DeFi Be Warned: The Short, Unhappy Life of Yam Finance

DeFi Be Warned: The Short, Unhappy Life of Yam Finance

Was Yam Finance’s short-lived rebasing project a useful economic experiment or just another scam? The crypto community is divided.

There are some decentralized finance projects that make flash loans; Yam Finance (YAM) was a DeFi project that made a flash appearance.

YAM, which initially described itself as a “minimally viable monetary experiment,” launched on August 11 amid some fanfare, and in less than two days, its market value soared from zero to $57 million. But on late Wednesday, the company announced that it found a bug in its rebasing contract and by Thursday, its market capitalization crashed back to zero. To no avail, the DeFi community rallied to save the project, whose rebase function turned it into a kind of global competition, with investors gambling on the token price.

YAM’s short life has also highlighted a divide in the crypto community, with some concerned about the somewhat reckless direction that DeFi appears to be taking. Whether this divergence is generational, a matter of Bitcoinist versus DeFi “degenerates,” or something else entirely isn’t really clear, but an informal Cointelegraph survey uncovered two radically different views of YAM’s rebasing experiment.

Erik Voorhees, CEO of ShapeShift, said on August 11, “YAM looks like a scam. [...] Projects like this are not going to be good for DeFi.” Meanwhile, Messari CEO Ryan Selkis slammed YAM Finance as a “perfect P&D [pump and dump] setup” with a 20% chance of becoming DeFi’s version of The DAO, Ethereum’s 2016 near-death experience.

Meanwhile, software engineer and one-time Bitcoin core developer Jameson Lopp called on the crypto community to “shun and shame the folks who promote ridiculously irresponsible financial products” like YAM.

Theoretic experiment or classic pump and dump?

Taylor Monahan, founder and CEO of blockchain interaction interface provider MyCrypto, told Cointelegraph, “YAM marks a turning point where things go from a bit wild to downright scary.” She mentioned that “everyone knows there is a lot of value at stake” in DeFi projects — more than $6 billion this week — “but no one imagined an openly unaudited project with absurd branding would capture $500 million in less than a day.”

The bug that was discovered in the YAM protocol code resulted in excessive YAM reserves being minted, making it “impossible to take any future governance actions.” The project then called on the DeFi community for help, whose support was forthcoming, as BitMEX CEO Arthur Hayes tweeted: “I did my part to save YAM, did you do yours?” CoinGecko also aided the project, and its founder and CEO Bobby Ong described YAM to Cointelegraph as “a very successful crypto economic experiment — albeit a risky and careless one.”

YAM proved that one can bootstrap a successful project community on top of other communities “by leveraging on the various DeFi communities such as Chainlink, Synthetix, Aave, Maker and others,” Ong explained to Cointelegraph:

“It is a very interesting experiment as it also implemented a rebase function made popular by Ampleforth in its protocol rules. Tokens with rebase functions essentially turn it [the project] into a massive multiplayer crypto game with players all over the world betting on the token price. It creates an asset class that is not correlated with the price of Bitcoin, Ether, or any other tokens as its price is driven purely by its own protocol rules.”

Others, while sympathetic to the Yam enterprise, weren’t willing to go quite so far as describing it as an experiment — at least not in the scientific sense. Ruaridh O’Donnell, the co-founder and director of information systems at Kava, a DeFi lending platform, told Cointelegraph, “Calling it an experiment implies that it was a carefully set up system designed to prove out a new concept. It was not that. It was a quickly put together mash up of existing DeFi ideas.” He then added, “However, sometimes that is what we need to inspire the real versions that come along later.”

O’Donnell counseled taking the longer view. “New markets always have periods of over-hyping. They often follow an S-curve model where growth is slow at first before becoming over-hyped as people speculate on the potentials of the new technology, before evening out as people learn more,” he said.

Is DeFi overheating?

It may be difficult to maintain one’s equilibrium when a market is growing as fast as the DeFi market. When asked if DeFi was bubbling over, John Wagster, an attorney at Frost Brown Todd LLC, told Cointelegraph: “The rapid increase in the total amount of value locked in DeFi, from roughly $1 billion in May to over $6 billion today, could certainly be viewed as a sign that the market is overheating.” However, he also said that “the truly innovative concept of yield farming is the result of clever engineering that seems to have lured market participants looking for a new opportunity.”

Lex Sokolin, chief marketing officer and global fintech co-head at ConsenSys, told Cointelegraph: “Software scales ideas like never before, where a single developer can architect and deploy a fantastic DeFi application to $500 million in assets overnight [...] When compared with the existing financial systems within banking and fintech, this space moves much faster and with more momentum.” He further shared:

“My takeaway from YAM is that there is massive demand for financial infrastructure innovation, and that the demand can outpace the capacity of the existing operating environment.”

Monahan, on the other hand, is worried that “things that were dangerous yesterday — naive and reckless teams with good intentions — will quickly be replaced by all scams and money grabs and criminals. We are already seeing phishing sites and extensions exclusively targeting DeFi products — e.g., Uniswap. We are seeing Google ads and malicious DMs and tweets to fake sites.” She further shared:

“I said in February that the total value locked (TVL) for DeFi was clearly the early stages of going parabolic and it will happen faster than we foresee. COVID-19 put a damper on things but ultimately there is nothing — not even a global pandemic — that can stop the momentum of the crypto markets.”

Asked if DeFi was already boiling over, Tone Vays, Bitcoin analyst and organizer of The Financial Summit, told Cointelegraph: “Unfortunately due to the recent rise in Bitcoin, it does not look like DeFi is overheating yet, and that is why everyone is rushing to get rich from these scams while they can.” Vays went on to add:

“The developers don’t even really need a functioning product. The YAM founders probably wanted it to last more than two days, but considering there was a market on day one and it was valued at a $60 million market cap, the founder could have sold $5 million worth of YAM on day one and now can relax and enjoy the rest of life.”

Asked whether he considered YAM a scam, Vays answered, “To me, anyone that prints their money is running a scam. It was different when Satoshi [Nakamoto] did it because he was the first to solve an actual problem.” In contrast, CoinGecko’s Ong said: “I would not consider it a scam as the rules were clearly defined upfront for everyone to see. I do however consider YAM to be very risky and a careless experiment.”

The point about risk revolves around the rebase function, which can mint huge amounts of YAM tokens, thereby diluting existing token holders, but this may not have been known to all participants. The project is being called careless because its code was not properly audited and tested before launch.

Incumbent systems are like complex cathedrals

There really isn’t much precedent for these sorts of weekly detonations. As Sokolin told Cointelegraph, “Incumbent systems have been built much more like complex cathedrals. [...] The crypto space will not feature-match 50 years of core banking and portfolio management software overnight.”

Ong added that he sees the current rush mimicking the mining craze of 2014–2016. Back then, however, one had to understand the mechanics of mining, but now, “one just has to have capital to stake and farm the early tokens, making this a more democratic process.”

There is a danger of moving too fast and breaking too much when it relates to people’s financial assets, added Sokolin, “If we want to get to mass retail adoption, the standards will end up being more stringent and the assets more regulated.” Ong also added: “Eventually, this ‘test in production’ behavior will result in a massive loss, and it won’t surprise me if a Mt. Gox-like catastrophe was to happen at some point.”

Lessons learned?

Has anything been gained from last week’s events? Wagster told Cointelegraph: “The fact that YAM apparently went live with unaudited software code is a huge red flag to anyone paying attention, but one bad apple should not spoil the whole bunch.” Ong added that in the future, those staking a large amount in DeFi should consider buying insurance. In this instance, “insurance for the YAM contract was available on Nexus Mutual but there was no buyer for this contract,” he said.

O’Donnell emphasized the outsized impact of coding errors in this high-stakes environment: “I think it highlights that building these systems is hard and quite unlike other software development. Mistakes can lead to catastrophic failures unlike anything a standard webapp is capable of.”

Vays was doubtful that any insights at all were gathered from the recent events: “The only thing useful that came from YAM is to show that these projects can lose you all your money in two days — but I already see people waiting for YAM 2.0 so the lesson was not learned.” Indeed, as Cointelegraph reported, total value locked in YAM has surpassed $400m since the collapse of the network, according to a report from crypto analytics firm Messari.

Others, however, believe the project’s quick demise may find a place in crypto’s annals. “YAM is now a cautionary tale,” Kara Miley, global public relations lead at ConsenSys, told Cointelegraph. “An audit could have prevented the initial issue — rebasing, as it was missing a basic mathematical function to get the right numbers — and a proper test suite would have caught this,” she added.

Still, Sokolin wouldn’t be surprised to see more implosions of this sort, given that DeFi is about committing financial assets on a potentially perpetual, decentralized network: “I would expect multiple periodic collapses within the DeFi space, but hope that their magnitude and impact — think the DAO, then the ICO collapse — will be less and less existential, and increasingly informative.” Meanwhile, Wagster said investors should remain ever vigilant:

“Expect highs and lows as the DeFi market matures — investors should approach the market with their eyes wide open. New investors in particular should avoid trying to cash in on a fad that is not yet well understood.”

As the dust from Yam Finance settles, many look out and see a bright horizon for DeFi yet. “The crypto community is sitting on one of the most fundamental innovations in the history of financial services,” Sokolin told Cointelegraph, “The key takeaway for me is to play the long game, rather than focus on asset prices in the short term.”

Uncategorized

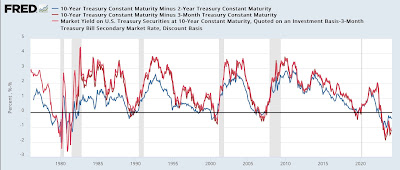

Manufacturing and construction vs. the still-inverted yield curve

– by New Deal democratProf. Menzie Chinn at Econbrowser makes the point that the yield curve is still inverted, and has not yet eclipsed the longest…

- by New Deal democrat

Prof. Menzie Chinn at Econbrowser makes the point that the yield curve is still inverted, and has not yet eclipsed the longest previous time between onset of such an inversion and a recession. So he believes the threat of recession is still on the table.

Uncategorized

Half Of Downtown Pittsburgh Office Space Could Be Empty In 4 Years

Half Of Downtown Pittsburgh Office Space Could Be Empty In 4 Years

Authored by Mike Shedlock via MishTalk.com,

The CRE implosion is picking…

Authored by Mike Shedlock via MishTalk.com,

The CRE implosion is picking up steam.

Check out the grim stats on Pittsburgh.

Unions are also a problem in Pittsburgh as they are in Illinois and California.

Downtown Pittsburgh Implosion

The Post Gazette reports nearly half of Downtown Pittsburgh office space could be empty in 4 years.

Confidential real estate information obtained by the Pittsburgh Post-Gazette estimates that 17 buildings are in “significant distress” and another nine are in “pending distress,” meaning they are either approaching foreclosure or at risk of foreclosure. Those properties represent 63% of the Downtown office stock and account for $30.5 million in real estate taxes, according to the data.

It also calculates the current office vacancy rate at 27% when subleases are factored in — one of the highest in the country.

And with an additional three million square feet of unoccupied leased space becoming available over the next five years, the vacancy rate could soar to 46% by 2028, based on the data.

Property assessments on 10 buildings, including U.S. Steel Tower, PPG Place, and the Tower at PNC Plaza, have been slashed by $364.4 million for the 2023 tax year, as high vacancies drive down their income.

Another factor has been the steep drop — to 63.5% from 87.5% — in the common level ratio, the number used to compute taxable value in county assessment appeal hearings.

The assessment cuts have the potential to cost the city, the county, and the Pittsburgh schools nearly $8.4 million in tax refunds for that year alone. Downtown represents nearly 25% of the city’s overall tax base.

In response Pittsburgh City Councilman Bobby Wilson wants to remove a $250,000 limit on the amount of tax relief available to a building owner or developer as long as a project creates at least 50 full-time equivalent jobs.

It’s unclear if the proposal will be enough. Annual interest costs to borrow $1 million have soared from $32,500 at the start of the pandemic in 2020 to $85,000 on March 1. Local construction costs have increased by about 30% since 2019.

But the city is doomed if it does nothing. Aaron Stauber, president of Rugby Realty said it will probably empty out Gulf Tower and mothball it once all existing leases expire.

“It’s cheaper to just shut the lights off,” he said. “At some point, we would move on to greener pastures.”

Where’s There’s Smoke There’s Unions

In addition to the commercial real estate woes, the city is also wrestling with union contracts.

Please consider Sounding the alarm: Pittsburgh Controller’s letter should kick off fiscal soul-searching

It’s only March, and Pittsburgh’s 2024 house-of-cards operating budget is already falling down. That’s the clear implication of a letter sent by new City Controller Rachael Heisler to Mayor Ed Gainey and members of City Council on Wednesday afternoon.

The letter is a rare and welcome expression of urgency in a city government that has fallen in complacency — and is close to falling into fiscal disaster.

The approaching crisis was thrown into sharp relief this week, when City Council approved amendments to the operating budget accounting for a pricey new contract with the firefighters union. The Post-Gazette Editorial Board had predicted that this contract — plus two others yet to be announced and approved — would demonstrate the dishonesty of Mayor Ed Gainey’s budget, and that’s exactly what’s happening: The new contract is adding $11 million to the administration’s artificially low 5-year spending projections, bringing expected 2028 reserves to just barely the legal limit.

But there’s still two big contracts to go, with the EMS union and the Pittsburgh Joint Collective Bargaining Committee, which covers Public Works workers. Worse, there are tens — possibly hundreds — of millions in unrealistic revenues still on the books. On this, Ms. Heisler’s letter only scratched the surface.

Similarly, as we have observed, the budget’s real estate tax revenue projections are radically inconsistent with reality. Due to high vacancies and a sharp reduction in the common level ratio, a significant drop in revenues was predictable — but not reflected in the budget. Ms. Heisler’s estimate of a 20% drop in revenues from Downtown property, or $5.3 million a year, may even be optimistic: Other estimates peg the loss at twice that, or more.

Left unmentioned in the letter are massive property tax refunds the city will owe, as well as fanciful projections of interest income that are inconsistent with the dwindling reserves, and drawing-down of federal COVID relief funds, predicted in the budget itself. That’s another unrealistic $80 million over five years.

Pittsburgh exited Act 47 state oversight after nearly 15 years on Feb. 12, 2018, with a clean bill of fiscal health.

It has already ruined that bill of health.

Act 47 in Pittsburgh

Flashback February 21, 2018: Act 47 in Pittsburgh: What Was Accomplished?

Pittsburgh’s tax structure was a much-complained-about topic leading up to the Act 47 declaration. The year following Pittsburgh’s designation as financially distressed under Act 47 it levied taxes on real estate, real estate transfers, parking, earned income, business gross receipts (business privilege and mercantile), occupational privilege and amusements. The General Assembly enacted tax reforms in 2004 giving the city authority to levy a payroll preparation tax in exchange for the immediate elimination of the mercantile tax and the phase out of the business privilege tax. The tax reforms increased the amount of the occupational privilege tax from $10 to $52 (this is today known as the local services tax and all municipalities outside of Philadelphia levy it and could raise it thanks to the change for Pittsburgh).

The coordinators recommended an increase in the deed transfer tax, which occurred in late 2004 (it was just increased again by City Council) and in the real estate tax, which increased in 2015.

Legacy costs, principally debt and underfunded pensions, were the primary focus of the 2009 amended recovery plan. The city’s pension funded ratio has increased significantly from where it stood a decade ago, rising from the mid-30 percent range to over 60 percent at last measurement.

The obvious question? Will the city stick to the steps taken to improve financially and avoid slipping back into distressed status? If Pittsburgh once stood “on the precipice of full-blown crisis,” as described in the first recovery plan, hopefully it won’t return to that position.

The Obvious Question

I could have answered the 2018 obvious question with the obvious answer. Hell no.

No matter how much you raise taxes, it will never be enough because public unions will suck every penny and want more.

On top of union graft, and insanely woke policies in California, we have an additional huge problem.

Hybrid Work Leaves Offices Empty and Building Owners Reeling

Hybrid work has put office building owners in a bind and could pose a risk to banks. Landlords are now confronting the fact that some of their office buildings have become obsolete, if not worthless.

Meanwhile, in Illinois …

Chicago Teachers’ Union Seeks $50 Billion Despite $700 Million City Deficit

Please note the Chicago Teachers’ Union Seeks $50 Billion Despite $700 Million City Deficit

The CTU wants to raise taxes across the board, especially targeting real estate.

My suggestion, get the hell out...

International

A popular vacation destination is about to get much more expensive

The entry fee to this destination known for its fauna has been unchanged since 1998.

When visiting certain islands and other remote parts of the world, travelers need to be prepared to pay more than just the plane ticket and accommodation costs.

Particularly for smaller places grappling with overtourism, local governments will often introduce "tourist taxes" to go toward things like reversing ecological degradation and keeping popular attractions clean and safe.

Related: A popular European city is introducing the highest 'tourist tax' yet

Located 900 kilometers off the coast of Ecuador and often associated with the many species of giant turtles who call it home, the Galápagos Islands are not easy to get to (visitors from the U.S. often pass through Quito and then get on a charter flight to the islands) but are often a dream destination for those interested in seeing rare animal species in an unspoiled environment.

Shutterstock

This is how much you'll have to pay to visit the Galápagos Islands

While local authorities have been charging a $100 USD entry fee for all visitors to the islands since 1998, Ecuador's Ministry of Tourism announced that this number would rise to $200 for adults starting from August 1, 2024.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to the local tourism board, the increase has been prompted by the fact that record numbers of visitors since the pandemic have started taking a toll on the local environment. The islands are home to just 30,000 people but have been seeing nearly 300,000 visitors each year.

"It is our collective responsibility to protect and preserve this unparalleled ecosystem for future generations," Ecuador's Minister of Tourism Niels Olsen said in a statement. "The adjustment in the entry fee, the first in 26 years, is a necessary measure to ensure that tourism in the Galápagos remains sustainable and mutually beneficial to both the environment and our local communities."

These are the other countries which are raising (or adding) their tourist taxes

While the $200 applies to most international adult arrivals, there are some exceptions that can make one eligible for a lower rate. Adult citizens of the countries that make up the South American treaty bloc Mercosur will pay a $100 fee while children from any country will also get a discounted rate that is currently set at $50. Children under the age of two will continue to get free access.

In recent years, multiple countries and destinations have either raised or introduced new taxes for visitors. Thailand recently started charging all international visitors between 150 and 300 baht (up to $9 USD) that are put toward a sustainability budget while the Italian city of Venice is running a test in which it charges those coming into the city during the most popular summer weekends five euros.

Places such as Bali, the Maldives and New Zealand have been charging international arrivals a fee for years while Iceland's Prime Minister Katrín Jakobsdóttir hinted at plans to introduce something similar at the United Nations Climate Ambition Summit in 2023.

"Tourism has really grown exponentially in Iceland in the last decade and that obviously is not just creating effects on the climate," Jakobsdóttir told a Bloomberg reporter. "Most of our guests visit our unspoiled nature and obviously that creates a pressure."

stocks pandemic european-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex