Futures Rebound As Facebook Soars; Dollar Steamrolls Higher As Yen Crashes

Futures Rebound As Facebook Soars; Dollar Steamrolls Higher As Yen Crashes

U.S. index futures, European bourses and Asian markets all rose…

U.S. index futures, European bourses and Asian markets all rose as "good enough (if hardly stellar)" earnings reports from Facebook parent Meta Platforms and Qualcomm boosted sentiment (just don't look at the collapse in Teladoc). As we hit the peak of earnings season, with Apple, Amazon and Twitter set to report earnings today, S&P futures jumped 1.5%, while he Nasdaq futs jumped 2.2%, fuelled by a nearly 20% surge in Meta, which would be its biggest post-earnings jump since 2013. Investors were happy after Facebook added more users than projected in the first quarter, even if revenue growth slowed to just 7%, the lowest since the IPO. The dollar continued its relentless ascent, boosted by a plunge in the yen (more here) rising to the highest level in more than five years thanks to nominal US yields which are the highest in developed markets. WTI futures traded at around $102 a barrel. The 10-year Treasury yield was down some 2 basis points to 2.8147%. Bitcoin climbed, trading just below $40,000.

U.S. chip stocks traded higher in the premarket as Qualcomm, the biggest maker of chips that run smartphones, surged on a strong sales forecast easing fears about demand and the macroeconomic environment, while PayPal shares gained after it reported better-than-expected revenue and active user figures. Here are some other notable premarket movers:

- Airline stocks gain in premarket trading after Southwest Airlines Co. said it expects a rebound in domestic travel to carry into the summer.

- PayPal (PYPL US) rises 3.6% in premarket trading after the payments firm reported better-than-expected first-quarter revenue and active user figures.

- Pinterest shares (PINS US) rise 9% in premarket trading after quarterly earnings beat estimates, though analysts cut price targets amid questions over user engagement.

- Teladoc Health (TDOC US) plunges 40% in premarket trading after cutting its revenue and earnings guidance, with analysts saying the outlook fuels the bear argument for the health-care technology company. Cathie Wood’s ARK Investment Management holds a stake.

- Ford’s (F US) first- quarter results that were mixed, according to analysts. A “modest” beat in 1Q was mostly driven by European operations. Shares rise 2.8% in pre-market trading.

- Atomera (ATOM US) surges as much as 18% in premarket trading, after the semiconductor materials and technology company entered into a new joint development agreement with a leading foundry partner.

- Statera BioPharma (STAB US) soars 81% in U.S. premarket trading, after the biotech company announced a strategic agreement with Immune Therapeutics (IMUN US).

- Sundial Growers (SNDL US) shares jump 11% in premarket trading after the cannabis producer reported 4Q adjusted Ebitda from continuing operations and net revenue that beat the average analyst estimate.

- Amgen (AMGN US) drops 5.9% in postmarket trading after an IRS probe of prior tax years, the biotechnology company also left its annual outlook unchanged despite a first-quarter earnings beat.

"The bullish mood is very much earnings related after some of the disappointing news earlier in the week,” said Roger Lee, head of U.K. Strategy at Investec. “Meta, Qualcomm, Paypal helped reassure following on from Microsoft’s good numbers.”

Thursday’s relief rally punctuates a week of nerves marked by China’s struggle to suppress Covid, Russia’s war in Ukraine, halts of Russian gas exports to Poland and Bulgaria, and worries that Federal Reserve monetary tightening may tip the U.S. economy into a recession. Almost 70 companies in Europe are due to publish results Thursday. About 61% of the companies that have reported so far have beaten estimates.

Despite the rebound in the past two days, US stocks have had a very rough month, with the S&P 500 set for its worst monthly return in two years, while the tech-heavy Nasdaq 100 is set for a 12% loss this month, its worst performance since October 2008. That may reverse if Amazon.com and Apple - which are among the companies set to report quarterly numbers on Thursday - report blowout earnings.

“Ironically the better the corporate earnings backdrop, the less recession risk there is, so the Fed can increase rates more aggressively and all the implications that will have on valuations,” said Roger Lee, a strategist at Investec. “Paradoxically good corporate news could ultimately be bad news for the market.”

It was an exciting session for central bank watchers with the BOJ surprising markets with an announcement that it would hold daily, unlimited fixed-rate operations to defend Yield Curve Control, in the process crushing the yen. Meanwhile, Sweden's central bank surprised most by raising its benchmark rate to send the krona soaring.

European stocks also rallied - the Stoxx 600 rose as much as 1.4% led by autos, tech and the banking sector although every industry group was in the green. Big individual contributors included TotalEnergies, Glencore and Capgemini, which all posted gains on buoyant earnings. DAX and CAC gain as much as 2%. Here are some of the biggest European movers today:

- Standard Chartered shares rise as much as 17% in London, the most since November 2020, following a rally in Hong Kong. The lender delivered a “stunning” 44% beat versus quarterly pretax profit consensus, according to Investec.

- Glencore gains as much as 2.7% in London after the commodity giant’s first-quarter production report; Morgan Stanley analysts say an uplift to marketing guidance overshadows weaker output.

- Barclays climbs as much as 3.7% after reporting what Citi described as an “impressive set of results” for 1Q. The broker highlighted the investment banking segment, noting that its performance was the main driver for the pretax profit beat.

- Smith & Nephew rises as much as 4.2% after reporting earnings that included beats in both overall revenue and all business areas. RBC notes the results were “well ahead” of both its own and consensus estimates.

- Albioma advances as much as 16% after U.S. private equity firm KKR agreed to acquire the French solar and biomass power producer for EU50/share plus EU0.84 dividend, in a deal valued at around EU1.6b.

- Whitbread gains as much as 4.9%, among the top performers in the Stoxx 600 Travel & Leisure Index, after the U.K. hotel operator reported results that Bernstein says show a “very strong start” to FY23.

- J Sainsbury drops as much as 6.9% after the U.K. grocer reported FY22 results and forecast FY23 adjusted pretax profit in the range of GBP630m- GBP690m. The guidance suggests cuts to consensus, according to Morgan Stanley.

- Delivery Hero falls as much as 12%, reversing an earlier 9% gain, with Goldman Sachs saying the company’s decision to stop reporting orders won’t be welcomed by investors. Analyst Rob Joyce notes that otherwise the company’s 1Q release was above guidance.

- Elior falls as much as 5% after UBS lowered its price target on the French caterer to EU3.30 from EU6.60, citing the impact on business from the omicron Covid-19 variant as well as uncertainty over new management and targets. The stock is now down 54% YTD.

- Weir Group drops as much as 6.4%, with analysts flagging the short-term hit for the mining-equipment firm related to its exit from Russia.

Asian stocks rose with Japan leading after the country’s central bank kept its easing stance unchanged, while the stabilizing of Covid cases in China also helped investor sentiment. The MSCI Asia Pacific Index advanced as much as 1%, rebounding from its lowest since mid-2020. Australian miner BHP Group and Chinese internet giant Alibaba provided the biggest boosts to the benchmark, with financials and materials leading the sectoral advances. Japan stocks outperformed in the region as the yen tumbled to the 130 per dollar level for the first time since 2002, bolstering exporters including Toyota Motor, which was the third-biggest contributor to the Asian measure’s gain.

The Bank of Japan “didn’t shift to a tightening policy bias and the yen fell as a result so that helped to boost Japanese stocks,” said Fumio Matsumoto, chief strategist at Okasan Securities. “Materials shares were doing well and I think their gains reflect easing of concerns over the global economic outlook, as cases in Shanghai are falling and iron ore prices seem to be rebounding,” Matsumoto said. Stocks in China gained for a second day after fresh policy pledges to promote internet platform firms and easing virus outbreaks in Beijing and Shanghai buoyed sentiment. Equity gauges across Australia, South Korea and India also advanced. The MSCI Asia Pacific Index is still poised for a fourth-straight weekly decline and its steepest monthly drop since March 2020

Japanese stocks jumped after the Bank of Japan maintained its ultra-easy monetary policy and the yen tumbled below the 130 per dollar level for the first time since 2002. The central bank kept its yield curve control settings and the scale of its asset purchases unchanged and said it would buy an unlimited amount of bonds at fixed-rates every business day to protect a 0.25% ceiling on 10-year government debt yields. The Japanese currency tumbled 1.4% against the greenback, bolstering the outlook for the nation’s exporters.

“It’s now abundantly clear to markets that Governor Kuroda, who is very strong-willed, and the BOJ will continue to insist that only when domestic wages rise more fully will inflation be persistent,” Nikko Asset Management strategist John Vail. “Until then, the BOJ will continue to cap bond yields, but some moderate policy tightening will likely occur later this year.” The Topix climbed 2.1% to close at 1,899.62, while the Nikkei advanced 1.7% to 26,847.90. Toyota Motor Corp. contributed the most to the Topix gain, increasing 3.2%. Out of 2,172 shares in the index, 1,720 rose and 395 fell, while 57 were unchanged

India’s benchmark equities index rose, tracking peers across Asia, buoyed by gains in Reliance Industries Ltd. The S&P BSE Sensex advanced 1.2% to 57,521.06, a one-week high, while the NSE Nifty 50 Index also climbed by a similar magnitude. Reliance added 1.5% to rise to a record and was the biggest boost to the Sensex, which had 26 of 30 member-stocks trading higher. All but one of 19 sectoral sub-indexes compiled by BSE Ltd. gained, led by a gauge of consumer goods companies. In earnings, of the 12 Nifty 50 firms that have announced results so far, five have missed, while seven have either met or beat analyst estimates.

In rates, Treasuries advanced across the curve, clawing back a portion of Wednesday’s losses. Session highs were reached late in Asia session after the BOJ pledged to buy unlimited amount of bonds at a fixed rate every business day to cap 10-year yields at 0.25%. 10Y TSY Yields are richer by 1bp-2bp across the curve with curve spreads little changed, the 10-year yield around 2.815% outperforms bunds by 3.5bp, gilts by 3bp. The week's coupon auction cycle concludes with $44b 7-year note sale at 1pm ET; Wednesday’s 5- year tailed by 0.9bp. European fixed income rallied after a soft Spanish inflation print, although the bulk of the move in the rates space is subsequently faded. German curve bear flattens, cheapening 2-3bps across the short end. Gilts bear steepened a touch. Peripheral spreads tighten with the belly of the Italian curve outperforming peers.

In FX, Bloomberg dollar spot index rises 0.4%, trading off the late Asia high. SEK outperforms in G-10, rallying after a surprise rate hike and more hawkish guidance. JPY is the standout underperformer with USD/JPY stalling near 131 after BOJ Kuroda’s press conference. JPY trades off worst levels after official comments that Japan will take appropriate action on FX if needed, describing the latest moves as warranting extreme concern. Some more details:

- The yen plunged, hitting a 20-year low against the dollar after the Bank of Japan pledged to keep rates at rock-bottom levels, sparking more demand for the greenback. USD/JPY continued to climb in the European session, up as much as 2% to hit 131.01, its highest since April 2002, before pulling back after a Japanese finance ministry official said it will act appropriately on FX if needed. USD/JPY has jumped 7.3% so far this month, its best performance since late 2016. Jerky moves in the yen suggest that its Ministry of Finance will continue to jawbone the currency as it approaches the next key level of 135. “Markets will likely next test intervention possibilities and at what level such warnings may appear,” according to Yoshifumi Takechi, chief analyst at Money Partners in Tokyo. If the currency pair rises past 135, then the probability of intervention may rise, he said

- The greenback boosted broadly, led higher on expectations that the Fed will raise interest rates by 50 basis points next week, embarking on an aggressive monetary tightening cycle. U.S. Treasuries advance, pushing two-year yield 2 basis points lower. “The focus of FX markets has primarily been on rate differentials and how bonds are adjusting given the continuous shift in growth conditions,” says Simon Harvey, head of FX analysis at Monex Europe, He adds that volatility in the bond market has also boosted the USD on safe-haven demand, suggesting that expectations for outperformance in U.S. rates is not the only driver of the stronger dollar. The Bloomberg Spot Dollar Index hits nearly 2-year high of 1,250 and is poised to post a near 5% gain in April, its best monthly performance since May 2012.

- EUR/USD slides to a five-year low of 1.0483 hit in early European trade, before pulling back to around 1.0505. EUR on track to lose more than 5% vs USD in April, its worst month since 2015.

- Swedish krona rallies after the Riksbank raises interest rates by 25 basis points from zero and signals up to three more hikes this year. EUR/SEK drops roughly 1% to 10.25, a one-week low, before paring move

- GBP/USD drops 0.7% to touch 1.2462, lowest since July 2020, as rate differentials continue to favour the USD

In commodities, oil edged higher with West Texas Intermediate futures around $103 a barrel. Crude prices have struggled for direction this week as China’s spreading virus outbreak continued to weigh on the outlook for global demand. Natural gas prices in Europe declined following two days of gains as buyers considered options to keep getting supply from Russia without violating sanctions. Spot gold pared losses, now little changed at $1,888/oz. Base metals are mixed; LME nickel falls 0.9% while LME aluminum gains 0.7%.

Looking at the the day ahead, data releases will include German CPI for April and US Q1 GDP reading, alongside the weekly initial jobless claims. From central banks, we’ll hear from ECB Vice President de Guindos and the ECB’s Wunsch, and the ECB will also be publishing their Economic Bulletin. Finally, earnings releases include Apple, Amazon, Mastercard, Eli Lilly, Merck & Co., Thermo Fisher Scientific, Comcast, Intel, McDonald’s, Caterpillar and Twitter.

Market Snapshot

- S&P 500 futures up 1.6% to 4,248.25

- STOXX Europe 600 up 1.3% to 450.14

- MXAP up 0.9% to 165.94

- MXAPJ up 1.2% to 548.04

- Nikkei up 1.7% to 26,847.90

- Topix up 2.1% to 1,899.62

- Hang Seng Index up 1.7% to 20,276.17

- Shanghai Composite up 0.6% to 2,975.49

- Sensex up 1.5% to 57,691.20

- Australia S&P/ASX 200 up 1.3% to 7,356.89

- Kospi up 1.1% to 2,667.49

- German 10Y yield little changed at 0.83%

- Euro down 0.1% to $1.0543

- Brent Futures down 0.3% to $105.00/bbl

- Gold spot down 0.2% to $1,882.45

- U.S. Dollar Index up 0.29% to 103.25

Top Overnight News from Bloomberg

- The ascendant U.S. dollar headed for its best month in a decade, as renewed yen selling cemented the greenback’s strength against major peers

- As inflation fears surge, holders of U.S. government debt are having a rough ride. Investors have abandoned the market en masse, making the first quarter the worst on record and devastating the value of bond portfolios. But now fixed- income returns are starting to get a lift from that same boogeyman

- The yen’s plunge to a 20-year low threatens to leave it significantly weaker for years to come, shaking up global money flows and undermining Japan’s efforts to get its fragile economy back on track

- Russia’s war in Ukraine has created new bottlenecks and these “are exacerbated by additional supply chain difficulties stemming from new pandemic measures in Asia,” ECB Vice President Luis de Guindos tells lawmakers in Brussels

- “My assessment is that we are very close to the peak and that we will start to see inflation decline in the second half of the year,” ECB Vice President Luis de Guindos says in Brussels

- The spike in energy costs was behind recent inflation-forecasting mistakes by the ECB, including the biggest in its history, according to new research from the institution

- “We expect underlying inflation to continue to rise, driven by high imported goods inflation, limited spare capacity in the Norwegian economy and prospects for rising wage growth,” Norges Bank Governor Ida Wolden Bache says in a statement

- Turkey central bank raised its end-2022 inflation estimate to 42.8%, from 23.2% in previous inflation report

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were higher across the board amid a slew of earnings updates and a dovish BoJ. ASX 200 gained with mining stocks mostly underpinned following production updates. Nikkei 225 benefitted as the BoJ reaffirmed its dovishness and kept its ultra-loose policy. Hang Seng and Shanghai Comp are both higher but with gains capped in the mainland due to ongoing lockdown fears with Hangzhou city to conduct mass testing and after China's Qinhuangdao city in the Hebei province locked down its district due to COVID.

Top Asian News

- China Stocks Rise for Second Day as Shanghai Covid Cases Decline

- StanChart Shares Soar 14% as Lender Raises Revenue Outlook

- China Cuts Coal Import Tariffs to Zero to Increase Supply

- Huawei’s Profit Dives 67% After U.S. Sanctions Wallop Phone Arm

Equities in Europe continue to gain heading into month-end, with overall sentiment across stocks bolstered by Meta (+17% pre-market) earnings yesterday. All sectors are in the green to varying degrees and clearly portray an anti-defensive bias – with the exception of Basic Resources, which sits at the bottom of the bunch after heavily outperforming yesterday. Stateside, US equity futures are firmer across the board, with the NQ clearly outpacing its peers.

Top European News

- Erdogan Plans Meeting With Saudi Crown Prince to Revive Ties

- Erdogan Says Jailed Businessman Kavala Is ‘Turkey’s Soros’

- JPM Quants Expects Global Earnings Downgrades and Volatility

- Riksbank Hikes Rate in U-Turn to Join Global Central Banks

FX:

- The Buck’s bull run continues, with DXY up to 103.700, Euro losing 1.0500+ status and Sterling testing sub-1.2500 Fib before retracements.

- Swedish Krona soars after surprise Riksbank rate hike, higher repo path and slowdown in QE.

- Japanese Yen extends losing streak following no change from ultra accommodative BoJ policy before partial recovery on extreme concern from Japan’s MOF.

- Japanese MOF official says excess FX volatility is undesirable, recent FX moves are "extremely worrying"; will take appropriate action if needed, communicating closely with the BoJ and foreign currency authorities, via Reuters .

- Yuan is weaker again as China increases efforts to contain covid and PBoC sets another softer onshore reference rate.

Fixed Income

- EU debt rattled to a degree by Riksbank decision to taper QE and US Treasuries to a lesser extent

- Bunds nearer 155.00 than 156.00, Gilts towards base of 119.68-08 range and 10 year T-note under 120-00 within a 120-01/119-19 band

- BTPs outperform on the eve of month end auctions after breaching, but unable to retain 133.00+ status

- Treasury curve flat ahead of 7 year issuance that normally entices foreign buyers even when the Dollar is not so elevated

Commodities

- WTI June and Brent July post modest intraday gains, but in the grander scheme, prices are consolidating.

- Spot gold briefly dipped under its 100 DMA (USD 1,877.50/oz) to a current low of around USD 1,871/oz as the Buck was rampant at the time.

- Base metals markets are relatively mixed with some underperformance seen in LME nickel.

- China is to grant zero-tariff on coal imports from May 1 2022 to March 31 2023 to increase supply.

US Event Calendar

- 08:30: April Initial Jobless Claims, est. 180,000, prior 184,000; Continuing Claims, est. 1.4m, prior 1.42m

- 08:30: 1Q GDP Annualized QoQ, est. 1.0%, prior 6.9%

- 1Q Personal Consumption, est. 3.5%, prior 2.5%

- 1Q GDP Price Index, est. 7.2%, prior 7.1%

- 1Q PCE Core QoQ, est. 5.5%, prior 5.0%

- 11:00: April Kansas City Fed Manf. Activity, est. 35, prior 37

DB's Jim Reid concludes the overnight wrap

We’ve also released our April survey results this morning (see link here). This was our first survey since Russia’s invasion of Ukraine, and you can see the impact across a number of answers. More than 60% of respondents expect the next US recession by 2023, in line with our out of consensus house view, while inflation expectations were revised higher in the US and EU. The survey results also show expectations for bonds and the S&P 500 to dip from current levels along with much more, so do peruse the full results.

Whilst global growth concerns remain prominent in markets, with investors having to navigate Chinese lockdowns, major geopolitical tensions and the prospect of a Fed-induced hard landing, equities begun to stabilise yesterday and the S&P 500 managed to eke out a +0.21% gain, albeit only after another second-half selloff that saw the index move down from its intraday high of +1.56% around the US lunchtime. Even with the equity gains however, geopolitical developments led to a weaker performance among a broader section of European assets, with the Euro itself nearing the $1.05 mark for the first time in nearly 5 years as multiple signs pointed to a further escalation between the EU and Russia on the energy side.

In terms of those developments, markets woke up to the news that Gazprom would be stopping gas flows to Poland and Bulgaria, which saw European natural gas futures surge more than 20% following the open. Russia said this was because they hadn’t agreed to pay for gas in rubles, but European Commission President von der Leyen said in a statement that Russia was using “gas as an instrument of blackmail”, and warned companies not to accede to Russia’s demands to pay in rubles. Later in the session it was even reported by Bloomberg that Germany was prepared to support an EU ban on Russian oil, on the condition it was gradual and came with a transition period, so this fits into the pattern over recent days of an acceleration in the EU’s attempts to eliminate its dependence on Russian energy. According to the report, the Russian oil ban would be part of the sixth package of sanctions, and proposals could be put forward as soon as next week.

By the end of the session, European natural gas futures had pared back their initial gains, and “only” closed up +4.09% at €107.43/MWh. But as mentioned at the top, the bigger damage was seen to the Euro’s value, which closed at a 5-year low of $1.0557, having started the month above $1.10, and this morning is down yet further at $1.0515. Those declines also came in spite of remarks from ECB President Lagarde, who leant into recent suggestions that we could get a rate hike as soon as July. In her remarks, she said that asset purchases would be concluding “probably in July”, and that would also be the time to “look at interest rates and an increase in interest rates.”

European sovereign bonds had a pretty mixed performance against this backdrop, but there was a consistent story of widening spreads as investors favoured bunds over peripheral debt. In fact, the gap between Italian 10yr yields over bunds widened by +2.8bps to 177bps yesterday, which is the widest its been since June 2020. Similar moves were seen in credit markets too, where Itraxx Crossover widened +4.0bps to 414bps, which is just shy of its recent peak at 421bps on March 7, and up from 333bps just over 3 weeks ago. Havens were the beneficiary of yesterday’s moves though, with yields on 10yr bunds down -1.2bps, and the US Dollar index (+0.64%) strengthened for the 18th time in the last 20 sessions, surpassing its March 2020 peak to close at levels not seen since early 2017. This morning that trend has accelerated following the Bank of Japan’s policy decision (more on which below), and the index has risen a further +0.50% to trade at levels not seen since 2002, at 103.47.

These signs of stress weren’t as evident in equity markets yesterday, which begun to recover from their Tuesday slump on both sides of the Atlantic. The S&P 500 rose +0.21%, which meant it was no longer in negative territory on a rolling annual basis, which it had been the previous session for the first time since May 2020, whilst Europe’s STOXX 600 (+0.73%) also posted a decent advance. That said, the S&P 500 is still down -7.65% over the month of April, keeping it on track for its worst monthly performance since the initial phase of the pandemic in March 2020. The equity reversal caused the Vix to retreat -1.92ppts but still finished above 30 for only the second time since mid-March. And on top of that, US Treasuries snapped their gains from Monday and Tuesday, with the 10yr yield up +11.1bps to 2.83%, as a rise in real yields (+8.5bps) drove the move higher on another day of heightened rates volatility ahead of next week’s FOMC.

After the close, Meta posted sales slightly below analyst estimates with earnings beating. Shares were more than +13% higher after the close, after Facebook’s daily users surprised to the upside and the firm cut their expense outlook. Like many other firms that have reported, the war, current inflation, and issues with supply chains have forced some of the platform’s advertisers to cut spending.

Overnight in Asia, the main news comes from the Bank of Japan’s decision, where they left their main policy interest rates unchanged, but did announce a decision to buy unlimited 10-yr JGBs at 0.25% every business day. They also raised their inflation forecasts, now projecting core CPI to to reach +1.9% in the current fiscal year ending in March 2023, before moderating to +1.1% in the following two fiscal years. So a big difference in stance to the other major central banks like the Fed and the ECB which have been progressively moving in a hawkish direction over recent months, and this saw the Japanese Yen weaken further, currently trading at 129.69 per US dollar, which is a level unseen since 2002.

Against that backdrop, the Nikkei (+1.32%) is leading the equity gains in Asia, although other indices including the Hang Seng (+1.22%), the CSI 300 (+0.37%), the Shanghai Composite (+0.25%) and the Kospi (+0.81%) are all in positive territory this morning. Meanwhile oil prices have lost ground as concerns about Chinese demand persist, and Brent Crude is down -1.41% this morning to $103.84/bbl. Looking forward, equity futures in the US are pointing towards further gains today, with those on the S&P 500 (+0.74%) and the NASDAQ 100 (+1.34%) moving higher.

Looking forward, we’ve got a couple of important data releases today. One is the first look at US GDP in the first quarter, for which our US economists have published a preview (link here). They see the reading coming in at exactly 0.0. The other is the German CPI reading for April, which comes ahead of the flash CPI reading tomorrow for the entire Euro Area. Our economist has also published a preview for that one (link here).

On yesterday’s data, the US goods trade deficit for March rose to a record of $125.3bn (vs. $105.0bn expected). Otherwise, the number of pending home sales fell -1.2% in March, marking a 5th consecutive monthly decline.

To the day ahead, and data releases will include the aforementioned German CPI for April and US Q1 GDP reading, alongside the weekly initial jobless claims. From central banks, we’ll hear from ECB Vice President de Guindos and the ECB’s Wunsch, and the ECB will also be publishing their Economic Bulletin. Finally, earnings releases include Apple, Amazon, Mastercard, Eli Lilly, Merck & Co., Thermo Fisher Scientific, Comcast, Intel, McDonald’s, Caterpillar and Twitter.

Government

The Grinch Who Stole Freedom

The Grinch Who Stole Freedom

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

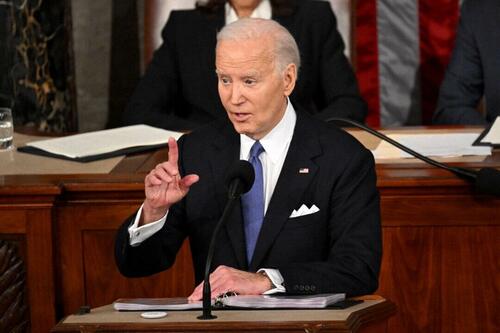

Before President Joe Biden’s State of the…

Authored by Jeffrey A. Tucker via The Epoch Times (emphasis ours),

Before President Joe Biden’s State of the Union address, the pundit class was predicting that he would deliver a message of unity and calm, if only to attract undecided voters to his side.

He did the opposite. The speech revealed a loud, cranky, angry, bitter side of the man that people don’t usually see. It seemed like the real Joe Biden I remember from the old days, full of venom, sarcasm, disdain, threats, and extreme partisanship.

The base might have loved it except that he made reference to an “illegal” alien, which is apparently a trigger word for the left. He failed their purity test.

The speech was stunning in its bile and bitterness. It’s beyond belief that he began with a pitch for more funds for the Ukraine war, which has killed 10,000 civilians and some 200,000 troops on both sides. It’s a bloody mess that could have been resolved early on but for U.S. tax funding of the conflict.

Despite the push from the higher ends of conservative commentary, average Republicans have turned hard against this war. The United States is in a fiscal crisis and every manner of domestic crisis, and the U.S. president opens his speech with a pitch to protect the border in Ukraine? It was completely bizarre, and lent some weight to the darkest conspiracies about why the Biden administration cares so much about this issue.

From there, he pivoted to wildly overblown rhetoric about the most hysterically exaggerated event of our times: the legendary Jan. 6 protests on Capitol Hill. Arrests for daring to protest the government on that day are growing.

The media and the Biden administration continue to describe it as the worst crisis since the War of the Roses, or something. It’s all a wild stretch, but it set the tone of the whole speech, complete with unrelenting attacks on former President Donald Trump. He would use the speech not to unite or make a pitch that he is president of the entire country but rather intensify his fundamental attack on everything America is supposed to be.

Hard to isolate the most alarming part, but one aspect really stood out to me. He glared directly at the Supreme Court Justices sitting there and threatened them with political power. He said that they were awful for getting rid of nationwide abortion rights and returning the issue to the states where it belongs, very obviously. But President Biden whipped up his base to exact some kind of retribution against the court.

Looking this up, we have a few historical examples of presidents criticizing the court but none to their faces in a State of the Union address. This comes two weeks after President Biden directly bragged about defying the Supreme Court over the issue of student loan forgiveness. The court said he could not do this on his own, but President Biden did it anyway.

Here we have an issue of civic decorum that you cannot legislate or legally codify. Essentially, under the U.S. system, the president has to agree to defer to the highest court in its rulings even if he doesn’t like them. President Biden is now aggressively defying the court and adding direct threats on top of that. In other words, this president is plunging us straight into lawlessness and dictatorship.

In the background here, you must understand, is the most important free speech case in U.S. history. The Supreme Court on March 18 will hear arguments over an injunction against President Biden’s administrative agencies as issued by the Fifth Circuit. The injunction would forbid government agencies from imposing themselves on media and social media companies to curate content and censor contrary opinions, either directly or indirectly through so-called “switchboarding.”

A ruling for the plaintiffs in the case would force the dismantling of a growing and massive industry that has come to be called the censorship-industrial complex. It involves dozens or even more than 100 government agencies, including quasi-intelligence agencies such as the Cybersecurity and Infrastructure Security Agency (CISA), which was set up only in 2018 but managed information flow, labor force designations, and absentee voting during the COVID-19 response.

A good ruling here will protect free speech or at least intend to. But, of course, the Biden administration could directly defy it. That seems to be where this administration is headed. It’s extremely dangerous.

A ruling for the defense and against the injunction would be a catastrophe. It would invite every government agency to exercise direct control over all media and social media in the country, effectively abolishing the First Amendment.

Close watchers of the court have no clear idea of how this will turn out. But watching President Biden glare at court members at the address, one does wonder. Did they sense the threats he was making against them? Will they stand up for the independence of the judicial branch?

Maybe his intimidation tactics will end up backfiring. After all, does the Supreme Court really think it is wise to license this administration with the power to control all information flows in the United States?

The deeper issue here is a pressing battle that is roiling American life today. It concerns the future and power of the administrative state versus the elected one. The Constitution contains no reference to a fourth branch of government, but that is what has been allowed to form and entrench itself, in complete violation of the Founders’ intentions. Only the Supreme Court can stop it, if they are brave enough to take it on.

If you haven’t figured it out yet, and surely you have, President Biden is nothing but a marionette of deep-state interests. He is there to pretend to be the people’s representative, but everything that he does is about entrenching the fourth branch of government, the permanent bureaucracy that goes on its merry way without any real civilian oversight.

We know this for a fact by virtue of one of his first acts as president, to repeal an executive order by President Trump that would have reclassified some (or many) federal employees as directly under the control of the elected president rather than have independent power. The elites in Washington absolutely panicked about President Trump’s executive order. They plotted to make sure that he didn’t get a second term, and quickly scratched that brilliant act by President Trump from the historical record.

This epic battle is the subtext behind nearly everything taking place in Washington today.

Aside from the vicious moment of directly attacking the Supreme Court, President Biden set himself up as some kind of economic central planner, promising to abolish hidden fees and bags of chips that weren’t full enough, as if he has the power to do this, which he does not. He was up there just muttering gibberish. If he is serious, he believes that the U.S. president has the power to dictate the prices of every candy bar and hotel room in the United States—an absolutely terrifying exercise of power that compares only to Stalin and Mao. And yet there he was promising to do just that.

Aside from demonizing the opposition, wildly exaggerating about Jan. 6, whipping up war frenzy, swearing to end climate change, which will make the “green energy” industry rich, threatening more taxes on business enterprise, promising to cure cancer (again!), and parading as the master of candy bar prices, what else did he do? Well, he took credit for the supposedly growing economy even as a vast number of Americans are deeply suffering from his awful policies.

It’s hard to imagine that this speech could be considered a success. The optics alone made him look like the Grinch who stole freedom, except the Grinch was far more articulate and clever. He’s a mean one, Mr. Biden.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Government

Vaccine-skeptical mothers say bad health care experiences made them distrust the medical system

Vaccine skepticism, and the broader medical mistrust and far-reaching anxieties it reflects, is not just a fringe position in the 21st century.

Why would a mother reject safe, potentially lifesaving vaccines for her child?

Popular writing on vaccine skepticism often denigrates white and middle-class mothers who reject some or all recommended vaccines as hysterical, misinformed, zealous or ignorant. Mainstream media and medical providers increasingly dismiss vaccine refusal as a hallmark of American fringe ideology, far-right radicalization or anti-intellectualism.

But vaccine skepticism, and the broader medical mistrust and far-reaching anxieties it reflects, is not just a fringe position.

Pediatric vaccination rates had already fallen sharply before the COVID-19 pandemic, ushering in the return of measles, mumps and chickenpox to the U.S. in 2019. Four years after the pandemic’s onset, a growing number of Americans doubt the safety, efficacy and necessity of routine vaccines. Childhood vaccination rates have declined substantially across the U.S., which public health officials attribute to a “spillover” effect from pandemic-related vaccine skepticism and blame for the recent measles outbreak. Almost half of American mothers rated the risk of side effects from the MMR vaccine as medium or high in a 2023 survey by Pew Research.

Recommended vaccines go through rigorous testing and evaluation, and the most infamous charges of vaccine-induced injury have been thoroughly debunked. How do so many mothers – primary caregivers and health care decision-makers for their families – become wary of U.S. health care and one of its most proven preventive technologies?

I’m a cultural anthropologist who studies the ways feelings and beliefs circulate in American society. To investigate what’s behind mothers’ vaccine skepticism, I interviewed vaccine-skeptical mothers about their perceptions of existing and novel vaccines. What they told me complicates sweeping and overly simplified portrayals of their misgivings by pointing to the U.S. health care system itself. The medical system’s failures and harms against women gave rise to their pervasive vaccine skepticism and generalized medical mistrust.

The seeds of women’s skepticism

I conducted this ethnographic research in Oregon from 2020 to 2021 with predominantly white mothers between the ages of 25 and 60. My findings reveal new insights about the origins of vaccine skepticism among this demographic. These women traced their distrust of vaccines, and of U.S. health care more generally, to ongoing and repeated instances of medical harm they experienced from childhood through childbirth.

As young girls in medical offices, they were touched without consent, yelled at, disbelieved or threatened. One mother, Susan, recalled her pediatrician abruptly lying her down and performing a rectal exam without her consent at the age of 12. Another mother, Luna, shared how a pediatrician once threatened to have her institutionalized when she voiced anxiety at a routine physical.

As women giving birth, they often felt managed, pressured or discounted. One mother, Meryl, told me, “I felt like I was coerced under distress into Pitocin and induction” during labor. Another mother, Hallie, shared, “I really battled with my provider” throughout the childbirth experience.

Together with the convoluted bureaucracy of for-profit health care, experiences of medical harm contributed to “one million little touch points of information,” in one mother’s phrase, that underscored the untrustworthiness and harmful effects of U.S. health care writ large.

A system that doesn’t serve them

Many mothers I interviewed rejected the premise that public health entities such as the Centers for Disease Control and Prevention and the Food and Drug Administration had their children’s best interests at heart. Instead, they tied childhood vaccination and the more recent development of COVID-19 vaccines to a bloated pharmaceutical industry and for-profit health care model. As one mother explained, “The FDA is not looking out for our health. They’re looking out for their wealth.”

After ongoing negative medical encounters, the women I interviewed lost trust not only in providers but the medical system. Frustrating experiences prompted them to “do their own research” in the name of bodily autonomy. Such research often included books, articles and podcasts deeply critical of vaccines, public health care and drug companies.

These materials, which have proliferated since 2020, cast light on past vaccine trials gone awry, broader histories of medical harm and abuse, the rapid growth of the recommended vaccine schedule in the late 20th century and the massive profits reaped from drug development and for-profit health care. They confirmed and hardened women’s suspicions about U.S. health care.

The stories these women told me add nuance to existing academic research into vaccine skepticism. Most studies have considered vaccine skepticism among primarily white and middle-class parents to be an outgrowth of today’s neoliberal parenting and intensive mothering. Researchers have theorized vaccine skepticism among white and well-off mothers to be an outcome of consumer health care and its emphasis on individual choice and risk reduction. Other researchers highlight vaccine skepticism as a collective identity that can provide mothers with a sense of belonging.

Seeing medical care as a threat to health

The perceptions mothers shared are far from isolated or fringe, and they are not unreasonable. Rather, they represent a growing population of Americans who hold the pervasive belief that U.S. health care harms more than it helps.

Data suggests that the number of Americans harmed in the course of treatment remains high, with incidents of medical error in the U.S. outnumbering those in peer countries, despite more money being spent per capita on health care. One 2023 study found that diagnostic error, one kind of medical error, accounted for 371,000 deaths and 424,000 permanent disabilities among Americans every year.

Studies reveal particularly high rates of medical error in the treatment of vulnerable communities, including women, people of color, disabled, poor, LGBTQ+ and gender-nonconforming individuals and the elderly. The number of U.S. women who have died because of pregnancy-related causes has increased substantially in recent years, with maternal death rates doubling between 1999 and 2019.

The prevalence of medical harm points to the relevance of philosopher Ivan Illich’s manifesto against the “disease of medical progress.” In his 1982 book “Medical Nemesis,” he insisted that rather than being incidental, harm flows inevitably from the structure of institutionalized and for-profit health care itself. Illich wrote, “The medical establishment has become a major threat to health,” and has created its own “epidemic” of iatrogenic illness – that is, illness caused by a physician or the health care system itself.

Four decades later, medical mistrust among Americans remains alarmingly high. Only 23% of Americans express high confidence in the medical system. The United States ranks 24th out of 29 peer high-income countries for the level of public trust in medical providers.

For people like the mothers I interviewed, who have experienced real or perceived harm at the hands of medical providers; have felt belittled, dismissed or disbelieved in a doctor’s office; or spent countless hours fighting to pay for, understand or use health benefits, skepticism and distrust are rational responses to lived experience. These attitudes do not emerge solely from ignorance, conspiracy thinking, far-right extremism or hysteria, but rather the historical and ongoing harms endemic to the U.S. health care system itself.

Johanna Richlin does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

disease control extremism pandemic covid-19 vaccine treatment testing fda deathsGovernment

Is the National Guard a solution to school violence?

School board members in one Massachusetts district have called for the National Guard to address student misbehavior. Does their request have merit? A…

Every now and then, an elected official will suggest bringing in the National Guard to deal with violence that seems out of control.

A city council member in Washington suggested doing so in 2023 to combat the city’s rising violence. So did a Pennsylvania representative concerned about violence in Philadelphia in 2022.

In February 2024, officials in Massachusetts requested the National Guard be deployed to a more unexpected location – to a high school.

Brockton High School has been struggling with student fights, drug use and disrespect toward staff. One school staffer said she was trampled by a crowd rushing to see a fight. Many teachers call in sick to work each day, leaving the school understaffed.

As a researcher who studies school discipline, I know Brockton’s situation is part of a national trend of principals and teachers who have been struggling to deal with perceived increases in student misbehavior since the pandemic.

A review of how the National Guard has been deployed to schools in the past shows the guard can provide service to schools in cases of exceptional need. Yet, doing so does not always end well.

How have schools used the National Guard before?

In 1957, the National Guard blocked nine Black students’ attempts to desegregate Central High School in Little Rock, Arkansas. While the governor claimed this was for safety, the National Guard effectively delayed desegregation of the school – as did the mobs of white individuals outside. Ironically, weeks later, the National Guard and the U.S. Army would enforce integration and the safety of the “Little Rock Nine” on orders from President Dwight Eisenhower.

One of the most tragic cases of the National Guard in an educational setting came in 1970 at Kent State University. The National Guard was brought to campus to respond to protests over American involvement in the Vietnam War. The guardsmen fatally shot four students.

In 2012, then-Sen. Barbara Boxer, a Democrat from California, proposed funding to use the National Guard to provide school security in the wake of the Sandy Hook school shooting. The bill was not passed.

More recently, the National Guard filled teacher shortages in New Mexico’s K-12 schools during the quarantines and sickness of the pandemic. While the idea did not catch on nationally, teachers and school personnel in New Mexico generally reported positive experiences.

Can the National Guard address school discipline?

The National Guard’s mission includes responding to domestic emergencies. Members of the guard are part-time service members who maintain civilian lives. Some are students themselves in colleges and universities. Does this mission and training position the National Guard to respond to incidents of student misbehavior and school violence?

On the one hand, New Mexico’s pandemic experience shows the National Guard could be a stopgap to staffing shortages in unusual circumstances. Similarly, the guards’ eventual role in ensuring student safety during school desegregation in Arkansas demonstrates their potential to address exceptional cases in schools, such as racially motivated mob violence. And, of course, many schools have had military personnel teaching and mentoring through Junior ROTC programs for years.

Those seeking to bring the National Guard to Brockton High School have made similar arguments. They note that staffing shortages have contributed to behavior problems.

One school board member stated: “I know that the first thought that comes to mind when you hear ‘National Guard’ is uniform and arms, and that’s not the case. They’re people like us. They’re educated. They’re trained, and we just need their assistance right now. … We need more staff to support our staff and help the students learn (and) have a safe environment.”

Yet, there are reasons to question whether calls for the National Guard are the best way to address school misconduct and behavior. First, the National Guard is a temporary measure that does little to address the underlying causes of student misbehavior and school violence.

Research has shown that students benefit from effective teaching, meaningful and sustained relationships with school personnel and positive school environments. Such educative and supportive environments have been linked to safer schools. National Guard members are not trained as educators or counselors and, as a temporary measure, would not remain in the school to establish durable relationships with students.

What is more, a military presence – particularly if uniformed or armed – may make students feel less welcome at school or escalate situations.

Schools have already seen an increase in militarization. For example, school police departments have gone so far as to acquire grenade launchers and mine-resistant armored vehicles.

Research has found that school police make students more likely to be suspended and to be arrested. Similarly, while a National Guard presence may address misbehavior temporarily, their presence could similarly result in students experiencing punitive or exclusionary responses to behavior.

Students deserve a solution other than the guard

School violence and disruptions are serious problems that can harm students. Unfortunately, schools and educators have increasingly viewed student misbehavior as a problem to be dealt with through suspensions and police involvement.

A number of people – from the NAACP to the local mayor and other members of the school board – have criticized Brockton’s request for the National Guard. Governor Maura Healey has said she will not deploy the guard to the school.

However, the case of Brockton High School points to real needs. Educators there, like in other schools nationally, are facing a tough situation and perceive a lack of support and resources.

Many schools need more teachers and staff. Students need access to mentors and counselors. With these resources, schools can better ensure educators are able to do their jobs without military intervention.

F. Chris Curran has received funding from the US Department of Justice, the Bureau of Justice Assistance, and the American Civil Liberties Union for work on school safety and discipline.

army governor pandemic mexico-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex