YTD 2022 saw dramatic slowdown in global IPO activity from a record year in 2021

YTD 2022 saw dramatic slowdown in global IPO activity from a record year in 2021

PR Newswire

LONDON, June 29, 2022

Global IPO volumes fell 46%, with proceeds down by 58% 1H year-over-year With global activity almost halved in YTD 2022, the Americas…

YTD 2022 saw dramatic slowdown in global IPO activity from a record year in 2021

PR Newswire

LONDON, June 29, 2022

- Global IPO volumes fell 46%, with proceeds down by 58% 1H year-over-year

- With global activity almost halved in YTD 2022, the Americas market recorded the biggest decline

- Middle East and India were some of the rare bright spots amidst a bearish market

LONDON, June 29, 2022 /PRNewswire/ -- IPO momentum continued to slow from Q1 into Q2, resulting in a considerable decline in both deal numbers and proceeds. Heightened volatility caused by geopolitical tensions and macroeconomic factors, declining valuation and poor post-IPO share price performance led to the postponement of many IPOs during the quarter. The dramatic slowdown in IPO activity in YTD 2022 after a record year in 2021 was experienced across most major markets.

For Q2 2022, the global IPO market saw 305 deals raising US$40.6b in proceeds, a decrease of 54% and 65%, respectively, year-over-year (YOY). YTD 2022, there were a total of 630 IPOs raising US$95.4b in proceeds, reflecting decreases of 46% and 58%, respectively, YOY.

The 10 largest IPOs by proceeds raised US$40b, with energy dominating three of the top four deals, replacing the technology sector as the top IPO fund raiser. The technology sector continued to lead by number, but the average IPO deal size came down from US$293m to US$137m, whereas energy has overtaken to lead by proceeds with average deal size increasing from US$191m to US$680m YOY.

Special purpose acquisition company (SPAC) IPOs are significantly down in line with traditional IPO activity despite new markets joining. The SPAC market has been challenged this year as a result of broader market conditions, regulatory uncertainty and increased redemptions. A record number of existing SPACs are actively seeking targets with the majority of them facing potential expiration in the next year. However, market performance and regulatory clarity will likely drive future deal flow.

In line with the sharp decline in global IPO activity, there was a sizable fall in cross-border activity affected by geopolitical pressures and government policies on overseas listings. These and other findings were published in the EY Global IPO Trends Q2 2022.

Overall regional performance: investors are refocusing on fundamentals

The Americas region completed 41 deals in Q2 2022, raising US$2.5b in proceeds, a decline of 73% in the number of deals and a 95% fall in proceeds YOY. The Asia-Pacific region recorded 181 IPOs, raising US$23.3b in proceeds in Q2, a decline YOY of 37% for volume and 42% in proceeds. EMEIA market IPO activity in Q2 2022 reported 83 deals and raised US$14.8b in proceeds, a YOY decline of 62% and 44%, respectively.

Given the tightened market liquidity and significant decline in stock prices of many new economy companies that went public during the last two years, investors are becoming more selective and are refocusing on the companies' fundamentals instead of just "growth" stories and projections, e.g., sustainable profits and free cash flows.

Paul Go, EY Global IPO Leader, says:

"Any initial momentum carried from a record IPO year of 2021 was quickly lost in the face of increasing market volatility from rising geopolitical tensions, unfavorable macroeconomic factors, weakening stock market/valuation and disappointing post-IPO performance, which further deterred IPO investor sentiment. With tightening market liquidity, investors have become more selective and are refocusing on companies that demonstrate resilient business models and profitable growth, while embedding ESG [environmental, social and governance] as part of their core business values."

Americas saw notable slowdown in IPO activity

Overall, IPO activity in the Americas region saw the sharpest decline (among all regions) in Q2 2022 compared with Q2 2021, with deals down 73% (41 IPOs) and proceeds falling by 95% (US$2.5b). However, compared with Q1 2022, both number of deals and proceeds are up (14% and 6%, respectively).

In the US, an overwhelming majority of 2021 IPOs are trading below offer price, and average performance is trailing broader market declines, influencing investor appetite to participate in new transactions. Despite the much-reduced level of global cross-border IPO activity YTD 2022, the US remains the top cross-border destination.

In Canada, following a record-breaking 2021, one listing on the Toronto Stock Exchange in May 2022 broke the drought in IPO activity. Market turmoil and uncertainties had shut down the TSX's main market listings in 2022, but there are companies in the pipeline that will be able to take advantage of the opportunity once the markets reopen.

Brazil's IPO market slowed to a crawl at the start of 2022 as dozens of companies scrapped or postponed deals. This is the first time that Brazil experienced a dearth of IPOs in the first half of the year since 2016. Market volatility is expected to continue as high inflation persists and interest rates climb to double digits.

Rachel Gerring, EY Americas IPO Leader, says:

"IPO activity across the Americas remains muted amid macroeconomic headwinds that continue to impact performance and valuation. These headwinds have led to a 'wait-and-see' approach. When markets begin to recover and confidence steadies, the types of companies that will kickstart the IPO market will likely be profitable, cash flow-oriented and with meaningful scale. Once the IPO market reopens, companies that move quickly will be able to take advantage of the most opportune moment."

Asia-Pacific IPO market was weakened in 2022

The Asia-Pacific area finished the quarter with a 42% decline in proceeds and 37% decline in deals YOY. However, Asia-Pacific markets performed relatively better benefiting from the two largest global IPOs YTD. The region saw 181 IPOs raising US$23.3b in proceeds during Q2, and 367 IPOs raising US$66.0b in proceeds YTD 2022. In terms of sector activity YTD, materials led the way with 78 IPOs, closely followed by industrials with 77 IPOs. YTD, the Shenzhen Stock Exchange had the highest number of deals with 82, constituting 13% of global IPOs. Meanwhile, the Shanghai Stock Exchange had the highest proceeds with US$32.8b, making up 34% of global IPOs YTD.

YTD 2022, Greater China saw a YOY decline of 36% in deals (191) and a 16% fall in proceeds (US$51.2b). A convergence of factors (COVID-19 restrictions, geopolitical unrest, weakened stock market, economic uncertainty and rising interest rates) had a negative impact on IPO activity in Hong Kong. With COVID-19 restrictions in Shanghai and Beijing lifting, along with the State Council's 33 stabilization policies and measures, China's economy is expected to rebound significantly in Q3 2022 and boost investor sentiment.

Japan saw 37 IPOs raise US$0.5b in total proceeds YTD, down 84% in proceeds and 31% in deals, YOY. Deteriorating investor sentiment is primarily driven by geopolitical conflicts, rising energy prices and depreciation of the Japanese yen. Tokyo Stock Exchange has been restructured into three new market segments – Prime, Standard, and Growth – to boost investor sentiment and gain global market share.

YOY, Australia and New Zealand IPO activity witnessed a modest YTD decline in number of IPOs (3%). However, the decline in proceeds was substantial (76%). It can be attributed to several big IPOs being deferred to 2022 Q3/Q4. While fundraising activities have slowed down mostly due to poor investor sentiment, there have been some M&A activities, including demerger and IPO transactions for carved-out businesses.

Ringo Choi, EY Asia-Pacific IPO Leader, says:

"A multitude of factors, from COVID-19 restrictions and war in Europe to rising inflation rates and US/China tensions, have weakened Asia-Pacific's IPO market in the first half of 2022. But a series of positive economic developments and new government policies in China should result in renewed optimism and a revival in IPO activity across the Asia-Pacific region for the remainder of the year."

EMEIA's IPO market continues to be affected by market volatility

In Q2, EMEIA remains the second largest IPO market after Asia-Pacific and saw 83 IPOs (a decline of 62% YOY) and proceeds raised were US$14.8b (a 44% decline YOY). YTD, there were 186 IPOs with US$24.4b in proceeds.

In the second quarter of 2022, deal numbers in Europe were 43 with proceeds of US$1.5b raised. Europe accounted for 15% of global IPO deals and 4% of proceeds in YTD 2022. Two European exchanges were among the top 12 exchanges by proceeds and one of them by number of deals.

During YTD 2022, India was the only region to witness a YOY rise in IPO activity, both by number of deals (18%) and proceeds (19%), with 32 IPOs in Q2 2022 comprising one of the largest ever IPOs in India that raised US$2.7b.

MENA IPO activity continues to look promising after a strong start to the year, despite uncertainties that are affecting the global IPO outlook. While there was a decline in terms of number of deals (54%), and with seven IPOs in Q2, several mega IPOs (IPOs with proceeds equal to or greater than US$1b) in the region led to a YOY increase of 382% in proceeds during YTD 2022, with 31 IPOs raising US$14.5b in proceeds. The region witnessed four of the top 10 global IPOs YTD.

In the UK, the slower pace of IPO activity was due to a dip in investor confidence from Q4 2021 that carried into 2022. YTD 2022 saw 13 IPOs (with 4 IPOs in Q2) with total proceeds of US$149m, a YOY decline of 71% by volume and 99% fall by proceeds. However, the UK markets regulator has set out plans to simplify listing on the London Stock Exchange to attract more fast-growing tech groups and start-ups in the face of increased competition from the US and the EU.

Dr. Martin Steinbach, EY EMEIA IPO Leader, says:

"Tough times and unusual uncertainties kept market volatility at elevated levels and led to subdued IPO activity. We are seeing investors being more selective and a shift to IPO stories related to energy transition and ESG."

Q3 2022 outlook: uncertainties and volatility are likely to remain

There were many mega IPOs postponed in the first half of 2022, which represent a healthy pipeline of deals that are likely to come to the market when the current uncertainties and volatility subside. However, strong headwinds from the current uncertainties and market volatility are likely to remain. These include geopolitical strains, macroeconomic factors, weak capital market performance and the impact from the lingering pandemic on global travel and related sectors.

The technology sector is likely to continue as the leading sector in terms of the number of deals coming to the market. However, with greater focus on renewable sources of energy in the face of increasing oil prices, the energy sector is expected to continue to lead by proceeds from bigger deals.

ESG will continue to be a sector-agnostic key theme for investors and IPO candidates. As global climate change and energy supply constraints intensify, companies that have embedded ESG into their core business values and operations should attract more investors and higher valuation.

Notes to editors

About EY

EY exists to build a better working world, helping to create long-term value for clients, people and society and build trust in the capital markets.

Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate.

Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the rights individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not practice law where prohibited by local laws. For more information about our organization, please visit ey.com.

This news release has been issued by EYGM Limited, a member of the global EY organization that also does not provide any services to clients.

About EY Private

As Advisors to the ambitious™, EY Private professionals possess the experience and passion to support private businesses and their owners in unlocking the full potential of their ambitions. EY Private teams offer distinct insights born from the long EY history of working with business owners and entrepreneurs. These teams support the full spectrum of private enterprises including private capital managers and investors and the portfolio businesses they fund, business owners, family businesses, family offices and entrepreneurs. Visit ey.com/private

About EY Initial Public Offering Services

Going public is a transformative milestone in an organization's journey. As the industry-leading advisor in initial public offering (IPO) services, EY teams advise ambitious organizations around the world and helps equip them for IPO success. EY teams serve as trusted business advisors guiding companies from start to completion, strategically positioning businesses to achieve their goals over short windows of opportunity and preparing companies for their next chapter in the public eye. ey.com/ipo

About the data

The data presented here is available on ey.com/ipo/trends. Q2 2022 (i.e., January-June) is based on completed IPOs from 1 January 2022 to 21 June and expected IPOs by the end of June 2022. Data as of close of business 21 June UK time. All data contained in this document is sourced from Dealogic, CB Insights, Crunchbase, SPAC Insider and EY analysis unless otherwise noted. SPAC IPOs are excluded in all data included in this report, except where indicated.

Second quarter IPO activity

Month/Quarter | Number of IPOs | Proceeds (US$b) |

April 2020 | 54 | $4.8 |

May 2020 | 44 | $8.5 |

June 2020 | 101 | $28.7 |

Q2 2020 | 199 | $42.0 |

April 2021 | 204 | $34.1 |

May 2021 | 175 | $31.2 |

June 2021 | 280 | $50.4 |

Q2 2021 | 659 | $115.7 |

April 2022 | 109 | $21.6 |

May 2022 | 83 | $8.1 |

June 2022 | 113 | $10.9 |

Q2 2022 | 305 | $40.6 |

Source: EY, Dealogic

Appendix: Global IPOs by sector – 2022 YTD refers to priced IPOs from 1 January to 21 June 2022 and expected IPOs by the end of June.

Sectors - YTD | Number of | Percentage of | Proceeds | Percentage of global |

Consumer products | 37 | 5.9 % | $ 1,221 | 1.3 % |

Consumer staples | 36 | 5.7 % | $ 2,925 | 3.1 % |

Energy | 41 | 6.5 % | $ 27,876 | 29.2 % |

Financials | 20 | 3.2 % | $ 4,766 | 5.0 % |

Health and life sciences | 80 | 12.7 % | $ 7,949 | 8.3 % |

Industrials | 109 | 17.3 % | $ 12,051 | 12.6 % |

Materials | 116 | 18.4 % | $ 8,487 | 8.9 % |

Media and entertainment | 12 | 1.9 % | $ 444 | 0.5 % |

Real estate | 29 | 4.6 % | $ 1,649 | 1.7 % |

Retail | 19 | 3.0 % | $ 2,670 | 2.8 % |

Technology | 120 | 19.0 % | $ 16,387 | 17.2 % |

Telecommunications | 11 | 1.8 % | $ 8,975 | 9.4 % |

Global total | 630 | 100 % | $ 95,400 | 100 % |

Source: EY, Dealogic

Figures may not total 100% due to rounding.

Lauren Mosery

EY Global Media Relations

+1 732 977 2063

lauren.mosery@ey.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/ytd-2022-saw-dramatic-slowdown-in-global-ipo-activity-from-a-record-year-in-2021-301578376.html

SOURCE EY

Uncategorized

Industrial Production Increased 0.1% in February

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 p…

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.

emphasis added

Click on graph for larger image.

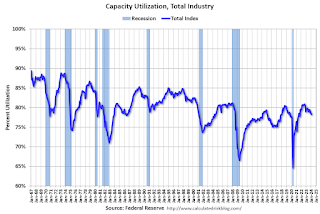

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

International

Fuel poverty in England is probably 2.5 times higher than government statistics show

The top 40% most energy efficient homes aren’t counted as being in fuel poverty, no matter what their bills or income are.

The cap set on how much UK energy suppliers can charge for domestic gas and electricity is set to fall by 15% from April 1 2024. Despite this, prices remain shockingly high. The average household energy bill in 2023 was £2,592 a year, dwarfing the pre-pandemic average of £1,308 in 2019.

The term “fuel poverty” refers to a household’s ability to afford the energy required to maintain adequate warmth and the use of other essential appliances. Quite how it is measured varies from country to country. In England, the government uses what is known as the low income low energy efficiency (Lilee) indicator.

Since energy costs started rising sharply in 2021, UK households’ spending powers have plummeted. It would be reasonable to assume that these increasingly hostile economic conditions have caused fuel poverty rates to rise.

However, according to the Lilee fuel poverty metric, in England there have only been modest changes in fuel poverty incidence year on year. In fact, government statistics show a slight decrease in the nationwide rate, from 13.2% in 2020 to 13.0% in 2023.

Our recent study suggests that these figures are incorrect. We estimate the rate of fuel poverty in England to be around 2.5 times higher than what the government’s statistics show, because the criteria underpinning the Lilee estimation process leaves out a large number of financially vulnerable households which, in reality, are unable to afford and maintain adequate warmth.

Energy security

In 2022, we undertook an in-depth analysis of Lilee fuel poverty in Greater London. First, we combined fuel poverty, housing and employment data to provide an estimate of vulnerable homes which are omitted from Lilee statistics.

We also surveyed 2,886 residents of Greater London about their experiences of fuel poverty during the winter of 2022. We wanted to gauge energy security, which refers to a type of self-reported fuel poverty. Both parts of the study aimed to demonstrate the potential flaws of the Lilee definition.

Introduced in 2019, the Lilee metric considers a household to be “fuel poor” if it meets two criteria. First, after accounting for energy expenses, its income must fall below the poverty line (which is 60% of median income).

Second, the property must have an energy performance certificate (EPC) rating of D–G (the lowest four ratings). The government’s apparent logic for the Lilee metric is to quicken the net-zero transition of the housing sector.

In Sustainable Warmth, the policy paper that defined the Lilee approach, the government says that EPC A–C-rated homes “will not significantly benefit from energy-efficiency measures”. Hence, the focus on fuel poverty in D–G-rated properties.

Generally speaking, EPC A–C-rated homes (those with the highest three ratings) are considered energy efficient, while D–G-rated homes are deemed inefficient. The problem with how Lilee fuel poverty is measured is that the process assumes that EPC A–C-rated homes are too “energy efficient” to be considered fuel poor: the main focus of the fuel poverty assessment is a characteristic of the property, not the occupant’s financial situation.

In other words, by this metric, anyone living in an energy-efficient home cannot be considered to be in fuel poverty, no matter their financial situation. There is an obvious flaw here.

Around 40% of homes in England have an EPC rating of A–C. According to the Lilee definition, none of these homes can or ever will be classed as fuel poor. Even though energy prices are going through the roof, a single-parent household with dependent children whose only income is universal credit (or some other form of benefits) will still not be considered to be living in fuel poverty if their home is rated A-C.

The lack of protection afforded to these households against an extremely volatile energy market is highly concerning.

In our study, we estimate that 4.4% of London’s homes are rated A-C and also financially vulnerable. That is around 171,091 households, which are currently omitted by the Lilee metric but remain highly likely to be unable to afford adequate energy.

In most other European nations, what is known as the 10% indicator is used to gauge fuel poverty. This metric, which was also used in England from the 1990s until the mid 2010s, considers a home to be fuel poor if more than 10% of income is spent on energy. Here, the main focus of the fuel poverty assessment is the occupant’s financial situation, not the property.

Were such alternative fuel poverty metrics to be employed, a significant portion of those 171,091 households in London would almost certainly qualify as fuel poor.

This is confirmed by the findings of our survey. Our data shows that 28.2% of the 2,886 people who responded were “energy insecure”. This includes being unable to afford energy, making involuntary spending trade-offs between food and energy, and falling behind on energy payments.

Worryingly, we found that the rate of energy insecurity in the survey sample is around 2.5 times higher than the official rate of fuel poverty in London (11.5%), as assessed according to the Lilee metric.

It is likely that this figure can be extrapolated for the rest of England. If anything, energy insecurity may be even higher in other regions, given that Londoners tend to have higher-than-average household income.

The UK government is wrongly omitting hundreds of thousands of English households from fuel poverty statistics. Without a more accurate measure, vulnerable households will continue to be overlooked and not get the assistance they desperately need to stay warm.

Torran Semple receives funding from Engineering and Physical Sciences Research Council (EPSRC) grant EP/S023305/1.

John Harvey does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

european uk pandemicUncategorized

Southwest and United Airlines have bad news for passengers

Both airlines are facing the same problem, one that could lead to higher airfares and fewer flight options.

Airlines operate in a market that's dictated by supply and demand: If more people want to fly a specific route than there are available seats, then tickets on those flights cost more.

That makes scheduling and predicting demand a huge part of maximizing revenue for airlines. There are, however, numerous factors that go into how airlines decide which flights to put on the schedule.

Related: Major airline faces Chapter 11 bankruptcy concerns

Every airport has only a certain number of gates, flight slots and runway capacity, limiting carriers' flexibility. That's why during times of high demand — like flights to Las Vegas during Super Bowl week — do not usually translate to airlines sending more planes to and from that destination.

Airlines generally do try to add capacity every year. That's become challenging as Boeing has struggled to keep up with demand for new airplanes. If you can't add airplanes, you can't grow your business. That's caused problems for the entire industry.

Every airline retires planes each year. In general, those get replaced by newer, better models that offer more efficiency and, in most cases, better passenger amenities.

If an airline can't get the planes it had hoped to add to its fleet in a given year, it can face capacity problems. And it's a problem that both Southwest Airlines (LUV) and United Airlines have addressed in a way that's inevitable but bad for passengers.

Image source: Kevin Dietsch/Getty Images

Southwest slows down its pilot hiring

In 2023, Southwest made a huge push to hire pilots. The airline lost thousands of pilots to retirement during the covid pandemic and it needed to replace them in order to build back to its 2019 capacity.

The airline successfully did that but will not continue that trend in 2024.

"Southwest plans to hire approximately 350 pilots this year, and no new-hire classes are scheduled after this month," Travel Weekly reported. "Last year, Southwest hired 1,916 pilots, according to pilot recruitment advisory firm Future & Active Pilot Advisors. The airline hired 1,140 pilots in 2022."

The slowdown in hiring directly relates to the airline expecting to grow capacity only in the low-single-digits percent in 2024.

"Moving into 2024, there is continued uncertainty around the timing of expected Boeing deliveries and the certification of the Max 7 aircraft. Our fleet plans remain nimble and currently differs from our contractual order book with Boeing," Southwest Airlines Chief Financial Officer Tammy Romo said during the airline's fourth-quarter-earnings call.

"We are planning for 79 aircraft deliveries this year and expect to retire roughly 45 700 and 4 800, resulting in a net expected increase of 30 aircraft this year."

That's very modest growth, which should not be enough of an increase in capacity to lower prices in any significant way.

United Airlines pauses pilot hiring

Boeing's (BA) struggles have had wide impact across the industry. United Airlines has also said it was going to pause hiring new pilots through the end of May.

United (UAL) Fight Operations Vice President Marc Champion explained the situation in a memo to the airline's staff.

"As you know, United has hundreds of new planes on order, and while we remain on path to be the fastest-growing airline in the industry, we just won't grow as fast as we thought we would in 2024 due to continued delays at Boeing," he said.

"For example, we had contractual deliveries for 80 Max 10s this year alone, but those aircraft aren't even certified yet, and it's impossible to know when they will arrive."

That's another blow to consumers hoping that multiple major carriers would grow capacity, putting pressure on fares. Until Boeing can get back on track, it's unlikely that competition between the large airlines will lead to lower fares.

In fact, it's possible that consumer demand will grow more than airline capacity which could push prices higher.

Related: Veteran fund manager picks favorite stocks for 2024

bankruptcy pandemic stocks-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

International1 week ago

International1 week agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International7 days ago

International7 days agoWalmart launches clever answer to Target’s new membership program

-

Spread & Containment2 days ago

Spread & Containment2 days agoIFM’s Hat Trick and Reflections On Option-To-Buy M&A

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex