Apple Stock Forecast as AAPL Price Hits New Highs

To start this Apple stock forecast, let’s look at unique comparison. AAPL stock price has had a great run and it might just be getting started…

The post Apple Stock Forecast as AAPL Price Hits New Highs appeared first on Investment U.

To start this Apple stock forecast, let’s look at unique comparison. Apple’s stock price has had a great run and it might just be getting started…

Despite being selected 199th overall by the New England Patriots in the 2000 NFL Draft, Tom Brady quickly rose through the depth chart. In his second year, he became the starter and never looked back. He started the next 18 seasons, winning 17 division titles as well as six Super Bowl rings. At 44 years old, Tom Brady is now one of the oldest players in the NFL. However, that didn’t stop him from joining the Tampa Bay Buccaneers in 2020 and winning yet another Super Bowl (number 7).

Each year after Tom Brady wins, people are quick to start doubting that he can continue his success. Searching for excuses, they’ll say that he can’t win without valuable teammates, he’s getting too old, or that he can’t win on a new team. Despite these predictions, Tom is fresh off a Super Bowl win (as well as Super Bowl MVP) and shows no signs of slowing down. If I had to assign one company as “The Tom Brady of Stocks” it would be Apple.

Apple was started back in 1976 by Steven Jobs, Steve Wozniak and Ronald Wayne. Despite humble beginnings, they quickly wowed consumers with their sleek technology. The company has grown at an incredibly quick pace since then and it feels as though each success is followed by an even bigger success.

Just like Tom, analysts can be quick to write-off Apple each year. They’ll say that its products don’t perform as well as competitors, that its best years are behind it, or that Apple’s stock is overpriced. However, Apple shows no signs of slowing down. It recently passed $2 trillion in market cap and is the world’s biggest company by market cap. It’s also one of the world’s most valuable brands.

So does this mean that Apple stock is a buy for every investor? Maybe! Let’s take a quick look at where Apple is at as a company as well as an Apple stock forecast…

NOTE: I’m not a financial advisor and am just offering my own research and commentary. Please do your own due diligence before making any investment decisions.

Apple Stock Forecast (Nasdaq: AAPL)

Just like Tom Brady, Apple’s stock has experienced win after win over the past few decades.

From 2010-2020, Apple’s stock rose approximately 1,000% compared to approximately 185% for the S&P 500. Its stock has already started the 2020s strong and is up over 100% in just a year and a half compared to 40% for the S&P 500.

Wait, hasn’t most of the decade been disrupted by a once-in-a-lifetime global pandemic? Wasn’t there talk of supply chains shutting down? Weren’t non-essential businesses forced to close? I guess none of that mattered for Apple’s stock!

So what’s Apple’s stock forecast looking forward?

To make a forecast for Apple’s stock, we need to see what changes it has in store for the future. To do this, let’s examine the ways that Apple makes money.

Apple mainly generates revenue from the sale of consumer technology like phones, laptops and wearables. Notably, its iPhone makes up close to 50% of its total revenue. Since its total revenue was $274 billion in 2020, this means that approximately $140 billion came from sales of the iPhone. For reference, this is more than the total market capitalization of Target.

Here’s what’s in store for Apple products:

- iPhone – The latest iPhone 13 was delayed due to COVID-19 but is set to debut in September 2020. One of the biggest expected upgrades is the ability to make emergency phone calls even if you don’t have cell service. According to Decluttr, a staggering 53% of users plan to upgrade to this new iPhone.

- iWatch – Apple Watch 7 is set to debut in September 2020. It’s expected to have longer battery life and improved health features.

Apple also generates revenue from fees charged to content owners who use any of its online stores. Apple’s online stores consist of the App Store, iTunes, Mac App Store, iBooks and Apple TV App Store. Its biggest profit puppy is the App Store.

- App Store – Grossed about $64 billion in 2020, which was a 28% increase from 2019. Apple takes either a 30% or 15% cut of all sales in its App Store, depending on the size of the company selling the products. This has drawn major criticism in recent years (more on this later).

Other Apple major products include Apple Music and Apple Pay.

- Apple Music – Has about 72 million users and brought in $4.1 billion for Apple in 2020. For reference, its main competitor Spotify has about 165 million users.

- Apple Pay – Has about 383 million users and is one of the most prominent mobile payment providers worldwide.

It’s a testament to how big Apple is that these two final products are almost considered afterthoughts. However, they’re both incredibly competitive in their industry. It’s almost as if to say “Oh yeah, Apple also does that Apple Pay thing”, which casually has more users than the entire U.S. population.

When you’re one of the largest companies in the world, your side projects are worth more than entire companies.

So what predictions can we make about Apple’s stock moving forward?

Apple Stock Prediction

My Apple stock prediction is definitely a rosy one.

Apple’s products have been incredibly popular for years and this trend is likely to continue. Even early data suggests that many people (53%) are interested in upgrading to the iPhone 13 from phones that are just a few years old. Barring some type of colossal cultural shift in thinking, Apple should continue to dominate in the electronics industry. This will be very good for Apple’s stock over the next few years.

With that said, there are always risks looming around the corner.

The biggest risk to this Apple stock forecast is the potential for increased regulations as well as lawsuits. The more it dominates, the more it seems like a Monopoly. A House Judiciary subcommittee has already stated that the App Store gives Apple too much power to favor its own apps over others.

Apple also recently lost an intense lawsuit with Epic Games in Australia. Epic Games bypassed Apple’s 30% App Store tax by listing the app for free and requiring users to pay once it was downloaded. This prompted Apple to remove the app from its store. Epic Games immediately sued and ended up winning the court case. This could set a precedent for how Apple operates in the United States.

Additionally, many politicians like Alexandria Ocasio-Cortez and Elizabeth Warren are pushing for major tech platforms to be broken up. And depending on those efforts, the outlook for Apple stock can change.

Is Apple Stock a Buy?

So, is Apple stock a buy? As usual, this answer will vary based on your own due diligence and risk tolerance. However, there are probably very few financial analysts who will advise you against buying a little Apple stock.

It posted total revenue of $274 billion in 2020, somehow increasing revenue by 5% in the middle of a pandemic. Through two quarters in 2021, it’s on pace to clear $320 billion in revenue for the year. Oh yeah, Apple also has nearly $200 billion in cash and marketable securities.

Even if it’s forced to make changes to its App Store, the bulk of its profits comes from the sale of iPhone anyway. “Regulating big tech” has also been a talking point in politics for years but, so far, very little progress has actually been made.

I hope that you’ve enjoyed my Apple stock forecast! And as always, please do your own due diligence before investing. You might also be interested in these top semiconductor stocks with the recent chip shortage.

If you’re looking for even more investing opportunities, sign up for Liberty Through Wealth below. It’s a free e-letter that’s packed with tips and tricks. You’ll hear directly from bestselling author and investment expert Alexander Green. He’s also worked as an investment advisor, research analyst and portfolio manager on Wall Street for 16 years.

The post Apple Stock Forecast as AAPL Price Hits New Highs appeared first on Investment U.

sp 500 nasdaq stocks pandemic covid-19Spread & Containment

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

There Goes The Fed’s Inflation Target: Goldman Sees Terminal Rate 100bps Higher At 3.5%

Two years ago, we first said that it’s only a matter…

Two years ago, we first said that it's only a matter of time before the Fed admits it is unable to rsolve the so-called "last mile" of inflation and that as a result, the old inflation target of 2% is no longer viable.

At some point Fed will concede it has no control over supply. That's when we will start getting leaks of raising the inflation target

— zerohedge (@zerohedge) June 21, 2022

Then one year ago, we correctly said that while everyone was paying attention elsewhere, the inflation target had already been hiked to 2.8%... on the way to even more increases.

The new inflation target has been set to 2.8%. The rest is just narrative fill for the next 2 years. https://t.co/X1xYkecyPy

— zerohedge (@zerohedge) February 21, 2023

And while the Fed still pretends it can one day lower inflation to 2% even as it prepares to cut rates as soon as June, moments ago Goldman published a note from its economics team which had to balls to finally call a spade a spade, and concluded that - as party of the Fed's next big debate, i.e., rethinking the Neutral rate - both the neutral and terminal rate, a polite euphemism for the inflation target, are much higher than conventional wisdom believes, and that as a result Goldman is "penciling in a terminal rate of 3.25-3.5% this cycle, 100bp above the peak reached last cycle."

There is more in the full Goldman note, but below we excerpt the key fragments:

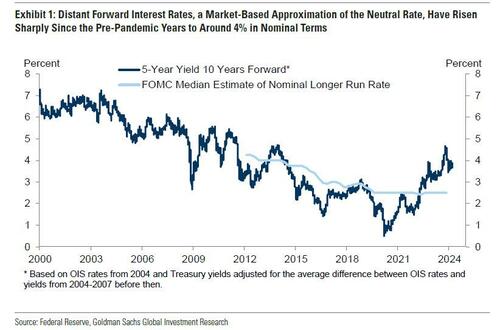

We argued last cycle that the long-run neutral rate was not as low as widely thought, perhaps closer to 3-3.5% in nominal terms than to 2-2.5%. We have also argued this cycle that the short-run neutral rate could be higher still because the fiscal deficit is much larger than usual—in fact, estimates of the elasticity of the neutral rate to the deficit suggest that the wider deficit might boost the short-term neutral rate by 1-1.5%. Fed economists have also offered another reason why the short-term neutral rate might be elevated, namely that broad financial conditions have not tightened commensurately with the rise in the funds rate, limiting transmission to the economy.

Over the coming year, Fed officials are likely to debate whether the neutral rate is still as low as they assumed last cycle and as the dot plot implies....

...Translation: raising the neutral rate estimate is also the first step to admitting that the traditional 2% inflation target is higher than previously expected. And once the Fed officially crosses that particular Rubicon, all bets are off.

... Their thinking is likely to be influenced by distant forward market rates, which have risen 1-2pp since the pre-pandemic years to about 4%; by model-based estimates of neutral, whose earlier real-time values have been revised up by roughly 0.5pp on average to about 3.5% nominal and whose latest values are little changed; and by their perception of how well the economy is performing at the current level of the funds rate.

The bank's conclusion:

We expect Fed officials to raise their estimates of neutral over time both by raising their long-run neutral rate dots somewhat and by concluding that short-run neutral is currently higher than long-run neutral. While we are fairly confident that Fed officials will not be comfortable leaving the funds rate above 5% indefinitely once inflation approaches 2% and that they will not go all the way back to 2.5% purely in the name of normalization, we are quite uncertain about where in between they will ultimately land.

Because the economy is not sensitive enough to small changes in the funds rate to make it glaringly obvious when neutral has been reached, the terminal or equilibrium rate where the FOMC decides to leave the funds rate is partly a matter of the true neutral rate and partly a matter of the perceived neutral rate. For now, we are penciling in a terminal rate of 3.25-3.5% this cycle, 100bps above the peak reached last cycle. This reflects both our view that neutral is higher than Fed officials think and our expectation that their thinking will evolve.

Not that this should come as a surprise: as a reminder, with the US now $35.5 trillion in debt and rising by $1 trillion every 100 days, we are fast approaching the Minsky Moment, which means the US has just a handful of options left: losing the reserve currency status, QEing the deficit and every new dollar in debt, or - the only viable alternative - inflating it all away. The only question we had before is when do "serious" economists make the same admission.

Meanwhile, nothing changes: total US debt jumps $57BN on March 15, to a record $34.543 trillion.

— zerohedge (@zerohedge) March 19, 2024

Three ways this ends: inflate it away, QE it all, or reserve status collapse

They now have.

And while we have discussed the staggering consequences of raising the inflation target by just 1% from 2% to 3% on everything from markets, to economic growth (instead of doubling every 35 years at 2% inflation target, prices would double every 23 years at 3%), and social cohesion, we will soon rerun the analysis again as the implications are profound. For now all you need to know is that with the US about to implicitly hit the overdrive of dollar devaluation, anything that is non-fiat will be much more preferable over fiat alternatives.

Much more in the full Goldman note available to pro subs in the usual place.

Spread & Containment

Household Net Interest Income Falls As Rates Spike

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical…

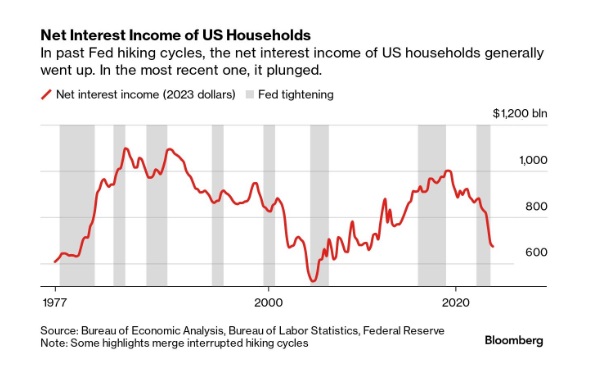

A Bloomberg article from this morning offered an excellent array of charts detailing the shifts in interest payment flows amid rising rates. The historical anomaly was both surprising and contradicted our priors.

10 Key Points:

- Historical Anomaly: This is the first time in the last fifty years that a Federal Reserve rate hike cycle has led to a significant drop in household net interest income.

- Interest Expense Increase: Since the Fed began raising rates in March 2022, Americans’ annual interest expenses on debts like mortgages and credit cards have surged by nearly $420 billion.

- Interest Income Lag: The increase in interest income during the same period was only about $280 billion, resulting in a net decline in household interest income, a departure from past trends.

- Consumer Debt Influence: The recent rate hikes impacted household finances more because of a higher proportion of consumer credit, which adjusts more quickly to rate changes, increasing interest costs.

- Banks and Savers: Banks have been slow to pass on higher interest rates to depositors, and the prolonged period of low rates before 2022 may have discouraged savers from actively seeking better returns.

- Shift in Wealth: There’s been a shift from interest-bearing assets to stocks, with dividends surpassing interest payments as a source of unearned income during the pandemic.

- Distributional Discrepancy: Higher interest rates benefit wealthier individuals who own interest-earning assets, whereas lower-income earners face the brunt of increased debt servicing costs, exacerbating economic inequality.

- Job Market Impact: Typically, Fed rate hikes affect households through the job market, as businesses cut costs, potentially leading to layoffs or wage suppression, though this hasn’t occurred yet in the current cycle.

- Economic Impact: The distribution of interest income and debt servicing means that rate increases transfer money from those more likely to spend (and thus stimulate the economy) to those less likely to increase consumption, potentially dampening economic activity.

- No Immediate Relief: Expectations for the Fed to reduce rates have diminished, indicating that high-interest expenses for households may persist.

Uncategorized

One more airline cracks down on lounge crowding in a way you won’t like

Qantas Airways is increasing the price of accessing its network of lounges by as much as 17%.

Over the last two years, multiple airlines have dealt with crowding in their lounges. While they are designed as a luxury experience for a small subset of travelers, high numbers of people taking a trip post-pandemic as well as the different ways they are able to gain access through status or certain credit cards made it difficult for some airlines to keep up with keeping foods stocked, common areas clean and having enough staff to serve bar drinks at the rate that customers expect them.

In the fall of 2023, Delta Air Lines (DAL) caught serious traveler outcry after announcing that it was cracking down on crowding by raising how much one needs to spend for lounge access and limiting the number of times one can enter those lounges.

Related: Competitors pushed Delta to backtrack on its lounge and loyalty program changes

Some airlines saw the outcry with Delta as their chance to reassure customers that they would not raise their fees while others waited for the storm to pass to quietly implement their own increases.

Shutterstock

This is how much more you'll have to pay for Qantas lounge access

Australia's flagship carrier Qantas Airways (QUBSF) is the latest airline to announce that it would raise the cost accessing the 24 lounges across the country as well as the 600 international lounges available at airports across the world through partner airlines.

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

Unlike other airlines which grant access primarily after reaching frequent flyer status, Qantas also sells it through a membership — starting from April 18, 2024, prices will rise from $600 Australian dollars ($392 USD) to $699 AUD ($456 USD) for one year, $1,100 ($718 USD) to $1,299 ($848 USD) for two years and $2,000 AUD ($1,304) to lock in the rate for four years.

Those signing up for lounge access for the first time also currently pay a joining fee of $99 AUD ($65 USD) that will rise to $129 AUD ($85 USD).

The airline also allows customers to purchase their membership with Qantas Points they collect through frequent travel; the membership fees are also being raised by the equivalent amount in points in what adds up to as much as 17% — from 308,000 to 399,900 to lock in access for four years.

Airline says hikes will 'cover cost increases passed on from suppliers'

"This is the first time the Qantas Club membership fees have increased in seven years and will help cover cost increases passed on from a range of suppliers over that time," a Qantas spokesperson confirmed to Simple Flying. "This follows a reduction in the membership fees for several years during the pandemic."

The spokesperson said the gains from the increases will go both towards making up for inflation-related costs and keeping existing lounges looking modern by updating features like furniture and décor.

While the price increases also do not apply for those who earned lounge access through frequent flyer status or change what it takes to earn that status, Qantas is also introducing even steeper increases for those renewing a membership or adding additional features such as spouse and partner memberships.

In some cases, the cost of these features will nearly double from what members are paying now.

stocks pandemic-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex