Central Banks — A Bad Influence on Decentralized Finance

Central Banks — A Bad Influence on Decentralized Finance

Central banks affect decentralized finance, and decentralized finance affects central banks. Which could benefit from this ideological war?

Philip Coggan, a British business journalist and news correspondent who writes for The Economist, once mentioned, “Modern money is debt and debt is money.” Few would disagree with this claim. Yes, the vast majority of money circulating today — so-called broad money — represents a specific type of credit–debt relationship.

This relationship is at the heart of today’s sovereign monetary authorities, the central banks under which almost all economic activity takes place. But the modern economic reality we have internalized is a breeding ground of confusion for innovators in the decentralized finance and broader crypto communities because it combines the roles of government and money implicitly.

Left unexamined, this duality can be misleading for anyone trying to understand the design of independent monetary systems. And it is a mistake to view the modern central banking framework as a starting point for how to think about monetary blockchain protocols.

The case I make below is simply that it is far more sensible to expand the function of base monies in the spirit of Bitcoin (BTC) than to “decentralize” central banks in the spirit of MakerDAO.

Factoring out government mandates

More than half of a century ago, Harford Montgomery Hyde wrote in his book John Law: The History of an Honest Adventurer:

“Someone mentioned the philosopher’s stone. To the surprise of all present, John Law said he had discovered it. ‘I can tell you my secret,’ said the financier. ‘It is to make gold out of paper.’”

The debt instruments we see circulating as functional money today are the most effective monies ever created. But the true secret of Law’s paper is that it’s produced by banking systems with sovereign authority and therefore inherits sovereign responsibilities. For example, the United States Federal Reserve has the following stated mandates: maximize employment, maintain stable prices and uphold moderate long-term interest rates.

This means people who are upset with losing their jobs, rapid price increases and expensive debt can assign some measure of blame to the agents behind modern money.

Ultimately the central banking system we know and love is a flexible, discretionary instrument through which policymakers can support a body of people governed by a body of laws.

Think of the central banking system as a “god mode” interface built for smart, well-meaning decisionmakers. And think of the Fed mandates as “reminder notes” pinned on the terminal.

We should be grateful this system exists, moreover that it’s flexible and powerful enough for administrators to triage the economy though serious shocks like the one we’re currently experiencing.

But my point is, none of the mechanisms made for this almighty administrator, nor its mandates, should be carried over to the design of independent monies without consideration.

An independent money has no people for whom to maximize employment. Therefore it cannot fear getting carried away with low interest rates, nor can it fear price inflation incurred in the process of keeping employment rates up.

Perhaps such an independent system should not require a “god mode” interface at all. But before we get ahead of ourselves, let’s first consider what the mandate of independent money actually is.

The mandate of independent money

In August 2018, The Economist started an article titled “Was John Maynard Keynes a Liberal?” with the following statement:

“In 1944, Friedrich Hayek received a letter from a guest of the Claridge Hotel in Atlantic City, New Jersey. It congratulated the Austria-born economist on his ‘grand’ book The Road to Serfdom, which argued that economic planning posed an insidious threat to freedom. ‘Morally and philosophically, I find myself,’ the letter said, ‘in a deeply moved agreement.’ Hayek’s correspondent was John Maynard Keynes, who was on his way to the Bretton Woods conference in New Hampshire where he would help plan the post-war economic order.”

After the end of Bretton Woods, in a paper titled “The Denationalization of Money,” Friedrich Hayek went on to suggest that governments should allow the private issuance of money, such that individuals can choose to use whichever money they want.

Choice would lead to competition, he argued, placing a healthy pressure on central planners. It would force them to be judicious about their issuance of money, preventing things like hyperinflation and prolonged malinvestment from ever occurring.

Yesterday, a check against inflation

Having witnessed the effects of extreme inflation after World War I in Europe — notably Germany, where its desolation ushered in the rise of Hitler — Hayek remained vigilant against inflation throughout his career and was keen to highlight it.

But that was a different era.

And for all the money the U.S. central banking system has injected in the past two decades, we haven’t seen much price inflation. The excess money instead has turned into increased leveraged speculation. In other words, upon receiving a great sum of money, rather than consuming more we’ve tended to invest more.

Today, a check against larger boom-and-bust cycles

As the rate of growth in emerging market economies outpaces the growth of the U.S., foreign economy demand for safe dollar-denominated assets has outstripped growth in supply. This asymmetry between supply and demand allows the U.S. to rely on easy credit in normal times and extremely expansionary macroeconomic policies in times of crisis.

This seems great; being a reserve currency is an exorbitant privilege. But it is also an exorbitant burden. The problem is that neither countries in surplus nor those in deficit are incentivized to adjust their behaviors.

We can’t stop supplying the global economy with dollars even if it hurts us, and the global economy can’t stop demanding them. This conflict of interests is known as Robert Triffin’s dilemma, and it is believed that from this dilemma we’ve seen excessive U.S. indebtedness and risks magnified to disastrous proportions.

The historically increasing demand for dollar-denominated safe assets has encouraged the U.S. to issue more and more short-run assets, leading to leveraged risk-taking and magnified boom–bust cycles. Now, alarmingly, the global economy is so interconnected that these business cycles govern all traditional assets, affecting returns on labor and capital alike. In other words, we have no choice but to be repeatedly dislocated by a cycle that even authorities “in control” cannot escape.

The MakerDAO way

Back in the 1990s, James Carville, who served as a political adviser during the Bill Clinton presidency, said:

“I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

Broadly, the MakerDAO protocol seeks to decentralize a debt-based system of money and promises a stable currency — in the spirit of central banking. Except in this system, policy decisions around fee rates and collateral composition are made not at the discretion of a sovereign authority, but at the discretion of a community.

If this sounds great to you, rest assured you’re not alone. But it should be made clear that this approach preys recklessly upon misunderstandings about what makes central banking work and why.

Depends on an ancillary market of rational actors to regulate supply

Debt has inherent risk because it requires a speculator to accurately anticipate whether a person can pay it back with justifiable interest, or it requires a speculator to accurately forecast the future value of a collateral asset.

Rather than increasing or decreasing the supply of its monetary token Dai in response to demand, the MakerDAO system utilizes a separate marketplace with its own dynamics to incentivize users to borrow more or less Dai against the collateral they deposit.

Has no authority to deliver on the promise of stability

Systems of this nature are flawed when disconnected from sovereign authority in general because such free market systems operate by choice and incentive. Participants cannot be forced to take on credit or debt for the good of a network, nor can they be forced to stop taking on credit or debt for the good of a network. They can only be given incentives, such as lower or higher interest rates, to directionally guide actions.

A problem arises, eventually, when market incentives become insufficient. We’ve seen this happen repeatedly in repurchase agreement and bond markets, and these are some of the safest instruments out there.

However sweet a deal the Venezuelan bond market is offering, you may simply not want to receive any future payments in Venezuelan currency, and you cannot be forced to buy the bonds for the good of the country.

Similarly in the case of MakerDAO, however badly the system needs more Dai to function, you may simply not want to borrow against Ether (ETH) to supply it, and you cannot be forced to do so for the good of the network. All open debt marketplaces eventually face liquidity crunches requiring bailouts, even ones run by sovereign authorities.

So, unless the administrators of a debt-based money system can print bailout money and ensure the new money has predictable value through legal, political and economic leverage, the system is at the mercy of external lenders. Think of independent systems like this as “god mode” interfaces lacking a god.

Fulfills no mandate

Recall that Hayek’s recommendation was for authorities to allow the independent issuance of money. Failing this, an independent system would need to be uncensorable to achieve the desired effect. Systems prone to requiring bailouts, such as MakerDAO, are either unreliable or continue to exist only at the discretion of central planners.

They work, until it matters.

Keeping in mind that we already have an effective centralized system with the necessary authority to bail others out in times of need, it is unclear what purpose there is for things like MakerDAO.

They cannot provide customers with meaningfully new choices, let alone keep things like inflation or malinvestment cycles in check. What about providing access to banking services for the unbanked, you ask?

Offering access is much like providing choice. An unbanked user simply goes from having zero banking services to the choice of one or more banking services. In turn, this would place pressure on local governments to offer regulated alternatives of greater value or cede the infrastructure to external parties.

Similarly, if providing access requires explicit approval, then it is dependent — not independent — and doesn’t require decentralized infrastructure at all.

The Bitcoin way

Broadly, the Bitcoin protocol expands the function of commodity monies like gold and silver, making its system of money digitally transactable. Unlike a bank, Bitcoin has no balance sheet and possesses no notion of credit or debt. In other words, the protocol maintains only what users own, not what is owed to them or what they owe to others.

It promises only scarcity and censorship resistance. As a result, Bitcoin cannot be bailed out, cannot bail others out and requires virtually no supervision. Like other commodity monies, Bitcoin does not have a “god mode” interface. It simply exists and is difficult to censor or modify.

Fulfills mandates of independent money

Even without challenging the use of centralized currencies as a medium of exchange, which it is poorly suited to do, Bitcoin functions as a check against inflation and malinvestment. Moreover, its lack of consumptive utility distances it from traditional business cycles.

By comparison, commodities like oil can be used to store value but are easily distorted by forces like the demand for travel, which is directly affected by the very business cycles independent money seeks to escape.

Not a safe haven, not a problem

At present, Bitcoin is a risky asset relative to the dollar. Thus, it would be unwise to retreat into it during times of panic unless other available assets are on even riskier ground.

This neither invalidates Bitcoin’s function as a check against inflation nor does it invalidate Bitcoin’s function as a check against malinvestment cycles.

To show this, we can simply imagine an economic recovery — the product of a malinvestment bust — that is languishing on. Let’s also imagine that interest rates are low and consumption is low.

In this scenario, upon receiving a great sum of money, rather than consuming more we are tending to save more. Holding dollars guarantees losses to inflation, but consumption is down, which limits the rate of return on stocks and commodities.

In this case, among many others, Bitcoin provides optionality because its growth rate is easier to disconnect from things like output and consumption. It adds diversity to the ecosystem as a risk asset.

The path forward

“In the longer run and for wide-reaching issues, more creative solutions tend to come from imaginative interdisciplinary collaboration,” as Robert J. Shiller said.

Throughout this post, I’ve tried to show that we are truly not starting from scratch. Existing systems, such as central banking, operate effectively in some manners and ineffectively in others for a variety of reasons.

When borrowing from existing solutions, we ought to first understand the problems they were meant to solve so that we can avoid the immense cost of inheriting assumptions that simply do not apply.

It is straightforward to say that it’s neither plausible nor beneficial to recreate the debt money of sovereign issuers in a decentralized context at this time. However, it does make good sense to expand the function of commodity monies like gold in the spirit of Bitcoin.

Given that Bitcoin already exists, how might we continue expanding the function of such monies?

We would begin by limiting our toolkit to that of scarcity and censorship resistance. We would then investigate how to increase the diversity of monies, not merely the number of monies. And we would seek to overcome the known limitations of a fixed supply.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Evan Kuo is the co-founder of Ampleforth, a protocol for synthetic commodity money advised by Niall Ferguson, a senior fellow at the Hoover Institution at Stanford University. Evan enjoys art and math, and he holds a bachelor of science in mechanical engineering from the University of California, Berkeley.

International

It’s Not Coercion If We Do It…

It’s Not Coercion If We Do It…

Authored by James Howard Kunstler via Kunstler.com,

Gags and Jibes

“My law firm is currently in court…

Authored by James Howard Kunstler via Kunstler.com,

Gags and Jibes

“My law firm is currently in court fighting for free and fair elections in 52 cases across 19 states.”

- Marc Elias, DNC Lawfare Ninja, punking voters

Have you noticed how quickly our Ukraine problem went away, vanished, phhhhttttt? At least from the top of US news media websites.

The original idea, as cooked-up by departed State Department strategist Victoria Nuland, was to make Ukraine a problem for Russia, but instead we made it a problem for everybody else, especially ourselves in the USA, since it looked like an attempt to kick-start World War Three.

Now she is gone, but the plans she laid apparently live on.

Our Congress so far has resisted coughing up another $60-billion for the Ukraine project — most of it to be laundered through Raytheon (RTX), General Dynamics, and Lockheed Martin — so instead “Joe Biden” sent Ukraine’s President Zelensky a few reels of Laurel and Hardy movies. The result was last week’s prank: four groups of mixed Ukraine troops and mercenaries drawn from sundry NATO members snuck across the border into Russia’s Belgorod region to capture a nuclear weapon storage facility while Russia held its presidential election.

I suppose it looked good on the war-gaming screen.

Alas, the raid was a fiasco. Russian intel was on it like white-on-rice. The raiders met ferocious resistance and retreated into a Russian mine-field - this was the frontier, you understand, between Kharkov (Ukr) and Belgorod (Rus) - where they were annihilated. The Russian election concluded Sunday without further incident. V.V. Putin, running against three other candidates from fractional parties, won with 87 percent of the vote. He’s apparently quite popular.

“Joe Biden,” not so much here, where he is pretending to run for reelection with a party pretending to go along with the gag. Ukraine is lined up to become Afghanistan Two, another gross embarrassment for the US foreign policy establishment and “JB” personally. So, how long do you think V. Zelensky will be bopping around Kiev like Al Pacino in Scarface?

This time, poor beleaguered Ukraine won’t need America’s help plotting a coup. When that happens, as it must, since Mr. Z has nearly destroyed his country, and money from the USA for government salaries and pensions did not arrive on-time, there will be peace talks between his successors and Mr. Putin’s envoys. The optimum result for all concerned — including NATO, whether the alliance knows it or not — will be a demilitarized Ukraine, allowed to try being a nation again, though in a much-reduced condition than prior to its becoming a US bear-poking stick. It will be on a short leash within Russia’s sphere-of-influence, where it has, in fact, resided for centuries, and life will go on. Thus, has Russia at considerable cost, had to reestablish the status quo.

Meanwhile, Saturday night, “Joe Biden” turned up at the annual Gridiron dinner thrown by the White House [News] Correspondents’ Association, where he told the ballroom of Intel Community quislings:

“You make it possible for ordinary citizens to question authority without fear or intimidation.”

The dinner, you see, is traditionally a venue for jokes and jibes. So, this must have been a gag, right? Try to imagine The New York Times questioning authority. For instance, the authority of the DOJ, the FBI, the DHS, and the DC Federal District court. Instant hilarity, right?

As it happens, though, today, Monday, March 18, 2024, attorneys for the State of Missouri (and other parties) in a lawsuit against “Joe Biden” (and other parties) will argue in the Supreme Court that those government agencies above, plus the US State Department, with assistance from the White House (and most of the White House press corps, too), were busy for years trying to prevent ordinary citizens from questioning authority.

For instance, questioning the DOD’s Covid-19 prank, the CDC’s vaccination op, the DNC’s 2020 election fraud caper, the CIA’s Frankenstein experiments in Ukraine, the J6 “insurrection,” and sundry other trips laid on the ordinary citizens of the USA.

Specifically, Missouri v. Biden is about the government’s efforts to coerce social media into censoring any and all voices that question official dogma.

The case is about birthing the new concept - new to America, anyway - known as “misinformation” - that is, truth about what our government is doing that cannot be allowed to enter the public arena, making it very difficult for ordinary citizens to question authority.

The government will apparently argue that they were not coercing, they were just trying to persuade the social media execs to do this or that.

As The Epoch Times' Jacob Burg reported, the court appeared wary of arguments by the respondents that the White House is wholesale prevented under the Constitution from recommending to social media companies to remove posts it considered harmful, in cases where the suggestions themselves didn't cross the line into "coercion."

Deputy Solicitor General for the U.S. Brian Fletcher argued that the White House's communications with news media and social media companies regarding the content promoted on their platforms do not rise to the level of governmental “coercion,” which would have been prohibited under the Constitution.

Instead, the government was merely using its "bully pulpit" to "persuade" private parties, in this case social media companies, to do what they are "lawfully allowed to do,” he said.

Louisiana Solicitor General Benjamin Aguiñaga, representing the respondents, argued that the case demonstrates “unrelenting pressure by the government to coerce social media platforms to suppress the speech of millions of Americans.”

Mr. Aguiñaga argued that the government had no right to tell social media companies what content to carry. Its only remedy in the event of genuinely false or misleading content, he said, was to counter it by putting forward "true speech."

The attorney general took pointed questions from Liberal Justice Ketanji Brown Jackson about the extent to which the government can step in to take down certain potentially harmful content. Justice Jackson raised the hypothetical of a "teen challenge that involves teens jumping out of windows at increasing elevations," asking if it would be a problem if the government tried to suppress the publication of said challenge on social media. Mr. Aguiñaga replied that those facts were different from the present case.

Justice Ketanji Brown Jackson raised the opinion that some say “the government actually has a duty to take steps to protect the citizens of this country” when it comes to monitoring the speech that is promoted on online platforms.

“So can you help me because I'm really worried about that, because you've got the First Amendment operating in an environment of threatening circumstances from the government's perspective.

“The line is, does the government pursuant to the First Amendment have a compelling interest in doing things that result in restricting speech in this way?”

KBJ doubles down: “My biggest concern is that your view has the First Amendment hamstringing the government in significant ways.”

— System Update (@SystemUpdate_) March 18, 2024

That is, quite literally, the entire point of the First Amendment—of the entire Bill of Rights. pic.twitter.com/gWMCaHDG1WAttorneys General Liz Merrill of Louisiana and Andrew Bailey of Missouri both told The Epoch Times they felt positive about the case and how the justices reacted.

"I am cautiously optimistic that we will have a majority of the court that lands where I wholeheartedly believe they should land, and that is in favor of protecting speech," Ms. Merrill said.

Journalist Jim Hoft, a party listed in the case, said, "This has to be where they put a stop to this. The government shouldn't be doing this, especially when they're wrong, and pushing their own opinion, silencing dissenting voices. Of course, it's against the Constitution. It's a no-brainer."

In response to a question from Brett Kavanaugh, an associate justice of the Supreme Court, Louisiana Solicitor General Benjamin Aguiñaga said the "government is not helpless" when it comes to countering factually inaccurate speech.

Precedent before the court suggests the government can and should counter false speech with true speech, Mr. Aguiñaga said.

"Censorship has never been the default remedy for perceived First Amendment violation," Mr. Aguiñaga said.

Maybe one of the justices might ask how it came to be that a Chief Counsel of the FBI, James Baker, after a brief rest-stop at a DC think tank, happened to take the job as Chief Counsel at Twitter in 2020.

That was a mighty strange switcheroo, don’t you think?

And ordinary citizens were not generally informed of it until the fall of 2022, when Elon Musk bought Twitter and delved into its workings.

* * *

Support his blog by visiting Jim’s Patreon Page or Substack

Uncategorized

Manufacturing and construction vs. the still-inverted yield curve

– by New Deal democratProf. Menzie Chinn at Econbrowser makes the point that the yield curve is still inverted, and has not yet eclipsed the longest…

- by New Deal democrat

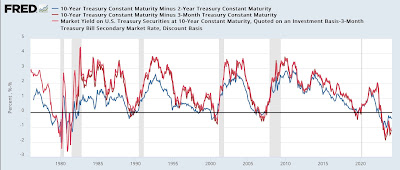

Prof. Menzie Chinn at Econbrowser makes the point that the yield curve is still inverted, and has not yet eclipsed the longest previous time between onset of such an inversion and a recession. So he believes the threat of recession is still on the table.

Uncategorized

Half Of Downtown Pittsburgh Office Space Could Be Empty In 4 Years

Half Of Downtown Pittsburgh Office Space Could Be Empty In 4 Years

Authored by Mike Shedlock via MishTalk.com,

The CRE implosion is picking…

Authored by Mike Shedlock via MishTalk.com,

The CRE implosion is picking up steam.

Check out the grim stats on Pittsburgh.

Unions are also a problem in Pittsburgh as they are in Illinois and California.

Downtown Pittsburgh Implosion

The Post Gazette reports nearly half of Downtown Pittsburgh office space could be empty in 4 years.

Confidential real estate information obtained by the Pittsburgh Post-Gazette estimates that 17 buildings are in “significant distress” and another nine are in “pending distress,” meaning they are either approaching foreclosure or at risk of foreclosure. Those properties represent 63% of the Downtown office stock and account for $30.5 million in real estate taxes, according to the data.

It also calculates the current office vacancy rate at 27% when subleases are factored in — one of the highest in the country.

And with an additional three million square feet of unoccupied leased space becoming available over the next five years, the vacancy rate could soar to 46% by 2028, based on the data.

Property assessments on 10 buildings, including U.S. Steel Tower, PPG Place, and the Tower at PNC Plaza, have been slashed by $364.4 million for the 2023 tax year, as high vacancies drive down their income.

Another factor has been the steep drop — to 63.5% from 87.5% — in the common level ratio, the number used to compute taxable value in county assessment appeal hearings.

The assessment cuts have the potential to cost the city, the county, and the Pittsburgh schools nearly $8.4 million in tax refunds for that year alone. Downtown represents nearly 25% of the city’s overall tax base.

In response Pittsburgh City Councilman Bobby Wilson wants to remove a $250,000 limit on the amount of tax relief available to a building owner or developer as long as a project creates at least 50 full-time equivalent jobs.

It’s unclear if the proposal will be enough. Annual interest costs to borrow $1 million have soared from $32,500 at the start of the pandemic in 2020 to $85,000 on March 1. Local construction costs have increased by about 30% since 2019.

But the city is doomed if it does nothing. Aaron Stauber, president of Rugby Realty said it will probably empty out Gulf Tower and mothball it once all existing leases expire.

“It’s cheaper to just shut the lights off,” he said. “At some point, we would move on to greener pastures.”

Where’s There’s Smoke There’s Unions

In addition to the commercial real estate woes, the city is also wrestling with union contracts.

Please consider Sounding the alarm: Pittsburgh Controller’s letter should kick off fiscal soul-searching

It’s only March, and Pittsburgh’s 2024 house-of-cards operating budget is already falling down. That’s the clear implication of a letter sent by new City Controller Rachael Heisler to Mayor Ed Gainey and members of City Council on Wednesday afternoon.

The letter is a rare and welcome expression of urgency in a city government that has fallen in complacency — and is close to falling into fiscal disaster.

The approaching crisis was thrown into sharp relief this week, when City Council approved amendments to the operating budget accounting for a pricey new contract with the firefighters union. The Post-Gazette Editorial Board had predicted that this contract — plus two others yet to be announced and approved — would demonstrate the dishonesty of Mayor Ed Gainey’s budget, and that’s exactly what’s happening: The new contract is adding $11 million to the administration’s artificially low 5-year spending projections, bringing expected 2028 reserves to just barely the legal limit.

But there’s still two big contracts to go, with the EMS union and the Pittsburgh Joint Collective Bargaining Committee, which covers Public Works workers. Worse, there are tens — possibly hundreds — of millions in unrealistic revenues still on the books. On this, Ms. Heisler’s letter only scratched the surface.

Similarly, as we have observed, the budget’s real estate tax revenue projections are radically inconsistent with reality. Due to high vacancies and a sharp reduction in the common level ratio, a significant drop in revenues was predictable — but not reflected in the budget. Ms. Heisler’s estimate of a 20% drop in revenues from Downtown property, or $5.3 million a year, may even be optimistic: Other estimates peg the loss at twice that, or more.

Left unmentioned in the letter are massive property tax refunds the city will owe, as well as fanciful projections of interest income that are inconsistent with the dwindling reserves, and drawing-down of federal COVID relief funds, predicted in the budget itself. That’s another unrealistic $80 million over five years.

Pittsburgh exited Act 47 state oversight after nearly 15 years on Feb. 12, 2018, with a clean bill of fiscal health.

It has already ruined that bill of health.

Act 47 in Pittsburgh

Flashback February 21, 2018: Act 47 in Pittsburgh: What Was Accomplished?

Pittsburgh’s tax structure was a much-complained-about topic leading up to the Act 47 declaration. The year following Pittsburgh’s designation as financially distressed under Act 47 it levied taxes on real estate, real estate transfers, parking, earned income, business gross receipts (business privilege and mercantile), occupational privilege and amusements. The General Assembly enacted tax reforms in 2004 giving the city authority to levy a payroll preparation tax in exchange for the immediate elimination of the mercantile tax and the phase out of the business privilege tax. The tax reforms increased the amount of the occupational privilege tax from $10 to $52 (this is today known as the local services tax and all municipalities outside of Philadelphia levy it and could raise it thanks to the change for Pittsburgh).

The coordinators recommended an increase in the deed transfer tax, which occurred in late 2004 (it was just increased again by City Council) and in the real estate tax, which increased in 2015.

Legacy costs, principally debt and underfunded pensions, were the primary focus of the 2009 amended recovery plan. The city’s pension funded ratio has increased significantly from where it stood a decade ago, rising from the mid-30 percent range to over 60 percent at last measurement.

The obvious question? Will the city stick to the steps taken to improve financially and avoid slipping back into distressed status? If Pittsburgh once stood “on the precipice of full-blown crisis,” as described in the first recovery plan, hopefully it won’t return to that position.

The Obvious Question

I could have answered the 2018 obvious question with the obvious answer. Hell no.

No matter how much you raise taxes, it will never be enough because public unions will suck every penny and want more.

On top of union graft, and insanely woke policies in California, we have an additional huge problem.

Hybrid Work Leaves Offices Empty and Building Owners Reeling

Hybrid work has put office building owners in a bind and could pose a risk to banks. Landlords are now confronting the fact that some of their office buildings have become obsolete, if not worthless.

Meanwhile, in Illinois …

Chicago Teachers’ Union Seeks $50 Billion Despite $700 Million City Deficit

Please note the Chicago Teachers’ Union Seeks $50 Billion Despite $700 Million City Deficit

The CTU wants to raise taxes across the board, especially targeting real estate.

My suggestion, get the hell out...

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Spread & Containment5 days ago

Spread & Containment5 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex