Cointelegraph Consulting: Going down the Metaverse

The Metaverse allows people to interact with one another, digital objects and the physical world through their avatar in a virtual environment.

As nonfungible token sales appear reanimated after a nearly two-month dry spell from their.

The Metaverse allows people to interact with one another, digital objects and the physical world through their avatar in a virtual environment.

As nonfungible token sales appear reanimated after a nearly two-month dry spell from their apex in May, a particular NFT application is gaining popularity more than ever: metaverses. Metaverses have gained their fair share of media attention lately, with big moves coming from companies like Facebook and Epic games. However, not everyone — even those who have been in crypto for a long time — has caught on to what metaverses are, despite the hype. But as more companies, celebrities and artists venture into the space, it has become another domain that deserves some thorough consideration.

The Metaverse is a network of virtual environments in which people can interact with each other, digital objectsand the physical world through their avatar. While definitions of the Metaverse vary, they orbit around technologies such as virtual reality, augmented reality, digital twins and blockchain. Herman Narula, CEO of Improbable, described the Metaverse as “something more than a game but less than the real world. The metaverse is to virtual worlds as a website is to the internet."

Metaverse bandwagon

For weeks, Mark Zuckerberg has been beating the drum for metaverses. The Facebook founder views virtual worlds as the next iteration of human interaction online. Zuckerberg sees Facebook transitioning from a social media firm with a set of connected applications to a metaverse company with a set of interconnected experiences. And its recent move to introduce Horizon Workrooms is a step in that direction. It’s also in a prime spot to run after its metaverse objectives, as it has invested heavily in VR technology for several years.

Another one bursting onto the scene is game and software developer Epic Games. Epic Games, of course, already has something to show for when it comes to metaverses, with the successful virtual concerts of Ariana Grande, Travis Scott and Marshmello that were held inside its flagship game, Fortnite. The $1 billion in funding that it received in April, with an additional $200 million deal from Sony Group, will help it pursue long-term growth opportunities with metaverses, especially as it is already remodeling the future of live events.

Why the Metaverse?

The Metaverse offers a vastly unique experience for everyone. It's a way for artists to connect with fans more interactively and perhaps individually, which is a step up from the livestream format delivered by artists like Post Malone, Dua Lipa, Gorillaz and many others when the pandemic struck in 2020.

On the other hand, Facebook's Horizon Workroom is geared toward replacing boring Zoom call meetings with a more interactive environment — a virtual conference room, if you will — for remote workers. Others also see a wide variety of applications that the Metaverse is going to be useful for. Education systems, for one, can benefit by allowing students, particularly in the medical field, to receive simulation training as opposed to just a one-way communication where teachers merely deliver the lessons to the students.

Metaverses and NFTs

The tie-in between metaverses and nonfungible tokens comes from NFTs’ capability to add a certificate of ownership or authenticity to the assets belonging to the digital world. Projects like Decentraland, The Sandbox, Landemic, CryptoVoxels, and SuperWorld involve acquiring a piece of this digital asset, which is primarily virtual land. NFTs help in verifying its uniqueness, and even its provenance.

For instance, Decentraland is based on the Ethereum blockchain and uses ERC-721 tokens called LAND to facilitate trading plots of virtual lands called parcels. This makes each land distinct and helps users establish ownership of a piece of the entire Decentraland real estate. This is built on its consensus layer, which maintains a ledger that tracks the ownership of each parcel.

LAND tokens enable owners to do various things within their digital real estate, like hosting games or experiences, organizing contests and events, or even renting it. The same concept applies to The Sandbox, the second-largest metaverse NFT project in terms of sales, behind Decentraland.

Download the 29th issue of the Cointelegraph Consulting Bi-weekly Newsletter in full, complete with charts and market signals, as well as news and overviews of fundraising events.

Metaverses and cryptocurrencies

Cryptocurrencies play the medium of exchange within the Metaverse, allowing users to exchange virtual goods. The two metaverses mentioned above enable players to transact using cryptocurrencies. Decentraland’s ERC-20 based token, MANA, is the legal tender for users to purchase plots of digital land, as are SAND tokens for The Sandbox. Such coins also give users the opportunity to participate in its development.

Users can use MANA tokens to vote on policy updates, land auctionsand subsidies for new developments on Decentraland, while users can use SAND tokens for more or less the same purpose. Moreover, cryptocurrencies can further open up the possibility of transacting goods from different games or metaverses on interoperable marketplaces.

Growth of metaverses

At this stage, metaverses haven’t reached their full potential, and companies are just beginning to explore the ways they could penetrate the space. Facebook and Epic games are just the two most recent examples of big names jumping on the bandwagon. However, companies like Microsoft and Amazon are also getting in on the act. Amazon, in particular, is developing a virtual “Amazon mall” where users can shop and interact with the products they want to buy. But whether or not these are going to support NFTs is still uncertain and maybe even unlikely.

Nonetheless, NFT sales from metaverses are gradually gaining a strong foothold against other categories. In the second quarter, their weekly sales topped $8 million at one point.

Total sales from 2017 through August 2021 amounted to $138 million, which is enough to take a 6.77% share of NFT sales by category. This puts the metaverse NFT category in third place for NFT sales, behind digital collectibles and artwork.

And as more and more well-known personalities and big companies take part in the trend, the numbers could very well improve before the end of the year. The growth of metaverses and NFTs in general is unprecedented, especially in 2021. Sales of NFTs in the metaverse are already up 428% from 2020 and averaged 149% growth during the past four years. If this explosive growth keeps the same pace, it would not be surprising to see sales breach the $120-million mark by early 2022.

Cointelegraph’s Market Insights Newsletter shares our knowledge on the fundamentals that move the digital asset market. The newsletter dives into the latest data on social media sentiment, on-chain metrics, and derivatives.

We also review the industry’s most important news, including mergers and acquisitions, changes in the regulatory landscape, and enterprise blockchain integrations. Sign up now to be the first to receive these insights. All past editions of Market Insights are also available on Cointelegraph.com.

ethereum blockchain crypto pandemic real estate cryptoSpread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

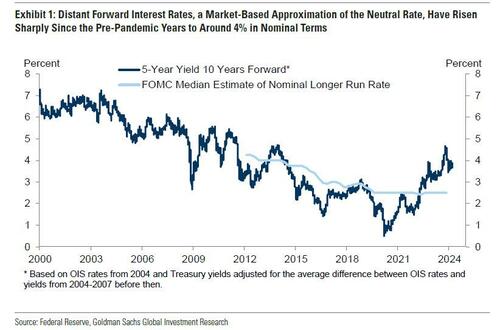

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

Spread & Containment

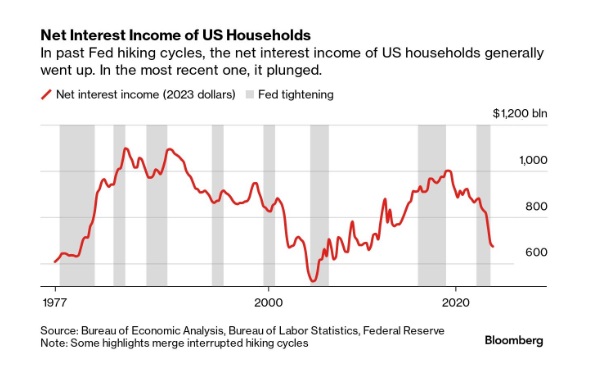

Household Net Interest Income Falls As Rates Spike

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex