Uncategorized

Four Innovative Industrial Stocks to Buy for Future Profits

Four innovative industrial stocks to buy for future profits are using technological advances to position themselves for success. The four innovative industrial…

Four innovative industrial stocks to buy for future profits are using technological advances to position themselves for success.

The four innovative industrial stocks to buy for future profits feature a provider of aftermarket distribution and repair services for land, sea and air transportation assets, an artificial intelligence (AI) enabler of on-demand manufacturing, a digital textile printer and an agricultural machinery manufacturer. Three of those four innovative industrial stocks are rated by Chicago-based investment firm William Blair & Co. to “outperform” the market while the final one is favored by a former money manager.

Investors need to beware that bearish sentiment has been extreme, laying the groundwork for an oversold rally where the huge price swings for the indexes typically signal an inflection point, opined seasoned Wall Street trader Bryan Perry, who heads the high income-oriented Cash Machine investment newsletter. There is a great deal of uncertainty regarding Ukraine, European fiscal policy, China’s ambitious rhetoric about Taiwan, major stress in the emerging market debt market, the strong dollar and persistent inflationary pressures dictating Fed rate hikes, he added.

Paul Dykewicz interviews Bryan Perry, head of the Cash Machine newsletter.

Four Innovative Industrial Stocks to Buy for Future Profits Face Risks

“Earnings expectations have been dramatically lowered, setting the table for an earnings season rally, but one that will likely be limited in upside as the Nov. 2 Federal Open Market Committee (FOMC) meeting nears,” Perry wrote to his subscribers in an Oct. 18 update. “The latest inflation data was nothing short of hot and will not help market bulls hoping for any inklings the Fed will dial back its rate hikes to curb inflation.”

High inflation, further Fed rate hikes, risk of a recession in America and Russia’s sustained invasion of Ukraine that began Feb. 24 are sources of uncertainty that are compounded by economic woes in Europe and Asia, wrote Mark Skousen, a presidential fellow in economics at Chapman University, in his latest monthly Forecasts & Strategies investment newsletter. The biggest drag on the market is the Federal Reserve’s plan to slow the economy, reduce demand and curb inflation, Skousen added.

Skousen, who uses his analysis of inflation, interest rates and monetary policy to recommend stocks and options to buy in his weekly Home Run Trader advisory service, said data show a slowing U.S. economy, but no recession thus far.

“Even though real gross domestic product (GDP) is slightly negative, second-quarter gross output (GO) — which measures total spending in the economy — grew by 1.7% in real terms,” Skousen stated. “GO includes the supply chain, which is still catching up from the lockdown-induced shortages.”

Mark Skousen, Forecasts & Strategies chief and Ben Franklin scion, meets Paul Dykewicz.

Four Innovative Industrial Stocks to Buy for Future Profits Amid War

Russia’s shelling of hospitals, schools, residential areas, churches, nuclear power plants, oil refineries, a children’s playground, a park, a German consulate, a business center and a theater used as a shelter have been combined with brutal rapes, torture and outright executions of Ukrainian civilians. Those acts caused many nations to place continuing sanctions on Russia that included scaling back or cutting ties with the aggressor as an exporter of grain, oil and natural gas.

Investors can consider an exchange-traded fund that offers broad exposure to companies providing industrial automation, as well as environmental awareness, said Bob Carlson, a pension fund manager who also leads the Retirement Watch investment newsletter.

Bob Carlson, investment guru of Retirement Watch, talks to Paul Dykewicz.

Carlson said he is keeping an eye on Robo Global Robotics and Automation (ROBO), a fund that seeks to follow an index focused on robotics-related or automation-oriented companies. However, the fund has fallen 40.34% so far in 2022 as technology and industrial companies plunged in value.

Both sectors performed poorly as interest rates rose in 2022, Carlson commented. ROBO may rebound but Carlson has held off adding it to his newsletter’s portfolio.

Four Innovative Industrial Stocks to Buy for Future Profits Feature VSE

Innovative industrial stocks that stand out from their competitors may offer the most potential. One example is VSE Corporation (NASDAQ: VSEC), an Alexandria, Virginia-based provider of aftermarket distribution and repair services for land, sea and air transportation assets in government and commercial markets. VSE gained an “outperform “ rating by the investment firm William Blair & Co.

VSE’s Chief Executive Officer John Cuomo and Chief Financial Officer Stephen Griffin spoke at William Blair’s recent conference “What’s Next for Industrials?”

William Blair values VSE shares in a range of $43 to $54, based on the bear and bull scenarios, respectively, based on a sum-of-the-parts valuation analysis. The bull case could occur if VSE gains scale organically and via strategic acquisitions, the investment firm wrote.

“In our view, the main risk for VSE shares is that the company does not renew its Navy foreign military sales ship transfer contract, which represented 13% of 2021 revenue and is now up for bid,” Wiliam Blair wrote. “While our $43 per share bear-case valuation assumes that VSE does not renew this contract, our base case assumes a successful extension given that VSE has held the contract since 1995 and has renewed it many times.”

Four Innovative Industrial Stocks to Buy for Future Profits Tap Robotics

VSE specializes in supply chain, maintenance, repair, and overhaul for transportation assets spanning land, sea, and air vehicles. Two of the biggest issues impacting customers are supply chain constraints and a labor shortage. VSE expects the labor shortage to continue through the next decade and is investing in automation to prepare for it.

“In response to the labor shortage, companies will need to invest in automation tools to reduce headcount per order,” William Blair wrote. “VSE has invested in a new warehouse distribution facility for its e-commerce business.”

The facility will feature a robotics pilot project. Robots are expected to assist in mitigating errors, expediting fulfillment, reducing overhead and facilitating enhanced inventory management. Ongoing supply chain volatility may lead e-commerce vendors to continue to look for alternative suppliers.

Cuomo told conference attendees that VSE still is in the “early innings” of gaining share because of supply chain disruption. Blockchain ultimately could provide airframers, airlines and suppliers with an increased level of transparency, so VSE has been in discussions with its supplier partners and customers about using that capability.

“A recession may lead to increased demand for aviation repairs,” William Blair wrote. “As an aftermarket business, the company is stocking up on inventory to support potentially elevated demand in the second half of 2022 and 2023.”

VSE’s Aviation segment provides aftermarket and distribution services to commercial, business and general aviation, cargo, military/defense and rotorcraft customers. The company’s Federal & Defense segment provides aftermarket and logistics services to improve operational readiness and extend the life cycle of military vehicles, ships and aircraft for the U.S. government and allied defense customers.

Chart courtesy of www.StockCharts.com.

Four Innovative Industrial Stocks to Buy for Future Profits Feature Xometry

Xometry, Inc. (NASDAQ: XMTR), headquartered in Gaithersburg, Maryland, a suburb not far from where I live just north of Washington, D.C., offers an artificial intelligence (AI) enabled marketplace to provide an array of on-demand manufacturing. The company’s proprietary technology allows buyers to source manufactured parts and assemblies efficiently from businesses that make their products.

Rated by William Blair to “outperform” the market, Xometry serves buyers of manufactured products that range from self-funded startups to Fortune 100 companies. Willliam Blair recently hosted Xometry’s Chief Executive Officer and Co-founder Randy Altschuler and Vice President of Investor Relations Shawn Milne, at the investment firm’s “What’s Next for Industrials?” conference.

One of the key points from the discussion highlighted how Xometry offers a marketplace for on-demand manufacturing, connecting its customers who are matched with manufacturing partners. The manufacturing market has been highly fragmented and suboptimal for buyers and sellers, but Xometry management spoke of an opportunity to digitize the market.

“Xometry uses artificial intelligence (AI) and machine learning to create an instant price for a buyer and supplier,” William Blair wrote. “The match is optimized, and the machine learning uses the data to become even smarter, resulting in better pricing and matching. After the recent Thomas acquisition, Xometry now has an estimated $2 trillion total addressable market, with more than 2,000 active sellers and 33,000-plus active buyers.”

Xometry Enters Four Innovative Industrial Stocks to Buy for Future Profits

Xometry also can aggregate the supplier base as a group purchasing organization, allowing manufacturing partners to obtain discounts on tooling, William Blair wrote. This saves the suppliers money and can permit them to price even more optimally for customers.

Since Xometry’s launch in 2014, the company has endured several macroeconomic challenges, including the pandemic, supply chain disruptions and inflation. During that time, Xometry has attained consistently strong growth.

“There has been relatively no impact from macroeconomic conditions on Xometry’s results,” William Blair wrote. “Management noted that the shift to digital in manufacturing just makes sense and should happen irrespective of macroeconomic conditions. Customers will continue to be concerned with supply chain resilience as small manufacturers become vulnerable in a potential recession. Local manufacturers will also need to find other work if the local customers they do business with slow down.”

Xometry can help resolve both sides of the problem. Diversity in the marketplace allows Xometry to avoid capacity issues to maintain consistent lead times.

Chart courtesy of www.StockCharts.com.

Joins Kornit Four Innovative Industrial Stocks to Buy for Future Profits

Kornit Digital Ltd. (NASDAQ: KRNT), a Rosh HaAyin, Israel-based provider of sustainable, on-demand, digital fashion and textile production technologies, seeks to empower manufacturers of apparel, accessories and home goods to access “just in time” production. By eliminating preparation time to maximize manufacturing efficiency, Kornit’s systems create new opportunities for revenue to ensure profitability from large and small orders, shrink carbon footprint and mitigate vulnerability to sudden shifts in demand.

Print operations are designed to allocate their human and capital resources more effectively, grow their e-commerce business, repatriate operations and even more, William Blair wrote in a recent research note. Kornit Digital aims to give textile decorators the efficiency and agility they demand, while offering consumers the responsible production practices and self-expression they seek. The company tries to become a lynchpin for capitalizing on the digital supply chain by letting print businesses eliminate the guesswork from demand fulfillment to gain long-term success.

William Blair recently hosted Kornit Chief Executive Officer Ronen Samuel and Global Head of Investor Relations Andrew Backman at the investment firm’s conference on industrial innovation. Despite near-term challenges, there continue to be multiple secular tailwinds that should benefit Kornit and the transition to digital textile printing.

Four Innovative Industrial Stocks to Buy for Future Profits

“Historically, fashion brands project what consumers will want to wear 12 to 18 months ahead of time and produce large volumes of clothing for the upcoming seasons,”William Blair wrote. “Consumers today want to be unique, which requires brands to produce lower volume runs more often.”

In addition, the textile industry typically wastes about 30% of the inventory produced, which is roughly 144 trillion liters of wasted water annually, according to William Blair. Kornit’s machines and inks are developed to operate low volume runs economically, compared to traditional screen printing.

On the sustainability side, Kornit’s Atlas MAX system uses up to 94% less water, 67% less energy and emits 82% less greenhouse gas emissions compared to screen printing, William Blair wrote. KornitX, the company’s marketplace solution, enables on-demand production closer to the point of need, allowing brands and fulfillers to quickly fill orders and compete with e-commerce companies like Amazon (AMZN) on delivery times.

In addition, KornitX continues to gain traction with customers and allows the expansion of their businesses without the need for large capital investments. KornitX currently operates on a revenue sharing model.

Chart courtesy of www.StockCharts.com.

Deere Leaps into Four Innovative Industrial Stocks to Buy for Future Profits

Deere & Co. (NYSE: DE), an innovative agricultural machinery company headquartered Moline, Illinois, has done an “excellent job” supporting its stock price, said Michelle Connell, CEO of Dallas-based Portia Capital Management. Deere also has used technology with its machinery to maximize crop yield, Connell said.

Michelle Connell heads Portia Capital Management, of Dallas, Texas.

With an eye toward the future, Deere signed a definitive agreement to acquire majority ownership last December in Kreisel Electric, Inc., a battery technology provider in Rainbach im Mühlkreis, Austria. Kreisel develops high-density, high-durability electric battery modules and packs. Plus, Kreisel developed a charging infrastructure platform that uses patented battery technology.

Since 2014, Kreisel has developed immersion-cooled electric battery modules and packs for high-performance and off-highway applications. Kreisel has a differentiated battery technology and battery-buffered charging infrastructure to serve a global customer base across multiple end markets, including commercial vehicles, off-highway vehicles, marine, e-motorsports and other high-performance applications.

Deere management projects demand growing for batteries as a sole- or hybrid-propulsion system for off-highway vehicles. Products such as turf equipment, compact utility tractors, small tractors, compact construction and road building equipment could rely solely on batteries as a main power source. Deere keeps investing in and developing technologies to innovate, deliver value to customers and foster a future with zero emissions propulsion systems.

“Deere recently announced that it will re-shore a facility from China to Louisiana,” Connell said. “An existing facility in Louisiana will be expanded in terms of space and personnel. As this area of the country is totally dependent on the declining production of oil, this is very timely and needed.”

Chart courtesy of www.StockCharts.com.

Bivalent COVID-19 Booster Vaccines Could Boost Businesses

A new bivalent COVID-19 booster is available in the United States that gives increased protection against the omicron BA.5 variant, which has become the predominant strain of the virus. As a resident of Maryland, I received a phone call from the state’s health department on Tuesday, Oct. 11, advising me of the booster’s availability at pharmacies near my home, and I arranged to receive the vaccine last weekend.

Even though COVID cases and deaths can hurt supply and demand for innovative industrial stocks, availability of a new booster to enhance the vaccine’s efficacy is a plus for business. Cases in the country totaled 96,939,034, as of Oct. 14, while deaths jumped to 1,065,260, according to Johns Hopkins University. America has amassed the most COVID-19 deaths and cases.

Worldwide COVID-19 deaths totaled 6,566,234, as of Oct. 14, according to Johns Hopkins. Global COVID-19 cases reached 624,187,937.

Roughly 79.9% of the U.S. population, or 265,111,489, have received at least one dose of a COVID-19 vaccine, as of Oct. 12, the CDC reported. Fully vaccinated people total 226,200,755, or 68.1%, of the U.S. population, according to the CDC. The United States also has given at least one COVID-19 booster vaccine to almost 110.8 million people.

The four innovative industrial stocks to buy for profits are available at discounted prices after the market’s drop so far this year. Despite high inflation, Russia’s war in Ukraine and rising recession risk after 0.75% rate hikes by the Fed in June, July and Sept. 21, the four innovative industrial stocks to buy for profits still seem promising.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for multiple-book pricing.

The post Four Innovative Industrial Stocks to Buy for Future Profits appeared first on Stock Investor.

dow jones nasdaq stocks pandemic covid-19 blockchain oilUncategorized

The hostility Black women face in higher education carries dire consequences

9 Black women who were working on or recently earned their PhDs told a researcher they felt isolated and shut out.

Isolated. Abused. Overworked.

These are the themes that emerged when I invited nine Black women to chronicle their professional experiences and relationships with colleagues as they earned their Ph.D.s at a public university in the Midwest. I featured their writings in the dissertation I wrote to get my Ph.D. in curriculum and instruction.

The women spoke of being silenced.

“It’s not just the beating me down that is hard,” one participant told me about constantly having her intelligence questioned. “It is the fact that it feels like I’m villainized and made out to be the problem for trying to advocate for myself.”

The women told me they did not feel like they belonged. They spoke of routinely being isolated by peers and potential mentors.

One participant told me she felt that peer community, faculty mentorship and cultural affinity spaces were lacking.

Because of the isolation, participants often felt that they were missing out on various opportunities, such as funding and opportunities to get their work published.

Participants also discussed the ways they felt they were duped into taking on more than their fair share of work.

“I realized I had been tricked into handling a two- to four-person job entirely by myself,” one participant said of her paid graduate position. “This happened just about a month before the pandemic occurred so it very quickly got swept under the rug.”

Why it matters

The hostility that Black women face in higher education can be hazardous to their health. The women in my study told me they were struggling with depression, had thought about suicide and felt physically ill when they had to go to campus.

Other studies have found similar outcomes. For instance, a 2020 study of 220 U.S. Black college women ages 18-48 found that even though being seen as a strong Black woman came with its benefits – such as being thought of as resilient, hardworking, independent and nurturing – it also came at a cost to their mental and physical health.

These kinds of experiences can take a toll on women’s bodies and can result in poor maternal health, cancer, shorter life expectancy and other symptoms that impair their ability to be well.

I believe my research takes on greater urgency in light of the recent death of Antoinette “Bonnie” Candia-Bailey, who was vice president of student affairs at Lincoln University. Before she died by suicide, she reportedly wrote that she felt she was suffering abuse and that the university wasn’t taking her mental health concerns seriously.

What other research is being done

Several anthologies examine the negative experiences that Black women experience in academia. They include education scholars Venus Evans-Winters and Bettina Love’s edited volume, “Black Feminism in Education,” which examines how Black women navigate what it means to be a scholar in a “white supremacist patriarchal society.” Gender and sexuality studies scholar Stephanie Evans analyzes the barriers that Black women faced in accessing higher education from 1850 to 1954. In “Black Women, Ivory Tower,” African American studies professor Jasmine Harris recounts her own traumatic experiences in the world of higher education.

What’s next

In addition to publishing the findings of my research study, I plan to continue exploring the depths of Black women’s experiences in academia, expanding my research to include undergraduate students, as well as faculty and staff.

I believe this research will strengthen this field of study and enable people who work in higher education to develop and implement more comprehensive solutions.

The Research Brief is a short take on interesting academic work.

Ebony Aya received funding from the Black Collective Foundation in 2022 to support the work of the Aya Collective.

depression pandemicUncategorized

US Economic Growth Still Expected To Slow In Q1 GDP Report

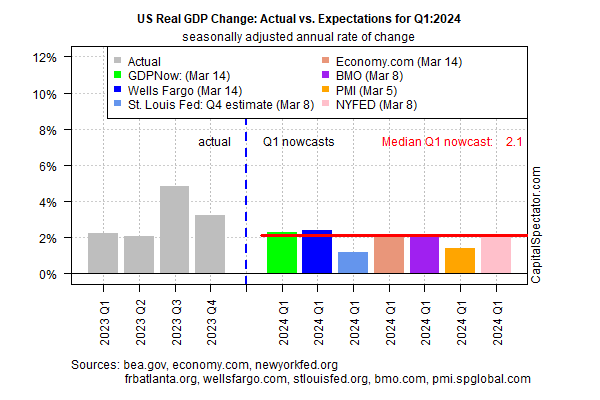

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised…

A new round of nowcasts continue to estimate that US economic activity will downshift in next month’s release of first-quarter GDP data. Today’s revised estimate is based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Output for the January-through-March period is currently projected to soften to a 2.1% increase (seasonally adjusted annual rate). The estimate reflects a substantially softer rise vs. Q4’s strong 3.2% advance, which in turn marks a downshift from Q3’s red-hot 4.9% increase, according to government data.

Today’s revised Q1 estimate was essentially unchanged from the previous Q1 nowcast (published on Mar. 7). At this late date in the current quarter, the odds are relatively high that the current median estimate is a reasonable guesstimate for the actual GDP data that the Bureau of Economic Analysis will publish in late-April.

GDP rising at roughly a 2% pace marks another slowdown from recent quarters, but if the current nowcast is correct it suggests that recession risk remains low. The question is whether the slowdown persists into Q2 and beyond. Given the expected deceleration in growth on tap for Q1, the economy may be flirting with a tipping point for recession later in the year. It’s premature to make such a forecast with high confidence, but it’s a scenario that’s increasingly plausible, albeit speculatively so for now.

Yesterday’s release of retail sales numbers for February aligns with the possibility that even softer growth is coming. Although spending rebounded last month after January’s steep decline, the bounce was lowr than expected.

“The modest rebound in retail sales in February suggests that consumer spending growth slowed in early 2024,” says Michael Pearce, Oxford Economics deputy chief US economist.

Reviewing retail spending on a year-over-year basis provides a clearer view of the softer-growth profile. The pace edged up to 1.5% last month vs. the year-earlier level, but that’s close to the slowest increase in the post-pandemic recovery.

Despite emerging signs of slowing growth, relief for the economy in the form of interest-rate cuts may be further out in time than recently expected, due to the latest round of sticky inflation news this week.

“When the Fed is contemplating a series of rate cuts and is confronted by suddenly slower economic growth and suddenly brisker inflation, they will respond to the new news on the inflation side every time,” says Chris Low, chief economist at FHN Financial. “After all, this is not the first time in the past couple of years consumers have paused spending for a couple of months to catch their breath.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

recession pandemic economic growth fed recession gdp recovery consumer spending

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocks-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A