Government

26 Governors Seek Meeting With Biden Over Border Surge

26 Governors Seek Meeting With Biden Over Border Surge

Authored by Phillip Wegmann via RealClearPolitics.com,

More than half of the country’s governors would like a moment of the president’s time – and soon: Twenty-six Republican governors..

Authored by Phillip Wegmann via RealClearPolitics.com,

More than half of the country’s governors would like a moment of the president’s time – and soon: Twenty-six Republican governors are urging Joe Biden to do more to address the deteriorating situation along the southern U.S. border.

“As chief executives of our states,” they write in a letter postmarked for Monday and first obtained by RealClearPolitics, “we request a meeting with you at The White House to bring an end to the national security crisis created by eight months of unenforced borders.”

The GOP chief executives are requesting an audience “within 15 days” given that the “the crisis that began at our southern border now extends beyond to every state and requires immediate action before the situation worsens.”

The letter is both a rebuke and an unwelcome distraction at a time when the White House is busy leaning on Congress to pass a $1 trillion physical infrastructure bill, a $3.5 trillion “human infrastructure” package, all while approving a budget that funds the government and increases the debt limit, which is required to keep federal agencies from shutting down.

Long before Biden received this unwelcome request from the governors, he acknowledged the problem. At his first press conference as president in March, he explained the uptick in illegal migrants by saying that a surge in late winter and early spring “happens every year.” Later that same month he deputized Vice President Kamala Harris with addressing “the root causes” of the influx.

Yet, the huge surge has continued and accelerated through the summer. The U.S. Border Patrol took more than 208,000 migrants into custody in the month of August, nearly as many as the previous month when more than 212,000 were interdicted along the southern border, a 21-year high.

Meanwhile, the president’s job approval rating has slipped underwater. According to the RealClearPolitics poll average, more Americans (49.7%) disapprove than approve (45.8%) of the job Biden is doing. His handling of the immigration issue is particularly unpopular.

“The negative impacts of an unenforced border policy on the American people can no longer be ignored,” wrote the governors in their letter.

“Border apprehensions are up almost 500% compared to last year, totaling more than 1.3 million — more people than the populations of nine U.S. states.”

The administration has been busy planning a deportation blitz of the Haitian migrants who have surged into Del Rio, Texas. As the Washington Post first reported, the federal government was prepared to send planeloads back to their homeland this week as part of the effort to stem the tide into a crude camp beneath an underpass where 15,000 have already clustered. Meanwhile, a federal judge on Thursday blocked the administration from using Title 42 authority, a public health order employed by former President Trump to expel migrant families during the pandemic. The administration has appealed the ruling.

Republicans continue to argue that Biden is not doing enough, that the public declarations from the White House that “the border is not open” are meaningless without more enforcement. Some, including South Dakota Gov. Kristi Noem and Florida Gov. Ron DeSantis, even sent their own state law enforcement personnel to the border earlier in the summer, a move the White House admitted it was powerless to stop.

“While governors are doing what we can, our Constitution requires that the President must faithfully execute the immigration laws passed by Congress. Not only has the federal government created a crisis, it has left our states to deal with challenges that only the federal government has a duty to solve,” the letter asserted.

“We have heard directly from our constituents about the damage this crisis has caused in our states, and it is our duty as elected officials to act swiftly to protect our communities, as it is yours,” they added.

Republicans have presented a united front on border security, and the issue will likely play a key factor in the midterm elections next year. Of the 27 GOP governors, all but one signed onto the letter. The lone state executive who didn’t do so was Vermont’s Phil Scott.

It seems unlikely Biden will sit down with the governors to discuss border security any time soon. Arkansas’ Asa Hutchinson, who signed the letter and who chairs the bipartisan National Governors Association, previously told RCP that several state executives were already frustrated that Biden and Harris have not joined their weekly COVID calls, a break from their predecessors’ habit.

Immigration and coronavirus, at least as political issues, have intersected. White House Press Secretary Jen Psaki confirmed last week that migrants crossing the southern border illegally would be exempt from federal vaccine mandates. And the need for health security, as it relates to illegal border-crossers, was one of the reasons the governors requested a meeting.

“The months-long surge in illegal crossings has instigated an international humanitarian crisis, spurred a spike in international criminal activity, and opened the floodgates to human traffickers and drug smugglers endangering public health and safety in our states,” they wrote to Biden. “A crisis that began at our southern border now extends beyond to every state and requires immediate action before the situation worsens.”

Government

Student loan borrowers may finally get answers to loan forgiveness issues

A major student loan service company has been invited to face Congress over its alleged servicing failures.

U.S. Sen. Elizabeth Warren (D-MA) wants answers from one of the top student loan service companies in the country for allegedly botching its student loan forgiveness process involving the federal Public Service Loan Forgiveness program, leaving borrowers confused and without answers.

The senator sent a letter to Mohela CEO Scott Giles on March 18 inviting him to testify before Congress at a hearing on April 10 titled “MOHELA’s Performance as a Student Loan Servicer.” During the hearing, Giles will have to answer for why his company allegedly failed to send billing statements to student loan borrowers in a timely manner and miscalculated monthly payments for borrowers when it was time for them to repay their loans in September last year.

Related: Here's who qualifies for Biden's student loan debt relief starting next month

Also, in the letter, Warren highlighted a report that claimed that Mohela failed to perform basic servicing functions for borrowers eligible for PSLF, which led to over 800,000 public service workers facing delays in receiving student debt relief. The report also accuses the company of using a “‘call deflection’ scheme” to keep customers away from speaking to a customer service representative and instead redirecting them to parts of their website.

“Your company has contributed to student loan borrowers’ difficulties by mishandling borrowers’ return to repayment following the COVID-19 pandemic-related pause on payments, interest, and collections and by impeding public servants’ access to PSLF relief,” wrote Warren in the letter.

The move from Warren comes after the U.S. Department of Education withheld $7.2 million in payments to its servicer Mohela in October as punishment because it failed to issue timely billing statements to 2.5 million borrowers which resulted in 800,000 borrowers becoming delinquent on their loans. The department ordered Mohela to put those affected by the issues into forbearance until the mess was resolved.

Mohela is also currently facing two class-action lawsuits, one filed in December last year and another in January this year, for its alleged “failure to timely process and render decisions for student loan borrowers enrolled in the Public Service Loan Forgiveness program.”

In response to recent criticism surrounding its alleged issues and failures regarding the PSLF program, Mohela claimed in a statement to the Missouri Independent that it “does not have authority to process loan forgiveness until authorization is provided by FSA, which can take months to occur.”

The company also claimed that there are “false accusations” inside of the bombshell report, which was released in February, that details the company’s servicing failures.

“It is unfortunate and irresponsible that information is being spun to create a false narrative in an attempt to mislead the public. False accusations are being disingenuously branded as an investigative report,” said Mohela.

white house congress pandemic covid-19International

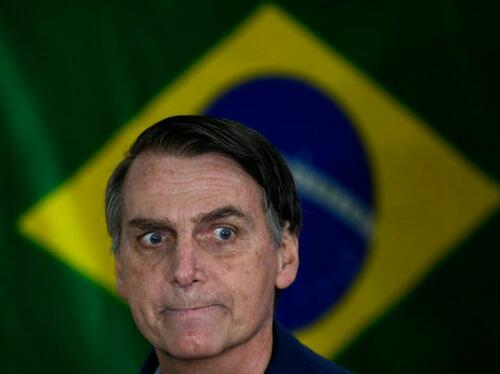

Bolsonaro Indicted By Brazilian Police For Falsifying Covid-19 Vaccine Records

Bolsonaro Indicted By Brazilian Police For Falsifying Covid-19 Vaccine Records

Federal police in Brazil have indicted former President Jair…

Federal police in Brazil have indicted former President Jair Bolsonaro for falsifying his Covid-19 vaccine card in order to travel to the United States and elsewhere during the pandemic.

Federal prosecutors will review the indictment and decide whether to pursue the case - which would be the first time the former president has faced criminal charges.

According to the indictment, Bolsonaro ordered a top deputy to obtain falsified Covid-19 vaccine records of himself and his 13-year-old daughter in late 2022, right before he flew to Florida for a three-month stay following his election loss.

Brazilian police are also waiting to hear back from the US DOJ on whether Bolsonaro used said cards to enter the United States, which would open him up to further criminal charges, the NY Times reports.

Bolsonaro has repeatedly claimed not to have received the Covid-19 vaccine, but denies any involvement in a plan to falsify his vaccination records. A previous investigation by Brazil's comptroller general concluded that Bolsonaro's vaccination records were false.

The records show that Bolsonaro, a COVID-19 skeptic who publicly opposed the vaccine, received a dose of the immunizer in a public healthcare center in Sao Paulo in July 2021. [ZH: hilarious, Reuters calling the vaccine an 'immunizer.']

The investigation concluded, however, that the former president had left the city the previous day and didn't leave Brasilia until three days later, according to a statement.

The nurse listed in the records as having applied the vaccine on Bolsonaro denied doing so and was no longer working at the center. The listed vaccine lot was also not available on that date, the comptroller general's office said. -Reuters

"It's a selective investigation. I'm calm, I don't owe anything," Bolsonaro told Reuters. "The world knows that I didn't take the vaccine."

During the pandemic, Bolsonaro panned the vaccine - and instead insisted on alternative treatments such as Ivermectin, which has antiviral properties against Covid-19. For this, he was investigated by Brazil's congress, which recommended that the former president be charged with "crimes against humanity," among other things, for his actions during the pandemic.

In May, Brazilian police raided Bolsonaro's home, confiscating his cell phone and arresting one of his closest aides and two of his security cards in connection to the vaccine record investigation.

Brazil's electoral court ruled that Bolsonaro can't run for public office until 2030 after he suggested that the country's voting system was rigged. For that, he has to sit out the 2026 election.

International

This gambling tech stock is future-proofing the world’s casinos

Supported by the universal thrill of a quick payout and the need for leisure, gambling stocks make a compelling case for long-term returns.

The post This…

Supported by the universal human thrill of a quick payout, and the need for leisure and entertainment to bring enjoyment to adult life, casinos will remain essential spaces for people to dream and play for the foreseeable future, making gambling stocks a prospective space to look for long-term returns.

According to Research and Markets, the global casino industry was valued at US$157.5 billion in 2022, and it will grow to US$224.1 billion by 2030 at a compound annual growth rate of 4.5 per cent. This trend includes:

Approximately 100 million gamblers in the United States, who generated US$66.5 billion in revenue in 2023, a 10 per cent gain from 2022, which itself was a record year A little fewer than 20 million gamblers in Canada, who generated about C$15 billion in revenue in 2023 A global addressable market of thousands of casinos, and more than 4.2 billion people who gamble at least once every year, according to a 2016 study by Casino.orgThe main challenge with attracting these billions through casino doors is they sway heavily toward middle age. The mean age of U.S. casino visitors has hovered around 50 for the past decade, with a similar trend across the world, forcing casinos to attract younger, tech-savvy customers, many with less gambling experience, to continue growing profits for their stakeholders over the long term.

Investors seeking exposure to a leadership position in building the bridge between casinos and the next generation of gamblers should evaluate Jackpot Digital (TSXV:JJ). The Vancouver-based company is a manufacturer of dealerless electronic table games that deliver immersive experiences tailored to the digital age, while earning casinos attractive returns on investment.

The gambling technology stock benefits from no direct competition in the dealerless poker space, with orders spanning North America, Europe, Asia, Africa and the Caribbean, a long-established presence with major cruise ship brands, such as Carnival, Princess Cruises and Holland America, and a growing land-based presence with orders or ongoing installations across 12 U.S. states. Its highlight partnership to date is a master services agreement with Penn Entertainment, the country’s largest regional gaming operator with 43 properties across 20 states.

Jackpot Digital’s differentiated technology and well-rounded management team are at the heart of its success in landing several blue-chip casino gaming companies as customers.

Jackpot BlitzThe gambling technology stock’s flagship product, Jackpot Blitz, is a dealerless poker table featuring three of the world’s most popular variations – Texas Hold’ em, Omaha, and Five-Card-Omaha – brought to life through slick 4k graphics on a 75-inch touchscreen, and offered in three formats – pot-limit, no-limit and fixed-limit – designed to attract a diversity of revenue from casual to experienced players.

Spokesperson and NFL championship-winning coach Jimmy Johnson explains the benefits of the Jackpot Blitz. Source: Jackpot Digital.The table also comes equipped with house-banked mini-games, including blackjack, baccarat and video poker, as well as side bets on the main poker game, such as Bet the Flop, all of which keep players engaged and entertained between, and even during, poker hands. The stunning Jackpot Blitz machine also offers multi-venue “Bad Beat” jackpot functionality, allowing casinos to offer a “Poker Powerball” with massive Jackpots, further enhancing the attractiveness of Jackpot Blitz to new players.

It’s by striking a balance between the needs of the modern gambler, and efficiency and profitability that in-person operators couldn’t hope to match – unless they ordered the machine for themselves – that Jackpot Digital has earned itself the top spot in dealerless poker.

Player benefitsWhen a veteran or novice gambler takes a seat at the Jackpot Blitz, his or her experience begins with an easy-to-use interface, laid out in a modern and stylish design, programmed to respond to hand gestures that bring real casino play into the digital age, including card bending and chip jingling.

Source: Jackpot Digital.The table’s intuitive controls, combined with instant payouts and its dealerless nature, translate into faster game play, which maximizes playing time and player excitement, while minimizing human error and the intimidation new gamblers might feel about approaching an analog poker table. The gambling technology stock’s in-house development team is also constantly working on new games to keep content fresh, with a special focus on bringing international games and regional versions of poker to casino audiences in Asia, South America and the Indian subcontinent.

As hands are laid down and pots pile up, players can also track game stats in real time, which inform future strategy and enhance the thrill of the moment with an added element of competition.

Operator benefitsFrom an operator’s perspective, a floor of automated gaming tables can meaningfully and instantly reduce casino staff expenditures and management pain points, while avoiding wage inflation, labour shortages and supply costs.

The Blitz is no slouch on revenue either, dealing more hands per hour, resulting in higher revenue and higher profitability, which is further enhanced by onboard side bets and mini-games that can be played while players are engaged in a poker hand.

The Jackpot Blitz’s economics are attractive to operators thanks to its ability to accommodate non-stop play, while monetizing downtime through side games and bets. While a human dealer must spend time shuffling, interacting with players, and consulting with colleagues, the Jackpot Blitz can accept wagers 100 per cent of the time, making sure gamblers get the action they came for and operators see a return on their investment.

Source: Jackpot Digital.

Source: Jackpot Digital.

Beyond gaming revenue, casinos are further incentivized to onboard the Jackpot Blitz because of its fully customizable advertising functions, including logos, card backs, chips and felt colors, all of which bolster casino culture and enable the pursuit of revenue from third-party advertising partners.

The Blitz ties its value proposition together by generating automatic reports – including demographics and consumer behaviour through a rewards card system – and plugging directly into most back-end management systems, saving casinos the hassle of manual tracking, while also minimizing tampering, money-laundering and theft through the use of isolated servers.

Whether it’s streamlining the player experience or putting automation at the service of operators’ bottom lines, Jackpot Digital’s flagship product is positioned to create value, and plenty of it.

Jackpot Digital’s path to profitabilityAfter existing as an exclusively cruise-ship-based operation since 2015, Jackpot Digital suffered a steep decline in revenue during the COVID pandemic, falling from C$2.18 million in 2019 to C$0.42 million in 2021.

Management quickly pivoted in the face of uncertainty, redesigning the Blitz to execute on a land-based expansion strategy – backed by Gaming Labs International certification in fall 2023 – which is bringing about a successful turnaround after the re-emergence of the casino business. Revenue more than tripled to C$1.43 million in 2022, and reached C$1.57 million through three quarters of 2023, with the company expecting to ramp up significant recurring revenue after it installs several dozen machines currently in its backlog.

The Jackpot Blitz electronic gaming table in action. Source: Jackpot Digital.

The Jackpot Blitz electronic gaming table in action. Source: Jackpot Digital.

The first installation of land-ready Jackpot Blitz machines is now completed at the Jackson Rancheria Casino in California, as the company announced today. The three-machine installation marks a new era of growth for the company, having announced 25 Blitz deals since November 2021 (slide 12), with many more across Canada and the United States in the works, in addition to a strong pipeline in Asia and Europe.

“Jackpot Digital could be a profitable company right now if it only focused on care and maintenance of the revenues it currently generates. But that’s not why we’re here,” Mathieu McDonald, Vice President of Corporate Development at Jackpot Digital, said in a recent interview with Stockhouse. “We intend to scale up to many multiples of the tables we have out right now, with the potential for up to 2,000 tables over the next three to five years.”

According to McDonald, the company is fielding three to five inquiries per week about the Blitz from casinos around the world that recognize the machines’ first-mover advantage in dealerless poker and potential expansion into other games in need of automation.

Jackpot Digital’s ambitious plan of action is supported by a management team of proven gambling, finance, advertising and legal professionals, many of which have been serving Jackpot stakeholders for more than two decades.

A long-tenured management teamThe management team behind Jackpot Digital is led by Jake Kalpakian, who has served as president and chief executive officer since 1999, including under the gambling technology stock’s former incarnation as Las Vegas From Home.com Entertainment Inc. Kalpakian brings more than 30 years of experience managing small-cap publicly listed companies, granting him a steady hand when it comes to maneuvering through the volatility of the economic cycle.

Kalpakian’s efforts are supported by three directors whose well-rounded expertise positions Jackpot Digital for long-term sustainable growth:

Gregory T. McFarlane, a director at Jackpot Digital since 1999, previously ran an independent advertising firm and holds a degree in mathematics from the University of Toronto. McFarlane is also a co-founder of the popular Control Your Cash personal finance website. Chief financial officer Neil Spellman, a director at the company since 2002, boasts an almost two-decade track record as vice president at Wall Street firm Smith Barney, where he developed a multi-industry understanding of the journey to profitability. Finally, Alan Artunian, a director since 2017, currently serves as CEO of Nice Guy Holdings, a corporate and legal consulting company advising clients across a diversity of sectors.Guided by a strategic management team, and benefiting from a macro-trend toward casino automation, Jackpot Digital is on course to ride a wave of millions of gamblers looking for an elegant, tech-informed alternative to traditional in-person play.

A multi-bagger opportunityThe Jackpot Digital opportunity sets up savvy investors who recognize the soundness of the company’s value proposition. The tremendous risk/reward value of Jackpot Digital gives investors the opportunity to ride the macro-trend toward casino automation, as deals for the Blitz keep pouring in, the company adds games to its portfolio, and the global casino industry adds hundreds of billions in revenue through this decade.

Join the discussion: Find out what everybody’s saying about this gambling technology stock on the Jackpot Digital Bullboard.

This is sponsored content issued on behalf of Jackpot Digital, please see full disclaimer here.

The post This gambling tech stock is future-proofing the world’s casinos appeared first on The Market Online Canada.

stocks pandemic small-cap africa south america canada europe-

Spread & Containment6 days ago

Spread & Containment6 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International2 weeks ago

International2 weeks agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized1 month ago

Uncategorized1 month agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized1 month ago

Uncategorized1 month agoIndustrial Production Decreased 0.1% in January

-

International2 weeks ago

International2 weeks agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized1 month ago

Uncategorized1 month agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex