Exchange reserves plunge to pre-$61K lows: 5 things to watch in Bitcoin this week

Hodlers are being patient amid warnings that a continuation of Bitcoin’s bull run may take "some time" thanks to mixed messages from on-chain indicators.

Bitcoin (BTC) sees a cautious start to the week as macro markets dither and Turke

Hodlers are being patient amid warnings that a continuation of Bitcoin's bull run may take "some time" thanks to mixed messages from on-chain indicators.

Bitcoin (BTC) sees a cautious start to the week as macro markets dither and Turkey’s currency loses 15% of its value overnight.

After a disappointing weekend that featured a rejection at $60,000, Bitcoin has yet to impress traders, who are expecting sideways action in the coming days.

Cointelegraph takes a look at five factors that could influence how Bitcoin price action evolves as a new week gets underway.

All quiet among stocks

The picture across equities is one of hesitancy on Monday as concerns over bond yields remain and coronavirus bites.

It has become a familiar picture for many, Asian markets opened with modest movement. A rise in economic activity will likely fuel bond worries with 10-year Treasury yields already at 1.7% in the United States after gaining rapidly in recent weeks.

Taking a different tone, China revealed that it had more money to spend in financial easing, something which officials claim will reduce risk, rather than add to it.

“This will not only provide positive incentives for economic players, but also help create an environment less likely to spawn financial risks,” Yi Gang, Governor of China’s central bank, the People’s Bank of China (PBoC), said at the weekend.

At the same time, multiple jurisdictions are seeing a return to or continuation of coronavirus lockdown, amid anger at the lack of progress in lifting restrictions on individual freedoms despite vaccine rollouts and the onset of spring.

Separately, turmoil for Turkey saw its national currency, the lira, shed 15% as soon as trading opened. The embattled economy did not benefit from a dip in sentiment after President Recep Tayyip Erdogan fired yet another central bank chief.

“Turkey picks worst time to fire central banker,” market commentator Holger Zschaepitz responded.

“Erdogan removed hawkish Gov Agbal, replacing him w/professor who says high interest rates cause inflation. Widening CA deficit, depleted FX reserves & inflation at 16% make a currency crisis more likely.”

BTC price fails to wow

Two days of disappointment has greeted Bitcoin traders as last weekend’s rally failed to see a repeat performance.

While analysts tipped BTC/USD for a breakout at some point over Saturday and Sunday, no such luck was had, as the pair saw a firm rejection close to $60,000.

The result, which took some by surprise, was a dip below $56,000 before a modest recovery to $57,700 on Bitstamp at the time of writing.

In his latest market comments, Cointelegraph contributor Michaël van de Poppe was unperturbed by the events, as Bitcoin merely continued moving within a familiar corridor.

“Bitcoin is so far, so good and that's great,” he told Twitter followers.

“The $55K region is an interesting point of interest after rejecting the $60K barrier. Expecting a sideways range for a little.”

Fellow Netherlands-based analyst and trader Crypto Ed confirmed a further light dip and rebound pattern overnight, with BTC/USD avoiding his scenario of a drop to under $52,000.

In an additional summary, Scott Melker likewise identified ranging behavior, summarizing price action as “still not much happening.”

Order book data from Binance highlighted the extent of the consolidation active on Bitcoin, with support and resistance closing in at $56,000 and $59,000, respectively, on Monday.

Difficulty continues into great unknown

Investors may be thirsty for fresh Bitcoin all-time highs, but two network fundamentals are already at or almost hitting new territory of their own.

At the time of writing, both hash rate and difficulty were firmly bullish — the former within 4% of all-time highs and the latter riding higher than ever.

A classic precursor to price upside, hash rate and mining difficulty underscore the strength and longevity of the current bull run. Hash rate provides an estimate of the computing power dedicated to processing transactions, while difficulty is an expression of the competition among miners for block subsidies.

At the latest automated readjustment on March 19, difficulty increased by 1.95%, marking a return further into uncharted territory after the previous adjustment ended up negative.

As Cointelegraph reported, such adjustments are an essential, if not most important economic feature of the Bitcoin network, allowing it to adapt to changing miner activity and maintain security.

“What critics refer to about Bitcoin being ‘speculative’ is that it provides no organic yield and never will, seeing it as ‘greater fool’ price appreciation,” popular Twitter account Parabolic Trav wrote about the phenomenon earlier this month.

“They fail to grasp the difficulty adjustment and the halving ‘Lesser supply reality’ counteracts ‘greater fool theory.’”

"Young" coins suggest bull run is far from done

Other on-chain indicators nonetheless paint a mixed picture of where exactly Bitcoin is in its bull cycle and how much price upside remains.

In terms of investor sentiment, however, there remains plenty of leeway, as longtime hodlers have still not been moved to sell en masse even at $60,000.

As analytics service Glassnode noted over the weekend, the proportion of coins belonging to older investors has not yet decreased in line with previous bull cycle tops, implying that there is longer to go before 2021 tops out.

At around $53,000, Bitcoin became a $1 trillion market cap asset — but this was still not sufficient incentive to awaken coins long held in storage.

“This is pretty solid price validation; $1T is already strongly supported by investors,” statistician Willy Woo commented on Glassnode data.

“I'd say there's a fair chance we'll never see Bitcoin below $1T again.”

Last week, meanwhile, Cointelegraph reported even more bullish prognoses from stock-to-flow price model creator PlanB, who forecast BTC/USD not stopping at $100,000 and continuing to an average of $288,000 this year.

Exchange reserves back near record lows

It’s not just well-known names favoring continuation. According to data from exchanges, the average hodler is bracing for the long haul and not planning to sell.

Compiled by on-chain resource CryptoQuant, inflows and outflows to major trading platforms are heavily skewed in favor of withdrawals, implying a lack of desire to sell or trade at short notice.

In fact, the weekend saw the largest outflows from exchanges since early March, just before Bitcoin hit current all-time highs of $61,700.

Last week, CryptoQuant CEO Ki Young Ju included the lack of exchange inflows among factors balancing some other, less impressive, indicator readings as part of the overall market picture. Bitcoin, he said, will likely take “some time” to beat its $61,700 record.

“I think BTC would take some time to get another leg up in terms of demand/supply,” he summarized.

International

Illegal Immigrants Leave US Hospitals With Billions In Unpaid Bills

Illegal Immigrants Leave US Hospitals With Billions In Unpaid Bills

By Autumn Spredemann of The Epoch Times

Tens of thousands of illegal…

By Autumn Spredemann of The Epoch Times

Tens of thousands of illegal immigrants are flooding into U.S. hospitals for treatment and leaving billions in uncompensated health care costs in their wake.

The House Committee on Homeland Security recently released a report illustrating that from the estimated $451 billion in annual costs stemming from the U.S. border crisis, a significant portion is going to health care for illegal immigrants.

With the majority of the illegal immigrant population lacking any kind of medical insurance, hospitals and government welfare programs such as Medicaid are feeling the weight of these unanticipated costs.

Apprehensions of illegal immigrants at the U.S. border have jumped 48 percent since the record in fiscal year 2021 and nearly tripled since fiscal year 2019, according to Customs and Border Protection data.

Last year broke a new record high for illegal border crossings, surpassing more than 3.2 million apprehensions.

And with that sea of humanity comes the need for health care and, in most cases, the inability to pay for it.

In January, CEO of Denver Health Donna Lynne told reporters that 8,000 illegal immigrants made roughly 20,000 visits to the city’s health system in 2023.

The total bill for uncompensated care costs last year to the system totaled $140 million, said Dane Roper, public information officer for Denver Health. More than $10 million of it was attributed to “care for new immigrants,” he told The Epoch Times.

Though the amount of debt assigned to illegal immigrants is a fraction of the total, uncompensated care costs in the Denver Health system have risen dramatically over the past few years.

The total uncompensated costs in 2020 came to $60 million, Mr. Roper said. In 2022, the number doubled, hitting $120 million.

He also said their city hospitals are treating issues such as “respiratory illnesses, GI [gastro-intenstinal] illnesses, dental disease, and some common chronic illnesses such as asthma and diabetes.”

“The perspective we’ve been trying to emphasize all along is that providing healthcare services for an influx of new immigrants who are unable to pay for their care is adding additional strain to an already significant uncompensated care burden,” Mr. Roper said.

He added this is why a local, state, and federal response to the needs of the new illegal immigrant population is “so important.”

Colorado is far from the only state struggling with a trail of unpaid hospital bills.

Dr. Robert Trenschel, CEO of the Yuma Regional Medical Center situated on the Arizona–Mexico border, said on average, illegal immigrants cost up to three times more in human resources to resolve their cases and provide a safe discharge.

“Some [illegal] migrants come with minor ailments, but many of them come in with significant disease,” Dr. Trenschel said during a congressional hearing last year.

“We’ve had migrant patients on dialysis, cardiac catheterization, and in need of heart surgery. Many are very sick.”

He said many illegal immigrants who enter the country and need medical assistance end up staying in the ICU ward for 60 days or more.

A large portion of the patients are pregnant women who’ve had little to no prenatal treatment. This has resulted in an increase in babies being born that require neonatal care for 30 days or longer.

Dr. Trenschel told The Epoch Times last year that illegal immigrants were overrunning healthcare services in his town, leaving the hospital with $26 million in unpaid medical bills in just 12 months.

ER Duty to Care

The Emergency Medical Treatment and Labor Act of 1986 requires that public hospitals participating in Medicare “must medically screen all persons seeking emergency care … regardless of payment method or insurance status.”

The numbers are difficult to gauge as the policy position of the Centers for Medicare & Medicaid Services (CMS) is that it “will not require hospital staff to ask patients directly about their citizenship or immigration status.”

In southern California, again close to the border with Mexico, some hospitals are struggling with an influx of illegal immigrants.

American patients are enduring longer wait times for doctor appointments due to a nursing shortage in the state, two health care professionals told The Epoch Times in January.

A health care worker at a hospital in Southern California, who asked not to be named for fear of losing her job, told The Epoch Times that “the entire health care system is just being bombarded” by a steady stream of illegal immigrants.

“Our healthcare system is so overwhelmed, and then add on top of that tuberculosis, COVID-19, and other diseases from all over the world,” she said.

A newly-enacted law in California provides free healthcare for all illegal immigrants residing in the state. The law could cost taxpayers between $3 billion and $6 billion per year, according to recent estimates by state and federal lawmakers.

In New York, where the illegal immigration crisis has manifested most notably beyond the southern border, city and state officials have long been accommodating of illegal immigrants’ healthcare costs.

Since June 2014, when then-mayor Bill de Blasio set up The Task Force on Immigrant Health Care Access, New York City has worked to expand avenues for illegal immigrants to get free health care.

“New York City has a moral duty to ensure that all its residents have meaningful access to needed health care, regardless of their immigration status or ability to pay,” Mr. de Blasio stated in a 2015 report.

The report notes that in 2013, nearly 64 percent of illegal immigrants were uninsured. Since then, tens of thousands of illegal immigrants have settled in the city.

“The uninsured rate for undocumented immigrants is more than three times that of other noncitizens in New York City (20 percent) and more than six times greater than the uninsured rate for the rest of the city (10 percent),” the report states.

The report states that because healthcare providers don’t ask patients about documentation status, the task force lacks “data specific to undocumented patients.”

Some health care providers say a big part of the issue is that without a clear path to insurance or payment for non-emergency services, illegal immigrants are going to the hospital due to a lack of options.

“It’s insane, and it has been for years at this point,” Dana, a Texas emergency room nurse who asked to have her full name omitted, told The Epoch Times.

Working for a major hospital system in the greater Houston area, Dana has seen “a zillion” migrants pass through under her watch with “no end in sight.” She said many who are illegal immigrants arrive with treatable illnesses that require simple antibiotics. “Not a lot of GPs [general practitioners] will see you if you can’t pay and don’t have insurance.”

She said the “undocumented crowd” tends to arrive with a lot of the same conditions. Many find their way to Houston not long after crossing the southern border. Some of the common health issues Dana encounters include dehydration, unhealed fractures, respiratory illnesses, stomach ailments, and pregnancy-related concerns.

“This isn’t a new problem, it’s just worse now,” Dana said.

Medicaid Factor

One of the main government healthcare resources illegal immigrants use is Medicaid.

All those who don’t qualify for regular Medicaid are eligible for Emergency Medicaid, regardless of immigration status. By doing this, the program helps pay for the cost of uncompensated care bills at qualifying hospitals.

However, some loopholes allow access to the regular Medicaid benefits. “Qualified noncitizens” who haven’t been granted legal status within five years still qualify if they’re listed as a refugee, an asylum seeker, or a Cuban or Haitian national.

Yet the lion’s share of Medicaid usage by illegal immigrants still comes through state-level benefits and emergency medical treatment.

A Congressional report highlighted data from the CMS, which showed total Medicaid costs for “emergency services for undocumented aliens” in fiscal year 2021 surpassed $7 billion, and totaled more than $5 billion in fiscal 2022.

Both years represent a significant spike from the $3 billion in fiscal 2020.

An employee working with Medicaid who asked to be referred to only as Jennifer out of concern for her job, told The Epoch Times that at a state level, it’s easy for an illegal immigrant to access the program benefits.

Jennifer said that when exceptions are sent from states to CMS for approval, “denial is actually super rare. It’s usually always approved.”

She also said it comes as no surprise that many of the states with the highest amount of Medicaid spending are sanctuary states, which tend to have policies and laws that shield illegal immigrants from federal immigration authorities.

Moreover, Jennifer said there are ways for states to get around CMS guidelines. “It’s not easy, but it can and has been done.”

The first generation of illegal immigrants who arrive to the United States tend to be healthy enough to pass any pre-screenings, but Jennifer has observed that the subsequent generations tend to be sicker and require more access to care. If a family is illegally present, they tend to use Emergency Medicaid or nothing at all.

The Epoch Times asked Medicaid Services to provide the most recent data for the total uncompensated care that hospitals have reported. The agency didn’t respond.

Continue reading over at The Epoch Times

Uncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

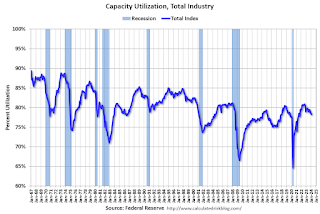

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex