You can’t talk about blockchain and not bring up CBDCs and stablecoins

Economies are currently experiencing the development of brand new ideas around CBDCs, stablecoins or private digital currencies.

Ever since the publication of Satoshi Nakamoto’s white paper back in November 2008, “Bitcoin: A Peer-to-Pe

Economies are currently experiencing the development of brand new ideas around CBDCs, stablecoins or private digital currencies.

Ever since the publication of Satoshi Nakamoto’s white paper back in November 2008, “Bitcoin: A Peer-to-Peer Electronic Cash System,” the term “blockchain” has been synonymous with digital currencies in the sense of the underlying technology that allows for the transfer of value, peer-to-peer.

What’s interesting is that the term “blockchain” is not used once in that white paper. The purpose of the paper was to propose a solution to the core issue of double-spending a digital currency, which is the representation of a transfer of value directly between transacting parties, without the use of a central trusted third party.

Currencies by definition are a medium of exchange for goods and services, a unit of account, as well as stores of value. Money, in its traditional sense, fulfills all of these three elements.

Central bank digital currency

There is continued significant interest in central bank digital currencies, or CBDCs, at this time — not from the blockchain and crypto community but actually from a core group of some of the most influential central banks, including the Bank of England, the Swiss National Bank, the European Central Bank, the Bank of Japan, the Bank of Canada, the Swedish Riksbank and the Bank of International Settlements.

Related: Did CBDCs affect the crypto space in 2020, and what’s next in 2021? Experts answer

The confirmation in late 2020 from the United Kingdom’s chancellor of the exchequer (the head of Her Majesty's Treasury), states that the United Kingdom will draft regulations for private stablecoins and research CBDCs, demonstrating the momentum that this topic currently has. China has undoubtedly emerged as a leader in its development of CBDCs, having recently proposed that there be a global set of rules that addresses issues such as interoperability between jurisdictions.

Related: How the digital yuan stablecoin impacts crypto in China: Experts answer

Central to any national monetary policy and financial stability is the public’s trust in central banks, and its trust that money provided by the central bank fulfills those three key elements of a currency — whether it’s issued in physical or digital form. A central bank digital currency is not a stablecoin nor is it a digital asset but rather a digital representation of cash — i.e., that a digital pound today is worth the same tomorrow and its purchasing power (what its holder can buy) does not fluctuate beyond certain thresholds.

The European Central Bank’s proposal for a digital euro is built upon the premise of complementing the current cash and wholesale central bank deposit system in place. It is seen as a way of ensuring that European citizens are provided with access to a safe form of money in a fast-changing digital world, while actively promoting innovation in the field of retail payments, supporting society’s vulnerable and reducing their potential financial exclusion. A digital euro is also seen as an option for the reduction of the overall cost and ecological footprint of the current monetary and payments system.

Related: All that mined is not green: Bitcoin’s carbon footprint hard to estimate

With economies currently experiencing the development of ideas around central bank issues, stablecoins or private digital currencies, the experience has been roughly the same as with previous monetary innovations: coins, banknotes, checks and credit cards. Many see blockchain and distributed ledger technology, or DLT, as the mechanism to replace electronic currency in traditional bank accounts. Just as paper money succeeded gold and silver, electronic transfers could replace paper money.

The rise of digital currencies

The current COVID-19 pandemic bought motivation for cashless transactions and impacted the way society interacts financially, which has accelerated the concept of digital currencies in people’s minds. With fewer cash transactions taking place, businesses and consumers are more aware of the attributes and advantages of digital currencies.

Related: How has the COVID-19 pandemic affected the crypto space? Experts answer

Already, central banks engage with other qualifying financial institutions, most often clearing banks, through the use of electronic central bank deposits. Alongside this system, they also issue banknotes and coins to the public. A shift to digital versions of those notes and coins is a natural progression in our more digitized world.

However, this trend could lead to an unintended consequence: Within a cashless society, where the public no longer has access to a state-guaranteed system of payment, the private sector would control access to, development of and pricing for alternative payment methods. Unless, that is, governments issue digital currencies to the public through their respective central banks. But in a system where central banks could have a direct relationship with each individual, there would be significant disruption in the commercial banking market, including the issues of significant data holding and related data privacy. Would citizens want the central bank to know about each transaction they’ve made?

To facilitate any CBDC, the technology platform should fulfill certain key attributes:

- Convenience: The penetration of smartphones in modern society allows for a “tap-to-pay” system that is well understood or for a QR code-based system.

- Security and resilience: Current mature cryptographic techniques provide users with data protection; either software- or hardware-based privacy enforcement. The resilience of a 24/7/365 infrastructure is critical to a CBDC’s performance.

- Speed and scalability: Transaction volumes and throughput will need to be maintained at a justifiable cost. Current centralized card networks show that very high transaction capacities are possible. Permissioned DLT networks could be equivalent substitutes for conventional technologies.

- Interoperability: The use of application programming interfaces, or APIs, are well established to support technologies interoperating and allow interaccount transactions. Common data standards will also play a part in interoperability.

With the example of Bitcoin (BTC), the blockchain infrastructure provides a fully decentralized, fully permissionless public network that, theoretically, no-one person, entity or authority has control over. In the same way, blockchain and/or DLTs can provide a similar network to support the issue of CBDCs among a national population.

However, the more popular framework for digital currencies is a centralized, permissioned network that provides the issuing authority, which is usually the national central bank, with a degree of control and greater oversight of the “blockchain” that records the digital currency transactions. That centralized permissioned distributed ledger could address these key attributes.

For some commentators, the ability of central banks to issue programmable CBDCs on a centralized permissioned blockchain is a positive development — for example, defining and controlling the uses of the digital money issued so that it can only be used for food, not alcohol, cigarettes or gambling. There are also transparency benefits that allow governments to act upon tax evasion and other criminal activity, by way of access to the underlying transactional data.

The original rationale for Satoshi’s white paper was to establish a protocol that allowed for the digital exchange of value, peer-to-peer without the reliance or requirement to go through a central authority.

It’s ironic that the very benefits that Satoshi explained in that white paper are now being considered by central banks as they research and consider how the technology could underpin new digitally issued currency. The two concepts have come into everyday conversation almost simultaneously, making it seem as if they are interwoven. Yet both the technology and the use case can exist apart.

Digital Isle of Man, an executive agency for the Isle of Man’s government, continues to encourage and support research into the issuance and use of digital currencies in all their forms, including stablecoins and CBDCs. Soramitsu, a fintech company delivering blockchain based solutions to businesses and governments — which is currently an associate of the agency’s accelerator program — recently announced its partnership with the National Bank of Cambodia to establish a secure, standardized digital currency alternative to paper bank notes on a single payment platform. The Bakong system is built upon the Hyperledger Iroha DLT, integrated with the traditional banking system, and providing users with easy access via ID document scan, photo check and biometric detection. Having such international experience provides the island with significant insight into any potential future implementation of digital currencies.

There are, of course, a number of technical, economic, financial and legal issues, including the impact of a digital currency on monetary policy, financial stability and banks’ business models, which are unfortunately beyond the limits of this article.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Uncategorized

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

NY Fed Finds Medium, Long-Term Inflation Expectations Jump Amid Surge In Stock Market Optimism

One month after the inflation outlook tracked…

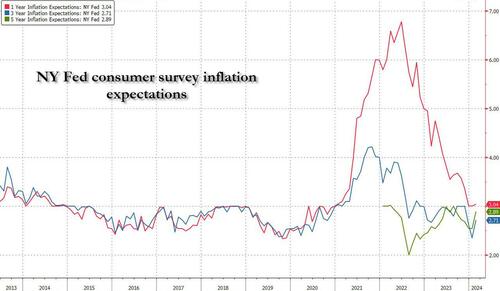

One month after the inflation outlook tracked by the NY Fed Consumer Survey extended their late 2023 slide, with 3Y inflation expectations in January sliding to a record low 2.4% (from 2.6% in December), even as 1 and 5Y inflation forecasts remained flat, moments ago the NY Fed reported that in February there was a sharp rebound in longer-term inflation expectations, rising to 2.7% from 2.4% at the three-year ahead horizon, and jumping to 2.9% from 2.5% at the five-year ahead horizon, while the 1Y inflation outlook was flat for the 3rd month in a row, stuck at 3.0%.

The increases in both the three-year ahead and five-year ahead measures were most pronounced for respondents with at most high school degrees (in other words, the "really smart folks" are expecting deflation soon). The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) decreased at all horizons, while the median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—declined at the one- and three-year ahead horizons and remained unchanged at the five-year ahead horizon.

Going down the survey, we find that the median year-ahead expected price changes increased by 0.1 percentage point to 4.3% for gas; decreased by 1.8 percentage points to 6.8% for the cost of medical care (its lowest reading since September 2020); decreased by 0.1 percentage point to 5.8% for the cost of a college education; and surprisingly decreased by 0.3 percentage point for rent to 6.1% (its lowest reading since December 2020), and remained flat for food at 4.9%.

We find the rent expectations surprising because it is happening just asking rents are rising across the country.

At the same time as consumers erroneously saw sharply lower rents, median home price growth expectations remained unchanged for the fifth consecutive month at 3.0%.

Turning to the labor market, the survey found that the average perceived likelihood of voluntary and involuntary job separations increased, while the perceived likelihood of finding a job (in the event of a job loss) declined. "The mean probability of leaving one’s job voluntarily in the next 12 months also increased, by 1.8 percentage points to 19.5%."

Mean unemployment expectations - or the mean probability that the U.S. unemployment rate will be higher one year from now - decreased by 1.1 percentage points to 36.1%, the lowest reading since February 2022. Additionally, the median one-year-ahead expected earnings growth was unchanged at 2.8%, remaining slightly below its 12-month trailing average of 2.9%.

Turning to household finance, we find the following:

- The median expected growth in household income remained unchanged at 3.1%. The series has been moving within a narrow range of 2.9% to 3.3% since January 2023, and remains above the February 2020 pre-pandemic level of 2.7%.

- Median household spending growth expectations increased by 0.2 percentage point to 5.2%. The increase was driven by respondents with a high school degree or less.

- Median year-ahead expected growth in government debt increased to 9.3% from 8.9%.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.6 percentage point to 26.1%, remaining below its 12-month trailing average of 30%.

- Perceptions about households’ current financial situations deteriorated somewhat with fewer respondents reporting being better off than a year ago. Year-ahead expectations also deteriorated marginally with a smaller share of respondents expecting to be better off and a slightly larger share of respondents expecting to be worse off a year from now.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 1.4 percentage point to 38.9%.

- At the same time, perceptions and expectations about credit access turned less optimistic: "Perceptions of credit access compared to a year ago deteriorated with a larger share of respondents reporting tighter conditions and a smaller share reporting looser conditions compared to a year ago."

Also, a smaller percentage of consumers, 11.45% vs 12.14% in prior month, expect to not be able to make minimum debt payment over the next three months

Last, and perhaps most humorous, is the now traditional cognitive dissonance one observes with these polls, because at a time when long-term inflation expectations jumped, which clearly suggests that financial conditions will need to be tightened, the number of respondents expecting higher stock prices one year from today jumped to the highest since November 2021... which incidentally is just when the market topped out during the last cycle before suffering a painful bear market.

Spread & Containment

A major cruise line is testing a monthly subscription service

The Cruise Scarlet Summer Season Pass was designed with remote workers in mind.

While going on a cruise once meant disconnecting from the world when between ports because any WiFi available aboard was glitchy and expensive, advances in technology over the last decade have enabled millions to not only stay in touch with home but even work remotely.

With such remote workers and digital nomads in mind, Virgin Voyages has designed a monthly pass that gives those who want to work from the seas a WFH setup on its Scarlet Lady ship — while the latter acronym usually means "work from home," the cruise line is advertising as "work from the helm.”

Related: Royal Caribbean shares a warning with passengers

"Inspired by Richard Branson's belief and track record that brilliant work is best paired with a hearty dose of fun, we're welcoming Sailors on board Scarlet Lady for a full month to help them achieve that perfect work-life balance," Virgin Voyages said in announcing its new promotion. "Take a vacation away from your monotonous work-from-home set up (sorry, but…not sorry) and start taking calls from your private balcony overlooking the Mediterranean sea."

Shutterstock

This is how much it'll cost you to work from a cruise ship for a month

While the single most important feature for successful work at sea — WiFi — is already available for free on Virgin cruises, the new Scarlet Summer Season Pass includes a faster connection, a $10 daily coffee credit, access to a private rooftop, and other member-only areas as well as wash and fold laundry service that Virgin advertises as a perk that will allow one to concentrate on work

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

The pass starts at $9,990 for a two-guest cabin and is available for four monthlong cruises departing in June, July, August, and September — each departs from ports such as Barcelona, Marseille, and Palma de Mallorca and spends four weeks touring around the Mediterranean.

Longer cruises are becoming more common, here's why

The new pass is essentially a version of an upgraded cruise package with additional perks but is specifically tailored to those who plan on working from the ship as an opportunity to market to them.

"Stay connected to your work with the fastest at-sea internet in the biz when you want and log-off to let the exquisite landscape of the Mediterranean inspire you when you need," reads the promotional material for the pass.

Amid the rise of remote work post-pandemic, cruise lines have been seeing growing interest in longer journeys in which many of the passengers not just vacation in the traditional sense but work from a mobile office.

In 2023, Turkish cruise line operator Miray even started selling cabins on a three-year tour around the world but the endeavor hit the rocks after one of the engineers declared the MV Gemini ship the company planned to use for the journey "unseaworthy" and the cruise ship line dealt with a PR scandal that ultimately sank the project before it could take off.

While three years at sea would have set a record as the longest cruise journey on the market, companies such as Royal Caribbean (RCL) (both with its namesake brand and its Celebrity Cruises line) have been offering increasingly long cruises that serve as many people’s temporary homes and cross through multiple continents.

stocks pandemic testingInternational

This is the biggest money mistake you’re making during travel

A retail expert talks of some common money mistakes travelers make on their trips.

Travel is expensive. Despite the explosion of travel demand in the two years since the world opened up from the pandemic, survey after survey shows that financial reasons are the biggest factor keeping some from taking their desired trips.

Airfare, accommodation as well as food and entertainment during the trip have all outpaced inflation over the last four years.

Related: This is why we're still spending an insane amount of money on travel

But while there are multiple tricks and “travel hacks” for finding cheaper plane tickets and accommodation, the biggest financial mistake that leads to blown travel budgets is much smaller and more insidious.

This is what you should (and shouldn’t) spend your money on while abroad

“When it comes to traveling, it's hard to resist buying items so you can have a piece of that memory at home,” Kristen Gall, a retail expert who heads the financial planning section at points-back platform Rakuten, told Travel + Leisure in an interview. “However, it's important to remember that you don't need every souvenir that catches your eye.”

More Travel:

- A new travel term is taking over the internet (and reaching airlines and hotels)

- The 10 best airline stocks to buy now

- Airlines see a new kind of traveler at the front of the plane

According to Gall, souvenirs not only have a tendency to add up in price but also weight which can in turn require one to pay for extra weight or even another suitcase at the airport — over the last two months, airlines like Delta (DAL) , American Airlines (AAL) and JetBlue Airways (JBLU) have all followed each other in increasing baggage prices to in some cases as much as $60 for a first bag and $100 for a second one.

While such extras may not seem like a lot compared to the thousands one might have spent on the hotel and ticket, they all have what is sometimes known as a “coffee” or “takeout effect” in which small expenses can lead one to overspend by a large amount.

‘Save up for one special thing rather than a bunch of trinkets…’

“When traveling abroad, I recommend only purchasing items that you can't get back at home, or that are small enough to not impact your luggage weight,” Gall said. “If you’re set on bringing home a souvenir, save up for one special thing, rather than wasting your money on a bunch of trinkets you may not think twice about once you return home.”

Along with the immediate costs, there is also the risk of purchasing things that go to waste when returning home from an international vacation. Alcohol is subject to airlines’ liquid rules while certain types of foods, particularly meat and other animal products, can be confiscated by customs.

While one incident of losing an expensive bottle of liquor or cheese brought back from a country like France will often make travelers forever careful, those who travel internationally less frequently will often be unaware of specific rules and be forced to part with something they spent money on at the airport.

“It's important to keep in mind that you're going to have to travel back with everything you purchased,” Gall continued. “[…] Be careful when buying food or wine, as it may not make it through customs. Foods like chocolate are typically fine, but items like meat and produce are likely prohibited to come back into the country.

Related: Veteran fund manager picks favorite stocks for 2024

stocks pandemic france-

Uncategorized3 weeks ago

Uncategorized3 weeks agoAll Of The Elements Are In Place For An Economic Crisis Of Staggering Proportions

-

Uncategorized1 month ago

Uncategorized1 month agoCathie Wood sells a major tech stock (again)

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoCalifornia Counties Could Be Forced To Pay $300 Million To Cover COVID-Era Program

-

Uncategorized2 weeks ago

Uncategorized2 weeks agoApparel Retailer Express Moving Toward Bankruptcy

-

Uncategorized4 weeks ago

Uncategorized4 weeks agoIndustrial Production Decreased 0.1% in January

-

International3 days ago

International3 days agoEyePoint poaches medical chief from Apellis; Sandoz CFO, longtime BioNTech exec to retire

-

International3 days ago

International3 days agoWalmart launches clever answer to Target’s new membership program

-

Uncategorized3 weeks ago

Uncategorized3 weeks agoRFK Jr: The Wuhan Cover-Up & The Rise Of The Biowarfare-Industrial Complex