From open arms to full bans: The latest on crypto regulation in Asia

From open arms to full bans: The latest on crypto regulation in Asia

A look at the legal status of crypto in Asia, where new crypto hubs are emerging and thriving despite uneven regulation.

When most people hear about buying Bitcoin (BTC) or other cryptocurrencies, they immediately think of the largest exchanges, most of which are located in Asia. Today, countries such as China and South Korea have become epicenters of blockchain innovation. However, in many countries, it’s still unclear whether cryptocurrencies are allowed, and if they are, what their status is.

So, here’s how the regulation of the cryptocurrency market in Asia is shaping up and what should be expected from governments in the near future.

China goes digital with the yuan

Today, China is home to many cryptocurrency projects and exchanges, and yet, crypto has actually been banned for several years now. In 2017, the People’s Bank of China, the nation’s central bank, banned initial coin offerings and cryptocurrency exchanges. Then the Shanghai branch of the PBoC announced its intention to root out the crypto industry in the country, equating the token sales to the illegal placement of securities or fundraising. Soon, the biggest crypto exchanges in the country, Huobi and OKCoin, announced they had stopped local trading.

The turning point came in July 2019 when a Chinese court ruled that Bitcoin was digital property. The court’s decision marked a shift in cryptocurrency adoption, and in October 2019, Chinese President Xi Jinping called for an increase in blockchain development efforts. Furthermore, the PBoC has said it’s prioritizing the launch of a central bank digital currency. However, the Chinese government is still quite cautious in its approach to both its own cryptocurrency and digital assets in general and has yet to issue regulations.

Konstantin Anissimov, executive director of exchange CEX.IO, believes that recent events in the world, such as the coronavirus pandemic and subsequent economic downturn, could push the Chinese government toward the legal adoption of cryptocurrencies:

“To maintain its status as leader in the tech and finance markets, China, which after being overly restrictive just a few years ago, now accelerates the efforts to create a legal framework to regulate cryptocurrency circulation and even considers the possibility of its own digital currency.”

But so far the government has not introduced a national digital currency, apparently due to the fact that it wants not only to introduce a digital cash replacement but also to create a universal payment system, such as Alipay, that will be used all over the world. At the moment, the PBoC is conducting pilot projects in the field of cryptocurrencies in several regions of the country and has registered at least a few patents related to digital currency.

In early August, it also became known that some of the country’s commercial banks are conducting tests with digital yuan wallets. At the end of the month, China’s Communist Party once again announced that it is betting on blockchain as a key tool for innovating nationwide social services.

Also noteworthy is that at the end of July 2019, a national project known as the Blockchain Service Network, or BSN, was launched to support medium-sized businesses in the development of blockchain projects by creating public blockchains that will comply with Chinese law and operate internationally. It was also announced that the BSN will integrate support for stablecoins, albeit no earlier than 2021, and will be able to become the infrastructure for the digital yuan.

Despite all of these positive signs of blockchain “acceptance,” some Chinese businesses still don’t believe that the government will legalize cryptocurrencies because digital money does not act as currency. Yifan He, CEO of Red Date Technology — a tech company involved in the BSN — told Cointelegraph:

“For China, it is for sure that in the foreseeable future, cryptocurrencies definitely won’t be legalized in China. Until today, I see cryptocurrencies as a form of investment, not really currencies. When some real currencies change hands, most of the time they are for purchasing merchandise or services. When most cryptocurrencies change hands today, 99% of the volume is for investment purposes. Therefore, of course they won’t replace fiat money because they are not functioning as currencies.”

Singapore regulates the way forward

The city-state of Singapore treats cryptocurrencies positively and doesn’t ignore them, and its financial regulators were among the first in 2020 to issue relevant laws within the framework under which the country’s crypto businesses operate.

In January, the Monetary Authority of Singapore, the nation’s central bank, issued the Payment Services Act, regulating the circulation of cryptocurrencies and the activities of related companies, which must comply with Anti-Money Laundering and Combating the Financing of Terrorism rules. Crypto companies must first register and then apply for a license to operate in Singapore. To clarify how to get a license, the Association of Cryptocurrency Enterprises and Startups Singapore has introduced a "Code of Practice" to assist companies in their applications.

Related: Singapore’s National Payments System Can Guide Global Crypto Adoption

The government did not stop at just issuing laws; it also began developing national blockchain projects. Earlier this summer, the Monetary Authority of Singapore announced that it was ready to test Project Ubin, its multicurrency blockchain payments project designed for commercial use and intended to facilitate more efficient cross-border payments. Moreover, in June, the central bank announced its readiness to cooperate with China in the creation of a CBDC.

At the moment, Singapore has clear legislation regarding cryptocurrencies, and no laws prohibit their possession, use or exchange for fiat currency. Registering a Singapore cryptocurrency company is also a legal matter.

South Korea

South Korea also has a clean-cut vision of cryptocurrencies; however, it approaches the regulation of digital assets in a very tough manner, viewing digital assets as legal tender. Its local exchanges are tightly controlled by government agencies, including the Financial Services Commission. In addition, the country’s Ministry of Economy and Finance can conduct comprehensive checks of Bitcoin exchanges. Since September 2017, ICOs and margin trading have been banned.

In March, the South Korean government passed a bill to regulate cryptocurrency exchanges in the country. The National Assembly adopted a revised bill on reporting and conducting certain types of financial transactions, including crypto. The government has until March 2021 to implement the law. Once in effect, blockchain startups will be given a six-month grace period to bring their activities in line with the new rules.

The bill will affect crypto exchanges, funds and crypto wallets; companies conducting ICOs; and other market participants. They will be required to comply with all financial reporting requirements, use only bank accounts with real names, conduct user identification such as Know Your Customer, and certify their information security management systems. In July, the government suggested introducing a tax on income from crypto trading and even set a rate of 20%, but so far, the law has not been adopted.

As for the use of blockchain in private business, the government contributes to the development of this sector in several ways, including through the use of a blockchain-based payment program in the city of Seongnam and crypto storage by four of the nation’s largest banks.

Indian uncertainty

The relationship between the Indian government and cryptocurrencies can be confusing to understand. The Reserve Bank of India’s 2018 ban on accounting organizations serving firms that work with crypto drove some companies out of business. The government planned to go even further, and in July 2019, it proposed a draft bill that would slap anyone dealing with crypto with a big fine or a 10-year prison sentence.

At the end of March, the Supreme Court of India unexpectedly heeded petitions from crypto businesses and overturned the central bank’s ban, declaring it unconstitutional. Some exchanges immediately seized the opportunity to start trading again. However, the situation has remained ambiguous ever since, as it’s still not clear whether the Indian government will push to create a regulatory framework for the development of the industry.

So far, it seems that the authorities may, and want to, regulate this area, but they are hesitant, so another ban looks like an easier way. For example, just five months after the first ban was lifted, Indian officials reiterated the possibility of banning cryptocurrency trading through legislative changes.

Related: Indian Banks Act Slow to Accept Crypto Industry Despite RBI’s Approval

Sumit Gupta, CEO and co-founder of CoinDCX — an Indian cryptocurrency exchange — told Cointelegraph that in countries such as India where the adoption and legalization of cryptocurrencies have not been as fast as in South Korea or Singapore, it will take time for businesses to get used to a new financial instrument:

“Over the course of 2020, we have seen regulation shift from a ’blanket ban’ to a more measured and calculated approach aimed at protecting investors and combating potential fraud within the industry. We believe that as traditional actors are increasingly comfortable with cryptocurrencies, we will see an uptick in cryptocurrency adoption across nations and regions.”

Government

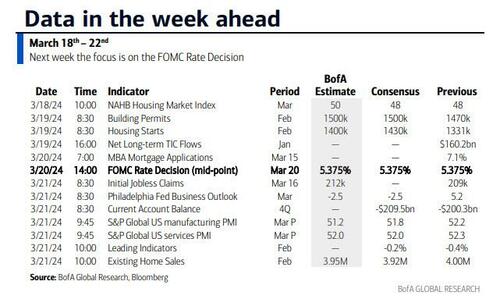

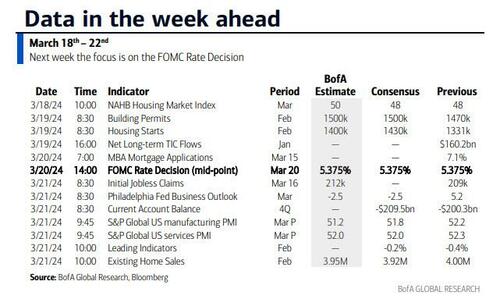

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

Government

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

Key Events This Week: Central Banks Galore Including A Historic Rate Hike By The BOJ

According to DB’s Jim Reid, "this could be a landmark…

According to DB's Jim Reid, "this could be a landmark week in markets as the last global holdout on negative rates looks set to be removed as the BoJ likely hikes rates from -0.1% tomorrow." That will likely overshadow the FOMC that concludes on Wednesday that will have its own signalling intrigue given recent strong inflation. We also have the RBA meeting tomorrow and the SNB and BoE meetings on Thursday to close out a big week for global central bankers with many EM countries also deciding on policy. We’ll preview the main meetings in more depth below but outside of this we have the global flash PMIs on Thursday as well as inflation reports in Japan (Thursday) and the UK (Wednesday). US housing data also permeates through the week as you'll see in the full global day-by-day week ahead at the end as usual.

Let’s go into detail now, starting with the BoJ tomorrow. We’ve had negative base rates now for 8 years which if is the longest run ever seen for any country in the history of mankind. In fact it is doubtful that pre-historic man was as generous as to charge negative interest rates on lending money prior to this! It also might be one of the longest global runs without any interest rate hikes given the 17 year run that could end tomorrow. So, as Reid puts it, a landmark event.

DB's Chief Japan economist expects the central bank to revise its policy and abandon both NIRP and the multi-tiered current account structure and set rates on all excess reserves at 0.1%. He also sees both the yield curve control (YCC) and the inflation-overshooting commitment ending, replaced by a benchmark for the pace of the bank’s JGB purchasing activity. The house view forecast of 50bps of hikes through 2025 is more hawkish than the market but risks are still tilted to the upside. On Friday, the Japan Trade Union Confederation (Rengo) announced the first tally of the results of this year's shunto spring wage negotiation. The wage increase rate, including the seniority-based wage hike, is 5.28%, which was significantly higher than expected. This year will probably see the highest wage settlements since 1991 which given Japan’s recent history is an incredible turnaround. This wage data news has firmed up expectations for tomorrow.

With regards to the FOMC which concludes on Wednesday, DB economists expect only minor revisions to the meeting statement that saw an overhaul last meeting. With regards to the SEP, the growth and unemployment forecasts are unlikely to change but the 2024 inflation forecasts potentially could; elsewhere, expect the Fed to revise up their 2024 core PCE inflation forecast by a tenth to 2.5%, although they see meaningful risks that it gets revised up even higher to 2.6%. In our economists' view, a 2.5% core PCE reading would allow just enough wiggle room to keep the 2024 fed funds rate at 4.6% (75bps of cuts). However, if core PCE inflation were revised up to 2.6%, it would likely entail the Fed moving their base case back to 50bps of cuts, as this would essentially reflect the same forecasts as the September 2023 SEP.

Beyond 2024, DB expect officials to build in less policy easing due to a higher r-star. If two of the eight officials currently at 2.5% move up by 25bps, then the long-run median forecast would edge up to 2.6%. This could be justified by a one-tenth upgrade to the long-run growth forecast. After all this information is released the presser from Powell will of course be heavily scrutinised, especially on how Powell sees recent inflation data. Powell should also provide an update on discussions around QT but it is unlikely they are ready yet to release updated guidance.

One additional global highlight this week might be a big fall in UK inflation on Wednesday, suggesting that headline CPI will slow to 3.4% (vs 4% in January) and core to 4.5% (5.1%). Elsewhere there is plenty of ECB speaker appearances including President Lagarde on Wednesday. They are all highlighted in the day-by-day guide at the end.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 18

- Data: US March New York Fed services business activity, NAHB housing market index, China February retail sales, industrial production, property investment, Eurozone January trade balance, Canada February raw materials, industrial product price index, existing home sales

Tuesday March 19

- Data: US January total net TIC flows, February housing starts, building permits, Japan January capacity utilization, Germany and Eurozone March Zew survey, Eurozone Q4 labour costs, Canada February CPI

- Central banks: BoJ decision, ECB's Guindos speaks, RBA decision

- Auctions: US 20-yr Bond ($13bn, reopening)

Wednesday March 20

- Data: UK February CPI, PPI, RPI, January house price index, China 1-yr and 5-yr loan prime rates, Japan February trade balance, Italy January industrial production, Germany February PPI, Eurozone March consumer confidence, January construction output

- Central banks: Fed's decision, ECB's Lagarde, Lane, De Cos, Schnabel, Nagel and Holzmann speak, BoC summary of deliberations

- Earnings: Tencent, Micron

Thursday March 21

- Data: US, UK, Japan, Germany, France and Eurozone March PMIs, US March Philadelphia Fed business outlook, February leading index, existing home sales, Q4 current account balance, initial jobless claims, UK February public finances, Japan February national CPI, Italy January current account balance, France March manufacturing confidence, February retail sales, ECB January current account, EU27 February new car registrations

- Central banks: BoE decision, SNB decision

- Earnings: Nike, FedEx, Lululemon, BMW, Enel

- Auctions: US 10-yr TIPS ($16bn, reopening)

- Other: European Union summit, through March 22

Friday March 22

- Data: UK March GfK consumer confidence, February retail sales, Germany March Ifo survey, January import price index, Canada January retail sales

* * *

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the Philadelphia Fed manufacturing index and existing home sales reports on Thursday. The March FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements from Fed officials this week, including Chair Powell, Vice Chair for Supervision Barr, and President Bostic.

Monday, March 18

- There are no major economic data releases scheduled.

Tuesday, March 19

- 08:30 AM Housing starts, February (GS +9.4%, consensus +7.4%, last -14.8%); Building permits, February (consensus +2.0%, last -0.3%)

Wednesday, March 20

- 02:00 PM FOMC statement, March 19 – March 20 meeting: As discussed in our FOMC preview, we continue to expect the committee to target a first cut in June, but we now expect 3 cuts in 2024 in June, September, and December (vs. 4 previously) given the slightly higher inflation path. We continue to expect 4 cuts in 2025 and now expect 1 final cut in 2026 to an unchanged terminal rate forecast of 3.25-3.5%. The main risk to our expectation is that FOMC participants might be more concerned about the recent inflation data and less convinced that inflation will resume its earlier soft trend. In that case, they might bump up their 2024 core PCE inflation forecast to 2.5% and show a 2-cut median.

Thursday, March 21

- 08:30 AM Current account balance, Q4 (consensus -$209.5bn, last -$200.3bn)

- 08:30 AM Philadelphia Fed manufacturing index, March (GS 3.2, consensus -1.3, last 5.2): We estimate that the Philadelphia Fed manufacturing index fell 2pt to 3.2 in March. While the measure is elevated relative to other surveys, we expect a boost from the rebound in foreign manufacturing activity and the pickup in US production and freight activity.

- 08:30 AM Initial jobless claims, week ended March 16 (GS 210k, consensus 215k, last 209k): Continuing jobless claims, week ended March 9 (consensus 1,815k, last 1,811k)

- 09:45 AM S&P Global US manufacturing PMI, March preliminary (consensus 51.8, last 52.2): S&P Global US services PMI, March preliminary (consensus 52.0, last 52.3)

- 10:00 AM Existing home sales, February (GS +1.2%, consensus -1.6%, last +3.1%)

- 02:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair Michael for Supervision Barr will participate in a fireside chat in Ann Arbor, MI with students and faculty. A moderated Q&A is expected. On February 14, Barr said the Fed is “confident we are on a path to 2% inflation,” but the recent report showing prices rose faster than anticipated in January “is a reminder that the path back to 2% inflation may be a bumpy one.” Barr also noted that “we need to see continued good data before we can begin the process of reducing the federal funds rate.”

Friday, March 22

- 09:00 AM Fed Reserve Chair Powell speaks: The Federal Reserve Board will host a Fed Listens event in Washington D.C. on “Transitioning to the Post-Pandemic Economy.” Chair Powell will deliver opening remarks. Vice Chair Phillip Jefferson and Fed Governor Michelle Bowman will moderate conversations with leaders from various organizations. On March 6, Chair Powell noted in his congressional testimony that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

- 12:00 PM Federal Reserve Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will participate in a virtual event on “International Economic and Monetary Design.” A moderated Q&A is expected.

- 04:00 PM Atlanta Fed President Bostic (FOMC voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation at the 2024 Household Finance Conference in Atlanta. On March 4, Bostic said, “I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time.” Bostic also noted, “I expect the first interest rate cut, which I have penciled in for the third quarter, will be followed by a pause in the following meeting.”

Source: DB, Goldman, BofA

Spread & Containment

Supreme Court To Hear Arguments In Biden Admin’s Censorship Of Social Media Posts

Supreme Court To Hear Arguments In Biden Admin’s Censorship Of Social Media Posts

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

The…

Authored by Tom Ozimek via The Epoch Times (emphasis ours),

The U.S. Supreme Court will soon hear oral arguments in a case that concerns what two lower courts found to be a “coordinated campaign” by top Biden administration officials to suppress disfavored views on key public issues such as COVID-19 vaccine side effects and pandemic lockdowns.

The Supreme Court has scheduled a hearing on March 18 in Murthy v. Missouri, which started when the attorneys general of two states, Missouri and Louisiana, filed suit alleging that social media companies such as Facebook were blocking access to their platforms or suppressing posts on controversial subjects.

The initial lawsuit, later modified by an appeals court, accused Biden administration officials of engaging in what amounts to government-led censorship-by-proxy by pressuring social media companies to take down posts or suspend accounts.

Some of the topics that were targeted for downgrade and other censorious actions were voter fraud in the 2020 presidential election, the COVID-19 lab leak theory, vaccine side effects, the social harm of pandemic lockdowns, and the Hunter Biden laptop story.

The plaintiffs argued that high-level federal government officials were the ones pulling the strings of social media censorship by coercing, threatening, and pressuring social media companies to suppress Americans’ free speech.

‘Unrelenting Pressure’

In a landmark ruling, Judge Terry Doughty of the U.S. District Court for the Western District of Louisiana granted a temporary injunction blocking various Biden administration officials and government agencies such as the Department of Justice and FBI from collaborating with big tech firms to censor posts on social media.

Later, the Court of Appeals for the Fifth Circuit agreed with the district court’s ruling, saying it was “correct in its assessment—‘unrelenting pressure’ from certain government officials likely ‘had the intended result of suppressing millions of protected free speech postings by American citizens.’”

The judges wrote, “We see no error or abuse of discretion in that finding.”

The ruling was appealed to the Supreme Court, and on Oct. 20, 2023, the high court agreed to hear the case while also issuing a stay that indefinitely blocked the lower court order restricting the Biden administration’s efforts to censor disfavored social media posts.

Supreme Court Justices Samuel Alito, Neil Gorsuch, and Clarence Thomas would have denied the Biden administration’s application for a stay.

“At this time in the history of our country, what the Court has done, I fear, will be seen by some as giving the Government a green light to use heavy-handed tactics to skew the presentation of views on the medium that increasingly dominates the dissemination of news,” Justice Alito wrote in a dissenting opinion.

“That is most unfortunate.”

The Supreme Court has other social media cases on its docket, including a challenge to Republican-passed laws in Florida and Texas that prohibit large social media companies from removing posts because of the views they express.

Oral arguments were heard on Feb. 26 in the Florida and Texas cases, with debate focusing on the validity of laws that deem social media companies “common carriers,” a status that could allow states to impose utility-style regulations on them and forbid them from discriminating against users based on their political viewpoints.

The tech companies have argued that the laws violate their First Amendment rights.

The Supreme Court is expected to issue a decision in the Florida and Texas cases by June 2024.

‘Far Beyond’ Constitutional

Some of the controversy in Murthy v. Missouri centers on whether the district court’s injunction blocking Biden administration officials and federal agencies from colluding with social media companies to censor posts was overly broad.

In particular, arguments have been raised that the injunction would prevent innocent or borderline government “jawboning,” such as talking to newspapers about the dangers of sharing information that might aid terrorists.

But that argument doesn’t fly, according to Philip Hamburger, CEO of the New Civil Liberties Alliance, which represents most of the individual plaintiffs in Murthy v. Missouri.

In a series of recent statements on the subject, Mr. Hamburger explained why he believes that the Biden administration’s censorship was “far beyond anything that could be constitutional” and that concern about “innocent or borderline” cases is unfounded.

For one, he said that the censorship that is highlighted in Murthy v. Missouri relates to the suppression of speech that was not criminal or unlawful in any way.

Mr. Hamburger also argued that “the government went after lawful speech not in an isolated instance, but repeatedly and systematically as a matter of policy,” which led to the suppression of entire narratives rather than specific instances of expression.

“The government set itself up as the nation’s arbiter of truth—as if it were competent to judge what is misinformation and what is true information,” he wrote.

“In retrospect, it turns out to have suppressed much that was true and promoted much that was false.”

The suppression of reports on the Hunter Biden laptop just before the 2020 presidential election on the premise that it was Russian disinformation, for instance, was later shown to be unfounded.

Some polls show that if voters had been aware of the report, they would have voted differently.

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex