International

Falcon’s Chief Executive Officer, Issues Corporate Update Letter

Falcon Gold Corp. (TSXV:FG)(GR:3FA)(OTCQB:FGLDF); ("Falcon" or the "Company") is pleased to announce a corporate update letter to shareholders in an address from its Chief Executive Officer Karim RayaniDear Shareholders:As a new year begins, I would like.

Falcon Gold Corp. (TSXV:FG)(GR:3FA)(OTCQB:FGLDF); ("Falcon" or the "Company") is pleased to announce a corporate update letter to shareholders in an address from its Chief Executive Officer Karim Rayani

Dear Shareholders:

As a new year begins, I would like to share some of our successes over the past year and objectives for the ensuing year. With the world scale pandemic continuing its attack on the globe, it can be sometimes hard to discern the clear road ahead. Despite all that is happening, my commitment remains the same to our Company since the first day I signed on as Chief Executive Officer. My focus is and always has been on creating shareholder value, and it will be no different as we embark on a new year. I'm very pleased with Falcon's progress during 2021, we have a clear roadmap going into 2022 and we are committed to continuing that success.

Central Canada Project

We continue to make great progress at the historic Central Canada gold mine trend in the developing Atikokan camp. This flagship project lies just 20 kms southeast of Agnico Eagles Hammond Reef Deposit which hosts a measured resource of 3.32 million ounces of gold.

Falcon has completed two successful rounds of drilling that complement and validate the historic workings as we work towards our main goal of delineating a resource. In addition to the extensive mapping and sampling of outcrop exposures of the Central Canada mine trend, Falcon has received the reinterpretation of the 2021 heliborne high-resolution magnetic and time-domain electromagnetic survey utilizing artificial intelligent (AI) computer analyses. This type of AI system is an evolving and promising application that may be capable of identifying areas of complex folding and faulting and could accelerate the process of deciphering and modelling the complex structural setting of the property.

Through our past year exploration efforts, we are now pleased to report that the Central Canada Mine trend has been extended to a strike length of over 140m. This mine trend includes the historical J.J. Walshe Shaft. Detailed mapping and sampling across the property also resulted in new discoveries of the Sugar Shear, Monte, Honey, and Hoist Zones. The Sugar Shear returned grab sample results up to 23 g/t Au and has been traced on surface for over 360m and presents a previously undocumented target of high merit for future exploration efforts (Figure 1).

Figure 1. Gold-bearing zones of the Central Canada gold project.

The company is now ready to begin an exciting chapter in its future exploration efforts at Central Canada. Plans are in place to begin a Phase 3 drilling program. The objective of the drilling will be to target the gold mineralization in the J.J. Walshe shaft area and to test other strong gold-bearing zones such as the No. 2 Vein, the Sugar Shear Zone and drill the Honey Zone. As the snow melts in the spring, summer programs will consist of further mapping, ground-truthing the targets of merit highlighted by the AI analyses, stripping and a Phase 4 drill program scheduled for the fall of 2022.

Newfoundland Acquisitions

Falcon continues to search out opportunities and build value by project generation and has made a number of acquisitions in Central Newfoundland as of late. The Hope Brook and Baie Verte Projects are the first in a number of announcements to come. Both these acquisitions are very strategic in our long-term objective of securing key areas that have seen little historical exploration and host structural similarities to the recent success of the Newfoundland exploration boom. The ever-evolving understanding of the geological nature of the central Newfoundland gold belt is also presenting opportunities through the success of First Mining, Sokoman-Benton JV and Matador Resources which all have a large presence in the area with defined resources. Matador's Cape Ray deposit hosts 837,000 ounces of Au at an average grade of 2 g/t and is contiguous to Falcon's ground. First Mining's Hope Brook project located to the south of Falcon has a resource of 5.5 million tonnes containing 844,000 ounces Au grading 4.77 g/t. Falcon's claims are located along the same structural trend as the Hope Brook Project.

Not only known for its gold the Hope Brook camp is quickly becoming an area of interest for lithium, just recently the Benton - Sokoman JV announced the first lithium-bearing pegmatite discovery located 400m meters away from our property boundary. Recent geophysical interpretation shows the same controlling structures that host the Kraken Pegmatite dyke swarm discovered by Benton-Sokoman extend onto Falcon's ground. Falcon now controls a large footprint in the Hope Brook camp of the southern central Newfoundland gold belt along key structural trends and the discovery of lithium in the area presents an additional layer of potential success for more discoveries. The Company has applied for the necessary permitting and is looking forward to mobilizing crews as soon as conditions allow.

Falcon's Baie Verte project consisting of 13,700 hectares is located along the Baie Verte Brompton Line (BVBL) of the central Newfoundland gold belt. The BVBL is a major crustal scale structural feature and through the Baie Verte peninsula and currently hosts all of Newfoundland's gold production. Current producing mines include Anaconda Mining Inc.'s Point Rousse gold mine and Rambler Metals Mining operations. Former producing mines include the Terra Nova mine and deposits of the Rambler mining camp. All these current gold mines and former producers are in close proximity to the Baie Verte Brompton line. Additionally, there are more than 100 gold prospects along the BVBL, and Falcon has taken advantage of this key structural corridor having acquired ground over a 70 km strike length.

On November 17th Falcon announced a strategic partnership with Marvel Discovery in the Hope Brook camp of the central Newfoundland gold belt. Called the Golden Brook, this strategic alliance covers additional ground along the Baie Verte Brompton Line. The 50-50 joint venture between Falcon and Marvel now brings total landholdings to 115,000 hectares. This alliance provides numerous upside potential to both companies including synergies of shared capital and administration costs while collectively targeting those areas of high merit for a Tier 1 gold discovery that is not hampered by property boundaries.

The newly formed JV also controls strategic ground 13 kilometers (km) southwest of the Glover Island (GI) trend. The GI trend is an 11km mineralized corridor host to 17 base metal, polymetallic mineral prospects and numerous gold showings and anomalies. The GI trend hosts the Lunch Pond South deposit with inferred resources of 120,000 ounces of gold. Not only known for its base and precious metals, the GI Trend and BVBL corridor contains the Four Corners project which hosts an apparent large iron-titanium-vanadium bearing deposit owned by Triple Nine Resources. This deposit has thus far been outlined for over 3km in length with widths of up to 200m and to a depth of 600m. The Falcon-Marvel JV is well positioned along this important mineralized corridor and by combining exploration strategies and synergies is well poised for success.

British Columbia Projects:

Gaspard Claims

Falcon announced on February 4, 2021, the acquisition of the Gaspard Gold Claims near Spences Bridge. The Gaspard claims are located in what may be an extension of the Spences Bridge gold belt. The Spences Bridge gold belt is host to several significant developing gold deposits such as Westhaven Gold Corp.'s Shovelnose gold project and the Blackdome Zone gold-silver deposit owned by Tempus Resources. The former Blackdome mine produced 225,000 of gold at an average grade of 20 g/t Au. The Blackdome has a reported resources of 144,500 tonnes with an average grade of 11.29 grams per tonne gold and 50.01 g/t silver, and an inferred resource of 90,600 tonnes grading 8.79 g/t gold and 18.61 g/t silver (Tempus Resources Ltd.) The Blackdome is classified as low-sulphidation epithermal gold and silver mineralization and represents a similar target type for the Gaspard claims.

Historical exploration programs at Gaspard reported anomalous heavy mineral concentrate stream sediments returning grades from 94 parts per billion gold to 5,910 parts per billion gold within four adjacent streams. This defines a continuous gold anomaly over an upstream distance of 1.8km. To date, Falcon has completed its first phase of exploration to delineate and investigate the styles of gold mineralization associated with this stream sediment anomaly.

Falcon has fulfilled its obligations in expenditures during the 2021 field season and now controls 100% interest in the project.

Sunny Boy-Spitfire

On August 09, 2021, the Company announced the commencement of Phase 2 exploration efforts at the High-Grade Sunny Boy-Spitfire project near Merritt B.C. The company's first phase in 2020, was successful in identifying gold mineralization over a 300-metre strike length through grab and channel sampling. Highlights of the September 2020, sampling program were a 2.2 m channel sample that averaged 59.8 g/t Au which included a one meter channel sample that assayed 122 g/t Au. Both channel samples were taken from the Master Vein.

In 2021 Falcon's second phase of exploration consisted of packsack drilling along the Master Vein and parallel mineralized horizons.

Highlights of the 2021 exploration efforts include:

- Grab samples on the Master vein ranging from 1.09 g/t Au to 168 g/t Au and 17.5 g/t silver and 0.7 per cent Cu;

- Backpack drilling from surface of 68.7 g/t Au and 11.8 g/t Ag over a drilled intersection of 0.47 m;

- A grab sample from Vein 2 reporting 1.52 g/t Au;

- A grab sample from Vein 3 reporting 2.58 g/t Au and 1.2 g/t Ag.

Falcon Gold is very encouraged by the results of the pack-sack drilling and sampling along six parallel vein structures with anomalous to high grade gold results in every sample reported. Due to visible gold noted in many of the samples, Falcon has commissioned total metallics gold analyses to determine the effect of the nuggety nature of gold may have had original fire assay method results. These values will be released once they have been obtained.

Alex Pleson, P.Geo. Dispute

On November 23, 2021, the Company filed a lawsuit in the Supreme Court of British Columbia against Alex Pleson, P.Geo (PGO) of Pleson Geoscience of Ontario Canada. Mr. Pleson failed to transfer claims he staked on behalf of the company and did not report the work he performed for the company to the standards expected of a professional geoscientist. The lawsuit does not affect any of our plans moving forward and the company is optimistic the matter will be solved in a timely manner.

Viernes Project, Northern Chile

On December 16,2021 Falcon signed a definitive option to-purchase agreement on the Viernes Project. The Viernes project is located 122km southeast of Antofagasta city in northern Chile. The claims encompass 13 claim blocks covering 3,300 hectares and are directly adjacent to Yamana's El-Penon gold-silver mine. Production from the El-Penon in 2021 was 160,000 ounces of gold and 5,000,000 million ounces of silver. The property is also located 30 km from the Escondida copper-gold porphyry cluster operated by BHP and Rio Tinto.

Since the 1990's this area has produced 30.6 million tonnes of copper (57 times the annual Canadian production), 9.2 million ounces of gold (1.5 times the annual Canadian production) and 129.3 million ounces of silver (8.6 times the Canadian annual production) through multiple world class discoveries. Terms of the option to-purchase agreement are subject to TSX Venture Exchange policy.

Latamark Resources formed; South America Issuer planned

On October 7,2021 the Company formed Latamark Resources Corp., a wholly owned subsidiary of Falcon Gold., The company intends to spin out its Argentine gold asset located in the renowned Sierra de Las Minas district of southern La Rioja province in San Juan. The district is reported to host several formerly producing gold and silver mines.

On Feb. 9, 2021, the company was able to reinstate the property option for a reduction from the original agreement. The original terms were calling for escalating annual payments over a six-year term totaling $500,000 (U.S.) and the issuance of four million common shares with property expenditures of US$1.74 million Falcon was successful in reworking the terms to share payments of 500,000 common shares plus 500,000 warrants to be paid to the vendors and by spending US$350,000 in exploration expenditures to earn an 80-per-cent interest in the project. Upon completion of payments and expenditures, Falcon will hold an 80-per-cent interest and the vendors would retain 20-per-cent ownership in the property. For a 30-month period following acquiring 80% Falcon reserves the right to purchase the vendors' 20% remaining interest for a further payment of two million Falcon common shares and a one-time US$1.5-million payment. The vendor retains a 2% NSR with a buyback clause of 1% for $$$$$ which Falcon Gold can elect to do so at any time.

The company will update shareholders in the coming weeks on the necessary requirements for shareholder approval. Falcon can make no assurances that a spinout will take place as it is subject to several conditions that include board approval, satisfying the TSX Venture requirements, legal and tax ramifications, determining the final details of the transaction, receipt of all regulatory approval, the availability of financing for the new subsidiary, and the overall market conditions. The company will be providing further details in the coming weeks.

In Closing

The Company is looking forward to a robust exploration season in 2022. Falcon continues to build value for stake holders by acquiring, advancing, and exploring opportunities in the Americas. The Company is continuing to build upon the historic results and new discoveries at the Central Canada project as we complete further drilling, modeling, and resource delineation. The recent acquisitions in Newfoundland which is witnessing the largest exploration boom and discoveries in history is testament to Falcon recognizing where opportunities for success are the highest. Strategies in Chile are opportunistic in building shareholder value in the largest copper producing areas in the world. Copper demand is expected to increase dramatically in the near future as the world turns to green metal energy. We believe that Falcon presents incredible upside potential in 2022 when currently valued at such a low market capitalization as compared to some of our peers in the same jurisdictions. We thank all our current shareholders for their continued support and look forward to rewarding them with success.

Wishing you the best for 2022.

Cordially,

Karim Rayani

About Falcon Gold Corp.

Falcon is a Canadian mineral exploration company focused on generating, acquiring, and exploring opportunities in the Americas. Falcon's flagship project, the Central Canada Gold Mine, is approximately 20 km southeast of Agnico Eagle's Hammond Reef Gold Deposit which has currently estimated 3.32 million ounces of gold (123.5 million tonnes grading 0.84 g/t gold) mineral reserves, and 2.3 million ounces of measured and indicated mineral resources (133.4 million tonnes grading 0.54 g/t gold). The Hammond Reef gold property lies on the Hammond shear zone, which is a northeast-trending splay off the Quetico Fault Zone ("QFZ") and may be the control for the gold deposit. The Central Gold property lies on a similar major northeast-trending splay of the QFZ.

The Company holds 8 additional projects. The Esperanza Gold/Silver/Copper mineral concessions located in La Rioja Province, Argentina. The Springpole West Property in the world-renowned Red Lake mining camp; a 49% interest in the Burton Gold property with Iamgold near Sudbury Ontario; and in B.C., the Spitfire-Sunny Boy, Gaspard Gold claims; and most recently the Great Burnt, Hope Brook, and Baie Verte acquisitions adjacent to First Mining, Benton-Sokoman's JV, and Marvel Discovery in Central Newfoundland.

CONTACT INFORMATION:

"Karim Rayani"

Karim Rayani

Chief Executive Officer, Director

Telephone: (604) 716-0551

Email: info@falcongold.ca

Cautionary Language and Forward-Looking Statements

This news release may contain forward looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

This news release may contain forward looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, etc. Forward looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Falcon Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/681496/Falcons-Chief-Executive-Officer-Issues-Corporate-Update-Letter

News Provided by ACCESSWIRE via QuoteMedia

tsx pandemic tsx venture gold south america canada ontarioGovernment

Gen Z, The Most Pessimistic Generation In History, May Decide The Election

Gen Z, The Most Pessimistic Generation In History, May Decide The Election

Authored by Mike Shedlock via MishTalk.com,

Young adults are more…

Authored by Mike Shedlock via MishTalk.com,

Young adults are more skeptical of government and pessimistic about the future than any living generation before them.

This is with reason, and it’s likely to decide the election.

Rough Years and the Most Pessimism Ever

The Wall Street Journal has an interesting article on The Rough Years That Turned Gen Z Into America’s Most Disillusioned Voters.

Young adults in Generation Z—those born in 1997 or after—have emerged from the pandemic feeling more disillusioned than any living generation before them, according to long-running surveys and interviews with dozens of young people around the country. They worry they’ll never make enough money to attain the security previous generations have achieved, citing their delayed launch into adulthood, an impenetrable housing market and loads of student debt.

And they’re fed up with policymakers from both parties.

Washington is moving closer to passing legislation that would ban or force the sale of TikTok, a platform beloved by millions of young people in the U.S. Several young people interviewed by The Wall Street Journal said they spend hours each day on the app and use it as their main source of news.

“It’s funny how they quickly pass this bill about this TikTok situation. What about schools that are getting shot up? We’re not going to pass a bill about that?” Gaddie asked. “No, we’re going to worry about TikTok and that just shows you where their head is…. I feel like they don’t really care about what’s going on with humanity.”

Gen Z’s widespread gloominess is manifesting in unparalleled skepticism of Washington and a feeling of despair that leaders of either party can help. Young Americans’ entire political memories are subsumed by intense partisanship and warnings about the looming end of everything from U.S. democracy to the planet. When the darkest days of the pandemic started to end, inflation reached 40-year highs. The right to an abortion was overturned. Wars in Ukraine and the Middle East raged.

Dissatisfaction is pushing some young voters to third-party candidates in this year’s presidential race and causing others to consider staying home on Election Day or leaving the top of the ticket blank. While young people typically vote at lower rates, a small number of Gen Z voters could make the difference in the election, which four years ago was decided by tens of thousands of votes in several swing states.

Roughly 41 million Gen Z Americans—ages 18 to 27—will be eligible to vote this year, according to Tufts University.

Gen Z is among the most liberal segments of the electorate, according to surveys, but recent polling shows them favoring Biden by only a slim margin. Some are unmoved by those who warn that a vote against Biden is effectively a vote for Trump, arguing that isn’t enough to earn their support.

Confidence

When asked if they had confidence in a range of public institutions, Gen Z’s faith in them was generally below that of the older cohorts at the same point in their lives.

One-third of Gen Z Americans described themselves as conservative, according to NORC’s 2022 General Social Survey. That is a larger share identifying as conservative than when millennials, Gen X and baby boomers took the survey when they were the same age, though some of the differences were small and within the survey’s margin of error.

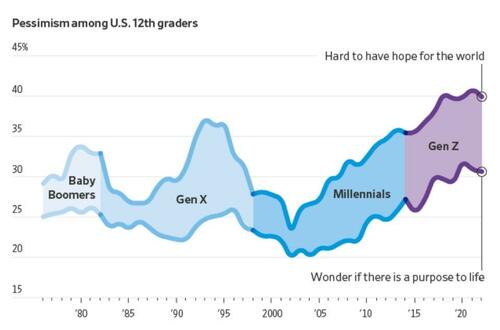

More young people now say they find it hard to have hope for the world than at any time since at least 1976, according to a University of Michigan survey that has tracked public sentiment among 12th-graders for nearly five decades. Young people today are less optimistic than any generation in decades that they’ll get a professional job or surpass the success of their parents, the long-running survey has found. They increasingly believe the system is stacked against them and support major changes to the way the country operates.

Gen Z future Outcome

“It’s the starkest difference I’ve documented in 20 years of doing this research,” said Twenge, the author of the book “Generations.” The pandemic, she said, amplified trends among Gen Z that have existed for years: chronic isolation, a lack of social interaction and a propensity to spend large amounts of time online.

A 2020 study found past epidemics have left a lasting impression on young people around the world, creating a lack of confidence in political institutions and their leaders. The study, which analyzed decades of Gallup World polling from dozens of countries, found the decline in trust among young people typically persists for two decades.

Young people are more likely than older voters to have a pessimistic view of the economy and disapprove of Biden’s handling of inflation, according to the recent Journal poll. Among people under 30, Biden leads Trump by 3 percentage points, 35% to 32%, with 14% undecided and the remaining shares going to third-party candidates, including 10% to independent Robert F. Kennedy Jr.

Economic Reality

Gen Z may be the first generation in US history that is not better off than their parents.

Many have given up on the idea they will ever be able to afford a home.

The economy is allegedly booming (I disagree). Regardless, stress over debt is high with younger millennials and zoomers.

This has been a constant theme of mine for many months.

Credit Card and Auto Delinquencies Soar

Credit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90 day or longer delinquencies.

Record High Credit Card Debt

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due.

For nearly all age groups, serious delinquencies are the highest since 2011.

Auto Loan Delinquencies

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29.Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

For further discussion please see Credit Card and Auto Delinquencies Soar, Especially Age Group 18 to 39

Generational Homeownership Rates

Home ownership rates courtesy of Apartment List

The above chart is from the Apartment List’s 2023 Millennial Homeownership Report

Those struggling with rent are more likely to be Millennials and Zoomers than Generation X, Baby Boomers, or members of the Silent Generation.

The same age groups struggling with credit card and auto delinquencies.

On Average Everything is Great

Average it up, and things look pretty good. This is why we have seen countless stories attempting to explain why people should be happy.

Krugman Blames Partisanship

With the recent rise in consumer sentiment, time to revisit this excellent Briefing Book paper. On reflection, I'd do it a bit differently; same basic conclusion, but I think partisan asymmetry explains even more of the remaining low numbers 1/ https://t.co/4lqm7X4472

— Paul Krugman (@paulkrugman) February 17, 2024

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

OK, there is a fair amount of partisanship in the polls.

However, Biden isn’t struggling from partisanship alone. If that was the reason, Biden would not be polling so miserably with Democrats in general, blacks, and younger voters.

This allegedly booming economy left behind the renters and everyone under the age of 40 struggling to make ends meet.

Many Are Addicted to “Buy Now, Pay Later” Plans

Buy Now Pay Later, BNPL, plans are increasingly popular. It’s another sign of consumer credit stress.

For discussion, please see Many Are Addicted to “Buy Now, Pay Later” Plans, It’s a Big Trap

The study did not break things down by home owners vs renters, but I strongly suspect most of the BNPL use is by renters.

What About Jobs?

Another seemingly strong jobs headline falls apart on closer scrutiny. The massive divergence between jobs and employment continued into February.

Nonfarm payrolls and employment levels from the BLS, chart by Mish.

Payrolls vs Employment Gains Since March 2023

-

Nonfarm Payrolls: 2,602,000

-

Employment Level: +144,000

-

Full Time Employment: -284,000

For more details of the weakening labor markets, please see Jobs Up 275,000 Employment Down 184,000

CPI Hot Again

CPI Data from the BLS, chart by Mish.

For discussion of the CPI inflation data for February, please see CPI Hot Again, Rent Up at Least 0.4 Percent for 30 Straight Months

Also note the Producer Price Index (PPI) Much Hotter Than Expected in February

Major Economic Cracks

There are economic cracks in spending, cracks in employment, and cracks in delinquencies.

But there are no cracks in the CPI. It’s coming down much slower than expected. And the PPI appears to have bottomed.

Add it up: Inflation + Recession = Stagflation.

Election Impact

In 2020, younger voters turned out in the biggest wave in history. And they voted for Biden.

Younger voters are not as likely to vote in 2024, and they are less likely to vote for Biden.

Millions of voters will not vote for either Trump or Biden. Net, this will impact Biden more. The base will not decide the election, but the Trump base is far more energized than the Biden base.

If Biden signs a TikTok ban, that alone could tip the election.

If No Labels ever gets its act together, I suspect it will siphon more votes from Biden than Trump. But many will just sit it out.

“We’re just kind of over it,” Noemi Peña, 20, a Tucson, Ariz., resident who works in a juice bar, said of her generation’s attitude toward politics. “We don’t even want to hear about it anymore.” Peña said she might not vote because she thinks it won’t change anything and “there’s just gonna be more fighting.” Biden won Arizona in 2020 by just over 10,000 votes.

The Journal noted nearly one-third of voters under 30 have an unfavorable view of both Biden and Trump, a higher number than all older voters. Sixty-three percent of young voters think neither party adequately represents them.

Young voters in 2020 were energized to vote against Trump. Now they have thrown in the towel.

And Biden telling everyone how great the economy is only rubs salt in the wound.

Government

Copper Soars, Iron Ore Tumbles As Goldman Says “Copper’s Time Is Now”

Copper Soars, Iron Ore Tumbles As Goldman Says "Copper’s Time Is Now"

After languishing for the past two years in a tight range despite recurring…

After languishing for the past two years in a tight range despite recurring speculation about declining global supply, copper has finally broken out, surging to the highest price in the past year, just shy of $9,000 a ton as supply cuts hit the market; At the same time the price of the world's "other" most important mined commodity has diverged, as iron ore has tumbled amid growing demand headwinds out of China's comatose housing sector where not even ghost cities are being built any more.

Copper surged almost 5% this week, ending a months-long spell of inertia, as investors focused on risks to supply at various global mines and smelters. As Bloomberg adds, traders also warmed to the idea that the worst of a global downturn is in the past, particularly for metals like copper that are increasingly used in electric vehicles and renewables.

Yet the commodity crash of recent years is hardly over, as signs of the headwinds in traditional industrial sectors are still all too obvious in the iron ore market, where futures fell below $100 a ton for the first time in seven months on Friday as investors bet that China’s years-long property crisis will run through 2024, keeping a lid on demand.

Indeed, while the mood surrounding copper has turned almost euphoric, sentiment on iron ore has soured since the conclusion of the latest National People’s Congress in Beijing, where the CCP set a 5% goal for economic growth, but offered few new measures that would boost infrastructure or other construction-intensive sectors.

As a result, the main steelmaking ingredient has shed more than 30% since early January as hopes of a meaningful revival in construction activity faded. Loss-making steel mills are buying less ore, and stockpiles are piling up at Chinese ports. The latest drop will embolden those who believe that the effects of President Xi Jinping’s property crackdown still have significant room to run, and that last year’s rally in iron ore may have been a false dawn.

Meanwhile, as Bloomberg notes, on Friday there were fresh signs that weakness in China’s industrial economy is hitting the copper market too, with stockpiles tracked by the Shanghai Futures Exchange surging to the highest level since the early days of the pandemic. The hope is that headwinds in traditional industrial areas will be offset by an ongoing surge in usage in electric vehicles and renewables.

And while industrial conditions in Europe and the US also look soft, there’s growing optimism about copper usage in India, where rising investment has helped fuel blowout growth rates of more than 8% — making it the fastest-growing major economy.

In any case, with the demand side of the equation still questionable, the main catalyst behind copper’s powerful rally is an unexpected tightening in global mine supplies, driven mainly by last year’s closure of a giant mine in Panama (discussed here), but there are also growing worries about output in Zambia, which is facing an El Niño-induced power crisis.

On Wednesday, copper prices jumped on huge volumes after smelters in China held a crisis meeting on how to cope with a sharp drop in processing fees following disruptions to supplies of mined ore. The group stopped short of coordinated production cuts, but pledged to re-arrange maintenance work, reduce runs and delay the startup of new projects. In the coming weeks investors will be watching Shanghai exchange inventories closely to gauge both the strength of demand and the extent of any capacity curtailments.

“The increase in SHFE stockpiles has been bigger than we’d anticipated, but we expect to see them coming down over the next few weeks,” Colin Hamilton, managing director for commodities research at BMO Capital Markets, said by phone. “If the pace of the inventory builds doesn’t start to slow, investors will start to question whether smelters are actually cutting and whether the impact of weak construction activity is starting to weigh more heavily on the market.”

* * *

Few have been as happy with the recent surge in copper prices as Goldman's commodity team, where copper has long been a preferred trade (even if it may have cost the former team head Jeff Currie his job due to his unbridled enthusiasm for copper in the past two years which saw many hedge fund clients suffer major losses).

As Goldman's Nicholas Snowdon writes in a note titled "Copper's time is now" (available to pro subscribers in the usual place)...

... there has been a "turn in the industrial cycle." Specifically according to the Goldman analyst, after a prolonged downturn, "incremental evidence now points to a bottoming out in the industrial cycle, with the global manufacturing PMI in expansion for the first time since September 2022." As a result, Goldman now expects copper to rise to $10,000/t by year-end and then $12,000/t by end of Q1-25.’

Here are the details:

Previous inflexions in global manufacturing cycles have been associated with subsequent sustained industrial metals upside, with copper and aluminium rising on average 25% and 9% over the next 12 months. Whilst seasonal surpluses have so far limited a tightening alignment at a micro level, we expect deficit inflexions to play out from quarter end, particularly for metals with severe supply binds. Supplemented by the influence of anticipated Fed easing ahead in a non-recessionary growth setting, another historically positive performance factor for metals, this should support further upside ahead with copper the headline act in this regard.

Goldman then turns to what it calls China's "green policy put":

Much of the recent focus on the “Two Sessions” event centred on the lack of significant broad stimulus, and in particular the limited property support. In our view it would be wrong – just as in 2022 and 2023 – to assume that this will result in weak onshore metals demand. Beijing’s emphasis on rapid growth in the metals intensive green economy, as an offset to property declines, continues to act as a policy put for green metals demand. After last year’s strong trends, evidence year-to-date is again supportive with aluminium and copper apparent demand rising 17% and 12% y/y respectively. Moreover, the potential for a ‘cash for clunkers’ initiative could provide meaningful right tail risk to that healthy demand base case. Yet there are also clear metal losers in this divergent policy setting, with ongoing pressure on property related steel demand generating recent sharp iron ore downside.

Meanwhile, Snowdon believes that the driver behind Goldman's long-running bullish view on copper - a global supply shock - continues:

Copper’s supply shock progresses. The metal with most significant upside potential is copper, in our view. The supply shock which began with aggressive concentrate destocking and then sharp mine supply downgrades last year, has now advanced to an increasing bind on metal production, as reflected in this week's China smelter supply rationing signal. With continued positive momentum in China's copper demand, a healthy refined import trend should generate a substantial ex-China refined deficit this year. With LME stocks having halved from Q4 peak, China’s imminent seasonal demand inflection should accelerate a path into extreme tightness by H2. Structural supply underinvestment, best reflected in peak mine supply we expect next year, implies that demand destruction will need to be the persistent solver on scarcity, an effect requiring substantially higher pricing than current, in our view. In this context, we maintain our view that the copper price will surge into next year (GSe 2025 $15,000/t average), expecting copper to rise to $10,000/t by year-end and then $12,000/t by end of Q1-25’

Another reason why Goldman is doubling down on its bullish copper outlook: gold.

The sharp rally in gold price since the beginning of March has ended the period of consolidation that had been present since late December. Whilst the initial catalyst for the break higher came from a (gold) supportive turn in US data and real rates, the move has been significantly amplified by short term systematic buying, which suggests less sticky upside. In this context, we expect gold to consolidate for now, with our economists near term view on rates and the dollar suggesting limited near-term catalysts for further upside momentum. Yet, a substantive retracement lower will also likely be limited by resilience in physical buying channels. Nonetheless, in the midterm we continue to hold a constructive view on gold underpinned by persistent strength in EM demand as well as eventual Fed easing, which should crucially reactivate the largely for now dormant ETF buying channel. In this context, we increase our average gold price forecast for 2024 from $2,090/toz to $2,180/toz, targeting a move to $2,300/toz by year-end.

Much more in the full Goldman note available to pro subs.

International

The millions of people not looking for work in the UK may be prioritising education, health and freedom

Economic inactivity is not always the worst option.

Around one in five British people of working age (16-64) are now outside the labour market. Neither in work nor looking for work, they are officially labelled as “economically inactive”.

Some of those 9.2 million people are in education, with many students not active in the labour market because they are studying full-time. Others are older workers who have chosen to take early retirement.

But that still leaves a large number who are not part of the labour market because they are unable to work. And one key driver of economic inactivity in recent years has been illness.

This increase in economic inactivity – which has grown since before the pandemic – is not just harming the economy, but also indicative of a deeper health crisis.

For those suffering ill health, there are real constraints on access to work. People with health-limiting conditions cannot just slot into jobs that are available. They need help to address the illnesses they have, and to re-engage with work through organisations offering supportive and healthy work environments.

And for other groups, such as stay-at-home parents, businesses need to offer flexible work arrangements and subsidised childcare to support the transition from economic inactivity into work.

The government has a role to play too. Most obviously, it could increase investment in the NHS. Rising levels of poor health are linked to years of under-investment in the health sector and economic inactivity will not be tackled without more funding.

Carrots and sticks

For the time being though, the UK government appears to prefer an approach which mixes carrots and sticks. In the March 2024 budget, for example, the chancellor cut national insurance by 2p as a way of “making work pay”.

But it is unclear whether small tax changes like this will have any effect on attracting the economically inactive back into work.

Jeremy Hunt also extended free childcare. But again, questions remain over whether this is sufficient to remove barriers to work for those with parental responsibilities. The high cost and lack of availability of childcare remain key weaknesses in the UK economy.

The benefit system meanwhile has been designed to push people into work. Benefits in the UK remain relatively ungenerous and hard to access compared with other rich countries. But labour shortages won’t be solved by simply forcing the economically inactive into work, because not all of them are ready or able to comply.

It is also worth noting that work itself may be a cause of bad health. The notion of “bad work” – work that does not pay enough and is unrewarding in other ways – can lead to economic inactivity.

There is also evidence that as work has become more intensive over recent decades, for some people, work itself has become a health risk.

The pandemic showed us how certain groups of workers (including so-called “essential workers”) suffered more ill health due to their greater exposure to COVID. But there are broader trends towards lower quality work that predate the pandemic, and these trends suggest improving job quality is an important step towards tackling the underlying causes of economic inactivity.

Freedom

Another big section of the economically active population who cannot be ignored are those who have retired early and deliberately left the labour market behind. These are people who want and value – and crucially, can afford – a life without work.

Here, the effects of the pandemic can be seen again. During those years of lockdowns, furlough and remote working, many of us reassessed our relationship with our jobs. Changed attitudes towards work among some (mostly older) workers can explain why they are no longer in the labour market and why they may be unresponsive to job offers of any kind.

And maybe it is from this viewpoint that we should ultimately be looking at economic inactivity – that it is actually a sign of progress. That it represents a move towards freedom from the drudgery of work and the ability of some people to live as they wish.

There are utopian visions of the future, for example, which suggest that individual and collective freedom could be dramatically increased by paying people a universal basic income.

In the meantime, for plenty of working age people, economic inactivity is a direct result of ill health and sickness. So it may be that the levels of economic inactivity right now merely show how far we are from being a society which actually supports its citizens’ wellbeing.

David Spencer has received funding from the ESRC.

uk pandemic-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment3 days ago

Spread & Containment3 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex