AI predictive model foresees spike in U.S. political violence

AI predictive model foresees spike in U.S. political violence, country risk in Q3-4 after “brief respite” Q3 2020 hedge fund letters, conferences and more GeoQuant’s “Year Ahead Report” predicts vaccine success, sweeping tech and Bitcoin regulation,…

AI predictive model foresees spike in U.S. political violence, country risk in Q3-4 after “brief respite”

Get The Full Ray Dalio Series in PDF

Get the entire 10-part series on Ray Dalio in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Q3 2020 hedge fund letters, conferences and more

GeoQuant’s “Year Ahead Report” predicts vaccine success, sweeping tech and Bitcoin regulation, opening of China Cold War, America’s deepening polarization and “EM-ification” -- politics looking more and more like a “developing country”

Firm Boasts 87.5% Correct Predictions since 2017, including “peak political violence” risk on Jan. 5 2021, 24 hours before Capitol riot

New York, NY - GeoQuant, the world’s first high-frequency political risk data firm, released its 2021 Year Ahead Report which outlines the company’s predictions for major political and economic events over the next 12 months.

Riding an 87.5% correct prediction rate since 2017, GeoQuant successfully called an increased threat of political violence in the first week of January 2021 (June 2020), the outcome of the US presidential election (April 2020), soft Brexit (originally in 2017 and reaffirmed in 2020), and both President Trump’s impeachment and subsequent acquittal (September 2019). The firm’s PhD-level political scientists utilize proprietary artificial intelligence driven data to predict major events, and with their latest report, the biggest trends for the coming year. This includes an overall near-term (Q1 and Q2) decline in global political risk as a COVID-19 vaccine is rolled out, as well as significant areas of underestimated market risk, particularly volatile U.S.-China relations and sweeping regulations for the tech sector worldwide.

Among the report’s key predictions in 2021:

U.S. political violence risk declines in short term, spikes in Q3 and Q4 2021, solidifying America as a “new emerging market”

The first two quarters of 2021 may provide a false sense of security as the latter quarters see a renewed increase in the risk of political violence, institutional risk and social polarization in the U.S. Six months before an insurrection broke out at the U.S. Capitol, GeoQuant predicted the all-time high spike in violence risk the first week of January 2021. That same risk will decline in the short term, but rise towards the end of the year.

Tech regulation is the biggest corporate risk of 2021

Simply put, while the tech sector has been the global economy’s big “winner” from the Covid-19 pandemic, it will be the biggest target of late and post-Covid politics, both in developed and emerging markets. The technology sector should expect a persistent push towards regulation, government intervention, and legislation. Not only is antitrust pressure likely to continue, but regulatory pressures around platform liability and tax rates are set to increase.

Government regulators will come for cryptocurrency

Following the trend of the tech world, the wild west of currency exchange will no longer have the free range it has enjoyed since its creation. Government regulators and lawmakers will advocate for and institute policies that seek to curb the “borderless” nature and anonymity of Bitcoin and other cryptos.

The deepening of a "Tech Cold War" between the U.S. and China

The contentious relationship between the U.S. and China that defined the Trump era will only get worse under President Biden. As issues over the Uighurs, Hong Kong, the South China Sea, and Taiwan persist, the tech sphere will be the primary arena where the two superpowers antagonize one another in the form of bans, regulation, and lawsuits. U.S.-China tensions have always been more about technology than trade and while tariff relief may be on the horizon, any deal with China will be more focused on solving tech and cybersecurity issues, not trade.

While country risks are forecast to decline, geopolitical risks will increase

This year’s broader decline in global risks of political violence is driven by a fall in risk within countries. But risks between countries--i.e. Geopolitical risks--are forecast to increase, especially after Q1. This global trend is driven primarily by (i) a growing U.,S.-China great power rivalry and higher tension in East Asia; (ii) a reversion to higher risk in the Middle East; and (iii) renewed tensions in Russia’s near-abroad, especially visavis Ukraine.

Global government instability on the decline

Government Instability Risk, a common driver of political and market disruptions, is forecast to decline. Among the G20, the UK remains a notable outlier reflecting GeoQuant’s analysis that UK politics will remain lively post-Brexit as Boris Johnson stays in power at the cost of alienating his Hard Brexit allies -- while China is forecast to post the greatest reduction in risk overall. Despite elite jockeying, Xi Jinping’s dominance of the CCP and the upper echelons of the Chinese government will remain largely unchallenged internally.

“Our data shows that the incoming Biden administration will break from its predecessor by ushering in a period of declining risk of political violence in the short-term. Whereas President Trump seemed to seek out spikes in political risk and market instability, his successor will chart a new course,” said Mark Rosenberg, CEO & Co-Founder of GeoQuant. “That being said, the year ahead will not be without its disruptions, and the violence and polarization we predicted spiking last week will be a fixture of America for a long time, confirming our analysis that the United States is much more akin to an emerging market with massive swings in risk with each electoral outcome much like emerging market governments. Additionally, there will likely be no greater loser than the technology sector as governments around the world are seeking to rein in what they see as the wild west of regulation. Tech will also be the new front lines of warfare with China, leading to more private sector crackdowns and legislation on both sides. While tech was the big winner of the past decade, they will start off the next one firmly on the defensive.”

See their full 2020 report and predictions here. In 2017, GeoQuant spearheaded the Mueller Risk Index which measured and predicted developments in the Mueller investigation on the stock market.

About GeoQuant

GeoQuant is an AI-driven political risk data firm that measures, analyzes and forecasts country risks at high-frequency.

The post AI predictive model foresees spike in U.S. political violence appeared first on ValueWalk.

emerging markets pandemic covid-19 cryptocurrency bitcoinUncategorized

Key shipping company files for Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Key shipping company files Chapter 11 bankruptcy

The Illinois-based general freight trucking company filed for Chapter 11 bankruptcy to reorganize.

The U.S. trucking industry has had a difficult beginning of the year for 2024 with several logistics companies filing for bankruptcy to seek either a Chapter 7 liquidation or Chapter 11 reorganization.

The Covid-19 pandemic caused a lot of supply chain issues for logistics companies and also created a shortage of truck drivers as many left the business for other occupations. Shipping companies, in the meantime, have had extreme difficulty recruiting new drivers for thousands of unfilled jobs.

Related: Tesla rival’s filing reveals Chapter 11 bankruptcy is possible

Freight forwarder company Boateng Logistics joined a growing list of shipping companies that permanently shuttered their businesses as the firm on Feb. 22 filed for Chapter 7 bankruptcy with plans to liquidate.

The Carlsbad, Calif., logistics company filed its petition in the U.S. Bankruptcy Court for the Southern District of California listing assets up to $50,000 and and $1 million to $10 million in liabilities. Court papers said it owed millions of dollars in liabilities to trucking, logistics and factoring companies. The company filed bankruptcy before any creditors could take legal action.

Lawsuits force companies to liquidate in bankruptcy

Lawsuits, however, can force companies to file bankruptcy, which was the case for J.J. & Sons Logistics of Clint, Texas, which on Jan. 22 filed for Chapter 7 liquidation in the U.S. Bankruptcy Court for the Western District of Texas. The company filed bankruptcy four days before the scheduled start of a trial for a wrongful death lawsuit filed by the family of a former company truck driver who had died from drowning in 2016.

California-based logistics company Wise Choice Trans Corp. shut down operations and filed for Chapter 7 liquidation on Jan. 4 in the U.S. Bankruptcy Court for the Northern District of California, listing $1 million to $10 million in assets and liabilities.

The Hayward, Calif., third-party logistics company, founded in 2009, provided final mile, less-than-truckload and full truckload services, as well as warehouse and fulfillment services in the San Francisco Bay Area.

The Chapter 7 filing also implemented an automatic stay against all legal proceedings, as the company listed its involvement in four legal actions that were ongoing or concluded. Court papers reportedly did not list amounts for damages.

In some cases, debtors don't have to take a drastic action, such as a liquidation, and can instead file a Chapter 11 reorganization.

Shutterstock

Nationwide Cargo seeks to reorganize its business

Nationwide Cargo Inc., a general freight trucking company that also hauls fresh produce and meat, filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Northern District of Illinois with plans to reorganize its business.

The East Dundee, Ill., shipping company listed $1 million to $10 million in assets and $10 million to $50 million in liabilities in its petition and said funds will not be available to pay unsecured creditors. The company operates with 183 trucks and 171 drivers, FreightWaves reported.

Nationwide Cargo's three largest secured creditors in the petition were Equify Financial LLC (owed about $3.5 million,) Commercial Credit Group (owed about $1.8 million) and Continental Bank NA (owed about $676,000.)

The shipping company reported gross revenue of about $34 million in 2022 and about $40 million in 2023. From Jan. 1 until its petition date, the company generated $9.3 million in gross revenue.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic covid-19 stocksUncategorized

Tight inventory and frustrated buyers challenge agents in Virginia

With inventory a little more than half of what it was pre-pandemic, agents are struggling to find homes for clients in Virginia.

No matter where you are in the state, real estate agents in Virginia are facing low inventory conditions that are creating frustrating scenarios for their buyers.

“I think people are getting used to the interest rates where they are now, but there is just a huge lack of inventory,” said Chelsea Newcomb, a RE/MAX Realty Specialists agent based in Charlottesville. “I have buyers that are looking, but to find a house that you love enough to pay a high price for — and to be at over a 6.5% interest rate — it’s just a little bit harder to find something.”

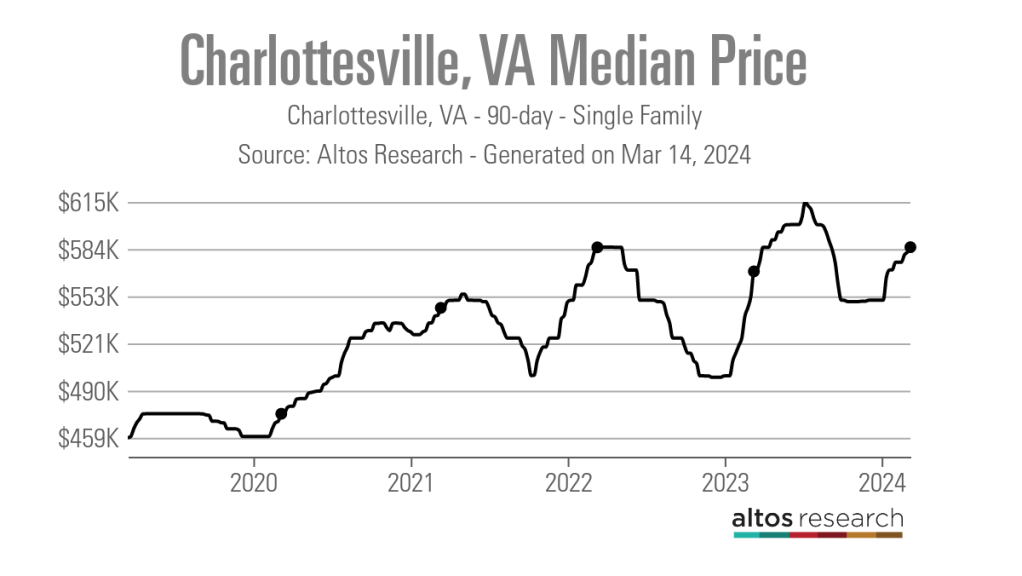

Newcomb said that interest rates and higher prices, which have risen by more than $100,000 since March 2020, according to data from Altos Research, have caused her clients to be pickier when selecting a home.

“When rates and prices were lower, people were more willing to compromise,” Newcomb said.

Out in Wise, Virginia, near the westernmost tip of the state, RE/MAX Cavaliers agent Brett Tiller and his clients are also struggling to find suitable properties.

“The thing that really stands out, especially compared to two years ago, is the lack of quality listings,” Tiller said. “The slightly more upscale single-family listings for move-up buyers with children looking for their forever home just aren’t coming on the market right now, and demand is still very high.”

Statewide, Virginia had a 90-day average of 8,068 active single-family listings as of March 8, 2024, down from 14,471 single-family listings in early March 2020 at the onset of the COVID-19 pandemic, according to Altos Research. That represents a decrease of 44%.

In Newcomb’s base metro area of Charlottesville, there were an average of only 277 active single-family listings during the same recent 90-day period, compared to 892 at the onset of the pandemic. In Wise County, there were only 56 listings.

Due to the demand from move-up buyers in Tiller’s area, the average days on market for homes with a median price of roughly $190,000 was just 17 days as of early March 2024.

“For the right home, which is rare to find right now, we are still seeing multiple offers,” Tiller said. “The demand is the same right now as it was during the heart of the pandemic.”

According to Tiller, the tight inventory has caused homebuyers to spend up to six months searching for their new property, roughly double the time it took prior to the pandemic.

For Matt Salway in the Virginia Beach metro area, the tight inventory conditions are creating a rather hot market.

“Depending on where you are in the area, your listing could have 15 offers in two days,” the agent for Iron Valley Real Estate Hampton Roads | Virginia Beach said. “It has been crazy competition for most of Virginia Beach, and Norfolk is pretty hot too, especially for anything under $400,000.”

According to Altos Research, the Virginia Beach-Norfolk-Newport News housing market had a seven-day average Market Action Index score of 52.44 as of March 14, making it the seventh hottest housing market in the country. Altos considers any Market Action Index score above 30 to be indicative of a seller’s market.

Further up the coastline on the vacation destination of Chincoteague Island, Long & Foster agent Meghan O. Clarkson is also seeing a decent amount of competition despite higher prices and interest rates.

“People are taking their time to actually come see things now instead of buying site unseen, and occasionally we see some seller concessions, but the traffic and the demand is still there; you might just work a little longer with people because we don’t have anything for sale,” Clarkson said.

“I’m busy and constantly have appointments, but the underlying frenzy from the height of the pandemic has gone away, but I think it is because we have just gotten used to it.”

While much of the demand that Clarkson’s market faces is for vacation homes and from retirees looking for a scenic spot to retire, a large portion of the demand in Salway’s market comes from military personnel and civilians working under government contracts.

“We have over a dozen military bases here, plus a bunch of shipyards, so the closer you get to all of those bases, the easier it is to sell a home and the faster the sale happens,” Salway said.

Due to this, Salway said that existing-home inventory typically does not come on the market unless an employment contract ends or the owner is reassigned to a different base, which is currently contributing to the tight inventory situation in his market.

Things are a bit different for Tiller and Newcomb, who are seeing a decent number of buyers from other, more expensive parts of the state.

“One of the crazy things about Louisa and Goochland, which are kind of like suburbs on the western side of Richmond, is that they are growing like crazy,” Newcomb said. “A lot of people are coming in from Northern Virginia because they can work remotely now.”

With a Market Action Index score of 50, it is easy to see why people are leaving the Washington-Arlington-Alexandria market for the Charlottesville market, which has an index score of 41.

In addition, the 90-day average median list price in Charlottesville is $585,000 compared to $729,900 in the D.C. area, which Newcomb said is also luring many Virginia homebuyers to move further south.

“They are very accustomed to higher prices, so they are super impressed with the prices we offer here in the central Virginia area,” Newcomb said.

For local buyers, Newcomb said this means they are frequently being outbid or outpriced.

“A couple who is local to the area and has been here their whole life, they are just now starting to get their mind wrapped around the fact that you can’t get a house for $200,000 anymore,” Newcomb said.

As the year heads closer to spring, triggering the start of the prime homebuying season, agents in Virginia feel optimistic about the market.

“We are seeing seasonal trends like we did up through 2019,” Clarkson said. “The market kind of soft launched around President’s Day and it is still building, but I expect it to pick right back up and be in full swing by Easter like it always used to.”

But while they are confident in demand, questions still remain about whether there will be enough inventory to support even more homebuyers entering the market.

“I have a lot of buyers starting to come off the sidelines, but in my office, I also have a lot of people who are going to list their house in the next two to three weeks now that the weather is starting to break,” Newcomb said. “I think we are going to have a good spring and summer.”

real estate housing market pandemic covid-19 interest rates-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International7 days ago

International7 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A