International

B2Gold Announces Receipt of New Menankoto Permit, Located Near the Fekola Mine, Mali and Updated Mineral Resource Estimate for the Cardinal Zone at Fekola

B2Gold Corp. (TSX: BTO) (NYSE AMERICAN: BTG) (NSX: B2G) ("B2Gold" or the "Company") is pleased to announce that the Government of Mali has recently granted B2Gold’s Malian subsidiary a new exploration permit covering the same perimeter as the Menankoto…

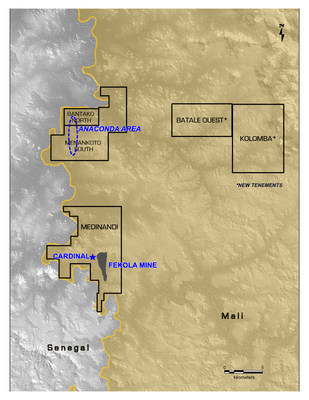

B2Gold Corp. (TSX: BTO) (NYSE AMERICAN: BTG) (NSX: B2G) ("B2Gold" or the "Company") is pleased to announce that the Government of Mali has recently granted B2Gold's Malian subsidiary a new exploration permit covering the same perimeter as the Menankoto permit (the "Menankoto Permit"), which together with the Bantako North permit comprises the Anaconda area, located 20 kilometres from the Fekola Mine. The Company is also pleased to announce an updated and significantly increased Mineral Resource estimate for the Cardinal-FMZ deposits (the "Cardinal Zone"), located approximately 500 metres from the Fekola resource pit.

Highlights

Receipt of New Menankoto Permit

- Exploration on the Menankoto Permit expected to commence by February 15, 2022 , initially with two drill rigs and additional drill rigs to be deployed shortly thereafter, with drilling continuing on the Bantako North permit (which together with the Menankoto Permit comprise the Anaconda area)

- In 2022, the Company will continue drilling to infill and extend the saprolite resource area and to follow up on the sulphide mineralization at the Anaconda area, including the Mamba, Adder and several other targets below the saprolite mineralization in 2022. The good grade and width combinations at the Anaconda area continue to provide a strong indication of the potential for Fekola-style south plunging bodies of sulphide mineralization, which remains open down plunge below the saprolite

- Preliminary planning by the Company has demonstrated that a pit situated on the Anaconda area could provide saprolite material to be trucked to and fed into the Fekola mill commencing in late 2022, subject to obtaining all necessary permits and completion of a final mine plan

- The Company has budgeted $33 million in 2022 to facilitate Phase 1 saprolite mining at the

Anaconda area

Cardinal Zone Mineral Resource Update

- Significantly increased updated Mineral Resource estimate for Cardinal Zone (as at December 31, 2021 ) with an initial Indicated Mineral Resource estimate of 8,000,000 tonnes at 1.67 grams per tonne (" g/ t") gold for 430,000 ounces of gold, and an updated Inferred Mineral Resource estimate of 19,000,000 tonnes at 1.21 g/t gold for 740,000 ounces of gold, constrained within a conceptual pit run at US$1,800 per ounce gold

- The oxide mineralization within the updated Indicated Mineral Resource for the Cardinal Zone, which is currently being mined, is a low-cost source of mill feed to the Fekola Mine, with approximately 50,000 ounces budgeted to be produced from the Cardinal Zone in 2022 (and has been included in the Fekola Mine's 2022 annual production guidance), and has the potential to add an average of approximately 60,000 ounces per year of sulphide mineralization over the next 6 to 8 years to Fekola's annual gold production

- Gold mineralization at the Cardinal Zone extends over 3.5 kilometres along strike and intersected up to 350 metres vertically below surface, with mineralization remaining open at depth and down-plunge

Receipt of New Menankoto Permit

In December 2021 , B2Gold and the Government of Mali were pleased to reach an agreement in principle relating to the dispute on the Menankoto Permit, where the Government of Mali agreed that it would grant a new exploration permit covering the same perimeter as the Menankoto Permit to a new Malian subsidiary of B2Gold, and B2Gold would withdraw the international arbitration proceedings that its Malian subsidiary commenced against the Republic of Mali . B2Gold's Malian subsidiary has now received the new Menankoto Permit, issued by the Government of Mali in compliance with the procedures and requirements set out under the Malian 2019 Mining Code (previous permit had been issued under the Malian 2012 Mining Code), which provides for an initial term of three years and renewable for 2 additional three year periods. B2Gold's Malian subsidiary has now withdrawn the international arbitration proceedings against the Republic of Mali .

Click here to view B2Gold's West Mali tenements map

With the receipt of the Menankoto Permit, exploration on the Menankoto Permit is expected to commence by February 15, 2022 , initially with two drill rigs operating, which will build on the $27 million that the Company has spent to date on Menankoto Permit, with additional drill rigs to be deployed shortly thereafter. The Company plans to continue focusing on upgrading and expanding the existing saprolite Mineral Resource estimate of 21.6 million tonnes at 1.11 g/t for 770,000 ounces for the Anaconda area (originally released in June 2017 ). An updated Mineral Resource estimate based on the results from the extensive 2020 and 2021 infill and exploration drill program is expected in the first quarter of 2022 and will feed into engineering studies currently underway. This updated Mineral Resource estimate will also include an initial Mineral Resource estimate for the sulphide material below the saprolite. Additionally, the Company has completed environmental and social studies to support permitting efforts.

In 2022, the Company will continue drilling to infill and extend the saprolite resource area and to follow up on the sulphide mineralization at the Anaconda area, including the Mamba, Adder and several other targets below the saprolite mineralization. The good grade and width combinations at the Anaconda area continue to provide a strong indication of the potential for Fekola-style south plunging bodies of sulphide mineralization, which remains open down plunge.

The potential to truck material from the nearby Anaconda area in late 2022 (comprised of the Menankoto Permit and the Bantako North permit) is currently being developed and is not included in Fekola's production guidance. The Fekola Mine has not included the Mineral Resources from the Anaconda area in the current Fekola life of mine plan. Preliminary planning by the Company has demonstrated that a pit situated on the Anaconda area could provide saprolite material to be trucked to and fed into the Fekola mill commencing in late 2022, increasing the ore processed and annual gold production from the Fekola mill, subject to obtaining all necessary permits and completion of a final mine plan, with the potential to add an average of approximately 80,000 to 100,000 ounces per year to Fekola's annual gold production. In 2022, a total of $33 million has been budgeted to facilitate Phase 1 saprolite mining at the Anaconda area. The Company plans on commencing a Phase II study when the updated Mineral Resource estimate on the sulphide material becomes available and based on 2022 exploration drilling results to review the project economics of trucking sulphide material to the Fekola mill as compared to constructing another stand-alone mill near the Anaconda area.

This additional feed from the Anaconda area to the Fekola Mine has the potential to provide immediate value to B2Gold and the State of Mali , B2Gold's 20% partner at the Fekola Mine, and communities near the project, and create significant long-term benefits for the Government of Mali as well as employment opportunities and value generation for the communities located both near the Menankoto deposit, regionally and nationally.

Since the Company commenced its investment in Mali , B2Gold has enjoyed a positive and mutually beneficial relationship with the Government of Mali . Most recently, B2Gold partnered with the Government of Mali to assist the people of Mali facing challenges created by the COVID-19 pandemic, as well as its impact on the mining sector. B2Gold continues to explore additional ways in which it might help both B2Gold's stakeholders and the Government deal with the ongoing impact of the pandemic.

Updated Cardinal Zone Mineral Resource Estimate

(at December 31, 2021 , reported on a 100% basis)

Indicated Mineral Resource Estimate (including $1,500 /oz Au sensitivity case)

| | At US$1,800/oz Au | At US$1,500/oz Au | ||||

| Domain | Tonnes | Gold (g/t Au) | Contained | Tonnes | Gold (g/t Au) | Contained |

| Oxide (Saprolite and Saprock) | 1,000,000 | 1.45 | 50,000 | 1,000,000 | 1.46 | 50,000 |

| Sulphide | 7,000,000 | 1.70 | 380,000 | 4,900,000 | 1.80 | 290,000 |

| Total Indicated Mineral Resources | 8,000,000 | 1.67 | 430,000 | 6,000,000 | 1.75 | 330,000 |

Inferred Mineral Resource Estimate (including $1,500 /oz Au sensitivity case)

| | At US$1,800/oz Au | At US$1,500/oz Au | ||||

| Domain | Tonnes | Gold Grade (g/t Au) | Contained Gold | Tonnes | Gold Grade (g/t Au) | Contained |

| Oxide (Saprolite and Saprock) | 1,900,000 | 0.75 | 50,000 | 1,600,000 | 0.80 | 40,000 |

| Sulphide | 17,100,000 | 1.26 | 690,000 | 4,100,000 | 1.45 | 190,000 |

| Total Inferred Mineral Resources | 19,000,000 | 1.21 | 740,000 | 5,700,000 | 1.27 | 230,000 |

Notes:

- Mineral Resources have been classified using CIM Standards. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- All tonnage, grade and contained metal content estimates have been rounded; rounding may result in apparent summation differences between tonnes, grade, and contained metal content.

- Mineral Resources are reported on a 100% project basis. The State of Mali hold a 20% interest in the Fekola Mine, which is located on the same mining permit as the Cardinal Zone.

- The Qualified Person for the resource estimate is Tom Garagan , P.Geo., B2Gold's Senior Vice President, Exploration.

- The Mineral Resource estimates for Cardinal Zone assumes an open pit mining method.

- Mineral Resources are reported within conceptual pit shells run with a gold price of $1,800 /oz, a metallurgical recovery of 94%, and operating cost estimates of US$1.50 - US$2.00 /t mined (mining), US$7 .26–US$12.00/t processed (processing), US$0.50 /t processed (haulage), and US$0.33 /t processed (general and administrative).

- Mineral Resources are reported at a cut-off grade of 0.25 g/t gold for oxide material, and a cut-off grade of 0.40 g/t gold for sulphide material.

Sensitivity to Mineral Resources

The Mineral Resource estimate for oxide mineralization is resilient to a lower gold price as the sensitivity case shows. The sensitivity case is reported within a pit shell run with a gold price of US$1,500 per ounce (as compared to the base case at US$1,800 per ounce gold), and the same operating costs and cut-off grades as the base case.

Cardinal Operations

Initial open pit mining operations at the Cardinal Zone have commenced and will continue to ramp up. To December 31, 2021 , 164,340 tonnes at an average grade of 1.66 g/t have been mined at the Cardinal Zone. The oxide mineralization within the updated Indicated Mineral Resource for the Cardinal Zone, which is currently in production, is expected to be a low-cost source of mill feed to the Fekola Mine, with approximately 50,000 ounces budgeted to be produced from the Cardinal Zone in 2022 (and has been included in the Fekola Mine's 2022 annual production guidance), and has the potential to add an average of approximately 60,000 ounces per year from the sulphide mineralization over the next 6 to 8 years to Fekola's annual gold production.

Cardinal Exploration Program

In 2021, B2Gold continued exploration of the Cardinal Zone as part of its $27 million exploration program in Mali. Concurrent drilling programs by the Fekola exploration and mine geology teams completed more than 50,000 metres of RC and diamond drilling towards the conversion of Inferred Mineral Resources to the Indicated category, for input to mine planning and the expansion of the known resource area, which remains open at depth.

The updated Mineral Resource estimate upgraded 430,000 ounces from Inferred to an Indicated category (initial Inferred Resource estimate was 640,000 ounces of gold in 13.0 million tonnes of ore at 1.54 g/t gold), which provides a more robust model for mine planning, while at the same time increasing the total Inferred Mineral Resource estimate to 740,000 ounces (an increase of 100,000 ounces to the initial Inferred Mineral Resource estimate).

The Cardinal Zone comprises multiple, sub-parallel, west-dipping shear zones with an average width of approximately 10 metres for the main Cardinal zone. The 2021 exploration program has shown that the Cardinal/FMZ system persists at depth, with holes such as FKD_610 (2.69 g/t gold over 21.40 m , from 253.80 m , including 5.31 g/t gold over 9.50 m ) and FKD_594 (3.96 g/t gold over 20.50 m ) returning excellent grade-width intersections below the reported resource and indicating further potential, down dip of recent drilling.

Select results from the 2021 Cardinal Zone drill program include:

| Target | Hole ID | From | To | Metres | Au (g/t) |

| Cardinal | FKD_521 | 231.30 | 242.20 | 10.90 | 3.78 |

| Cardinal | FKD_558 | 268.20 | 292.30 | 24.10 | 2.39 |

| Cardinal | FKD_565 | 270.00 | 295.70 | 25.70 | 2.02 |

| Cardinal | Incl | 274.50 | 285.00 | 10.50 | 3.51 |

| Cardinal | FKD_570 | 286.10 | 311.40 | 25.30 | 2.08 |

| Cardinal | Incl | 288.00 | 300.60 | 12.60 | 3.44 |

| Cardinal | FKD_572 | 269.30 | 291.60 | 22.30 | 2.90 |

| Cardinal | Incl | 276.10 | 280.00 | 3.90 | 6.91 |

| Cardinal | Incl | 285.00 | 291.60 | 6.60 | 4.83 |

| Cardinal | FKD_594 | 330.80 | 351.30 | 20.50 | 3.96 |

| Cardinal | FKD_598 | 221.30 | 251.72 | 30.42 | 2.12 |

| Cardinal | Incl | 236.00 | 251.72 | 15.72 | 3.49 |

| Cardinal | FKD_610 | 253.80 | 275.20 | 21.40 | 2.70 |

| Cardinal | Incl | 258.60 | 268.10 | 9.50 | 5.31 |

Composites are reported above 0.6 g/t gold cut-off, including intervals, above 1 g/t gold.

Metallurgical test work completed at SGS Lakefield confirmed the metallurgical response is aligned with previous test work and plant results confirming that the Cardinal zone mineralization is amenable to the Fekola plant operating conditions.

2022 Exploration Program

The 2022 Cardinal Zone exploration campaign will focus on expanding the known resource down dip and down plunge to the north, where the Cardinal/FMZ system intersects the Fekola Mine trend. In 2022, approximately $27 million is budgeted to be spent on exploration in Mali , focusing on the Anaconda area, Cardinal/FMZ, Fekola Deeps and Fekola North, with a total of 112,500 metres of diamond and RC drilling planned.

Resource Model Methodology

The updated Cardinal Zone Mineral Resource model was prepared in-house by B2Gold personnel. Lithology in the Cardinal Zone area is dominantly interbedded mudstones, siltstones and diorite intrusions, with bedding dipping 35-50° to the west. Shear zones associated with mineralization at the main Cardinal deposit are oriented NNE, dipping moderately to the west; shear zones associated with FMZ structures are oriented NNE, with most dipping steeply to the west. Three-dimensional mineralization domain models, which are used to control gold grade estimates, are supported by pyrite content, alteration, stratigraphy, and shear zone structures. There are 23 mineralization domains modeled.

The exploration drill data cut-off for the Cardinal Zone Mineral Resource estimate was December 31, 2021 and the drill data cut-off for RC drilled by the Fekola Mine was December 18, 2021 . A total of 1,193 drill holes (130,794 metres) were used in the estimate including 146 core holes (37,577 metres), 415 exploration RC holes (49,988 metres), 33 holes (10,074 metres) that are pre-collared with RC and completed with core, and 599 RC holes (33,155 metres) drilled by the Fekola Mine geology department. Assays were capped by mineralization domain, or groups of domains, ranging from a cap level of 3 g/t in the low grade (waste) domain to 5 to 30 g/t in the high-grade domains. Gold assays were capped prior to compositing to 2 metres. Grades were estimated into the block model using Ordinary Kriging with searches dynamically controlled along mineralization zone directions.

The block model estimates were validated by visual comparison to composite grades, comparison of global block statistics to declustered composites, swath plots by domain to check for local bias and comparison to change of support distributions. More than 10,000 bulk density measurements using the water-displacement method on air-dried core samples were used to assign density in the Cardinal Zone area. Density was assigned to the block model based on averages by mineralization domain and regolith. Nominal targeted drill hole spacing for Indicated Mineral Resources is 40 by 40 metres, and 80 by 80 metres for Inferred Mineral Resources.

QA/QC on Sample Collection and Assaying

The primary assay laboratories for exploration samples are SGS Laboratories in Bamako, Mali , and the Fekola Mine laboratory. Bureau Veritas Laboratories in Abidjan, Cote d'Ivoire was used as an alternate lab for a short period in 2020. Samples from RC drilling completed by the Fekola Mine geology department are assayed at the Fekola Mine laboratory. At each laboratory samples are prepared and analyzed using 50-gram fire assay with atomic absorption and/or gravimetric finish. Umpire assaying of exploration samples is conducted on a quarterly basis.

Quality assurance and quality control procedures include the systematic insertion of blanks, standards and duplicates into the sample sequences. The results of the control samples are evaluated on a regular basis with partial batches re-analyzed and/or resubmitted on exploration samples, as needed. All results stated in this announcement have passed B2Gold's quality assurance and quality control protocols.

Qualified Person

Tom Garagan , Senior Vice President of Exploration at B2Gold, a qualified person under National Instrument 43-101, has reviewed and approved the information contained in this news release.

About B2Gold Corp.

B2Gold is a low-cost international senior gold producer headquartered in Vancouver, Canada . Founded in 2007, today, B2Gold has operating gold mines in Mali , Namibia and the Philippines and numerous exploration and development projects in various countries including Mali , Colombia , Finland and Uzbekistan . B2Gold forecasts total consolidated gold production of between 990,000 and 1,050,000 ounces in 2022.

On Behalf of B2GOLD CORP.

" Clive T. Johnson "

President & Chief Executive Officer

For more information on B2Gold, please visit the Company website at www.b2gold.com or contact:

| Ian MacLean | Katie Bromley |

| Vice President, Investor Relations | Manager, Investor Relations & Public Relations |

| +1 604-681-8371 | +1 604-681-8371 |

The Toronto Stock Exchange and NYSE American LLC neither approve nor disapprove the information contained in this news release.

Production guidance presented in this news release reflect total production at the mines B2Gold operates on a 100% project basis. Please see our Annual Information Form dated March 30, 2021 for a discussion of our ownership interest in the mines B2Gold operates.

This news release includes certain "forward-looking information" and "forward-looking statements" (collectively forward-looking statements") within the meaning of applicable Canadian and United States securities legislation, including: projections; outlook; guidance; forecasts; estimates; and other statements regarding future or estimated financial and operational performance, gold production and sales, revenues and cash flows, and capital costs (sustaining and non-sustaining) and operating costs, and including, without limitation: total consolidated gold production of between 990,000 and 1,050,000 ounces in 2022 the potential upside to increase Fekola's gold production in 2022 by trucking material from the Anaconda area, including the potential to add approximately 80,000 to 100,000 per year to Fekola's annual production profile, and for the Anaconda area to provide saprolite material to feed the Fekola mill starting in late 2022; the potential for production from the Cardinal zone to add approximately 50,000 ounces in 2022 to the Company's production profile and approximately 60,000 per year over the next 6 to 8 years; and the completion of an updated mineral resource estimate for the Anaconda area in the first quarter of 2022. All statements in this news release that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made.

Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond B2Gold's control, including risks associated with or related to: the duration and extent of the COVID-19 pandemic, the effectiveness of preventative measures and contingency plans put in place by the Company to respond to the COVID-19 pandemic, including, but not limited to, social distancing, a non-essential travel ban, business continuity plans, and efforts to mitigate supply chain disruptions; escalation of travel restrictions on people or products and reductions in the ability of the Company to transport and refine doré; the volatility of metal prices and B2Gold's common shares; changes in tax laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; not achieving production, cost or other estimates; actual production, development plans and costs differing materially from the estimates in B2Gold's feasibility and other studies; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; the ability to replace mineral reserves and identify acquisition opportunities; the unknown liabilities of companies acquired by B2Gold; the ability to successfully integrate new acquisitions; fluctuations in exchange rates; the availability of financing; financing and debt activities, including potential restrictions imposed on B2Gold's operations as a result thereof and the ability to generate sufficient cash flows; operations in foreign and developing countries and the compliance with foreign laws, including those associated with operations in Mali , Namibia , the Philippine and Colombia and including risks related to changes in foreign laws and changing policies related to mining and local ownership requirements or resource nationalization generally, including in response to the COVID-19 outbreak; remote operations and the availability of adequate infrastructure; fluctuations in price and availability of energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory, political and country risks, including local instability or acts of terrorism and the effects thereof; the reliance upon contractors, third parties and joint venture partners; the lack of sole decision-making authority related to Filminera Resources Corporation, which owns the Masbate Project; challenges to title or surface rights; the dependence on key personnel and the ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; competition with other mining companies; community support for B2Gold's operations, including risks related to strikes and the halting of such operations from time to time; conflicts with small scale miners; failures of information systems or information security threats; the ability to maintain adequate internal controls over financial reporting as required by law, including Section 404 of the Sarbanes-Oxley Act; compliance with anti-corruption laws, and sanctions or other similar measures; social media and B2Gold's reputation; risks affecting Calibre having an impact on the value of the Company's investment in Calibre, and potential dilution of our equity interest in Calibre; as well as other factors identified and as described in more detail under the heading "Risk Factors" in B2Gold's most recent Annual Information Form, B2Gold's current Form 40-F Annual Report and B2Gold's other filings with Canadian securities regulators and the U.S. Securities and Exchange Commission (the "SEC"), which may be viewed at www.sedar.com and www.sec.gov , respectively (the "Websites"). The list is not exhaustive of the factors that may affect B2Gold's forward-looking statements

B2Gold's forward-looking statements are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related to B2Gold's ability to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; B2Gold's ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including gold; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

B2Gold's forward-looking statements are based on the opinions and estimates of management and reflect their current expectations regarding future events and operating performance and speak only as of the date hereof. B2Gold does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law. There can be no assurance that forward-looking statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what benefits or liabilities B2Gold will derive therefrom. For the reasons set forth above, undue reliance should not be placed on forward-looking statements.

View original content to download multimedia: https://www.prnewswire.com/news-releases/b2gold-announces-receipt-of-new-menankoto-permit-located-near-the-fekola-mine-mali-and-updated-mineral-resource-estimate-for-the-cardinal-zone-at-fekola-301473558.html

SOURCE B2Gold Corp.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2022/02/c2028.html

News Provided by Canada Newswire via QuoteMedia

tsx pandemic covid-19 fed social distancing recovery gold canadaInternational

There will soon be one million seats on this popular Amtrak route

“More people are taking the train than ever before,” says Amtrak’s Executive Vice President.

While the size of the United States makes it hard for it to compete with the inter-city train access available in places like Japan and many European countries, Amtrak trains are a very popular transportation option in certain pockets of the country — so much so that the country’s national railway company is expanding its Northeast Corridor by more than one million seats.

Related: This is what it's like to take a 19-hour train from New York to Chicago

Running from Boston all the way south to Washington, D.C., the route is one of the most popular as it passes through the most densely populated part of the country and serves as a commuter train for those who need to go between East Coast cities such as New York and Philadelphia for business.

Veronika Bondarenko

Amtrak launches new routes, promises travelers ‘additional travel options’

Earlier this month, Amtrak announced that it was adding four additional Northeastern routes to its schedule — two more routes between New York’s Penn Station and Union Station in Washington, D.C. on the weekend, a new early-morning weekday route between New York and Philadelphia’s William H. Gray III 30th Street Station and a weekend route between Philadelphia and Boston’s South Station.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Amtrak, these additions will increase Northeast Corridor’s service by 20% on the weekdays and 10% on the weekends for a total of one million additional seats when counted by how many will ride the corridor over the year.

“More people are taking the train than ever before and we’re proud to offer our customers additional travel options when they ride with us on the Northeast Regional,” Amtrak Executive Vice President and Chief Commercial Officer Eliot Hamlisch said in a statement on the new routes. “The Northeast Regional gets you where you want to go comfortably, conveniently and sustainably as you breeze past traffic on I-95 for a more enjoyable travel experience.”

Here are some of the other Amtrak changes you can expect to see

Amtrak also said that, in the 2023 financial year, the Northeast Corridor had nearly 9.2 million riders — 8% more than it had pre-pandemic and a 29% increase from 2022. The higher demand, particularly during both off-peak hours and the time when many business travelers use to get to work, is pushing Amtrak to invest into this corridor in particular.

To reach more customers, Amtrak has also made several changes to both its routes and pricing system. In the fall of 2023, it introduced a type of new “Night Owl Fare” — if traveling during very late or very early hours, one can go between cities like New York and Philadelphia or Philadelphia and Washington. D.C. for $5 to $15.

As travel on the same routes during peak hours can reach as much as $300, this was a deliberate move to reach those who have the flexibility of time and might have otherwise preferred more affordable methods of transportation such as the bus. After seeing strong uptake, Amtrak added this type of fare to more Boston routes.

The largest distances, such as the ones between Boston and New York or New York and Washington, are available at the lowest rate for $20.

stocks pandemic japan europeanInternational

The next pandemic? It’s already here for Earth’s wildlife

Bird flu is decimating species already threatened by climate change and habitat loss.

I am a conservation biologist who studies emerging infectious diseases. When people ask me what I think the next pandemic will be I often say that we are in the midst of one – it’s just afflicting a great many species more than ours.

I am referring to the highly pathogenic strain of avian influenza H5N1 (HPAI H5N1), otherwise known as bird flu, which has killed millions of birds and unknown numbers of mammals, particularly during the past three years.

This is the strain that emerged in domestic geese in China in 1997 and quickly jumped to humans in south-east Asia with a mortality rate of around 40-50%. My research group encountered the virus when it killed a mammal, an endangered Owston’s palm civet, in a captive breeding programme in Cuc Phuong National Park Vietnam in 2005.

How these animals caught bird flu was never confirmed. Their diet is mainly earthworms, so they had not been infected by eating diseased poultry like many captive tigers in the region.

This discovery prompted us to collate all confirmed reports of fatal infection with bird flu to assess just how broad a threat to wildlife this virus might pose.

This is how a newly discovered virus in Chinese poultry came to threaten so much of the world’s biodiversity.

The first signs

Until December 2005, most confirmed infections had been found in a few zoos and rescue centres in Thailand and Cambodia. Our analysis in 2006 showed that nearly half (48%) of all the different groups of birds (known to taxonomists as “orders”) contained a species in which a fatal infection of bird flu had been reported. These 13 orders comprised 84% of all bird species.

We reasoned 20 years ago that the strains of H5N1 circulating were probably highly pathogenic to all bird orders. We also showed that the list of confirmed infected species included those that were globally threatened and that important habitats, such as Vietnam’s Mekong delta, lay close to reported poultry outbreaks.

Mammals known to be susceptible to bird flu during the early 2000s included primates, rodents, pigs and rabbits. Large carnivores such as Bengal tigers and clouded leopards were reported to have been killed, as well as domestic cats.

Our 2006 paper showed the ease with which this virus crossed species barriers and suggested it might one day produce a pandemic-scale threat to global biodiversity.

Unfortunately, our warnings were correct.

A roving sickness

Two decades on, bird flu is killing species from the high Arctic to mainland Antarctica.

In the past couple of years, bird flu has spread rapidly across Europe and infiltrated North and South America, killing millions of poultry and a variety of bird and mammal species. A recent paper found that 26 countries have reported at least 48 mammal species that have died from the virus since 2020, when the latest increase in reported infections started.

Not even the ocean is safe. Since 2020, 13 species of aquatic mammal have succumbed, including American sea lions, porpoises and dolphins, often dying in their thousands in South America. A wide range of scavenging and predatory mammals that live on land are now also confirmed to be susceptible, including mountain lions, lynx, brown, black and polar bears.

The UK alone has lost over 75% of its great skuas and seen a 25% decline in northern gannets. Recent declines in sandwich terns (35%) and common terns (42%) were also largely driven by the virus.

Scientists haven’t managed to completely sequence the virus in all affected species. Research and continuous surveillance could tell us how adaptable it ultimately becomes, and whether it can jump to even more species. We know it can already infect humans – one or more genetic mutations may make it more infectious.

At the crossroads

Between January 1 2003 and December 21 2023, 882 cases of human infection with the H5N1 virus were reported from 23 countries, of which 461 (52%) were fatal.

Of these fatal cases, more than half were in Vietnam, China, Cambodia and Laos. Poultry-to-human infections were first recorded in Cambodia in December 2003. Intermittent cases were reported until 2014, followed by a gap until 2023, yielding 41 deaths from 64 cases. The subtype of H5N1 virus responsible has been detected in poultry in Cambodia since 2014. In the early 2000s, the H5N1 virus circulating had a high human mortality rate, so it is worrying that we are now starting to see people dying after contact with poultry again.

It’s not just H5 subtypes of bird flu that concern humans. The H10N1 virus was originally isolated from wild birds in South Korea, but has also been reported in samples from China and Mongolia.

Recent research found that these particular virus subtypes may be able to jump to humans after they were found to be pathogenic in laboratory mice and ferrets. The first person who was confirmed to be infected with H10N5 died in China on January 27 2024, but this patient was also suffering from seasonal flu (H3N2). They had been exposed to live poultry which also tested positive for H10N5.

Species already threatened with extinction are among those which have died due to bird flu in the past three years. The first deaths from the virus in mainland Antarctica have just been confirmed in skuas, highlighting a looming threat to penguin colonies whose eggs and chicks skuas prey on. Humboldt penguins have already been killed by the virus in Chile.

How can we stem this tsunami of H5N1 and other avian influenzas? Completely overhaul poultry production on a global scale. Make farms self-sufficient in rearing eggs and chicks instead of exporting them internationally. The trend towards megafarms containing over a million birds must be stopped in its tracks.

To prevent the worst outcomes for this virus, we must revisit its primary source: the incubator of intensive poultry farms.

Diana Bell does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

genetic pandemic mortality spread deaths south korea south america europe uk chinaInternational

This is the biggest money mistake you’re making during travel

A retail expert talks of some common money mistakes travelers make on their trips.

Travel is expensive. Despite the explosion of travel demand in the two years since the world opened up from the pandemic, survey after survey shows that financial reasons are the biggest factor keeping some from taking their desired trips.

Airfare, accommodation as well as food and entertainment during the trip have all outpaced inflation over the last four years.

Related: This is why we're still spending an insane amount of money on travel

But while there are multiple tricks and “travel hacks” for finding cheaper plane tickets and accommodation, the biggest financial mistake that leads to blown travel budgets is much smaller and more insidious.

This is what you should (and shouldn’t) spend your money on while abroad

“When it comes to traveling, it's hard to resist buying items so you can have a piece of that memory at home,” Kristen Gall, a retail expert who heads the financial planning section at points-back platform Rakuten, told Travel + Leisure in an interview. “However, it's important to remember that you don't need every souvenir that catches your eye.”

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Gall, souvenirs not only have a tendency to add up in price but also weight which can in turn require one to pay for extra weight or even another suitcase at the airport — over the last two months, airlines like Delta (DAL) , American Airlines (AAL) and JetBlue Airways (JBLU) have all followed each other in increasing baggage prices to in some cases as much as $60 for a first bag and $100 for a second one.

While such extras may not seem like a lot compared to the thousands one might have spent on the hotel and ticket, they all have what is sometimes known as a “coffee” or “takeout effect” in which small expenses can lead one to overspend by a large amount.

‘Save up for one special thing rather than a bunch of trinkets…’

“When traveling abroad, I recommend only purchasing items that you can't get back at home, or that are small enough to not impact your luggage weight,” Gall said. “If you’re set on bringing home a souvenir, save up for one special thing, rather than wasting your money on a bunch of trinkets you may not think twice about once you return home.”

Along with the immediate costs, there is also the risk of purchasing things that go to waste when returning home from an international vacation. Alcohol is subject to airlines’ liquid rules while certain types of foods, particularly meat and other animal products, can be confiscated by customs.

While one incident of losing an expensive bottle of liquor or cheese brought back from a country like France will often make travelers forever careful, those who travel internationally less frequently will often be unaware of specific rules and be forced to part with something they spent money on at the airport.

“It's important to keep in mind that you're going to have to travel back with everything you purchased,” Gall continued. “[…] Be careful when buying food or wine, as it may not make it through customs. Foods like chocolate are typically fine, but items like meat and produce are likely prohibited to come back into the country.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic france-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex