/C O R R E C T I O N from Source — McCoy Global Inc./

/C O R R E C T I O N from Source — McCoy Global Inc./

Canada NewsWire

EDMONTON, AB, Aug. 5, 2022

In the news release, McCOY GLOBAL ANNOUNCES SECOND QUARTER 2022 RESULTS, issued 05-Aug-2022 by McCoy Global Inc. over CNW, we are advised by the comp…

/C O R R E C T I O N from Source -- McCoy Global Inc./

Canada NewsWire

EDMONTON, AB, Aug. 5, 2022

In the news release, McCOY GLOBAL ANNOUNCES SECOND QUARTER 2022 RESULTS, issued 05-Aug-2022 by McCoy Global Inc. over CNW, we are advised by the company that in the Outlook and Forward-Looking Information section of the release, in the 8th paragraph, should read ''McCoy's backlog totals $27.4 million (US$23.1 million)''. The complete, corrected release follows:

McCOY GLOBAL ANNOUNCES SECOND QUARTER 2022 RESULTS

EDMONTON, AB, Aug. 5, 2022 /CNW/ - McCoy Global Inc. ("McCoy," "McCoy Global" or "the Corporation") (TSX: MCB) today announced its operational and financial results for the three months ended June 30, 2022.

- Net earnings remained strong at $1.1 million compared to $1.2 million in 2021 (of which $2.4 million related to loan forgiveness of the Corporation's US Paycheck Protection Program borrowings), and improved by $0.9 million from $0.2 million in the first quarter of 2022;

- Adjusted EBITDA1 improved more than tenfold to $2.3 million, or 18% of revenue, compared with $0.2 million, or 3% of revenue, in 2021. Sequentially, Adjusted EBITDA improved by $1.1 million from $1.4 million, or 16% of revenue, reported in the first quarter of 2022;

- Revenue more than doubled to $12.9 million compared with $6.1 million in 2021;

- Subsequent to June 30, 2022, McCoy received $11.3 million of orders received for Hydraulic Power Tongs, Casing Running Tools (CRT) and McCoy Torque Turn systems and related parts and accessories from a customer based in the Kingdom of Saudi Arabia, resulting in backlog of $27.4 million as at August 4, 2022, a level not experienced since Q1 2015;

- Twelfth (12th) quarter of positive Adjusted EBITDA, demonstrating solid earnings performance and operating leverage despite the unprecedented market conditions presented by the COVID-19 pandemic; and

- Advanced its Digital Technology Roadmap:

- Successfully completed customer field trials for McCoy's smartCRTTM , an intelligent, connected enhancement of our conventional casing running tool that offers superior safety, efficiency and simplified operating procedure with a Middle East National Oil Company. With this achievement behind us, we have also accepted an order for two of the smartCRTTM tools, scheduled for delivery in the fourth quarter of 2022.

- Reported the first two commercial sales for McCoy's FMS, the hydraulic rotary flush mounted spider that when fully connected (smartFMSTM), handles casing while providing information on the state of the tool to the driller's display in real-time as well as the ability to integrate with the smartCRT™.

"McCoy's strong second quarter financial results reflect steadily increasing customer demand and demonstrate the solid financial operating leverage we expect to deliver as our order book continues to build. With recent order intake activity, our backlog now sits at the highest levels we've seen since 2015 and we are solidly positioned to deliver on our financial results for the second half of 2022." said Jim Rakievich, President & CEO of McCoy. "Despite current economic uncertainty and commodity price volatility, increased drilling activity levels over the medium term paired with new international market entrants will serve to further enhance commercial opportunities. The strategic priorities we executed upon in 2020 and 2021 to first optimize cost structure and second, to advance our investments in developing smart technologies, positions us to capitalize on opportunities as market activity improves."

"Our second quarter performance demonstrated continued strength in several of our financial metrics. McCoy's continued fiscal discipline resulted in a more than tenfold increase in Adjusted EBITDA1 of $2.3 million or 18% of revenue for the second quarter (Q2 2021 – Adjusted EBITDA of $0.2 million, or 3% of revenue). Though operating cashflows were impacted by $4.2 million investment in working capital, this was largely driven by an increase in trade receivable balances related to the large volume of customer shipments that took place near the end of the quarter. Despite the many supply chain challenges faced globally, successful supply chain management has also allowed us to not only navigate cost headwinds, but also successfully sustain inventory investment levels in conjunction with increasing order intake activity." said Lindsay McGill, Vice President & CFO of McCoy. "As of June 30, 2022, McCoy reported net cash of $4.1 million with an additional US$2.5 million available under an undrawn operating facility, which will well position McCoy for revenue growth in the year ahead."

- Total revenue of $12.9 million, compared with $6.1 million in Q2 2021;

- Adjusted EBITDA1 increased to $2.3 million, or 18% of revenue, compared with $0.2 million, or 3% of revenue, in Q2 2021;

- Net earnings of $1.1 million, compared to net earnings of $1.2 million in Q1 2021 of which $2.3 million related to forgiveness for first-round funding under the US Paycheck Protection Loan Program (PPP);

- Booked backlog2 of $14.6 million at June 30, 2022, up from $10.2 million in the second quarter of 2021, additional order intake received subsequent to June 30, 2022 bolstered backlog levels to $27.4 million as at August 4, 2022;

- Book-to-bill ratio3 was 0.88 for the three months ended June 30, 2022, compared with 1.21 in the second quarter of 2021;

Revenue of $12.9 million for three months ended June 30, 2022, continued to benefit from improved global drilling activity levels, particularly with respect to capital equipment and related parts and accessories. Revenue for the second quarter of 2021 of $6.1 million was impacted by the decline in order intake experienced as a result of second and third waves of the COVID-19 pandemic.

Gross profit, as a percentage of revenue for the three months June 30, 2022, was 32%, a six percentage point improvement from the second quarter of 2021. Although product mix has been more heavily weighted towards capital equipment, which typically commands higher material cost and in turn lower product line margins, the unfavourable shift in product mix experienced throughout Q2 2022 was more than offset by the benefit of increased production throughput. Despite the many supply chain challenges faced globally, successful supply chain management has also allowed us to navigate cost headwinds, maintain, and in some cases improve, product margins.

For the three months June 30, 2022, general and administrative expenses (G&A) was consistent with the comparative period as the Corporation continues to maintain discipline around overhead expenditures, further demonstrating the solid financial operating leverage we expect to deliver as our order book builds.

Sales and marketing expenses for the second quarter of 2022 increased by $0.1 million from the comparative period to $0.5 million due to additional travel activity to support rebounding order intake and maintain our market leading customer engagement.

During the three months June 30, 2022, with $0.1 million of capitalized development expenditures, McCoy further advanced its Digital Technology Roadmap initiative through the continued development of 'smart' product offerings which will be digitally integrated into its automated tubular running system smartTRTM.

For the three months ended June 30, 2022, other gains, net was nominal. In the comparative period, other gains, net of $2.1 million was comprised primarily of US $2.0 million loan forgiveness of the US Paycheck Protection Program, government assistance payments related to the Canadian Emergency Wage and Rent Subsidies, as well as gains on the disposal of property, plant and equipment, offset by a one-time retroactive payment to employees and foreign exchange losses.

Net earnings for the three months ended June 30, 2022 was $1.1 million or $0.04 per basic share, compared with net earnings of $1.2 million, which included $2.3 million related to forgiveness for first-round funding under the US Paycheck Protection Loan Program (PPP), or $0.04 per basic share in the second quarter of 2021.

Adjusted EBITDA1 for the three months ended June 30, 2022 was $2.3 million compared with $0.2 million for the second quarter of 2021.

As at June 30, 2022 the Corporation had $8.4 million in cash and cash equivalents, of which $0.8 million was restricted under the conditions of the Corporation's credit facility.

($000 except per share amounts and percentages) | Q2 2022 | Q2 2021 | % Change |

Total revenue | 12,863 | 6,086 | 111 % |

Gross profit | 4,077 | 1,566 | 160 % |

as a percentage of revenue | 32 % | 26 % | 6 % |

Net earnings | 1,051 | 1,151 | (9 %) |

per common share – basic | 0.04 | 0.04 | 8 % |

per common share – diluted | 0.04 | 0.03 | 42 % |

Adjusted EBITDA1 | 2,296 | 174 | 1,220 % |

per common share – basic | 0.08 | 0.01 | 712 % |

per common share – diluted | 0.08 | 0.01 | 700 % |

Total assets | 59,375 | 53,505 | 11 % |

Total liabilities | 17,395 | 17,802 | (2 %) |

Total non-current liabilities | 5,413 | 9,872 | (45 %) |

The second quarter of 2022 represents McCoy's twelfth (12th) consecutive quarter of positive Adjusted EBITDA performance and demonstrates the Corporation's solid earnings performance and operating leverage despite the unprecedented market conditions presented by the COVID-19 pandemic.

($000 except per share | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 |

Revenue | 12,863 | 8,891 | 9,451 | 9,855 | 6,086 | 7,374 | 9,369 | 7,621 |

Net earnings (loss) | 1,051 | 174 | 2,464 | 621 | 1,151 | (158) | (2,150) | (720) |

per share – basic | 0.04 | 0.01 | 0.09 | 0.02 | 0.04 | (0.01) | (0.08) | (0.03) |

per share – diluted | 0.04 | 0.01 | 0.08 | 0.02 | 0.04 | (0.01) | (0.08) | (0.03) |

EBITDA1 | 1,943 | 1,146 | 3,504 | 1,550 | 2,077 | 749 | (1,116) | 312 |

Adjusted EBITDA1 | 2,296 | 1,461 | 1,213 | 1,376 | 174 | 673 | 153 | 365 |

The oil & gas extraction complex has experienced an increasingly volatile pricing environment and growing public and investor pressure to reduce its impact on the environment and improve safety. In turn, producers have been acutely focused on managing their costs and adapting their business strategy to demonstrate compliance with broader sustainability efforts.

McCoy has a reputation of expertise and innovation within tubular running services (TRS) operations globally. The Corporation has extensive experience launching new products into the markets it serves, offering the highest quality and safety standards available, unparalleled customer support, and has done so for more than three decades.

McCoy believes the TRS space is primed for transformation employing automation and machine learning. Tools and processes used in TRS today are mechanical, highly repetitive, require significant labour inputs, have a high rate of personnel safety exposure, and maintain minimal well integrity data. Recognizing this opportunity, McCoy has conceptualized a 'Smart' TRS system that will operate autonomously using the Corporation's cloud-based data repository and machine learning to improve effectiveness. Our cloud-based platform and digital infrastructure that was developed in 2019, will enable future digital product offerings and enhancements. This cloud based, real time, remote data transmission infrastructure will support our ability to integrate, digitize, and automate the historically manual processes of tubular make up through our smartTRTM automated casing running system. The product suite includes five 'Smart' products: Virtual Thread-RepTM, smartCRTTM, smartFMSTM, McCoy's smartTong, and McCoy's smart tailing stabbing arm (smartTSATM).

McCoy is engaged with three key customer groups:

Service Companies and Drilling Contractors - Producers are challenging contractors, across the board, to reduce costs. In many cases, their largest cost is people. With five years of decreasing oil and gas activity, personnel have left the industry to the point where there is now a critical shortage of skilled and experienced labour. Personnel safety, the shortage of experienced people, and the reality that 65% of TRS cost is directly attributable to labour, is a driving force behind the transition to an increasingly automated system.

Producers – McCoy's Virtual Thread RepTM consolidates data on every connection made in a Producer's completion program. This repository of data supports verifiable and reliable well integrity that validates Environmental Social Governance (ESG) initiatives. In addition to providing enhanced data, remote operation can reduce up to 85% of the labour costs associated with TRS for our Producer group.

Tubular Manufacturers – Threaded connection integrity is the standard that all manufacturers are measured by. Tubular connections at wellsite, which are currently made up by people, will be controlled, and torqued to factory specifications by McCoy's 'Smart' tools, leveraging autonomous machine learning. OEM's and manufacturers will benefit from reduced operational risk with systems in place to ensure connections are made correctly and in accordance with specifications related to project parameters, reducing the environmental impact of faulty connections and leaking wells.

McCoy's digital strategy will meet this demand. Our cloud platform is the nucleus of the Corporation's digital strategy and serves as a repository for real-time, complete well integrity data.

Including the $11.3 million of orders received for Hydraulic Power Tongs, Casing Running Tools (CRT) and MTT systems and related parts and accessories from a customer based in the Kingdom of Saudi Arabia in July, as at August 4, 2022, McCoy's backlog totals $27.4 million (US$23.1 million). McCoy's order book has not been at this level since the first quarter of 2015, and this magnitude of backlog will support strong revenue and earnings performance for the second half of 2022 and into 2023.

Although we expect the shift in product mix from these capital equipment orders to compress gross margin to some degree, as our capital equipment product lines typically command higher material costs in comparison to aftermarket products, this is expected to be partially offset by the benefit of increased production throughput against our fixed production overheads.

Despite current economic uncertainty and commodity price volatility, over the medium term, market fundamentals continue to be robust. Increased drilling activity levels paired with new international market entrants will serve to further enhance commercial opportunities for our smartCRTTM. We also expect that the tightening labour market faced by our customers will serve to accelerate adoption of many of our new smart technology offerings, particularly in the US land region in both the near and long term.

As 2022 progresses, we continue to focus on our key strategic initiatives to deliver value to all of our stakeholders:

- Growing market adoption of new and recently developed 'smart' portfolio products;

- Taking advantage of the current market trajectory by focusing on revenue generation while continuing to successfully mitigate supply chain and logistic challenges;

- Continuing to build our equipment rental fleet to offer flexible solutions to customers where meaningful returns are expected;

- Prudently investing in technology development initiatives; and

- Generating cashflow from operations through fiscal discipline and continued working capital efficiency.

Subsequent to June 30, 2022, the Corporation committed to pursuing a sale and leaseback arrangement for its real estate located in Cedar Park, Texas currently held at net book value of $3.4 million. Proceeds from a potential sale transaction are expected to be used to repay the Corporation's US$3.4 million term loan bearing interest at US Prime plus 4.95% in addition to funding current working capital increases and providing financial flexibility for future strategic growth.

In its continuing evaluation of opportunities to unlock shareholder value, the Corporation also intends to pursue the implementation of a normal course issuer bid (NCIB), subject to Toronto Stock Exchange approval.

We believe this strategy, together with our committed and agile team, McCoy's global brand recognition, intimate customer knowledge and global footprint will further advance McCoy's competitive position, regardless of the market environment.

McCoy Global is transforming well construction using automation and machine learning to maximize wellbore integrity and collect precise connection data critical to the global energy industry. The Corporation has offices in Canada, the United States of America, and the United Arab Emirates and operates internationally in more than 50 countries through a combination of direct sales and key distributors.

Throughout McCoy's 100-year history, it has proudly called Edmonton, Alberta, Canada its corporate headquarters. The Corporation's shares are listed on the Toronto Stock Exchange and trade under the symbol "MCB".

1 EBITDA is calculated under IFRS and is reported as an additional subtotal in the Corporation's consolidated statements of cash flows. EBITDA is defined as net earnings (loss), before depreciation of property, plant and equipment; amortization of intangible assets; income tax expense (recovery); and finance charges, net. Adjusted EBITDA is a non-GAAP measure defined as net (loss) earnings, before: depreciation of property, plant and equipment; amortization of intangible assets; income tax expense (recovery); finance charges, net; provisions for excess and obsolete inventory; other (gains) losses, net; restructuring charges; share-based compensation; and impairment losses. The Corporation reports on EBITDA and adjusted EBITDA because they are key measures used by management to evaluate performance. The Corporation believes adjusted EBITDA assists investors in assessing McCoy Global's current operating performance on a consistent basis without regard to non-cash, unusual (i.e. infrequent and not considered part of ongoing operations), or non-recurring items that can vary significantly depending on accounting methods or non-operating factors. Adjusted EBITDA is not considered an alternative to net (loss) earnings in measuring McCoy Global's performance. Adjusted EBITDA does not have a standardized meaning and is therefore not likely to be comparable to similar measures used by other issuers. For comparative purposes, in previous financial disclosures 'adjusted EBITDA' was defined as "net earnings (loss) before finance charges, net, income tax expense (recovery), depreciation, amortization, impairment losses, restructuring charges, non-cash changes in fair value related to derivative financial instruments and share-based compensation."

($000 except per share amounts and percentages) | Q2 2022 | Q2 2021 |

Net earnings | 1,051 | 1151 |

Depreciation of property, plant and equipment | 440 | 490 |

Amortization of intangible assets | 269 | 194 |

Finance charges, net | 183 | 242 |

EBITDA | 1,943 | 2,077 |

Provisions for (recovery of) excess and obsolete inventory | 234 | (112) |

Other gains, net | (2) | (2,125) |

Share-based compensation | 121 | 334 |

Adjusted EBITDA | 2,296 | 174 |

2 McCoy Global defines backlog as orders that have a high certainty of being delivered and is measured on the basis of a firm customer commitment, such as the receipt of a purchase order. Customers may default on or cancel such commitments, but may be secured by a deposit and/or require reimbursement by the customer upon default or cancellation. Backlog reflects likely future revenues; however, cancellations or reductions may occur and there can be no assurance that backlog amounts will ultimately be realized as revenue, or that the Corporation will earn a profit on backlog once fulfilled. Expected delivery dates for orders recorded in backlog historically spanned from one to six months.

3 The book-to-bill ratio is a measure of the amount of net sales orders received to revenues recognized and billed in a set period of time. The ratio is an indicator of customer demand and sales order processing times. The book-to-bill ratio is not a GAAP measure and therefore the definition and calculation of the ratio will vary among other issuers reporting the book-to-bill ratio. McCoy Global calculates the book-to-bill ratio as net sales orders taken in the reporting period divided by the revenues reported for the same reporting period.

4 New product and technology offerings as products or technologies introduced to our portfolio in the past 36 months.

This News Release contains forward looking statements and forward looking information (collectively referred to herein as "forward looking statements") within the meaning of applicable Canadian securities laws. All statements other than statements of present or historical fact are forward looking statements. Forward looking information is often, but not always, identified by the use of words such as "could", "should", "can", "anticipate", "expect", "objective", "ongoing", "believe", "will", "may", "projected", "plan", "sustain", "continues", "strategy", "potential", "projects", "grow", "take advantage", "estimate", "well positioned" or similar words suggesting future outcomes. This New Release contains forward looking statements respecting the business opportunities for the Corporation that are based on the views of management of the Corporation and current and anticipated market conditions; and the perceived benefits of the growth strategy and operating strategy of the Corporation are based upon the financial and operating attributes of the Corporation as at the date hereof, as well as the anticipated operating and financial results. Forward looking statements regarding the Corporation are based on certain key expectations and assumptions of the Corporation concerning anticipated financial performance, business prospects, strategies, the sufficiency of budgeted capital expenditures in carrying out planned activities, the availability and cost of labour and services and the ability to obtain financing on acceptable terms, which are subject to change based on market conditions and potential timing delays. Although management of the Corporation consider these assumptions to be reasonable based on information currently available to them, they may prove to be incorrect. By their very nature, forward looking statements involve inherent risks and uncertainties (both general and specific) and risks that forward looking statements will not be achieved. Undue reliance should not be placed on forward looking statements, as a number of important factors could cause the actual results to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates and intentions expressed in the forward looking statements, including inability to meet current and future obligations; inability to complete or effectively integrate strategic acquisitions; inability to implement the Corporation's business strategy effectively; access to capital markets; fluctuations in oil and gas prices; fluctuations in capital expenditures of the Corporation's target market; competition for, among other things, labour, capital, materials and customers; interest and currency exchange rates; technological developments; global political and economic conditions; global natural disasters or disease; and inability to attract and retain key personnel. Readers are cautioned that the foregoing list is not exhaustive. The reader is further cautioned that the preparation of financial statements in accordance with IFRS requires management to make certain judgments and estimates that affect the reported amounts of assets, liabilities, revenues and expenses. These judgments and estimates may change, having either a negative or positive effect on net earnings as further information becomes available, and as the economic environment changes. The information contained in this News Release identifies additional factors that could affect the operating results and performance of the Corporation. We urge you to carefully consider those factors. The forward looking statements contained herein are expressly qualified in their entirety by this cautionary statement. The forward looking statements included in this News Release are made as of the date of this New Release and the Corporation does not undertake and is not obligated to publicly update such forward looking statements to reflect new information, subsequent events or otherwise unless so required by applicable securities laws.

SOURCE McCoy Global Inc.

Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

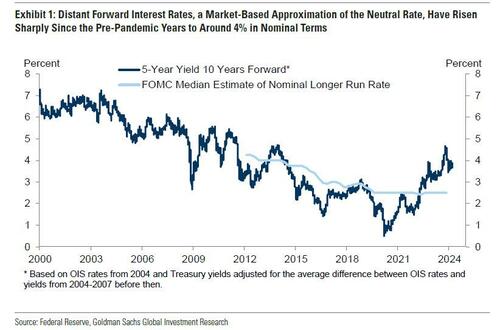

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

Spread & Containment

Household Net Interest Income Falls As Rates Spike

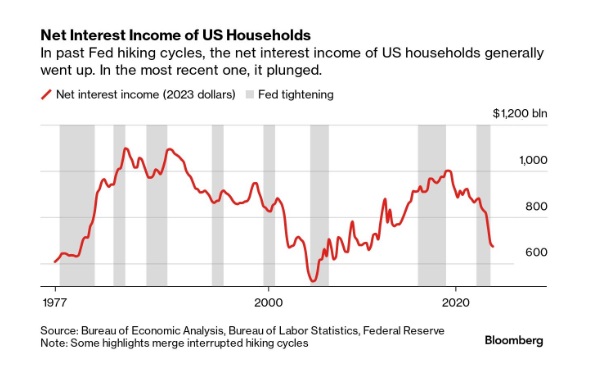

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex