Exploring Kusama Kings, Kusama’s majestic new NFT collection

In an exclusive interview with CryptoSlate, the creators of Kusama Kings talk about the issues with minting NFTs, utilizing Kusama’s potential, and the unusually strong community bond NFTs can facilitate.

The post Exploring Kusama Kings, Kusama’s…

In an exclusive interview with CryptoSlate, the creators of Kusama Kings talk about the issues with minting NFTs, utilizing Kusama’s potential, and the unusually strong community bond NFTs can facilitate.

Kusama, Singular, and lowering the barrier for entry

Polkadot’s more chaotic cousin Kusama has been a testing ground for many innovative dApps, but it wasn’t until late 2021 that it really began to gain traction as a go-to platform for NFTs. Singular, the first marketplace to offer Kusama-native NFTs, has seen a huge rise in popularity this year and has hosted a slew of hugely successful NFT collections.

The latest hit to launch on Singular, however, is rather unique.

Kusama Kings, a limited collection of NFTs, is a perfect example of how lowering the barrier for entry into DeFi benefits the whole industry.

RD Studios, the duo behind the Kusama Kings collection, are relative newcomers to the industry. The pseudonymous cousins held jobs in traditional finance and art until last year when the looming pandemic pushed them to explore the world of crypto. Kusamabinladen, a 29-year-old British native, had his baptism by fire in 2017 when he first entered crypto. A year later, he suffered the fate of many of his peers when the market sank, which pushed him back into the world of traditional finance.

“I fully dove back in when COVID-19 struck and haven’t looked back since,” he told CryptoSlate in an interview.

He got his inspiration for the Kusama Kings collection while on holiday in Kyrgyzstan this fall. Despite being quite new to the world of NFTs, he and his partner managed to launch the entire collection in two weeks. KBL says it’s all thanks to Singularity.

“I can’t even describe how easy it is. This is what blew me away when I first went on the site,” he explained. “The UI and the ease of process they have created are incredible and are why I believe they will go on to be the leader in the space.”

The philosophy of NFTs

Singularity’s low barrier for entry, enabled by Kusama’s unique design, is especially beneficial to artists like Rachel. The second half of the RD Studios duo, she had no contact with the industry until this September when the idea of Kusama KIngs was first presented to her.

“NFTs present a fantastic opportunity for artists,” she said, referring to the marketplace offered by Singular. “Artists now have a method for gaining total creative freedom over their work, while potentially earning far more than possible when selling art through traditional means.”

The ease of use platforms like Singular offer levels the playing field for artists, allowing literally anyone to mint an NFT paying just cents in minting fees. And then, once introduced to the world of cryptocurrencies, artists blur the lines between the art and finance sectors, she added.

Despite frequently being called a bubble by the mainstream media, KBL believes there’s much more to NFTs than just flipping for profit. An NFT is a combination of art and utility, and having utility means having unlimited potential, he explained.

“Why just buy art when you can have art with unlimited utility. It’s just so exciting to me and an area we will keep trying to innovate in.”

These innovations include launching a new collection under the Kusama Kingdom brand early next year, hosting real-world events for King holders, and creating a pop-up physical NFT gallery in London. He doesn’t dismiss the idea of launching King tokens in the future but said that it would take a lot of time and effort to get both the mechanics and the tokenomics right so the tokens don’t become a gimmick.

In the meantime, the duo will focus on leveraging the Kusama Kings brand to allow those holding King NFTs access to presales and seed rounds of projects that aren’t open to the public.

“I think this is going to be a real driver of utility on top of what we already bring as it would mean that, in time, the Kings pay for themselves for the early investors.”

Another initiative the duo will focus on are DAOs. KBL said that they want Kusama Kings to become a House on the RomeDAO Finance platform, a new Ohm-fork on the Moonriver network. The rebase protocol has an ambitious goal of becoming the reserve currency both for Polkadot (DOT) and Kusama (KSM), a perfect match for the Kings community.

“Given that our members are largely very bullish on the ecosystem, we wanted to get behind this project with full support. We have collectively accumulated over 1% of the supply in order to apply for a house, which will allow us to participate actively in the governance of the project and apply for grants from their treasury.”

And it’s not just grants they’re looking for—KBL said that becoming a House on RomeDAO will present a great bonding opportunity for the community. They plan on releasing an NFT series that would be redeemable for real-life merch, which would go to the Kings’ treasury to support future events.

A die-hard community with a family feel

A collection with the 3rd highest volume on Singular, Kusama Kings raised over 900 KSM in less than seven weeks since its launch. The Legendary Alien King, the rarest of the 110 Kings minted, sold for a record 46 KSM, worth around $15,500 at press time.

None of this, however, got to KBL the way the Kings community did. With just 110 NFTs to be minted, a tight-knit group gathered around the Kings in the official Discord chat, which quickly evolved from a notification channel to a family-like gathering.

“For me, the best part is ‘The Great Hall.'”

The private area of the Discord hosts a myriad of different channels, such as gaming, launchpads, DAOs, and crowdloans, and is a place where those holding Kings talk about everything and anything.

“The community being built there is one of the best I have seen in crypto—from experienced venture capitalists to relative newcomers in crypto looking for advice.”

The collection’s small scope means that everyone knows each other and feels comfortable reaching out to each other, he said. King holders also have direct access to the project’s creators to stay informed both about its current state and its path forward.

“This isn’t something you get with collections with over 10,000 pieces and I think it’s a really nice change.”

“I regularly see people spotting others with KSM and other tokens if they’re short of need something sniped while they wait for their funds to arrive. The level of trust is unprecedented. That is what drives the value for me and what separates a JPEG from an NFT.”

Disclaimer: The CryptoSlate CEO holds a Kusama King.

The post Exploring Kusama Kings, Kusama’s majestic new NFT collection appeared first on CryptoSlate.

crypto pandemic covid-19 cryptoSpread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

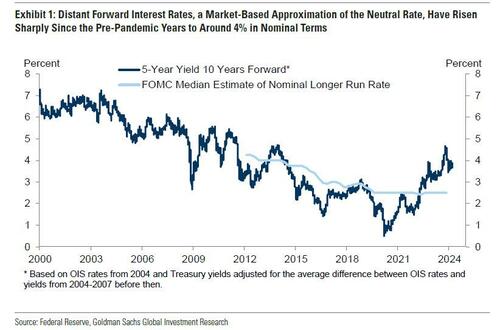

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

Spread & Containment

Household Net Interest Income Falls As Rates Spike

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

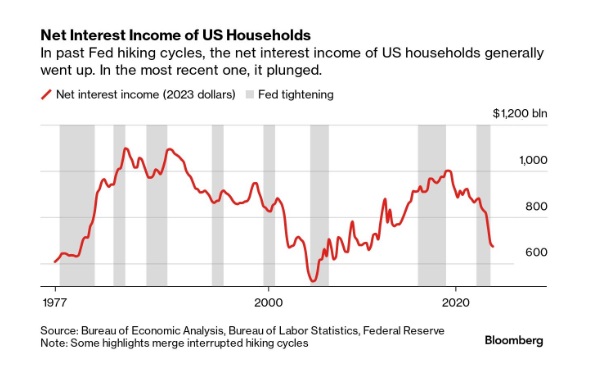

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment7 days ago

Spread & Containment7 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex