International

Coal Outlook 2022: Lower Prices Ahead, Investment Slows Down

Click here to read the previous coal outlook.Like all other commodities, coal had to navigate the COVID-19 pandemic in 2020, with prices for the material stabilizing and then pulling back by the end of the year. In 2021, coal prices surged on the back…

Click here to read the previous coal outlook.

Like all other commodities, coal had to navigate the COVID-19 pandemic in 2020, with prices for the material stabilizing and then pulling back by the end of the year.

In 2021, coal prices surged on the back of the economic recovery, but with renewable energy adoption continuing to grow as governments push for cleaner sources of power, many wonder what could be next for coal.

As the new year starts, what can investors expect in 2022? Read on to learn more about coal’s performance in 2021, as well as what experts see coming for the future coal outlook.

Coal trends 2021: The year in review

Following an uncertain 2020, 2021 was set to be a year of reopenings and economic recovery. For coal, demand remained strong, with the amount of coal-generated electricity worldwide surging toward a new annual record.

After falling in 2019 and 2020, global power generation from coal is expected to jump by 9 percent in 2021 to an all-time high of 10,350 terawatt hours, according to the International Energy Agency’s (IEA) Coal 2021 report.

“The rebound is being driven by this year’s rapid economic recovery, which has pushed up electricity demand much faster than low-carbon supplies can keep up,” the IEA states. “The steep rise in natural gas prices has also increased demand for coal power by making it more cost-competitive.”

Prices for coal ended 2020 on the rebound as demand started to surge, and the commodity was lifted further in 2021 as demand outstripped supply in China, known as the global coal price setter. Supply disruptions and higher natural gas prices globally also helped to buoy prices for coal.

“Coal prices reached all-time highs in early October 2021, with imported thermal coal in Europe, for example, hitting US$298 per tonne,” the IEA report reads. “Quick policy intervention by the Chinese government to balance the market had a rapid effect on prices.”

Looking over to how supply performed in 2021, output was unable to keep pace with demand.

“The main coal exporting countries were prevented from fully taking advantage of high prices by supply chain disruptions, such as flooding in Indonesian mines,” the IEA report says. “Years of lower investment due to financing and bureaucratic restrictions also played a role. Outside China, most of the additional production in 2021 came from existing mines or reopened mines that had been idled during periods of low prices.”

Similarly, metallurgical coal saw strong demand and tight supply — which drove prices higher throughout 2021.

“China’s informal import restrictions on Australian exports have obliged the country’s steel mills to draw in supply from virtually all non-Australian sources. India, Japan, South Korea and the EU have all switched to Australian-sourced imports in response,” the Australian Office of the Chief Economist (OCE) explains in its latest report.

Coal outlook 2022: What’s ahead for supply, demand and prices

When looking at what’s ahead, IHS Markit analysts believe that while the current thermal coal market is very solidly bullish, this strength is a near-term phenomenon.

“Zooming out from the current volatility, the fundamentals look bearish,” they said.

In 2021, pledges to reach net-zero emissions took center stage, with coal being a main driver of discussions.

“The pledges to reach net zero emissions made by many countries, including China and India, should have very strong implications for coal – but these are not yet visible in our near-term forecast, reflecting the major gap between ambitions and action,” the IEA's coal report notes.

Looking over to future supply, surging prices have not led to a rush of coal investment.

“Investment in coal remains low amidst market and policy pressure, which has been affected by announcements in and around the recent COP26 summit,” the Australian OCE says.

From the projects that are moving forward, there is a growing preference for expansions of brownfield sites over new greenfield investments, the OCE states in a separate report, Resources and Energy Major Projects 2021.

“The growing reluctance to commit to greenfield coal projects has been impacted by an expanding list of lenders/investors who have withdrawn from financing new thermal coal projects,” the OCE comments. “Some pension and equity funds are also divesting from, or limiting their exposure to, thermal coal, limiting the range of investment financing options available to coal project developers.”

Australian thermal coal prices weakened slightly over the last month of 2021 amid ongoing intervention in the market by the Chinese government, taken in response to soaring prices in September and October.

“Despite this, upward support to prices came from concerns over weather-induced supply disruptions, with flooding in Australia hampering access to coal mines,” FocusEconomics analysts said about the material in their latest report. “This follows a trend of weather-related disruptions in the last year, with forecasts for Australia indicating a wetter-than-average summer.”

Panelists polled recently by the firm see thermal coal prices trending downwards next year as supply normalizes somewhat and amid weaker demand growth overall. They project that the price of thermal coal will average US$115.10 in Q4 2022 and US$89.10 in Q4 2023.

Similarly, IHS Markit is confident that weaker thermal coal prices are coming.

“It is difficult to imagine that a supply-side that was more than able to meet 2019 demand levels would have much trouble meeting a 2022 demand level that is likely 40 to 50 (million metric tonnes) lower than that,” analysts said.

However, there are risks around the timing, with prices expected to ease substantially in spring 2022. “But if the equipment shortage in Indonesia lingers or prolonged rains return in 2022, then prices could remain supported longer,” as per IHS Markit. "And if the coming winter proves mild then an earlier timing could easily occur."

Looking over to metallurgical coal, prices for Australian coking coal should decrease from their current high level next year as supply and demand imbalances ease.

“An expected increase in global supply amid fading bottlenecks, soft demand from China and a normalization of energy demand growth should underpin the moderation,” FocusEconomics analysts said. “The Omicron variant poses a significant risk, as do adverse weather conditions.”

FocusEconomics panelists see prices averaging US$178 in Q4 2022 and US$135 in Q4 2023.

“Growth in steel production is one of the main drivers that contribute the most to the rising global demand of metallurgical coal,” IHS Markit analysts said. “Mainland China should reach peak steel production in the coming years but there are still large uncertainties around when.”

For the OCE, supply and demand are expected to come into better balance over 2022 as supply disruptions pass. Supply growth is expected from Canada, the US, Australia and Mongolia.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

economic recovery pandemic covid-19 recovery commodities south korea india japan canada europe eu chinaInternational

TikTok Ban Obscures Chinese Stock Gold Rush

No one wants to invest in China right now. The country’s stock market is teetering on the brink of collapse. And it is about to lose its biggest foothold…

No one wants to invest in China right now.

The country’s stock market is teetering on the brink of collapse.

And it is about to lose its biggest foothold in America — TikTok.

Yet, beneath its crumbling economy, military weather balloons and blatant propaganda tools lie some epic opportunities…

…if you have the stomach and the knowledge.

Because as Jim Woods wrote in his newsletter last month:

“China has been so battered for so long, that there is a lot of deep value here for the ‘blood in the ‘’red’’ streets’ investors.”

And boy was he right.

However, this battle-tested veteran didn’t recommend buying individual Chinese stocks.

He was more interested in the exchange-traded funds (ETFs) like the CHIQ.

And here’s why…

Predictable Manipulation

China’s heavy-handed approach creates gaping economic inefficiencies.

When markets falter, President Xi calls on his “national team” to prop up prices.

$17 billion flowed into index-tracking funds in January as the Hang Sang fell over 13% while the CSI dropped over 7%.

Jim Woods saw this coming from a mile away.

In late February, he highlighted the Chinese ETF CHIQ in late February, which has rallied rather nicely since then.

This ETF focuses on the Chinese consumer, a recent passion project for the central government.

You see, around 2018, when President Xi decided to smother his own economy, notable shifts were already taking place.

The once burgeoning retail market had slowed markedly. Developers left cities abandoned, including weird copies of Paris (Tianducheng) and England.

Source: Shutterstock

So, Xi and co. shifted the focus to the consumer… which went terribly.

For starters, a lot of the consumer wealth was tied up in real estate.

Then you had a growing population of unemployed younger adults who didn’t have any money to spend.

Once the pandemic hit, everything collapsed.

That’s why it took China far longer to recover even a sliver of its former economy.

While it’s not the growth engine of the early 2000s, the old girl still has some life left in it.

As Jim pointed out, China’s consumer spending rebounded nicely in Q4 2023.

Source: National Bureau of Statistics of China

Combined with looser central bank policy, it was only a matter of time before Chinese stocks caught a lift.

The resurgence may be largely tied to China’s desire to travel. After all, its people have been cooped up longer than any other country.

But make no mistake, this doesn’t make China a long-term investment.

Beyond what most people understand about China’s politics, there’s a little-known fact about how they treat foreign investors.

Money in. Nothing out.

When we buy a stock, we’re taking partial ownership in that company. This entitles us to a portion of the profits (or assets).

That doesn’t happen with Chinese companies.

American depository receipts (ADRs) aren’t actual shares of a company. It’s a note that the intermediary ties to shares of the company they own overseas.

So, we can only own Chinese companies indirectly.

But there’s another key feature you probably weren’t aware of.

Many of the Chinese companies we, as Americans invest in, don’t pay dividends. In fact, a much smaller percentage of Chinese companies pay any dividends.

Alibaba is a perfect example.

Despite generating billions of dollars in cash every year, it doesn’t pay dividends.

What do its managers do with the money?

Other than squirreling away $80 billion on its balance sheets, they do share buybacks.

Plenty of investors will tell you that’s even better than dividends.

But you have no legal ownership rights in China. So, what is that ADR in reality?

We’d argue nothing but paper profits at best, and air at worst.

That’s why it’s flat-out dangerous to own shares of individual Chinese companies long-term.

Any one of them can be nationalized at any moment.

Chinese ETFs reduce that risk through diversification, similar to junk bond funds.

Short of an all-out ban, like between the United States and Russia, the majority of the ETF holdings should remain intact.

Opportunistic Investing

If China is so unstable, and capable of changing at a moment’s notice, how can investors uncover pockets of value?

As Jim showed with his ETF selection, you can have some sector or thematic idea so long as you have the data to support it.

China, like any large institution, isn’t going to change its broad economic policies overnight.

As long as you study the general movements of the government, you can steer clear of the catastrophic zones and towards the diamond caves.

Because when things look THIS bad, you know the opportunities are even juicier.

But rather than try to run this maze solo, take this opportunity to check out Jim Woods’ latest report on China.

In it, he details the broad economic themes driving the Chinese government, and how to exploit them for gain.

Click here to explore Jim Woods’ report.

The post TikTok Ban Obscures Chinese Stock Gold Rush appeared first on Stock Investor.

stocks pandemic real estate etf consumer spending gold russia chinaInternational

The Great Escape… of UK Unemployment Reporting

https://bondvigilantes.com/wp-content/uploads/2024/03/1-the-great-escape-of-uk-unemployment-reporting-1024×576.pngThe Bank of England Monetary Policy Committee…

The Bank of England Monetary Policy Committee potentially has a problem: it requires data to make its labour market forecasts and assessments, but the unemployment statistics have become increasingly unreliable. This is because the Labour Force Survey participation rate (on which the unemployment figures are based) has fallen below 50% since 2018 and has been as low as 15% recently[1]. What is the solution to this difficult measurement problem? An answer can be found in the classic war film, The Great Escape.

In 1943, the Escape Committee of Stalag Luft III was tasked with digging a tunnel to freedom. Unfortunately, they had a problem. They needed to measure the distance between one of the prisoner’s huts and the forest beyond the prison perimeter, but they had no reliable tools to measure this critical variable. Fortunately they had two mathematicians within the group who came up with a method to gauge the distance to the forest so that the tunnel would be long enough to ensure escape without detection. The idea was to eyeball the distance using a 20 foot tree for scale (the tree was the one ‘accurate’ measurement around which they could work with). They got individual prisoners to gauge the distance from the hut to the tree and then averaged all of the estimates. The critical distance measure was therefore the average of a large sample size of guesstimates. Fortunately, it more or less worked. Happily, modern economists have an equivalent to rely on in the area of unemployment. Their version of the Stalag Luft III tree strategy is something called the Beveridge Curve.

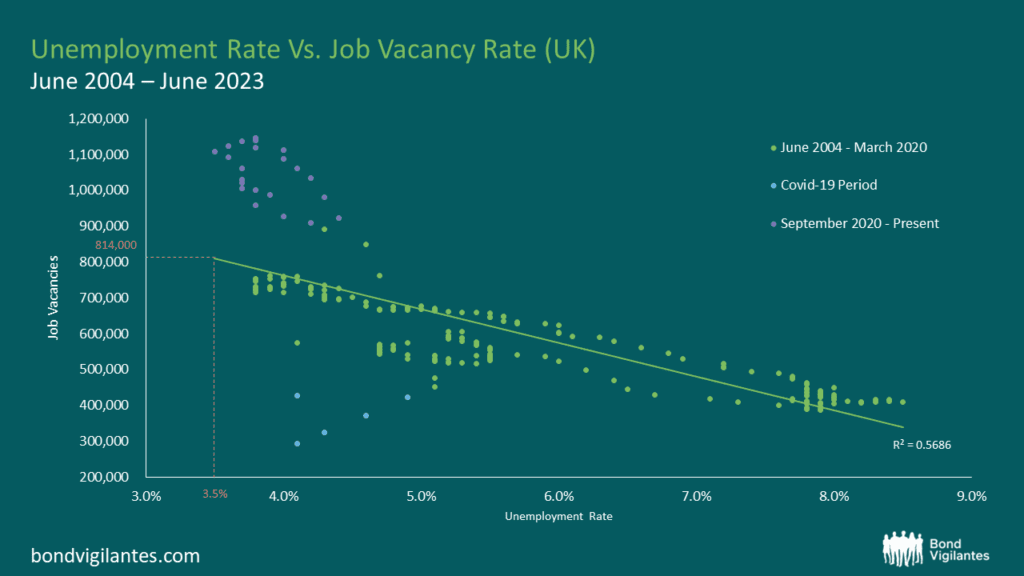

The Beveridge Curve is simply an observed relationship between an economy’s unemployment rate and its job vacancy rate at the same point in time. An excellent exposition can be found in the Bond Vigilantes archive[2]. When you plot the two variables against one another over a given period, the data points disclose a curve. This curve shows us that when unemployment increases, job vacancies decrease and vice versa. I have plotted the current curve below using the available data from the Office for National Statistics (ONS)[3]. The bottom left quadrant of the graph (the blue dots) relate to the Covid-19 era and the top left quadrant (the purple dots) represent the last 2 years’ worth of data. The green dots represent the remaining data from July 2004 to June 2023.

Source: Office for National Statistics, Dataset JP9Z & UNEM

Source: Office for National Statistics, Dataset JP9Z & UNEM

From these charts and new data from the ONS, we can observe that in the UK, the level of unemployment is increasing and that the job vacancy rate is decreasing. At face value, this suggests that current Bank of England monetary policy is working and that the inflation rate is slowing as the economy cools. One could argue that we are on track for a reasonably soft landing. Nothing new so far.

Things become more interesting when we consider the Beveridge Curve in conjunction with the most recent job vacancy data. We are told that there are now 814,000 job vacancies as of the 31st December 2023[4]. Ordinarily, we would use the curve and clearly be able to extrapolate from the Job Vacancy data what our Unemployment figure might be. However, we also know that the current unemployment data is unreliable, which makes this harder. Using our model inclusive of data oddities, we could extrapolate that with 814,000 job vacancies, we might expect an unemployment rate of around 3.5%. Yet, we know that our unemployment figures are unreliable so the question therefore is, how big an increase in unemployment are we likely to see given what we know about job vacancies?

In order to estimate the magnitude of the rise in unemployment, we need to look further afield. If we study the levels of economic inactivity in the UK, we can observe that they have remained stationary at 22%[5] for the last decade. We can also see that the population of the UK has risen over the same period by around 5.91%[6]. Further, we know that the Labour Force Survey (LFS) samples 40,000 households per quarter to obtain its data, but of late has had a response rate of only 15% (6,000 households). Therefore a critical question for policy makers is what is happening with the 85%, the non-responders?

Given the small sample size, it is entirely possible that the LFS suffered survey bias that is being erroneously weighted away. In other words, the LFS compensates for the paucity of response data by accessing other regional population statistics as a legitimate part of their methodology. The problems of non-responders are being addressed in upcoming LFS releases but for the time being, the data is not as clear as it ought to be. With such a small sample size, it seems possible – indeed probable – that unemployment levels are being underreported. This would explain why the current unemployment rate of 3.8%[7] is dramatically lower than the historic average of 6.7% (1971-2023). We see further evidence for this in the forecasts of the UK’s unemployment rate on Bloomberg which have been consistently above the actual levels for the last few published data points. So whilst the published headline figures might be looking reasonable, the underlying story looks like it could be hiding something more sinister.

Through it all, the Beveridge Curve remains a reasonable template. Job vacancies are definitely falling, so we should expect to see unemployment rising. Like the Stalag Luft III measurement solution, the Beveridge Curve offers a constructive way out of our present statistical dilemma. That being said, analogies can only be taken so far. Unfortunately for the inmates of Stalag Luft III, the calculation didn’t quite work and the tunnel came up short. No one actually made a Great Escape. What does this mean for UK unemployment data? Time may tell.

[1] The UK’s ‘official’ labour data is becoming a nonsense (harvard.edu)

[2] https://bondvigilantes.com/blog/2013/11/a-shifting-beveridge-curve-does-the-us-have-a-long-term-structural-unemployment-problem/

[3] Unemployment – Office for National Statistics (ons.gov.uk)

[4] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/timeseries/jp9z/unem

[5] https://www.ethnicity-facts-figures.service.gov.uk/work-pay-and-benefits/unemployment-and-economic-inactivity/economic-inactivity/latest/#:~:text=data%20shows%20that%3A-,22%25%20of%20working%20age%20people%20in%20England%2C%20Scotland%20and%20Wales,for%20a%20job)%20in%202022

[6] https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationestimates/bulletins/annualmidyearpopulationestimates/mid2021

[7] https://www.ons.gov.uk/employmentandlabourmarket/peoplenotinwork/unemployment

unemployment covid-19 monetary policy unemployment ukInternational

Germany Is Running Out Of Money And Debt Levels Are Exploding, Finance Minister Warns

Germany Is Running Out Of Money And Debt Levels Are Exploding, Finance Minister Warns

By John Cody of Remix News

German Finance Minister…

By John Cody of Remix News

German Finance Minister Christian Lindner is warning his own government that state finances are quickly growing out of hand, and the government needs to change course and implement austerity measures. However, the dispute over spending is only expected to escalate, with budget shortfalls causing open clashes among the three-way left-liberal coalition running the country.

With negotiations kicking off for the 2025 budget, much is at stake. However, the picture has been complicated after the country’s top court ruled that the government could not shift €60 billion in money earmarked for the coronavirus crisis to other areas of the budget, with the court noting that the move was unconstitutional.

Since then, the government has been in crisis mode, and sought to cut the budget in a number of areas, including against the country’s farmers. Those cuts already sparked mass protests, showcasing how delicate the situation remains for the government.

Lindner, whose party has taken a beating in the polls, is desperate to create some distance from his coalition partners and save his party from electoral disaster. The finance minster says the financial picture facing Germany is dire, and that the budget shortfall will only grow in the coming years if measures are not taken to rein in spending.

“In an unfavorable scenario, the increasing financing deficits lead to an increase in debt in relation to economic output to around 345 percent in the long term,” reads the Sustainability Report released by his office. “In a favorable scenario, the rate will rise to around 140 percent of gross domestic product by 2070.”

Under EU law, Germany has limited its debt levels to 60 percent of economic output, which requires dramatic savings. A huge factor is Germany’s rapidly aging population, with a debt explosion on the horizon as more and more citizens head into retirement while tax revenues shrink and the social welfare system grows — in part due to the country’s exploding immigrant population.

Lindner’s partners, the Greens and Social Democrats (SPD), are loath to cut spending further, as this will harm their electoral chances. In fact, Labor Minister Hubertus Heil is pushing for a new pension package that will add billions to the country’s debt, which remarkably, Lindner also supports.

Continue reading at rmx.news

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex