Uncategorized

6 Questions for JW Verret — the blockchain professor who’s tracking the money

J.W. Verret is the “Blockchain Professor.” He may be tracking your money, but he’s advocating for crypto.

J.W. Verret is a Harvard-educated…

J.W. Verret is the “Blockchain Professor.” He may be tracking your money, but he’s advocating for crypto.

J.W. Verret is a Harvard-educated attorney who teaches corporate finance and accounting at George Mason University. His work has increasingly intersected with the cryptocurrency sector in recent years, as his legion of Twitter followers who know him as “BlockProf,” or the Blockchain Professor are poignantly aware.

Aside from his work at GMU, Verret has become known as a vocal advocate for crypto as the top honcho at Crypto Freedom Lab, a think tank fighting devoted to preserving “freedom and privacy for crypto developers and users.” He also serves as a professional legal witness for defendants accused wrongfully, Verret would argue of evading financial-tracking laws. In between, he finds time to serve as a regular columnist for Cointelegraph.

1) You’re very busy professionally teaching at George Mason University, serving on committees with the Securities and Exchange Commission, going to trials as expert witness. How did life lead you to cryptocurrency?

I spent 15 years as a libertarian regulation/financial person, writing it, think-tanking it in Washington, D.C. For the first 10 years, I lost everything I fought for in the Dodd-Frank era.

The thing with crypto is that it’s been a freedom revolution in finance. It fixes, or aims to fix, problems in finance that government regulation only aims to fix. Regulation entrenches intermediaries where crypto fixes problems by eliminating the need for those intermediaries. And that was very interesting to me.

2) You served on the SEC’s Investor Advisory Committee. Youve also been very vocal in criticising Chairman Gary Gensler. How was that experience?

It was a good experience. I replaced Hester Pierce when she became an SEC commissioner. I wrote a lot of dissents as a committee member, so I hope I did Hester proud, but I do not think they’ll invite me back in the future under the current chairman. It seems like he’s been trying to just destroy this industry. He could’ve reached out to the industry to try to make things work, but he has no interest in that, and he’s sued some of the best actors in crypto Coinbase and Kraken while ignoring the worst.

3) You’re a vocal proponent of ZCash. Explain your interest there.

Zcash is like Bitcoin, but private. It’a a great invention. Whoever the developers were deserve a Nobel Prize.

I own a lot of Bitcoin. I think it’s a tremendous innovation. But for day-to-day payments, I think we need some privacy, and it’s hard to get that with Bitcoin. I’m also a fan of Monero. which has some pretty good privacy technology. But they’re both pretty good projects t’s possible to like both the Rolling Stones and the Beatles.

Also read: The Supreme Court could stop the SECs war on crypto

There are no other privacy tokens that are in the same ballpark. There are some that are really neat innovations, but they’re not at the level you need to have the same privacy. There are some interesting ones, sure. Other projects I’m very excited about are Samourai Wallet and Sparrow Wallet, which offer a bit of privacy for BItcoin transactions.

4) On that note, how do you think the future of crypto is going to be defined? Is it going to be defined as a way to achieve greater privacy in transaction? Will it be defined by efficiency in the sense that its easier to use than traditional finance instruments? Will it be defined by crime? Or will it be some mixture of these?

That’s an interesting question. I think it will be some combination of all those things. Crime is often a testing ground for new technology. It certainly was for the internet. In the 1990s, a lot of criminals used the internet. I think the strongest forces in determining what cryptos survive will be some mixture of efficiency and scale, but I think privacy will be a part of it. As governments and big corporations fight back against trustless, disintermediated property transfers, the only way to protect yourself will be using privacy coins and privacy protocols.

5) Youre also serving as a professional witness in U.S. v. Sterlingov, where the U.S. government is charging 33-year-old Roman Sterlingov with developing Bitcoin Fog a crypto mixer. Tell me about that.

I spend a lot of time as a forensic accountant, but I’m also into privacy. Some people think that’s a conflict: How can you be privacy while also following the money? But I dont see that as a conflict at all. Some of the people most into privacy who I know are forensic investigators. I’m a believer in public information. People should learn what it takes to be private. The worst people tend not to be smart anyway they make mistakes, and they dont use privacy tools optimally.

In terms of U.S. v. Sterlingov, Im providing some expert help in forensic accounting and money laundering. It’s been helpful to merge my legal and accounting perspectives to aid the legal team. I also do some work helping customers of large crypto exchanges when their crypto is frozen, and we ultimately resolve it when we figure out that the customer did nothing wrong but were falsely flagged by crypto tracing tools.

False positives in crypto tracing can have a real cost and that is one thing that concerns me about the dominance of some of the tracing firms. TRM and Ciphertrace seem like they try to get things right and don’t overclaim their tracing capabilities but that’s not true of every firm in this industry.

6) I hear you have opinions about UFOs. Can you tell us what you know?

I’m really into podcasts about the history of investigations into UFOs. Some good ones are Strange Arrivals and High Strange. Id also recommend reading J. Allen Hyneks The Hynek UFO Report, which is about the Project Bluebook Report. He was a physics professor at a little school and the Air Force asked him to look into it one day. I think they thought he’d be a front man and he was, but then he changed.

The government knows no more now than it did 50 years ago. They may know more than they’ve shared, but I don’t think they understand it. The Navy pilot revelations are pretty amazing. So I think they do exist. I think they’re probably probes of some kind that are unmanned nothing armageddon or conspiracy. I just think they want to see what we’re up to.

Uncategorized

Homes listed for sale in early June sell for $7,700 more

New Zillow research suggests the spring home shopping season may see a second wave this summer if mortgage rates fall

The post Homes listed for sale in…

- A Zillow analysis of 2023 home sales finds homes listed in the first two weeks of June sold for 2.3% more.

- The best time to list a home for sale is a month later than it was in 2019, likely driven by mortgage rates.

- The best time to list can be as early as the second half of February in San Francisco, and as late as the first half of July in New York and Philadelphia.

Spring home sellers looking to maximize their sale price may want to wait it out and list their home for sale in the first half of June. A new Zillow® analysis of 2023 sales found that homes listed in the first two weeks of June sold for 2.3% more, a $7,700 boost on a typical U.S. home.

The best time to list consistently had been early May in the years leading up to the pandemic. The shift to June suggests mortgage rates are strongly influencing demand on top of the usual seasonality that brings buyers to the market in the spring. This home-shopping season is poised to follow a similar pattern as that in 2023, with the potential for a second wave if the Federal Reserve lowers interest rates midyear or later.

The 2.3% sale price premium registered last June followed the first spring in more than 15 years with mortgage rates over 6% on a 30-year fixed-rate loan. The high rates put home buyers on the back foot, and as rates continued upward through May, they were still reassessing and less likely to bid boldly. In June, however, rates pulled back a little from 6.79% to 6.67%, which likely presented an opportunity for determined buyers heading into summer. More buyers understood their market position and could afford to transact, boosting competition and sale prices.

The old logic was that sellers could earn a premium by listing in late spring, when search activity hit its peak. Now, with persistently low inventory, mortgage rate fluctuations make their own seasonality. First-time home buyers who are on the edge of qualifying for a home loan may dip in and out of the market, depending on what’s happening with rates. It is almost certain the Federal Reserve will push back any interest-rate cuts to mid-2024 at the earliest. If mortgage rates follow, that could bring another surge of buyers later this year.

Mortgage rates have been impacting affordability and sale prices since they began rising rapidly two years ago. In 2022, sellers nationwide saw the highest sale premium when they listed their home in late March, right before rates barreled past 5% and continued climbing.

Zillow’s research finds the best time to list can vary widely by metropolitan area. In 2023, it was as early as the second half of February in San Francisco, and as late as the first half of July in New York. Thirty of the top 35 largest metro areas saw for-sale listings command the highest sale prices between May and early July last year.

Zillow also found a wide range in the sale price premiums associated with homes listed during those peak periods. At the hottest time of the year in San Jose, homes sold for 5.5% more, a $88,000 boost on a typical home. Meanwhile, homes in San Antonio sold for 1.9% more during that same time period.

| Metropolitan Area | Best Time to List | Price Premium | Dollar Boost |

| United States | First half of June | 2.3% | $7,700 |

| New York, NY | First half of July | 2.4% | $15,500 |

| Los Angeles, CA | First half of May | 4.1% | $39,300 |

| Chicago, IL | First half of June | 2.8% | $8,800 |

| Dallas, TX | First half of June | 2.5% | $9,200 |

| Houston, TX | Second half of April | 2.0% | $6,200 |

| Washington, DC | Second half of June | 2.2% | $12,700 |

| Philadelphia, PA | First half of July | 2.4% | $8,200 |

| Miami, FL | First half of June | 2.3% | $12,900 |

| Atlanta, GA | Second half of June | 2.3% | $8,700 |

| Boston, MA | Second half of May | 3.5% | $23,600 |

| Phoenix, AZ | First half of June | 3.2% | $14,700 |

| San Francisco, CA | Second half of February | 4.2% | $50,300 |

| Riverside, CA | First half of May | 2.7% | $15,600 |

| Detroit, MI | First half of July | 3.3% | $7,900 |

| Seattle, WA | First half of June | 4.3% | $31,500 |

| Minneapolis, MN | Second half of May | 3.7% | $13,400 |

| San Diego, CA | Second half of April | 3.1% | $29,600 |

| Tampa, FL | Second half of June | 2.1% | $8,000 |

| Denver, CO | Second half of May | 2.9% | $16,900 |

| Baltimore, MD | First half of July | 2.2% | $8,200 |

| St. Louis, MO | First half of June | 2.9% | $7,000 |

| Orlando, FL | First half of June | 2.2% | $8,700 |

| Charlotte, NC | Second half of May | 3.0% | $11,000 |

| San Antonio, TX | First half of June | 1.9% | $5,400 |

| Portland, OR | Second half of April | 2.6% | $14,300 |

| Sacramento, CA | First half of June | 3.2% | $17,900 |

| Pittsburgh, PA | Second half of June | 2.3% | $4,700 |

| Cincinnati, OH | Second half of April | 2.7% | $7,500 |

| Austin, TX | Second half of May | 2.8% | $12,600 |

| Las Vegas, NV | First half of June | 3.4% | $14,600 |

| Kansas City, MO | Second half of May | 2.5% | $7,300 |

| Columbus, OH | Second half of June | 3.3% | $10,400 |

| Indianapolis, IN | First half of July | 3.0% | $8,100 |

| Cleveland, OH | First half of July | 3.4% | $7,400 |

| San Jose, CA | First half of June | 5.5% | $88,400 |

The post Homes listed for sale in early June sell for $7,700 more appeared first on Zillow Research.

federal reserve pandemic home sales mortgage rates interest ratesUncategorized

February Employment Situation

By Paul Gomme and Peter Rupert The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000…

By Paul Gomme and Peter Rupert

The establishment data from the BLS showed a 275,000 increase in payroll employment for February, outpacing the 230,000 average over the previous 12 months. The payroll data for January and December were revised down by a total of 167,000. The private sector added 223,000 new jobs, the largest gain since May of last year.

Temporary help services employment continues a steep decline after a sharp post-pandemic rise.

Average hours of work increased from 34.2 to 34.3. The increase, along with the 223,000 private employment increase led to a hefty increase in total hours of 5.6% at an annualized rate, also the largest increase since May of last year.

The establishment report, once again, beat “expectations;” the WSJ survey of economists was 198,000. Other than the downward revisions, mentioned above, another bit of negative news was a smallish increase in wage growth, from $34.52 to $34.57.

The household survey shows that the labor force increased 150,000, a drop in employment of 184,000 and an increase in the number of unemployed persons of 334,000. The labor force participation rate held steady at 62.5, the employment to population ratio decreased from 60.2 to 60.1 and the unemployment rate increased from 3.66 to 3.86. Remember that the unemployment rate is the number of unemployed relative to the labor force (the number employed plus the number unemployed). Consequently, the unemployment rate can go up if the number of unemployed rises holding fixed the labor force, or if the labor force shrinks holding the number unemployed unchanged. An increase in the unemployment rate is not necessarily a bad thing: it may reflect a strong labor market drawing “marginally attached” individuals from outside the labor force. Indeed, there was a 96,000 decline in those workers.

Earlier in the week, the BLS announced JOLTS (Job Openings and Labor Turnover Survey) data for January. There isn’t much to report here as the job openings changed little at 8.9 million, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively.

As has been the case for the last couple of years, the number of job openings remains higher than the number of unemployed persons.

Also earlier in the week the BLS announced that productivity increased 3.2% in the 4th quarter with output rising 3.5% and hours of work rising 0.3%.

The bottom line is that the labor market continues its surprisingly (to some) strong performance, once again proving stronger than many had expected. This strength makes it difficult to justify any interest rate cuts soon, particularly given the recent inflation spike.

unemployment pandemic unemploymentUncategorized

Mortgage rates fall as labor market normalizes

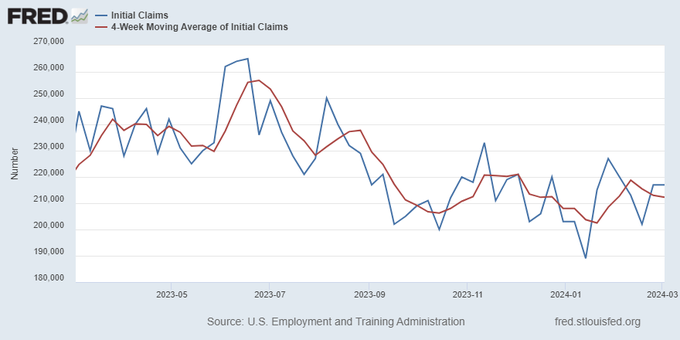

Jobless claims show an expanding economy. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

Total employment data

4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

From BLS: Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

- Less than a high school diploma: 6.1%

- High school graduate and no college: 4.2%

- Some college or associate degree: 3.1%

- Bachelor’s degree or higher: 2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

recession unemployment covid-19 fed federal reserve mortgage rates recession recovery unemployment-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex