Futures Dead Cat Bounced As BTFDers Emerge On Turnaround Tuesday

Futures Dead Cat Bounced As BTFDers Emerge On Turnaround Tuesday

The relentless rout that erased $3.4 trillion from the Nasdaq 100 in the…

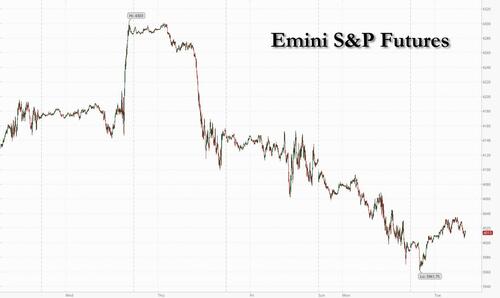

The relentless rout that erased $3.4 trillion from the Nasdaq 100 in the past month paused on Turnaround Tuesday as battered tech valuations attracted scattered dip buyers, but nothing like the full-throttled BTFD buying parade observed in months gone by. Futures on the tech-heavy gauge advanced as much 1.4% as bargain hunters returned after the Nasdaq 100 slumped to the lowest since November 2020 on Monday, capping three days of major losses. S&P 500 futures were 0.7% higher to 4,016 after rising as much as 1.2% earlier but also after plunging to as low as 3,961.

After rising as high as 3.20% on Monday, 10-year Treasury yields dropped for a second day, sliding below 3.0% and providing further relief to technology shares. The dollar erased a loss and Treasuries edged higher, signaling the return of some haven demand amid nervousness over the path of Federal Reserve policy. European bonds rallied.

The Nasdaq’s 14-day relative-strength index (RSI) closed at 33 on Monday, getting closer to the level of 30, which to some analysts indicates a security is oversold and is poised to rise. Another sharp selloff “seems unlikely without an external trigger,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “Nevertheless, as long as the problems persist, we do not expect a big recovery and have used the relief rally to move our equity exposure to neutral.”

Indeed, traders have been caught between stubbornly high inflation that erodes asset values and central-bank tightening that threatens to slow economic growth, or even push some nations into recession. Recent U.S. data suggesting the Federal Reserve will stay on an aggressive rate-hike path have sparked the latest bout of risk-off trades. Fresh outbreaks of Covid in China, and the nation’s stringent measures to control them, have worsened sentiment.

“For now, investors need to be prepared for continued volatility,” UBS Global Wealth CIO Solita Marcelli wrote in a note. She added “sentiment is bearish” but not capitulating.

In premarket trading, electric vehicle makers are up, with Tesla, Rivian and Lucid set to rebound after losing $188 billion in three days. AMC Entertainment is 6.4% higher after reporting better-than-expected quarterly results as hits like “Spider-Man: No Way Home” lured people back to movie theaters. Bank stocks edge higher in premarket trading amid a broader rebound for equity markets after Monday’s rout. S&P 500 futures are up about 0.8% this morning, while the U.S. 10-year yield retreats for a second day to sit at roughly 3%. In corporate news, BlackRock said it won’t support efforts by shareholders who try to micromanage companies on climate change. Meanwhile, Bitcoin rebounded back above $30,000 after briefly sinking below the closely watched level.

Here are some of the biggest U.S. movers today:

- Most large cap U.S. technology and internet stocks rose in premarket trading, on course to recoup some of the heavy losses they suffered in a steep selloff over the last three sessions. Apple (AAPL US) is up 1.2%, Microsoft (MSFT US) +1.2% and Meta (FB US) +2.8%.

- AMC Entertainment (AMC US) is up 3.8% in premarket trading after reporting better-than-expected quarterly results as hits like “Spider-Man: No Way Home” lured people back to movie theaters.

- Electric vehicle makers Tesla (TSLA US), Rivian (RIVN US) and Lucid (LCID US) are rebounding after losing $188 billion in three days of heavy selling in technology and growth stocks.

- Shockwave Medical (SWAV US) may move after it raised its revenue guidance for the full year, with analysts saying that the company’s performance was boosted by its coronary business. Shares rose 11% in extended trading on Monday.

- Upstart Holdings (UPST US) shares plunge 48% in premarket trading after the cloud-based artificial intelligence lending platform cut full- year revenue guidance on macro uncertainties. Piper Sandler cut the stock to neutral.

- Novavax (NVAX US) is down 21% premarket, with analysts saying that the biotech firm’s revenue for the first quarter missed expectations.

- Plug Power (PLUG US) shares are 5.6% lower premarket after the fuel cell company reported net revenue for the first quarter that missed the average analyst estimate, with KeyBanc noting pressure on margins and higher costs.

- Video game stocks may move after Sony’s earnings fell short of estimates amid supply constraints and component shortages. Watch shares in Activision Blizzard (ATVI US), Electronic Arts (EA US) and Take-Two Interactive (TTWO US).

U.S. stocks and particularly the Nasdaq 100 have been crushed this year (amid a tireless tirade from JPM's Marko Kolanovic to buy each and every dip) as investors fret over recession risks from the Federal Reserve embarking on aggressive monetary tightening amid surging inflation. In the latest policy comments, Atlanta Fed President Raphael Bostic said he favors continuing to raise rates by half-point moves rather than anything larger. He said the odds for a 75-basis-point hike are low but added he’s taking nothing off the table.

European stocks trade well, with most cash indexes gaining over 1% to recover roughly half of Monday’s losses when the index slumped to its lowest level in two months. Euro Stoxx 50 rose as much as 1.75%, FTSE MIB outperforms slightly, FTSE 100 lags but still adds 1%. Construction, banks and autos lead broad-based Stoxx 600 sectoral gains. The Stoxx 600 energy sub-index edges lower, being one of the worst-performing sectors in a rising broader market for European stocks, as oil keeps falling. Shell declines as much as 1.5%, TotalEnergies SE -1.6%, Equinor -4.5%. Here are some of the biggest European movers today:

- Luxury stocks such as Kering (+0.5%) and Watches of Switzerland (+4.2%) rebounded after the declines of the previous sessions, with investors hopeful that the Covid-19 situation in the key market of China may be slightly improving.

- Hermes rises as much as +1.6%, LVMH +2.4%

- Airbus gains as much as 3.7% in Paris trading after being raised to buy from hold at Societe Generale, with the broker highlighting the planned production ramp-up of the “highly profitable” A320 family.

- Swedish Match rises as much as 28% after Philip Morris International said it’s in talks to buy the company. While a deal would make strategic sense, a counter-bid can’t be ruled out, analysts said.

- Centrica climbs as much as 6.5%, the most since Feb. 25, after the company guided adjusted earnings per share to be at the top end of the consensus range.

- Euroapi soars as much as 9.5% after the Sanofi spinoff is initiated with a buy recommendation and EU20 price target at Deutsche Bank, which sees “good value” and an attractive business.

- E-commerce stocks rise in Europe, with many outperforming the benchmark Stoxx 600 Index, buoyed by dip buyers returning to growth and technology shares that have been battered this year.

- Zalando up as much as 4.9%, Home24 +12%, Moonpig +3.6%

Earlier in the session, Asian stocks extended their decline to a seventh day as the specter of rapid credit tightening in the U.S. and protracted lockdowns in Chinese cities prompted some investors around the region to reduce holdings of riskier assets. The MSCI Asia Pacific Index fell as much as 2.1% to its lowest level since July 2020, weighed down tech shares after a three-day selloff in the Nasdaq 100. Hong Kong’s Hang Seng Index ended 1.8% lower as the market reopened after a holiday, though benchmarks in mainland China rebounded from early-trading lows on hopes for easier monetary conditions.

- MSCI Asia Pacific Index down 0.7%

- Japan’s Topix index down 0.9%; Nikkei 225 down 0.6%

- Hong Kong’s Hang Seng Index down 1.8%; Hang Seng China Enterprises down 2.2%; Shanghai Composite up 1.1%; CSI 300 up 1.1%

- Taiwan’s Taiex index up 0.1%

- South Korea’s Kospi index down 0.5%; Kospi 200 down 0.5%

- Australia’s S&P/ASX 200 down 1%; New Zealand’s S&P/NZX 50 down 1.3%

- India’s S&P BSE Sensex Index down 0.2%; NSE Nifty 50 down 0.4%

“There’s nowhere to escape so it’s pretty tough,” said Yuya Fukue, a trader at Rheos Capital Works. “Economic data appears to be deteriorating of late, though that has seemed to have gone little noticed while the markets were so focused on the Fed’s policy. It feels as if the game is changing.” Among Chinese tech giants, Alibaba tumbled 4.8% in Hong Kong, while Tencent dropped 2.3%. Regional declines were broad, with investors dumping even this year’s star energy shares as oil prices eased. Singapore’s Straits Times Index and Australia’s S&P/ASX 200 both dropped about 1%. The Philippine benchmark ended 0.6% lower, recovering after skidding more than 3%, after Ferdinand Marcos Jr. won a landslide victory in the country’s presidential election. Mainland Chinese shares closed higher after the People’s Bank of China repeated a pledge to proactively address mounting economic pressure and highlighted a drop in deposit rates, which could spur banks to lower the cost of borrowing for the first time in months. “The market was a bit oversold. In addition, PBOC is also mentioning a drop in deposit rates, raising expectations of more room for banks to increase lending,” said Aw Hsi Lien, a strategist at Tokai Tokyo Research.

India’s benchmark equity index slipped to a two-month low amid a weaker trend in Asia as surging oil prices and inflationary pressures weighed on investor sentiment. The S&P BSE Sensex fell 0.2% to 54,364.85 in Mumbai, after swinging between gains and losses several times during the session. The NSE Nifty 50 Index slipped 0.4% to 16,240.05. This is the third consecutive session of declines for the key indexes. Sixteen of the 19 sector sub-indexes compiled by BSE Ltd. dropped, led by metal stocks. Reliance Industries Ltd. slipped 1.7% to a seven-week low and was the biggest drag on the Sensex, which saw 18 out of its 30 member-stocks trading lower. In earnings, among the 27 Nifty 50 companies that have announced results so far, 10 have missed estimates while 17 either exceeded or met forecasts.

In FX, the Bloomberg Dollar Spot Index fell 0.1% after climbing to a two-year high on Monday, and the greenback was steady or weaker against all of its Group-of-10 peers. The euro consolidated and the region’s yields fell as Italian bonds led an advance. The pound was steady against both the dollar and euro while gilts outperformed peers. Domestic focus is on the Queen’s speech laying out the government’s agenda for the next parliamentary session and Brexit risks after reports the U.K. is preparing to scrap parts of the Northern Ireland protocol. U.K. retail sales are falling on an annual basis for the first time since the start of last year as the cost of living crisis crushes consumer confidence and puts the brakes on spending. Scandinavian currencies led gains among G-10 pairs after both currencies fell to the weakest level in around two years versus the dollar on Monday. The Australian and New Zealand dollars also bounced off two-year lows as stock indexes trimmed an intraday decline. Aussie’s gains were tempered as iron ore fell for a third day to bring the three-day slide to about 15%. The yen edged lower as Treasury yields recovered from a sharp overnight drop. Bonds pared earlier gain after the 10-year debt sale. Bank of Japan Executive Director Shinichi Uchida says that widening the central bank’s yield target band would be equivalent to a rate hike and wouldn’t be favorable for Japan’s economy

In rates, Treasuries rose in early U.S. trading with belly leading gains and the curve flattening modestly after Monday’s bull-steepening. Yields are richer by ~4bp across in belly of the curve, steepening 5s30s spread by ~3bp as long-end yields lag; 10-year trading just around 3%, richer by ~3bp on the day, trailing gilts by ~7bp in the sector. Core European rates outperform led by gilts while stocks and U.S. futures recover a portion of Monday’s steep losses. Bunds bull-flatten, while peripheral spreads tightened to Germany with short-dated BTPs outperforming. Treasury auction cycle begins with 3-year note sale, and several Fed speakers are slated. U.S. new-issue auction cycle consists of $45b 3-year note, followed by 10- and 30-year sales Wednesday and Thursday. WI 3-year yield ~2.800% is higher than auction stops since 2018 and ~6bp cheaper than last month’s, which stopped through by 0.1bp. Three-month dollar Libor +0.13bp at 1.39986%

In commodities, crude futures are choppy, WTI dips back into the red having stalled near $104. The outlook for crude remains clouded after the European Union softened some proposed sanctions on Russia. In cryptocurrencies, Bitcoin traded near $31,300 after earlier sliding below $30,000. Spot gold rises ~$9 near $1,863/oz. Much of the base metals complex trades poorly. LME copper outperforms, holding in the green but off best levels after a test of $9,400/MT.

Bitcoin reclaimed the $31K handle, but is yet to make a concerted move higher.

Looking ahead, we get the April NFIB Small Business Optimism print (93.2, Exp. 92.9), Chinese M2, Speeches from Fed's Williams, Waller, Bostic, Barkin, Kashkari, Mester, ECB's de Guindos & BoE's Saunders, Supply from the US. Earnings from Norwegian Cruise Line & Warner Music. Biden speaks on soaring inflation at 11am EDT. Biden will also meet with Italian Prime Minister Draghi at the White House, and the UK state opening of Parliament is taking place, where the government outlines its legislative programme for the year ahead. Of course, the big event is tomorrow morning when the US CPI print comes.

Market Snapshot

- S&P 500 futures up 1.1% to 4,031.75

- STOXX Europe 600 up 1.2% to 422.32

- MXAP down 0.8% to 159.98

- MXAPJ down 0.8% to 523.71

- Nikkei down 0.6% to 26,167.10

- Topix down 0.9% to 1,862.38

- Hang Seng Index down 1.8% to 19,633.69

- Shanghai Composite up 1.1% to 3,035.84

- Sensex up 0.4% to 54,674.30

- Australia S&P/ASX 200 down 1.0% to 7,051.16

- Kospi down 0.5% to 2,596.56

- German 10Y yield little changed at 1.07%

- Euro little changed at $1.0564

- Brent Futures up 0.8% to $106.83/bbl

- Gold spot up 0.5% to $1,862.69

- U.S. Dollar Index little changed at 103.65

Top Overnight News from Bloomberg

- The EU is considering the issuance of joint debt to finance Ukraine’s long-term reconstruction, which may end up costing hundreds of billions of euros, according to an EU official familiar with the plan

- China’s provinces are set to sell a historic amount of new special bonds by the end of June as part of an infrastructure investment push intended to rescue an economy stymied by Covid outbreaks and lockdowns

- Hungarian Prime Minister Viktor Orban’s talks with the head of the EU about proposed sanctions on Russian oil imports made progress, but failed to reach a breakthrough, according to both sides

- Investor confidence in Germany’s pandemic rebound improved, but remained deeply negative as the war in Ukraine darkens the outlook for Europe’s largest economy. The ZEW institute’s gauge of expectations rose to -34.3 in May from -41 the previous month, defying expectations for a third straight deterioration. An index of current conditions worsened

- Saudi Arabia’s oil minister warned that spare capacity is decreasing in all sectors of the energy market, as prices of products from crude to diesel and natural gas trade at or near multi-year highs in the wake of Russia’s invasion of Ukraine

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly negative after the resumed sell-off on Wall St where the S&P 500 slipped beneath the 4,000 level for the first time since March 2021. ASX 200 briefly gave up the 7,000 status with notable underperformance in the energy and mining-related sectors. Nikkei 225 slumped from the open although moved off its lows as participants digested stronger than expected Household Spending data and after BoJ's Uchida dismissed the prospects of a tweak to the BoJ’s 50bps yield target band. Hang Seng and Shanghai Comp both initially joined in on the selling with heavy losses in the tech sector contributing to the underperformance in Hong Kong on return from the extended weekend, although the downside in the mainland was later reversed after the recent policy support efforts by China’s MIIT and CBIRC.

Top Asian News

- China Tech Stocks Slide as Growth Woes, Global Rout Grip Traders

- Investor’s Guide to the 2022 Philippine Presidential Election

- ArcelorMittal Evaluating Bidding for ACC, Ambuja: ET Now

- Philippine Stocks Fall as Traders Weigh Marcos Win, Global Rout

European equities feel some reprieve following the prior session’s selloff; Euro Stoxx 50 +1.2%. Relatively broad-based gains are seen across the majors with some mild underperformance in the FTSE 100. Sectors show some of the more defensive sectors at the bottom of the bunch – alongside energy – whilst Construction, Autos, Banks, and Industrial Goods reside as the current winners. US equity futures are firmer across the board, ES +1.0%, with the NQ narrowly outpacing peers after underperforming yesterday.

Top European News

- Russian Gas Flows to Europe Remain Steady on Key Links

- Highest Inflation in Three Decades Boosts Czech Rate Hike Case

- BPER Banca Soars After Earnings Beat, With Fees as Highlight

- Russia’s Economy Facing Worst Contraction Since 1994

FX

- The Dollar retains a firm underlying bid ahead of another slew of Fed speakers; risk sentiment remains fluid and fragile.

- The Swiss Franc has hit a fresh 2022 peak vs the Greenback; USD/JPY is consolidating around 130.00.

- EUR/USD was unfazed by mixed German ZEW data but later lost ground under 1.0550.

- Cable rotates either side of 1.2350 awaiting Brexit/N. Ireland news, further political fallout and more comments from BoE hawk Saunders.

- Crude and commodity FX have gleaned a degree of traction from partial recoveries or stabilisation in underlying prices.

- CBRT and regulator have asked banks to undertake FX transactions with corporate clients between 10:00-16:00, when the market is liquid, via Reuters citing bankers.

Fixed Income

- Core benchmarks bounce further after a brief breather early on, with little in way of fresh fundamentals behind the upside.

- Initial highs were faded pre-UK/German issuance; once this cleared, Bunds and Gilts lifted to 152.50+ and 119.00+ peaks.

- Stateside, USTs are bolstered but far from best, with the curve re-flattening into today's 3yr sale and yet more Fed speak.

Commodities

- Crude futures have come under renewed pressure in recent trade after seeing some gains in the European morning.

- The initial downside coincided with the mixed Germany ZEW reports alongside the downbeat commentary from Hungary regarding an imminent oil ban; albeit, benchmarks are off overnight USD 100.44/bbl and USD 103.19/bbl respective lows.

- Saudi Energy Minister says it is "mind-boggling" why focus is on high oil prices and not on gasoline, diesel or others. World needs to wake up to an existing reality that it is running out of energy capacity at all levels, via Reuters.

- UAE Energy Minister says oil prices could double or triple in "chaotic" market.

- US officials reportedly asked Brazil's Petrobras in March to boost output, but it the oil Co. said it could not, according to Reuters sources.

- China's Shenghong Petrochemical has started a trial operation at its (320k BPD) greenfield refining complex in east China, according to Reuters sources.

- Germany is said to be shifting away from plans for a strategic national coal reserve, according sources cited by Reuters.

- Spot gold holds onto mild gains as DXY pulled back from the fresh YTD highs set yesterday.

- LME futures post mild gains following yesterday’s downside with the market still looking somewhat fragile.

DB's Jim Reid concludes the overnight wrap

It's school photo day today. After discussing it with my kids last night I said to them that I'd dig out my old school photos so they could see me at school. Without hesitation and with a straight face Maisie said, "Are they in black and white Daddy?". I was half amused and half depressed.

Markets are pretty black at the moment with little white on show. Actually the only bright colour is a sea of red. Indeed after a rocky few weeks in markets, there’s been a further rout over the last 24 hours as investor jitters about the global growth outlook have continued to escalate. There has been some respite in Asia but markets remain very shaky. There wasn’t really a single catalyst to yesterday’s steep declines, but ultimately there’s been a growing scepticism in markets as to whether the Fed and other central banks will actually be able to achieve a soft landing without a recession as they seek to bring down inflation. One interesting development though was that rates rallied as the equity slump intensified, rather than both selling off as has been the norm in recent weeks.

Although the day lacked a single catalyst, the bond market moves seem to turn around the same time as Atlanta Fed President Bostic spoke. He picked up where Chair Powell left things after last week’s press conference. Bostic signaled that +50bp hikes were part of his core view, placing low odds on anything larger, stating +50bp hikes were “already a pretty aggressive move.” Like other Fed speakers, he signaled a desire to get policy to neutral and then assess. While he isn’t a voter this year, his voice does carry weight at the hawkish end of the committee so the price action likely reflected the market believing that a consensus continues to build for 50bps, and not 75bps, even among the hawks.

Sovereign bonds were actually seeing a strong sell-off before his comments but rallied fairly fiercely from around the same time. 10yr Treasury yields hit an intraday high of 3.20% during the European morning (+7.5bps on the day) but ended up closing -9.3bps lower at 3.03%, showing that wide intraday ranges and volatility continue to grip the market. With the Fed continuing to put a perceived ceiling on the near-term pace of hikes, 2yr yields rallied -13.7bps on the day with the curve steepening another +5.3bps. The amount of Fed hikes priced in by the December meeting down by -15.5bps. As I type, 10yr US yields are fairly flat in Asia.

The move echoed in Europe, where 10yr bunds rallied -3.5bps to 1.09%. The broader risk-off move meant that there was a further widening in spreads yesterday, with the gap between Italian 10yr BTPs over bunds widening by +4.9bps to 205bps, which is the widest they’ve been since May 2020. And that widening was seen on the credit side as well, where iTraxx Main moved above 100bps for the first time since April 2020 in trading, before falling back somewhat to settle at 98bps (+1.4bps).

Against this backdrop, the S&P 500 fell by a sizeable -3.20% that takes the index to its lowest level in over a year. That comes on the backs of 5 consecutive weekly losses, which is already the longest run in over a decade, and given the performance yesterday it would take a strong comeback over the remaining four days this week to avoid that run extending to 6 weeks. See my Chart of the Day yesterday (link here) for more on how rare it has been to see an 11 year run without a 5 successive weekly decline.

Energy was the worst performing US sector, falling an astonishing -8.30%, in its worst one-day performance since June 2020, after the fall in oil (more below). The sector is still by far the best performing S&P sector YTD, up +36.79%, with every other sector in the red. Despite the rate rally, it was a bad day for mega-cap and other growth tech stocks. Indeed, the NASDAQ fell a further -4.29% to its lowest level since November 2020, whilst the FANG+ index of 10 megacap tech stocks fell an even larger -5.48%. For reference, that now takes the FANG+ index’s decline since its all-time high in November to a massive -38.22%. Even a high quality component like Amazon is now down -35.75% since March 29th and is pretty much back to pre-covid levels. Over the other side of the pond, Europe saw some sizeable declines as well, with the STOXX 600 down -2.90% to leave the index not far away from its recent lows in early March.

With the Fed set to continue their hiking cycle, just as the ECB are still pondering on when to even start hikes and China’s growth prospects are fading, the US dollar has continued to benefit. Yesterday, the Japanese Yen (+0.21% vs USD) was the top-performing G10 currency, in line with its traditional status as a safe haven, but Bitcoin continued to lose ground, falling to its lowest level since July last year, after falling to $31,562. It briefly fell below 30k this morning. It's been interesting that Bitcoin is not getting much mention with all the inflationary issues seen in recent months. It seems to be suffering from a higher dollar, higher real yields and a tech related sell-off.

Markets continue to fall in Asia but US futures are up. Hang Seng (-3.06%) is the largest underperformer, but is paring its losses after falling more than -4% as the market returned after a holiday with the Chinese listed tech firms among the worst hit. Elsewhere, the Nikkei (-0.93%) and Kospi (-0.95%) are down. Meanwhile, mainland Chinese stocks are trading in positive territory with the Shanghai Composite (+0.17%) and CSI (+0.15%) somewhat recovering from opening losses. Looking ahead, S&P 500 (+0.56%), NASDAQ 100 (+0.92%) and DAX (+0.25%) futures are moving higher.

Early morning data showed that Japan’s household spending declined -2.3% y/y in March, its first drop in three months albeit the fall was less than -3.3% estimated by Bloomberg and followed +1.1% growth in February.

Back to inflation and one potentially problematic indicator came from the New York Fed’s latest consumer survey, which found that median inflation expectations for 3 years ahead rose to +3.9%, which is the highest since December, and up from +3.5% back in January. It’s still not as high as the +4.2% readings back in September and October, but will obviously be unwelcome news to the Fed whose path to a soft landing is in part reliant on inflation expectations remaining well anchored around target.

Turning to the situation in Ukraine, a key risk event yesterday had been Russia’s Victory Day parade, where it was speculated that President Putin would move towards a general mobilisation. However, in reality it finished with surprisingly little news, and whilst not showing a path towards de-escalation, didn’t move to escalate things further. Separately, it was reported by Bloomberg that the EU would soften its proposed sanctions package on Russian oil exports, with an article saying that they would drop the proposal to ban EU-owned vessels transporting Russian oil to third countries. The sanctions package has already come under criticism from some member states, and the article said that Hungary and Slovakia had been offered a longer time period lasting until end-2024 to comply with the proposals to ban Russian oil imports, with Hungary in particular saying more talks were needed to support oil-related sanctions. So with no further escalation and a softening in sanctions, oil prices fell back significantly amidst weak risk appetite more generally. Brent crude was down -5.74%, whilst WTI fell -6.09%, which follows 2 consecutive weekly gains for both. This morning oil prices are again lower with Brent and WTI futures -1.74% and -1.68% lower respectively.

To the day ahead now, and central bank speakers include the Fed’s Williams, Barkin, Waller, Kashkari and Mester, along with ECB Vice President de Guindos and Bundesbank President Nagel. Data releases include Italy’s industrial production for March and Germany’s ZEW survey for May. Finally on the political side, President Biden will meet with Italian Prime Minister Draghi at the White House, and the UK state opening of Parliament is taking place, where the government outlines its legislative programme for the year ahead.

Government

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The U.S. Department of Veterans Affairs (VA) reviewed no data when deciding in 2023 to keep its COVID-19 vaccine mandate in place.

VA Secretary Denis McDonough said on May 1, 2023, that the end of many other federal mandates “will not impact current policies at the Department of Veterans Affairs.”

He said the mandate was remaining for VA health care personnel “to ensure the safety of veterans and our colleagues.”

Mr. McDonough did not cite any studies or other data. A VA spokesperson declined to provide any data that was reviewed when deciding not to rescind the mandate. The Epoch Times submitted a Freedom of Information Act for “all documents outlining which data was relied upon when establishing the mandate when deciding to keep the mandate in place.”

The agency searched for such data and did not find any.

“The VA does not even attempt to justify its policies with science, because it can’t,” Leslie Manookian, president and founder of the Health Freedom Defense Fund, told The Epoch Times.

“The VA just trusts that the process and cost of challenging its unfounded policies is so onerous, most people are dissuaded from even trying,” she added.

The VA’s mandate remains in place to this day.

The VA’s website claims that vaccines “help protect you from getting severe illness” and “offer good protection against most COVID-19 variants,” pointing in part to observational data from the U.S. Centers for Disease Control and Prevention (CDC) that estimate the vaccines provide poor protection against symptomatic infection and transient shielding against hospitalization.

There have also been increasing concerns among outside scientists about confirmed side effects like heart inflammation—the VA hid a safety signal it detected for the inflammation—and possible side effects such as tinnitus, which shift the benefit-risk calculus.

President Joe Biden imposed a slate of COVID-19 vaccine mandates in 2021. The VA was the first federal agency to implement a mandate.

President Biden rescinded the mandates in May 2023, citing a drop in COVID-19 cases and hospitalizations. His administration maintains the choice to require vaccines was the right one and saved lives.

“Our administration’s vaccination requirements helped ensure the safety of workers in critical workforces including those in the healthcare and education sectors, protecting themselves and the populations they serve, and strengthening their ability to provide services without disruptions to operations,” the White House said.

Some experts said requiring vaccination meant many younger people were forced to get a vaccine despite the risks potentially outweighing the benefits, leaving fewer doses for older adults.

“By mandating the vaccines to younger people and those with natural immunity from having had COVID, older people in the U.S. and other countries did not have access to them, and many people might have died because of that,” Martin Kulldorff, a professor of medicine on leave from Harvard Medical School, told The Epoch Times previously.

The VA was one of just a handful of agencies to keep its mandate in place following the removal of many federal mandates.

“At this time, the vaccine requirement will remain in effect for VA health care personnel, including VA psychologists, pharmacists, social workers, nursing assistants, physical therapists, respiratory therapists, peer specialists, medical support assistants, engineers, housekeepers, and other clinical, administrative, and infrastructure support employees,” Mr. McDonough wrote to VA employees at the time.

“This also includes VA volunteers and contractors. Effectively, this means that any Veterans Health Administration (VHA) employee, volunteer, or contractor who works in VHA facilities, visits VHA facilities, or provides direct care to those we serve will still be subject to the vaccine requirement at this time,” he said. “We continue to monitor and discuss this requirement, and we will provide more information about the vaccination requirements for VA health care employees soon. As always, we will process requests for vaccination exceptions in accordance with applicable laws, regulations, and policies.”

The version of the shots cleared in the fall of 2022, and available through the fall of 2023, did not have any clinical trial data supporting them.

A new version was approved in the fall of 2023 because there were indications that the shots not only offered temporary protection but also that the level of protection was lower than what was observed during earlier stages of the pandemic.

Ms. Manookian, whose group has challenged several of the federal mandates, said that the mandate “illustrates the dangers of the administrative state and how these federal agencies have become a law unto themselves.”

Government

Are Voters Recoiling Against Disorder?

Are Voters Recoiling Against Disorder?

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super…

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super Tuesday primaries have got it right. Barring cataclysmic changes, Donald Trump and Joe Biden will be the Republican and Democratic nominees for president in 2024.

With Nikki Haley’s withdrawal, there will be no more significantly contested primaries or caucuses—the earliest both parties’ races have been over since something like the current primary-dominated system was put in place in 1972.

The primary results have spotlighted some of both nominees’ weaknesses.

Donald Trump lost high-income, high-educated constituencies, including the entire metro area—aka the Swamp. Many but by no means all Haley votes there were cast by Biden Democrats. Mr. Trump can’t afford to lose too many of the others in target states like Pennsylvania and Michigan.

Majorities and large minorities of voters in overwhelmingly Latino counties in Texas’s Rio Grande Valley and some in Houston voted against Joe Biden, and even more against Senate nominee Rep. Colin Allred (D-Texas).

Returns from Hispanic precincts in New Hampshire and Massachusetts show the same thing. Mr. Biden can’t afford to lose too many Latino votes in target states like Arizona and Georgia.

When Mr. Trump rode down that escalator in 2015, commentators assumed he’d repel Latinos. Instead, Latino voters nationally, and especially the closest eyewitnesses of Biden’s open-border policy, have been trending heavily Republican.

High-income liberal Democrats may sport lawn signs proclaiming, “In this house, we believe ... no human is illegal.” The logical consequence of that belief is an open border. But modest-income folks in border counties know that flows of illegal immigrants result in disorder, disease, and crime.

There is plenty of impatience with increased disorder in election returns below the presidential level. Consider Los Angeles County, America’s largest county, with nearly 10 million people, more people than 40 of the 50 states. It voted 71 percent for Mr. Biden in 2020.

Current returns show county District Attorney George Gascon winning only 21 percent of the vote in the nonpartisan primary. He’ll apparently face Republican Nathan Hochman, a critic of his liberal policies, in November.

Gascon, elected after the May 2020 death of counterfeit-passing suspect George Floyd in Minneapolis, is one of many county prosecutors supported by billionaire George Soros. His policies include not charging juveniles as adults, not seeking higher penalties for gang membership or use of firearms, and bringing fewer misdemeanor cases.

The predictable result has been increased car thefts, burglaries, and personal robberies. Some 120 assistant district attorneys have left the office, and there’s a backlog of 10,000 unprosecuted cases.

More than a dozen other Soros-backed and similarly liberal prosecutors have faced strong opposition or have left office.

St. Louis prosecutor Kim Gardner resigned last May amid lawsuits seeking her removal, Milwaukee’s John Chisholm retired in January, and Baltimore’s Marilyn Mosby was defeated in July 2022 and convicted of perjury in September 2023. Last November, Loudoun County, Virginia, voters (62 percent Biden) ousted liberal Buta Biberaj, who declined to prosecute a transgender student for assault, and in June 2022 voters in San Francisco (85 percent Biden) recalled famed radical Chesa Boudin.

Similarly, this Tuesday, voters in San Francisco passed ballot measures strengthening police powers and requiring treatment of drug-addicted welfare recipients.

In retrospect, it appears the Floyd video, appearing after three months of COVID-19 confinement, sparked a frenzied, even crazed reaction, especially among the highly educated and articulate. One fatal incident was seen as proof that America’s “systemic racism” was worse than ever and that police forces should be defunded and perhaps abolished.

2020 was “the year America went crazy,” I wrote in January 2021, a year in which police funding was actually cut by Democrats in New York, Los Angeles, San Francisco, Seattle, and Denver. A year in which young New York Times (NYT) staffers claimed they were endangered by the publication of Sen. Tom Cotton’s (R-Ark.) opinion article advocating calling in military forces if necessary to stop rioting, as had been done in Detroit in 1967 and Los Angeles in 1992. A craven NYT publisher even fired the editorial page editor for running the article.

Evidence of visible and tangible discontent with increasing violence and its consequences—barren and locked shelves in Manhattan chain drugstores, skyrocketing carjackings in Washington, D.C.—is as unmistakable in polls and election results as it is in daily life in large metropolitan areas. Maybe 2024 will turn out to be the year even liberal America stopped acting crazy.

Chaos and disorder work against incumbents, as they did in 1968 when Democrats saw their party’s popular vote fall from 61 percent to 43 percent.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Spread & Containment

The Coming Of The Police State In America

The Coming Of The Police State In America

Authored by Jeffrey Tucker via The Epoch Times,

The National Guard and the State Police are now…

Authored by Jeffrey Tucker via The Epoch Times,

The National Guard and the State Police are now patrolling the New York City subway system in an attempt to do something about the explosion of crime. As part of this, there are bag checks and new surveillance of all passengers. No legislation, no debate, just an edict from the mayor.

Many citizens who rely on this system for transportation might welcome this. It’s a city of strict gun control, and no one knows for sure if they have the right to defend themselves. Merchants have been harassed and even arrested for trying to stop looting and pillaging in their own shops.

The message has been sent: Only the police can do this job. Whether they do it or not is another matter.

Things on the subway system have gotten crazy. If you know it well, you can manage to travel safely, but visitors to the city who take the wrong train at the wrong time are taking grave risks.

In actual fact, it’s guaranteed that this will only end in confiscating knives and other things that people carry in order to protect themselves while leaving the actual criminals even more free to prey on citizens.

The law-abiding will suffer and the criminals will grow more numerous. It will not end well.

When you step back from the details, what we have is the dawning of a genuine police state in the United States. It only starts in New York City. Where is the Guard going to be deployed next? Anywhere is possible.

If the crime is bad enough, citizens will welcome it. It must have been this way in most times and places that when the police state arrives, the people cheer.

We will all have our own stories of how this came to be. Some might begin with the passage of the Patriot Act and the establishment of the Department of Homeland Security in 2001. Some will focus on gun control and the taking away of citizens’ rights to defend themselves.

My own version of events is closer in time. It began four years ago this month with lockdowns. That’s what shattered the capacity of civil society to function in the United States. Everything that has happened since follows like one domino tumbling after another.

It goes like this:

1) lockdown,

2) loss of moral compass and spreading of loneliness and nihilism,

3) rioting resulting from citizen frustration, 4) police absent because of ideological hectoring,

5) a rise in uncontrolled immigration/refugees,

6) an epidemic of ill health from substance abuse and otherwise,

7) businesses flee the city

8) cities fall into decay, and that results in

9) more surveillance and police state.

The 10th stage is the sacking of liberty and civilization itself.

It doesn’t fall out this way at every point in history, but this seems like a solid outline of what happened in this case. Four years is a very short period of time to see all of this unfold. But it is a fact that New York City was more-or-less civilized only four years ago. No one could have predicted that it would come to this so quickly.

But once the lockdowns happened, all bets were off. Here we had a policy that most directly trampled on all freedoms that we had taken for granted. Schools, businesses, and churches were slammed shut, with various levels of enforcement. The entire workforce was divided between essential and nonessential, and there was widespread confusion about who precisely was in charge of designating and enforcing this.

It felt like martial law at the time, as if all normal civilian law had been displaced by something else. That something had to do with public health, but there was clearly more going on, because suddenly our social media posts were censored and we were being asked to do things that made no sense, such as mask up for a virus that evaded mask protection and walk in only one direction in grocery aisles.

Vast amounts of the white-collar workforce stayed home—and their kids, too—until it became too much to bear. The city became a ghost town. Most U.S. cities were the same.

As the months of disaster rolled on, the captives were let out of their houses for the summer in order to protest racism but no other reason. As a way of excusing this, the same public health authorities said that racism was a virus as bad as COVID-19, so therefore it was permitted.

The protests had turned to riots in many cities, and the police were being defunded and discouraged to do anything about the problem. Citizens watched in horror as downtowns burned and drug-crazed freaks took over whole sections of cities. It was like every standard of decency had been zapped out of an entire swath of the population.

Meanwhile, large checks were arriving in people’s bank accounts, defying every normal economic expectation. How could people not be working and get their bank accounts more flush with cash than ever? There was a new law that didn’t even require that people pay rent. How weird was that? Even student loans didn’t need to be paid.

By the fall, recess from lockdown was over and everyone was told to go home again. But this time they had a job to do: They were supposed to vote. Not at the polling places, because going there would only spread germs, or so the media said. When the voting results finally came in, it was the absentee ballots that swung the election in favor of the opposition party that actually wanted more lockdowns and eventually pushed vaccine mandates on the whole population.

The new party in control took note of the large population movements out of cities and states that they controlled. This would have a large effect on voting patterns in the future. But they had a plan. They would open the borders to millions of people in the guise of caring for refugees. These new warm bodies would become voters in time and certainly count on the census when it came time to reapportion political power.

Meanwhile, the native population had begun to swim in ill health from substance abuse, widespread depression, and demoralization, plus vaccine injury. This increased dependency on the very institutions that had caused the problem in the first place: the medical/scientific establishment.

The rise of crime drove the small businesses out of the city. They had barely survived the lockdowns, but they certainly could not survive the crime epidemic. This undermined the tax base of the city and allowed the criminals to take further control.

The same cities became sanctuaries for the waves of migrants sacking the country, and partisan mayors actually used tax dollars to house these invaders in high-end hotels in the name of having compassion for the stranger. Citizens were pushed out to make way for rampaging migrant hordes, as incredible as this seems.

But with that, of course, crime rose ever further, inciting citizen anger and providing a pretext to bring in the police state in the form of the National Guard, now tasked with cracking down on crime in the transportation system.

What’s the next step? It’s probably already here: mass surveillance and censorship, plus ever-expanding police power. This will be accompanied by further population movements, as those with the means to do so flee the city and even the country and leave it for everyone else to suffer.

As I tell the story, all of this seems inevitable. It is not. It could have been stopped at any point. A wise and prudent political leadership could have admitted the error from the beginning and called on the country to rediscover freedom, decency, and the difference between right and wrong. But ego and pride stopped that from happening, and we are left with the consequences.

The government grows ever bigger and civil society ever less capable of managing itself in large urban centers. Disaster is unfolding in real time, mitigated only by a rising stock market and a financial system that has yet to fall apart completely.

Are we at the middle stages of total collapse, or at the point where the population and people in leadership positions wise up and decide to put an end to the downward slide? It’s hard to know. But this much we do know: There is a growing pocket of resistance out there that is fed up and refuses to sit by and watch this great country be sacked and taken over by everything it was set up to prevent.

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex