Futures Coiled Ahead Of Fed Decision, Biden-Putin Summit

Futures Coiled Ahead Of Fed Decision, Biden-Putin Summit

US equity futures rebounded from a modest overnight drop in a rangebound session, coiled as investors turned cautious ahead of a policy decision from the Federal Reserve which some…

US equity futures rebounded from a modest overnight drop in a rangebound session, coiled as investors turned cautious ahead of a policy decision from the Federal Reserve which some such as DB's Jim Reid have called the "most important for Powell's career" (preview here). Oil extended a powerful rally and the dollar fell. Emini S&P futures were unchanged at 4,236.5 following Tuesday's modest drop which snapped a three-day winning streak amid weakness in technology and real estate; Nasdaq 100 futures rose 0.2%. The 10-year Treasury yield hovered around 1.5%. The dollar edged lower versus major peers, and bitcoin dropped back under $40,000.

“The FOMC meeting is unlikely to offer any surprises today as the Fed has painted itself into a corner,” Kaia Parv, head of investment research at FXPRIMUS, wrote in emailed comments. “The Fed is clearly hesitant to disturb the markets since an increasing portion of U.S. household wealth is tied to equity investments.” Here are some of the biggest U.S. movers today:

- Arrival (ARVL) jumps 11% in premarket trading, after climbing 6% on Tuesday, amid increasing references to the stock on Reddit. Other meme stocks are falling with GameStop (GME) down 1.1% and AMC Entertainment (AMC) slipping 1.6%.

- BioNTech ADRs (BNTX) fall 2.2% after Redburn cuts its rating to sell from neutral on an “excellent company” as it waits for a more attractive entry point following a strong rally in the shares.

- Blue Apron (APRN) tumbles 13% in premarket trading after the meal-kit company said it plans to sell shares.

- Electric-vehicle maker Greenland Technologies Holding (GTEC) surges 27% in premarket trading after saying customers can reserve its new GEL-1800 1.8 ton electric loader and GEX-8000 electric excavator online with a $250 refundable deposit.

- Oracle (ORCL) shares fall 4.7% with analysts saying the software group’s solid 4Q update is not good enough to extend the rally into the numbers.

- Roblox (RBLX) slumps 7.7% following postmarket losses, after the video-game company said May bookings declined from the previous month. Analysts think the decline was worse than expected.

Europe's Stoxx 600 extended gains to 0.3%, its ninth straight record ahead of the Fed with chemicals and utilities climbing the most among sectors. Here are some of the biggest European movers today:

- European renewable-energy stocks outperformed amid a series of positive broker notes and news in the sector, including an upgrade for Orsted and a takeover offer for Spanish solar company Solarpack.

- Swissquote Group shares gained as much as 17% to a record after the company said it expects to increase its full-year 2021 guidance significantly.

- Solarpack shares surged as much as 44% after Swedish investment firm EQT offered to buy the company for EU881.2m.

- Sareum Holdings Plc shares rose as much as 34% in London, having more than tripled so far this month, after the company announced on Tuesday it had raised GBP1.47m through a subscription for new shares.

- CD Projekt shares fell as much as 4.7%, reversing early gains that had followed Sony’s decision to reinstate Cyberpunk 2077 to the PlayStation store. Analysts see limited incremental uplift to sales from such a move after the troubled game’s launch.

Asian equities slid from a two-week high, led by a retreat in consumer discretionary and health-care shares, amid market wariness over the outcome of this week’s FOMC meeting. The MSCI Asia Pacific Index fell 0.3% after reversing an earlier gain of as much as 0.2%, dragged lower by a slump in Chinese stocks led by metals and commodity stocks following the latestcrackdown on high commodity prices by Beijing.

Meituan, Alibaba Group Holding and Sony Group drove a subgauge of consumer discretionary shares lower, while a measure of healthcare stocks is poised to halt the longest rally in more than a year. A measure of the region’s financial stocks climbed, set to snap a three-day losing streak and cushioning the market’s drop. “So long as there isn’t any drastic rise in U.S. yields, equities are likely to stay relatively stable,” said Hideyuki Suzuki, a general manager at SBI Securities. Still, “there’s a need to keep caution on what comes out of this event.” South Korea was among the day’s top performers while markets in China continued to underperform.

As noted earlier, Chinese stocks fell on Wednesday, as worries that the government plans to rein in commodity prices weighed on metals shares, while foreign investors continued to sell ahead of a policy decision from the U.S. Federal Reserve. The benchmark CSI 300 Index closed down 1.7% and the ChiNext tumbled 4.2% as declines in material and technology stocks offset a rally in financial and energy companies.

China is expanding its oversight of commodities trading by state firms to overseas markets, and pledged to release the nation’s reserves of base metals. The metals subgauge slumped 3.1%, its biggest drop in about a month. Meanwhile, the government’s crackdown on drugmaker monopoly practices also hit health-care shares, leading to a 3% drop in that sub-index. Separately, today’s drop started before China released reports on retail-sales growth and property investment in May, which came below market consensus. Foreign investors sold a combined 405 million yuan ($63 million) worth of mainland shares on a net basis, the third consecutive day of selling A shares, Bloomberg-compiled data show

Japanese stocks were mixed as investors awaited statements from the Federal Reserve and Bank of Japan later this week. Machinery makers were the biggest boost to the Topix, which closed little changed after climbing Tuesday to the highest since April 5. Electronics makers fell, and Nintendo dragged game makers lower after its presentation at the key E3 conference failed to offer new catalysts. Fast Retailing was the biggest contributor to a loss in the Nikkei 225, which dropped 0.5%. “There’s likely to be profit-taking following yesterday’s rise,” said Mitsushige Akino, a senior executive officer at Ichiyoshi Asset Management. “Current monetary policies are likely to be kept in place during this month’s FOMC meeting, but there’s a need to monitor the press conference and commentary as there could be some wild swings triggered by some participants.” The value of Japan’s exports jumped 49.6% in May compared with a year earlier, below the forecast 50.8% gain. U.S. stocks dipped overnight as the market digested a drop in American retail sales and an uptick in producer prices.

For traders across the globe, discretion has been the better part of valor ahead of the conclusion of the Fed’s two-day meeting at 2pm ET as investors focus on possible hints about when the Federal Reserve will slow the pace of emergency asset purchases. Trading could be choppy around the event as forecasts from Fed members might read as hawkish, while the news conference from Fed Chair Jerome Powell has tended to sound dovish. The FOMC statement is set to include updated forecasts, and expectations are that officials would broadcast any taper plans well in advance.

"We think Chair Powell will indicate officials discussed talking about tapering, but tapering itself is still someway off given the Fed remains well short on making substantial progress on employment with payrolls still 7.3 million below pre-pandemic levels," said NAB economics director Tapas Strickland.

Key will be Fed members' projections, or dot plots, for interest rates and whether more now tip a hike in 2023. Previously only 7 out of 18 had seen such a move. The lack of a 2023 hike in the dots could be seen as dovish and lead to a further sharp drop in TSY yields sparked by massive short covering. There could also be some upward movement in inflation projections for this year and next, given the last two readings on consumer prices surprised to the high side. BofA's latest (laughable) survey of fund managers suggests most are sanguine on the outlook. Some 72% said inflation was transitory, while only 23% saw it as permanent.

In fx, the Bloomberg Dollar Spot Index inched lower and the greenback was mixed versus its Group-of-10 peers, though moves were overall small. The euro hovered above in a narrow 18 pips range and European government bond yields fell slightly. The pound rose to a session high versus the dollar after inflation unexpectedly surged past the BOE’s 2% target for the first time in almost two years, and ahead of a vote in parliament on plans to delay the final stage of pandemic reopening by a further four weeks. The Aussie dollar advanced, even after a China’s main economic data missed estimates in May and speech Thursday by RBA Governor Philip Lowe; New Zealand’s dollar rose versus all its Group- of-10 peers as it was bought against the Aussie. The yen was a tad higher while Japanese government bonds fell amid caution about how their U.S. peers may react in the wake of the upcoming Federal Reserve policy decision.

The onshore yuan rose for the first time in four days as the dollar weakened ahead of the Federal Reserve’s policy decision. Investors were also weighing activity data which showed a continued stabilization in China’s economic recovery. Retail spending lagged expectations in May due to a higher comparison a year ago according to China’s National Bureau of Statistics.

The yield on 10-year Treasuries was little changed at 1.484% richer by 0.8bp on the day vs 1.5bp decline for German 10-year, and erasing declines during European session, dragged higher by bunds after German 10-year auction. Price action was muted over Asia session, with low volumes. Yields, richer from belly to long-end, remain within a basis point of Tuesday’s close in limited price action ahead of FOMC decision at 2pm ET. For Fed decision, Bloomberg economist survey found low expectations for moves toward tapering; sell- side strategists, however, have flagged hawkish risk around the meeting following last week’s sharp bull-flattening rally.

“The outlook looks pretty positive but a lot of investors are asking for there to be better clarity on when we are going to have some start to the taper,” Julie Biel, portfolio manager and senior research analyst at Kayne Anderson Rudnick, said on Bloomberg Television. “There’s a lot of nerves that we are going to wait too long, the economy is going to overheat and then we’re going to have to taper all at once.”

In commodities, oil trimmed a powerful rally that saw Brent close in on $75 a barrel, after industry data pointed to a substantial draw in U.S. crude stockpiles; metals dropped as China stepped up its campaign to rein in commodity prices.

Bitcoin dropped below $40,000 after closing Tuesday at its highest level since May.

Looking at the day ahead now, the main highlight will be the aforementioned Federal Reserve decision and Chair Powell’s subsequent press conference. Other central bank speakers include the ECB’s Vice President de Guindos and the ECB’s Elderson, along with BoC Governor Macklem. Data releases include figures for May on US housing starts and building permits, along with the UK’s CPI. Finally, US President Biden will meet Russian President Putin in Geneva.

Market Snapshot

- S&P 500 futures little changed at 4,233.5

- STOXX Europe 600 little changed at 459.07

- MXAP down 0.3% to 209.66

- MXAPJ down 0.5% to 700.93

- Nikkei down 0.5% to 29,291.01

- Topix little changed at 1,975.86

- Hang Seng Index down 0.7% to 28,436.84

- Shanghai Composite down 1.1% to 3,518.33

- Sensex down 0.3% to 52,597.65

- Australia S&P/ASX 200 little changed at 7,386.17

- Kospi up 0.6% to 3,278.68

- Brent Futures up 0.14% to $74.09/bbl

- Gold spot little changed at $1,859.06

- U.S. Dollar Index little changed at 90.50

- German 10Y yield fell 0.5bps to -0.236%

- Euro little changed at $1.2124

Top Overnight News from Bloomberg

- Investors are trimming bets against the dollar ahead of the Federal Reserve decision Wednesday over fears that a hawkish policy tilt is being underpriced, leaving bears to once again wrestle with a resilient greenback

- Joe Biden and Vladimir Putin kick off what could be more than four hours of meetings on Wednesday afternoon in Geneva, with officials from both countries keeping expectations low for any breakthrough agreement

- European Central Bank President Christine Lagarde is getting tougher with the institution’s unwieldy group of 25 policy makers over the agenda for monetary stimulus

- The European Central Bank is set to extend a key plank of its pandemic relief measures by nine months to ensure lenders keep supplying credit to the economy, according to people familiar with the matter

- China’s main economic data missed estimates in May as the recovery continues to stabilize from the first quarter’s record expansion, with retail spending still lagging expectations

- EU gives green light to lift travel restrictions for American tourists, AFP reports, citing unidentified European sources. The lifting of restrictions covers non-vaccinated Americans too

- European equities may be starting to show signs of overheating after posting their longest record-setting streak since 1999, yet the latest Bank of America fund manager survey shows that more than half of investors expect this bull market to continue into next year

Quick look at global markets courtesy of Newsquawk

Asian equity markets were subdued and US equity futures traded flat overnight following the losses on Wall St, where the S&P 500 and NDX pulled back from record highs amid cautiousness heading into today's FOMC announcement where participants will be eyeing the latest Fed dot plots, as well as any clues regarding future tapering discussions. Nonetheless, ASX 200 (+0.1%) was kept afloat for most of the session and posted another record high with gains led by the energy sector after further upside in oil. Nikkei 225 (-0.5%) was lacklustre following mostly disappointing data releases including weaker than expected Machinery Orders and Exports, despite the latter printing its fastest pace of growth since 1980 largely due to base effects. Hang Seng (-0.7%) and Shanghai Comp. (-1.0%) were pressured ahead of the latest activity data from China, with Industrial Production and Retail Sales rescheduled to the European morning hours. There was also further criticism from the West in which the US-EU summit statement noted they remained "seriously concerned" about the situation in the East and South China Seas and oppose any unilateral attempts to change the status quo and increase tensions. Furthermore, the Pentagon is mulling setting up a permanent naval task force in the region to counter China's growing military strength. China later responded that it firmly opposes the content of US-EU statement and accused the US of using the G7 to interfere in Taiwan affairs. Finally, 10yr JGBs were slightly lower after recent pressure in global counterparts and despite the cautious picture in regional bourses, while the BoJ's presence in the market for nearly JPY 1.4tln of JGBs with 1yr-10yr maturities did little to spur price actions as global markets looked ahead to the FOMC meeting later.

Top Asian News

- Billionaire Who Helped Evergrande Hit by Bond, Stock Selloff

- Chinese Clear Brace Maker More Than Doubles on Hong Kong Debut

- PUBG Maker Plans to Raise $5 Billion in Landmark Korea IPO

- Wanda Light Asset Said to Gear Up for $3 Billion Hong Kong IPO

European equities trade modestly firmer though conviction is slim (Euro Stoxx 50 +0.2%) after the mild upside bias initially dissipated heading into the FOMC announcement and amid a lack of fresh fundamental news-flow; though this has returned somewhat on the arrival of US participants. US equity futures also trade with no firm direction but a slight downside bias. Back to Europe, Germany’s DAX (U/C) mildly underperforms with the index pressured by its Auto & Parts sector and heavyweight SAP (-1.0%). To elaborate, Autos & Parts continue to react to the domino effect emanating from the chip shortages – with Volkswagen (-1.4%) having to further wind down operations at its Wolfsburg factory. SAP meanwhile is sullied by Oracle’s near-5% after-market declines yesterday (-4.5% pre-market), as its guided EPS underwhelmed and fell short of analyst forecasts. Thus, the Auto and Tech sectors reside as the laggards alongside Basic Resources – which bears the brunt of further China intervention (refer to the Commodities section below). This upside meanwhile sees some of the more defensive sectors that were underperforming at the cash open, including Healthcare and Food & Beverage, whilst Oil & Gas continue to reap rewards from elevated oil prices. In terms of individual movers, Santander (-1.0%) lost steam and conformed to the broader losses across banks despite reports that the Co. is to sell its non-performing assets.

Top European News

- U.K. Inflation Surges to 2.1%, Unexpectedly Passing BOE Goals

- Lagarde Takes Bolder Tone in Setting Agenda for ECB Stimulus

- Siemens Energy Swarmed by Nations After Wind-Turbine Plants

- Atlantia Seeks Tech Expansion With $10 Billion Autostrade Check

In FX, the Kiwi is leading the G10 pack, or revival against the Greenback to be more precise, ahead of the Fed and NZ Q1 GDP and irrespective of marginally worse than expected current account data overnight. It’s debatable whether Nzd/Usd also derived impetus to rebound from yesterday’s near 0.7100 lows from another change to the RBNZ’s policy remit that will now include tighter LVR or debt serviceability restrictions aimed at keeping house prices at sustainable levels as this move was flagged in the latest FSR, and indeed Aud/Nzd is holding relatively firm within a 1.0770-95 range amidst resilience in the Aussie before Thursday’s labour report and a speech by RBA Governor Lowe. Moreover, Aud/Usd is defying downward external pressure from steeper retreats in copper and iron ore as China continues its campaign to crackdown on commodity prices via the release of reserves and limiting the amount of overseas exposure by state firms to retest offers/resistance around 0.7700. Elsewhere, Sterling has also staged a partial recovery to reclaim 1.4100+ and 0.8600+ status vs the Buck and Euro respectively, albeit tentatively in wake of firmer than forecast UK CPI data (headline and core). However, the Pound is also weighing up and being hampered by the ongoing rift on NI protocol with the EU, as remarks from Frost indicate little sign of a compromise.

- DXY/JPY/EUR/CAD/CHF - Beyond the deviations noted above, Dollar/major pairings look pretty much locked down for the final pre-FOMC countdown, and the lack of movement in the index is testament to the rangebound trend, if not quite reluctance to veer to far before the main mid-session event (for which a full preview is available via the Research Suite). In fact, the DXY has recoiled into an even narrower 90.576-437 band awaiting US housing starts, building permits and import/export prices that might prompt a bit more price action pre-Fed, SEP and chair Powell’s post-policy meeting press conference. Accordingly, the Yen is straddling 110.00, Euro 1.2125 with eyes on 1.2 bn option expiry interest between 1.2120-15 and the 50 DMA (at 1.2104 today), the Loonie pivots 1.2080 in advance of Canadian CPI and Franc is hovering just above 0.9000 ahead of the SNB on Thursday.

- SCANDI/EM - The Nok looks somewhat apprehensive into the Norges Bank tomorrow circa 10.1100 against the Eur, with the key question to be answered is will the repo rate path be brought forward again, while the Sek is also showing caution around the same level in cross terms even though Sweden’s Labour Agency has revised its 2021 jobless forecast down markedly. Conversely, EM currencies are reclaiming lost ground vs the Usd, including the Cnh and Cny after sub-consensus Chinese data and more retaliation from the Foreign Ministry against US-EU criticism, but especially the Rub heading into the Putin-Biden Summit, with underlying support from oil as Brent extends further above Usd 74/brl and WTI towards Usd 73 to the benefit of the Mxn. Meanwhile, the Try is treading water before the CBRT tomorrow.

In commodities, WTI and Brent front-month futures have waned off the best levels seen during the US session yesterday, whereby the contract notched highs of around USD 72.80/bbl and 74.75/bbl respectively. The benchmarks now reside around just above USD 72/bbl and USD 74/bbl apiece – with news flow also light in the run-up to the FOMC meeting. Before that, the weekly EIA crude stocks will be eyed, especially in the wake of the much larger-than-expected draw in Private stockpiles last night (-8.54mln vs exp. -3.3mln), which alongside technical factors and bullish commentary provided a further tailwind for the complex. On the Iranian front, updates have been quiet in terms of progress, although reports did the rounds suggesting that Iran could renew its extended pact with the IAEA if needed – which expires on June 24th after the June 18th Iranian elections. Analysts have warned that a new Iranian government could shift the dials in terms of negotiation. Elsewhere, spot gold and silver remain caged within recent ranges in anticipation of the Fed, with the former still in proximity to its 200 DMA (1,838) and 50 DMA (1,830) – with technicians still on watch for a golden cross. Elsewhere, industrial metals remained in focus overnight after China confirmed yesterday’s speculations that it will release national reserves of copper, aluminium, and zinc in the near term. 3M LME copper has pared back earlier losses in which it briefly dipped below USD 9,500/t – but the red metal holds onto a bulk of yesterday’s losses. Overnight, Dalian iron ore futures also saw downside in light of China’s intervention coupled with rising shipments from Australia and Brazil.

US Event Calendar

- 8:30am: May Import Price Index MoM, est. 0.8%, prior 0.7%; Import Price Index YoY, est. 10.9%, prior 10.6%

- 8:30am: May Export Price Index MoM, est. 0.8%, prior 0.8%; Export Price Index YoY, est. 15.1%, prior 14.4%

- 8:30am: May Housing Starts MoM, est. 3.9%, prior -9.5%; Building Permits MoM, est. -0.2%, prior 0.3%, revised -1.3%

- 8:30am: May Housing Starts, est. 1.63m, prior 1.57m; Building Permits, est. 1.73m, prior 1.76m, revised 1.73m

- 2pm: June FOMC Rate Decision

DB's Jim Reid concludes the overnight wrap

This morning I’m opening for research at the annual European Leverage Finance conference, which is one of DB’s largest global conferences, with a speech on my macro outlook. I’m talking at 9am BST with the opening remarks from Paul Achleitner (DB Chairman) and Mark Fedorcik (Head of IB) at 8:15am. So if you’re down to attend please log in to watch. I’m broadcasting from home and to ensure that those who have seen my home set up before don’t get too bored I’ve rotated my art! In our old house we commissioned extraordinarily talented Russian students to paint and export (great value) copies of averagely famous works of art and then got a company to make them look old. They didn’t all work in our new house so they are on rotation on an easel in my WFH set up. By the way my wife who studied art thought this was a terrible idea but learnt to live with it when the cost of buying antique or new art was totted up. As a philistine I was very happy.

I’m not sure if art prices are going up enough in this inflation wave for me to make money from even a fake art collection but yesterday marked yet another win for those of us in the inflation camp, as US producer prices rose by a stronger-than-anticipated +6.6% over the last year (vs. +6.2% expected). However the sub components with the most impact could again be put down to transitory factors if you wanted to argue that point of view. So nothing much changed on the great debate in financial markets at the moment.

Today will provide the latest salvo in this “Battle Royale”, as the Federal Reserve will be releasing their latest monetary policy decision later on, alongside the all-important dot plot of where FOMC members think the federal funds rate should be in the coming years, as well as their own inflation forecasts. This is actually the first time we’ll have heard from any Fed officials (due to blackout period) following the CPI report that came in at a higher-than-expected +5.0% last week.

In terms of what to expect later, our US economists write in their preview (link here) that they think Chair Powell will indicate in the press conference that officials discussed what economic conditions they would like to see to begin tapering. However, they don’t anticipate that formal thresholds will be provided, as the FOMC will want to maintain their optionality as they assess various indicators to benchmark the economy’s progress. In terms of the dots, they expect the median dot will signal rates continuing near zero through the end of 2023, as was the case in March although it will be a close call and the market is moving ever so slightly more hawkish than that. Their DB view is that with the labour market lagging, a lack of strong evidence disproving inflation is transitory, and market pricing moving closer to the Fed’s view, that the FOMC won’t yet feel compelled to send a hawkish signal.

Ahead of the Fed’s announcements, markets remained in something of a holding pattern yesterday with Treasury yields mostly unchanged (-0.2bps) even after that PPI report. Yields reached their intraday highs (1.5108%) shortly after US retail sales and PPI data was released before steadily falling to close just above 1.49%. The noise in markets this week so far is that the balance of risks lean slightly in favour of the Fed taking a small incremental hawkish shift which has helped rates sell off a touch overall from last week’s yield lows.

For US equities it was also a slightly negative story, with the S&P 500 down -0.20% from its all-time high the previous day, after growth industries such as semiconductors (-0.83%) and media (-0.63%) led the index lower along with autos (-2.05 %) which was driven mostly by a -3.0% loss in Tesla – just as much as a growth stock as it is an automaker. The drop in growth stocks caused the NASDAQ to fall -0,71% from its own record highs. Meanwhile, energy stocks (+2.06%) strongly outperformed as oil prices continued their upward march.

On that topic and returning to the inflation theme, oil prices hit fresh highs once again yesterday, with both Brent crude (+1.55%) and WTI (+1.75%) at their highest levels in more than 2 years, at $73.99/bbl and $72.12/bbl respectively. They are up a further c. +0.90% this morning. That said, other commodities didn’t have such a good day yesterday, with copper (-4.29%), wheat (-1.93%) and gold (-0.38%) all moving lower.

Europe’s STOXX 600 (+0.11%) saw a (slightly) stronger performance once again, reaching a new all-time high in its 8th consecutive daily advance, which is its longest winning run since April 2019. And sovereign bond yields moved higher too, with those on 10yr bunds (+1.9ps), OATs (+2.0bps) and BTPs (+0.8bps) all rising.

Asian markets are mostly trading lower this morning outside of the Kospi (+0.52%) which is up. The Nikkei (-0.44%), Hang Seng (-0.23%) and Shanghai Comp (-0.77%) are all down. Meanwhile, futures on the S&P 500 (+0.01%) and those on the Stoxx 50 (+0.05%) are trading broadly flat ahead of today’s FOMC decision. In other news, China’s State-owned Assets Supervision and Administration Commission has ordered state enterprises to control risk and limit exposure to overseas commodities markets. The regulator has also asked the companies to report their futures positions for the SASAC to review. The move marks the latest attempt to exercise control over soaring raw materials prices. Coinciding with this, Bloomberg also reported that China will release its strategic reserves of copper, aluminium and zinc in batches.

As we mentioned in yesterday’s edition, the US and the EU came to an agreement at their summit yesterday on a 5-year tariff truce over aircraft subsidies for Airbus and Boeing. This marks a boost for relations between the two sides, which had proven increasingly strained under the Trump administration. Today however, attention will turn to President Biden’s meeting with Russian President Putin in Geneva, which a US official said was expected to last 4-5 hours. They’re expected to discuss a number of issues, including a renewal of the New START nuclear arms deal, although no policy announcements are expected to result.

Staying with President Biden, his domestic agenda is now focused around a potential infrastructure bill that is currently taking many forms in Washington DC. The White House said yesterday that there is no set timeline for bipartisan talks, however Democratic lawmakers in the House indicated they viewed the end of next week as the end of talks with their Republican counterparts. The Senate heads on a three week recess on 24 June, which was originally a marker that House leadership had pointed to. However it seems like this topic could drag into the summer and thereby push out the potential simulative effect of the legislation.

Turning to the pandemic, there were continued signs of concern in the UK as the weekly average of cases rose to 7,672 yesterday, which is the highest since March 2. However cases have shown some sign of stabilising in recent days but it’s too early to say if this is a trend. We also got the news from Scottish First Minister Nicola Sturgeon that said that the easing of restrictions was likely to be pushed back three weeks so as to get more people vaccinated, which would follow England’s move to delay the easing of restrictions until next month. And in a sign that other countries are toughening up border restrictions against British arrivals, Ireland’s RTE reported that those arriving from Britain who haven’t been vaccinated will need to self-isolate for 10 days under a plan approved by the cabinet. On the other hand, the US continues its reopening with the governor of New York State, once the global epicenter of the pandemic, announcing that all remaining state pandemic mandates were lifted following report that 70% of adults had received at least one dose of vaccine. The German government also hit a vaccine milestone yesterday, with Chancellery Minister Braun estimating that the country has surpassed 50% of the population having had at least one jab.

Looking at yesterday’s other data, US retail sales surprised to the downside in May with a -1.3% contraction (vs. -0.8% expected), though the previous month’s growth was revised 0.9pp higher to +0.9%. We also had the industrial production reading, which grew by +0.8% in May (vs. +0.7% expected), along with the New York Fed’s Empire State manufacturing survey for June, which saw the headline general business conditions index fall to 17.4 (vs. 22.7 expected). One notable feature in that survey was that the delivery times index reached a record high of 29.8. Finally in the UK, payrolled employment rose for a 6th month running, with a +197k increase in May relative to April, though it still remains -553k beneath its level in February 2020. Separately, the unemployment rate fell to 4.7% as expected in the three months to April.

To the day ahead now, and the main highlight will be the aforementioned Federal Reserve decision and Chair Powell’s subsequent press conference. Other central bank speakers include the ECB’s Vice President de Guindos and the ECB’s Elderson, along with BoC Governor Macklem. Data releases include figures for May on US housing starts and building permits, along with the UK’s CPI. Finally, US President Biden will meet Russian President Putin in Geneva.

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

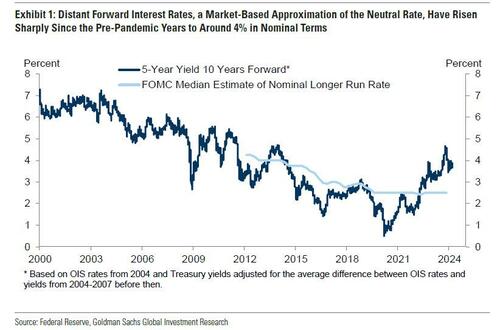

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

Spread & Containment

Household Net Interest Income Falls As Rates Spike

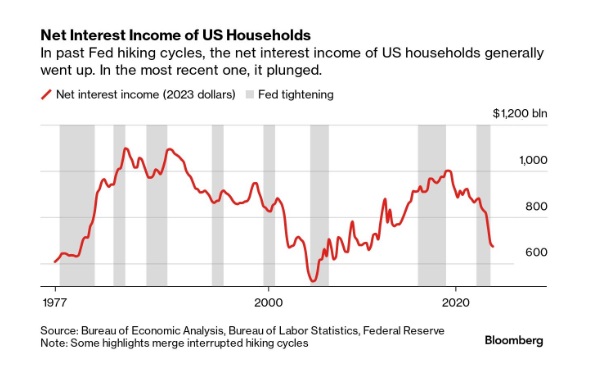

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex