A New World Monetary Order is Emerging, and Bitcoin is Poised to Be a Part of It

It seems that the more intense the chaos, the deeper the changes emerge from it.

The post A New World Monetary Order is Emerging, and Bitcoin is Poised…

It seems that the more intense the chaos, the deeper the changes emerge from it. In the present post-Covid-19 chaos of supply disruptions, 40-year high inflation rates, and a war in Europe—we seem to be on the brink of a major monetary pivot. To understand its implications and how digital assets fit into it, we first must revisit the previous reset.

World War II as the First Great Reset

As World War II chaos was coming to closure in July 1944, it birthed a new paradigm we still live in today. In the Bretton Woods mountain resort, 44 nations set up a new international monetary system. The arrangement was simple.

As the economic and military powerhouse, the US would become the monetary center, as other nations would peg their currencies to the dollar. In turn, the dollar itself would be pegged to US gold reserves, at $35 per ounce. Other nations would then contract or expand their USD supply within the 1% range of the fixed-rate, as investors used forex brokers to exchange foreign currencies.

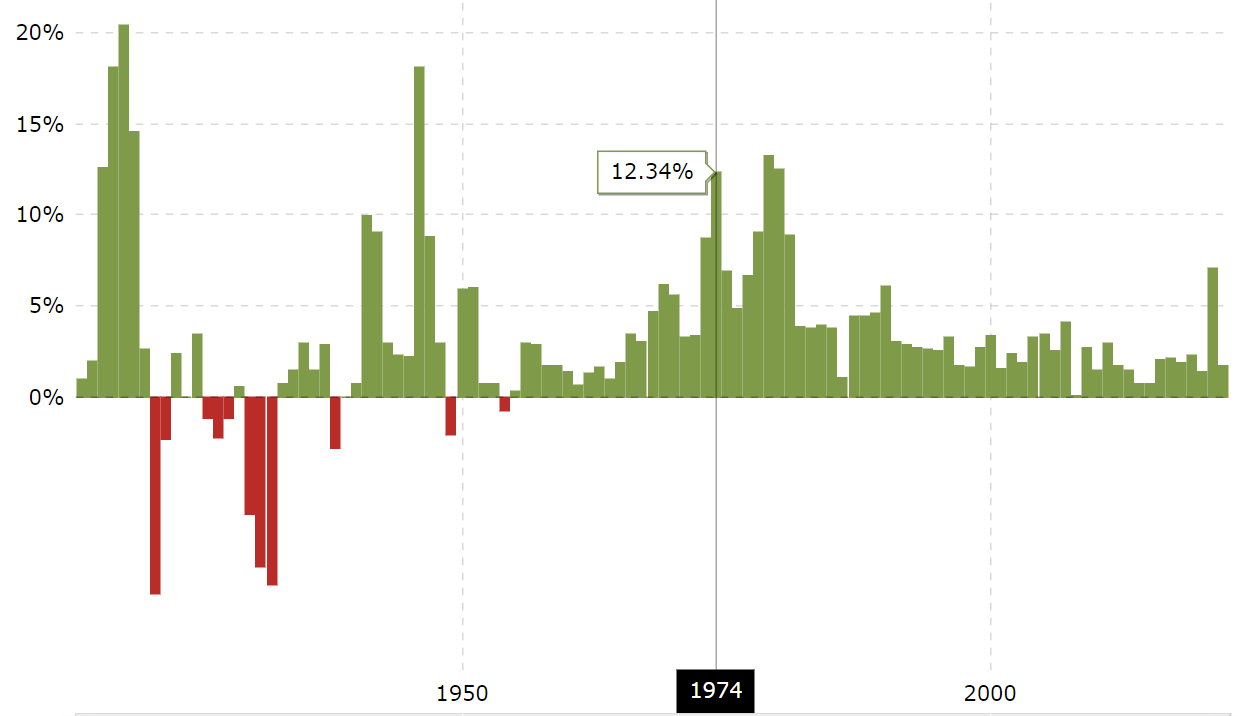

President Richard Nixon abandoned the gold peg in 1971—and effectively the Bretton Woods system altogether—framing it as “There is no longer any need for the United States to compete with one hand tied behind her back.” Yet, the Bretton Woods legacy remained. Both the International Monetary Fund (IMF) and the World Bank have served as key cogs for the post-Bretton Woods era – the petro-dollar.

The US as the World’s Money Controller

President Nixon was correct in that the gold peg hobbled US expansion. On both sides of the equation, the gold peg has a number of issues:

- Because the money supply was constrained by a fixed exchange rate, so too were the government’s expansionary policies. These ranged from unemployment interventions to military spending.

- Furthermore, the gold peg was a double-edged sword. Although countries that pegged their currencies to the dollar ceded some of their domestic economic policies, they could also redeem dollars for gold.

- While the gold itself is rare and expensive to mine, its supply is not fixed. Even so, its supply doesn’t match up with the economic growth of the global economy.

- If a nation falls into a deficit, when the government’s income is lower than its spending, it has fewer options available to right the course around the recession storm.

Altogether, it was the last point that made Nixon cut off the gold peg. He needed the Federal Reserve to provide an inexpensive money supply via lower interest rates. In this way, the economy would be flooded with cash, meaning it would grow sufficiently to offset a recession, regardless of the dollar being devalued in the process. Sound familiar?

We have certainly seen record-high stock market gains thanks to the Fed’s injection of trillions of USD, which triggered a new era of retail traders using commission-free stock trading platforms. Needless to say, with the stabilizing gold peg gone, the 1970s were a period of the Great Inflation, just as appears to be happening now.

Nonetheless, things would have been worse without the USD growing into its petrodollar status. In a nutshell, the USD has become the world’s global reserve currency because the US spends nearly as much on the military as the entire world.

With influence over Europe stemming from WWII firmly entrenched and its control over the Gulf states, the US has been using the petrodollar as a vehicle to offset the downsides of unlocking its money supply and relentless spending. Both OPEC (Organization of Petroleum Exporting Countries) and non-OPEC nations, such as Russia and Qatar, have been using dollars to trade oil and gas.

Such a system holds a glaring vulnerability that the West punctured this March, as it took unprecedented financial moves against Russia.

New World Monetary Order Emerging

As a nation with the world’s largest landmass, Russia holds an abundance of energy reserves. Accordingly, Russia’s main exports are energy-related products, at 63%, of which 26% and 12% constitute crude oil and gas, respectively. This places Russia in a domineering position against Europe, which largely depends on Russian energy imports.

Furthermore, according to National Geographic, Russia and Ukraine are supplying the world with a 12% caloric intake, via 30% wheat production. So, what happens when these two nations go to war with each other?

Much of this depends on the West’s response—which to date, has been sanctioned. It would take quite some time to list all the sanctions against Russia thus far. Suffice to say, the key one was the seizure of Russia’s forex reserves by G7 nations. This marks a clean break from established international norms, which China and India took note of, as well as Saudi Arabia. Consequently, they have all expressed plans or considerations to start trading energy products in non-petrodollar (USD) currencies.

Likewise, President Putin accelerated these considerations by signing an executive order by which unfriendly nations (those that imposed sanctions) would have to pay in Russian rubles for not only oil and gas imports but wheat as well. In other words, Putin has poised the ruble to become a commodity-based currency.

As Zoltan Pozsar, the Former Federal Reserve and U.S. Treasury Department official put it:

“A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money, and this crisis is about the rising allure of outside money over inside money.”

So far, G7 ministers have rejected Russia’s demand to pay for its energy products in rubles. By the same token, Germany and Austria are already preparing for gas rationing, with the former often dubbed as Europe’s economic engine. Moreover, the CEO of Germany’s multinational BASF SE, the world’s largest chemical producer, warned of a complete supply chain collapse.

“To put it bluntly: This could bring the German economy into its worst crisis since the end of the Second World War and destroy our prosperity. For many small and medium-sized companies, in particular, it could mean the end. We can’t risk that!”

In between the US and Russia, Europe is at a turning point, just like it was in 1944 with the setup of the Bretton Woods monetary order. However, while these cycles seem to repeat, one novelty cannot be dismissed—decentralized networks which have the capability to create sovereign digital money.

Bitcoin – the Global Reserve Currency for the Little Guy

In this midst of the current state of the world’s monetary world order, new assets have emerged that have the potential to remain neutral. This is a critical benefit that Bitcoin offers to the world—a sovereign, stateless, digital currency with a fixed supply.

Unlike gold, however, Bitcoin is also not seizable. If one remembers their recovery seed phrase, they can always restore access to their assets on Bitcoin’s blockchain network. While a recent EU proposal tries to crack down on un-hosted wallets, legislative words are a far cry from technological reality.

Corporate investors are already seeing Bitcoin in this light, as a new Bitcoin Standard is evolving beyond the gold standard. Last week, Michael Saylor’s MicroStrategy took out a BTC-collateralized loan from Silvergate Bank worth $205 million. Why? To buy more BTC of course, on top of MicroStrategy’s already substantial 125,051 bitcoins (~$6 billion).

Both parties can only be confident in such debt leveraging if they view Bitcoin’s rise as inevitable. By the same token, Terraform Labs’ foundation is gradually increasing its Bitcoin supply with the end goal to top $10 billion worth of BTC.

This is quite significant as Terra aims to replace both Visa and Mastercard as a global payment system with its algorithmic stablecoin TerraUSD (UST). Just as Russia is in the process of expanding its ruble collateralization with commodities, so is Terra’s UST being collateralized by Bitcoin.

This is quite significant as Terra aims to replace both Visa and Mastercard as a global payment system with its algorithmic stablecoin TerraUSD (UST). Just as Russia is in the process of expanding its ruble collateralization with commodities, so is Terra’s UST being collateralized by Bitcoin.

In turn, Terra’s own ecosystem is bolstered by its Anchor Protocol, which produces a roughly 19% APY on UST deposits. The environment makes yield farming an attractive means of generating passive income, especially when considering the current CPI inflation rate in the US, which is approaching 8%.

The difference is, that Russia must now broker complicated deals with other nations, meaning there are multiple hurdles ahead. In contrast, blockchain assets are native to the internet—where decentralized and secure environments can potentially create conditions without geopolitical or ideological constraints. Most importantly, if the petrodollar is on its way out, regardless of how long that may take, the cost of the Fed’s endless money supply will no longer be alleviated.

With so many uncertainties in this new monetary world order, Bitcoin’s fundamental appeal and track record speak for themselves.

The post A New World Monetary Order is Emerging, and Bitcoin is Poised to Be a Part of It appeared first on CryptoSlate.

bitcoin blockchain btc covid-19 currencies commodities gold oilUncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesGovernment

Survey Shows Declining Concerns Among Americans About COVID-19

Survey Shows Declining Concerns Among Americans About COVID-19

A new survey reveals that only 20% of Americans view covid-19 as "a major threat"…

A new survey reveals that only 20% of Americans view covid-19 as "a major threat" to the health of the US population - a sharp decline from a high of 67% in July 2020.

What's more, the Pew Research Center survey conducted from Feb. 7 to Feb. 11 showed that just 10% of Americans are concerned that they will catch the disease and require hospitalization.

"This data represents a low ebb of public concern about the virus that reached its height in the summer and fall of 2020, when as many as two-thirds of Americans viewed COVID-19 as a major threat to public health," reads the report, which was published March 7.

According to the survey, half of the participants understand the significance of researchers and healthcare providers in understanding and treating long COVID - however 27% of participants consider this issue less important, while 22% of Americans are unaware of long COVID.

What's more, while Democrats were far more worried than Republicans in the past, that gap has narrowed significantly.

"In the pandemic’s first year, Democrats were routinely about 40 points more likely than Republicans to view the coronavirus as a major threat to the health of the U.S. population. This gap has waned as overall levels of concern have fallen," reads the report.

More via the Epoch Times;

The survey found that three in ten Democrats under 50 have received an updated COVID-19 vaccine, compared with 66 percent of Democrats ages 65 and older.

Moreover, 66 percent of Democrats ages 65 and older have received the updated COVID-19 vaccine, while only 24 percent of Republicans ages 65 and older have done so.

“This 42-point partisan gap is much wider now than at other points since the start of the outbreak. For instance, in August 2021, 93 percent of older Democrats and 78 percent of older Republicans said they had received all the shots needed to be fully vaccinated (a 15-point gap),” it noted.

COVID-19 No Longer an Emergency

The U.S. Centers for Disease Control and Prevention (CDC) recently issued its updated recommendations for the virus, which no longer require people to stay home for five days after testing positive for COVID-19.

The updated guidance recommends that people who contracted a respiratory virus stay home, and they can resume normal activities when their symptoms improve overall and their fever subsides for 24 hours without medication.

“We still must use the commonsense solutions we know work to protect ourselves and others from serious illness from respiratory viruses, this includes vaccination, treatment, and staying home when we get sick,” CDC director Dr. Mandy Cohen said in a statement.

The CDC said that while the virus remains a threat, it is now less likely to cause severe illness because of widespread immunity and improved tools to prevent and treat the disease.

“Importantly, states and countries that have already adjusted recommended isolation times have not seen increased hospitalizations or deaths related to COVID-19,” it stated.

The federal government suspended its free at-home COVID-19 test program on March 8, according to a website set up by the government, following a decrease in COVID-19-related hospitalizations.

According to the CDC, hospitalization rates for COVID-19 and influenza diseases remain “elevated” but are decreasing in some parts of the United States.

Government

Rand Paul Teases Senate GOP Leader Run – Musk Says “I Would Support”

Rand Paul Teases Senate GOP Leader Run – Musk Says "I Would Support"

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump…

Republican Kentucky Senator Rand Paul on Friday hinted that he may jump into the race to become the next Senate GOP leader, and Elon Musk was quick to support the idea. Republicans must find a successor for periodically malfunctioning Mitch McConnell, who recently announced he'll step down in November, though intending to keep his Senate seat until his term ends in January 2027, when he'd be within weeks of turning 86.

So far, the announced field consists of two quintessential establishment types: John Cornyn of Texas and John Thune of South Dakota. While John Barrasso's name had been thrown around as one of "The Three Johns" considered top contenders, the Wyoming senator on Tuesday said he'll instead seek the number two slot as party whip.

Paul used X to tease his potential bid for the position which -- if the GOP takes back the upper chamber in November -- could graduate from Minority Leader to Majority Leader. He started by telling his 5.1 million followers he'd had lots of people asking him about his interest in running...

Thousands of people have been asking if I'd run for Senate leadership...

— Rand Paul (@RandPaul) March 8, 2024

...then followed up with a poll in which he predictably annihilated Cornyn and Thune, taking a 96% share as of Friday night, with the other two below 2% each.

????????️VOTE NOW ????️ ???? Who would you like to be the next Senate leader?

— Rand Paul (@RandPaul) March 8, 2024

Elon Musk was quick to back the idea of Paul as GOP leader, while daring Cornyn and Thune to follow Paul's lead by throwing their names out for consideration by the Twitter-verse X-verse.

I would support Rand Paul and suspect that other candidates will not actually run polls out of concern for the results, but let’s see if they will!

— Elon Musk (@elonmusk) March 8, 2024

Paul has been a stalwart opponent of security-state mass surveillance, foreign interventionism -- to include shoveling billions of dollars into the proxy war in Ukraine -- and out-of-control spending in general. He demonstrated the latter passion on the Senate floor this week as he ridiculed the latest kick-the-can spending package:

This bill is an insult to the American people. The earmarks are all the wasteful spending that you could ever hope to see, and it should be defeated. Read more: https://t.co/Jt8K5iucA4 pic.twitter.com/I5okd4QgDg

— Senator Rand Paul (@SenRandPaul) March 8, 2024

In February, Paul used Senate rules to force his colleagues into a grueling Super Bowl weekend of votes, as he worked to derail a $95 billion foreign aid bill. "I think we should stay here as long as it takes,” said Paul. “If it takes a week or a month, I’ll force them to stay here to discuss why they think the border of Ukraine is more important than the US border.”

Don't expect a Majority Leader Paul to ditch the filibuster -- he's been a hardy user of the legislative delay tactic. In 2013, he spoke for 13 hours to fight the nomination of John Brennan as CIA director. In 2015, he orated for 10-and-a-half-hours to oppose extension of the Patriot Act.

Among the general public, Paul is probably best known as Capitol Hill's chief tormentor of Dr. Anthony Fauci, who was director of the National Institute of Allergy and Infectious Disease during the Covid-19 pandemic. Paul says the evidence indicates the virus emerged from China's Wuhan Institute of Virology. He's accused Fauci and other members of the US government public health apparatus of evading questions about their funding of the Chinese lab's "gain of function" research, which takes natural viruses and morphs them into something more dangerous. Paul has pointedly said that Fauci committed perjury in congressional hearings and that he belongs in jail "without question."

Musk is neither the only nor the first noteworthy figure to back Paul for party leader. Just hours after McConnell announced his upcoming step-down from leadership, independent 2024 presidential candidate Robert F. Kennedy, Jr voiced his support:

Mitch McConnell, who has served in the Senate for almost 40 years, announced he'll step down this November.

— Robert F. Kennedy Jr (@RobertKennedyJr) February 28, 2024

Part of public service is about knowing when to usher in a new generation. It’s time to promote leaders in Washington, DC who won’t kowtow to the military contractors or…

In a testament to the extent to which the establishment recoils at the libertarian-minded Paul, mainstream media outlets -- which have been quick to report on other developments in the majority leader race -- pretended not to notice that Paul had signaled his interest in the job. More than 24 hours after Paul's test-the-waters tweet-fest began, not a single major outlet had brought it to the attention of their audience.

That may be his strongest endorsement yet.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex