Uncategorized

California Doctor Fired After Writing Letter Criticizing Lockdown Orders

California Doctor Fired After Writing Letter Criticizing Lockdown Orders

Authored by Kipp Jones via The Western Journal,

A doctor in Northern California has been fired from his job after he co-authored a letter that questioned the science…

Authored by Kipp Jones via The Western Journal,

A doctor in Northern California has been fired from his job after he co-authored a letter that questioned the science behind his county’s lockdown order.

Dr. Michael deBoisblanc was working as the trauma medical director for John Muir Health in Contra Costa County, California, until last Friday, after he questioned the scientific basis for again locking down citizens of the area.

KNTV reported that deBoisblanc wrote a letter to the county health director and board of supervisors voicing his concern regarding the continued lockdown policies prior to his dismissal.

The former medical director spoke from his own experience as a parent, expressing his apprehension that Bay Area students were not being allowed to attend in-person classes, according to KTVU-TV.

Along with doctors Pete Mazolewski and Brian Hopkins, deBoisblanc wrote that there were “deep concerns regarding more lockdown measures.”

“The science is clear,” the letter continued, “that more lockdowns lead to much more non COVID morbidity and mortality.”

“Public policy is being based on erroneous assumptions,” it added.

The trauma physician said “we’re worried some of the actions the county and government is taking can definitely have negative impacts on the public health,” according to KTVU.

DeBoisblanc’s letter seemed to ruffle the feathers of those at the county health department and other San Francisco Bay area officials.

John Gioia, the District 1 Supervisor for Contra Costa County, defended the California lockdown, which is based largely on a reported shortage of hospital beds.

“All of these orders have been based on strong science and good data,” Gioia said.

“They are citing data that our health department believes is not reflective of accurate current thinking [in the letter].”

But another area leader said that more transparency is needed from health officials during the pandemic.

“That only engenders trust and leads people to understand why we’re making these decisions and why we need them to behave in certain ways,” San Francisco District 6 Supervisor Matt Haney said.

DeBoisblanc seemingly had merely sought for clear answers regarding those affected by lockdowns, including embattled small business owners.

“We felt these were important questions that the people who are affected by these measures deserved answers to,” he said.

But deBoisblanc has now been moved to the back of California’s large unemployment line.

His employment at the hospital in Walnut Creek was terminated last week with little explanation from superiors.

“The Medical Director of Trauma and Regional Transfer Services is a contracted position and, after careful consideration, John Muir Health is not continuing with Dr. deBoisblanc in that position,” a statement issued by John Muir Health read.

Dr. deBoisblanc spoke to Fox News on Wednesday regarding his termination of employment, as well as the lockdown’s effects on school children who are being kept out of classrooms.

“All the data that I am aware of, looking at children and the virus, shows that it’s safe,” he told the network.

“There are many other states now that have months of track records showing that it’s safe for their kids to go back to school.

“And the state of California and the county is just not making that possible.”

The doctor also defended restaurants and small businesses, which have been intensely struggling during the pandemic.

“These are restaurants that are just trying to survive, and keep their doors open,” he said.

“It’s been very difficult for them.”

DeBoisblanc later revealed that he was not fired from his job solely because of the letter, but he said it was “clearly related to the letter.”

The California Department of Public Health announced a regional stay-at-home order on Dec. 3, which urged most residents of the state to stay home during the Christmas month, citing the shortage of hospital beds and rising number of cases. Contra Costa Health Services echoed this request in a media release on Dec. 16.

“Due to the dwindling supply of hospital beds for patients who need intensive care in the Bay Area, the state will apply a regional stay-at-home order across the nine-county region to slow the spread of COVID-19 and prevent the region’s hospitals from becoming overwhelmed,” the release stated.

“Now more than ever, Contra Costa Health Services (CCHS) urges everyone who lives or works in the county to follow the health advice within the law to keep themselves and their loved ones safe during the holiday season.”

The order, among other recommendations, urged people to avoid “in-person gatherings with people who do not live in your household, especially indoors.”

Despite his termination, deBoisblanc had only kind words for health care workers at his former hospital attempting to navigate the difficulties of the pandemic.

“That’s a great hospital, they are doing amazing things,” he told Fox.

“The doctors and nurses there taking care of COVID patients are risking their health every day. They just got the first round of the vaccine. And let me tell you, it’s a big relief for them.”

Uncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

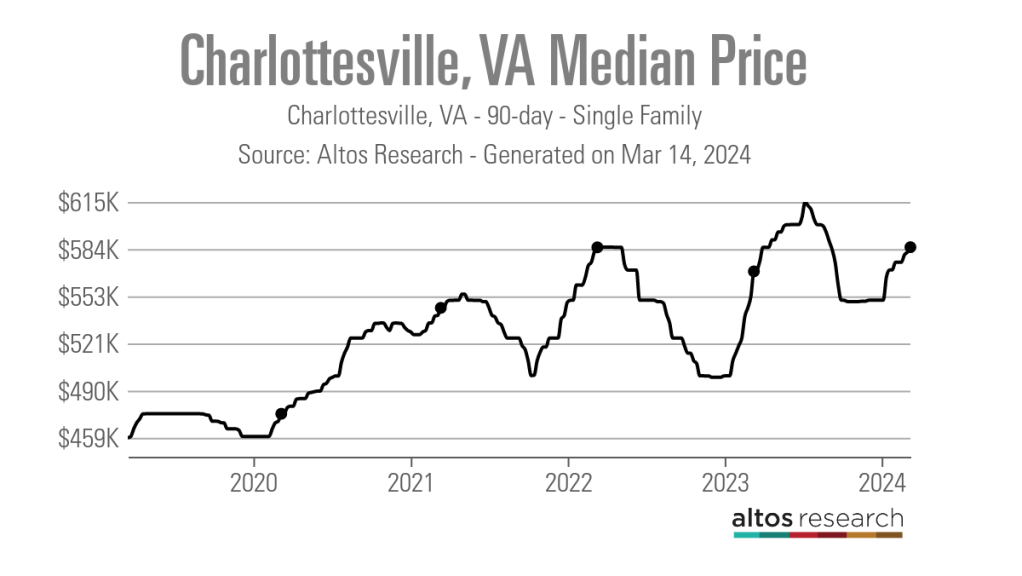

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A