Futures Drift Before Taper-Triggering Jobs Report

Futures Drift Before Taper-Triggering Jobs Report

US equity-index drifted in a tight range overnight, in a tight range before key jobs data that could provide clues on the Federal Reserve’s policy. As noted in our preview, unless the jobs…

US equity-index drifted in a tight range overnight, in a tight range before key jobs data that could provide clues on the Federal Reserve’s policy. As noted in our preview, unless the jobs report is a disaster, it will virtually assure the Fed launches tapering in one month. Markets drifted higher on Thursday after the Senate averted the risk of an immediate default, pushing global stocks on course for their best week since early September, but a late day selloff wiped away most gains and closed spoos below the critical 4400 level. At 07:30 a.m. ET, Dow e-minis were up 35 points, or 0.10%, S&P 500 e-minis were up 5.00 points, or 0.1%, and Nasdaq 100 e-minis were up 10.75 points, or 0.07%. Treasury Yields were 1 point higher after earlier tagging 1.60%, the highest since June. The dollar was flat while Brent topped $83 before paring gains. Bitcoin traded above $55,000.

Uncertainty over the debt ceiling negotiations and a run-up in U.S. Treasury yields over elevated inflation were major concerns among investors earlier this week, injecting volatility in equity markets this week. High-growth FAAMG stocks slipped in premarket trading following sharp gains in previous session. Energy firms including Chevron Corp and Exxon Mobil gained about 0.8% tracking crude prices, while major U.S. lenders also edged up as the benchmark 10-year yield hit its highest level since June 4. Here are some of the biggest movers and stocks to watch today:

- Tesla (TSLA US) shares in focus after Elon Musk says a global shortage of chips and ships is the only thing standing in the way of the company maintaining sales growth in excess of 50%

- Sundial Growers (SNDL US) shares rise as much as 19% in U.S. premarket after the Canadian cannabis producer said it will buy liquor and pot retailer Alcanna for $276m in stock

- Allogene Therapeutics (ALLO US) plunges 36% in U.S. premarket trading after an early-stage study of its cell therapy was put on hold by U.S. regulators

- Prelude Therapeutics (PRLD US) fell in U.S. premarket trading, adding to Thursday’s 40% plunge on early- stage data for the company’s experimental cancer treatments that Barclays says came in below expectations

- Vaxart (VXRT US) rises 8% in U.S. premarket trading after its oral tablet vaccine candidate cut transmission of Covid-19 in animals, according to data from a study led by Duke University

- Faraday Future (FFIE US) slides 4% in U.S. premarket trading after J Capital says it is short on the stock. The short-seller says they don’t think the company “will ever sell a car”

- Codiak Biosciences (CDAK US) shares fell 6% in Thursday postmarket trading after disclosing that Sarepta Therapeutics is terminating a research license and option agreement

- Agile Therapeutics (AGRX US) tumbled Thursday postmarket after the women’s health-care company said that it intends to offer and sell shares of its common stock, as well as warrants to purchase shares of its common stock, in an underwritten public offering

Looking to today's main event, economists expect September hiring to have surged by 500,000 jobs as the summer wave of COVID-19 infections began to subside, and as millions of Americans no longer receive jobless benefits, positioning the Fed to start scaling back its monthly bond buying. “All roads lead to non-farm payrolls data which will decide, in the market’s minds, whether the start of the Fed taper is a done deal for December,” said Jeffrey Halley, senior market analyst at OANDA. “I do not believe that markets have priced in the Fed taper and its implications to any large degree yet. Even a weak number probably only delays the inevitable for another month.”

Even “reasonably soft” payrolls and unemployment figures wouldn’t be enough to change the minds of its officials, according to Ipek Ozkardeskaya, senior analyst at Swissquote. “Only a shockingly low figure could do that,” she said. “The persistent rise in oil prices can only continue boosting inflation fears and the central bank hawks, limiting the upside potential in case of a further recovery in stocks.”

“As soon as you start thinking about tapering it’s really hard to not then think about what that means for the Fed funds rate and when that might start to increase,” Kim Mundy, currency strategist and international economist at Commonwealth Bank of Australia in Sydney, said on Bloomberg Television. “We do see scope that markets can start to price in a more aggressive Fed funds rate hike cycle.”

In Europe, tech companies led the Stoxx Europe 600 Index down 0.2%, with energy stocks and carmakers being the only industry groups with meaningful gains. Chip stocks fell, especially Apple suppliers, following a profit warning from Asian peer and fellow supplier AAC Technologies. On the other end, European travel stocks rose after U.K. confirmed the travel “red list” will be cut to just seven countries; British Airways parent IAG and TUI led the advances. Here are some of the biggest European movers today:

- Daimler shares gains as much as 3.2%, outperforming peers, after UBS upgrades stock to buy from neutral, calling it an earnings momentum story that stands to gain from strong demand, electrification trends and its future focus on passenger cars.

- Adler shares rise as much as 13% after shareholder Aggregate sells a call option to Vonovia for a 13.3% stake in the German real estate investment firm at a strike price of EU14 per share.

- Cewe Stiftung shares jump as much as 4.2%, their best day in over three months, after the photography services firm gets a new buy rating at Hauck & Aufhaeuser.

- Weir shares fall as much as 6.3%, to the lowest since Nov. 13, after the U.K. machinery maker announced that a ransomware attack will affect full-year profitability; Jefferies says it’s unlikely that guidance beyond that will be revised.

- Zur Rose slumps as much as 9.2% after Berenberg downgrades the Swiss online pharmacy to hold from buy, citing the expected negative impact from a delay in the implementation of mandatory e-prescriptions in Germany.

- Czech digital-payments provider Eurowag shares slide as much as 10% as it starts trading in London, after pricing its IPO below an initial range and making its debut a day later than planned.

Asian stocks rose for a second day as China’s market reopened higher and the U.S. Senate approved a short-term increase in the debt ceiling. The MSCI Asia Pacific Index advanced as much as 1% in a rally led by consumer discretionary shares. Alibaba and Tencent were among the biggest contributors to the gauge’s climb. Shares in mainland China surged more than 1% as investors returned from the Golden Week holiday.

Chinese property shares fell after a report that more than 90% of China’s top 100 property developers’ sales declined in September by an average of 36% from the same period last year, while investor concerns about developers’ liquidity rose after Fantasia bonds were suspended from trading. In mainland: CSI 300 Real Estate Index drops as much as 2%, Seazen Holdings falls as much as 5%, Poly Developments -4%.

Asia’s stock benchmark is slightly down for the week, as rising bond yields weighed on tech-heavy indexes in South Korea, Taiwan and Japan. The gauge is down more than 1% this month amid an energy shortage in China and India. “Markets may not want to commit directionally” given that we have non-farm payrolls data on the docket, making a follow-through of today’s rally suspect, said Ilya Spivak, the head of Greater Asia at DailyFX. Traders are expecting today’s U.S. employment data to provide clues on the direction of the world’s largest economy. On Thursday, the U.S. averted what would have been its first default on a debt payment. Most major benchmarks in Asia climbed, led by Japan, Indonesia and Australia. India’s central bank kept its lending rates at a record low at a policy meeting today.

In Australia, the S&P/ASX 200 index rose 0.9% to close at 7,320.10. All industry groups edged higher. The benchmark rose 1.9% for the week, the biggest weekly gain since early August. Miners led the charge, having the best week since July, banks the best since the start of March. EML Payments tumbled after an update on its Ireland subsidiary from the country’s central bank. Chalice Mining continued its rebound, finishing the session the strongest performer in the mining subgauge. There is a risk of excessive borrowing due to low interest rates and rising house prices, Reserve Bank of Australia said in its semiannual Financial Stability Review released Friday. In New Zealand, the S&P/NZX 50 index fell 0.1% to 13,086.60

In rates, Treasury futures remained under pressure after paring declines that pushed 10-year yield as high as 1.5995% during European morning, highest since June 4; the 1.60% zone is thought to have potential to spur next wave of convexity hedging. U.K. 10-year is higher by 4bp, German by 2.3bp - gilts underperformed, weighing on Treasuries as money markets continue to bring forward BOE rate-hike expectations. During U.S. session, September jobs report may seal case for Fed taper announcement in November.

In FX, the greenback traded in a narrow range versus G10 peers while 10-year Treasury yields approached 1.6%, outperforming Bunds. Gilt yields rose 5-6bps across the curve; demand for downside protection in the pound eases this week as the U.K. currency moves off cycle lows amid money markets repricing. U.K. wage growth rose at its strongest pace on record in a survey of job recruiters, indicating strains from a shortage of workers are persisting. Turkish lira initially weakens above 8.96/USD before recouping half of its losses

In commodities, oil extended a rebound, on track for a seventh weekly gain. Crude futures pushed to the best levels for the week. WTI rises 1.5% near $79.50, Brent pops back on to a $83-handle. Spot gold trades a $5 range near $1,757/oz. Base metals are mostly positive, with LME nickel gaining over 3.5%.

Looking at the day ahead, the highlight will be the aforementioned September jobs report. Central bank speakers include ECB President Lagarde and the ECB’s Panetta.

Market Snapshot

- S&P 500 futures little changed at 4,389.50

- STOXX Europe 600 down 0.3% to 457.18

- MXAP up 0.4% to 194.72

- MXAPJ up 0.2% to 636.80

- Nikkei up 1.3% to 28,048.94

- Topix up 1.1% to 1,961.85

- Hang Seng Index up 0.6% to 24,837.85

- Shanghai Composite up 0.7% to 3,592.17

- Sensex up 0.7% to 60,070.61

- Australia S&P/ASX 200 up 0.9% to 7,320.09

- Kospi down 0.1% to 2,956.30

- Brent Futures up 1.4% to $83.09/bbl

- Gold spot up 0.0% to $1,756.25

- U.S. Dollar Index little changed at 94.29

- German 10Y yield up +3.4 bps to -0.151%

- Euro little changed at $1.1549

Top Overnight News from Bloomberg

- Global talks to reshape the corporate tax landscape are set to resume on Friday after Ireland’s decision to adhere to the world consensus on a minimum rate removed one hurdle to an agreement that still hangs in the balance

- Germany’s Social Democrats hailed a positive start in their effort to form a government after their first meeting with the Greens and the pro-business Free Democrats

- A U.S. nuclear-powered attack submarine struck an object while submerged in international waters in the Indo- Pacific region last week, the Navy said, adding that no life- threatening injuries were reported

- China drained the most short- term liquidity from the banking system in a year on a net basis as it reduced support after a week-long holiday. Government bond futures slid by the most since August

- China’s central bank will continue to push for the reform of its benchmark loan rate and make deposit rates more market-based, according to a senior official

- India’s central bank surprised markets by suspending its version of quantitative easing, signaling the start of tapering pandemic-era stimulus measures as an economic recovery takes hold

- U.K. government bond yields have climbed to levels last seen before the Brexit referendum in 2016 relative to German peers, as traders brace for inflation in Britain over the next decade to far outpace the rate in Europe’s largest economy

A detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mostly higher as the region conformed to the global upbeat mood after the agreement in Washington to raise the debt ceiling which the Senate approved, with the overnight bourses also invigorated by the return of China and strong Caixin PMI data. The ASX 200 (+0.9%) was led higher by strength in mining names with underlying commodity prices boosted as Chinese buyers flocked back to market which helped the ASX disregard a record increase in daily COVID-19 cases in Victoria state. Nikkei 225 (+1.3%) was the biggest gainer and reclaimed the 28k level as exporters benefitted from a softer currency, while attention turns to PM Kishida who will outline his policy program today and is reportedly planning to present an additional budget after the election. Furthermore, there were recent comments from an ally of the new PM who suggested that capital gains tax could be raised to 25% from the current 20% without affecting stock prices, although this failed to dent the mood in Tokyo and weaker than expected Household Spending was also brushed aside. The gains for the KOSPI (-0.1%) were later reversed alongside the tentative price action in index heavyweight Samsung Electronics after its Q3 prelim. results showed oper. profit likely rose to its highest in three years but missed analysts’ forecasts. Hang Seng (+0.6%) and Shanghai Comp. (+0.7%) were mixed with the latter jubilant on reopen from the Golden Week holiday after improved Caixin Services and Composite PMI data which both returned to expansionary territory. This helped mainland stocks overlook the recent developer default fears and largest daily liquidity drain by the PBoC since October last year, although Hong Kong initially lagged amid heavy Northbound Stock Connect trade. Finally, 10yr JGBs declined on spillover selling from T-notes and with havens shunned amid the gains across riskier assets, although downside in JGBs was limited given the BoJ’s presence in the market for nearly JPY 1.5tln of JGBs with up to 10yr maturities.

Top Asian News

- Gold Steadies Ahead of Key U.S. Jobs Report as Yields Climb

- Investors Fear Tax Talk in Kishida’s ‘New Japanese Capitalism’

- China Coal Prices Plunge as Producers Vow to Ease Shortages

- China Developer Stocks Fall After Report of Monthly Sales Drop

An initially contained to marginally-firmer European cash open followed an upbeat APAC handover (ex-Hang Seng) was short-lived with bourses coming under moderate pressure; Euro Stoxx 600 -0.3%. As such, major indices are all in the red, except for of the UK FTSE 100 which is essentially unchanged and bolstered by strength in heavy-weight energy and mining names given broader price action the return of China. Sectors were initially mixed at the open, but in-fitting with the action in indices, has turned to a predominantly negative performance ex-energy. Crossing to the US, futures have directionally been following European peers, but the magnitude has been more contained, with the ES unchanged as we await the September labour market report for any read across to the Fed’s policy path; however, officials have already made it clear that it would have to be a very poor report to spark a deviation from its announced intentions, where it is expected to announce an asset purchase tapering in November. Returning to Europe, Daimler (+2.5%) stands out in the individual stocks space, firmer after a broker upgrade and notable price target lift at UBS; Marks & Spencer (+1.5%) is also supported on broker action. To the downside lies Weir Group (-3.0%) after reports of a ransomware attack.

Top European News

- Adler’s Largest Shareholder Sells Option on Stake to Vonovia; A Controversial Tycoon Sits on Adler’s $9 Billion Pile of Debt

- Chip Stocks Drag Tech Gauge Lower as Asian Apple Supplier Warns

- European Gas Rises as Bumpy Ride Continues With Cold Air Coming

- Lira Weakens to Fresh Low as Rising U.S. Yields Add Pressure

In FX, the Dollar is trying to regroup and firm up again after its latest downturn amidst a further rebound in US Treasury yields, more pronounced curve re-steepening, and perhaps some relief that the Senate finally passed the debt ceiling extension bill, albeit by a slender margin and only delaying the issue until early December. Looking at the DXY as a benchmark, a marginally higher low above 94.000 and lower high below 94.500 is keeping the index contained as the clock ticks down to September’s jobs report that is expected to show a recovery in hiring after the prior month’s shortfall, but anecdotal data has been rather mixed to offer little clear pointers for the bias around consensus - full preview of the latest BLS release is available via the Research Suite under the Ad-hoc Economic Analysis section. From a technical perspective, near term support for the DXY resides at 94.077 (vs the current 94.139 base) and resistance sits at 94.448 (compared to a 94.338 intraday high).

- TRY - A double whammy for the already beleaguered Lira as oil prices come back to the boil and ‘sources’ suggest that Turkish President Erdogan’s patience is wearing thin with the latest CBRT Governor as the Bank waited until September to cut rates. Recall, Erdogan has already ousted a CBRT chief for not loosening monetary policy in his belief that lowering the cost of borrowing will bring inflation down, and although the reports have been by a senior member of his administration there is a distinct feeling of no smoke without fire in the markets as Usd/Try remains bid having only held below 9.0000 by short distance between 8.9707-8.8670 parameters.

- CHF/JPY - No real surprise that the low yielders and funders are underperforming, even though broadly upbeat risk sentiment during APAC hours has not rolled over to the European session. The Franc has retreated to 0.9300 vs the Buck and Yen is trying to fend off pressure on the 112.00 handle after failing to sustain momentum through 111.50 before weaker than expected Japanese household spending data overnight. However, decent option expiry interest from 111.85-75 (1.4 bn) may weigh on Usd/Jpy pending the aforementioned US payrolls outcome.

- AUD - Some payback for the Aussie after Thursday’s outperformance, as Aud/Usd loses a bit more momentum following its rebound beyond 0.7300 and with hefty option expiries at 0.7335 (2.7 bn) capping the upside more than smaller size at the round number (1.1 bn) cushions the downside.

In commodities, WTI and Brent remain on an upward trajectory after the mid-week pullback; as it stands, crude benchmarks are near fresh highs for the week, with WTI for November eyeing USD 80/bbl once again. Fresh news flow for the complex has been sparse, aside from substantial UK press focus on the domestic energy price cap potentially set to increase next year. More broadly, US officials have largely reiterated commentary from the Energy Department provided on Thursday around not currently intending act on energy costs with a reserve release. The session ahead has just the Baker Hughes rig count specifically for crude scheduled, though the complex may well get dragged into a broader risk move depending on the initial reaction to and analysis on NFP. For metals, spot gold and silver are contained around the unchanged mark and haven’t been affected by any significant amount by the firmer USD or elevated yield space thus far. Elsewhere, base metals are buoyed by China’s return and strong Caixin data from the region, although it is worth highlighting that the likes of LME copper are well off earlier highs.

US Event Calendar

- 8:30am: Sept. Change in Nonfarm Payrolls, est. 500,000, prior 235,000

- Change in Private Payrolls, est. 450,000, prior 243,000

- Change in Manufact. Payrolls, est. 25,000, prior 37,000

- Unemployment Rate, est. 5.1%, prior 5.2%

- Sept. Underemployment Rate, prior 8.8%

- Labor Force Participation Rate, est. 61.8%, prior 61.7%

- Average Weekly Hours All Emplo, est. 34.7, prior 34.7

- Average Hourly Earnings MoM, est. 0.4%, prior 0.6%

- Average Hourly Earnings YoY, est. 4.6%, prior 4.3%

- 10am: Aug. Wholesale Trade Sales MoM, est. 0.9%, prior 2.0%; Wholesale Inventories MoM, est. 1.2%, prior 1.2%

DB's Jim Reid concludes the overnight wrap

I’ve never quite understood why you’d go to the cinema if you’ve got a nice telly at home but such has been the nature of life over the last 19 months that I was giddy with excitement last night at booking tickets for James Bond at the local cinema next week. We’ve booked it on the same night as our first ever physical parents evening where I’ll maybe have the first disappointing clues that my three children aren’t going to be child prodigies and that maybe they’ll even have to settle for a career in finance!

Markets have been stirred but not completely shaken this week and yesterday they continued to rebound thanks to the near-term resolution on the US debt ceiling alongside subsiding gas prices, which took the sting out of two of the most prominent risks for investors over the last couple of weeks. That provided a significant boost to risk appetite, and by the close of trade, the S&P 500 had recovered +0.83% in its 3rd consecutive move higher, which put it back to just -3.0% beneath its all-time high in early September, whilst Europe’s STOXX 600 was also up +1.60% and closed before a later US sell-off. Attention will today focus squarely on the US jobs report at 13:30 London time, which is the last one before the Fed’s next decision in early November, where a potential tapering announcement is likely bar an extraordinarily poor number today, or an exogenous event in the next few weeks.

Starting with the debt ceiling, yesterday saw Democratic and Republican Senators agree to pass legislation to raise the ceiling by enough to get to early December, meaning we won’t have to worry about it for another 8 whole weeks. The Senate voted 50-48 with no Republicans blocking the legislation to increase the debt limit by $480bn, with House Majority leader Hoyer saying that the House would convene on Tuesday to pass the measure as well. To raise it for a longer period, the chatter out of Washington made it clear that Democrats would need to need to raise the debt ceiling in a partisan manner as part of the reconciliation process.

As we mentioned in yesterday’s edition, this extension means that a number of deadlines have now been punted into the year end, including the government funding and the debt ceiling (both now expiring the first Friday of December), just as the Democrats are also seeking to pass Biden’s economic agenda through a reconciliation bill containing much of their social proposals, alongside the $550bn bipartisan infrastructure package. And on top of that, we’ve also got the decision on whether Chair Powell will be re-nominated as Fed Chair, with the decision 4 years ago coming at the start of November. So a busy end to the year in DC.

The other main story yesterday was the sizeable decline in European natural gas prices, with the benchmark future down -10.73% to post its biggest daily loss since August. Admittedly, they’re still up almost five-fold since the start of the year, but relative to their intraday peak on Wednesday they’ve now shed -37.5%. So nearly a double bear market all of a sudden! The moves follow Wednesday’s signal that Russia could supply more gas to Europe. However, even as energy prices were starting to fall back from their peak, the effects of inflation were being felt elsewhere, with the UN’s world food price index climbing to its highest level in a decade in September.

Looking ahead, today’s main focus will be on the US jobs report for September later on. Last month the report significantly underwhelmed expectations, coming in at just +235k, which was well beneath the +733k consensus expectation and the slowest pace since January. That raised questions as to the state of the labour market recovery, and helped to complicate a potential decision on tapering, with nonfarm payrolls still standing over 5m beneath their pre-Covid peak. This month, our US economists are expecting a somewhat stronger +400k increase in nonfarm payrolls, which should see the unemployment rate tick down to a post-pandemic low of 5.1%. On the bright side at least, the ADP’s report of private payrolls for September on Wednesday came in at an above-forecast 568k (vs. 430k expected), while the weekly initial jobless claims out yesterday for the week through October 2 were beneath expectations at 326k (vs. 348k expected).

Ahead of that, global equities posted a decent rebound across the board, with cyclicals leading the march higher on both sides of the Atlantic. As mentioned at the top, the S&P 500 advanced +0.83%, which was part of a broad-based advance that saw over 390 companies move higher on the day. That said the index was up as much as +1.5% in early US trading before slipping lower in the US afternoon. The pullback was partly due to new headlines that China’s central bank plans to continue addressing monopolistic actions in internet companies that operate in the payments sector. Nonetheless, Megacap tech stocks were among the big winners yesterday, with the FANG+ index up +2.08%, whilst the small-cap Russell 2000 index was also up +1.58%. In Europe, the STOXX 600 (+1.60%) posted its strongest daily gain since July, and the broader gains helped the STOXX Banks index (+1.61%) surpass its pre-pandemic high, taking it to levels not seen since April 2019, even as sovereign bond yields moved lower.

Speaking of sovereign bonds, yesterday saw a divergent set of moves once again, with yields on 10yr Treasuries up +5.2bps to 1.573%, their highest level since June, whereas those across the European continent moved lower. The US increase came against the backdrop of that debt ceiling resolution, and there was a noticeable rise in yields for Treasury bills that mature in December, which is where the debt ceiling deadline has now been kicked to. Elsewhere in North America, the Bank of Canada’s Macklem joined the global central bank chorus and noted inflation pressures were likely to be temporary, even if they’ve been more persistent than previously expected. Meanwhile over in Europe, lower inflation expectations helped yields move lower, with those on 10yr bunds (-0.3bps), OATs (-1.1bps) and BTPs (-3.6bps) all moving back.

Overnight in Asia, all markets are trading in the green with the Nikkei (+2.16%) leading the way, along with CSI (+1.34%), Shanghai Composite (+0.60%), KOSPI (+0.22%) and Hang Seng (+0.04%). Chinese markets reopened after a week-long holiday so the focus will again be back on property market debt, and today the PBOC injected just 10bn Yuan with its 7-day reverse repos, resulting in a net liquidity withdrawal of 330bn Yuan. That comes as the services and composite PMIs did see a pickup from August level, with the services PMI up to 53.4 (vs. 49.2 expected), moving back above the 50 mark that separates expansion from contraction. In Japan however, household spending was down -3.0% year-on-year in August (vs. -1.2% expected) which came amidst a surge in the virus there. There’s also some news on the ESG front, with finance minister Shunichi Suzuki saying that the country would introduce ESG factors when considering the finance ministry’s foreign reserves. Looking forward, S&P 500 futures (+0.06%) are pointing to a small move higher.

In Germany, as talks got underway today on a potential traffic-light coalition, it was reported by DPA that CDU leader Armin Laschet had signalled his willingness to stand down, with the report citing unidentified participants from internal discussions. In televised remarks last night, Laschet said that his party needs fresh voices across the board and that new leadership will be in place soon. This moves comes as Germany’s Social Democratic Party held talks with the Greens and the Free Democratic Party to enact a new three-way ruling coalition, which would leave the CDU out of power entirely.

There wasn’t a massive amount of data yesterday, though German industrial production fell by -4.0% in August (vs. -0.5% expected), which follows the much weaker than expected data on factory orders the previous day. Elsewhere, the Manheim used car index increased +5.3% in September, its first positive reading in 4 months. Our US economics team points out that there tends to be around a two month lag between wholesale prices and CPI prints, so we aren’t likely to see this impact next week’s CPI print but it will likely prevent a bigger fall towards the end of the year.

To the day ahead now, and the highlight will be the aforementioned September jobs report from the US. Central bank speakers include ECB President Lagarde and the ECB’s Panetta.

Uncategorized

Apartment permits are back to recession lows. Will mortgage rates follow?

If housing leads us into a recession in the near future, that means mortgage rates have stayed too high for too long.

In Tuesday’s report, the 5-unit housing permits data hit the same levels we saw in the COVID-19 recession. Once the backlog of apartments is finished, those jobs will be at risk, which traditionally means mortgage rates would fall soon after, as they have in previous economic cycles.

However, this is happening while single-family permits are still rising as the rate of builder buy-downs and the backlog of single-family homes push single-family permits and starts higher. It is a tale of two markets — something I brought up on CNBC earlier this year to explain why this trend matters with housing starts data because the two marketplaces are heading in opposite directions.

The question is: Will the uptick in single-family permits keep mortgage rates higher than usual? As long as jobless claims stay low, the falling 5-unit apartment permit data might not lead to lower mortgage rates as it has in previous cycles.

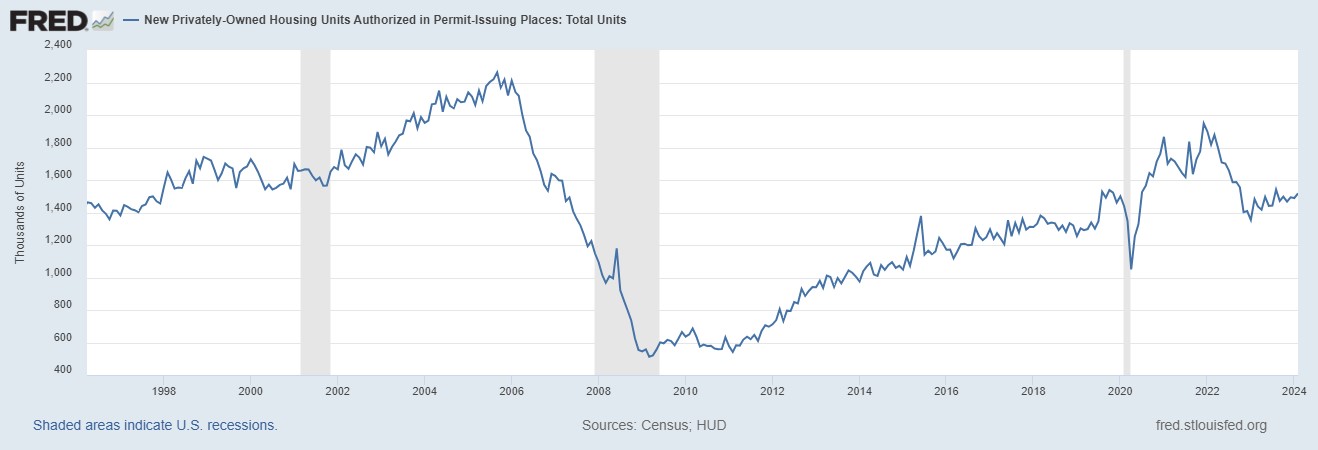

From Census: Building Permits: Privately‐owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,518,000. This is 1.9 percent above the revised January rate of 1,489,000 and 2.4 percent above the February 2023 rate of 1,482,000.

When people say housing leads us in and out of a recession, it is a valid premise and that is why people carefully track housing permits. However, this housing cycle has been unique. Unfortunately, many people who have tracked this housing cycle are still stuck on 2008, believing that what happened during COVID-19 was rampant demand speculation that would lead to a massive supply of homes once home sales crashed. This would mean the builders couldn’t sell more new homes or have housing permits rise.

Housing permits, starts and new home sales were falling for a while, and in 2022, the data looked recessionary. However, new home sales were never near the 2005 peak, and the builders found a workable bottom in sales by paying down mortgage rates to boost demand. The first level of job loss recessionary data has been averted for now. Below is the chart of the building permits.

On the other hand, the apartment boom and bust has already happened. Permits are already back to the levels of the COVID-19 recession and have legs to move lower. Traditionally, when this data line gets this negative, a recession isn’t far off. But, as you can see in the chart below, there’s a big gap between the housing permit data for single-family and five units. Looking at this chart, the recession would only happen after single-family and 5-unit permits fall together, not when we have a gap like we see today.

From Census: Housing completions: Privately‐owned housing completions in February were at a seasonally adjusted annual rate of 1,729,000.

As we can see in the chart below, we had a solid month of housing completions. This was driven by 5-unit completions, which have been in the works for a while now. Also, this month’s report show a weather impact as progress in building was held up due to bad weather. However, the good news is that more supply of rental units will mean the fight against rent inflation will be positive as more supply is the best way to deal with inflation. In time, that is also good news for mortgage rates.

Housing Starts: Privately‐owned housing starts in February were at a seasonally adjusted annual rate of 1,521,000. This is 10.7 percent (±14.2 percent)* above the revised January estimate of 1,374,000 and is 5.9 percent (±10.0 percent)* above the February 2023 rate of 1,436,000.

Housing starts data beat to the upside, but the real story is that the marketplace has diverged into two different directions. The apartment boom is over and permits are heading below the COVID-19 recession, but as long as the builders can keep rates low enough to sell more new homes, single-family permits and starts can slowly move forward.

If we lose the single-family marketplace, expect the chart below to look like it always does before a recession — meaning residential construction workers lose their jobs. For now, the apartment construction workers are at the most risk once they finish the backlog of apartments under construction.

Overall, the housing starts beat to the upside. Still, the report’s internals show a marketplace with early recessionary data lines, which traditionally mean mortgage rates should go lower soon. If housing leads us into a recession in the near future, that means mortgage rates have stayed too high for too long and restrictive policy by the Fed created a recession as we have seen in previous economic cycles.

The builders have been paying down rates to keep construction workers employed, but if rates go higher, it will get more and more challenging to do this because not all builders have the capacity to buy down rates. Last year, we saw what 8% mortgage rates did to new home sales; they dropped before rates fell. So, this is something to keep track of, especially with a critical Federal Reserve meeting this week.

recession covid-19 fed federal reserve home sales mortgage rates recessionGovernment

Young People Aren’t Nearly Angry Enough About Government Debt

Young People Aren’t Nearly Angry Enough About Government Debt

Authored by The American Institute for Economic Research,

Young people sometimes…

Authored by The American Institute for Economic Research,

Young people sometimes seem to wake up in the morning in search of something to be outraged about. We are among the wealthiest and most educated humans in history. But we’re increasingly convinced that we’re worse off than our parents were, that the planet is in crisis, and that it’s probably not worth having kids.

I’ll generalize here about my own cohort (people born after 1981 but before 2010), commonly referred to as Millennials and Gen Z, as that shorthand corresponds to survey and demographic data. Millennials and Gen Z have valid economic complaints, and the conditions of our young adulthood perceptibly weakened traditional bridges to economic independence. We graduated with record amounts of student debt after President Obama nationalized that lending. Housing prices doubled during our household formation years due to zoning impediments and chronic underbuilding. Young Americans say economic issues are important to us, and candidates are courting our votes by promising student debt relief and cheaper housing (which they will never be able to deliver).

Young people, in our idealism and our rational ignorance of the actual appropriations process, typically support more government intervention, more spending programs, and more of every other burden that has landed us in such untenable economic circumstances to begin with. Perhaps not coincidentally, young people who’ve spent the most years in the increasingly partisan bubble of higher education are also the most likely to favor expanded government programs as a “solution” to those complaints.

It’s Your Debt, Boomer

What most young people don’t yet understand is that we are sacrificing our young adulthood and our financial security to pay for debts run up by Baby Boomers. Part of every Millennial and Gen-Z paycheck is payable to people the same age as the members of Congress currently milking this system and miring us further in debt.

Our government spends more than it can extract from taxpayers. Social Security, which represents 20 percent of government spending, has run an annual deficit for 15 years. Last year Social Security alone overspent by $22.1 billion. To keep sending out checks to retirees, Social Security goes begging to the Treasury Department, and the Treasury borrows from the public by issuing bonds. Bonds allow investors (who are often also taxpayers) to pay for some retirees’ benefits now, and be paid back later. But investors only volunteer to lend Social Security the money it needs to cover its bills because the (younger) taxpayers will eventually repay the debt — with interest.

In other words, both Social Security and Medicare, along with various smaller federal entitlement programs, together comprising almost half of the federal budget, have been operating for a decade on the principle of “give us the money now, and stick the next generation with the check.” We saddle future generations with debt for present-day consumption.

The second largest item in the budget after Social Security is interest on the national debt — largely on Social Security and other entitlements that have already been spent. These mandatory benefits now consume three quarters of the federal budget: even Congress is not answerable for these programs. We never had the chance for our votes to impact that spending (not that older generations were much better represented) and it’s unclear if we ever will.

Young Americans probably don’t think much about the budget deficit (each year’s overspending) or the national debt (many years’ deficits put together, plus interest) much at all. And why should we? For our entire political memory, the federal government, as well as most of our state governments, have been steadily piling “public” debt upon our individual and collective heads. That’s just how it is. We are the frogs trying to make our way in the watery world as the temperature ticks imperceptibly higher. We have been swimming in debt forever, unaware that we’re being economically boiled alive.

Millennials have somewhat modest non-mortgage debt of around $27,000 (some self-reports say twice that much), including car notes, student loans, and credit cards. But we each owe more than $100,000 as a share of the national debt. And we don’t even know it.

When Millennials finally do have babies (and we are!) that infant born in 2024 will enter the world with a newly minted Social Security Number and $78,089 credit card bill for Granddad’s heart surgery and the interest on a benefit check that was mailed when her parents were in middle school.

Headlines and comments sections love to sneer at “snowflakes” who’ve just hit the “real world,” and can’t figure out how to make ends meet, but the kids are onto something. A full 15 percent of our earnings are confiscated to pay into retirement and healthcare programs that will be insolvent by the time we’re old enough to enjoy them. The Federal Reserve and government debt are eating the economy. The same interest rates that are pushing mortgages out of reach are driving up the cost of interest to maintain the debt going forward. As we learn to save and invest, our dollars are slowly devalued. We’re right to feel trapped.

Sure, if we’re alive and own a smartphone, we’re among the one percent of the wealthiest humans who’ve ever lived. Older generations could argue (persuasively!) that we have no idea what “poverty” is anymore. But with the state of government spending and debt…we are likely to find out.

Despite being richer than Rockefeller, Millennials are right to say that the previous ways of building income security have been pushed out of reach. Our earning years are subsidizing not our own economic coming-of-age, but bank bailouts, wars abroad, and retirement and medical benefits for people who navigated a less-challenging wealth-building landscape.

Redistribution goes both ways. Boomers are expected to pass on tens of trillions in unprecedented wealth to their children (if it isn’t eaten up by medical costs, despite heavy federal subsidies) and older generations’ financial support of the younger has had palpable lifting effects. Half of college costs are paid by families, and the trope of young people moving back home is only possible if mom and dad have the spare room and groceries to make that feasible.

Government “help” during COVID-19 resulted in the worst inflation in 40 years, as the federal government spent $42,000 per citizen on “stimulus” efforts, right around a Millennial’s average salary at that time. An absurd amount of fraud was perpetrated in the stimulus to save an economy from the lockdown that nearly ruined it. Trillions in earmarked goodies were rubber stamped, carelessly added to young people’s growing bill. Government lenders deliberately removed fraud controls, fearing they couldn’t hand out $800 billion in young people’s future wages away fast enough. Important lessons were taught by those programs. The importance of self-sufficiency and the dignity of hard work weren’t top of the list.

Boomer Benefits are Stagnating Hiring, Wages, and Investment for Young People

Even if our workplace engagement suffered under government distortions, Millennials continue to work more hours than other generations and invest in side hustles and self employment at higher rates. Working hard and winning higher wages almost doesn’t matter, though, when our purchasing power is eaten from the other side. Buying power has dropped 20 percent in just five years. Life is $11,400/year more expensive than it was two years ago and deficit spending is the reason why.

We’re having trouble getting hired for what we’re worth, because it costs employers 30 percent more than just our wages to employ us. The federal tax code both requires and incentivizes our employers to transfer a bunch of what we earned directly to insurance companies and those same Boomer-busted federal benefits, via tax-deductible benefits and payroll taxes. And the regulatory compliance costs of ravenous bureaucratic state. The price paid by each employer to keep each employee continues to rise — but Congress says your boss has to give most of the increase to someone other than you.

Federal spending programs that many people consider good government, including Social Security, Medicare, Medicaid, and health insurance for children (CHIP) aren’t a small amount of the federal budget. Government spends on these programs because people support and demand them, and because cutting those benefits would be a re-election death sentence. That’s why they call cutting Social Security the “third rail of politics.” If you touch those benefits, you die. Congress is held hostage by Baby Boomers who are running up the bill with no sign of slowing down.

Young people generally support Social Security and the public health insurance programs, even though a 2021 poll by Nationwide Financial found 47 percent of Millennials agree with the statement “I will not get a dime of the Social Security benefits I have earned.”

In the same survey, Millennials were the most likely of any generation to believe that Social Security benefits should be enough to live on as a sole income, and guessed the retirement age was 52 (it’s 67 for anyone born after 1959 — and that’s likely to rise). Young people are the most likely to see government guarantees as a valid way to live — even though we seem to understand that those promises aren’t guarantees at all.

Healthcare costs tied to an aging population and wonderful-but-expensive growth in medical technologies and medications will balloon over the next few years, and so will the deficits in Boomer benefit programs. Newly developed obesity drugs alone are expected to add $13.6 billion to Medicare spending. By 2030, every single Baby Boomer will be 65, eligible for publicly funded healthcare.

The first Millennial will be eligible to claim Medicare (assuming the program exists and the qualifying age is still 65, both of which are improbable) in 2046. As it happens, that’s also the year that the Boomer benefits programs (which will then be bloated with Gen Xers) and the interest payments we’re incurring to provide those benefits now, are projected to consume 100 percent of federal tax revenue.

Government spending is being transferred to bureaucrats and then to the beneficiaries of government spending who are, in some sense, your diabetic grandma who needs a Medicare-paid dialysis treatment, but in a much more immediate sense, are the insurance companies, pharma giants, and hospital corporations who wrote the healthcare legislation. Some percentage of every college graduate’s paycheck buys bullets that get fired at nothing and inflating the private investment portfolios of government contractors, with dubious, wasteful outcomes from the prison-industrial complex to the perpetual war machine.

No bank or nation in the world can lend the kind of money the American government needs to borrow to fulfill its obligations to citizens. Someone will have to bite the bullet. Even some of the co-authors of the current disaster are wrestling with the truth.

Forget avocado toast and streaming subscriptions. We’re already sensing it, but we haven’t yet seen it. Young people are not well-informed, and often actively misled, about what’s rotten in this economic system. But we are seeing the consequences on store shelves and mortgage contracts and we can sense disaster is coming. We’re about to get stuck with the bill.

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

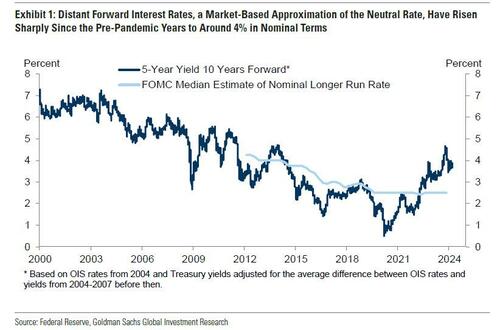

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

-

Spread & Containment7 days ago

Spread & Containment7 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex