Uncategorized

Defense Metals Variability Flotation Tests Yield High Rare Earth Recoveries to High Grade Concentrates

Defense Metals Variability Flotation Tests Yield High Rare Earth Recoveries to High Grade Concentrates

PR Newswire

VANCOUVER, BC, Feb. 14, 2023

VANCOUVER, BC, Feb. 14, 2023 /PRNewswire/ – Defense Metals Corp. (“Defense Metals” or the “Company”) (TS…

Defense Metals Variability Flotation Tests Yield High Rare Earth Recoveries to High Grade Concentrates

PR Newswire

VANCOUVER, BC, Feb. 14, 2023

VANCOUVER, BC, Feb. 14, 2023 /PRNewswire/ - Defense Metals Corp. ("Defense Metals" or the "Company") (TSXV: DEFN) (OTCQB: DFMTF) (FSE:35D) announces the completion of flotation tests on variability samples and a master composite ("Master Composite" or "MC") prepared from drill core obtained from its 100% owned Wicheeda Rare Earth Element (REE) deposit located in British Columbia, Canada.

John Goode, Defense Metals' metallurgical advisor, stated:

"Flotation tests on variability samples from the dominant lithological unit of the Wicheeda REE deposit gave an average of 81% recovery to a concentrate assaying 45% rare earth oxide. Wicheeda is one of the few rare earth deposits under development from which a high-grade mineral flotation concentrate can be produced at recovery rates similar to those obtained by current rare earth producers. High-grade concentrates at high recoveries are a critical requirement for positive production economics. These successful flotation results help to position Defense Metals' Wicheeda deposit as one of the best in North America."

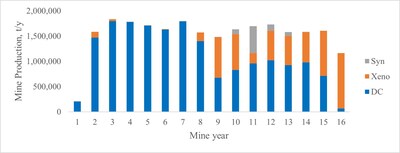

Defense Metals completed flotation tests on variability samples that are representative of the three key REE-bearing lithologies in the Wicheeda deposit: 1) the higher-grade dolomite carbonatite ("DC") which makes up 73% of the deposit, 2) the xenolithic carbonatite ("XE") that represents 24%; and 3) the syenite ("SYN"). The primary rare earths minerals are monazite, bastnäsite and synchysite/parisite. Figure 1 shows the mine plan as presented in the Independent Preliminary Economic Assessment issued in 20221.

Figure 1. Wicheeda REE Deposit Lithologies During Mine Life

- Table 1 results show that if the flotation plant is fed DC material at an average grade of 3.3% Total Rare Earth Oxide ("TREO") and is operated to produce a flotation concentrate containing 45% TREO, an average 81% recovery will be observed. If 50% TREO were targeted, recovery would be expected to be 77%. The DC mineralized material will be essentially the only lithology fed to the flotation plant in the first eight years as shown in Figure 1.

Table 1: Recovery rates at concentrates of specified grades - DC samples

Note to Table 1: DC Comp is a blend of all DC variability samples. |

- If the flotation plant is fed DC material mixed with other lithological types, as planned for later in the mine life, recoveries at different target concentrate grades will be as shown in Table 2. Of the four blends tested, when producing a 40% TREO flotation concentrate the recovery rate averaged 80% with higher recoveries when the DC content was higher.

Table 2: Recovery rates at concentrates of specified grades - DC blends

Notes to Table 2: DC-XE2 and DC-XE3 are 1:2 and 2:1 blends of DC and XE Comp, respectively. DC-SYN2 is 2:1 blend of DC Comp and SYN2. MC is a blend of DC (73.4%), XE (22.5%), and SYN (3.8%). |

- Table 3 shows the testwork results for the variability samples comprising pure XE and SYN lithologies. The flotation plant is expected to only see such lithologies when they are blended with DC. However, the data show that if the lower grade XE and SYN material are processed alone, at a target flotation concentrate grade of 40% TREO, the average recovery rate will be 59%.

Table 3: Recovery rates at concentrates of specified grades - SYN and XE samples

Notes to Table 3: SYN Comp and XE Comp are composites of respective variability samples. DC01 was mis-identified as being DC, but assays and mineralogy showed it to be XE and it was treated as such. N/A indicates insufficient data for meaningful average. |

As noted above, in the first 8 years of the mine life, over 90% of the flotation plant feed will be DC material, with higher rare earth grade, with the later years being mostly DC and XE material at relatively lower grades (see Figure 1).

The grade-recovery-concentrate data provided above will support the upcoming preliminary feasibility study (PFS) and allow the development of an updated and enhanced mine plan incorporating drilling completed following the PEA that identifies lithology and feed grades to arrive at estimates of the concentrate and REO production rates in each year.

Defense Metals prepared 17 variability samples covering different lithologies, areas of the deposit, and head grades using drill core material. The average mass of each sample was 31 kg, with the Total Rare Earth Oxide ("TREO") assays ranging from 1.07% to 4.52% with an average of 2.34% TREO. Drill core material was also used to make a 260 kg Master Composite sample containing each of the three lithologies in their respective life-of-mine proportions. The MC sample had a head grade assay of 2.49% TREO.

All variability samples and the MC sample were shipped to SGS, Lakefield, Ontario where they were checked, crushed, and composited. A total of 87 flotation tests were completed to investigate the impact of collector type and dosage, depressant type and dosage, pulp temperature, pulp density, pulp pH, and flotation feed size.

Bulk flotation and other operations continue at SGS in order to prepare concentrate samples for continuing hydrometallurgical test work and planned hydrometallurgical pilot plant testing.

Feed samples were analyzed by Inductively coupled plasma mass spectrometry (ICP-MS) and flotation products were analyzed by SGS using wavelength dispersive X-ray fluorescence (WD-XRF) following lithium borate fusion of the sample. The SGS analyses included a quality assurance / quality control (QA/QC) program including the insertion of rare earth element standard and blank samples.

Defense Metals detected no significant QA/QC issues during review of the data. Defense Metals is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the data referred to herein. SGS Lakefield is an ISO/IEC 17025 and ISO9001:2015 accredited laboratory. SGS is independent of Defense Metals Corp.

The scientific and technical information contained in this news release, as it relates to the Wicheeda Rare Earth Element Project, has been reviewed and approved by John Goode, P. Eng., who is a Qualified Person as defined by National Instrument 43-101 and has provided the technical information relating to metallurgy in this news release. Kristopher J. Raffle, P.Geo. (BC), a director of the Company, is the Qualified Person as defined in National Instrument 43-101 for the information relating to resources in this news release.

Defense Metals 100% owned, 4,262-hectare (~10,532-acre) Wicheeda REE property is located approximately 80 km northeast of the city of Prince George, British Columbia; population 77,000. The Wicheeda REE Project is readily accessible by all-weather gravel roads and is near infrastructure, including hydro power transmission lines and gas pipelines. The nearby Canadian National Railway and major highways allow easy access to the port facilities at Prince Rupert, the closest major North American port to Asia.

The 2021 Wicheeda REE Project Preliminary Economic Assessment technical report ("PEA") outlined a robust after-tax net present value (NPV@8%) of $517 million and an 18% IRR1. This PEA contemplated an open pit mining operation with a 1.75:1 (waste:mill feed) strip ratio providing a 1.8 Mtpa ("million tonnes per year") mill throughput producing an average of 25,423 tonnes REO annually over a 16 year mine life. A Phase 1 initial pit strip ratio of 0.63:1 (waste:mill feed) would yield rapid access to higher grade surface mineralization in year 1 and payback of $440 million initial capital within 5 years.

Defense Metals Corp. is a company focused on the development of its 100% owned Wicheeda Rare Earth Element mineral deposit, located near Prince George, British Columbia, Canada, that contains metals and elements commonly used in in green energy, aerospace, automotive and defense technologies. Rare earth elements are especially important in the production of magnets used in wind turbines and in permanent magnet motors for electric vehicles. Defense Metals Corp. trades in Canada under the symbol "DEFN" on the TSX Venture Exchange, in the United States, under "DFMTF" on the OTCQB and in Germany on the Frankfurt Exchange under "35D".

Todd Hanas, Bluesky Corporate Communications Ltd.

Vice President, Investor Relations

Tel: (778) 994 8072

Email: todd@blueskycorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release contains "forward–looking information or statements" within the meaning of applicable securities laws, which may include, without limitation, statements relating to advancing the Wicheeda REE Project, the continuing hydrometallurgical test work and planned hydrometallurgical pilot plant testing, completing the planned PFS, the Company's plans for its Wicheeda REE Project, the expected results and outcomes, the technical, financial and business prospects of the Company, its project and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of rare earth elements, the anticipated costs and expenditures, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company's views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration and metallurgy results, risks related to the inherent uncertainty of exploration and cost estimates, the potential for unexpected costs and expenses and those other risks filed under the Company's profile on SEDAR at www.sedar.com. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, adverse weather and climate conditions, failure to maintain or obtain all necessary government permits, approvals and authorizations, failure to maintain community acceptance (including First Nations), risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of personnel, materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), risks relating to inaccurate geological, metallurgical and engineering assumptions, decrease in the price of rare earth elements, the impact of Covid-19 or other viruses and diseases on the Company's ability to operate, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to, the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, loss of key employees, consultants, or directors, increase in costs, delayed drilling results, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward–looking statements or forward–looking information, except as required by law.

View original content to download multimedia:https://www.prnewswire.com/news-releases/defense-metals-variability-flotation-tests-yield-high-rare-earth-recoveries-to-high-grade-concentrates-301746013.html

SOURCE Defense Metals Corp.

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemicUncategorized

Star Wars icon gives his support to Disney, Bob Iger

Disney shareholders have a huge decision to make on April 3.

Disney's (DIS) been facing some headwinds up top, but its leadership just got backing from one of the company's more prominent investors.

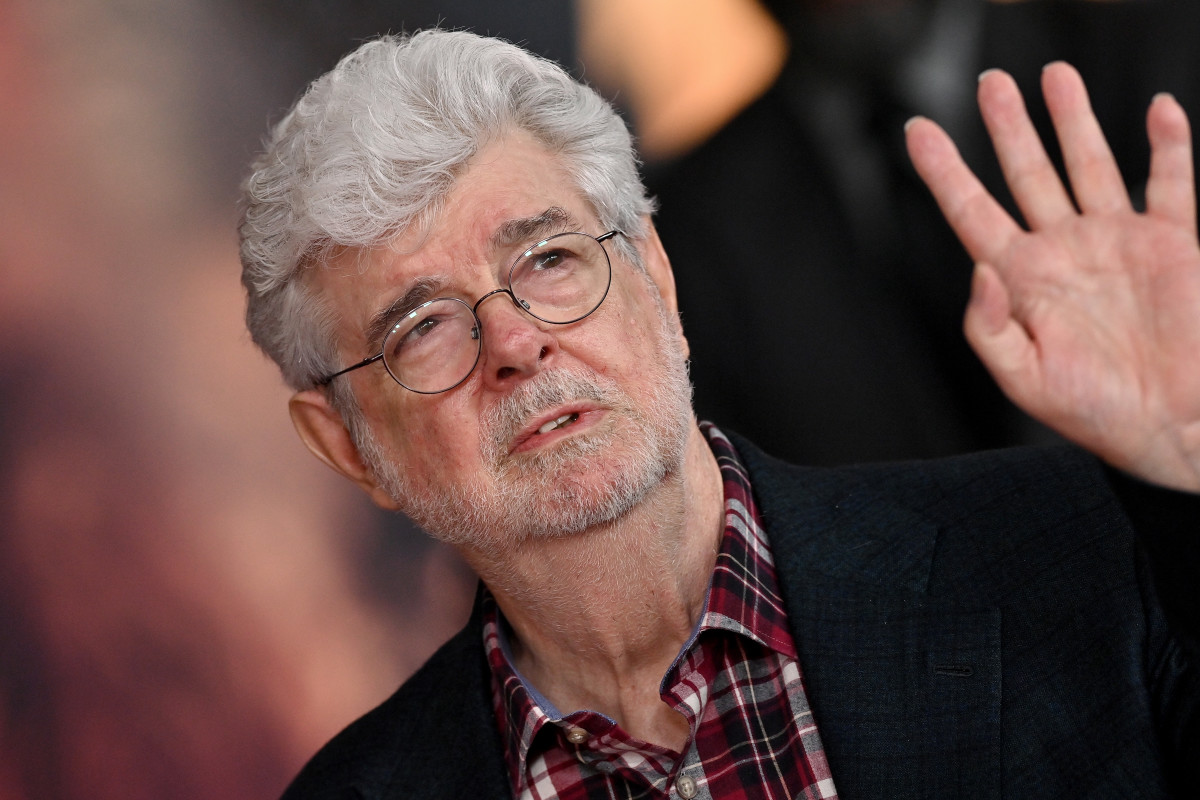

Star Wars creator George Lucas put out of statement in support of the company's current leadership team, led by CEO Bob Iger, ahead of the April 3 shareholders meeting which will see investors vote on the company's 12-member board.

"Creating magic is not for amateurs," Lucas said in a statement. "When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same."

Related: Disney stands against Nelson Peltz as leadership succession plan heats up

Lucasfilm was acquired by Disney for $4 billion in 2012 — notably under the first term of Iger. He received over 37 million in shares of Disney during the acquisition.

Lucas' statement seems to be an attempt to push investors away from the criticism coming from The Trian Partners investment group, led by Nelson Peltz. The group, owns about $3 million in shares of the media giant, is pushing two candidates for positions on the board, which are Peltz and former Disney CFO Jay Rasulo.

Peltz and Co. have called out a pair of Disney directors — Michael Froman and Maria Elena Lagomasino — for their lack of experience in the media space.

Related: Women's basketball is gaining ground, but is March Madness ready to rival the men's game?

Blackwells Capital is also pushing three of its candidates to take seats during the early April shareholder meeting, though Reuters has reported that the firm has been supportive of the company's current direction.

Disney has struggled in recent years amid the changes in media and the effects of the pandemic — which triggered the return of Iger at the helm in late 2022. After going through mass layoffs in the spring of 2023 and focusing on key growth brands, the company has seen a steady recovery with its stock up over 25% year-to-date and around 40% for the last six months.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic recoveryUncategorized

Another airline is making lounge fees more expensive

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment7 days ago

Spread & Containment7 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex