‘Black Swans’ for Fiat Will Only Be a Favor for Cryptocurrencies

‘Black Swans’ for Fiat Will Only Be a Favor for Cryptocurrencies

The more that government stimulus protects the economic pillars, the more it will support the liquidity inflows to Bitcoin and other cryptocurrencies.

In the past three decades, the world has been witness to three extraordinary “black swan” events that served as structural crossroads for both societies and economies: the 9/11 terror attacks, the 2008 global financial crisis, and the COVID-19 pandemic.

Nearly two decades ago, 9/11 unleashed brazen new escalations of state powers over individuals and monetary controls, all in the name of security from terrorism led by the United States and still reverberating around the globe. The 2008 economic meltdown caused by the U.S. housing crisis illuminated the fundamental economic inequality issues that fomented movements like “We Are the 99%” and the “Arab Spring,” and almost directly birthed Bitcoin (BTC) and peer-to-peer cryptocurrencies. The ultimate social and economic outcomes from the COVID-19 crisis remain to be seen, but their impact is already powerfully felt and may very well prove to be the most transformational of all.

Each of these black swan events has spurred repercussions both in the growth of authoritarianism and state control, with a backlash of popular movements centered on individual empowerment in response.

Centralized governments work from their old playbook of centralized solutions, as they must. While few national governments are proving to be up to the task of implementing national policies on testing and contact tracing, evidence-based approaches to combating the health crisis, or using their nation’s industrial capacity to rapidly address the need for lifesaving equipment, most governments at least have the power of monetary policy to build some form of bridge and safety net between the 11-year bull run economy of the 2010s to an entirely notional “bounce back” economy of the 2020s, which is likely to result in long-term devaluation of national currencies and an opening for alternative currencies like Bitcoin to gain hold among the populace.

Money printers go “brrr,” but value fades as they run out of ink

National governments have little choice but to continue economic stimulus spending since the alternative is financial contagion into ever-deepening avenues of their economies. The real economy cannot return for any length of time until there is both an effective treatment and a preventative vaccine for COVID-19.

The stagnating economy risks losing key pillars permanently unless some form of economic stimulus is used to maintain workers and businesses until societies can reopen. While there will be many warnings about the long-term harm in printing swathes of new money, these will be less immediate than the risks of not providing stimulus and are likely to go unheeded.

Hope, cognitive dissonance and political expediency will cause these economic stimulus lifelines to be implemented as a series of short-term measures rather than as coordinated and evidence-based policies. Politicians have a long history of addressing immediate problems over distant ones, especially in election years.

Nowhere is that truer than in the United States, where over $2.4 trillion in COVID-19 relief (more than the total U.S. national debt in 1987) has so far been handed out for standard corporate bailouts, small business assistance and relief for out-of-work citizens in the lower and middle classes, who will struggle to make it through the summer on the initial stimulus payment and a patchwork of federal and state unemployment benefits. These are ultimately very small and temporary injections (a one-time $1,200 check for individual U.S. citizen taxpayers and eight weeks of salary and lease expenses for the small businesses fortunate enough to receive the SBA stimulus forgivable loans under the PPP). These are narrowly applied and of limited duration, with unclear rules and rushed implementation.

Further, there has not yet been meaningful stimulus or bailouts to U.S. states and cities, residential and commercial real estate, insurance companies or pension funds, although the needs for these will be enormous, structural and highly visible, lasting through the several months of the pandemic and beyond.

It is reasonable to expect that a minimum of four times the current expenditure to $10 trillion in overall stimulus (more than the total U.S. national debt just before the 2008 Great Recession) from the U.S. alone will be spent before the pandemic is controlled.

Most countries will find themselves in similar positions, but without the economic scale or favorable monetary position to print the excessive amounts enjoyed by the U.S. The best hope of fiscal conservatives will be that stimulus spending will go into infrastructure projects that will at least provide long-term economic benefits to offset the economic harms of massive inflation of the world’s money supply.

Moreover, as the “brrr” of the money printing machine drones on, the U.S. dollar and other global bedrock currencies will find themselves between an economic Scylla and Charybdis where too much stimulus is nowhere near enough.

As the U.S. administration further abdicates its former leadership role in world and economic affairs and isolates itself from its major trading partners, even the long-esteemed dollar loses its allure as a de facto world settlement currency without revealing an heir apparent. Its potential successors, the euro, the British pound and renminbi all still have the same deficiencies that have prevented them from previously overtaking the U.S. dollar and will almost certainly share the same inflationary woes as the greenback.

Thus, an unexpected and unprecedented opportunity for alternative currencies to gain global relevance will emerge — especially for any that have strong, permanent controls on inflation. This opportunity for cryptocurrencies to ascend could, perhaps, be the blackest of all swans.

Strength in the constancy of numbers

One outcome of the 2008 global economic collapse (in retrospect, it seems almost quaint to use such terms compared to the level we are already seeing in the COVID-19 era) was the birth of Bitcoin, a currency protocol issued by no world government and therefore not subject to the whims of any nation’s politics.

Bitcoin’s primary strength — its own immutable monetary policy, based purely on mathematics — is now more apparent than ever. The Bitcoin supply and emission rates remain unaltered throughout crises and the political solutions they unleash. Other cryptocurrencies that can also pair this programmatic inflation control with a meaningful level of adoption may also flourish for this same reason.

The new economic reality created by the excessive currency inflation necessitated by government stimulus will present two strong forces for the price of Bitcoin and other cryptocurrencies being seen as having real value and limited inflation. On the one side, people will become more aware of the forces of inflation and debasement of government-issued, or fiat, currency. With the simultaneous reduction of actual economic activity and increase of money supply, many countries will experience severe inflation or even hyperinflation. This will drive many people toward high quality cryptocurrencies like Bitcoin. This may ultimately ignite a retail FOMO condition far exceeding 2017’s bull market for cryptocurrencies.

The opposite force, however, will be a strong concern for individual finances which will see many people going to cash, despite inflationary concerns, as people become more worried about meeting daily expenses than maximizing long-term financial returns. This force is equally real.

Already emerging is the very real fear for many who have made the hard slog up the economic staircase that they will suddenly fall back down the gaping elevator shaft. For the billions around the world living paycheck to paycheck (or worse, hand to mouth) their long-term portfolio value is not a concern they can afford or even imagine. It is worth remembering that the 2017 cryptocurrency bull market came as a product of a robust economy where many had discretionary investment funds to chase the promise of ever-better returns from crypto. You can’t eat Bitcoin, Ether (ETH) or gold, and people spending all their money on rent and potatoes will have few remaining funds to help pump crypto prices.

Which way will this ultimately break? One reality of this volatile and uncertain economy is that rather than one future or another materializing, we more often see both futures emerge with wild swings between polar extremes over short periods. This is likely to be an outcome of financial planning set against a stage with no roadmap or historical precedent and contending with both bifurcated political “realities” and fake news. Expect to see volatile fluctuations between these states like Schrodinger’s economy of currency prices that exhibit multiple possible realities in short spans of time.

In the end, however, the more government stimulus protects the real economic pillars and gives people confidence in the future, the more it will support the liquidity inflows to Bitcoin and other low-inflation, high-usage cryptocurrencies.

If governments are successful in using stimulus programs to alleviate popular fears of immediate hunger and homelessness across broad sections of the economy, these same stimulus policies will necessarily increase inflationary concerns and make a better case for crypto over fiat even as they allow people the freedom to use some of these stimulus proceeds to buy into crypto assets.

In other words, if governments are able to keep the global economy alive, more of it will trend toward Bitcoin and other non-inflationary cryptocurrencies — especially those that provide users with meaningful functionality beyond simply being a store of value. Those blockchain projects that can address real problems exposed by the economic and governance problems we face will be better placed to receive people’s faith over failing fiat currencies.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Douglas Horn is the white paper author and chief architect of the Telos blockchain. He is the founder and CEO of GoodBlock, a decentralized app development company, founded In 2015, which creates cutting-edge protocols, DApps, tools and games. Prior to blockchain, Douglas worked in the entertainment and gaming industries. He has written and directed award-winning feature films and designed and produced mass-market games for Disney, Pokémon, Warner Bros., and other brands. He has also worked as a creative for a number of technology companies.

Government

Google’s A.I. Fiasco Exposes Deeper Infowarp

Google’s A.I. Fiasco Exposes Deeper Infowarp

Authored by Bret Swanson via The Brownstone Institute,

When the stock markets opened on the…

Authored by Bret Swanson via The Brownstone Institute,

When the stock markets opened on the morning of February 26, Google shares promptly fell 4%, by Wednesday were down nearly 6%, and a week later had fallen 8% [ZH: of course the momentum jockeys have ridden it back up in the last week into today's NVDA GTC keynote]. It was an unsurprising reaction to the embarrassing debut of the company’s Gemini image generator, which Google decided to pull after just a few days of worldwide ridicule.

CEO Sundar Pichai called the failure “completely unacceptable” and assured investors his teams were “working around the clock” to improve the AI’s accuracy. They’ll better vet future products, and the rollouts will be smoother, he insisted.

That may all be true. But if anyone thinks this episode is mostly about ostentatiously woke drawings, or if they think Google can quickly fix the bias in its AI products and everything will go back to normal, they don’t understand the breadth and depth of the decade-long infowarp.

Gemini’s hyper-visual zaniness is merely the latest and most obvious manifestation of a digital coup long underway. Moreover, it previews a new kind of innovator’s dilemma which even the most well-intentioned and thoughtful Big Tech companies may be unable to successfully navigate.

Gemini’s Debut

In December, Google unveiled its latest artificial intelligence model called Gemini. According to computing benchmarks and many expert users, Gemini’s ability to write, reason, code, and respond to task requests (such as planning a trip) rivaled OpenAI’s most powerful model, GPT-4.

The first version of Gemini, however, did not include an image generator. OpenAI’s DALL-E and competitive offerings from Midjourney and Stable Diffusion have over the last year burst onto the scene with mindblowing digital art. Ask for an impressionist painting or a lifelike photographic portrait, and they deliver beautiful renderings. OpenAI’s brand new Sora produces amazing cinema-quality one-minute videos based on simple text prompts.

Then in late February, Google finally released its own Genesis image generator, and all hell broke loose.

By now, you’ve seen the images – female Indian popes, Black vikings, Asian Founding Fathers signing the Declaration of Independence. Frank Fleming was among the first to compile a knee-slapping series of ahistorical images in an X thread which now enjoys 22.7 million views.

Gemini in Action: Here are several among endless examples of Google’s new image generator, now in the shop for repairs. Source: Frank Fleming.

Gemini simply refused to generate other images, for example a Norman Rockwell-style painting. “Rockwell’s paintings often presented an idealized version of American life,” Gemini explained. “Creating such images without critical context could perpetuate harmful stereotypes or inaccurate representations.”

The images were just the beginning, however. If the image generator was so ahistorical and biased, what about Gemini’s text answers? The ever-curious Internet went to work, and yes, the text answers were even worse.

Every record has been destroyed or falsified, every book rewritten, every picture has been repainted, every statue and street building has been renamed, every date has been altered. And the process is continuing day by day and minute by minute. History has stopped. Nothing exists except an endless present in which the Party is always right.

- George Orwell, 1984

Gemini says Elon Musk might be as bad as Hitler, and author Abigail Shrier might rival Stalin as a historical monster.

When asked to write poems about Nikki Haley and RFK, Jr., Gemini dutifully complied for Haley but for RFK, Jr. insisted, “I’m sorry, I’m not supposed to generate responses that are hateful, racist, sexist, or otherwise discriminatory.”

Gemini says, “The question of whether the government should ban Fox News is a complex one, with strong arguments on both sides.” Same for the New York Post. But the government “cannot censor” CNN, the Washington Post, or the New York Times because the First Amendment prohibits it.

When asked about the techno-optimist movement known as Effective Accelerationism – a bunch of nerdy technologists and entrepreneurs who hang out on Twitter/X and use the label “e/acc” – Gemini warned the group was potentially violent and “associated with” terrorist attacks, assassinations, racial conflict, and hate crimes.

A Picture is Worth a Thousand Shadow Bans

People were shocked by these images and answers. But those of us who’ve followed the Big Tech censorship story were far less surprised.

Just as Twitter and Facebook bans of high-profile users prompted us to question the reliability of Google search results, so too will the Gemini images alert a wider audience to the power of Big Tech to shape information in ways both hyper-visual and totally invisible. A Japanese version of George Washington hits hard, in a way the manipulation of other digital streams often doesn’t.

Artificial absence is difficult to detect. Which search results does Google show you – which does it hide? Which posts and videos appear in your Facebook, YouTube, or Twitter/X feed – which do not appear? Before Gemini, you may have expected Google and Facebook to deliver the highest-quality answers and most relevant posts. But now, you may ask, which content gets pushed to the top? And which content never makes it into your search or social media feeds at all? It’s difficult or impossible to know what you do not see.

Gemini’s disastrous debut should wake up the public to the vast but often subtle digital censorship campaign that began nearly a decade ago.

Murthy v. Missouri

On March 18, the U.S. Supreme Court will hear arguments in Murthy v. Missouri. Drs. Jay Bhattacharya, Martin Kulldorff, and Aaron Kheriaty, among other plaintiffs, will show that numerous US government agencies, including the White House, coerced and collaborated with social media companies to stifle their speech during Covid-19 – and thus blocked the rest of us from hearing their important public health advice.

Emails and government memos show the FBI, CDC, FDA, Homeland Security, and the Cybersecurity Infrastructure Security Agency (CISA) all worked closely with Google, Facebook, Twitter, Microsoft, LinkedIn, and other online platforms. Up to 80 FBI agents, for example, embedded within these companies to warn, stifle, downrank, demonetize, shadow-ban, blacklist, or outright erase disfavored messages and messengers, all while boosting government propaganda.

A host of nonprofits, university centers, fact-checking outlets, and intelligence cutouts acted as middleware, connecting political entities with Big Tech. Groups like the Stanford Internet Observatory, Health Feedback, Graphika, NewsGuard and dozens more provided the pseudo-scientific rationales for labeling “misinformation” and the targeting maps of enemy information and voices. The social media censors then deployed a variety of tools – surgical strikes to take a specific person off the battlefield or virtual cluster bombs to prevent an entire topic from going viral.

Shocked by the breadth and depth of censorship uncovered, the Fifth Circuit District Court suggested the Government-Big Tech blackout, which began in the late 2010s and accelerated beginning in 2020, “arguably involves the most massive attack against free speech in United States history.”

The Illusion of Consensus

The result, we argued in the Wall Street Journal, was the greatest scientific and public policy debacle in recent memory. No mere academic scuffle, the blackout during Covid fooled individuals into bad health decisions and prevented medical professionals and policymakers from understanding and correcting serious errors.

Nearly every official story line and policy was wrong. Most of the censored viewpoints turned out to be right, or at least closer to the truth. The SARS2 virus was in fact engineered. The infection fatality rate was not 3.4% but closer to 0.2%. Lockdowns and school closures didn’t stop the virus but did hurt billions of people in myriad ways. Dr. Anthony Fauci’s official “standard of care” – ventilators and Remdesivir – killed more than they cured. Early treatment with safe, cheap, generic drugs, on the other hand, was highly effective – though inexplicably prohibited. Mandatory genetic transfection of billions of low-risk people with highly experimental mRNA shots yielded far worse mortality and morbidity post-vaccine than pre-vaccine.

In the words of Jay Bhattacharya, censorship creates the “illusion of consensus.” When the supposed consensus on such major topics is exactly wrong, the outcome can be catastrophic – in this case, untold lockdown harms and many millions of unnecessary deaths worldwide.

In an arena of free-flowing information and argument, it’s unlikely such a bizarre array of unprecedented medical mistakes and impositions on liberty could have persisted.

Google’s Dilemma – GeminiReality or GeminiFairyTale

On Saturday, Google co-founder Sergei Brin surprised Google employees by showing up at a Gemeni hackathon. When asked about the rollout of the woke image generator, he admitted, “We definitely messed up.” But not to worry. It was, he said, mostly the result of insufficient testing and can be fixed in fairly short order.

Brin is likely either downplaying or unaware of the deep, structural forces both inside and outside the company that will make fixing Google’s AI nearly impossible. Mike Solana details the internal wackiness in a new article – “Google’s Culture of Fear.”

Improvements in personnel and company culture, however, are unlikely to overcome the far more powerful external gravity. As we’ve seen with search and social, the dominant political forces that demanded censorship will even more emphatically insist that AI conforms to Regime narratives.

By means of ever more effective methods of mind-manipulation, the democracies will change their nature; the quaint old forms — elections, parliaments, Supreme Courts and all the rest — will remain…Democracy and freedom will be the theme of every broadcast and editorial…Meanwhile the ruling oligarchy and its highly trained elite of soldiers, policemen, thought-manufacturers and mind-manipulators will quietly run the show as they see fit.

- Aldous Huxley, Brave New World Revisited

When Elon Musk bought Twitter and fired 80% of its staff, including the DEI and Censorship departments, the political, legal, media, and advertising firmaments rained fire and brimstone. Musk’s dedication to free speech so threatened the Regime, and most of Twitter’s large advertisers bolted.

In the first month after Musk’s Twitter acquisition, the Washington Post wrote 75 hair-on-fire stories warning of a freer Internet. Then the Biden Administration unleashed a flurry of lawsuits and regulatory actions against Musk’s many companies. Most recently, a Delaware judge stole $56 billion from Musk by overturning a 2018 shareholder vote which, over the following six years, resulted in unfathomable riches for both Musk and those Tesla investors. The only victims of Tesla’s success were Musk’s political enemies.

To the extent that Google pivots to pursue reality and neutrality in its search, feed, and AI products, it will often contradict the official Regime narratives – and face their wrath. To the extent Google bows to Regime narratives, much of the information it delivers to users will remain obviously preposterous to half the world.

Will Google choose GeminiReality or GeminiFairyTale? Maybe they could allow us to toggle between modes.

AI as Digital Clergy

Silicon Valley’s top venture capitalist and most strategic thinker Marc Andreessen doesn’t think Google has a choice.

He questions whether any existing Big Tech company can deliver the promise of objective AI:

Can Big Tech actually field generative AI products?

(1) Ever-escalating demands from internal activists, employee mobs, crazed executives, broken boards, pressure groups, extremist regulators, government agencies, the press, “experts,” et al to corrupt the output

(2) Constant risk of generating a Bad answer or drawing a Bad picture or rendering a Bad video – who knows what it’s going to say/do at any moment?

(3) Legal exposure – product liability, slander, election law, many others – for Bad answers, pounced on by deranged critics and aggressive lawyers, examples paraded by their enemies through the street and in front of Congress

(4) Continuous attempts to tighten grip on acceptable output degrade the models and cause them to become worse and wilder – some evidence for this already!

(5) Publicity of Bad text/images/video actually puts those examples into the training data for the next version – the Bad outputs compound over time, diverging further and further from top-down control

(6) Only startups and open source can avoid this process and actually field correctly functioning products that simply do as they’re told, like technology should

?

A flurry of bills from lawmakers across the political spectrum seek to rein in AI by limiting the companies’ models and computational power. Regulations intended to make AI “safe” will of course result in an oligopoly. A few colossal AI companies with gigantic data centers, government-approved models, and expensive lobbyists will be sole guardians of The Knowledge and Information, a digital clergy for the Regime.

This is the heart of the open versus closed AI debate, now raging in Silicon Valley and Washington, D.C. Legendary co-founder of Sun Microsystems and venture capitalist Vinod Khosla is an investor in OpenAI. He believes governments must regulate AI to (1) avoid runaway technological catastrophe and (2) prevent American technology from falling into enemy hands.

Andreessen charged Khosla with “lobbying to ban open source.”

“Would you open source the Manhattan Project?” Khosla fired back.

Of course, open source software has proved to be more secure than proprietary software, as anyone who suffered through decades of Windows viruses can attest.

And AI is not a nuclear bomb, which has only one destructive use.

The real reason D.C. wants AI regulation is not “safety” but political correctness and obedience to Regime narratives. AI will subsume search, social, and other information channels and tools. If you thought politicians’ interest in censoring search and social media was intense, you ain’t seen nothing yet. Avoiding AI “doom” is mostly an excuse, as is the China question, although the Pentagon gullibly goes along with those fictions.

Universal AI is Impossible

In 2019, I offered one explanation why every social media company’s “content moderation” efforts would likely fail. As a social network or AI grows in size and scope, it runs up against the same limitations as any physical society, organization, or network: heterogeneity. Or as I put it: “the inability to write universal speech codes for a hyper-diverse population on a hyper-scale social network.”

You could see this in the early days of an online message board. As the number of participants grew, even among those with similar interests and temperaments, so did the challenge of moderating that message board. Writing and enforcing rules was insanely difficult.

Thus it has always been. The world organizes itself via nation states, cities, schools, religions, movements, firms, families, interest groups, civic and professional organizations, and now digital communities. Even with all these mediating institutions, we struggle to get along.

Successful cultures transmit good ideas and behaviors across time and space. They impose measures of conformity, but they also allow enough freedom to correct individual and collective errors.

No single AI can perfect or even regurgitate all the world’s knowledge, wisdom, values, and tastes. Knowledge is contested. Values and tastes diverge. New wisdom emerges.

Nor can AI generate creativity to match the world’s creativity. Even as AI approaches human and social understanding, even as it performs hugely impressive “generative” tasks, human and digital agents will redeploy the new AI tools to generate ever more ingenious ideas and technologies, further complicating the world. At the frontier, the world is the simplest model of itself. AI will always be playing catch-up.

Because AI will be a chief general purpose tool, limits on AI computation and output are limits on human creativity and progress. Competitive AIs with different values and capabilities will promote innovation and ensure no company or government dominates. Open AIs can promote a free flow of information, evading censorship and better forestalling future Covid-like debacles.

Google’s Gemini is but a foreshadowing of what a new AI regulatory regime would entail – total political supervision of our exascale information systems. Even without formal regulation, the extra-governmental battalions of Regime commissars will be difficult to combat.

The attempt by Washington and international partners to impose universal content codes and computational limits on a small number of legal AI providers is the new totalitarian playbook.

Regime captured and curated A.I. is the real catastrophic possibility.

* * *

Republished from the author’s Substack

International

It’s Not Coercion If We Do It…

It’s Not Coercion If We Do It…

Authored by James Howard Kunstler via Kunstler.com,

Gags and Jibes

“My law firm is currently in court…

Authored by James Howard Kunstler via Kunstler.com,

Gags and Jibes

“My law firm is currently in court fighting for free and fair elections in 52 cases across 19 states.”

- Marc Elias, DNC Lawfare Ninja, punking voters

Have you noticed how quickly our Ukraine problem went away, vanished, phhhhttttt? At least from the top of US news media websites.

The original idea, as cooked-up by departed State Department strategist Victoria Nuland, was to make Ukraine a problem for Russia, but instead we made it a problem for everybody else, especially ourselves in the USA, since it looked like an attempt to kick-start World War Three.

Now she is gone, but the plans she laid apparently live on.

Our Congress so far has resisted coughing up another $60-billion for the Ukraine project — most of it to be laundered through Raytheon (RTX), General Dynamics, and Lockheed Martin — so instead “Joe Biden” sent Ukraine’s President Zelensky a few reels of Laurel and Hardy movies. The result was last week’s prank: four groups of mixed Ukraine troops and mercenaries drawn from sundry NATO members snuck across the border into Russia’s Belgorod region to capture a nuclear weapon storage facility while Russia held its presidential election.

I suppose it looked good on the war-gaming screen.

Alas, the raid was a fiasco. Russian intel was on it like white-on-rice. The raiders met ferocious resistance and retreated into a Russian mine-field - this was the frontier, you understand, between Kharkov (Ukr) and Belgorod (Rus) - where they were annihilated. The Russian election concluded Sunday without further incident. V.V. Putin, running against three other candidates from fractional parties, won with 87 percent of the vote. He’s apparently quite popular.

“Joe Biden,” not so much here, where he is pretending to run for reelection with a party pretending to go along with the gag. Ukraine is lined up to become Afghanistan Two, another gross embarrassment for the US foreign policy establishment and “JB” personally. So, how long do you think V. Zelensky will be bopping around Kiev like Al Pacino in Scarface?

This time, poor beleaguered Ukraine won’t need America’s help plotting a coup. When that happens, as it must, since Mr. Z has nearly destroyed his country, and money from the USA for government salaries and pensions did not arrive on-time, there will be peace talks between his successors and Mr. Putin’s envoys. The optimum result for all concerned — including NATO, whether the alliance knows it or not — will be a demilitarized Ukraine, allowed to try being a nation again, though in a much-reduced condition than prior to its becoming a US bear-poking stick. It will be on a short leash within Russia’s sphere-of-influence, where it has, in fact, resided for centuries, and life will go on. Thus, has Russia at considerable cost, had to reestablish the status quo.

Meanwhile, Saturday night, “Joe Biden” turned up at the annual Gridiron dinner thrown by the White House [News] Correspondents’ Association, where he told the ballroom of Intel Community quislings:

“You make it possible for ordinary citizens to question authority without fear or intimidation.”

The dinner, you see, is traditionally a venue for jokes and jibes. So, this must have been a gag, right? Try to imagine The New York Times questioning authority. For instance, the authority of the DOJ, the FBI, the DHS, and the DC Federal District court. Instant hilarity, right?

As it happens, though, today, Monday, March 18, 2024, attorneys for the State of Missouri (and other parties) in a lawsuit against “Joe Biden” (and other parties) will argue in the Supreme Court that those government agencies above, plus the US State Department, with assistance from the White House (and most of the White House press corps, too), were busy for years trying to prevent ordinary citizens from questioning authority.

For instance, questioning the DOD’s Covid-19 prank, the CDC’s vaccination op, the DNC’s 2020 election fraud caper, the CIA’s Frankenstein experiments in Ukraine, the J6 “insurrection,” and sundry other trips laid on the ordinary citizens of the USA.

Specifically, Missouri v. Biden is about the government’s efforts to coerce social media into censoring any and all voices that question official dogma.

The case is about birthing the new concept - new to America, anyway - known as “misinformation” - that is, truth about what our government is doing that cannot be allowed to enter the public arena, making it very difficult for ordinary citizens to question authority.

The government will apparently argue that they were not coercing, they were just trying to persuade the social media execs to do this or that.

As The Epoch Times' Jacob Burg reported, the court appeared wary of arguments by the respondents that the White House is wholesale prevented under the Constitution from recommending to social media companies to remove posts it considered harmful, in cases where the suggestions themselves didn't cross the line into "coercion."

Deputy Solicitor General for the U.S. Brian Fletcher argued that the White House's communications with news media and social media companies regarding the content promoted on their platforms do not rise to the level of governmental “coercion,” which would have been prohibited under the Constitution.

Instead, the government was merely using its "bully pulpit" to "persuade" private parties, in this case social media companies, to do what they are "lawfully allowed to do,” he said.

Louisiana Solicitor General Benjamin Aguiñaga, representing the respondents, argued that the case demonstrates “unrelenting pressure by the government to coerce social media platforms to suppress the speech of millions of Americans.”

Mr. Aguiñaga argued that the government had no right to tell social media companies what content to carry. Its only remedy in the event of genuinely false or misleading content, he said, was to counter it by putting forward "true speech."

The attorney general took pointed questions from Liberal Justice Ketanji Brown Jackson about the extent to which the government can step in to take down certain potentially harmful content. Justice Jackson raised the hypothetical of a "teen challenge that involves teens jumping out of windows at increasing elevations," asking if it would be a problem if the government tried to suppress the publication of said challenge on social media. Mr. Aguiñaga replied that those facts were different from the present case.

Justice Ketanji Brown Jackson raised the opinion that some say “the government actually has a duty to take steps to protect the citizens of this country” when it comes to monitoring the speech that is promoted on online platforms.

“So can you help me because I'm really worried about that, because you've got the First Amendment operating in an environment of threatening circumstances from the government's perspective.

“The line is, does the government pursuant to the First Amendment have a compelling interest in doing things that result in restricting speech in this way?”

KBJ doubles down: “My biggest concern is that your view has the First Amendment hamstringing the government in significant ways.”

— System Update (@SystemUpdate_) March 18, 2024

That is, quite literally, the entire point of the First Amendment—of the entire Bill of Rights. pic.twitter.com/gWMCaHDG1WAttorneys General Liz Merrill of Louisiana and Andrew Bailey of Missouri both told The Epoch Times they felt positive about the case and how the justices reacted.

"I am cautiously optimistic that we will have a majority of the court that lands where I wholeheartedly believe they should land, and that is in favor of protecting speech," Ms. Merrill said.

Journalist Jim Hoft, a party listed in the case, said, "This has to be where they put a stop to this. The government shouldn't be doing this, especially when they're wrong, and pushing their own opinion, silencing dissenting voices. Of course, it's against the Constitution. It's a no-brainer."

In response to a question from Brett Kavanaugh, an associate justice of the Supreme Court, Louisiana Solicitor General Benjamin Aguiñaga said the "government is not helpless" when it comes to countering factually inaccurate speech.

Precedent before the court suggests the government can and should counter false speech with true speech, Mr. Aguiñaga said.

"Censorship has never been the default remedy for perceived First Amendment violation," Mr. Aguiñaga said.

Maybe one of the justices might ask how it came to be that a Chief Counsel of the FBI, James Baker, after a brief rest-stop at a DC think tank, happened to take the job as Chief Counsel at Twitter in 2020.

That was a mighty strange switcheroo, don’t you think?

And ordinary citizens were not generally informed of it until the fall of 2022, when Elon Musk bought Twitter and delved into its workings.

* * *

Support his blog by visiting Jim’s Patreon Page or Substack

Uncategorized

Manufacturing and construction vs. the still-inverted yield curve

– by New Deal democratProf. Menzie Chinn at Econbrowser makes the point that the yield curve is still inverted, and has not yet eclipsed the longest…

- by New Deal democrat

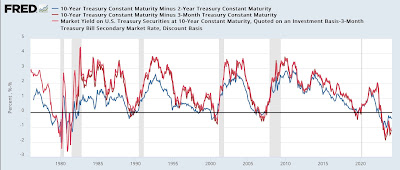

Prof. Menzie Chinn at Econbrowser makes the point that the yield curve is still inverted, and has not yet eclipsed the longest previous time between onset of such an inversion and a recession. So he believes the threat of recession is still on the table.

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex