Uncategorized

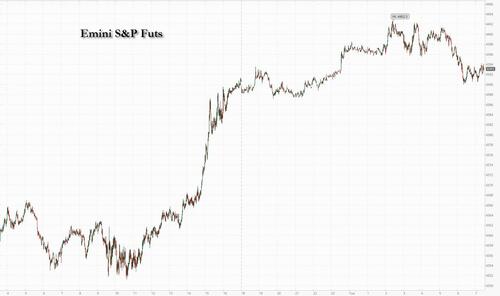

Futures Hit 4400 And Reverse Ahead Of CPI Report

Futures Hit 4400 And Reverse Ahead Of CPI Report

US equity futures traded sharply higher in early trading, with spoos (Sept futs contract)…

US equity futures traded sharply higher in early trading, with spoos (Sept futs contract) rising briefly above 4,400 before giving up much of their advance as traders awaited a crucial CPI print which will show pressures have cooled enough to allow the Fed to put tightening campaign on pause Wednesday and as traders assessed the impact of economic stimulus from China. As of 7:50am ET, S&P futures were flat at 4,390; Nasdaq futures were more buoyant, rising 0.3% on more positive tech news with Oracle’s earnings beat after surging 1.5% the day before to the highest level in over a year. 10Y Treasury yields are flat at 3.73% while a measure of the dollar weakens. Spot gold prices and oil are climbing, while iron ore is declining.

In premarket trading, Oracle shares rose 5% after the software company reported fourth-quarter results that beat expectations and gave a forecast for revenue growth that is ahead of the analyst consensus estimate. US-listed China stocks gained in premarket trading, with Alibaba Group Holding Ltd. rising 2% and Baidu Inc. up 4.7%, after China's central bank unexpectedly lowered its seven-day reverse repurchase rate. Agribusiness Bunge dropped after reporting that it will buy Glencore Plc-backed Viterra in a stock-and-cash deal. Apple slipped after a downgrade from UBS Group AG. Here are some other notable premarket movers:

- Amazon.com rises 0.7% and has been at the forefront of this year’s rally in megacap technology stocks, but it’s also the furthest from regaining its record peak, suggesting to some that the shares still have room to run.

- Devon Energy is up as much as 2% after Goldman Sachs analyst Neil Mehta upgraded the energy company’s rating to buy from neutral on attractive valuation following months of underperformance.

- Manchester United shares rise as much as 31% as the bidding process for the Premier League football club heats up.

- Assurant rises 1.1% to overweight from neutral, seeing a number of near-term catalysts on the horizon for the business services company and finding the current stock price an attractive entry point for investors.

- Salesforce shares are up 0.7% following an event the software company hosted that was focused on AI. While analysts see long-term potential for Salesforce from AI, some noted the event may not have lived up to high expectations.

- Surmodics rises 3.3% as it is upgraded to buy from hold at Needham, which says the medical devices company’s SurVeil drug-coated balloon is likely to be approved sooner than expected by the US Food and Drug Administration following several positive developments.

Global stock markets are green across the globe amid talk of potential stimulus measures in China, with European stocks following their Asian counterparts higher after Wall Street closed firmly in the green on Monday.

Overnight China cut its 7-day reverse repo rates from 2% to 1.9%, the first such reduction in 10 months, raising speculation that it could trim the Loan Prime Rate next week. Separately, Bloomberg reported that China is (again) weighing broad stimulus with property support and rate cuts although this story has been floated so many times we doubt anyone actually believes it. Plans reportedly include at least a dozen measures to support domestic demand and the property sector. Interest rate reductions are also being mulled. State Council may discuss policies as soon as Friday, although may not be announced or implemented.

Meanwhile, as previewed yesterday, confidence is mounting that the latest reading of the US CPI due at 830am will show pressures have cooled enough to allow Federal Reserve policymakers to put their tightening campaign on pause Wednesday. It would mark the first time they forgo a rate hike after 10 consecutive moves in the key rate since March 2022 (read our full preview here).

Here is what the street expects the BLS will report, first the core May prints:

- Core CPI MoM is 0.4% (0.4% prior)

- Core CPI YoY 5.2% (5.5% prior).

And now the May headline CPIs:

- Headline MoM of 0.2% (prior 0.4%)

- Headline YoY 4.1% (prior 4.9%).

And here is JPM's market reaction matrix.

“The market’s dovish expectations for the Fed’s decision later this week are closely tied to declining inflation, and any CPI figures that deviate from expectations could lead to significant repricing and impact sentiment towards riskier assets,” said Pierre Veyret, technical analyst at ActivTrades. Falling energy prices in May should offset increases in other categories to leave the headline index roughly unchanged, according to Anna Wong, Bloomberg’s chief US economist. Excluding food and energy, prices probably rose 0.3% — a deceleration from April’s 0.4% increase, she said.

That said, the market is still allowing for a possible Fed rate increase next month, with swaps showing an almost quarter-point of additional tightening priced in by the July meeting.

Interest rates in the UK, meanwhile, may still need to move higher. Figures showed that Britain’s labor market tightened unexpectedly in April, the latest evidence that the resilient economy continues to defy efforts to cool demand and inflationary pressures. The data spurred traders to ramp up bets that the Bank of England will keep raising rates. The pound strengthened.

In other news, Bank of America’s latest global survey of fund managers showed investors are “exclusively long” tech stocks amid the buzz around artificial intelligence. Long Big Tech was the most crowded trade, according to 55% of the participants, the strongest conviction since 2020.

European stocks erased their opening gains as initial optimism that China is considering a broad package of stimulus measures gave way to edginess ahead of the US inflation report due later in the day. The Stoxx 600 Index was little changed with mining and technology stocks gaining most, and real estate and utilities declining. Among individual movers, Finnish refiner Neste Oyj rose after being upgraded to outperform at RBC, while Polish e-commerce platform Allegro.eu SA fell after a group of shareholders offered a block of shares at a discount to the last close. Here are some of the most notable European movers:

- Neste gains as much as 4.9% after being raised to outperform at RBC following underperformance in the Finnish refiner’s shares and on a better growth outlook for its sustainable aviation fuel business

- Duerr shares gain as much as 4.8% after the engineering company agreed to buy BBS Automation Group from a group led by EQT at an enterprise value of €440m to €480m

- Hexagon rises as much as 6.4% after the Swedish software maker said a pact with US chipmaker Nvidia will allow its tools to be connected to Nvidia’s platform used for creating virtual spaces

- Embracer rises as much as 12%, the most since May 30, after the Swedish game- developer announced a restructuring program that will cut capital expenditure and overhead costs

- Kinepolis rises as much as 7.4%, the most since February 2022, after the movie theater operator announced after Monday’s close a share buyback program of up to €10 million

- DocMorris jumps as much as 20%, the most since February, after Germany’s Minister of Health Karl Lauterbach said digital e-prescriptions would be available nationwide starting July 1

- Allegro drops as much as 6.5%, the lowest in over a month, after a group of shareholders offered about 53m shares in the e-commerce platform to institutional buyers at PLN 32.25 apiece

- Almirall drops as much as 11% after the Spanish pharma firm said it has set the price of new shares to be issued in a capital increase at €8.2 each, representing ~5.7% discount to their last close

- Admiral drops as much as 7.4%, the most in more than three months, as Citi cuts the motor insurer to sell on an expected reset of earnings expectations and material downside risk in the 1H numbers

- CMC Markets shares drop as much as 7.3% at the open after the online trading platform’s FY results, with slower client activity weighing on its outlook and prompting PT cuts from brokers

Earlier in the session, Asian markets rose by more than 1% as China was said to consider broad stimulus measures, partially reported by Bloomberg News earlier this month. Investor speculation about looming cuts to China’s longer-term policy rates also intensified on Tuesday after the central bank unexpectedly lowered its seven-day reverse repurchase rate.

“The message is mixed: on the one hand, they surprised the market by announcing a cut in the short-term rate, but on the other, it also shows that the Chinese recovery is really weak,” said Charles-Henry Monchau, chief investment officer at Banque Syz.

- China's Shanghai Comp. and the Hang Seng were both initially subdued despite the PBoC’s cut to its short-term interbank funding rate which raises the prospects of a cut to the MLF rate and benchmark LPR, with sentiment dampened by ongoing growth concerns and lingering frictions after the US added 43 entities to its export control list.

- Australia's ASX 200 just about kept afloat but with upside capped after mixed data in which Westpac Consumer Confidence improved but remained near recession lows and NAB Business Confidence deteriorated.

- Japan's Nikkei 225 resumed its outperformance and breached the 33,000 level for the first time in over three decades amid strength in automakers and with SoftBank spearheading the advances on news that Intel is to discuss being an anchor investor in the Arm IPO.

- India’s benchmark index posted its biggest advance since May 26, tracking improved risk-on sentiment across global markets on expectations that world interest rates are close to their peak. The S&P BSE Sensex rose 0.7% to 63,143.16 in Mumbai, while the NSE Nifty 50 Index increased 0.6%. The Sensex has been trading near its all-time high for several sessions, but has failed to close above the peak of 63,284.19 on Dec. 1.

Emerging markets rose as China’s surprise short-term policy interest rate cut and the possibility of stimulus measures eased concerns about faltering growth in the world’s largest developing economy. MSCI’s developing-nation equities gauge rose 1% to a four-month high, with Asian technology stocks leading gains. In South Africa, Johannesburg’s benchmark stock index climbed as much as 2%, boosted by a rally in mining companies.

In FX, the Bloomberg Dollar Spot Index fell 0.3% to the lowest since May 17 ahead of CPI data. US consumers’ near-term inflation expectations in May hit a two-year low, backing the case for the Federal Reserve to halt policy tightening. The pound rose as much as 0.5% against the dollar, after hot labor market data fanned concerns that Bank of England still hasn’t done enough to bring inflationary pressures to heel. Traders priced in a further 120 basis points of interest rate hikes, taking the key rate to above 5.7% in February 2024. South Korea’s won outperformed emerging peers amid dollar sales by exporters. The yuan pared losses, after earlier reaching a six- month low after the central bank’s rate cut. The threat of a devaluation in Nigeria’s currency following the ouster of the country’s central bank governor has sent investors seeking cover in the derivatives market.

“The US dollar is likely to remain heavy until the US CPI is released,” Commonwealth Bank of Australia strategists led by Joseph Capurso wrote in a research note. “Assuming the US CPI does not provide a positive shock, we expect the US dollar to ease if the FOMC sounds modestly dovish to justify their flagged ‘pause’”

In rates, treasuries were little changed as US trading day gets under way, shrugging off steep curve-flattening selloff in gilts sparked by hot UK wage data. TSY yields are within 1bp of Monday’s closing levels, when key curve spreads including 2s10s and 5s30s steepened from lowest levels since March; the 10Y Treasury was at 3.74% last. UK yields, off session peaks, remain higher by more than 15bp at front end with long-end yields little changed; UK 2-year rose as much as 20bp to 4.84%, highest level since 2008. Compressed Treasury coupon auction cycle is set to conclude with $18b 30-year bond reopening; WI yield 3.88% is within 1bp of March result, which was highest since November.

Session highlights include May CPI report expected to show further moderation in inflation on day before Fed rate decision and 30-year bond auction at 1pm New York time. Swaps continue to price in about one-in-three odds of a quarter point rate increase, and to nearly fully price in a hike by July.

In commodities, oil rebounded from its lowest level in almost three months on hopes for China stimulus, developments that also boosted iron ore. WTI rose 1% to trade near $67.80. Spot gold adds 0.3% to around $1,963. Bitcoin rises 1%.

Looking to the day ahead now, the main highlight is the all important CPI data at 8:30 a.m., after which the FOMC will start its two-day meeting at 10:00 a.m. Also at 10:00 a.m., Treasury Secretary Janet Yellen will testify to the House financial services panel. At 11:30 a.m., the US will sell $38 billion 52-week bills and $45 billion 42-day CMBs, and then another $18 billion 30-year bonds at 1:00 p.m. Later, at 3:00 p.m., Donald Trump will appear in federal court in Miami. Also today, NATO's Stoltenberg is meeting with President Biden. In corporate news, it’s Home Depot’s investor day and Elon Musk is due to speak at the Edison Electric Institute Conference at 11:00 a.m.

Other data releases include UK unemployment for April, and the German ZEW survey for June. From central banks, we’ll hear from BoE Governor Bailey and the BoE’s Dhingra, as well as the ECB’s De Cos. In addition, incoming BoE MPC member Megan Greene will appear before the House of Commons’ Treasury Committee.

Market Snapshot

- S&P 500 futures up 0.3% to 4,355.50

- STOXX Europe 600 up 0.3% to 462.08

- German 10Y yield little changed at 2.37%

- Euro up 0.4% to $1.0802

- MXAP up 1.1% to 167.45

- MXAPJ up 1.0% to 527.08

- Nikkei up 1.8% to 33,018.65

- Topix up 1.2% to 2,264.79

- Hang Seng Index up 0.6% to 19,521.42

- Shanghai Composite up 0.1% to 3,233.67

- Sensex up 0.5% to 63,030.48

- Australia S&P/ASX 200 up 0.2% to 7,138.86

- Kospi up 0.3% to 2,637.95

- Brent Futures up 1.0% to $72.55/bbl

- Gold spot up 0.3% to $1,963.42

- U.S. Dollar Index down 0.37% to 103.28

Top Overnight News

- China cut 7-day reverse repo rates from 2% to 1.9%, the first such reduction in 10 months, raising speculation that it could trim the Loan Prime Rate next week. RTRS

- China is considering a broad package of stimulus measures as pressure builds on Xi Jinping’s government to boost the world’s second-largest economy, according to people familiar with the matter. BBG

- SoftBank is planning a fresh round of layoffs at its Vision Fund investment arm, two people familiar with the matter said, the latest cost-cutting move at the Japanese conglomerate. The layoffs, which could be announced in the next two weeks, may impact up to 30% of its staff at the unit. RTRS

- UK jobs data for April comes in hot, with a jump in wages (+7.2% vs. the St +6.95) and a decline in the unemployment rate (3.8% vs. the Street 4%). RTRS

- GIR expects a 0.44% increase in May core CPI—above consensus of 0.4%—which would nonetheless lower the year-over-year rate to 5.32% (vs. 5.2% consensus). We expect a 0.21% increase in May headline CPI (vs. 0.2% consensus), which would lower the year-over-year rate to 4.19% (vs. 4.1% consensus). (GIR)

- Donald Trump is due in a Miami federal court this afternoon to face charges alleging he jeopardized national security. The 37-count indictment accuses him of mishandling classified documents after he left the White House. After the hearing, the former president will head to his New Jersey golf club to deliver a speech and hold a fundraiser. BBG

- US junk bond defaults start to spike as higher rates and sluggish growth begin to weigh on the economy (there have been $21B in junk defaults so far this year, more than in all of 2021 and 2022 combined). FT

- Across the country, there are signs that Americans are pulling back on restaurant outings, hotel stays and airline tickets, after months of exuberant consumption. Spending on a range of services, including international travel, taxi rides and clothing alterations, fell in April for this first time this year, according to federal data. People are also spending less on public transportation, child care and funerals. Washington Post

- Apartment rent growth is declining fast, shifting the rental market to the tenant’s favor for the first time in years. The average of six national rental-price measures from rental-listing and property data companies shows new-lease asking rents rose just under 2% over the 12 months ending in May. That is down from the double-digit increases of a year ago and represents the largest deceleration over any year in recent history, according to data firm CoStar Group and rental software company RealPage. WSJ

- Offices in New York City crossed the 50% threshold last week for the first time since the Covid-19 pandemic eviscerated the local economy at the start of the outbreak. Building occupancies in the New York metro area hit 50.5% of pre-pandemic levels in the week ended Wednesday, June 7, according to data from security firm Kastle Systems, up 4.2 percentage points from the week before. BBG

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks eventually traded mostly higher following the gains on Wall St where the S&P 500 and Nasdaq 100 rose to their best levels in a year with big tech supported as yields softened ahead of the upcoming risk events, while the region also digested the PBoC’s cut to its 7-day reverse repo rate. ASX 200 just about kept afloat but with upside capped after mixed data in which Westpac Consumer Confidence improved but remained near recession lows and NAB Business Confidence deteriorated. Nikkei 225 resumed its outperformance and breached the 33,000 level for the first time in over three decades amid strength in automakers and with SoftBank spearheading the advances on news that Intel is to discuss being an anchor investor in the Arm IPO. Hang Seng and Shanghai Comp. were both initially subdued despite the PBoC’s cut to its short-term interbank funding rate which raises the prospects of a cut to the MLF rate and benchmark LPR, with sentiment dampened by ongoing growth concerns and lingering frictions after the US added 43 entities to its export control list.

Top Asian News

- PBoC injected CNY 2bln via 7-day reverse repos and cut the rate by 10bps to 1.90% from 2.00%.

- China is said to be weighing broad stimulus with property support and rate cuts, according to Bloomberg sources; Plans include at least a dozen measures to support domestic demand and the property sector. Interest rate reductions are also being mulled. State Council may discuss policies as soon as Friday, although may not be announced or implemented.

- China's state planner (NDRC) issues notice on lowering costs this year; to exempt and reduce VAT for small businesses until year-end. Will steadily lower loan interest rates. To introduce targeted tax and fee reduction policies in science and tech. Will guide financial institutions to raise medium and long-term loan issuances for the manufacturing industry.

European bourses are firmer though have eased off of post-open best levels, Euro Stoxx 50 +0.3%. The region is continuing the upside from yesterday's session and was unreactive to German ZEW with markets fully focused on today's US CPI. Sectors are mixed, Basic Resources outperforms as metals make gains following Chinese stimulus reports and action, a narrative which is also supporting Luxury. Elsewhere, Tech is bolstered by Oracle post-earnings.

Stateside, futures are firmer across the board with the NQ +0.5% incrementally outperforming given the tech sectors strength; overall, action has modestly extended on Monday's strength as we look to the inflation release. Oracle Corp (ORCL) - Q4 2023 (USD): Adj. EPS 1.67 (exp. 1.58), Revenue 13.84bln (exp. 13.73bln), raised quarterly dividend to USD 0.40/shr from 0.32/shr. Cloud services and license support revenue rose 23% Y/Y to USD 9.37 (exp. 9.1bln). Cloud license and on-premise license revenue fell 15% Y/Y to USD 2.15bln (exp. 2.33bln). Guides Q1 EPS USD 1.12-1.16 (exp. 1.17), guides Q1 rev. growth of 8%-10% (exp. 8.8% growth), adds FX will have a positive 0%-1% impact on rev. and + USD 0.01 on EPS. (PR Newswire) +4.3% in pre-market trade.

Top European News

- BoE's Greene (appointee, joins July 5th) says UK labour market surprisingly tight; indicators are not evolving as one might expect given significant monetary policy tightening. If you engage in stop-start monetary policy, can end up with worse outcomes. UK is seeing some second-round effects in inflation. Reasonable to expect inflation to come down fairly quickly. Expects it will be easier to get inflation down to 5% from 10%, than to 2% from 5%. If UK inflation drivers are persistent, BoE needs to lean against this.

- UK Energy Secretary Shapps says the UK does not need more green subsidies, and dismisses calls from green industries for a UK-version of the US' Inflation Reduction Act, via Politico.

- EU's Sefcovic warned that barriers between the UK and EU are likely to deepen further despite the resolution of a diplomatic stand-off over Northern Ireland creating a “new spirit” in relations, according to the FT.

- Germany aims to buy six Iris-T defence systems for around EUR 900mln for its air force; to decide on the purchase on Wednesday, via Reuters citing sources.

FX

- Dollar soggy pre-US CPI as DXY drifts down between 103.620-210 bounds.

- Euro takes mixed German ZEW survey in stride as it probes option expiries, 1.0800 and 100 DMA vs Greenback.

- Sterling revival forged on strength of UK jobs and wage data, with Cable back above 1.2550 from almost round number below.

- Yuan regroups after PBoC reverse repo cut as reports swirl regarding more Chinese stimulus, USD/CNY and USD/CNH off circa 7.1675 and 7.1785 respective peaks.

- PBoC set USD/CNY mid-point at 7.1498 vs exp. 7.1490 (prev. 7.1212)

- South African Electricity Minister Ramokopa says over 5500 megawatts of renewable projects will be coming online by 2026; 55 gigawatts of wind and solar projects are under development across the country.

Fixed Income

- Bonds mixed again and UK debt still underperforming as strong labour data backs up hawkish BoE rhetoric.

- Gilts near the base of 94.80-95.18 parameters post-mediocre 2033 DMO auction, Bunds underpinned within 134.01-55 range after conflicting German ZEW survey findings and T-note afloat between 113-13+/22 bounds pre-US CPI and long bond sale.

Commodities

- Crude benchmarks are firmer intraday though more broadly are consolidating after Monday's subdued settlement, action which was driven in part by Goldman Sachs cutting its forecasts.

- Currently, WTI and Brent are firmer by around USD 1.00/bbl to USD 1.30/bbl and some USD 0.20/bbl from their initial session peaks at USD 67.15/bbl and USD 71.94/bbl respectively.

- Spot gold is once again gleaning some incremental upside from the softer USD, though is generally contained pre-CPI. Conversely, base metals are bid on the PBoC action and subsequent source reports and commentary around support measures.

- Boliden (BOL SS) reports a fire at the Rönnskär copper smelter facility, all production there is stopped until further notice. Initial assessment is this can be resumed in a few weeks. Boliden notes Rönnskär can produce 250k/T of copper per year, making it one of the world’s largest smelters

Crypto

- Bitcoin is rangebound and yet to deviate meaningfully from the USD 26k mark with specifics limited and markets broadly focused on upcoming US CPI as the final and potentially decisive input before Wednesday's FOMC.

Geopolitics

- Belarusian President Lukashenko says Belarus will not hesitate to use nuclear weapons in the case of aggression against it, via Belta; says deployment of Russian tactical nuclear weapons in Belarus is a deterrent to discourage potential aggressors.

- Ukrainian air defence systems were engaged in repelling air attacks in the Kyiv region, according to the region's military administration, while it was also reported that Russia conducted strikes on the city of Kryvyi Rih, according to the mayor.

- Russian Defence Ministry says their forces have seized German Leopard tanks, via Ria.

- US President Biden's admin. is expected to approve depleted-uranium tank rounds for Ukraine, via WSJ citing sources.

- Latest US aid package to Ukraine will include more Bradley and Stryker fighting vehicles, according to NYT.

- US Central Command said a helicopter mishap in Northeastern Syria injured 22 US service members on June 11th and the cause is under investigation although there was no enemy fire reported, according to Reuters.

US Event Calendar

- 06:00: May SMALL BUSINESS OPTIMISM, 89.4; est. 88.5, prior 89.0

- 08:30: May CPI MoM, est. 0.1%, prior 0.4%

- 08:30: May CPI YoY, est. 4.1%, prior 4.9%

- 08:30: May CPI Ex Food and Energy YoY, est. 5.2%, prior 5.5%

- 08:30: May CPI Ex Food and Energy MoM, est. 0.4%, prior 0.4%

- 08:30: May Real Avg Weekly Earnings YoY, prior -1.1%, revised -1.2%

- 08:30: May Real Avg Hourly Earning YoY, prior -0.5%, revised -0.6%

DB's Jim Reid concludes the overnight wrap

Markets have remained buoyant as we arrive at the start of a pivotal few days on the macro calendar. In fact, for the first time since January 2022, we’re able to write that the S&P 500 (+0.93%) closed at a one-year high, having now surpassed its local peak from last August during the bear-market rally. That optimism surrounding the outlook can be seen in other ways too. For instance, futures show investors are increasingly sceptical that the Fed will cut rates in the months ahead, which is a big turnaround from the substantial cuts that were priced during the market turmoil in March. Furthermore, the risk-on tone has led investors to move out of sovereign bonds, and another milestone from yesterday was that the 2yr real Treasury yield closed at a post-GFC high of 2.51%. There’s no sign of any let-up either, with futures on the S&P 500 up another +0.21% this morning.

Now of course, if you wanted to play devil’s advocate, this is still an incredibly narrow rally that’s been predominantly led by big tech stocks. For example, the equal-weighted version of the S&P 500 still hasn’t regained its levels prior to SVB’s collapse in March, so we’re not seeing broad-based gains for the index just yet. As it happens, yesterday’s advance was very much in that spirit, with the NASDAQ (+1.53%) and the FANG+ index (+1.85%) of 10 megacap tech stocks outpacing the broader equity market once again. In the meantime, banks (-0.56%) underperformed following announcements by KeyCorp and Citizens Financial Group that they were seeing a softer net income forecast and an increase in charge-offs, respectively. AI remains a key theme, and after the close Oracle (+3.64% in after-market trading) bounced after reporting increased sales numbers and rose guidance on higher AI infrastructure demand.

That positive backdrop sets us up for an incredibly eventful week ahead, which kicks off today with the US CPI release for May. The inflation picture has remained challenging over recent months, since although headline inflation has cooled significantly, core inflation has remained stubbornly persistent. Indeed, the monthly core CPI print has been at least +0.4% for 5 consecutive months now, which is still too fast for comfort for the Fed. This time around, our US economists see that trend broadly continuing, with monthly core inflation coming in at +0.37%, which would only take the year-on-year rate down to +5.3%. And for headline, they see a monthly gain of just +0.01%, leaving the year-on-year rate at a 26-month low of +4.0%, which would be less than half the rate from a year earlier.

Of course, the big question from the CPI will be how it affects the Fed’s policy decision tomorrow. Currently this morning, futures are pricing in just a 20% likelihood of a further hike in June, suggesting that they’ll finally hit the pause button after a series of 10 successive increases. But given there’s only a day to go, the fact that markets are still pricing in a non-trivial likelihood of a June hike shows that they’re not ready to discount the probability of a move just yet. The view of our economists is that the Fed will remain on hold this week, and even if the CPI surprised moderately on the upside, the Fed could instead meet that with a stronger tightening signal from the dot plot and Chair Powell’s press conference. Their view is it would take a sizeable outperformance to see the FOMC surprise the market with a hike.

With the CPI release to look forward to, investors became increasingly sceptical that the Fed would end up cutting rates this year. Indeed, the rate priced in for the December meeting moved up to a post-SVB high of 5.063% yesterday, which is only just beneath where the effective fed funds rate currently is at 5.08%. The 2yr yield had also been on track for a post-SVB high, but came down later in the session to end -1.8bps lower at 4.577%, while the 10yr yield was just lower than unchanged at 3.735%. As mentioned at the top, there was also a notable move higher in real yields, and the 2yr TIPS yield closed at its highest level since 2009 at 2.44%.

While Treasuries slightly gained ground, gilts underperformed yesterday, where the 10yr yield was up by +10.0bps on the day to 4.33%. In fact, the 2yr gilt yield even surpassed its closing high from when Liz Truss was PM, taking them up to levels last seen in 2008 at 4.62%. One factor driving that was a speech from the BoE’s Mann, who is the most hawkish member on the MPC. She said that she was “very concerned” about persistent pressures on inflation, which helped to cement market expectations that there’d be at least 100bps of further rate hikes from the BoE over the rest of the year. These comments weren’t enough to support the pound, however, which weakened by -0.50% against the US Dollar to $1.251.

For Europe, this increasing positivity led to another round of tightening in sovereign bond spreads. There were several examples of this, but one was the gap between Italian and German 10yr yields, which fell to just 167bps by the close yesterday, marking its tightest level since April 2022. The 10yr bund yield did actually rise by +0.9bps, moving higher along with Treasuries and gilts, but elsewhere on the continent the pattern was mostly lower, with yields on 10yr OATs (-0.5bps) and BTPs (-5.7bps) falling back. Otherwise, the major equity indices proved resilient, and the STOXX 600 advanced +0.16%.

Those overnight gains are also echoing in Asian equity markets this morning, and have got some further support after the People’s Bank of China lowered their seven-day reverse repo rate by 10bps to 1.9%. That’s the first cut in that rate since August 2022, and comes amidst increasingly weak data releases over recent months. In response, the offshore Yuan has weakened to 7.17 per US Dollar overnight, and yields on 10yr government bonds are down -4.1bps to their lowest since September, at 2.64%.

This backdrop has seen the main equity indices advance across the region. The Nikkei (+1.96%) is leading the way, hitting a post-1990 high this morning and taking its YTD gains to +26.73%. Otherwise, there’s been gains for the KOSPI (+0.48%), the Hang Seng (+0.40%), and the CSI 300 (+0.12%), whereas the Shanghai Comp (-0.06%) is one of the few major indices to lose ground. US equity futures are also pointing higher, with those on the S&P 500 up +0.21%.

Elsewhere yesterday, the Nigerian Naira was one of the world’s top-performing currencies, strengthening +1.08% against the US Dollar. That follows the move by new President Bola Tinubu to suspend the central bank governor on Friday night. It also comes amidst a broader uptick in volatility across frontier markets like Nigeria, Egypt and Pakistan, not least due to rising global interest rates and the strong dollar. For those interested in more information, our colleagues in EM Research are hosting a client call at 2pm London time today on their new coverage of, and toolkit for, frontier market currencies. Clients can register for the call using this link.

Ahead of the CPI release, there was some mixed news on the inflation expectations side from the New York Fed’s latest survey. The good news was that 1yr expectations were down to a two-year low of 4.1%. But longer-term expectations continued to creep higher, with 5yr expectations hitting an 11-month high of 2.7%.

To the day ahead now, and the main highlight will be the US CPI release for May. Other data releases include UK unemployment for April, and the German ZEW survey for June. From central banks, we’ll hear from BoE Governor Bailey and the BoE’s Dhingra, as well as the ECB’s De Cos. In addition, incoming BoE MPC member Megan Greene will appear before the House of Commons’ Treasury Committee.

Uncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemploymentUncategorized

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Inside The Most Ridiculous Jobs Report In History: Record 1.2 Million Immigrant Jobs Added In One Month

Last month we though that the January…

Last month we though that the January jobs report was the "most ridiculous in recent history" but, boy, were we wrong because this morning the Biden department of goalseeked propaganda (aka BLS) published the February jobs report, and holy crap was that something else. Even Goebbels would blush.

What happened? Let's take a closer look.

On the surface, it was (almost) another blockbuster jobs report, certainly one which nobody expected, or rather just one bank out of 76 expected. Starting at the top, the BLS reported that in February the US unexpectedly added 275K jobs, with just one research analyst (from Dai-Ichi Research) expecting a higher number.

Some context: after last month's record 4-sigma beat, today's print was "only" 3 sigma higher than estimates. Needless to say, two multiple sigma beats in a row used to only happen in the USSR... and now in the US, apparently.

Before we go any further, a quick note on what last month we said was "the most ridiculous jobs report in recent history": it appears the BLS read our comments and decided to stop beclowing itself. It did that by slashing last month's ridiculous print by over a third, and revising what was originally reported as a massive 353K beat to just 229K, a 124K revision, which was the biggest one-month negative revision in two years!

Of course, that does not mean that this month's jobs print won't be revised lower: it will be, and not just that month but every other month until the November election because that's the only tool left in the Biden admin's box: pretend the economic and jobs are strong, then revise them sharply lower the next month, something we pointed out first last summer and which has not failed to disappoint once.

In the past month the Biden department of goalseeking stuff higher before revising it lower, has revised the following data sharply lower:

— zerohedge (@zerohedge) August 30, 2023

- Jobs

- JOLTS

- New Home sales

- Housing Starts and Permits

- Industrial Production

- PCE and core PCE

To be fair, not every aspect of the jobs report was stellar (after all, the BLS had to give it some vague credibility). Take the unemployment rate, after flatlining between 3.4% and 3.8% for two years - and thus denying expectations from Sahm's Rule that a recession may have already started - in February the unemployment rate unexpectedly jumped to 3.9%, the highest since February 2022 (with Black unemployment spiking by 0.3% to 5.6%, an indicator which the Biden admin will quickly slam as widespread economic racism or something).

And then there were average hourly earnings, which after surging 0.6% MoM in January (since revised to 0.5%) and spooking markets that wage growth is so hot, the Fed will have no choice but to delay cuts, in February the number tumbled to just 0.1%, the lowest in two years...

... for one simple reason: last month's average wage surge had nothing to do with actual wages, and everything to do with the BLS estimate of hours worked (which is the denominator in the average wage calculation) which last month tumbled to just 34.1 (we were led to believe) the lowest since the covid pandemic...

... but has since been revised higher while the February print rose even more, to 34.3, hence why the latest average wage data was once again a product not of wages going up, but of how long Americans worked in any weekly period, in this case higher from 34.1 to 34.3, an increase which has a major impact on the average calculation.

While the above data points were examples of some latent weakness in the latest report, perhaps meant to give it a sheen of veracity, it was everything else in the report that was a problem starting with the BLS's latest choice of seasonal adjustments (after last month's wholesale revision), which have gone from merely laughable to full clownshow, as the following comparison between the monthly change in BLS and ADP payrolls shows. The trend is clear: the Biden admin numbers are now clearly rising even as the impartial ADP (which directly logs employment numbers at the company level and is far more accurate), shows an accelerating slowdown.

But it's more than just the Biden admin hanging its "success" on seasonal adjustments: when one digs deeper inside the jobs report, all sorts of ugly things emerge... such as the growing unprecedented divergence between the Establishment (payrolls) survey and much more accurate Household (actual employment) survey. To wit, while in January the BLS claims 275K payrolls were added, the Household survey found that the number of actually employed workers dropped for the third straight month (and 4 in the past 5), this time by 184K (from 161.152K to 160.968K).

This means that while the Payrolls series hits new all time highs every month since December 2020 (when according to the BLS the US had its last month of payrolls losses), the level of Employment has not budged in the past year. Worse, as shown in the chart below, such a gaping divergence has opened between the two series in the past 4 years, that the number of Employed workers would need to soar by 9 million (!) to catch up to what Payrolls claims is the employment situation.

There's more: shifting from a quantitative to a qualitative assessment, reveals just how ugly the composition of "new jobs" has been. Consider this: the BLS reports that in February 2024, the US had 132.9 million full-time jobs and 27.9 million part-time jobs. Well, that's great... until you look back one year and find that in February 2023 the US had 133.2 million full-time jobs, or more than it does one year later! And yes, all the job growth since then has been in part-time jobs, which have increased by 921K since February 2023 (from 27.020 million to 27.941 million).

Here is a summary of the labor composition in the past year: all the new jobs have been part-time jobs!

But wait there's even more, because now that the primary season is over and we enter the heart of election season and political talking points will be thrown around left and right, especially in the context of the immigration crisis created intentionally by the Biden administration which is hoping to import millions of new Democratic voters (maybe the US can hold the presidential election in Honduras or Guatemala, after all it is their citizens that will be illegally casting the key votes in November), what we find is that in February, the number of native-born workers tumbled again, sliding by a massive 560K to just 129.807 million. Add to this the December data, and we get a near-record 2.4 million plunge in native-born workers in just the past 3 months (only the covid crash was worse)!

The offset? A record 1.2 million foreign-born (read immigrants, both legal and illegal but mostly illegal) workers added in February!

Said otherwise, not only has all job creation in the past 6 years has been exclusively for foreign-born workers...

... but there has been zero job-creation for native born workers since June 2018!

This is a huge issue - especially at a time of an illegal alien flood at the southwest border...

... and is about to become a huge political scandal, because once the inevitable recession finally hits, there will be millions of furious unemployed Americans demanding a more accurate explanation for what happened - i.e., the illegal immigration floodgates that were opened by the Biden admin.

Which is also why Biden's handlers will do everything in their power to insure there is no official recession before November... and why after the election is over, all economic hell will finally break loose. Until then, however, expect the jobs numbers to get even more ridiculous.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire