FDA Approves Direct Biologics to Proceed with a Landmark Phase 3 Acute Respiratory Distress Syndrome (ARDS) Trial

FDA Approves Direct Biologics to Proceed with a Landmark Phase 3 Acute Respiratory Distress Syndrome (ARDS) Trial

PR Newswire

AUSTIN, Texas, April 21, 2022

AUSTIN, Texas, April 21, 2022 /PRNewswire/ — Direct Biologics, a regenerative biotechnology…

FDA Approves Direct Biologics to Proceed with a Landmark Phase 3 Acute Respiratory Distress Syndrome (ARDS) Trial

PR Newswire

AUSTIN, Texas, April 21, 2022

AUSTIN, Texas, April 21, 2022 /PRNewswire/ -- Direct Biologics, a regenerative biotechnology company with a groundbreaking extracellular vesicle (EV) platform technology, announced today that the FDA has approved the company to proceed with its Phase 3 clinical trial using its investigational EV drug, ExoFlo, to treat Acute Respiratory Distress Syndrome (ARDS) due to Covid-19. Direct Biologics is the first and only EV company to receive FDA Phase 3 approval for an Investigational New Drug (IND) indication to date.

The Phase 3 trial will be conducted under the auspices of the first Regenerative Medicine Advanced Therapy (RMAT) designation approved by the FDA for an EV therapeutic, making Direct Biologics one of only 70 companies in the history of the FDA to have been officially awarded RMAT. Like the fast track and breakthrough designations, the RMAT was created by the FDA to expedite approval for promising regenerative medicines which demonstrate the ability to treat serious life-threatening diseases.

"Receiving FDA approval for Phase 3 is a key milestone for Direct Biologics," said Mark Adams, Co-Founder and CEO. "Coupled with the RMAT designation, we are now on an accelerated path towards commercialization with a potential life-saving drug—ExoFlo. This Phase 3 trial titled "Extinguish Covid-19" is an international, multicenter, double-blind, randomized, placebo-controlled Phase 3 trial. Our objective is to enroll patients with ARDS in hospital sites across US, Spain, India, Jordan, Egypt, Lebanon, and South Africa, and to demonstrate a significant mortality reduction following treatment with ExoFlo compared to standard of care alone. As pioneers in the field of regenerative medical therapies, we at Direct Biologics are changing the future of medicine."

"Whether Covid-19 remains a pandemic or becomes an endemic, one area of unmet need remains the same: an effective therapeutic for ARDS. People over age 65 and those with comorbidities, once infected with SARS-CoV-2, will always be vulnerable to progression to severe infection and ARDS," said Joe Schmidt, Co-Founder and President. "Revealing robust safety and a promising 60-day mortality reduction, our Phase 2 trial showed that ExoFlo can make a profound life-saving difference for patients hospitalized with ARDS. Receiving FDA approval to proceed to Phase 3 is a monumental achievement because there is no known treatment for ARDS. Physicians and patients across the world have long been waiting for a solution."

"Working to develop ExoFlo is a privilege," said Dr. Vik Sengupta, Chief Medical Officer. "The growing body of clinical data indicates that ExoFlo is a drug that brings hope to the treatment of a disease for which the standard of care has not improved in decades. This hope is most poignantly captured by the stories of patients who have received ExoFlo for treatment. Just last week, a woman in Virginia was reunited with her children after languishing on mechanical ventilator for 2 months due to developing ARDS induced by Covid-19. But in a final attempt to save the patient's life, the ICU physicians petitioned to treat her with ExoFlo under compassionate use, and she made a miraculous recovery. There are millions of people like her who never make it out of the hospital. We want to change that story by establishing ExoFlo as the gold standard treatment for ARDS and making it accessible to patients in hospitals around the world."

About Direct Biologics

Headquartered in Austin, TX, Direct Biologics is a market-leading innovator and cGMP manufacturer of regenerative medicine products. The flagship product, ExoFlo, contains thousands of signals in the form of regulatory proteins, microRNA, and messenger RNA that are responsible for cell-to-cell communication. ExoFlo harnesses the natural healing power of mesenchymal stem cells (MSC) without requiring the addition of stem cells themselves. Physicians can learn more at clinicaltrials.gov. For more information on Direct Biologics and regenerative medicine, visit directbiologics.com.

View original content to download multimedia:https://www.prnewswire.com/news-releases/fda-approves-direct-biologics-to-proceed-with-a-landmark-phase-3-acute-respiratory-distress-syndrome-ards-trial-301530556.html

SOURCE Direct Biologics

Spread & Containment

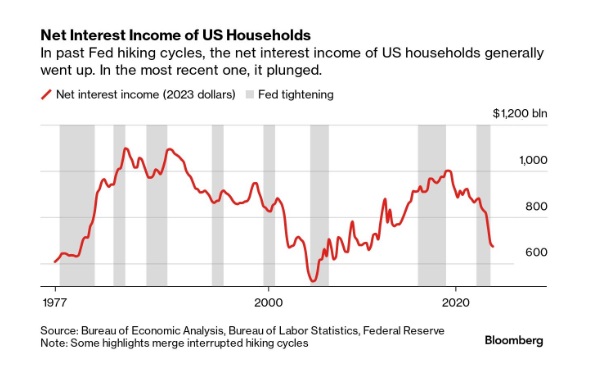

Household Net Interest Income Falls As Rates Spike

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemicUncategorized

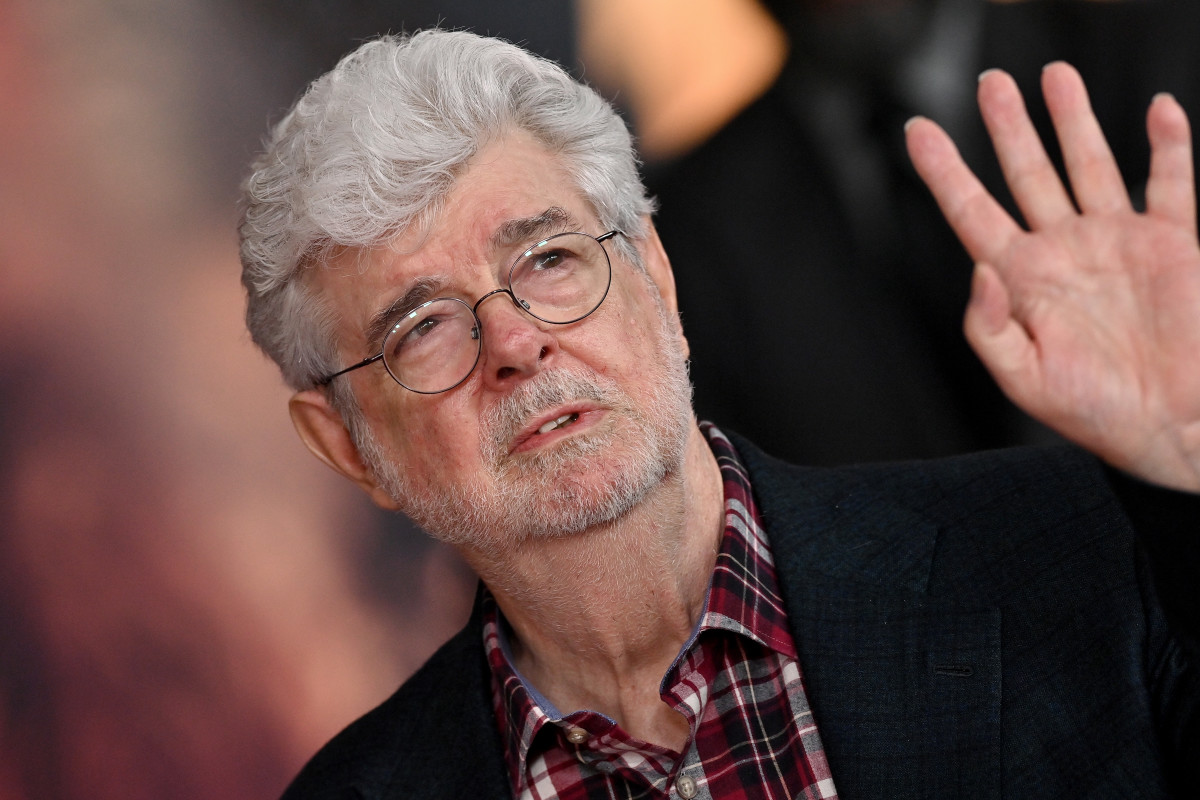

Star Wars icon gives his support to Disney, Bob Iger

Disney shareholders have a huge decision to make on April 3.

Disney's (DIS) been facing some headwinds up top, but its leadership just got backing from one of the company's more prominent investors.

Star Wars creator George Lucas put out of statement in support of the company's current leadership team, led by CEO Bob Iger, ahead of the April 3 shareholders meeting which will see investors vote on the company's 12-member board.

"Creating magic is not for amateurs," Lucas said in a statement. "When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same."

Related: Disney stands against Nelson Peltz as leadership succession plan heats up

Lucasfilm was acquired by Disney for $4 billion in 2012 — notably under the first term of Iger. He received over 37 million in shares of Disney during the acquisition.

Lucas' statement seems to be an attempt to push investors away from the criticism coming from The Trian Partners investment group, led by Nelson Peltz. The group, owns about $3 million in shares of the media giant, is pushing two candidates for positions on the board, which are Peltz and former Disney CFO Jay Rasulo.

Peltz and Co. have called out a pair of Disney directors — Michael Froman and Maria Elena Lagomasino — for their lack of experience in the media space.

Related: Women's basketball is gaining ground, but is March Madness ready to rival the men's game?

Blackwells Capital is also pushing three of its candidates to take seats during the early April shareholder meeting, though Reuters has reported that the firm has been supportive of the company's current direction.

Disney has struggled in recent years amid the changes in media and the effects of the pandemic — which triggered the return of Iger at the helm in late 2022. After going through mass layoffs in the spring of 2023 and focusing on key growth brands, the company has seen a steady recovery with its stock up over 25% year-to-date and around 40% for the last six months.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic recovery-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex