Uncategorized

How blockchain tech and dMRV can help carbon trading markets

Combining blockchain with digital monitoring, reporting and verification protocols may not only improve VCMs but even rescue them.

…

Combining blockchain with digital monitoring, reporting and verification protocols may not only improve VCMs but even rescue them.

There is a global consensus that greenhouse gas (GHG) emissions are warming the planet, but efforts to accurately measure, report and verify these emissions continue to challenge researchers, nonprofits, corporations and governments.

This is especially the case with “nature-based” projects to reduce carbon dioxide levels, like planting trees or restoring mangrove forests.

This has inhibited the development of a voluntary carbon market (VCM) on which carbon offset credits are traded. These “offsets” are sometimes viewed as licenses to pollute, but VCMs overall are thought to be beneficial to the planet because they help quantify the environmental impact of industrial and consumer activities and, at least indirectly, motivate companies to curb emissions.

However, VCMs have recently come under intense criticism. A nine-month investigation by the United Kingdom’s Guardian newspaper and several other organizations found that more than 90% of “rainforest offset credits” approved by the leading certification firm Verra “are likely to be ‘phantom credits’ and do not represent genuine carbon reductions.”

This finding shook the carbon trading sector, but it has also spurred some new thinking about ways to measure, report or verify the efficacy of carbon-reduction projects. Digital monitoring, reporting and verification (dMRV), for example, largely automates this process, making use of new technologies like remote sensing, satellite imagery and machine learning. DMRV also uses blockchain technology for traceability, security, transparency and other purposes.

All this is still new, but many believe dMRV can reinvigorate carbon markets following the Verra scandal. It can also compensate for a shortfall of human auditors and inspectors available globally to assess GHG projects, especially the more problematic “nature-based” projects. In addition, it can gather a broader range of data and potentially make it available in real time. Importantly, it will allow a global comparison of projects for the first time.

“A huge difference”

“DMRV will make a huge difference here, since it moves the quantitative comparison of various nature-based interventions onto a global field where they can be comparable with each other — something that is not possible in the current systems as projects self-report against their own baselines,” Anil Madhavapeddy, a professor at the University of Cambridge and director of the Cambridge Centre for Carbon Credits, told Cointelegraph.

Some go even further. “Digital Measurement, Reporting, and Verification (dMRV) technology has the potential to revolutionize the way the voluntary carbon market (VCM) operates,” declared dClimate, a decentralized infrastructure network for climate data, in a March blog post.

Still, questions remain: Maybe this is all too little, too late for averting climate change? And if not too late, won’t progress stall if better methodologies aren’t developed, like quantifying how much a Brazilian rainforest reduces global carbon? Are blockchains necessary for the process, and if so, why? And can dMRV really “revolutionize” voluntary carbon markets, or is this just excessive hyperbole?

“It is not too late,” Miles Austin, CEO of climate tech firm Hyphen Global AG, told Cointelegraph. “We find ourselves at a pivotal moment.” The Verra scandal and continued allegations of “greenwashing” on the part of corporations have made more companies leery of supporting carbon-reduction projects.

“The perceptions of trust and feasibility associated with nature-based assets, both within the public and private sectors, have been adversely affected,” Austin noted. But he added that at this critical juncture:

“DMRV can have a significant impact to not only improve these markets but save them.”

It might be helpful to compare dMRV with traditional MRV, which aims to help prove that an activity — like planting trees or scrubbing smokestack emissions — has actually occurred. It is a prerequisite before a monetary value can be attached to the activity, and a necessity for carbon trading markets to work.

MRV has been “underpinning” sustainability reporting for years, Anna Lerner Nesbitt, CEO of the Climate Collective, told Cointelegraph. However, “it has a lot of weaknesses,” including a high reliance on subjective data, steep costs, lengthy timelines and a dependence on “international experts” — i.e., consultants.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon

According to Cambridge Centre’s Madhavapeddy, the inherent difficulty with quantifying nature-based projects “is that the conventional mechanisms for doing so — over the past decades — have been very manual and hard to compare across projects.”

Quantification mechanisms used for these assessments are far from being standardized. They include assessing “additionality” (i.e., what’s the net difference climatewise of a project?), permanence (how long will its effects last?), and leakage (did a negative externality, like cutting down a forest, just move somewhere else?).

DMRV, said Nesbitt, relies on emerging technologies and more granular data for “a fully digitized MRV protocol that not only collects digital data via Internet of Things, sensors and digital technologies but also processes and stores data on a fully digital and decentralized blockchain ledger.”

DMRV can also potentially reduce the workload of auditors and inspectors called upon to validate emissions-reduction projects, according to Daniel Voyce, chief technology officer of sustainability-focused solutions provider Tymlez, who wrote:

“With manual MRV recording each auditor or inspector might only be able to verify 150 projects each year due to chasing down the data they need and having to collate it all.”

Digitizing the process could reduce time and costs by 75%, he estimated.

Can blockchain help fix a “convoluted” process?

What role, if any, does blockchain play in all this? “I think if we are being honest, voluntary carbon markets — and regulated carbon markets — need blockchain for asset issuance and traceability,” Michael Kelly, co-founder and chief product officer at Open Forest Protocol — an open platform for scaling nature-based solutions — told Cointelegraph.

The current MRV process is “convoluted,” he said, with “no visibility into issuance schedules, no traceability, quite frequent double-spending, etc.” As a result, “people are hesitant to touch carbon credits.”

DMRV combined with blockchain could change things. “Once they can see everything about it [a project] — down to the upload of each tree in a sample plot for a 20-year time period — we will see new participants coming into the arena.”

Some incremental improvements in MRV — like digitizing submission forms — don’t really need blockchain tech, noted Nesbitt, but that might soon change with the addition of “features like smart contracts that allow for more inclusive or just asset pricing, baking in a reasonable compensation for local communities involved in carbon credit projects.”

However, there may be limits on how much blockchain tech alone can fix things. Blockchains can enable “transparency, security, automation and immutable records of data flows in an auditable fashion,” but that might not be enough, suggested Hyphen’s Austin, adding:

“DMRV can only be as good as the data and methodology used. If you take a flawed methodology and digitize it with blockchain, you now have an immutable and transparently flawed dMRV.”

Improving methodologies is crucial in Austin’s view. “Activity-based approaches work well in the case of combustion engines or industrial processes, which you can accurately measure and multiply by a factor,” he told Cointelegraph.

But these don’t really work on “nature-based solutions.” A forest in Brazil may sequester more carbon dioxide than an equally sized forest in Indonesia based on many variables, including drought, rainfall and humidity, for example.

“Nature is a breathing and living asset; therefore, methodologies need to measure the actual amount of CO2/CO2e [carbon dioxide/carbon dioxide equivalent] that is a sink or source instead of calculating a best guess,” said Austin.

Work is being done in this area, especially in the wake of the Verra controversy. “Researchers in this field are showing how the quality of ‘avoided deforestation’ carbon credits could be improved,” Julia Jones, professor in conservation science at Bangor University, told Cointelegraph. “However, there is, of course, some lag between new research and it getting into policy and practice.”

The Cambridge Center for Carbon Credits actually built a research prototype last year of what a carbon credits marketplace might look like on the Tezos blockchain. “Our first observation was that the blockchain really wasn’t the bottleneck here — all of that infrastructure works fine and has a solid technical roadmap for scaling,” Madhavapeddy told Cointelegraph. The barrier lay elsewhere.

“The blocker to any meaningful deployment came from the lack of supply of credible projects, since the quantification mechanisms” — i.e., additionality, permanence and leakage — “are only just maturing as satellite infrastructure and the associated algorithms are peer-reviewed and deployed.”

Kelly also cited a shortage of “quality carbon development projects and accessible credits,” especially in the nature-based asset subsector, as a significant obstacle for VCMs.

Projects like reforestation, afforestation, mangrove restoration and biodiversity conservation are now short of funding. This project shortfall leads to a low supply of credits, which becomes a sort of chicken-and-egg problem.

“The result of this system is that carbon credits remain a relatively illiquid, convoluted and difficult-to-scale system that disincentivizes stakeholders from financing, purchasing and trading the assets to participate in the market,” said Kelly.

“The biggest barrier right now is the collective credibility of the voluntary markets, and we hope that our work on the digitization and systematic design and publishing of analyses can help bridge that gap,” said Madhavapeddy.

A “perfect storm”?

What about claims, like those cited above, that dMRV technology has the potential to revolutionize the way the voluntary carbon market operates? Is that going too far?

Recent: Islamic finance and Web3 take stage at Istanbul Blockchain Week

“DMRV is at the center of strengthening data integrity, which in turn would improve process integrity,” said Nesbitt. “So yes, I think dMRV is vital to set up the voluntary carbon market for success. But saying it will revolutionize the market might be taking it a bit too far given the many dMRV improvements and applications already in implementation.”

Kelly sees two promising trends in the wake of the Guardian expose. Legacy incumbents like Verra and Gold Standard are now more intent on digitizing their processes and “becoming more transparent and trustworthy,” he said, while “stakeholders are more willing to try new solutions, or service providers, especially if they have higher standards for trust, visibility and quality.”

The result could be a “perfect storm for catalyzing a liquid voluntary carbon market — on-chain,” he added.

bitcoin blockchain btc goldUncategorized

One city held a mass passport-getting event

A New Orleans congressman organized a way for people to apply for their passports en masse.

While the number of Americans who do not have a passport has dropped steadily from more than 80% in 1990 to just over 50% now, a lack of knowledge around passport requirements still keeps a significant portion of the population away from international travel.

Over the four years that passed since the start of covid-19, passport offices have also been dealing with significant backlog due to the high numbers of people who were looking to get a passport post-pandemic.

Related: Here is why it is (still) taking forever to get a passport

To deal with these concurrent issues, the U.S. State Department recently held a mass passport-getting event in the city of New Orleans. Called the "Passport Acceptance Event," the gathering was held at a local auditorium and invited residents of Louisiana’s 2nd Congressional District to complete a passport application on-site with the help of staff and government workers.

'Come apply for your passport, no appointment is required'

"Hey #LA02," Rep. Troy A. Carter Sr. (D-LA), whose office co-hosted the event alongside the city of New Orleans, wrote to his followers on Instagram (META) . "My office is providing passport services at our #PassportAcceptance event. Come apply for your passport, no appointment is required."

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The event was held on March 14 from 10 a.m. to 1 p.m. While it was designed for those who are already eligible for U.S. citizenship rather than as a way to help non-citizens with immigration questions, it helped those completing the application for the first time fill out forms and make sure they have the photographs and identity documents they need. The passport offices in New Orleans where one would normally have to bring already-completed forms have also been dealing with lines and would require one to book spots weeks in advance.

These are the countries with the highest-ranking passports in 2024

According to Carter Sr.'s communications team, those who submitted their passport application at the event also received expedited processing of two to three weeks (according to the State Department's website, times for regular processing are currently six to eight weeks).

While Carter Sr.'s office has not released the numbers of people who applied for a passport on March 14, photos from the event show that many took advantage of the opportunity to apply for a passport in a group setting and get expedited processing.

Every couple of months, a new ranking agency puts together a list of the most and least powerful passports in the world based on factors such as visa-free travel and opportunities for cross-border business.

In January, global citizenship and financial advisory firm Arton Capital identified United Arab Emirates as having the most powerful passport in 2024. While the United States topped the list of one such ranking in 2014, worsening relations with a number of countries as well as stricter immigration rules even as other countries have taken strides to create opportunities for investors and digital nomads caused the American passport to slip in recent years.

A UAE passport grants holders visa-free or visa-on-arrival access to 180 of the world’s 198 countries (this calculation includes disputed territories such as Kosovo and Western Sahara) while Americans currently have the same access to 151 countries.

stocks pandemic covid-19 grantsUncategorized

Fast-food chain closes restaurants after Chapter 11 bankruptcy

Several major fast-food chains recently have struggled to keep restaurants open.

Competition in the fast-food space has been brutal as operators deal with inflation, consumers who are worried about the economy and their jobs and, in recent months, the falling cost of eating at home.

Add in that many fast-food chains took on more debt during the covid pandemic and that labor costs are rising, and you have a perfect storm of problems.

It's a situation where Restaurant Brands International (QSR) has suffered as much as any company.

Related: Wendy's menu drops a fan favorite item, adds something new

Three major Burger King franchise operators filed for bankruptcy in 2023, and the chain saw hundreds of stores close. It also saw multiple Popeyes franchisees move into bankruptcy, with dozens of locations closing.

RBI also stepped in and purchased one of its key franchisees.

"Carrols is the largest Burger King franchisee in the United States today, operating 1,022 Burger King restaurants in 23 states that generated approximately $1.8 billion of system sales during the 12 months ended Sept. 30, 2023," RBI said in a news release. Carrols also owns and operates 60 Popeyes restaurants in six states."

The multichain company made the move after two of its large franchisees, Premier Kings and Meridian, saw multiple locations not purchased when they reached auction after Chapter 11 bankruptcy filings. In that case, RBI bought select locations but allowed others to close.

Image source: Chen Jianli/Xinhua via Getty

Another fast-food chain faces bankruptcy problems

Bojangles may not be as big a name as Burger King or Popeye's, but it's a popular chain with more than 800 restaurants in eight states.

"Bojangles is a Carolina-born restaurant chain specializing in craveable Southern chicken, biscuits and tea made fresh daily from real recipes, and with a friendly smile," the chain says on its website. "Founded in 1977 as a single location in Charlotte, our beloved brand continues to grow nationwide."

Like RBI, Bojangles uses a franchise model, which makes it dependent on the financial health of its operators. The company ultimately saw all its Maryland locations close due to the financial situation of one of its franchisees.

Unlike. RBI, Bojangles is not public — it was taken private by Durational Capital Management LP and Jordan Co. in 2018 — which means the company does not disclose its financial information to the public.

That makes it hard to know whether overall softness for the brand contributed to the chain seeing its five Maryland locations after a Chapter 11 bankruptcy filing.

Bojangles has a messy bankruptcy situation

Even though the locations still appear on the Bojangles website, they have been shuttered since late 2023. The locations were operated by Salim Kakakhail and Yavir Akbar Durranni. The partners operated under a variety of LLCs, including ABS Network, according to local news channel WUSA9.

The station reported that the owners face a state investigation over complaints of wage theft and fraudulent W2s. In November Durranni and ABS Network filed for bankruptcy in New Jersey, WUSA9 reported.

"Not only do former employees say these men owe them money, WUSA9 learned the former owners owe the state, too, and have over $69,000 in back property taxes."

Former employees also say that the restaurant would regularly purchase fried chicken from Popeyes and Safeway when it ran out in their stores, the station reported.

Bojangles sent the station a comment on the situation.

"The franchisee is no longer in the Bojangles system," the company said. "However, it is important to note in your coverage that franchisees are independent business owners who are licensed to operate a brand but have autonomy over many aspects of their business, including hiring employees and payroll responsibilities."

Kakakhail and Durranni did not respond to multiple requests for comment from WUSA9.

bankruptcy pandemicUncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

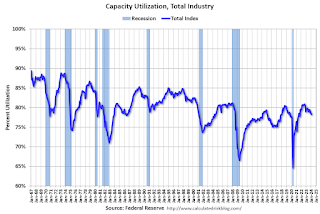

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.Click on graph for larger image.

emphasis added

This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International1 week ago

International1 week agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment3 days ago

Spread & Containment3 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex