Uncategorized

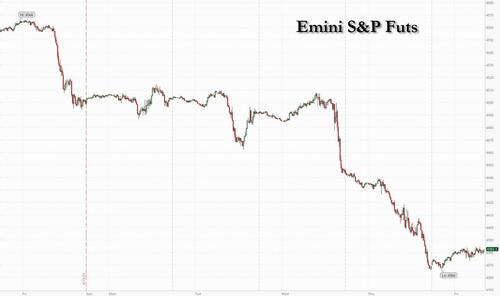

Futures Rebound After Three Day Rout As Rates Ease From 2007 High

Futures Rebound After Three Day Rout As Rates Ease From 2007 High

US equity futures rebounded from a furious three-day selloff at the end…

US equity futures rebounded from a furious three-day selloff at the end of a bruising week for investors which sent markets to the lowest level in over a month as investors are forced to accept the idea of higher-for-longer interest rates (at least until the Fed once again breaks something, which it will). As of 7:45am ET, S&P 500 added 0.3%, a modest rebound after the index fell the most since March on Thursday; the tech-heavy Nasdaq 100 climbed 0.5%.European stocks pared their losses while Asian markets closed week well in the green, except for Japan where not even continued BOJ dovishness and a collapsing yen is enough to support risk. Treasury yields retreated across the curve, after 10-year rates briefly climbed above 4.5% in early trading in Asia. The Bloomberg Dollar Spot Index was little changed, with the Japanese yen and British pound leading declines among Group-of-10 currencies. Brent crude climbed 0.5% to $93.80 after a three-day drop. Gold and Bitcoin rose.

In premarket trading, megacap tech stocks rose, set to rebound slightly after Thursday’s losses as US 10-year yields dipped slightly from highest since 2007. Apple, Amazon.com, Alphabet, Meta Platforms, Tesla, Nvidia were all in the green. Activision Blizzard gained 1.8% as Microsoft’s $69 billion acquisition of the gaming company looked set to clear its final regulatory hurdle. Here are some other notable premarket movers:

- Alibaba Group and other US-listed Chinese stocks are rallying, a day after the Nasdaq Golden Dragon China Index fell to the lowest level since July. BABA is up 3.9%.

- Coeur Mining is up 5.2% after RBC upgrades to outperform from sector perform.

- Ralph Lauren shares are up 1.2%, after Raymond James started coverage on the apparel company with an outperform rating and $135 price target, writing that “expectations are relatively low for RL,” while the “below-average valuation creates an attractive entry point.”

- Roku shares are up 1.4% in premarket trading, after CFRA upgraded the streaming-video platform company to hold from sell.

- Scholastic shares fall 18% in US premarket trading after the children’s publishing company reported a larger-than-expected adjusted loss per share for the first quarter as the company spent on other areas of its business for growth, and flagged the seasonality of sales in its Education Solutions unit. Sales also declined.

- Wayfair gains 2.4% in premarket trading after Bernstein raises the online home-furnishings retailer to market perform from underperform, citing improving revenue growth and management’s positive messaging on margins.

Global central banks this week stressed that they remain vigilant about the risks of inflation and warned investors against premature expectations of rate cuts. The increasing possibility that monetary policy will lead to recession is prompting investors to dump stocks at the fastest pace since December, BofA's Michael Hartnett said, who noted that equity funds had outflows of $16.9 billion in the week through Sept. 20. Hartnett warned that persistently high rates could lead to a hard economic landing in 2024, and result in “pops and busts” in financial markets.

“What matters more than Fed hikes themselves is whether a recession occurs or not,” said Wolf von Rotberg, an equity strategist at Bank J Safra Sarasin Ltd. “It would be a remarkable accomplishment if it were avoided, yet that seems unlikely. If a recession were to happen, the equity market is not prepared for it.”

The latest evidence of resilience in the US labor market reinforced the case for the Fed’s stance of holding interest rates higher for longer. Applications for US unemployment benefits fell to the lowest level since January last week, figures out Thursday showed.

“The prospect of interest rates staying higher for longer has given investors a lingering headache and sentiment has worsened as the week progressed,” said Russ Mould, investment director at AJ Bell. “Many investors had hoped we would approach the end of 2023 with a clearer picture on when interest rates will start to be cut. That scenario has now been muddied by comments from the Fed that it is prepared to raise rates further if necessary and keep a restrictive policy until there are clear signs that inflation is moving back to target levels.”

Always an outlier, amid a hawkish barrage of central bank announcements, overnight the yen weakened after the Bank of Japan held interest rates, its 10-year yield target and forward guidance unchanged. The central bank reiterated its expectation that inflation is decelerating.

European stocks were lower, with the Stoxx 600 down 0.2% and almost all sectors in the red. Construction, retail and real estate are the worst performers. In individual moves in Europe, Adevinta ASA soared after the classifieds company said it received a takeover proposal from private equity investors including Blackstone Inc. and Permira. Meanwhile there were fresh signs of frailty in the euro-area economy Friday as figures showed private-sector activity in France and Germany continued to shrink in September. Here are the most notable European movers:

- Adevinta shares surge as much as 24% after the European classifieds company confirms it received a takeover offer from Permira and Blackstone, with analysts saying any deal is likely to be at a price well above where the stock is trading. The move also lifts peers including Rightmove and Auto Trader.

- Ascential shares jump as much as 12%, most since Jan. 25, after earnings that showed a strong performance in the UK firm’s events business, according to Citigroup.

- Ubisoft shares gain as much as 4.2% on Friday after the UK’s antitrust regulator said a revised proposal from Microsoft to sell some gaming rights to the French video-game maker opens the door for its Activision acquisition to be cleared.

- BioGaia shares rise as much as 8.6%, the most since April, after Handelsbanken raised its recommendation for the Swedish probiotics firm to buy, saying share price now reflects warranted concerns over customer demand and tough comparables in its 3Q report.

- Jungheinrich shares gain as much as 3.2% after Barclays initiated coverage of the warehouse machinery company with an ‘overweight’ rating, citing an attractive valuation.

- Dutch lenders ABN Amro -4.3% and ING Groep -5.2% slide after the parliament’s lower house approved a proposal to increase bank tax to support lower-income households.

- Alten shares fall as much as 7.8%, the most since January, after the engineering and technology consulting firm reported a bigger-than-expected drop in profitability due to lower activity levels and higher operating expenses.

- Var Energi shares drop as much as 7.6% as the co’s offering of 157.3m shares by holder prices via Barclays Bank Ireland, DNB Bank, Morgan Stanley & Co. International, SpareBank 1 Markets.

- Italgas shares decline as much as 2.8%, touching its lowest level since late October, after a placement of about 14.5m shares offered on behalf of buyers of exchangeable bonds who wish to sell shares to hedge market risk, according to terms of the deal seen by Bloomberg.

- Solutions 30 shares drop as much as 21% after the French technology-services company reported a wider first-half loss and a narrower profit margin.

Earlier in the session, Asian stock retraced early declines and closed in the green. Chinese shares rallied, a move that likely reflects “short covering on expectations of more policy support measures over the weekend, just like the government’s moves in every weekend this month,” said Steven Leung, an executive director at Uob Kay Hian Hong Kong Limited.

- Hang Seng and Shanghai Comp shrugged off early jitters amid supportive measures including Beijing’s draft rules to promote a high level of opening up and encourage foreign investments, while China's market regulator also issued measures to promote the private economy.

- Japan's Nikkei 225 was pressured following the mostly firmer-than-expected Japanese CPI data but then pared some of the losses following the lack of hawkish surprises from the BoJ.

- Australia's ASX 200 was dragged lower with real estate and tech among the worst performers after the Australian 10yr yield touched its highest level since 2014, while the flash PMI data was mixed and showed a deeper contraction in manufacturing.

In FX, the Japanese yen and British pound are rooted to the bottom of the G-10 rankings today. The yen added to its post-BOJ fall as Governor Ueda tempered expectations they were close to raising interest rates - USD/JPY rises 0.4% to trade near 148.20. Sterling slipped 0.4% after UK retail sales and composite PMI both fell short of estimates. The Bloomberg Dollar Spot Index rises 0.1%. EURUSD dropped 0.4% to 1.0615, lowest since March 17, after French manufacturing and services PMIs came in below estimates; currency pared losses after German PMI data came stronger-than-expected

In rates, 10-year yields fall 2bps to 4.47% after touching a new cycle high above 4.5% for the first time since 2007 during Asian trading hours. The US session includes the first Fed speakers since Wednesday’s policy decision. Yields are lower by 1bp-2bp with curve spreads little changed on the day; in 10-year sector bunds trade cheaper by ~2.5bp vs Treasuries while gilts keep pace. Futures block trade of 5-year contracts at 6:35am New York time appeared consistent with a seller. Dollar IG issuance slate empty so far and expected to be muted; weekly volume stands at around $16b, in line with estimates for $15b to $20b. US economic data slate includes September S&P manufacturing and services PMIs at 9:45am.

In commodities, oil rose, in part supported by news that Russia would ban exports of diesel-type fuel and gasoline; crude futures advanced, with WTI rising 1% to trade near $90.50. European natural gas prices fell as Chevron and labor unions in Australia agreed to end strikes at major export plants that roiled the market for more than a month. Spot gold adds 0.3%.

At 8:50 a.m., Federal Reserve Governor Lisa Cook will give a keynote address at a National Bureau of Economic Research event. At 9:45 a.m., we’ll get the latest reading on S&P Global’s manufacturing and services gauges. San Francisco Fed Mary Daly will speak in a fireside chat at 1 p.m., and Minneapolis Fed President Neel Kashkari will appear in a separate event at the same time.

Market Snapshot

- S&P 500 futures up 0.2% to 4,378.75

- STOXX Europe 600 down 0.3% to 453.29

- Nikkei down 0.5% to 32,402.41

- Topix down 0.3% to 2,376.27

- Hang Seng Index up 2.3% to 18,057.45

- Shanghai Composite up 1.5% to 3,132.43

- Sensex down 0.1% to 66,136.23

- Australia S&P/ASX 200 little changed at 7,068.84

- Kospi down 0.3% to 2,508.13

- German 10Y yield little changed at 2.72%

- Euro down 0.2% to $1.0642

- Brent Futures up 0.4% to $93.64/bbl

- Gold spot up 0.3% to $1,926.57

- U.S. Dollar Index up 0.23% to 105.60

- MXAP up 0.3% to 159.89

- MXAPJ up 0.9% to 496.80

Top Overnight News

- The BOJ left its monetary policy unchanged, capping a week of central bank decisions that have roiled financial markets. Kazuo Ueda said the distance toward ending the YCC program and negative rate regime hasn't changed much. Market watchers expect the yen to drop toward 150 per dollar, with intervention possible as it nears that level. BBG

- China is considering relaxing foreign ownership caps in listed local companies to lure global funds back to its stock market, people familiar said. The country currently caps it at 30%, and subjects a single foreign shareholder to a 10% limit. BBG

- JPM will include Indian gov’t bonds in its emerging market index, a move that could trigger billions of inflows to the market. Nikkei

- Euro-area private sector activity shrank for the fourth consecutive month, suggesting the economy contracted in the current quarter. The composite PMI hit 47.1 in September, an improvement on August but still in contraction. While Germany's downturn eased, it deepened in France. UK figures showed the sharpest decline since January 2021. BBG

- European gas prices dropped after Chevron and labor unions resolved a dispute at key LNG facilities in Australia that began Sept. 8th. The agreement brings an end to strikes at the Gorgon and Wheatstone plants, which accounted for about 7% of the world's LNG supply last year. BBG

- Euro zone companies are finally absorbing wage pressures and the labor market has started to soften, European Central Bank chief economist Philip Lane said on Thursday, suggesting inflation pressures from employee pay rises are finally subsiding. RTRS

- AAPL cools the pace of compensation increases for retail employees, the latest sign of the labor market easing. BBG

- Hollywood studios will continue negotiations w/the WGA on Friday amid hopes for a breakthrough that settles the strike relatively soon. WaPo

- AMZN confirmed recent media reports with a plan to begin running advertisements inside its Prime Video content. The company will sell an ad-free upgrade option for Prime members who pay an additional $2.99/month (given that Prime cost $14.99 per month, this is effectively a ~20% price hike in the US for people who want to keep ads out of their content). WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid a higher yield environment and after this week’s central bank frenzy culminated with a lack of surprises from the BoJ. ASX 200 was dragged lower with real estate and tech among the worst performers after the Australian 10yr yield touched its highest level since 2014, while the flash PMI data was mixed and showed a deeper contraction in manufacturing. Nikkei 225 was pressured following the mostly firmer-than-expected Japanese CPI data but then pared some of the losses following the lack of hawkish surprises from the BoJ. Hang Seng and Shanghai Comp shrugged off early jitters amid supportive measures including Beijing’s draft rules to promote a high level of opening up and encourage foreign investments, while China's market regulator also issued measures to promote the private economy.

Top Asian News

- China mulls easing foreign stake limits to lure global funds, via Bloomberg.

- PBoC releases list for systemic important banks; will promote stable operations and healthy development of systemically important banks, according to Reuters.

- Chinese Vice President Han Zheng said China remains committed to opening itself up to the wider world and to an independent foreign policy, while it stays committed to safeguarding sovereignty and territorial integrity, according to Reuters.

- China's market regulator issued measures to promote the private economy and China will continue to break down market access barriers for the private economy, according to state media.

- Japanese PM Kishida said he will reform the asset management sector and will introduce a new programme to assist new entrants to the asset management sector. Furthermore, Kishida said it is important for FX to move stably, reflecting economic fundamentals.

European bourses are mostly lower, but have trimmed the losses seen at the cash open. The main macro story for the region thus far has been the flash PMI prints for September. Sectors in Europe are mostly lower with the exception of Basic Resources which is in marginally positive territory thanks to underlying metals prices. On the downside, the Construction & Materials sector lags. US futures are trading slightly firmer following the biggest US stock drop since March, in yesterday's session.

Top European News

- UK Recession Risk Grows as Companies Cut Staff at a Sharp Pace

- Dutch Lenders Slide After Parliament Approves Bank Tax Increase

- European Stocks Slide on Interest Rate Woes; Dutch Banks Slide

- Dutch Lenders Slide as Parliament Approves Share Buyback Tax

- Grim Euro-Area Private Sector Suggests Quarterly Contraction

- Alten Falls as Profit Dragged by Expenses, Lower Activity Level

- Vodafone in Negotiations to Sell Spanish Business to Zegona

FX

- DXY is on a firmer footing following the uneventful BoJ decision overnight coupled with weakness from the EUR post-PMI.

- EUR and GBP both declined following overall downbeat PMI data in which the overarching theme was growth concerns.

- USD/JPY hit a high of 148.42 after the BoJ announcement overnight which offered no hawkish surprises whilst Governor Ueda repeated that the central bank will not hesitate to take additional easing measures if necessary.

- Antipodeans outperform in tandem with optimism surrounding China which has also propped up commodities.

- PBoC set USD/CNY mid-point at 7.1729 vs exp. 7.3009 (prev. 7.1730)

Fixed Income

- Debt futures faded from post-French PMI peaks and never really threatened best levels again.

- Bunds returned to flat on the day within a 130.19-129.50 range and OATs recently dipped below par between 124.87-124.21 parameters, while Gilts are holding above 96.00 having reached 96.37 from their 95.65 early Liffe low.

- T-note is closer to 108-19+ overnight high than 108-09 base awaiting the fate of preliminary US PMIs and Fed rhetoric from Daly, Cook and Kashkari with an element of pre-weekend short covering probably in mind.

Commodities

- WTI and Brent November futures are choppy in the European morning, with the complex swayed by mixed flash PMI data from France and Germany, with price action within yesterday’s range but underpinned by Russia’s gasoline and diesel export ban which came into effect yesterday.

- Dutch TTF is on a firmer footing despite Chevron’s Australia LNG workers suspending industrial action after reaching a deal. The upside for the complex could emanate from the Russian gasoline/diesel export ban, whilst recent reports also suggested firmer Chinese LNG demand.

- Metals are resilient to the firmer Dollar with spot gold rising from a 1,919.12/oz low, above its 200 DMA (1,925.29/oz) to a high just shy of its 50 DMA (1,929.58/oz).

- Base metals meanwhile have rebounded and trimmed a bulk of yesterday’s losses, with some citing optimism of a Chinese economic rebound amid recent stimulus measures, with desks also pointing to restocking ahead of China’s 8-day long holiday commencing next Friday.

- Australian unions agreed to endorse recommendations made by the industrial umpire to end the dispute with Chevron (CVX) and agreed to call off strikes at Chevron facilities. Chevron (CVX) Australia spokesperson says unions have advised the Co. and the Fair Work Commission that industrial action has been suspended.

- Russian Kremlin said the fuel export ban will last for as long as necessary to ensure stability of the fuel market, according to Reuters.

- Russia's Kremlin said there has been no progress on the Black Sea grain deal issue, with no talks between the Russian and Turkish presidents scheduled, according to Reuters.

Geopolitics

- Belarus Defence Ministry announces that Belarus and Russia are to commence joint military drills, according to Reuters.

- US President Biden said in a meeting with Ukrainian President Zelensky that Russia alone stands in the way of peace and Russia is seeking more weapons from Iran and North Korea, while he added that Russia hopes to use winter as a weapon against the Ukrainian people.

- Biden announced USD 325mln of security aid for Ukraine and that the first US Abrams tanks would be delivered to Ukraine next week.

- Ukrainian President Zelensky said that they reached an agreement to strengthen Ukraine's defence capabilities and that the US will help Ukraine boost air defence during the winter, while they agreed on steps to expand exports of grain from Ukraine, according to Reuters.

- Chinese Vice President Han Zheng said China supports all efforts that are conducive to the peaceful resolution of the Ukraine crisis and stands ready to continue playing a constructive role for an early attainment of peace, according to Reuters.

US Event Calendar

- 09:45: Sept. S&P Global US Services PMI, est. 50.7, prior 50.5

- 09:45: Sept. S&P Global US Manufacturing PM, est. 48.2, prior 47.9

- 09:45: Sept. S&P Global US Composite PMI, est. 50.4, prior 50.2

Central Bank Speakers

- 08:50: Fed’s Cook Speaks at NBER AI Conference

- 13:00: Fed’s Daly to Discuss Monetary Policy, Economy

- 13:00: Fed’s Kashkari Speaks

DB's Jim Reid concludes the overnight wrap

Markets experienced another big sell-off yesterday, with longer-dated yields hitting new highs for the cycle across several countries. In fact, the US 10yr Treasury yield has surpassed the 4.5% mark in trading overnight, which is the first time that’s happened since 2007. And the moves haven’t just been confined to Treasuries, since Bloomberg’s global aggregate bond index closed at its lowest level of 2023 so far yesterday. Meanwhile for equities, the losses gathered pace towards the end of the session, and the S&P 500 (-1.64%) experienced its worst day since March.

In large part, those moves have been driven by the prospect that central banks are likely to keep policy rates in restrictive territory for longer than previously thought. That was prompted initially by the Fed’s hawkish dot plot on Wednesday. But the sell-off then got fresh momentum yesterday from theUS weekly jobless claims, which came in at their lowest since January at 201k. That pushed the 4-week moving average to its lowest level since March, offering further evidence that this strength doesn’t just look like a blip.

That backdrop led to an intense bond sell-off, since the strong labour market data suggested that any rate cuts were still some way off. By the close yesterday, the 10yr Treasury yield (+8.7bps) was at a post-2007 high of 4.494%, and it remains there overnight after coming down slightly from the 4.5% mark. At the same time, the 10yr real yield (+6.6bps) also hit a post-2009 high of 2.11%. Yesterday’s rise was even stronger at the long-end, with the 30yr yield seeing its sharpest rise since April, up +12.8bps to 4.57%. That said, front-end yields actually fell on the day, with the 2yr yield ending the day -3.1bps lower at 5.15%. As a result, the 2s10s slope saw its most significant steepening since the March banking stress (to -65.4bps), and overnight it’s steepened a bit further to -63.9bps. Over in Europe it was much the same story, with yields on 10yr bunds (+3.5bps) hitting their highest intraday level since 2011 at one point, although they then pared back those gains somewhat to close at 2.73%.

This rise in nominal and real yields meant that equities continued to struggle, and the S&P 500 (-1.64%) seeing its worst day since March and closing at its lowest level in nearly 3 months. It also means that we’ve now had a 5% sell-off in the index since its recent peak at end-July, which is the first time since the SVB sell-off in March that we’ve experienced a decline of that magnitude. At the same time, the VIX index of volatility rose for a 5th consecutive day, up a further +2.4pts to 17.5pts, which is its highest level in a month. The NASDAQ saw an even sharper loss (-1.82%). Meanwhile, the small-cap Russell 2000 (-1.56%) is now in technical correction territory, having shed more than -10% since its peak in end-July. And over in Europe there were losses across the continent, with the STOXX 600 down -1.37%.

Overnight in Asia, the main story is that the Bank of Japan has left policy unchanged at their latest meeting, in line with expectations. We’ll have to see what Governor Ueda says in the press conference, but so far the Japanese Yen has weakened -0.30% against the dollar overnight, since the ongoing stimulus has put further pressure on the Yen. Ahead of the decision, the latest CPI numbers for August were also stronger than expected, with headline CPI at +3.2% (vs. +3.0% expected). Following the decision, Japanese equities have pared back some of their earlier losses, but the Nikkei is still down -0.38%. But outside of Japan the picture has been more mixed, with losses for the KOSPI (-0.41%), but gains for the Hang Seng (+1.21%), the CSI 300 (+1.03%) and the Shanghai Comp (+0.77%). Looking forward, there’s also been a stabilisation in US equity futures, with those on the S&P 500 up +0.17% overnight .

The other important news overnight has been from the September flash PMIs. In Japan, they’ve weakened relative to August, with the composite PMI down to 51.8, which is its lowest level since February. But in Australia, there’s been a recovery in the composite PMI, which has risen to a 3-month high of 50.2. So all eyes will be on the US and European numbers later to see the direction of travel as we come to the end of Q3.

Elsewhere yesterday, t he Bank of England kept their policy rate on hold at 5.25%, which ended a run of 14 successive hikes. It was a narrow 5-4 vote among the committee, with 4 of the members preferring a 25bp hike, and their statement still signalled the potential for more hikes. For instance, it said that “Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.” The other important development came with regards to quantitative tightening, where they voted to reduce the gilt portfolio by £100bn over the year from October, taking the total down to £658bn .

For markets, the decision to leave rates unchanged came as something of a surprise, since swaps had been pricing in a 63% likelihood of a hike immediately prior to the decision. As a result, sterling fell against both the US dollar (-0.37%) and the Euro (-0.39%). However, gilt yields followed a pattern similar to the rest of Europe, with a noticeable steepening amidst rises in both the 2yr (+2.5bps) and the 10yr yield (+9.0bps). Looking forward, our UK economist thinks it’s more likely than not that rates have peaked. See his full recap here.

Central banks were in the spotlight elsewhere yesterday, with decisions in several other European countries. In Sweden, the Riksbank raised their policy rate to 4%, in line with expectations. Likewise in Norway, the Norges Bank hiked by 25bps to 4.25%, and Governor Bache said “There will likely be one additional policy rate hike, most probably in December”. However, in Switzerland, the SNB left rates unchanged at 1.75%, contrary to the consensus of economists who expected a 25bp hike. As a result, the Swiss Franc was the worst-performing G10 currency yesterday, weakening by -0.66% against the US Dollar .

Looking at yesterday’s other data, US existing home sales fell to an annualised rate of 4.04m in August (vs. 4.10m expected), leaving them at a 7-month low. Meanwhile, the Conference Board’s Leading Index fell by -0.4%, marking its 17th consecutive monthly decline.

To the day ahead now, and data highlights include the September flash PMIs from Europe and the US, along with UK retail sales for August. Central bank speakers include ECB Vice President de Guindos, along with the Fed’s Cook, Daly and Kashkari.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire