her watch with “no end in sight.” She said many who are illegal immigrants arrive with treatable illnesses that require simple antibiotics. “Not a lot of GPs [general practitioners] will see you if you can’t pay and don’t have insurance.”

She said the “undocumented crowd” tends to arrive with a lot of the same conditions. Many find their way to Houston not long after crossing the southern border. Some of the common health issues Dana encounters include dehydration, unhealed fractures, respiratory illnesses, stomach ailments, and pregnancy-related concerns.

“This isn’t a new problem, it’s just worse now,” Dana said.

Medicaid Factor

One of the main government healthcare resources illegal immigrants use is Medicaid.

All those who don’t qualify for regular Medicaid are eligible for Emergency Medicaid, regardless of immigration status. By doing this, the program helps pay for the cost of uncompensated care bills at qualifying hospitals.

However, some loopholes allow access to the regular Medicaid benefits. “Qualified noncitizens” who haven’t been granted legal status within five years still qualify if they’re listed as a refugee, an asylum seeker, or a Cuban or Haitian national.

Yet the lion’s share of Medicaid usage by illegal immigrants still comes through state-level benefits and emergency medical treatment.

A Congressional report highlighted data from the CMS, which showed total Medicaid costs for “emergency services for undocumented aliens” in fiscal year 2021 surpassed $7 billion, and totaled more than $5 billion in fiscal 2022.

Both years represent a significant spike from the $3 billion in fiscal 2020.

An employee working with Medicaid who asked to be referred to only as Jennifer out of concern for her job, told The Epoch Times that at a state level, it’s easy for an illegal immigrant to access the program benefits.

Jennifer said that when exceptions are sent from states to CMS for approval, “denial is actually super rare. It’s usually always approved.”

She also said it comes as no surprise that many of the states with the highest amount of Medicaid spending are sanctuary states, which tend to have policies and laws that shield illegal immigrants from federal immigration authorities.

Moreover, Jennifer said there are ways for states to get around CMS guidelines. “It’s not easy, but it can and has been done.”

The first generation of illegal immigrants who arrive to the United States tend to be healthy enough to pass any pre-screenings, but Jennifer has observed that the subsequent generations tend to be sicker and require more access to care. If a family is illegally present, they tend to use Emergency Medicaid or nothing at all.

The Epoch Times asked Medicaid Services to provide the most recent data for the total uncompensated care that hospitals have reported. The agency didn’t respond.

Continue reading over at The Epoch Times

International

Fuel poverty in England is probably 2.5 times higher than government statistics show

The top 40% most energy efficient homes aren’t counted as being in fuel poverty, no matter what their bills or income are.

The cap set on how much UK energy suppliers can charge for domestic gas and electricity is set to fall by 15% from April 1 2024. Despite this, prices remain shockingly high. The average household energy bill in 2023 was £2,592 a year, dwarfing the pre-pandemic average of £1,308 in 2019.

The term “fuel poverty” refers to a household’s ability to afford the energy required to maintain adequate warmth and the use of other essential appliances. Quite how it is measured varies from country to country. In England, the government uses what is known as the low income low energy efficiency (Lilee) indicator.

Since energy costs started rising sharply in 2021, UK households’ spending powers have plummeted. It would be reasonable to assume that these increasingly hostile economic conditions have caused fuel poverty rates to rise.

However, according to the Lilee fuel poverty metric, in England there have only been modest changes in fuel poverty incidence year on year. In fact, government statistics show a slight decrease in the nationwide rate, from 13.2% in 2020 to 13.0% in 2023.

Our recent study suggests that these figures are incorrect. We estimate the rate of fuel poverty in England to be around 2.5 times higher than what the government’s statistics show, because the criteria underpinning the Lilee estimation process leaves out a large number of financially vulnerable households which, in reality, are unable to afford and maintain adequate warmth.

Energy security

In 2022, we undertook an in-depth analysis of Lilee fuel poverty in Greater London. First, we combined fuel poverty, housing and employment data to provide an estimate of vulnerable homes which are omitted from Lilee statistics.

We also surveyed 2,886 residents of Greater London about their experiences of fuel poverty during the winter of 2022. We wanted to gauge energy security, which refers to a type of self-reported fuel poverty. Both parts of the study aimed to demonstrate the potential flaws of the Lilee definition.

Introduced in 2019, the Lilee metric considers a household to be “fuel poor” if it meets two criteria. First, after accounting for energy expenses, its income must fall below the poverty line (which is 60% of median income).

Second, the property must have an energy performance certificate (EPC) rating of D–G (the lowest four ratings). The government’s apparent logic for the Lilee metric is to quicken the net-zero transition of the housing sector.

In Sustainable Warmth, the policy paper that defined the Lilee approach, the government says that EPC A–C-rated homes “will not significantly benefit from energy-efficiency measures”. Hence, the focus on fuel poverty in D–G-rated properties.

Generally speaking, EPC A–C-rated homes (those with the highest three ratings) are considered energy efficient, while D–G-rated homes are deemed inefficient. The problem with how Lilee fuel poverty is measured is that the process assumes that EPC A–C-rated homes are too “energy efficient” to be considered fuel poor: the main focus of the fuel poverty assessment is a characteristic of the property, not the occupant’s financial situation.

In other words, by this metric, anyone living in an energy-efficient home cannot be considered to be in fuel poverty, no matter their financial situation. There is an obvious flaw here.

Around 40% of homes in England have an EPC rating of A–C. According to the Lilee definition, none of these homes can or ever will be classed as fuel poor. Even though energy prices are going through the roof, a single-parent household with dependent children whose only income is universal credit (or some other form of benefits) will still not be considered to be living in fuel poverty if their home is rated A-C.

The lack of protection afforded to these households against an extremely volatile energy market is highly concerning.

In our study, we estimate that 4.4% of London’s homes are rated A-C and also financially vulnerable. That is around 171,091 households, which are currently omitted by the Lilee metric but remain highly likely to be unable to afford adequate energy.

In most other European nations, what is known as the 10% indicator is used to gauge fuel poverty. This metric, which was also used in England from the 1990s until the mid 2010s, considers a home to be fuel poor if more than 10% of income is spent on energy. Here, the main focus of the fuel poverty assessment is the occupant’s financial situation, not the property.

Were such alternative fuel poverty metrics to be employed, a significant portion of those 171,091 households in London would almost certainly qualify as fuel poor.

This is confirmed by the findings of our survey. Our data shows that 28.2% of the 2,886 people who responded were “energy insecure”. This includes being unable to afford energy, making involuntary spending trade-offs between food and energy, and falling behind on energy payments.

Worryingly, we found that the rate of energy insecurity in the survey sample is around 2.5 times higher than the official rate of fuel poverty in London (11.5%), as assessed according to the Lilee metric.

It is likely that this figure can be extrapolated for the rest of England. If anything, energy insecurity may be even higher in other regions, given that Londoners tend to have higher-than-average household income.

The UK government is wrongly omitting hundreds of thousands of English households from fuel poverty statistics. Without a more accurate measure, vulnerable households will continue to be overlooked and not get the assistance they desperately need to stay warm.

Torran Semple receives funding from Engineering and Physical Sciences Research Council (EPSRC) grant EP/S023305/1.

John Harvey does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

european uk pandemicGovernment

Looking Back At COVID’s Authoritarian Regimes

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked,…

After having moved from Canada to the United States, partly to be wealthier and partly to be freer (those two are connected, by the way), I was shocked, in March 2020, when President Trump and most US governors imposed heavy restrictions on people’s freedom. The purpose, said Trump and his COVID-19 advisers, was to “flatten the curve”: shut down people’s mobility for two weeks so that hospitals could catch up with the expected demand from COVID patients. In her book Silent Invasion, Dr. Deborah Birx, the coordinator of the White House Coronavirus Task Force, admitted that she was scrambling during those two weeks to come up with a reason to extend the lockdowns for much longer. As she put it, “I didn’t have the numbers in front of me yet to make the case for extending it longer, but I had two weeks to get them.” In short, she chose the goal and then tried to find the data to justify the goal. This, by the way, was from someone who, along with her task force colleague Dr. Anthony Fauci, kept talking about the importance of the scientific method. By the end of April 2020, the term “flatten the curve” had all but disappeared from public discussion.

Now that we are four years past that awful time, it makes sense to look back and see whether those heavy restrictions on the lives of people of all ages made sense. I’ll save you the suspense. They didn’t. The damage to the economy was huge. Remember that “the economy” is not a term used to describe a big machine; it’s a shorthand for the trillions of interactions among hundreds of millions of people. The lockdowns and the subsequent federal spending ballooned the budget deficit and consequent federal debt. The effect on children’s learning, not just in school but outside of school, was huge. These effects will be with us for a long time. It’s not as if there wasn’t another way to go. The people who came up with the idea of lockdowns did so on the basis of abstract models that had not been tested. They ignored a model of human behavior, which I’ll call Hayekian, that is tested every day.

These are the opening two paragraphs of my latest Defining Ideas article, “Looking Back at COVID’s Authoritarian Regimes,” Defining Ideas, March 14, 2024.

Another excerpt:

That wasn’t the only uncertainty. My daughter Karen lived in San Francisco and made her living teaching Pilates. San Francisco mayor London Breed shut down all the gyms, and so there went my daughter’s business. (The good news was that she quickly got online and shifted many of her clients to virtual Pilates. But that’s another story.) We tried to see her every six weeks or so, whether that meant our driving up to San Fran or her driving down to Monterey. But were we allowed to drive to see her? In that first month and a half, we simply didn’t know.

Read the whole thing, which is longer than usual.

(0 COMMENTS) budget deficit coronavirus covid-19 white house fauci trump canada-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex