Uncategorized

Chairman of the Board Of Avia Solutions Group Gediminas Ziemelis: Aviation could see $779 billion in total revenues in 2023

Chairman of the Board Of Avia Solutions Group Gediminas Ziemelis: Aviation could see $779 billion in total revenues in 2023

PR Newswire

LONDON, Jan. 3, 2023

LONDON, Jan. 3, 2023 /PRNewswire/ — Amidst misfortunes, continued conflicts, pandemic-forc…

Chairman of the Board Of Avia Solutions Group Gediminas Ziemelis: Aviation could see $779 billion in total revenues in 2023

PR Newswire

LONDON, Jan. 3, 2023

LONDON, Jan. 3, 2023 /PRNewswire/ -- Amidst misfortunes, continued conflicts, pandemic-forced setbacks, and a blurred horizon, the global aviation sector has reported an encouraging recovery, as evidenced by the changing trends across core operating areas, including passenger service, airfreight, business aviation, MRO services, and ACMI markets. Despite the challenges that the industry has faced in 2022, aviation stakeholders have expressed optimism about the coming year, with many predicting a complete return to normalcy, a shift toward new performance trends, more significant operational profits, and fewer challenges.

On December 7, while marking International Civil Aviation Day, the IATA made a clarion call on the management of airlines to create and communicate a message that would help buttress global awareness of the significant role that international civil aviation plays toward social and economic development in different countries. According to a communique by the aviation regulator, disentangling from the pandemic-related turbulence and the far-reaching economic and operational shocks should remain a top priority for many airlines as they welcome the new year. Many carriers are looking toward less stormy skies and reflecting these improvements in their bottom lines.

Starting January 2023 and through the first and second quarters of the fiscal year 2023, global airlines are expected to disconnect from the COVID-19-related turbulence and forge their path toward total recovery and better operating profits. Current statistics by the World Economic Forum predict that the net earnings for the global aviation industry will clock at $4.7 billion, although lower than the $26.4 billion reported in 2019.

During the first quarter of 2022, IATA forecasts indicated that global airlines would report operating losses to a tune of $6.9 billion, representing an improvement from 2020 and 2021 figures of $137.7 and $42.0 billion, respectively. As the industry warms up for 2023 prospects, aviation experts and air transport associations like IATA anticipates a return to profitability, effectiveness, and fewer disruptions.

Concerning profit margins, the figure is projected at 0.6% for the financial year 2023. While this figure is relatively lower compared to 3.1% in 2019, it goes without saying that global carriers have a lot of ground to cover before they can toss back to previous heights.

Despite the observed hits in 2022, global carriers have suffered substantial losses, partly due to staff shortages, which have sent the entire industry into a near labor crisis with thousands of cancelled and rescheduled flights. The reality is that many airlines are yet to come out of the woods, but a hopeful prospect is on the horizon. Expectedly, global carriers will carry on with the same predicaments in 2023 but to a lesser magnitude compared to what they have dealt with in 2022.

Until now, many carriers continue to face unremitting pressures, which have largely weighed down on their operational economics and the wider global economy. Notwithstanding such challenges, many airlines are better poised and have excellent chances of dealing with potential headwinds and operational uncertainties from now on. This should offer enough reasons for aviation stakeholders to remain optimistic about favorable prospects in 2023.

It is expected that an increasing number of airlines will deploy robust strategies to leverage the continued rebound in passenger demand. The airline industry is projected to reach $779 billion in total revenues in 2023, owing to the growing passenger demand.

North America is expected to report the fastest and most significant turnaround in net returns compared to other regional markets, followed by European and Middle Eastern carriers. Mainly, this profit growth will stem partly from the reduced flight cancelations and decreased workforce challenges, enabling airlines to capitalize on increasing passenger demand to drive revenue growth. Forecast data by IATA predicts that air passenger demand will hit 85.5% of the figure reported in 2019 throughout 2023. Overall, the industry will ship about 4.2 billion passengers to various global destinations in the coming year.

Focusing on cargo markets, the airfreight segment has become the lifeblood and will remain a central force, contributing a significant share of revenues for many airlines in 2023, albeit at a lower scale. Revenues from this aviation segment will increase to $149.4 billion, representing a $52 billion drop in figures reported in the last quarter of 2022. Nonetheless, the cargo market will register a more favorable performance than in 2019, in line with IATA predictions.

The growing attractiveness and democratization of private flying signals favorable prospects for the business aviation segment, including private jet operators and manufacturers. A Honeywell survey has estimated that about 74% of the current new private flyers will continue taking private flights in 2023 at the same or higher levels as in 2022. Consequently, such trends may push the demand for charter fleets and compel private jet operators to invest in more diversified aircraft models to suffice the changing expectations among customers for safety, convenience, travel speed, flexibility, and ergonomics.

Nonetheless, challenges such as high operating costs from increasing energy prices, fleet capacity shortages, labor market shortages, limited access to maintenance, repair, and overhaul (MRO) services, and difficulties in recruiting personnel who can provide specific skill sets will continue to persist. Such issues may weigh on revenue drivers, prompting airlines to take tactical measures and develop strategic plans to address these issues. For example, airlines will likely enter into ACMI agreements to effectively outsource personnel, aircraft, and other critical functions to achieve operational effectiveness.

As the aviation industry approaches the final stretch of 2022, there is growing optimism that this extremity will also bring to an end the chaotic experiences that have occasioned the air travel space. Many airlines look forward to more seamless operations, minimal flight cancellations, disrupted schedules and reduced staffing problems. If this is the case, passengers should expect fewer inconveniences and enhanced travel experiences, which may drive more demand, particularly in the commercial aviation segment.

About Gediminas Ziemelis:

Throughout a business development career spanning more than 24 years, Gediminas Ziemelis has established over 50 start-ups and green-field investments in various industries such as IT, media, luxury furniture, pharma, clinics, agriculture, and across other industry sectors. At present, these companies are either owned by PE "Vertas Management", or have previously been sold and are now components of other sizeable organisations.

Gediminas Ziemelis is the founder and chairman of Avia Solutions Group, currently operating a fleet of 155 aircraft, one of the largest and fastest growing end-to-end capacity solutions' providers for passenger and cargo airlines worldwide. The Group manages 8 airlines in different countries and has more than 500 licenses for its wide range of activities across multiple business sectors. The Group administers over 100 offices and production facilities globally.

Spanning his career to date, G. Ziemelis has received many prestigious awards and industry recognitions. In 2016, G. Ziemelis received a prestigious European Business Award in recognition of his visionary business management and development skills. The same year, under his leadership, Avia Solutions Group was named a national public champion in the category of Entrepreneurship, earning a spot in the top 110 European businesses. Twice – in 2012 and again in 2014 – Ziemelis was acknowledged as one of the top 40 most talented young leaders in the global aerospace industry by the leading USA aerospace magazine 'Aviation Week'.

Over his career, Gediminas Ziemelis has taken part in many impressive business ventures. Between 2014 – 2017, he personally supported and consulted Chinese Banks (including ICBCL, CMBL, and Skyco Leasing) concerning financing aircraft sale-leaseback transactions where the total value was more than US$ 4 bn.

Between 2006 – 2019, Avia Solutions Group Chairman executed successful IPOs of 4 companies at OMX and WSE, oversaw many public bonds issues, along with the raising of public capital worth more than US$ 400 M.

His total net worth is US$ 1.68 bn, according to local business media

www.gediminasziemelis.com

www.linkedin.com/in/gediminasziemelis

www.facebook.com/gediminas.ziemelis

For media inquiries:

Vilma Vaitiekunaite

+370 686 16336

vilma.vaitiekunaite@aviasg.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/chairman-of-the-board-of-avia-solutions-group-gediminas-ziemelis-aviation-could-see-779-billion-in-total-revenues-in-2023-301712306.html

SOURCE Avia Solutions Group

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemicUncategorized

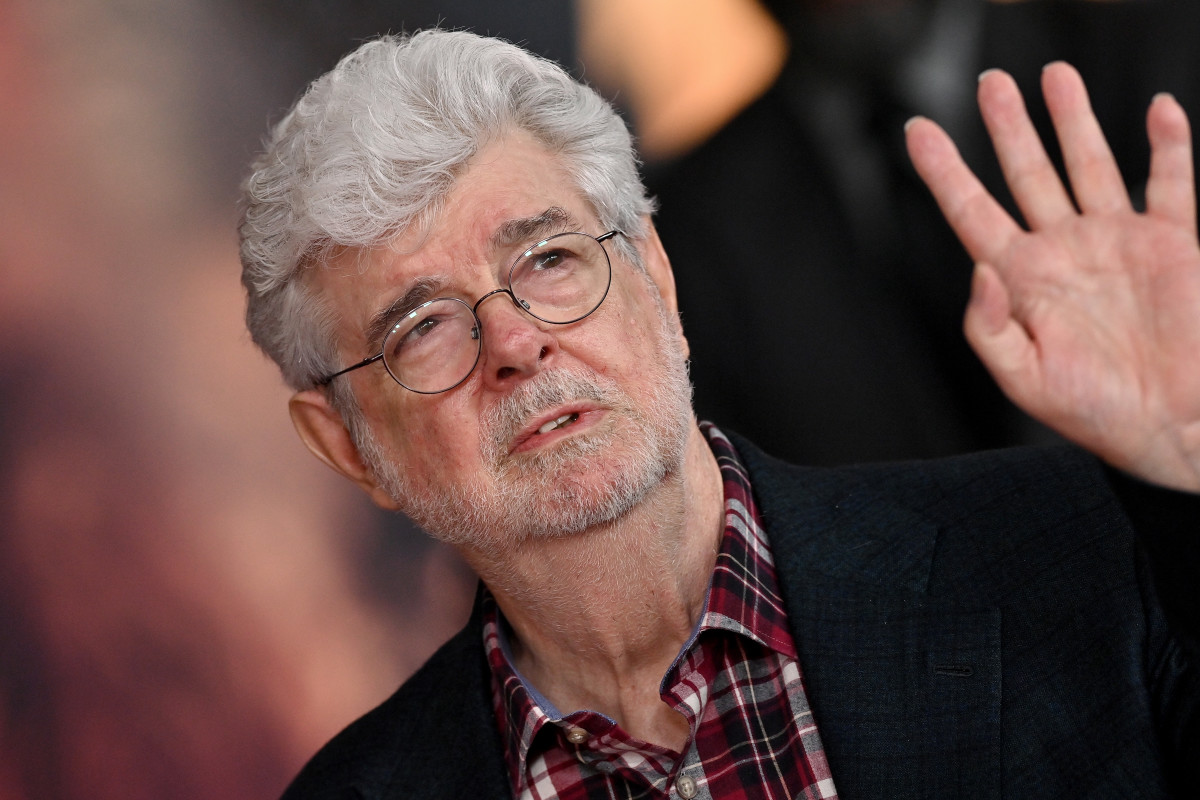

Star Wars icon gives his support to Disney, Bob Iger

Disney shareholders have a huge decision to make on April 3.

Disney's (DIS) been facing some headwinds up top, but its leadership just got backing from one of the company's more prominent investors.

Star Wars creator George Lucas put out of statement in support of the company's current leadership team, led by CEO Bob Iger, ahead of the April 3 shareholders meeting which will see investors vote on the company's 12-member board.

"Creating magic is not for amateurs," Lucas said in a statement. "When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same."

Related: Disney stands against Nelson Peltz as leadership succession plan heats up

Lucasfilm was acquired by Disney for $4 billion in 2012 — notably under the first term of Iger. He received over 37 million in shares of Disney during the acquisition.

Lucas' statement seems to be an attempt to push investors away from the criticism coming from The Trian Partners investment group, led by Nelson Peltz. The group, owns about $3 million in shares of the media giant, is pushing two candidates for positions on the board, which are Peltz and former Disney CFO Jay Rasulo.

Peltz and Co. have called out a pair of Disney directors — Michael Froman and Maria Elena Lagomasino — for their lack of experience in the media space.

Related: Women's basketball is gaining ground, but is March Madness ready to rival the men's game?

Blackwells Capital is also pushing three of its candidates to take seats during the early April shareholder meeting, though Reuters has reported that the firm has been supportive of the company's current direction.

Disney has struggled in recent years amid the changes in media and the effects of the pandemic — which triggered the return of Iger at the helm in late 2022. After going through mass layoffs in the spring of 2023 and focusing on key growth brands, the company has seen a steady recovery with its stock up over 25% year-to-date and around 40% for the last six months.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic recoveryUncategorized

Another airline is making lounge fees more expensive

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex