Uncategorized

Film capacitor market 2023-2027; a descriptive analysis of the five forces model, market dynamics, and segmentation – Technavio

Film capacitor market 2023-2027; a descriptive analysis of the five forces model, market dynamics, and segmentation – Technavio

PR Newswire

NEW YORK, Jan. 11, 2023

NEW YORK, Jan. 11, 2023 /PRNewswire/ — According to Technavio, the global film capa…

Film capacitor market 2023-2027; a descriptive analysis of the five forces model, market dynamics, and segmentation - Technavio

PR Newswire

NEW YORK, Jan. 11, 2023

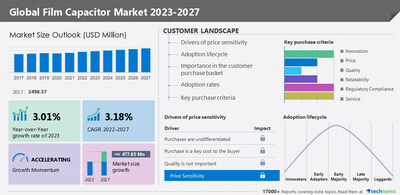

NEW YORK, Jan. 11, 2023 /PRNewswire/ -- According to Technavio, the global film capacitor market size is estimated to grow by USD 477.85 million from 2022 to 2027. The market is estimated to grow at a CAGR of 3.18% during the forecast period. APAC held the largest share of the global market in 2022, and the market in the region is estimated to witness an incremental growth of 69%. For more insights on market size, Request a sample report

The global cloud data warehouse market is fragmented, and the five forces analysis covers –

- Bargaining Power of Buyers

- The threat of New Entrants

- Threat of Rivalry

- Bargaining Power of Suppliers

- Threat of Substitutes

- Interpretation of porter's five models helps to strategize the business, for entire details – buy the report!

The report includes the market's adoption lifecycle, from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Segment Overview

Technavio has segmented the market based on Type (Polyester film capacitors, Polypropylene film capacitors, PTFE film capacitors, and Others), Application (AC applications and DC applications), and Geography (APAC, Europe, North America, Middle East and Africa, and South America).

- The market share growth by the polyester film capacitor segment will be significant during the forecast period. Polyester film capacitors are priced at very low prices and hence, they are procured on a large scale by end-users. Additionally, the increased use of polyester film capacitors in various power applications such as coupling and decoupling is driving the growth of the segment.

By geography, the global film capacitor market is segmented into APAC, Europe, North America, Middle East and Africa, and South America. The report provides actionable insights and estimates the contribution of all regions to the growth of the global film capacitor market.

- APAC is estimated to contribute 69% to the growth of the global market during the forecast period. Factors such as increasing investments in power grid projects and the rising focus on renewable energy production are driving the growth of the film capacitor market in APAC.

Key factor driving market growth

- The market is driven by increasing investments in R&D.

- The lack of product differentiation in the market has driven many vendors to develop new products by identifying new materials that can be used as a dielectric.

- They are heavily investing in R&D to develop products that can be used in next-generation applications such as artificial intelligence (AI), robotics, machine learning, and quantum computing.

- For example, in July 2020, Exxelia unveiled two new film capacitors, series 253P and 560P, which can deliver great performance even at high temperatures up to 200 degrees C.

- Such product innovations among vendors are expected to drive the growth of the market film capacitors market during the forecast period.

Leading trends influencing the market

- The introduction of nanolayer film capacitors is the key trend in the market.

- Improving the energy density of the dielectric material is crucial for enhancing the dielectric strength.

- Thus, it is essential to reduce the overall size of the component. Also, film capacitors should be able to operate at higher temperatures to make them useful in industrial applications.

- This can be achieved with a nanolayer dielectric. It has a high energy density, which is a desired feature in the development of next-generation capacitors.

- Nanolayer dielectrics are considered the next-generation polymer dielectrics that can be used in power electronics, printable technology, and pulsed power technology sectors.

- The advent of nanolayer dielectrics is expected to positively influence the growth of the market during the forecast period.

Major challenges hindering market growth

- The increasing number of counterfeit products is identified as the key challenge in the market.

- The number of counterfeit products is increasing in the market. These products are relatively inexpensive when compared with real products.

- They are made of passive components such as resistors, inductors, and capacitors on a circuit board.

- Some of the counterfeit manufacturers make capacitors from scrap materials, which results in wrong capacitance values.

- The use of such counterfeit products can cause severe damage to the device, equipment, or power systems they are used in.

- The increasing availability of such counterfeit products is reducing the growth potential in the market.

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the film capacitor market between 2023 and 2027

- Precise estimation of the size of the film capacitor market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the film capacitor market industry across APAC, Europe, North America, Middle East and Africa, and South America

- A thorough analysis of the market's competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of film capacitor market vendors

Gain instant access to 17,000+ market research reports.

Technavio's SUBSCRIPTION platform

- The printed circuit board (PCB) market is estimated to grow at a CAGR of 5.05% between 2022 and 2027. The size of the market is forecast to increase by USD 19,059.2 million. The rising adoption of smartphones is notably driving the printed circuit board market growth, although factors such as rising environmental concerns over the disposal of PCBs may impede the market growth.

- The motherboard market is estimated to grow at a CAGR of 17.53% between 2022 and 2027. The size of the market is forecast to increase by USD 10,466.71 million. The rising adoption of smartphones is notably driving the market growth, although factors such as the availability of substitutes may impede the market growth.

Film Capacitor Market Scope | |

Report Coverage | Details |

Page number | 168 |

Base year | 2022 |

Historic period | 2017-2021 |

Forecast period | 2023-2027 |

Growth momentum & CAGR | Accelerate at a CAGR of 3.18% |

Market growth 2023-2027 | USD 477.85 million |

Market structure | Fragmented |

YoY growth 2022-2023 (%) | 3.01 |

Regional analysis | APAC, Europe, North America, Middle East and Africa, and South America |

Performing market contribution | APAC at 69% |

Key countries | US, China, Japan, Germany, and UK |

Competitive landscape | Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

Key companies profiled | Cefem Group, Cornell Dubilier Electronics Inc., Custom Electronics Inc., DongGuan Xuansn Electronic Tech, Electro Technik Industrtries Inc., Foshan Shunde District Sheng Ye, Hi Fi Collective Ltd., Hitachi Ltd., Icel Srl, Kyocera Corp., NICHICON Corp., Ningbo Topo Electronic Co. Ltd., Panasonic Holdings Corp., Suntan Technology Co. Ltd., TDK Corp., Vishay Intertechnology Inc., WIMA GmbH and Co. KG, Wurth Elektronik GmbH and Co. KG, XIAMEN FARATRONIC Co. Ltd., and Yageo Corp. |

Market dynamics | Parent market analysis, market growth inducers and obstacles, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and market condition analysis for the forecast period. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Type

- Exhibit 06: Executive Summary – Chart on Market Segmentation by Application

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global - Market size and forecast 2022-2027 ($ million)

- Exhibit 15: Data Table on Global - Market size and forecast 2022-2027 ($ million)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global film capacitor market 2017 - 2021

- Exhibit 18: Historic Market Size – Data Table on Global film capacitor market 2017 - 2021 ($ million)

- 4.2 Type Segment Analysis 2017 - 2021

- Exhibit 19: Historic Market Size – Type Segment 2017 - 2021 ($ million)

- 4.3 Application Segment Analysis 2017 - 2021

- Exhibit 20: Historic Market Size – Application Segment 2017 - 2021 ($ million)

- 4.4 Geography Segment Analysis 2017 - 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 - 2021 ($ million)

- 4.5 Country Segment Analysis 2017 - 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 - 2021 ($ million)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis - Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition - Five forces 2022 and 2027

6 Market Segmentation by Type

- 6.1 Market segments

- Exhibit 30: Chart on Type - Market share 2022-2027 (%)

- Exhibit 31: Data Table on Type - Market share 2022-2027 (%)

- 6.2 Comparison by Type

- Exhibit 32: Chart on Comparison by Type

- Exhibit 33: Data Table on Comparison by Type

- 6.3 Polyester film capacitors - Market size and forecast 2022-2027

- Exhibit 34: Chart on Polyester film capacitors - Market size and forecast 2022-2027 ($ million)

- Exhibit 35: Data Table on Polyester film capacitors - Market size and forecast 2022-2027 ($ million)

- Exhibit 36: Chart on Polyester film capacitors - Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Polyester film capacitors - Year-over-year growth 2022-2027 (%)

- 6.4 Polypropylene film capacitors - Market size and forecast 2022-2027

- Exhibit 38: Chart on Polypropylene film capacitors - Market size and forecast 2022-2027 ($ million)

- Exhibit 39: Data Table on Polypropylene film capacitors - Market size and forecast 2022-2027 ($ million)

- Exhibit 40: Chart on Polypropylene film capacitors - Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Polypropylene film capacitors - Year-over-year growth 2022-2027 (%)

- 6.5 PTFE film capacitors - Market size and forecast 2022-2027

- Exhibit 42: Chart on PTFE film capacitors - Market size and forecast 2022-2027 ($ million)

- Exhibit 43: Data Table on PTFE film capacitors - Market size and forecast 2022-2027 ($ million)

- Exhibit 44: Chart on PTFE film capacitors - Year-over-year growth 2022-2027 (%)

- Exhibit 45: Data Table on PTFE film capacitors - Year-over-year growth 2022-2027 (%)

- 6.6 Others - Market size and forecast 2022-2027

- Exhibit 46: Chart on Others - Market size and forecast 2022-2027 ($ million)

- Exhibit 47: Data Table on Others - Market size and forecast 2022-2027 ($ million)

- Exhibit 48: Chart on Others - Year-over-year growth 2022-2027 (%)

- Exhibit 49: Data Table on Others - Year-over-year growth 2022-2027 (%)

- 6.7 Market opportunity by Type

- Exhibit 50: Market opportunity by Type ($ million)

7 Market Segmentation by Application

- 7.1 Market segments

- Exhibit 51: Chart on Application - Market share 2022-2027 (%)

- Exhibit 52: Data Table on Application - Market share 2022-2027 (%)

- 7.2 Comparison by Application

- Exhibit 53: Chart on Comparison by Application

- Exhibit 54: Data Table on Comparison by Application

- 7.3 AC applications - Market size and forecast 2022-2027

- Exhibit 55: Chart on AC applications - Market size and forecast 2022-2027 ($ million)

- Exhibit 56: Data Table on AC applications - Market size and forecast 2022-2027 ($ million)

- Exhibit 57: Chart on AC applications - Year-over-year growth 2022-2027 (%)

- Exhibit 58: Data Table on AC applications - Year-over-year growth 2022-2027 (%)

- 7.4 DC applications - Market size and forecast 2022-2027

- Exhibit 59: Chart on DC applications - Market size and forecast 2022-2027 ($ million)

- Exhibit 60: Data Table on DC applications - Market size and forecast 2022-2027 ($ million)

- Exhibit 61: Chart on DC applications - Year-over-year growth 2022-2027 (%)

- Exhibit 62: Data Table on DC applications - Year-over-year growth 2022-2027 (%)

- 7.5 Market opportunity by Application

- Exhibit 63: Market opportunity by Application ($ million)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 64: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 65: Chart on Market share by geography 2022-2027 (%)

- Exhibit 66: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 67: Chart on Geographic comparison

- Exhibit 68: Data Table on Geographic comparison

- 9.3 APAC - Market size and forecast 2022-2027

- Exhibit 69: Chart on APAC - Market size and forecast 2022-2027 ($ million)

- Exhibit 70: Data Table on APAC - Market size and forecast 2022-2027 ($ million)

- Exhibit 71: Chart on APAC - Year-over-year growth 2022-2027 (%)

- Exhibit 72: Data Table on APAC - Year-over-year growth 2022-2027 (%)

- 9.4 Europe - Market size and forecast 2022-2027

- Exhibit 73: Chart on Europe - Market size and forecast 2022-2027 ($ million)

- Exhibit 74: Data Table on Europe - Market size and forecast 2022-2027 ($ million)

- Exhibit 75: Chart on Europe - Year-over-year growth 2022-2027 (%)

- Exhibit 76: Data Table on Europe - Year-over-year growth 2022-2027 (%)

- 9.5 North America - Market size and forecast 2022-2027

- Exhibit 77: Chart on North America - Market size and forecast 2022-2027 ($ million)

- Exhibit 78: Data Table on North America - Market size and forecast 2022-2027 ($ million)

- Exhibit 79: Chart on North America - Year-over-year growth 2022-2027 (%)

- Exhibit 80: Data Table on North America - Year-over-year growth 2022-2027 (%)

- 9.6 Middle East and Africa - Market size and forecast 2022-2027

- Exhibit 81: Chart on Middle East and Africa - Market size and forecast 2022-2027 ($ million)

- Exhibit 82: Data Table on Middle East and Africa - Market size and forecast 2022-2027 ($ million)

- Exhibit 83: Chart on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- Exhibit 84: Data Table on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- 9.7 South America - Market size and forecast 2022-2027

- Exhibit 85: Chart on South America - Market size and forecast 2022-2027 ($ million)

- Exhibit 86: Data Table on South America - Market size and forecast 2022-2027 ($ million)

- Exhibit 87: Chart on South America - Year-over-year growth 2022-2027 (%)

- Exhibit 88: Data Table on South America - Year-over-year growth 2022-2027 (%)

- 9.8 China - Market size and forecast 2022-2027

- Exhibit 89: Chart on China - Market size and forecast 2022-2027 ($ million)

- Exhibit 90: Data Table on China - Market size and forecast 2022-2027 ($ million)

- Exhibit 91: Chart on China - Year-over-year growth 2022-2027 (%)

- Exhibit 92: Data Table on China - Year-over-year growth 2022-2027 (%)

- 9.9 US - Market size and forecast 2022-2027

- Exhibit 93: Chart on US - Market size and forecast 2022-2027 ($ million)

- Exhibit 94: Data Table on US - Market size and forecast 2022-2027 ($ million)

- Exhibit 95: Chart on US - Year-over-year growth 2022-2027 (%)

- Exhibit 96: Data Table on US - Year-over-year growth 2022-2027 (%)

- 9.10 Japan - Market size and forecast 2022-2027

- Exhibit 97: Chart on Japan - Market size and forecast 2022-2027 ($ million)

- Exhibit 98: Data Table on Japan - Market size and forecast 2022-2027 ($ million)

- Exhibit 99: Chart on Japan - Year-over-year growth 2022-2027 (%)

- Exhibit 100: Data Table on Japan - Year-over-year growth 2022-2027 (%)

- 9.11 Germany - Market size and forecast 2022-2027

- Exhibit 101: Chart on Germany - Market size and forecast 2022-2027 ($ million)

- Exhibit 102: Data Table on Germany - Market size and forecast 2022-2027 ($ million)

- Exhibit 103: Chart on Germany - Year-over-year growth 2022-2027 (%)

- Exhibit 104: Data Table on Germany - Year-over-year growth 2022-2027 (%)

- 9.12 UK - Market size and forecast 2022-2027

- Exhibit 105: Chart on UK - Market size and forecast 2022-2027 ($ million)

- Exhibit 106: Data Table on UK - Market size and forecast 2022-2027 ($ million)

- Exhibit 107: Chart on UK - Year-over-year growth 2022-2027 (%)

- Exhibit 108: Data Table on UK - Year-over-year growth 2022-2027 (%)

- 9.13 Market opportunity by geography

- Exhibit 109: Market opportunity by geography ($ million)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 110: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 111: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 112: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 113: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 114: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 115: Matrix on vendor position and classification

- 12.3 Cornell Dubilier Electronics Inc.

- Exhibit 116: Cornell Dubilier Electronics Inc. - Overview

- Exhibit 117: Cornell Dubilier Electronics Inc. - Product / Service

- Exhibit 118: Cornell Dubilier Electronics Inc. - Key offerings

- 12.4 Custom Electronics Inc.

- Exhibit 119: Custom Electronics Inc. - Overview

- Exhibit 120: Custom Electronics Inc. - Product / Service

- Exhibit 121: Custom Electronics Inc. - Key offerings

- 12.5 Foshan Shunde District Sheng Ye

- Exhibit 122: Foshan Shunde District Sheng Ye - Overview

- Exhibit 123: Foshan Shunde District Sheng Ye - Product / Service

- Exhibit 124: Foshan Shunde District Sheng Ye - Key offerings

- 12.6 Hi Fi Collective Ltd.

- Exhibit 125: Hi Fi Collective Ltd. - Overview

- Exhibit 126: Hi Fi Collective Ltd. - Product / Service

- Exhibit 127: Hi Fi Collective Ltd. - Key offerings

- 12.7 Hitachi Ltd.

- Exhibit 128: Hitachi Ltd. - Overview

- Exhibit 129: Hitachi Ltd. - Business segments

- Exhibit 130: Hitachi Ltd. - Key news

- Exhibit 131: Hitachi Ltd. - Key offerings

- Exhibit 132: Hitachi Ltd. - Segment focus

- 12.8 Icel Srl

- Exhibit 133: Icel Srl - Overview

- Exhibit 134: Icel Srl - Product / Service

- Exhibit 135: Icel Srl - Key offerings

- 12.9 Kyocera Corp.

- Exhibit 136: Kyocera Corp. - Overview

- Exhibit 137: Kyocera Corp. - Business segments

- Exhibit 138: Kyocera Corp. - Key offerings

- Exhibit 139: Kyocera Corp. - Segment focus

- 12.10 NICHICON Corp.

- Exhibit 140: NICHICON Corp. - Overview

- Exhibit 141: NICHICON Corp. - Product / Service

- Exhibit 142: NICHICON Corp. - Key offerings

- 12.11 Panasonic Holdings Corp.

- Exhibit 143: Panasonic Holdings Corp. - Overview

- Exhibit 144: Panasonic Holdings Corp. - Business segments

- Exhibit 145: Panasonic Holdings Corp. - Key news

- Exhibit 146: Panasonic Holdings Corp. - Key offerings

- Exhibit 147: Panasonic Holdings Corp. - Segment focus

- 12.12 Suntan Technology Co. Ltd.

- Exhibit 148: Suntan Technology Co. Ltd. - Overview

- Exhibit 149: Suntan Technology Co. Ltd. - Product / Service

- Exhibit 150: Suntan Technology Co. Ltd. - Key offerings

- 12.13 TDK Corp.

- Exhibit 151: TDK Corp. - Overview

- Exhibit 152: TDK Corp. - Business segments

- Exhibit 153: TDK Corp. - Key news

- Exhibit 154: TDK Corp. - Key offerings

- Exhibit 155: TDK Corp. - Segment focus

- 12.14 Vishay Intertechnology Inc.

- Exhibit 156: Vishay Intertechnology Inc. - Overview

- Exhibit 157: Vishay Intertechnology Inc. - Business segments

- Exhibit 158: Vishay Intertechnology Inc. - Key news

- Exhibit 159: Vishay Intertechnology Inc. - Key offerings

- Exhibit 160: Vishay Intertechnology Inc. - Segment focus

- 12.15 WIMA GmbH and Co. KG

- Exhibit 161: WIMA GmbH and Co. KG - Overview

- Exhibit 162: WIMA GmbH and Co. KG - Product / Service

- Exhibit 163: WIMA GmbH and Co. KG - Key offerings

- 12.16 XIAMEN FARATRONIC Co. Ltd.

- Exhibit 164: XIAMEN FARATRONIC Co. Ltd. - Overview

- Exhibit 165: XIAMEN FARATRONIC Co. Ltd. - Product / Service

- Exhibit 166: XIAMEN FARATRONIC Co. Ltd. - Key offerings

- 12.17 Yageo Corp.

- Exhibit 167: Yageo Corp. - Overview

- Exhibit 168: Yageo Corp. - Business segments

- Exhibit 169: Yageo Corp. - Key offerings

- Exhibit 170: Yageo Corp. - Segment focus

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 171: Inclusions checklist

- Exhibit 172: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 173: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 174: Research methodology

- Exhibit 175: Validation techniques employed for market sizing

- Exhibit 176: Information sources

- 13.5 List of abbreviations

- Exhibit 177: List of abbreviations

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/film-capacitor-market-2023-2027-a-descriptive-analysis-of-the-five-forces-model-market-dynamics-and-segmentation---technavio-301716688.html

SOURCE Technavio

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemployment-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex