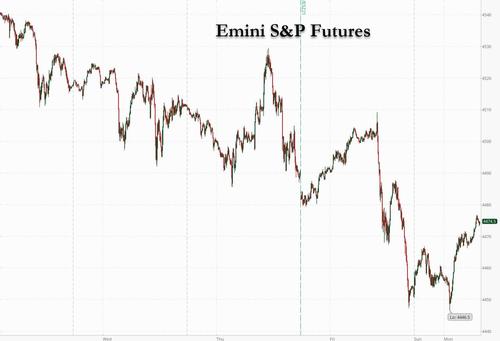

Futures Bounce After 5-Days Of Declines Ahead Of Tomorrow’s Critical CPI

Futures Bounce After 5-Days Of Declines Ahead Of Tomorrow’s Critical CPI

World stocks ground higher with US futures and European stocks all in the green after a slow start of the week in Asia, amid concerns over accelerating inflation as…

World stocks ground higher with US futures and European stocks all in the green after a slow start of the week in Asia, amid concerns over accelerating inflation as well as tax and regulatory pressures on the world’s biggest companies. After five straight day of declines in US stocks, as concerns over the delta variant and tapering of the stimulus cooled risk appetite, and which led Wall Street indexes to lose between 1.6% to 2.2% last week as a surge in August producer prices and a sharp drop in jobless claims spurred fears the Federal Reserve could start unwinding stimulus as soon November, futures on major U.S. equity indexes all rose on Monday as traders await tomorrow's CPI data. S&P 500 E-minis were up 23.50 points, or 0.53% at 730 am ET, Dow E-minis were up 200 points, or 0.58%, while Nasdaq 100 E-minis were up 78.25 points, or 0.51%. Industrial metals rose, with aluminum reaching $3,000 a ton in London for the first time in 13 years amid supply disruptions.

The session started on the back foot with Chinese stocks coming under fresh pressure from new government regulations on major technology firms after the FT reported that Beijing seeks to break up Alipay, sending the Hang Seng Index tumbling after a sharp rebound on Friday. U.S.-listed Chinese stocks, including Alibaba Group Holding , fell in premarket trading. Also in premarket trading, AMC led gains in the U.S. premarket session, rising 1.9%. Chinese technology shares tumbled after a report that officials are seeking to break up Ant Group Co.’s Alipay. Meanwhile, Europe’s Stoxx 600 Index advanced 0.4%, led by gains in energy companies. Apple Inc rose 0.9% in premarket trading ahead of tomorrow's latest iPhone reveal after a mixed court ruling in Epic Games’ antitrust case against the iPhone maker knocked nearly $90 billion off its market value on Friday. Here are some of the other big premarket movers today:

- Chinese stocks listed in the U.S. slip following the latest crackdown on the sector; the stocks slumped in Asia trading after a report that the Chinese government intends to break up Ant Group’s Alipay business. Alibaba (BABA) shares down 2.1%, NetEase (NTES) -2.3%, Pinduoduo (PDD) -1.7%, Baidu (BIDU) down 1.6%.

- Aterian (ATER) and Support.com (SPRT) among the retail- trader favorites rising in U.S. premarket trading. Aterian, a consumer-product tech platform company, up 11% amid touts and discussion of the stock on Reddit and StockTwits.

- Farmmi (FAMI) shares fall 33% in U.S. premarket trading after the Chinese agricultural products distributor said it plans a share offering.

- Apple (AAPL) shares up 0.9%. The group could see billions wiped off its profit by forcing a major change to the way it generates money from its App Store, analysts say. The stock lost almost $85 billion in market value during the previous session.

The dollar rose and Treasury yields dropped of ahead of tomorrow's critical inflation data that traders will use to assess expectations about the timing of stimulus withdrawal and interest-rate hikes. A report on Tuesday may show consumer prices in the U.S. moderated in August. A report on Tuesday may show consumer prices in the U.S. moderated in August.

"[The CPI] number will be the main highlight of the week as we approach a second half of September that will be full of politics," DB's Jim Reid wrote in a note on Monday, citing the upcoming German election and U.S. debt-ceiling deadline.

In its preview of tomorrow's August CPI, Reid writes that "it will be a very important statistic ahead of the Federal Reserve’s policy decision next week. The Fed are now on media blackout ahead of this. However the impact of the number is debatable the Fed seem fixated with employment, especially payrolls, at the moment and it will take a lot of convincing that any high number tomorrow will be anything other than driven by transitory factors. For the record, headline CPI was at +5.4% year on year in June and July, which are the highest rates of price growth since the financial crisis. Core was at 4.3% last month - two-tenth down from the prior month’s highest reading since 1991. That said, our economists are expecting a slowdown in the month-on-month reading in August, and their forecasts for CPI of +0.4% and core CPI of +0.2% in August would be the slowest in six months. This would bring the YoY rates down to 5.3% and 4.1% respectively. The consensus has core at 4.2%."

With oil prices rising to one-week high on US supply concerns, energy stocks rose while major Wall Street banks tracked mild gains in U.S. Treasury yields. Buying into sectors such as energy, financials and industrials, which are expected to benefit from an economic recovery this year, has put the S&P 500 on a seven-month winning streak this year. But rising infections of the Delta COVID-19 variant and staggered vaccination rates have dampened hopes of an economic recovery in recent weeks.

Also on the radar is the Biden government’s corporate tax hike plan. U.S. House Democrats are expected to propose raising corporate tax rate to 26.5% from 21% as part of a sweeping plan that includes tax increases on the wealthy, corporations and investors, according to two people familiar with the matter.

Meanwhile, banks continue to flag caution, with a Deutsche Bank survey found Wall Street respondents expect a 5-10% equity market correction by year-end, with COVID and inflation seen as the main risks. BNP Paribas, while expecting the S&P 500 to stay unchanged by end-2021, highlighted risks from “higher yields and taxes, at a time when earnings momentum has slowed from excellent to good”.

In Europe, energy companies fueled gains in the Stoxx Europe 600 gauge, which traded up 0.8% at session highs. All European bourses were in the green, as risk sentiment turned constructive shrugging off a mixed Asian handover. Germany's DAX and Italy's FTSE MIB outperformed, raising as much as 0.8%. Oil & gas, utilities and construction are the strongest sectors with retail and travel names in the red. Industrial metals were on the up with ongoing supply disruptions, as aluminum hit $3,000 a ton in London for the first time in 13 years. A market gauge of euro zone inflation expectations rose to its highest since mid-2015 on Monday in a further sign that investor perceptions over the direction of future inflation is shifting. Here are some of the biggest European movers today:

- Utilities stocks outperform, with the Stoxx 600 Utilities index up as much as 1.4%, with Morgan Stanley saying the U.K. expanding its next renewables auction is a positive for the sector.

- Deutsche Bank shares climb as much as 2.4% after the lender was upgraded to neutral from underperform at Mediobanca, which says that improvements in its operations outside the investment bank will limit the downside for the stock.

- Zooplus shares jump as much as 8.8% after private equity group Hellman & Friedman raised its takeover bid for the online pet products retailer, following the confirmation of a rival suitor for the company last week.

- Valneva shares drop as much as 45% after the U.K. government said it’s cancelling its supply contract for Covid-19 vaccines. Portzamparc says the decision is “obviously a blow” for Valneva.

- AB Foods shares decline as much as 4% after analysts noted softer Primark sales in 4Q, hurt by the impact of the delta variant along with the so-called pingdemic.

- S4 Capital shares drop as much as 6.2% after reporting a 1H pretax loss of GBP19.4m as Morgan Stanley (overweight) says the stock may need a “pause” following its strong recent run

- Svenska Cellulosa shares fall as much as 6.1% as Nordic forestry companies decline after downgrades from Danske Bank. Holmen shares decline as much as 5.7% alongside UPM (-3.8%) and Stora Enso (-3.7%) on the news

Sentiment was more subdued earlier in the session, with MSCI’s index of Asia-Pacific shares outside Japan lost 1.2%. The latest source of worry is a Financial Times report that Beijing is aiming to break up Alipay, the payments app owned by Jack Ma’s Ant Group. The report, which pushed the Chinese blue-chip index 0.5% lower, shows there may be no let-up in the regulatory clobbering Chinese firms have received this year. It follows a Friday court ruling on Apple that hit the iPhone maker’s shares, while more reports emerged at the weekend that U.S. Democrats are mulling proposals to increase taxes on corporations and the wealthy. “We will see more of the state finding ways to extract funding from those it deems most capable of providing it,” said Tom O’Hara, portfolio manager at Janus Henderson.

Adding to concerns is the continued acceleration in inflation, with Japan reporting wholesale prices at 13-year highs last month. That comes on top of data showing factory gate inflation at more than decade-highs in the United States and China, pressuring firms to pass on price rises to consumers.

“The market has been looking through inflation levels, assuming they are transitory and that interest rates won’t go up much but the conundrum is that wherever we look, we see inflation, whether on supermarket shelves or at the petrol pump,” O’Hara added. “We will probably see more inflation and interest rate rises than people think.”

Investors will pay attention to upcoming Chinese data on retail sales and industrial output which could show a further slowdown in the world’s second-biggest economy.

In rates, Treasury 10-year yields fell two basis points to 1.32% following Friday’s four basis points rise, cementing their third weekly gain last week, the longest streak since mid-March and tension will likely build before the Sept. 21-22 U.S. Federal Reserve meeting. The curve was flatter, even as crude oil’s advance to a six-week high boosts energy shares in European and U.S. equity benchmarks. The 30-year Treasury yield is back below its 50-DMA with Fed slated to purchase long-end sectors in Monday’s purchase operation. Yields from the 5-year are lower with 30-year leading, down more than 2bp at 1.912%, inside Friday’s range; 5s30s yield curve breached 110bp, touching lowest level since Aug. 27, extending the flattening move unleashed by strong demand for Thursday’s 30-year bond auction. With no major economic data slated and potentially consequential August CPI data ahead Tuesday, Fed’s daily purchase operation in 22.5- to 30-year sector will be a focal point. Gilts are 1-1.5bps richer across the curve with a modest flattening bias.

In FX, the Bloomberg Dollar Spot Index gained 0.1% as the dollar advanced against most of its G-10 peers ahead of U.S. inflation data on Tuesday, which may add to the case for the Federal Reserve to start slowing its asset purchases this year and as Goldman said over the weekend, a taper is now virtually certain to being in November and end in July as per a trial balloon leaked to the WSJ. Adding to this, Philadelphia Fed President Patrick Harker told Nikkei in an interview that he is supportive of moving toward a tapering process “sooner rather than later. ”

Elsewhere, The euro fell to more than a two-week low of $1.1775 before paring some losses; Bunds were little changed, the pound dipped against the dollar, with U.K. inflation and jobs data coming up this week which may help shape the tone BOE policy makers take at their policy meeting next week. Net leveraged futures and options positions on the British currency flipped short for the first time since December, according to the latest data from the Commodity Futures Trading Commission. Australia’s dollar was little changed after earlier falling to the lowest in almost two weeks. Australia’s yield curve steepened following Treasury moves on Friday.

In commodities, oil jumped mocking China's SPR release, and rose to one-week highs above $73 a barrel due to shuttered output in the United States, the world’s biggest producer, following damage from Hurricane Ida. Economic growth worries, however, have been seeping into the market, with producers’ group OPEC expected to cut its forecasts for 2022 oil demand. Spot gold gave back small gains to trade flat near $1,788/oz. Base metals are mixed. LME aluminum briefly hits $3,000/MT for the first time in 13 years; the rest of the complex is in the red with LME nickel off as much as 3%.

With little on today's calendar, investors will pay attention to upcoming Chinese data on retail sales and industrial output which could show a further slowdown in the world’s second-biggest economy. U.S. consumer prices, due on Wednesday, are also seen easing a touch, albeit to a still-high 4.2%, while the spread of the Delta COVID variant may have softened retail sales.

Market Snapshot

- S&P 500 futures up 0.5% to 4,479.50

- STOXX Europe 600 up 0.5% to 468.66

- MXAP down 0.5% to 205.57

- MXAPJ down 0.7% to 662.56

- Nikkei up 0.2% to 30,447.37

- Topix up 0.3% to 2,097.71

- Hang Seng Index down 1.5% to 25,813.81

- Shanghai Composite up 0.3% to 3,715.37

- Sensex little changed at 58,255.03

- Australia S&P/ASX 200 up 0.3% to 7,425.21

- Kospi little changed at 3,127.86

- Brent Futures up 0.8% to $73.52/bbl

- Gold spot up 0.1% to $1,790.15

- U.S. Dollar Index up 0.2% to 92.783

- German 10Y yield rose 1 bps to -0.330%

- Euro down 0.2% to $1.1787

Top Overnight News from Bloomberg

- House Democrats have drafted a package of tax increases that falls short of President Joe Biden’s ambition, an acknowledgment of how politically precarious the White House’s $3.5 trillion economic agenda is for party moderates

- Boris Johnson will unveil the U.K.’s new approach in tackling Covid this week, preparing the country for a mass booster vaccination program and potential shots for teenagers -- but scrapping plans for mandatory vaccine certificates in England

- Chinese technology shares fell once again Monday on the latest moves from Beijing to reshape online businesses

- Chinese data this week will show the damage done from a widespread Covid outbreak last month that partially shut the world’s third-busiest container port and sent parts of the country back into lockdown. Growth in industrial production, retail sales and investment likely weakened in August. Purchasing managers’ surveys and other high frequency indicators already foreshadowed a sharp drop in spending after tough new virus restrictions were introduced to contain cases

- Two weeks before Germany goes to the polls in a watershed election, center-left front-runner Olaf Scholz fended off attacks over his track record as finance minister to consolidate his position as the most likely successor to Chancellor Angela Merkel

A more detailed look courtesy of Newsquawk

Asia-Pac stocks began the week cautiously following last week's five-day losing streak on Wall Street and ongoing regulatory tightening by Beijing, with participants also digesting the latest missile launches by North Korea over the weekend. US equity futures overnight posted mild gains which later faded. The ASX 200 (+0.3%) eked marginal gains amid continued strength in the commodity-related sectors following recent upside in oil and base metals, but with advances capped by underperformance in tech and the current virus situation. Nikkei 225 (+0.2%) lacked firm direction amid a choppy currency and with autos pressured after US House Democrats proposed increasing EV tax credits to as much as USD 12.5k per vehicle for union-made zero-emission models assembled in the US - which would essentially penalize non-union made EVs such as Toyota and Tesla. The KOSPI (+0.1%) was negative after North Korea test-fired new long-range missiles which allegedly hit targets 1,500km away. The Hang Seng (-1.5%) and Shanghai Comp. (+0.3%) were varied with Hong Kong weighed heavily by losses in real estate and tech after China's industry ministry told technology companies including Tencent and Alibaba to stop blocking each other's website links from their platform, with the latter also pressured by news that Beijing wants to break up Ant Group's Alipay and create a separate app for its loan business. There were also hefty declines for SOHO China which fell nearly 40% after Blackstone abandoned its USD 3bln takeover of the property developer, while the mainland showed some resilience with the Shanghai bourse cushioned despite the US weighing a trade probe in a bid to pressure China and the disruptions in Shanghai due to an approaching typhoon. Finally, 10yr JGBs were flat amid the cautiousness in the region and recent treasury selling in the US, while demand was also sapped by the lack of BoJ purchases in the market today.

Top Asian News

- HNA Secures Strategic Investors for Hainan Air, Airport Business

- Sydney Airport’s $17.4 Billion Bid Shows Long-Term Allure

- Evergrande Offers New Wealth Product Payment Plan Under Pressure

- Nissan Offers Rare Dollar Bond Tied to Libor Replacement

Bourses in Europe have adopted a more constructive risk bias (Euro Stoxx 50 +0.6%; Stoxx 600 +0.5%) following the mixed trade/indecision seen in APAC, with news flow also exceptionally light in early European hours. US equity futures have piggy-backed on the mild gains seen across Europe, with the calendar today especially light ahead of US CPI tomorrow – whilst the NQ (+0.3%) narrowly lags vs the more cyclically exposed RTY (+0.8%) and YM (+0.5%) and ES (+0.5%). Back to Europe, sectors are mostly higher with clear outperformance in Oil & Gas following the advances in crude overnight and during early European hours, whilst Retail and Travel & Leisure reside as the laggards – with easyJet (-13%) plumbing the depts after the Ryanair (+1.3%) CEO said easyJet would essentially have to merge with WizzAir to survive – a bid that easyJet rejected according to sources last week. Elsewhere, Autos were bolstered at the cash open with Daimler (+1.2%) and BMW (+1.2%) spearheading the gains following reports the Co. intends to limit the supply of premium models shipped even when the chip shortage eases in a bid to secure the 'hefty' price increases attained during COVID-19. In terms of individual movers, Valneva (-35%) slumped over 40% at the open after the UK Government terminated its COVID-19 vaccine supply agreement with the Co., alleging that the Co. is in breach of its obligations under the agreement.

Top European News

- Energy Crunch Deepens as U.S. Warns Europe Isn’t Doing Enough

- Hungary Raises 2021 FX Borrowing Cap on Potential EU Fund Delay

- CVC to Buy $8 Billion Asset Manager Glendower in Strategy Shift

- Brevan Howard Forms Digital Assets Unit in Crypto Investing Push

In FX, the Dollar index has rebounded from overnight lows to post a marginal new peak beyond last week’s apex, at 92.880 amidst broad gains, but not all round as high beta and commodity counterparts resist the Greenback’s advances on a combination of upbeat risk sentiment and firm underlying prices. However, the Buck is deriving momentum from the latest Fed official advocating a slowdown in the pace of QE sooner rather than later, as Harker believes that inflation might be long lasting rather than transitory, and presumably is not overly concerned by the fact that the last BLS report did not meet consensus on the headline front. Meanwhile, the DXY is also underpinned ahead of US inflation data on Tuesday following firmer than forecast PPI last Friday.

- CHF/EUR/JPY - All softer vs the Dollar, and the Franc back below 0.9200 irrespective of a dip in weekly Swiss sight deposits at domestic banks after more verbal SNB intervention from Zurbruegg who reiterated that negative rates are still needed to prevent the Chf from rising, while adding that it would appreciate markedly and economic growth would slow if the Bank was to hike now. Meanwhile, the Euro has lost grip of the 1.1800 handle amidst reports of stop-selling and the Yen has slipped under 110.00 again regardless of an encouraging improvement in Japan’s Q3 business survey index.

- AUD/NZD/CAD - As noted earlier, the so called activity and petro currencies are outperforming or managing to outpace the Greenback on specific supportive factors, with the Aussie also benefiting from repositioning off a net short base as CFTC data as at September 7 showed the most oversold levels in 3 years. Aud/Usd is hovering near the top of a 0.7368-36 range, with Nzd/Usd mostly above 0.7100 even though NZ PM Ardern announced that Auckland’s lockdown will be extended for a week and move to alert level 3 on September 22nd due to the ongoing occurrence of ‘mystery’ COVID-19 cases, while the rest of the country will stay on alert level 2 until the same date. Elsewhere, the Loonie is keeping afloat of 1.2700 in advance of Canadian manufacturing sales tomorrow and last Friday’s solid jobs update against the backdrop of a rebound in WTI from circa Usd 69.50/brl to just 4 cents shy of Usd 70.50 at best.

- GBP - Sterling is somewhat betwixt and between due to its cyclical characteristics, but having stopped short of 1.3850 and reversing through the 200 DMA (around 1.3826), Cable saw a few sell orders triggered at 1.3800, but managed to contain losses to only a 2-3 pips, while the Pound remains elevated against the Euro as the cross sits beneath 0.8550 and hardly reacts to comments from ECB’s Schnabel on the subject of inflation. In short, she thinks inflation will noticeably decrease as soon as next year, but if it sustainably reaches the 2% target unexpectedly soon, the Bank will act equally quickly and resolutely.

- SCANDI/EM - No sign of Norwegian election jitters whatsoever, as Eur/Nok trades south of 10.2000 with fuel coming from Brent’s revival to top Usd 73.50/brl, while Eur/Huf is also lower following the NBH’s decision to offer extra Euro liquidity via a 2 week FX swap tender on Wednesday. Conversely, the Try is being hampered by the higher cost of oil, considerably weaker than expected Turkish ip and a wider than anticipated current account deficit.

In commodities, WTI and Brent front month futures are choppy but ultimately on a firmer footing, with the former back holding ground above USD 70/bbl and the latter around USD 73.50/bbl. There have been several developments over the weekend on both the supply and demand sides of the equation. Demand continues to be threatened by the Delta variant, with the Chinese city of Putian placed under lockdown to contain the Delta variant COVID-19 outbreak and New Zealand's Auckland extending its lockdown for a week. That being said, the UK will announce they are dropping plans that would have required COVID-19 vaccine passports for entry to nightclubs, cinemas and sports venues, whilst the UK health minister is looking to end PCR tests for travel as soon as possible. Meanwhile, on the supply side, US Gulf of Mexico production is slowly coming back online. However, traders must be cognisant of Tropical Storm Nicholas – which is expected to strengthen to a tropical storm later today and resides on the west Gulf Coast. Elsewhere, there have been some developments in Iranian talks whereby Tehran will permit IAEA monitoring and resume JCPOA talks – however, Iran has not budged from its earlier stance regarding nuclear negotiations. In terms of banking commentary, BofA said a cold winter could lead to USD 100/bbl oil sooner than expected. Turning to precious metals, spot gold and silver trade with modest losses with news flow also light. Citi projects a lower trading band for gold, around the USD 1,700/oz, albeit with low conviction; dovish surprise at the September FOMC meeting could allow a break higher towards USD 1,900/oz. Over to base metals, copper gave up earlier gains but remains caged, with LME metals now all posting losses. There were also reports earlier in the session that the Yunnan province in China ordered green aluminium producers to hold monthly output for September-December at levels no higher than August, according to a document and have ordered the cement industry to reduce September production by over 80% from August levels – with iron and aluminium part of the cement manufacturing process.

US Event Calendar

- 2pm: Aug. Monthly Budget Statement, est. -$175b, prior -$200b

DB's Jim Reid concludes the overnight wrap

Well Britain has been in a state of shock this weekend after Emma Raducanu became the first ever qualifier to win a tennis major at the US Open. My wife and I have been carefully tracking her progress in recent months as she went to my wife’s school in Kent - albeit 29 years apart. My wife’s sporting claim to fame from the same school was that she did a gymnastics routine at half time at the then called Milk Cup Final at Wembley in the mid-1980s. Sadly that didn’t earn the $2.5m that Raducanu picked up on Saturday.

I suspect the financial market shock equivalent of Radacanu winning the US Open would be US CPI at 15% YoY tomorrow. That number will be the main highlight of the week as we approach a second half of September that will be full of politics with the German election, the US debt ceiling deadline approaching fast, and with the US infrastructure bill (maybe) coming towards a climax.

Previewing tomorrow’s August US CPI and it will be a very important statistic ahead of the Federal Reserve’s policy decision next week. The Fed are now on media blackout ahead of this. However the impact of the number is debatable the Fed seem fixated with employment, especially payrolls, at the moment and it will take a lot of convincing that any high number tomorrow will be anything other than driven by transitory factors. For the record, headline CPI was at +5.4% year on year in June and July, which are the highest rates of price growth since the financial crisis. Core was at 4.3% last month - two-tenth down from the prior month’s highest reading since 1991. That said, our economists are expecting a slowdown in the month-on-month reading in August, and their forecasts for CPI of +0.4% and core CPI of +0.2% in August would be the slowest in six months. This would bring the YoY rates down to 5.3% and 4.1% respectively. The consensus has core at 4.2%.

According to our economists new cars are likely to present a bit of a curveball to both inflation (up) and activity readings (down) in the near-term given the continued chip shortages. GM announced it was pausing production at most of its domestic assembly plants after Labour Day for this reason. This may impact claims just as unemployment benefits expire and encourage people back to work.

In terms of other US data, Wednesday's industrial production and Thursday's retail sales reports will be of note. The former is more likely to be impacted next month by the auto shutdowns. However the latter will be hit now by the lack of available new cars at the moment. The University of Michigan’s preliminary consumer sentiment index for September on Friday will also be of interest, given the measure fell to its lowest level in almost a decade in August. Elsewhere on Wednesday, there’ll be fresh data from China for August on retail sales and industrial production, which will also be closely followed by investors amidst fears of a slowing economy there. The day by day calendar for the week ahead is at the end.

On the political side, we would expect more details on the Democrats' priorities for their $3.5trn reconciliation bill this week. There is a Wednesday deadline for the various committees to complete their legislative work on the bill. However deadlines have come and gone on this in recent months. Overnight, Bloomberg has reported that to improve the chances of the package passing, the House Democrats are set to propose raising the top corporate tax rate to 26.5% among other measures. This is less than the 28% that the Biden administration has sought. Further, the top rate on capital gains would rise from 20% to 25%, instead of the 39.6% Biden proposed that would have been equal to a new top rate on regular income. Democrats are also proposing a 3% surtax on individuals with adjusted gross income in excess of $5 million and to treat cryptocurrency the same as other financial instruments, raising an estimated $16 billion. Lastly, a document circulating among members of both parties cites preliminary estimates that the new proposals would raise $2.9 trillion in revenue when combined with $700 billion in revenue and cost savings from Medicare drug price changes.

Saying with politics there are just two weeks from yesterday until the German federal election, which will have big implications for both domestic and European policy. Last night the chancellor candidates debated again on TV, and a snap poll for ARD television showed that a striking 41% thought that the SPD’s Scholz was the most convincing performer. This compares to 27% for Laschet and 25% for the Greens candidate Baerbock. Prior to this, the INSA poll on Sunday showed that the SPD had extended their lead over the Conservatives. The poll put the SPD on 26%, up +1pp from a week ago and at their highest rating since June 2017.The conservatives were unchanged at 20% and the Greens were down +1pp at 15%.

Asian markets have started the week on a softer note as a report from the Financial Times said that China is seeking to break up Ant Group Co.’s Alipay and create a separate app for its loan business. Under the plan, Ant will turn over user data underpinning its lending decisions to a new credit scoring joint venture, which will be partly state-owned. Further, a statement from China’s Ministry of Human Resources and Social Security said that China’s Major platform operators must review the working conditions of gig economy workers that rely on their platforms to ensure their income rights and safety. These measures mark the latest salvo in the ongoing Chinese regulatory crackdown and are weighing on the broader market. The Nikkei (-0.26%), CSI (-0.44%), ShenZhen Comp (-0.26%), Hang Seng (-1.98%) and Kospi (-0.20%) are all losing ground. Elsewhere, yields on 10y USTs are down -1.1bps and futures on the S&P 500 are up +0.17%. In terms of overnight data releases, Japan’s August PPI printed at 0.0% mom (vs. +0.3% mom expected).

Turning to the pandemic, Scott Gottlieb, a board member of the Pfizer Inc. and the former head of the US FDA, said Covid-19 vaccines for kids could arrive as soon as Halloween this year. Pfizer has said it will have data on Covid-19 vaccines for children by the end of Sept., and the FDA will take “weeks, not months,” to evaluate the data and make a decision. The data will be for kids aged 5 to 11 years. Meanwhile, here in the UK, Health Minister Sajid Javid said that PM Johnson will announce the next steps on Tuesday for managing Covid over the autumn and winter with Booster vaccines also on the agenda. The announcement is likely to include plans to abandon proof of vaccinations to enter certain venues, and may soon drop mandatory testing for returning travelers as part of a further easing of coronavirus restrictions.

Recapping last week now and global equity markets lost some momentum as risk sentiment dropped amidst high valuation worries and ongoing concerns that the delta variant could slow down economic growth. The S&P 500 fell every day of the holiday-shortened week to end -1.69% lower (-0.77% Friday), and it’s five-day losing streak is the longest run since February. Cyclicals and smaller cap stocks particularly struggled as the Russell 2000 declined -2.81%, its largest weekly loss since July. European equities similarly fell back, despite a dovish ECB meeting, as the STOXX 600 ended the week -1.18% lower after Friday’s -0.26% loss.

Even with the steady risk off, bond yields rose. US 10yr Treasury yields ended the week up +1.9bps, most of that coming after Friday’s +4.4bp rise. The overall week’s move was driven by rising inflation expectations (+5.3bps), which overcame dropping real rates (-3.2bps). Increasing inflation expectations got a boost from Friday’s PPI print which showed prices for final demand rose +0.7% m/m (+0.6% expected) and +8.3% y/y (+8.2% expected), while core PPI rose +0.6% m/m and 6.7% y/y. Although not far off consensus, the report reinforces the issues that rising labour costs and supply chain bottlenecks have caused for suppliers and we will see how this translates to consumers in this week’s US CPI report.

Bond yields in Europe moved higher across much of the continent even with the ECB meeting being slightly more dovish prompting a counter trend rally on Thursday. Overall, yields on 10yr bunds rose +3.1bps, rising for a third straight week for the first time since April, whilst 10yr OATs and Gilts rose +1.7bps and +4.1bps respectively. With investors seeking havens, the US dollar index rose +0.59% last week, after having declined in each of the two previous weeks.

International

Beloved mall retailer files Chapter 7 bankruptcy, will liquidate

The struggling chain has given up the fight and will close hundreds of stores around the world.

It has been a brutal period for several popular retailers. The fallout from the covid pandemic and a challenging economic environment have pushed numerous chains into bankruptcy with Tuesday Morning, Christmas Tree Shops, and Bed Bath & Beyond all moving from Chapter 11 to Chapter 7 bankruptcy liquidation.

In all three of those cases, the companies faced clear financial pressures that led to inventory problems and vendors demanding faster, or even upfront payment. That creates a sort of inevitability.

Related: Beloved retailer finds life after bankruptcy, new famous owner

When a retailer faces financial pressure it sets off a cycle where vendors become wary of selling them items. That leads to barren shelves and no ability for the chain to sell its way out of its financial problems.

Once that happens bankruptcy generally becomes the only option. Sometimes that means a Chapter 11 filing which gives the company a chance to negotiate with its creditors. In some cases, deals can be worked out where vendors extend longer terms or even forgive some debts, and banks offer an extension of loan terms.

In other cases, new funding can be secured which assuages vendor concerns or the company might be taken over by its vendors. Sometimes, as was the case with David's Bridal, a new owner steps in, adds new money, and makes deals with creditors in order to give the company a new lease on life.

It's rare that a retailer moves directly into Chapter 7 bankruptcy and decides to liquidate without trying to find a new source of funding.

Image source: Getty Images

The Body Shop has bad news for customers

The Body Shop has been in a very public fight for survival. Fears began when the company closed half of its locations in the United Kingdom. That was followed by a bankruptcy-style filing in Canada and an abrupt closure of its U.S. stores on March 4.

"The Canadian subsidiary of the global beauty and cosmetics brand announced it has started restructuring proceedings by filing a Notice of Intention (NOI) to Make a Proposal pursuant to the Bankruptcy and Insolvency Act (Canada). In the same release, the company said that, as of March 1, 2024, The Body Shop US Limited has ceased operations," Chain Store Age reported.

A message on the company's U.S. website shared a simple message that does not appear to be the entire story.

"We're currently undergoing planned maintenance, but don't worry we're due to be back online soon."

That same message is still on the company's website, but a new filing makes it clear that the site is not down for maintenance, it's down for good.

The Body Shop files for Chapter 7 bankruptcy

While the future appeared bleak for The Body Shop, fans of the brand held out hope that a savior would step in. That's not going to be the case.

The Body Shop filed for Chapter 7 bankruptcy in the United States.

"The US arm of the ethical cosmetics group has ceased trading at its 50 outlets. On Saturday (March 9), it filed for Chapter 7 insolvency, under which assets are sold off to clear debts, putting about 400 jobs at risk including those in a distribution center that still holds millions of dollars worth of stock," The Guardian reported.

After its closure in the United States, the survival of the brand remains very much in doubt. About half of the chain's stores in the United Kingdom remain open along with its Australian stores.

The future of those stores remains very much in doubt and the chain has shared that it needs new funding in order for them to continue operating.

The Body Shop did not respond to a request for comment from TheStreet.

bankruptcy pandemic canadaGovernment

Are Voters Recoiling Against Disorder?

Are Voters Recoiling Against Disorder?

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super…

Authored by Michael Barone via The Epoch Times (emphasis ours),

The headlines coming out of the Super Tuesday primaries have got it right. Barring cataclysmic changes, Donald Trump and Joe Biden will be the Republican and Democratic nominees for president in 2024.

With Nikki Haley’s withdrawal, there will be no more significantly contested primaries or caucuses—the earliest both parties’ races have been over since something like the current primary-dominated system was put in place in 1972.

The primary results have spotlighted some of both nominees’ weaknesses.

Donald Trump lost high-income, high-educated constituencies, including the entire metro area—aka the Swamp. Many but by no means all Haley votes there were cast by Biden Democrats. Mr. Trump can’t afford to lose too many of the others in target states like Pennsylvania and Michigan.

Majorities and large minorities of voters in overwhelmingly Latino counties in Texas’s Rio Grande Valley and some in Houston voted against Joe Biden, and even more against Senate nominee Rep. Colin Allred (D-Texas).

Returns from Hispanic precincts in New Hampshire and Massachusetts show the same thing. Mr. Biden can’t afford to lose too many Latino votes in target states like Arizona and Georgia.

When Mr. Trump rode down that escalator in 2015, commentators assumed he’d repel Latinos. Instead, Latino voters nationally, and especially the closest eyewitnesses of Biden’s open-border policy, have been trending heavily Republican.

High-income liberal Democrats may sport lawn signs proclaiming, “In this house, we believe ... no human is illegal.” The logical consequence of that belief is an open border. But modest-income folks in border counties know that flows of illegal immigrants result in disorder, disease, and crime.

There is plenty of impatience with increased disorder in election returns below the presidential level. Consider Los Angeles County, America’s largest county, with nearly 10 million people, more people than 40 of the 50 states. It voted 71 percent for Mr. Biden in 2020.

Current returns show county District Attorney George Gascon winning only 21 percent of the vote in the nonpartisan primary. He’ll apparently face Republican Nathan Hochman, a critic of his liberal policies, in November.

Gascon, elected after the May 2020 death of counterfeit-passing suspect George Floyd in Minneapolis, is one of many county prosecutors supported by billionaire George Soros. His policies include not charging juveniles as adults, not seeking higher penalties for gang membership or use of firearms, and bringing fewer misdemeanor cases.

The predictable result has been increased car thefts, burglaries, and personal robberies. Some 120 assistant district attorneys have left the office, and there’s a backlog of 10,000 unprosecuted cases.

More than a dozen other Soros-backed and similarly liberal prosecutors have faced strong opposition or have left office.

St. Louis prosecutor Kim Gardner resigned last May amid lawsuits seeking her removal, Milwaukee’s John Chisholm retired in January, and Baltimore’s Marilyn Mosby was defeated in July 2022 and convicted of perjury in September 2023. Last November, Loudoun County, Virginia, voters (62 percent Biden) ousted liberal Buta Biberaj, who declined to prosecute a transgender student for assault, and in June 2022 voters in San Francisco (85 percent Biden) recalled famed radical Chesa Boudin.

Similarly, this Tuesday, voters in San Francisco passed ballot measures strengthening police powers and requiring treatment of drug-addicted welfare recipients.

In retrospect, it appears the Floyd video, appearing after three months of COVID-19 confinement, sparked a frenzied, even crazed reaction, especially among the highly educated and articulate. One fatal incident was seen as proof that America’s “systemic racism” was worse than ever and that police forces should be defunded and perhaps abolished.

2020 was “the year America went crazy,” I wrote in January 2021, a year in which police funding was actually cut by Democrats in New York, Los Angeles, San Francisco, Seattle, and Denver. A year in which young New York Times (NYT) staffers claimed they were endangered by the publication of Sen. Tom Cotton’s (R-Ark.) opinion article advocating calling in military forces if necessary to stop rioting, as had been done in Detroit in 1967 and Los Angeles in 1992. A craven NYT publisher even fired the editorial page editor for running the article.

Evidence of visible and tangible discontent with increasing violence and its consequences—barren and locked shelves in Manhattan chain drugstores, skyrocketing carjackings in Washington, D.C.—is as unmistakable in polls and election results as it is in daily life in large metropolitan areas. Maybe 2024 will turn out to be the year even liberal America stopped acting crazy.

Chaos and disorder work against incumbents, as they did in 1968 when Democrats saw their party’s popular vote fall from 61 percent to 43 percent.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Government

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Veterans Affairs Kept COVID-19 Vaccine Mandate In Place Without Evidence

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The…

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

The U.S. Department of Veterans Affairs (VA) reviewed no data when deciding in 2023 to keep its COVID-19 vaccine mandate in place.

VA Secretary Denis McDonough said on May 1, 2023, that the end of many other federal mandates “will not impact current policies at the Department of Veterans Affairs.”

He said the mandate was remaining for VA health care personnel “to ensure the safety of veterans and our colleagues.”

Mr. McDonough did not cite any studies or other data. A VA spokesperson declined to provide any data that was reviewed when deciding not to rescind the mandate. The Epoch Times submitted a Freedom of Information Act for “all documents outlining which data was relied upon when establishing the mandate when deciding to keep the mandate in place.”

The agency searched for such data and did not find any.

“The VA does not even attempt to justify its policies with science, because it can’t,” Leslie Manookian, president and founder of the Health Freedom Defense Fund, told The Epoch Times.

“The VA just trusts that the process and cost of challenging its unfounded policies is so onerous, most people are dissuaded from even trying,” she added.

The VA’s mandate remains in place to this day.

The VA’s website claims that vaccines “help protect you from getting severe illness” and “offer good protection against most COVID-19 variants,” pointing in part to observational data from the U.S. Centers for Disease Control and Prevention (CDC) that estimate the vaccines provide poor protection against symptomatic infection and transient shielding against hospitalization.

There have also been increasing concerns among outside scientists about confirmed side effects like heart inflammation—the VA hid a safety signal it detected for the inflammation—and possible side effects such as tinnitus, which shift the benefit-risk calculus.

President Joe Biden imposed a slate of COVID-19 vaccine mandates in 2021. The VA was the first federal agency to implement a mandate.

President Biden rescinded the mandates in May 2023, citing a drop in COVID-19 cases and hospitalizations. His administration maintains the choice to require vaccines was the right one and saved lives.

“Our administration’s vaccination requirements helped ensure the safety of workers in critical workforces including those in the healthcare and education sectors, protecting themselves and the populations they serve, and strengthening their ability to provide services without disruptions to operations,” the White House said.

Some experts said requiring vaccination meant many younger people were forced to get a vaccine despite the risks potentially outweighing the benefits, leaving fewer doses for older adults.

“By mandating the vaccines to younger people and those with natural immunity from having had COVID, older people in the U.S. and other countries did not have access to them, and many people might have died because of that,” Martin Kulldorff, a professor of medicine on leave from Harvard Medical School, told The Epoch Times previously.

The VA was one of just a handful of agencies to keep its mandate in place following the removal of many federal mandates.

“At this time, the vaccine requirement will remain in effect for VA health care personnel, including VA psychologists, pharmacists, social workers, nursing assistants, physical therapists, respiratory therapists, peer specialists, medical support assistants, engineers, housekeepers, and other clinical, administrative, and infrastructure support employees,” Mr. McDonough wrote to VA employees at the time.

“This also includes VA volunteers and contractors. Effectively, this means that any Veterans Health Administration (VHA) employee, volunteer, or contractor who works in VHA facilities, visits VHA facilities, or provides direct care to those we serve will still be subject to the vaccine requirement at this time,” he said. “We continue to monitor and discuss this requirement, and we will provide more information about the vaccination requirements for VA health care employees soon. As always, we will process requests for vaccination exceptions in accordance with applicable laws, regulations, and policies.”

The version of the shots cleared in the fall of 2022, and available through the fall of 2023, did not have any clinical trial data supporting them.

A new version was approved in the fall of 2023 because there were indications that the shots not only offered temporary protection but also that the level of protection was lower than what was observed during earlier stages of the pandemic.

Ms. Manookian, whose group has challenged several of the federal mandates, said that the mandate “illustrates the dangers of the administrative state and how these federal agencies have become a law unto themselves.”

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoIndustrial Production Decreased 0.1% in January

-

International2 days ago

International2 days agoWalmart launches clever answer to Target’s new membership program

-

International2 days ago

International2 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex